Raleigh Housing Market: Trends & Prices (2025)

Raleigh Housing Market: Trends & Prices (2025)

Raleigh Real Estate Market Overview

By Kenny Zhu

(Last Updated – 1/2026)

Raleigh — the City of Oaks — is one to watch on the housing market scene. With its job opportunities and quality of life, people are choosing to move there, driving up housing demand in recent years.

Raleigh is the second-most populous city in North Carolina — with a population of about 482,295 residents — and also happens to be one of the fastest-growing cities in the United States. In 2024, Raleigh was also named the fifth-most educated city in America, with over half of its residents holding at least a bachelor’s degree.

Those who call Raleigh a college town are spot-on, as Raleigh is home to at least 10 major colleges, including North Carolina State University. The city is within an hour’s drive of both Duke University and the University of North Carolina at Chapel Hill, making it neutral ground for Blue Devils and Tar Heels fans alike.

Raleigh, though, is known for more than just brains and basketball; it’s also a great place to find smoked “whole hog” barbecue, complete with signature vinegar and pepper-based glaze.

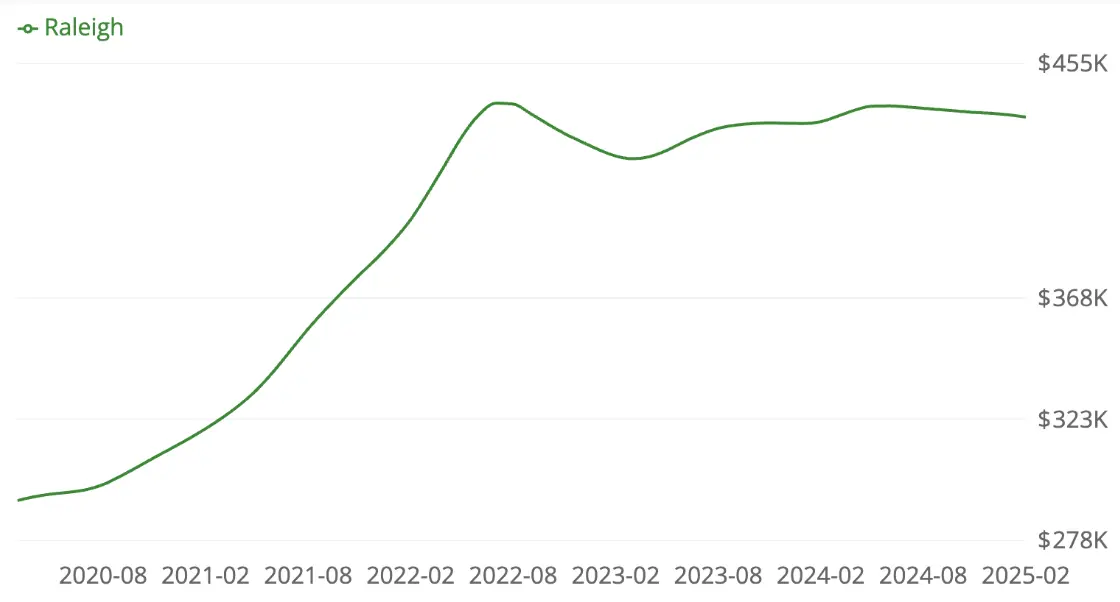

Home values in the area are up 0.4% over the past year, slower than the national growth rate of 2.6%, according to Zillow. Factors for this include already somewhat high home prices and a more steady supply and demand in the city.

If you’re thinking of buying property in Raleigh, you’ll want to check out our assessment of the homebuying, demographic, and market trends in the area.

Raleigh Real Estate Market Trends

While the Raleigh housing market may not be as hot as it was in 2022 to 2023, when the U.S. News & World Report ranked it the #1 hottest real estate market in the nation, it still remains a strong market with high demand and rising prices.

Raleigh’s home prices are projected to continue to rise slightly in the coming year, according to forecasting real estate trends from Norada Real Estate Investments.

Despite a decline in home sales since last year and an increase in the average amount of days listings spend on the market, the steady rise in home prices may signal a housing market that has more room to run.

Homes sold on the real estate market in Raleigh typically close around 1% below the listing price and typically spend around 45 days on the market before an offer is accepted.

$436,250

Median Sale Price

$234

Median Price Per Square Foot

45 days

Median Time on Market

Raleigh Housing Market Forecast

Prospective homebuyers may not need to be vigilant if they hope to buy a house in 2025, as data from Zillow shows that home prices are likely to only gently uptick in the coming year, if at all.

Currently, the average home in Raleigh spends around 45 days on the market before it’s snapped up, so homebuyers shopping for a house in the interim may have some breathing room.

Demographics of the Raleigh Market

Raleigh households tend to be wealthier and more educated than the United States as a whole. This is possibly due to its proximity to some of the most prestigious educational institutions in the South.

In fact, UNC, North Carolina State University, Duke University, and their affiliate health systems all rank among the top 10 employers in the greater Raleigh-Wake County metropolitan area.

As part of the Research Triangle, the city and its surrounding areas have seen major growth in professional services over recent years, including in the tech, healthcare, financial services, education, and government sectors.

In fact, Raleigh has developed a reputation as a rapidly developing tech hub in the South, ranking 6th among the top cities in the U.S. for tech professionals in 2024.

Major tech companies like International Business Machines, Red Hat Inc. (a subsidiary of IBM) and Cisco Systems all house major branches in and around Raleigh, and each location employs thousands of Raleigh residents.

Median Household Income: $82,424

Median Age: 34.6

College Educated: 52.9%

Homeowners: 51.2%

Married: 42%

Popular Raleigh Neighborhoods

The capital of the Tar Heel State isn’t just a great place for basketball, tailgating, and barbecue; it’s also an excellent place to live.

Based on key characteristics, including home values, growth in home prices, and population, we’ve isolated five popular Raleigh neighborhoods to help you on your home shopping journey.

North Raleigh

Without a doubt, North Raleigh is a popular neighborhood in the city; it encompasses a number of growing residential enclaves, including the quaint Falls River community as well as the posh North Ridge area.

North Raleigh is an excellent area for any family looking to put down roots. There’s a variety of activities, restaurants, and parks in the area for families to enjoy, including the scenic Shelley Lake Park and the 237-acre Durant Nature Preserve.

Quick Facts

Population:

76,649

Median Age:

43.1

Housing Units:

34,422

Bike Score:

52

Walk Score:

28

Transit Score:

31

Median Household Income:

$80,005

North Raleigh Housing Market

The North Raleigh neighborhood is split into several distinct residential enclaves and features homes across a variety of price points, ranging from entry level to high end.

On a relative basis, home prices in North Raleigh are somewhat more expensive than the city overall, by about 4.3%.

Median Home Price

$455,000

Median Price Per Square Ft.

$224

North Hills

Also known as “Raleigh’s Midtown,” fast-growing North Hills is located north of Raleigh’s downtown and features fine dining, live entertainment, and bustling shopping districts.

The North Hills area features a large number of luxury apartments for rent. The neighborhood is known to be generally walkable, quiet on residential streets, and close to amenities.

Recommended: Price-to-Rent Ratio in 50 Cities

Quick Facts

Population:

3,479

Median Age:

38

Housing Units:

1,927

Bike Score:

43

Walk Score:

30

Transit Score:

30

Median Household Income:

$86,414

North Hills Housing Market

Homes in North Hills typically sit on the high end of the market and many of the properties located within its residential districts fall within the category of upscale or luxury homes.

North Hill’s growth rate in home prices (31.4% since last year) more than doubles that of the state of Raleigh as a whole (14.5% compared to last year), according to February 2025 data from Redfin.

While North Hill ranks higher on the list in terms of median listing home prices in the Raleigh real estate market, there are other neighborhoods with homes in the million dollar average range, like Glenwood and Five Points East.

Median Home Price

$920,000

Median Price Per Square Foot

$345

Five Points

Situated right below North Hills, Five Points will take you “inside the beltline,” a saying locals use for neighborhoods within the I-440 loop. A historic neighborhood that was developed in the 1910s to 1920s, Five Points is so called as it includes five smaller neighborhoods: Hayes Barton, Vanguard Park, Bloomsbury, Georgetown, and Roanoke Park.

Within the Raleigh beltway, the area is known for its tree-lined streets, boutique shops, and even its breweries.

Quick Facts

Population:

8,669

Median Age:

42.3

Housing Units:

3,508

Bike Score:

66

Walk Score:

44

Transit Score:

39

Median Household Income:

$148,413

Five Points Housing Market

Homes in the Five Points neighborhood range in price; you’ll find properties from $250,000 to over a million here. A smaller neighborhood, the area features a blend of charming historic properties to some newly constructed homes.

Five Points shares many characteristics with its North Hills neighbor, including its high growth rate and above-average home prices, which stand at 35.9% and $905,000, respectively, per Redfin data from February 2025.

Five Points median home prices and growth rate since last year sit well above Raleigh real estate trends overall.

Median Home Price

$905,000

Median Price Per Square Foot

$410

Oakwood

Another historic neighborhood, Oakwood sits right on the edge of downtown Raleigh. With its Victorian-era homes and tree-lined streets, this area has a lot of character and unique architecture. North Carolina’s largest, intact nineteenth-century neighborhood, Historic Oakwood has become a coveted area, and many residents have been there for a long time.

Similar to North Hills and Five Points, home prices in Five Points are generally on the higher end, at the $1 million median price point for Oakwood, with a high growth rate compared to last year.

Quick Facts

Population:

1,708

Median Age:

35

Housing Units:

791

Bike Score:

84

Walk Score:

68

Transit Score:

65

Median Household Income:

$68,458

Oakwood Housing Market

Homes in Oakwood are generally more than double the average when it comes to the real estate market in Raleigh, NC. The area has also seen well above-average growth in home prices in February 2025 compared to last year.

Home prices in Oakwood are up a drastic 45.1% since last year, relative to the Raleigh housing price growth of 14.5%, per Redfin. However, homes in Oakwood can stay on the market for much longer than last year, at a median of 92 days currently.

Median Home Price

$1,000,000

Median Price Per Square Foot

$447

Northwest Raleigh

Northwest Raleigh is a populous neighborhood in the city that is home to the prestigious Brier Creek Country Club and borders key landmarks like William B. Umstead State Park and the Raleigh-Durham International Airport.

Northwest Raleigh’s prime location also puts it within driving distance of both Downtown Raleigh and North Carolina State University. The area is known for its low crime rates and quality school districts.

Quick Facts

Population:

81,974

Median Age:

37.3

Housing Units:

28,556

Bike Score:

44

Walk Score:

76

Transit Score:

29

Median Household Income:

$78,719

Northwest Raleigh Housing Market

Home prices in Northwest Raleigh generally sit above the city average, at about 14% higher. Northwest Raleigh homes are also up about 11.7% in price compared to last year.

Median Home Price

$497,000

Median Price Per Square Foot

$239

SoFi Home Loans

It’s easy to see why the Raleigh real estate market has been active. There are some amazing neighborhoods to choose from, whether you’re single or have a family to look after.

If you think Raleigh could be your home sweet home, then you may need to consider your mortgage financing options.

Looking for an affordable option for a home mortgage loan? SoFi can help: We offer low down payments (as little as 3% - 5%*) with our competitive and flexible home mortgage loans. Plus, applying is extra convenient: It's online, with access to one-on-one help.

View your rate

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

SOHL-Q425-208

Free California HELOC Payment Calculator

California HELOC Calculator

By SoFi Editors | Updated December 18, 2025

Understanding the equity in your home is a critical component of modern financial strategy. The California HELOC payment calculator is a valuable first step, translating abstract financial concepts into tangible figures for personal planning. This free HELOC calculator helps you estimate your monthly payments and total interest costs, before you formally apply for a line of credit with a lender.

By demystifying these figures, the calculator helps you grasp the key concepts you need to know before deciding if a HELOC is the right choice for your financial goals.

- Key Points

- • HELOCs and other home equity financing options allow you to use your home as collateral to secure funds.

- • A HELOC is a revolving line of credit that operates in two phases: a draw period (often 10 years) when you can borrow funds, and a subsequent repayment period (typically 10 to 20 years) when you repay the principal and interest.

- • You pay interest only on the amount you have borrowed from your credit line, not on the entire credit limit available to you.

- • HELOCs usually come with a variable interest rate, which can change over time. This contrasts with the fixed interest rate commonly associated with a traditional home loan.

- • To qualify, lenders generally require that homeowners have a minimum of 15% equity in their home. Qualified borrowers may be able to access up to 90% of their home equity.

Calculator Definitions

• HELOC Balance: The HELOC balance is the total amount of principal that a borrower currently owes on their line of credit.

• Current Interest Rate: This is the rate at which interest accrues on your outstanding balance. For most HELOCs, this is a variable rate that can change over time in response to market shifts.

• Draw Period: The draw period is the specific time frame, often lasting between 5 and 10 years, during which you can access funds from your HELOC up to your approved credit limit.

• Repayment Period: The repayment period is the phase that begins after the draw period ends, typically lasting 10 to 20 years. During this time, you can no longer borrow funds and must make regular payments on both the principal and interest.

• Monthly Interest Payment: This refers to the minimum payment required during the draw period. Some HELOCs allow for interest-only payments during this phase, which cover the interest accrued on the borrowed amount but do not reduce the principal balance.

• Monthly Principal and Interest Payment: This is the standard payment made during the repayment period. It includes a portion of the principal balance and the accrued interest, and is designed to pay off the line of credit over the specified term.

• Total Interest: This figure represents the cumulative amount of interest you will pay over the life of the HELOC. It includes all interest payments from the beginning of the draw period through the end of the repayment period.

How to Use the California HELOC Calculator

A HELOC payment calculator is a straightforward tool designed to demystify how a HELOC works. By inputting a few key pieces of financial information, you can get a clear estimate of what your payments could look like, providing a solid foundation for financial planning.

Step 1: Enter Your Planned or Actual HELOC Balance

Enter the outstanding principal balance on your current HELOC. If you are exploring a new line of credit, input the potential amount you are thinking about borrowing to see how it might affect your budget.

Step 2: Estimate Your Interest Rate

Input the annual interest rate for your line of credit. Since most HELOCs feature variable rates that can fluctuate, this figure will be used as an estimate to model potential payments and interest costs.

Step 3: Choose the Length of the Draw Period

Enter the duration of the draw period for your HELOC, which is typically between 5 and 10 years. This is the period during which you can access funds, and its length affects the overall timeline of your line of credit.

Step 4: Select Your Repayment Period

Enter the length of the repayment period, which often ranges from 10 to 20 years. This phase follows the draw period and determines the schedule over which you will pay back the principal and accumulated interest.

Step 5: Review Your Results

The HELOC payment calculator will provide you with estimated figures, including your potential monthly payments during both the draw and repayment periods, as well as the total interest you might pay over the life of the line of credit. Remember that these numbers are estimates intended for planning and informational purposes.

These estimated results provide a financial snapshot. To fully understand the mechanics behind these numbers, let’s explore in detail what is a home equity line of credit?

What Is a Home Equity Line of Credit?

A home equity line of credit, or HELOC, is a flexible financial tool available to homeowners who have built up equity in their property. Understanding its mechanics is the first step toward determining if it aligns with your financial strategy for how to get equity out of your home.

A HELOC is a revolving line of credit that functions much like a credit card but is secured by the equity in your home. Your home equity is the difference between the property’s current market value and the amount you still owe on your mortgage. Because the line of credit is secured by your home, lenders typically offer more competitive interest rates compared to unsecured options like credit cards or personal loans.

HELOCs are structured in two distinct phases. The first is the draw period, which typically lasts 5 to 10 years. During this time, you can withdraw funds as needed, up to your approved credit limit, and you are often only required to make payments on the interest that accrues on your outstanding balance. A HELOC interest-only calculator can give you the payment info for that first phase only.

Once the draw period ends, the repayment period begins, usually lasting 10 to 20 years. During this phase, you can no longer withdraw funds, and your required monthly payments will increase significantly to cover both the principal balance and the interest. Homeowners should use a HELOC repayment calculator to prepare for this transition, to ensure the new, larger payment fits their long-term budget.

Most HELOCs have variable interest rates, meaning the rate can fluctuate over time. This is a key distinction from a standard home equity loan, which usually offers a fixed interest rate and a predictable monthly payment schedule.

Accessing the funds from your HELOC is designed for convenience. Common methods include using special checks provided by the lender, a dedicated debit or access card, or transferring money directly to your checking account through online banking.

With these mechanics in mind, a specialized free HELOC calculator becomes the essential tool for translating these concepts—like draw periods and variable rates—into personalized, actionable figures.

Recommended: HELOC vs. Home Equity Loan

Home Equity Trends in California

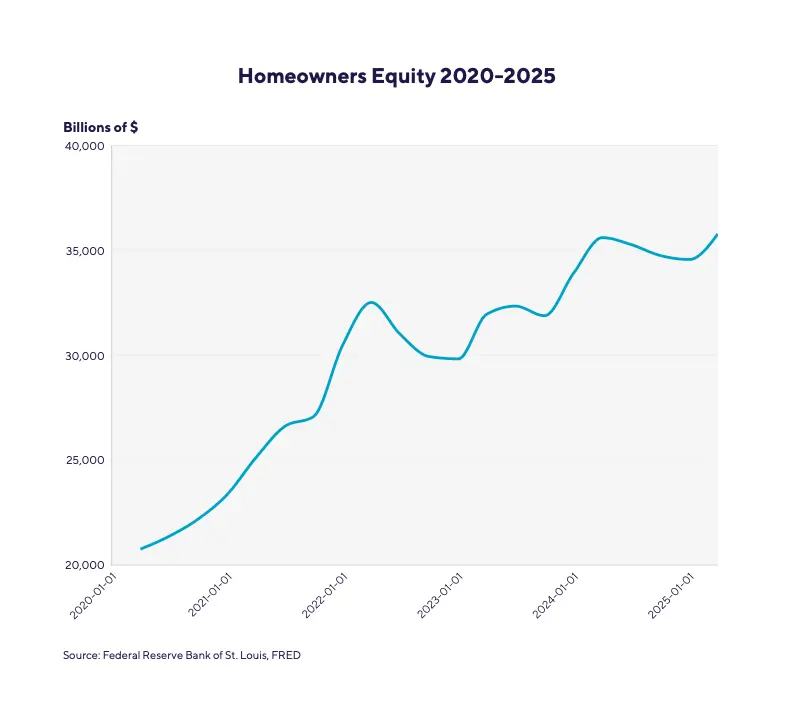

The ability to secure and utilize different types of home equity loans is directly tied to the amount of equity a homeowner possesses, a figure that is heavily influenced by the dynamics of the housing market.

In recent years, rising home prices have impacted homeowners and prospective buyers in different ways. While appreciating home values can make it more challenging for first-time buyers to enter the market, this same trend has led to a significant “spike in home equity” for existing homeowners. As property values increase, the gap between a home’s market worth and the owner’s outstanding mortgage balance widens, creating more accessible equity.

Many homeowners, particularly in high-value states like California, may have more equity than they realize. Even those who have owned their homes for just a few years may find they have built enough equity to meet the minimum 15% lender requirement sooner than they might have expected, especially if they purchased in a rapidly appreciating market.

In California, home equity has increased 79% over the last five years. As a result, homeowners are sitting on a huge amount of equity: $348,200 on average. That’s more than enough to fund a home renovation or other large purchase and still maintain a comfortable equity cushion.

Current HELOC rates by state.

Compare current home interest rates by state and find a HELOC rate that suits your financial goals.

Select a state to view current rates:

How to Use the HELOC Calculator Data to Your Advantage

The data generated by a HELOC payment calculator is more than just a set of numbers; it provides actionable insights that can be used to make sound financial decisions. By translating your home equity into concrete borrowing potential and estimated costs, the calculator empowers you to plan strategically for your financial future.

• Budgeting for major projects: The estimated monthly payments for both the draw and repayment periods can be directly integrated into your household budget. This allows you to realistically assess the affordability of a large-scale project, such as a kitchen remodel or adding a new pool. By understanding the potential impact on your monthly cash flow, you can plan renovations without overextending your finances.

• Evaluating debt consolidation: If you are considering using a HELOC to consolidate high-interest debt, the calculator’s output is essential. You can compare the estimated monthly payment and total interest paid on the HELOC against the combined payments and interest costs of your current credit cards or personal loans. This direct comparison will reveal whether consolidation would result in genuine savings and a more manageable single payment.

• Informed lender conversations: Approaching a lender with a clear understanding of your borrowing capacity and estimated payments puts you in a position of strength. Instead of starting from scratch, you can have a more productive and confident discussion about your financial options, armed with realistic expectations and a solid baseline for negotiating terms.

• Understanding long-term impact: The calculator’s estimate of the total interest paid over the entire life of the HELOC provides a crucial long-term perspective. This figure helps you appreciate the full cost of borrowing and encourages a responsible approach to using the funds, ensuring that the benefits of the project or expense outweigh the long-term interest costs.

Armed with these insights, it becomes easier to follow best practices for managing this powerful financial tool.

Tips on HELOCs

While a HELOC can be a powerful and flexible financial tool, it requires careful and responsible management to avoid pitfalls. The following tips are designed to help you use your line of credit wisely, ensuring it serves as a benefit rather than a burden.

• Shop and compare lenders: Do not settle for the first offer you receive. Take the time to compare options from multiple lenders, including banks, credit unions, and online providers. Look beyond the advertised interest rate and scrutinize the full terms. Pay close attention to potential fees, such as annual fees, inactivity fees, and early termination or prepayment penalties, as these can significantly impact the overall cost of borrowing.

• Develop a clear repayment plan: Treat your home equity with the respect it deserves as a significant asset. Avoid the temptation to use HELOC funds for depreciating assets or discretionary lifestyle spending without an ironclad repayment strategy. Every draw should be an investment—in your property’s value or your family’s financial health—not a liability that puts your home at risk.

• Prepare for the repayment period: One of the most common surprises for HELOC borrowers is the significant increase in monthly payments when the line of credit transitions from the interest-only draw period to the principal-and-interest repayment period. Use a HELOC calculator to estimate what these future payments will be and ensure they fit comfortably within your long-term budget to avoid “payment shock.”

• Understand the risks of variable rates: Most HELOCs come with a variable interest rate, which means your monthly payment can increase if market rates rise. You must be financially prepared for potential fluctuations in your payment obligations. Budgeting for a rate that is higher than the current one can provide a valuable financial cushion.

• Maintain your financial health: Lenders look for strong financial credentials when approving a HELOC. This typically includes a credit score of 640 or higher and a debt-to-income (DTI) ratio below 45%. (To learn your DTI, add up all your monthly debt payments and divide by your gross monthly income.) Before applying, review your credit report for any errors, and work on managing your overall debt to position yourself for the best possible interest rate and terms.

While a HELOC is a strong option for many, it’s also wise to consider other financial products that might better suit your needs.

Alternatives to HELOCs

A HELOC is just one of several ways to access home equity or secure financing for a major expense. The best choice depends entirely on your individual financial circumstances, your goals, and your comfort with different repayment structures. It is always wise to evaluate all available options before making a decision.

Home Equity Loan

A home equity loan, often called a second mortgage, provides a one-time lump sum of cash that you borrow against your home’s equity. It is known for its fixed interest rate and predictable, regular monthly payments over a set term, making it a good option for those who know the exact amount they need for a specific project. A home equity loan calculator can help you compare the cost of this product to that of a HELOC.

Recommended: What Is a Home Equity Loan?

Home Improvement Loan

A home improvement loan is a type of personal loan specifically intended for financing home renovations and repairs. It is typically an installment loan, which means it comes with a fixed interest rate and predictable monthly payments. Because it’s not secured by your home, the interest rate is usually higher than that of a home equity loan.

Personal Line of Credit

A personal line of credit (PLOC) is an unsecured revolving line of credit that functions similarly to a HELOC (and a credit card) but does not use your home as collateral. Because it is unsecured, a PLOC may have a higher interest rate and a lower credit limit compared to a HELOC.

Cash-Out Refinance

A cash-out mortgage refinance replaces your current mortgage with a new, larger one. The difference between the new mortgage amount and your old mortgage balance is paid to you in cash. This consolidates your debt into a single mortgage payment but resets your mortgage term.

When comparing a cash-out refinance vs. home equity line of credit, you should understand that the former leaves you with one payment. The latter gives you a second payment on top of your original mortgage payment.

Understanding these alternatives provides a broader context for making the best financial choice for your future.

The Takeaway

A California HELOC calculator is a smart first step for any homeowner considering tapping into their home equity. It provides a clear, no-commitment estimate of borrowing power and potential costs, transforming a complex financial product into a manageable set of figures for planning. This preliminary step of calculation is not just about numbers; it’s about empowerment. It enables homeowners to make strategic, well-informed financial decisions regarding their most significant asset.

SoFi now partners with Spring EQ to offer flexible HELOCs. Our HELOC options allow you to access up to 90% of your home’s value, or $500,000, at competitively lower rates. And the application process is quick and convenient.

Unlock your home’s value with a home equity line of credit from SoFi, brokered through Spring EQ.

FAQ

What is the difference between a HELOC and a home equity loan?

A HELOC is a revolving line of credit with a typically variable interest rate, allowing you to borrow and repay funds as needed during a draw period. A home equity loan provides a one-time lump sum of cash with a fixed interest rate and predictable monthly payments from the start.

How much can I borrow with a HELOC?

Lenders typically allow you to borrow up to 90% of your equity. The exact amount depends on your creditworthiness, your income, your other debts, and the lender’s policies.

What can I use the money for from a HELOC?

You can use HELOC funds for almost anything, including home improvements, debt consolidation, educational expenses, medical bills, or other major purchases. However, borrowing against your home should be done with a clear purpose and a repayment plan.

Is a HELOC interest rate fixed or variable?

Most HELOCs have a variable interest rate that is tied to the U.S. Prime Rate. This means the rate, and your monthly payments, can change over time. Some lenders may offer a fixed-rate option.

What happens when the draw period ends?

When the draw period ends, the repayment period begins. You can no longer borrow from the line of credit, and your required monthly payments will increase to include both principal and interest.

What is the benefit of having a variable interest rate?

A variable interest rate can fluctuate with market conditions. While this means your rate could increase, it also means it could decrease if benchmark rates fall, which would lower your monthly interest payments.

Are there closing costs or fees for a HELOC?

Yes, HELOCs can have closing costs, typically ranging from 2% to 5% of the credit limit, though some lenders may waive them. Other potential fees include annual maintenance fees, inactivity fees, and early termination penalties.

What is the minimum credit score I need to qualify for a HELOC?

Requirements vary by lender, but a credit score of at least 640 is usually necessary to qualify, and many lenders like to see 680 or above. And a score of 700+ will help borrowers secure the most competitive interest rates.

Is the interest on a HELOC tax-deductible?

Interest paid on HELOCs and home equity loans may be tax-deductible. There are limits on the total amount of mortgage debt on which interest can be deducted, and in order to capture this deduction a homeowner would need to itemize deductions on their tax return. Your best move is to consult a tax advisor.

Learn more about mortgages:

SoFi Loan Products Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

Checking Your Rates: To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score. However, if you choose a product and continue your application, we will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull and may affect your credit.

²SoFi Bank, N.A. NMLS #696891 (Member FDIC), offers loans directly or we may assist you in obtaining a loan from SpringEQ, a state licensed lender, NMLS #1464945.

All loan terms, fees, and rates may vary based upon your individual financial and personal circumstances and state.You should consider and discuss with your loan officer whether a Cash Out Refinance, Home Equity Loan or a Home Equity Line of Credit is appropriate. Please note that the SoFi member discount does not apply to Home Equity Loans or Lines of Credit not originated by SoFi Bank. Terms and conditions will apply. Before you apply, please note that not all products are offered in all states, and all loans are subject to eligibility restrictions and limitations, including requirements related to loan applicant’s credit, income, property, and a minimum loan amount. Lowest rates are reserved for the most creditworthy borrowers. Products, rates, benefits, terms, and conditions are subject to change without notice. Learn more at SoFi.com/eligibility-criteria. Information current as of 06/27/24.In the event SoFi serves as broker to Spring EQ for your loan, SoFi will be paid a fee.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

SOHE-Q425-055

Get prequalified in minutes for a SoFi Home Loan.

Is 675 a Good Credit Score?

Is 675 a Good Credit Score?

By Laurel Tincher

(Last Updated – 12/2025)

A 675 credit score is considered a good score, but it’s at the very low end of that range. This score can definitely be high enough to open some doors for you financially speaking, but it may not be high enough to get the most favorable terms for, say, a mortgage or car loan.

Read on to learn more about the answer to “Is 675 a good credit score?” and learn how to build that important three-digit number.

Key Points

• A 675 credit score is considered good but is at the lower end of this range.

• With this score, you can qualify for loans and credit cards, but with less favorable terms.

• Potential drawbacks include higher interest rates and fewer rewards on credit cards.

• To improve your credit score, pay bills on time and keep credit card balances low.

• Regularly check credit reports for errors and avoid multiple new credit applications.

What Does a 675 Credit Score Mean?

A FICO® Score of 675 falls into the low end of the good credit range, which typically runs from 670 to 739. Despite not fitting into the excellent or upper reaches of the good categories, a score of 675 indicates a responsible credit history. Here’s how FICO categorizes its scores:

• Excellent: 800 to 850

• Very Good: 740 to 799

• Good: 670 to 739

• Fair: 580 to 669

• Poor: 300 to 579

Credit score ranges are used by lenders to evaluate the risk involved in giving credit to someone. A score of 675 indicates that the applicant has exhibited a moderate degree of creditworthiness. This may indicate a track record of:

• On-time debt payments

• A manageable debt-to-income ratio

• Overall healthy financial standing

It’s important to remember that a credit score of 675 can be built. When applying for loans or credit cards, those in the 675 range can pay a little bit more in interest than people with higher scores. If you had a higher credit score, you might be offered a lower annual percentage rate, or APR.

Gaining a better understanding of the factors that impact credit scores (and making a concerted effort to build yours) can lead to better terms and financial prospects.

💡 Quick Tip: Before choosing a personal loan, ask about the lender’s fees: origination, prepayment, late fees, etc. One question can save you many dollars.

What Else Can You Get with a 675 Credit Score?

People with a credit score of 675 can qualify for a range of financial products, though there might be some restrictions. Even if they are eligible for credit cards, their interest rates and benefits might not be as good as those offered to those with better credit scores. For large expenditures like a home or car, lenders may grant loans, but the interest rates may be on the higher end.

Reducing outstanding debt, avoiding late payments or defaults, and making consistent, on-time payments are all critical steps that can build one’s score. People who work to keep or build their credit score put themselves in a better position to access a wider variety of financial products with better terms and conditions.

Can I Get a Credit Card with a 675 Credit Score?

It is possible to get a credit card with a 675 credit score, and you may have several solid options from which to choose. However, there are rewards if you build your score even higher, including possibly a lower APR and/or fees or access to enhanced rewards.

By using a credit card responsibly, you can work to build your score. It’s worth noting that the single biggest contributing factor to your score is your credit history, meaning on-time payments. Set up payment alerts or opt into automatic payments to help ensure that you pay your bill on time, every time.

💡 Quick Tip: Generally, the larger the personal loan, the bigger the risk for the lender — and the higher the interest rate. So one way to lower your interest rate is to try downsizing your loan amount.

Can I Get an Auto Loan with a 675 Credit Score?

You can get an auto loan with a credit score of 675, but the terms and interest rates might not be as good as what is available to people with higher credit scores. You will find that offers may well vary from lender to lender.

Worth noting: 690 was found to be the average score among those who get a used car loan. Those buying a new car typically have a score of 757 or above.

That said, those with a credit score of 675 should shop around. You may find that if you can make a higher down payment, you could be rewarded with terms you find more affordable.

Recommended: Why Your Debt-to-Income Ratio Matters

Can I Get a Mortgage with a 675 Credit Score?

With a credit score of 675, you will likely be approved by a mortgage lender with what’s considered a good interest rate. But you may not receive the best rate — that’s often reserved for those with high scores, such as 740 and above.

In order to improve your chances of getting approved for a mortgage with more favorable terms, you may want to think about other aspects that lenders take into account, like:

• A steady job history with a reliable income

• A larger down payment.

Also, know that if your credit score is below 675, there are still options to be found:

• You may be able to find a conventional loan with a score of 620 or higher.

• You may qualify for a FHA loan with a credit score of 500 or higher.

• You may qualify for a VA or USDA loan with a credit score of 640 or higher.

Can I Get a Personal Loan with a 675 Credit Score?

With a credit score of 675, you can usually qualify for a personal loan. This can be good news, since personal loans can be used in a variety of ways, such as debt consolidation, home renovations, or medical bills.

However, you may find that not all lenders approve you; some prefer prospective borrowers to have credit scores in the 700s. And those that do offer you a loan may not have the best terms, such as the lower APRs.

In other words, it’s in your best interests to shop around and see what offers are available. It can also help to follow the steps mentioned above to build your score, such as always paying bills on time, keeping your amounts owed low (under 30% of your credit limit), and not applying for too much new credit at the same time.

Recommended: Can You Refinance a Personal Loan?

Takeaway

Is a 675 credit score good? Yes. A FICO Score of 675, which is at the lower end of the good range, is typically high enough to qualify for loans and mortgages. However, you may have to pay a little bit more in interest and have less favorable terms than people with better scores. You also may benefit from building your score a bit higher before applying for a loan. You might qualify with more lenders and for better terms.

Think twice before turning to high-interest credit cards. Consider a SoFi personal loan instead. SoFi offers competitive fixed rates and same-day funding. See your rate in minutes.

Photo credit: iStock/PeopleImages

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

Disclaimer: Many factors affect your credit scores and the interest rates you may receive. SoFi is not a Credit Repair Organization as defined under federal or state law, including the Credit Repair Organizations Act. SoFi does not provide “credit repair” services or advice or assistance regarding “rebuilding” or “improving” your credit record, credit history, or credit rating. For details, see the FTC’s website .

Non affiliation: SoFi isn’t affiliated with any of the companies highlighted in this article.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

Third Party Trademarks: Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

SOPL-Q425-085

Is 678 a Good Credit Score?

Is 678 a Good Credit Score?

By Laurel Tincher

(Last Updated – 12/2025)

A credit score of 678 is typically considered to be in the good range, though closer to the lower end than the higher.

Your credit score plays an important role in your financial life since it’s a snapshot of your creditworthiness. Those three digits can be a key factor when you apply for loans, mortgages, credit cards, and other forms of financing. A good score can open doors for you, but it may not get you the best offers available.

Here, you’ll take a closer look at what a 678 credit score means and how it can impact your borrowing options.

Key Points

• A credit score of 678 is considered good but is on the lower end of this range.

• Individuals with this score can qualify for personal loans, auto loans, and credit cards.

• However, they may not receive the most favorable interest rates or terms.

• There is potential to improve the score and access better financial offers.

• Tips include paying bills on time, keeping credit card balances low, and regularly checking the credit report.

What Does a 678 Credit Score Mean?

A 678 credit score is typically considered to be good, but it’s nudging towards the lower end of that range.

In general, credit scores range from 300 to 850, with 300 being the lowest number. The most popular credit scoring system is FICO®, and here’s a look at its score ranges:

• Excellent: 800 to 850

• Very Good: 740 to 799

• Good: 670 to 739

• Fair: 580 to 669

• Poor: 300 to 579

So, is a 678 a good credit score? Most definitely, according to the FICO scoring system. People with a credit score of 678 are seen by lenders as moderate credit risks, which indicates that they are handling their debt well. This score points to a history of good credit management, prompt payments, and a manageable debt load.

For these reasons, people with a credit score of 678 may qualify for a variety of credit products, including personal loans, auto loans, and credit cards. But there is room for improvement. If you build your credit score higher, you might qualify for lower interest rates and better terms when opening a line of credit or securing a loan.

What Else Can You Get with a 678 Credit Score?

A credit score of 678 is typically high enough to qualify for credit cards with fair terms, which can help you establish a good credit history. People with a 678 credit score can often take advantage of various benefits and rewards programs offered by credit card issuers, such as cash back, travel perks, and other incentives.

It’s also likely you will qualify for a home loan, personal loan, and car loan with favorable (though perhaps not optimal) terms.

Can I Get a Credit Card with a 678 Credit Score?

It is absolutely possible to get a credit card with a 678 credit score. A credit score of 678 places you in the good credit range, typically qualifying you for a line of credit with credit card companies.

Of the many credit card options available, it’s possible that the terms you’re offered might not be as good as those for people with excellent credit. For example, a number of issuers provide credit cards with rewards for those with a 678 credit score. However, people with higher scores might qualify for those offers with the very best cash back incentives, loyalty programs, and the most favorable interest rates.

When shopping for a new card, be sure to evaluate the details, including the credit limit, annual fees (if any), and other specifics. That can help ensure you get the best overall deal possible.

Getting a credit card with a 678 credit score not only enables people to pay for their daily needs, but it also gives them a chance to show that they manage their credit responsibly. That in turn can help you maintain your credit score or build it.

Can I Get an Auto Loan with a 678 Credit Score?

It is indeed possible to get an auto loan with a credit score of 678. According to Experian®, applicants typically need a credit score of 661 or higher to be approved for a car loan.

That said, you may have more options if you build your score a bit. Research indicates that the average credit score for a used-car loan was 690 and 757 for a new-car loan. A credit score in those ranges could unlock more offers or better terms.

Recommended: What Is an Installment Loan?

Can I Get a Mortgage with a 678 Credit Score?

It is possible to get a mortgage with a credit score of 678, but you may not get as favorable rates and terms as someone with a score in the 700s or higher.

For a conventional mortgage, you may be approved with a credit score of 620 or higher. However, those with a 740 score or higher are likely to qualify for better terms.

Government-backed home loans are also available and can be good options for people with lower credit scores. For example, FHA loans may be secured with a credit score as low as 500, though most require 580 or higher.

Recommended: Personal Loan Terms to Know Before Applying

Can I Get a Personal Loan with a 678 Credit Score?

Generally, it is possible to get a personal loan with a 678 credit score. In fact, there are lenders who offer this kind of loan for individuals with credit scores of 610 or 640 and up.

For the most favorable terms though (say, the lowest annual percentage rate), you may need a score of 680 or 690. Since a 678 credit score is so close to those numbers, you might want to work on building your score before securing a loan.

Ways to do that can include paying on time without fail, keeping your credit card balances at less than 30% of your limit, and also reviewing your credit report to check for (and resolve) any incorrect information.

In addition, other factors may play a role in the terms you are offered, such as income and employment stability. Once the loan is secured, you can use it in a variety of ways, from credit card debt consolidation to funding a vacation or wedding.

Recommended: Personal Loan Terms to Know Before Applying

Takeaway

Is a 678 credit score good? Yes, it does put you in that range, though towards the lower end. It reflects that you have probably been managing your credit responsibly and are therefore creditworthy. However, you may not qualify for the most favorable terms for loans and lines of credit, which are typically reserved for those with a credit score in the 700s or higher.

It can be a wise move to shop around and see what offers you’re eligible for. Some lenders focus on those with good credit scores versus those with excellent ones and may have terms that suit your needs.

Think twice before turning to high-interest credit cards. Consider a SoFi personal loan instead. SoFi offers competitive fixed rates and same-day funding. See your rate in minutes.

Photo credit: iStock/fizkes

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

Disclaimer: Many factors affect your credit scores and the interest rates you may receive. SoFi is not a Credit Repair Organization as defined under federal or state law, including the Credit Repair Organizations Act. SoFi does not provide “credit repair” services or advice or assistance regarding “rebuilding” or “improving” your credit record, credit history, or credit rating. For details, see the FTC’s website .

Non affiliation: SoFi isn’t affiliated with any of the companies highlighted in this article.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

Third Party Trademarks: Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

SOPL-Q425-086

Is 660 a Good Credit Score?

Is 660 a Good Credit Score?

By Jackie Lam

(Last Updated – 11/2025)

If you have a credit score of 660, you are landing in the fair credit range. While it’s higher than what is categorized as a poor credit score, having a fair credit score could limit your financing options or cause you to pay higher interest rates.

That said, you can get approved for credit cards and loans with a 660 credit score. Learn more about what this score equates to and what kind of financing you can scoop up by being a member of the 660 credit-score club.

Key Points

• A 660 credit score is categorized as fair, nearly reaching the good range.

• Approval for credit cards, auto loans, and mortgages is possible, though not at the best rates.

• Increasing the score by 10 points might lead to better loan terms and savings.

• FHA loans require a minimum score of 580, with a 3.5% down payment.

• Conventional loans often demand a score of 670 for the most favorable rates.

What Does a 660 Credit Score Mean?

The two most popular consumer credit companies are FICO® and VantageScore®. However, lenders use FICO more widely, with most — 90% to be exact — using FICO Scores. To simplify matters, this article focuses solely on FICO scoring models.

Generally, when it comes to credit score ranges, you can have a score that’s anywhere between 300 to 850. A 300 credit score is your lowest score, while an 850 is the highest. Let’s take a closer look at these FICO Score ranges:

• Poor: 300-579

• Fair: 580-669

• Good: 670-739

• Very Good: 740-799

• Excellent: 800-850

So, a 660 score is considered a fair credit score. However, it’s close to a credit score in the good range. For context: in 2023, the average credit score for the U.S. consumer was 715, which puts most American consumers squarely in the good zone.

💡 Quick Tip: Before choosing a personal loan, ask about the lender’s fees: origination, prepayment, late fees, etc. SoFi personal loans come with no-fee options, and no surprises.

What Else Can You Get with a 660 Credit Score?

Is a 660 credit score good? Not quite. You need a 670 to qualify for that designation. A 660 credit score, however, can likely get you approved for many things: credit cards, auto loans, and mortgages, to name a few. Note that depending on the lender and their requirements, you may qualify for a personal loan as well.

You’ll learn about getting approved for these different forms of credit and loans in a bit. But to reiterate an important point first: While there are overall ranges for minimum credit requirements for different types of financing, the specifics hinge on the lender. Each lender will have varying credit and financial requirements, and they might weigh each factor differently.

Some factors include:

• Employment history

• Income

• Assets

• Debt level

• Whether you’re applying with a co-borrower or cosigner

Recommended: FICO Score vs. Credit Score: What’s the Difference?

Can I Get a Credit Card with a 660 Credit Score?

You can certainly get approved with a 660 score, as there’s no minimum score for a credit card. However, cards with more favorable interest rates, premium rewards, and travel perks are typically reserved for those with higher credit scores.

You most likely won’t be approved for a card with a zero-percent introductory rate, as those cards are reserved for those with a 670 credit score or higher.

Along the same lines, you likely won’t be approved for a balance transfer card. That’s because you usually need a minimum credit score of 670 or higher.

To secure a card with lower interest rates, perks, zero-percent intro rates, or balance transfer cards, you might want to work on building your credit first. Strategies include:

• Always making on-time payments.

• Keeping your credit utilization ratio low, ideally below 30%.

• Keeping older accounts that are in good standing open, as this can extend the length of your credit history.

• Showing you can handle a mix of credit types responsibly, such as lines of credit and installment loans.

• Not applying for too much credit in a short window of time, if possible.

Remember, if you have a 660 credit score, you only need to build it by 10 points to be in the “good credit” range.

Can I Get an Auto Loan With a 660 Credit Score?

You can certainly get an auto loan with that credit score, as qualifications vary by lender. According to the Q2 2025 State of the Automotive Finance Market Report from Experian, 10.86% of new auto loans went to borrowers with near-prime credit scores (601-660). But interestingly, lenders might require you to have a credit score of at least 661 — considered a prime VantageScore — to snag lower interest rates and flexible terms on a car loan.

If you’re teetering on the threshold of that minimum 661+ credit score, it’s a smart idea to work to build your credit.

Can I Get a Mortgage with a 660 Credit Score?

Having a 660 credit score means you can qualify for a mortgage. The minimum credit score requirements for government-backed mortgages are as follows:

• FHA loan: 580 credit score with a 3.5% minimum down payment.

• USDA loan: The USDA doesn’t have a minimum credit score requirement. However, partnering lenders might require a minimum score of 640.

• VA loan: No minimum credit score, but typically requires at least a 640 score.

Though you may be able to qualify for a conventional loan with a credit score of 660, lenders usually require a minimum score of 670 or higher to land the best interest rates and terms. Conventional loans are the most common type of mortgage. So, it’s a good idea to do what you can to build your credit score by a few points.

Can I Get a Personal Loan with a 660 Credit Score?

Getting a personal loan as a member of the 660 credit-score club can be a bit trickier than getting approval for a credit card or car loan. Lenders generally have a minimum credit score of 670. If credit is extended to you, there’s a good chance you will pay a higher interest rate as you’re deemed less creditworthy and, in turn, more risky.

While most personal loans are unsecured, which means you don’t have to offer collateral, secured personal loans do exist. When you offer collateral, the minimum credit score could be lower than for unsecured personal loans.

Recommended: Can I Pay Off a Personal Loan Early?

The Takeaway

Is 660 a good credit score? Technically, a 660 credit score is considered a fair credit score and may qualify you for loans. However, you’d likely net lower interest rates and better terms on credit cards and loans with a higher score.

You’re quite close to entering the threshold for good credit, which is 670. If you aren’t in a rush, building your credit can help you save money and potentially make it easier to get approved for financing in the future.

Think twice before turning to high-interest credit cards. Consider a SoFi personal loan instead. SoFi offers competitive fixed rates and same-day funding. See your rate in minutes.

Photo credit: iStock/Prostock-Studio

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

Disclaimer: Many factors affect your credit scores and the interest rates you may receive. SoFi is not a Credit Repair Organization as defined under federal or state law, including the Credit Repair Organizations Act. SoFi does not provide “credit repair” services or advice or assistance regarding “rebuilding” or “improving” your credit record, credit history, or credit rating. For details, see the FTC’s website .

Non affiliation: SoFi isn’t affiliated with any of the companies highlighted in this article.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

Third Party Trademarks: Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

SOPL-Q425-082