Home Mortgage

Calculator

Our mortgage calculator makes it easy to see how home price, interest rate, and down payment affect your monthly mortgage payment.

How to Use the Mortgage Calculator

Welcome to the SoFi mortgage payment calculator. Whether you have found your dream home or are wondering what your purchase budget should be — or already own a home and are considering a refinance — this calculator will help you determine what your monthly home loan payment will be and how much interest you’ll pay over the life of your loan. Let the number crunching begin.

Step 1: Enter your property value.

Use the value or listed price of your desired home or the current estimated value of the home you wish to refinance.

Step 2: Enter a down payment amount or percent down

Enter a down payment of at least 3%. If you’re considering a mortgage refinance, enter the amount of equity you currently have in your home (subtract the amount you owe on your current mortgage from your home’s estimated current value).

Enter a down payment amount and the mortgage payment calculator will give you the percentage down, and vice versa. So you could also choose to enter a percent down to see what your down payment would need to be. Putting 20% down on a property will allow you to avoid paying private mortgage insurance (PMI), but many homebuyers put down less than 20%, especially if they qualify as first-time homebuyers.

If you think you will need to borrow more than $766,550 to purchase a home, you’re likely a candidate for a jumbo loan and a lender may require you to put down at least 10%. (Some pricier areas have higher minimums for jumbo loans — enter the zip code of the location you’re shopping in at Fannie Mae’s mapping tool to see the jumbo loan number for your area.)

Step 3: Enter an interest rate.

Plug in the day’s average fixed rate for a 15- or 30-year mortgage, or use the rate a lender has suggested you may qualify for.

Step 4: Choose a loan term.

The term is the number of years the loan will last. The lower the term, the higher the monthly payment but the greater the savings in total interest paid.

Understanding the Results

The calculator will immediately show the following results:

• Loan amount: This is the amount you would borrow, also known as the principal.

• Monthly payment: This is what you would pay toward the principal and interest each month. Remember that you will also need to pay for property taxes, homeowners insurance, and perhaps homeowners association (HOA) fees and private mortgage insurance (PMI). Some of these costs will be higher or lower depending on the cost of living in your area.

• Total interest paid: This is the amount of interest paid over the life of the loan.

• Payoff date: Here, the mortgage loan calculator shows the day you’d pay off your mortgage unless you refinanced or paid it off early.

• Amortization chart: This chart shows interest paid, principal paid, and the remaining amount of the loan with each mortgage payment. Move your cursor to the right to see how payments are amortized over time. The amortization chart can also serve as a mortgage payment calculator: As you move your cursor you can see how much money would be required to pay off the principal you owe at different times during the loan. If you do want to pay off your mortgage, get the exact amount due from your lender.

Benefits of Using a Mortgage Payment Calculator

Mortgages can be complicated, especially if you’re buying your first home, but there are many ways a mortgage payment calculator can help. Playing with different property values can give you a general idea of how a home’s price might impact your monthly payments and what a mortgage loan may cost in total over the life of the loan.

It’s also helpful to use a home mortgage calculator to compare the monthly payment for different types of mortgage loans (15- vs. 30-year terms). And it’s useful to see how sizing up (or trimming back) your down payment amount might affect your monthly costs. (If you think you might struggle to come up with any down payment at all, there are down payment assistance programs that can help.)

The only downside of using a mortgage calculator? As noted above, many mortgage calculators don’t include property taxes, homeowners insurance, mortgage insurance, or HOA fees — so they don’t provide a complete picture of the recurring expenses on a property. And of course the numbers you get from a mortgage calculator are only as solid as the numbers you put in: If you put in a low interest rate that you can’t qualify for because of steep debts or a shaky credit history, your actual results in the mortgage market will differ.

Formula for Calculating a Mortgage Payment

The mathematical formula for a home mortgage calculator is pretty complicated, which is why this calculator is so handy. If you wanted to do the math by hand, your formula would look like the one below. In this example:

M = Monthly mortgage payment

P = Principal (the amount you borrow)

R = Your base interest rate. (Use the base rate, not the APR.) You’ll divide this by 12 because the rate is an annual one and you are solving for a monthly payment amount.

N = Number of payments in your loan term. A 15-year term, for example, would have 180 monthly payments.

M = P [R(1 + R)ⁿ] / [(1 + R)ⁿ − 1]²

Deciding How Much House You Can Afford

Using a mortgage calculator is one way to begin to get a handle on how much house you can afford. You can also use a home affordability calculator , which will take into account your annual income and debts to generate a maximum home price that would be within your budget.

There are also longstanding guidelines for homebuyers that can help you determine what you can afford. One is the 28/36 rule, which states that your total mortgage payment, including principal, interest, taxes, and insurance, should not exceed 28% of your gross income, and your mortgage payment plus any other debt payments should not exceed 36% of your gross income. To learn what your monthly limits would be under the 28/36 rule, simply multiply your monthly gross income by 0.28 and again by 0.36.

Recommended: Average Monthly Expenses for One Person

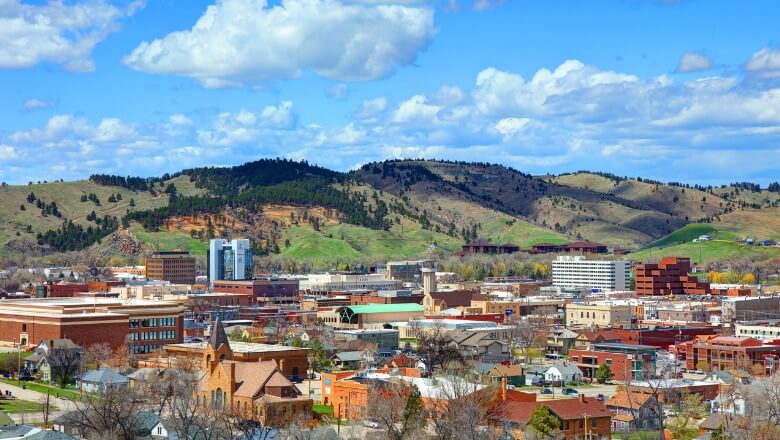

Additionally, before you settle on a location, do your homework on the cost of living and mortgage rates. It might just surprise you.

Current Mortgage Rates by State

How Lenders Decide How Much You Can Afford to Borrow

There’s another important calculation involved in the homebuying process: the number-crunching a prospective lender will do to determine the size of loan and terms you might qualify for. Each lender has its own formula, but in general a lender will be looking at your debt-to-income ratio, which is your total debt divided by your total income, shown as a percentage. (Generally, lenders are looking for 43% or less.)

Lenders will also examine your credit history, your income history, your down payment amount, and other factors to arrive at whether you are a good candidate for a loan and, if so, what terms you’ll be offered.

What’s Next: Get Preapproved for a Mortgage Loan

Once you’ve used a mortgage calculator to estimate how much you might be able to pay for a house, you can get prequalified for a mortgage with a few lenders to obtain a clearer idea of what interest rate and loan amount a lender might offer you, based on a high-level look at your finances. As you get serious about home-shopping, you’ll want to take the next step and get preapproved for a mortgage with at least one lender.

Going through the mortgage preapproval process involves a thorough review of your credit and financial history. If you seem to be a good candidate for a home loan, the lender will give you a letter stating that you qualify for a loan of a certain amount and at a certain interest rate. The letter is an offer, but not a firm commitment. It’s typically good for up to 90 days. If you’re competing with other buyers in a hot market, being preapproved for financing will make you more attractive to sellers.

Recommended: Best Affordable Places in the U.S.

Components of a Mortgage Payment

Principal and interest are the foundation of a mortgage payment, and the amount of your monthly payment that goes to each of these expenses changes over the life of the loan, with more of the payment being applied to interest costs early in the life of the loan. As you make payments over the years, more money will gradually go toward paying down the principal.

Typical Costs Included in a Mortgage Payment

Principal and interest aren’t the whole story. Maybe you’ve heard of PITI, which stands for principal, interest, taxes, and insurance. Property taxes and homeowners insurance costs can often be rolled into mortgage payments. The money is held in an escrow account, and payments are then made by your mortgage servicer. You can decide whether taxes and insurance become part of your monthly mortgage payment when you choose your home mortgage loan.

Tips on Reducing Your Mortgage Payment

After you’ve had your home loan for a while, you might be interested in lowering your mortgage payments. One way is to apply any bonus or windfall to the principal. Another option might be to refinance to a lower interest rate. Maybe rates have dropped or your credit score has improved significantly since you bought your home — in this case, a refinance might offer real savings. You can put a lower interest rate into a mortgage payment calculator to see how a refinance would affect your monthly payments and interest paid over the life of a new loan.

Another way to reduce your monthly payment: If your equity in the home has hit 20% of its original value (the value when you purchased it), you can write to request that your lender cancel PMI. As long as the property has held its value, you have kept current on your monthly payments, and there are no liens or additional mortgages on the home, your request should be granted.

The Takeaway

A mortgage payment calculator can give you an idea of what your monthly mortgage payments would look like based on how much you spend on a house, what size down payment you make, and what interest rate you obtain. It’s also a good way to see how much interest you would pay over the life of a loan. Getting prequalified for a home loan with one or more lenders will give you an even clearer idea. And obtaining a mortgage preapproval will tell you exactly how much you may qualify to borrow from a lender and what your monthly payments might be.

Looking for an affordable option for a home mortgage loan? SoFi can help: We offer low down payments (as little as 3% - 5%*) with our competitive and flexible home mortgage loans. Plus, applying is extra convenient: It's online, with access to one-on-one help.

FAQ

What is a mortgage payment?

A borrower makes monthly payments, typically made up of principal, interest, taxes, insurance, and any private mortgage insurance required by the lender. With a fixed-rate mortgage, monthly payments stay the same, but the amount of each payment that is put toward principal vs. interest is divvied up differently over time. A mortgage loan calculator can show what monthly payments would be based on different loan types and interest rates.

How does my credit score affect my mortgage loan interest rate?

Those with the highest scores get the lowest rates. Even a small increase in rate can make a big difference over the life of a loan.

What is principal and interest on a mortgage loan?

The principal is the amount borrowed. The interest is the price paid for borrowing.

How much should I put down on a mortgage?

Twenty percent down on a conventional loan is ideal, but most people are not able to come up with that much. Some conventional and government-backed loans allow for low down payments or none at all.

Should I choose a 30-year or 15-year mortgage term?

If you can comfortably swing the payments on a 15-year mortgage and you have emergency and retirement savings, the shorter loan term could be a smart choice because the total savings in interest will be substantial.

How can I get a lower mortgage interest rate?

Advertised rates are often misleading, so shoppers beware. Many house hunters ask for loan estimates from several lenders after applying for a mortgage. Be sure to examine the details and compare apples to apples. There may be room to negotiate with a chosen lender. FHA, VA, and USDA loans may have lower rates than conventional loans (but they require either mortgage insurance or fees).

How much income do you need for a $400,000 mortgage?

It would take an annual income of about $130,000 to afford a $400,000 mortgage. If you have significant debts, you might need to earn more.

Can I afford a $300K house on a $70K salary?

One rule of thumb is that your home’s cost should not be more than three times your annual income. So it would be difficult to cover the costs of a $300,000 house on a $70,000 salary — unless you are able to contribute a large down payment. Use a home affordability calculator to zero in on your personal budget number.

What is a livable hourly wage?

The living wage in the United States is $25.02 per hour, or $104,077.70 per year (before taxes) for a household of two working adults and two kids, according to 2022 analysis from the Massachusetts Institute of Technology Living Wage Calculator. This is a national average, and your personal number will depend on costs in your local area and your family size.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

*SoFi requires Private Mortgage Insurance (PMI) for conforming home loans with a loan-to-value (LTV) ratio greater than 80%. As little as 3% down payments are for qualifying first-time homebuyers only. 5% minimum applies to other borrowers. Other loan types may require different fees or insurance (e.g., VA funding fee, FHA Mortgage Insurance Premiums, etc.). Loan requirements may vary depending on your down payment amount, and minimum down payment varies by loan type.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

¹FHA loans are subject to unique terms and conditions established by FHA and SoFi. Ask your SoFi loan officer for details about eligibility, documentation, and other requirements. FHA loans require an Upfront Mortgage Insurance Premium (UFMIP), which may be financed or paid at closing, in addition to monthly Mortgage Insurance Premiums (MIP). Maximum loan amounts vary by county. The minimum FHA mortgage down payment is 3.5% for those who qualify financially for a primary purchase. SoFi is not affiliated with any government agency.

†Veterans, Service members, and members of the National Guard or Reserve may be eligible for a loan guaranteed by the U.S. Department of Veterans Affairs. VA loans are subject to unique terms and conditions established by VA and SoFi. Ask your SoFi loan officer for details about eligibility, documentation, and other requirements. VA loans typically require a one-time funding fee except as may be exempted by VA guidelines. The fee may be financed or paid at closing. The amount of the fee depends on the type of loan, the total amount of the loan, and, depending on loan type, prior use of VA eligibility and down payment amount. The VA funding fee is typically non-refundable. SoFi is not affiliated with any government agency.

Qualifying for the reward requires using a real estate agent that participates in HomeStory’s broker to broker agreement to complete the real estate buy and/or sell transaction. You retain the right to negotiate buyer and or seller representation agreements. Upon successful close of the transaction, the Real Estate Agent pays a fee to HomeStory Real Estate Services. All Agents have been independently vetted by HomeStory to meet performance expectations required to participate in the program. If you are currently working with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®. A reward is not available where prohibited by state law, including Alaska, Iowa, Louisiana and Missouri. A reduced agent commission may be available for sellers in lieu of the reward in Mississippi, New Jersey, Oklahoma, and Oregon and should be discussed with the agent upon enrollment. No reward will be available for buyers in Mississippi, Oklahoma, and Oregon. A commission credit may be available for buyers in lieu of the reward in New Jersey and must be discussed with the agent upon enrollment and included in a Buyer Agency Agreement with Rebate Provision. Rewards in Kansas and Tennessee are required to be delivered by gift card.

HomeStory will issue the reward using the payment option you select and will be sent to the client enrolled in the program within 45 days of HomeStory Real Estate Services receipt of settlement statements and any other documentation reasonably required to calculate the applicable reward amount. Real estate agent fees and commissions still apply. Short sale transactions do not qualify for the reward. Depending on state regulations highlighted above, reward amount is based on sale price of the home purchased and/or sold and cannot exceed $9,500 per buy or sell transaction. Employer-sponsored relocations may preclude participation in the reward program offering. SoFi is not responsible for the reward.

SoFi Bank, N.A. (NMLS #696891) does not perform any activity that is or could be construed as unlicensed real estate activity, and SoFi is not licensed as a real estate broker. Agents of SoFi are not authorized to perform real estate activity.

If your property is currently listed with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®.

Reward is valid for 18 months from date of enrollment. After 18 months, you must re-enroll to be eligible for a reward.

SoFi loans subject to credit approval. Offer subject to change or cancellation without notice.

The trademarks, logos and names of other companies, products and services are the property of their respective owners.

SOHL-Q324-106

You Might Also Like

Understanding the Different Types of Mortgage Loans

The process of applying for a mortgage loan can be complicated, and one of the first steps for a homebuyer is to decide which type… More

Adjustable Rate Mortgage (ARM) vs. Fixed Rate Mortgage

If you’re in the market for a home loan this year, one of your first decisions will be choosing what kind of loan to take out. The most common types of mortgage loans are… More

Home Mortgage Loans: Is 20% Down Dated Advice?

If you’re ready to buy your first home, you’ve likely heard that a 20% down payment on a mortgage is pretty… More

Refinance your way

to a better mortgage

Checking your rates will not affect your credit score✝︎.

Where we lend

SoFi Lending Corp.

SoFi loans are originated through SoFi Bank, N.A., NMLS #696891 (Member FDIC), and through SoFi Lending Corp. NMLS #1121636, a lender licensed by states. SoFi Lending Corp. or an affiliate is licensed to originate mortgages in Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Montana, Nebraska, Nevada, New Jersey, New Hampshire, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, Washington, D.C., West Virginia, Wisconsin, and Wyoming. For information on SoFi Lending Corp. licenses, see Licenses.

View Mortgage Licenses and Eligibility