October 2025 Market Lookback

A Shutdown to Trump All Others

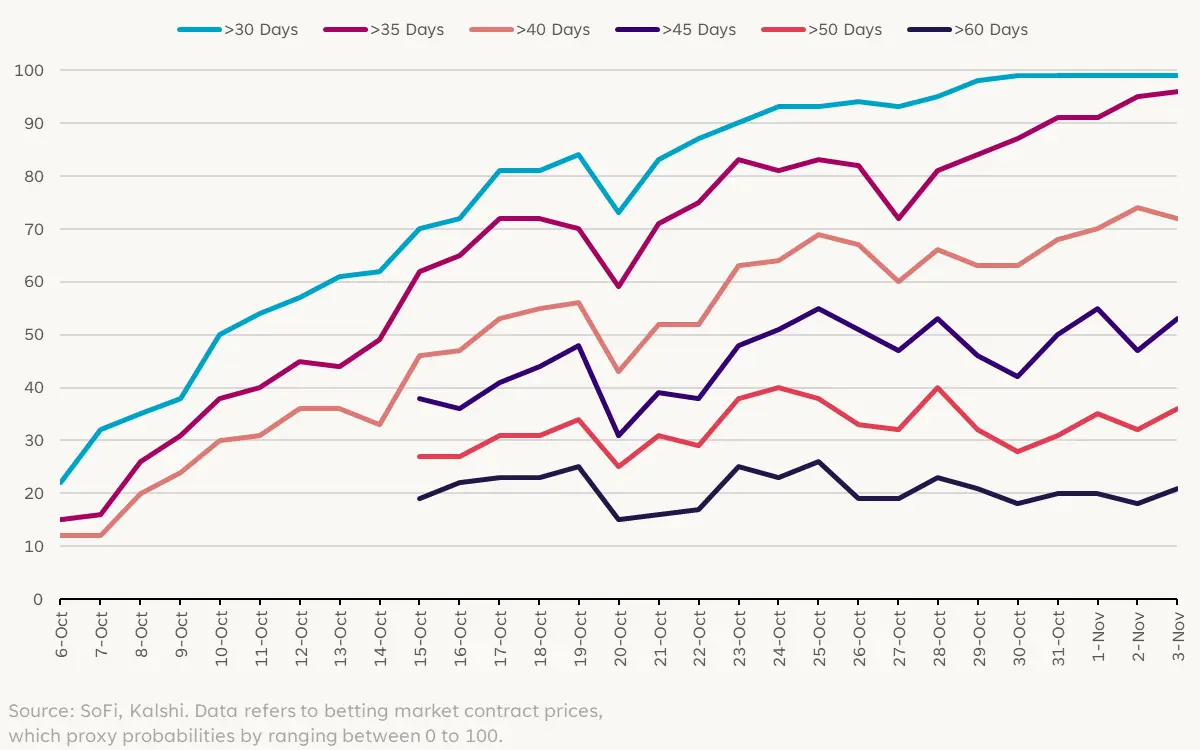

The federal government officially entered a shutdown at 12:01 a.m. ET on Oct. 1, the 11th such event involving furloughs in U.S. history. As usual, the lapse in federal funding stems from partisan politics. The shutdown is on track to become the longest government shutdown in U.S. history, surpassing the 35-day record set in 2018-19.

The human and economic costs are vast and grow more severe the longer they last.

The Bipartisan Policy Center estimates that 670,000 federal employees have been furloughed, while another 730,000 are required to work without pay. Exact figures are hard to pin down, but consensus suggests that shutdowns lower GDP by 0.1 to 0.2 percentage points for every week they go on.

It’s already lasted over four weeks, and betting markets suggest roughly even odds that the shutdown lasts somewhere between 45 and 50 days, which would bring us to mid-November — a little over a week before Thanksgiving. Though shutdowns have historically had a limited and temporary impact on the stock market, the longer this one lasts, the harder it is to imagine it not being consequential.

How Many Days Will the Government Be Shut Down This Year?

Euphoria: Earned or Borrowed?

Last month, while Washington grappled with internal dysfunction (what’s new?), the market was focused on other things.

Trade tensions with China briefly ratcheted higher when President Trump threatened the country with an additional 100% tariff. Stocks initially fell sharply on the news, but two things may have led to a fairly quick reversal. First, Trump began to walk back the threat in a move reminiscent of TACO summer. Perhaps more importantly, however, earnings season began, and the results were mostly stellar. This helped offset macroeconomic uncertainty and reinforced the powerful narrative around artificial intelligence, which has driven investor optimism all year long.

The strength of Q3 2025 earnings season was evident. With nearly half of S&P 500 companies reporting in October, 82.8% reported higher-than-expected earnings per share, substantially above the 5-year and 10-year averages of 78.6% and 76.3%, respectively. If sustained for the rest of the Q3 earnings season, that would mark the best performance since the second quarter of 2021.

Alongside this fundamental strength, the market turned notably speculative. Lower quality and higher beta stocks surged, with investors increasingly willing to chase momentum in a possible sign of fear of missing out (FOMO).

% of Companies With Positive EPS Surprises

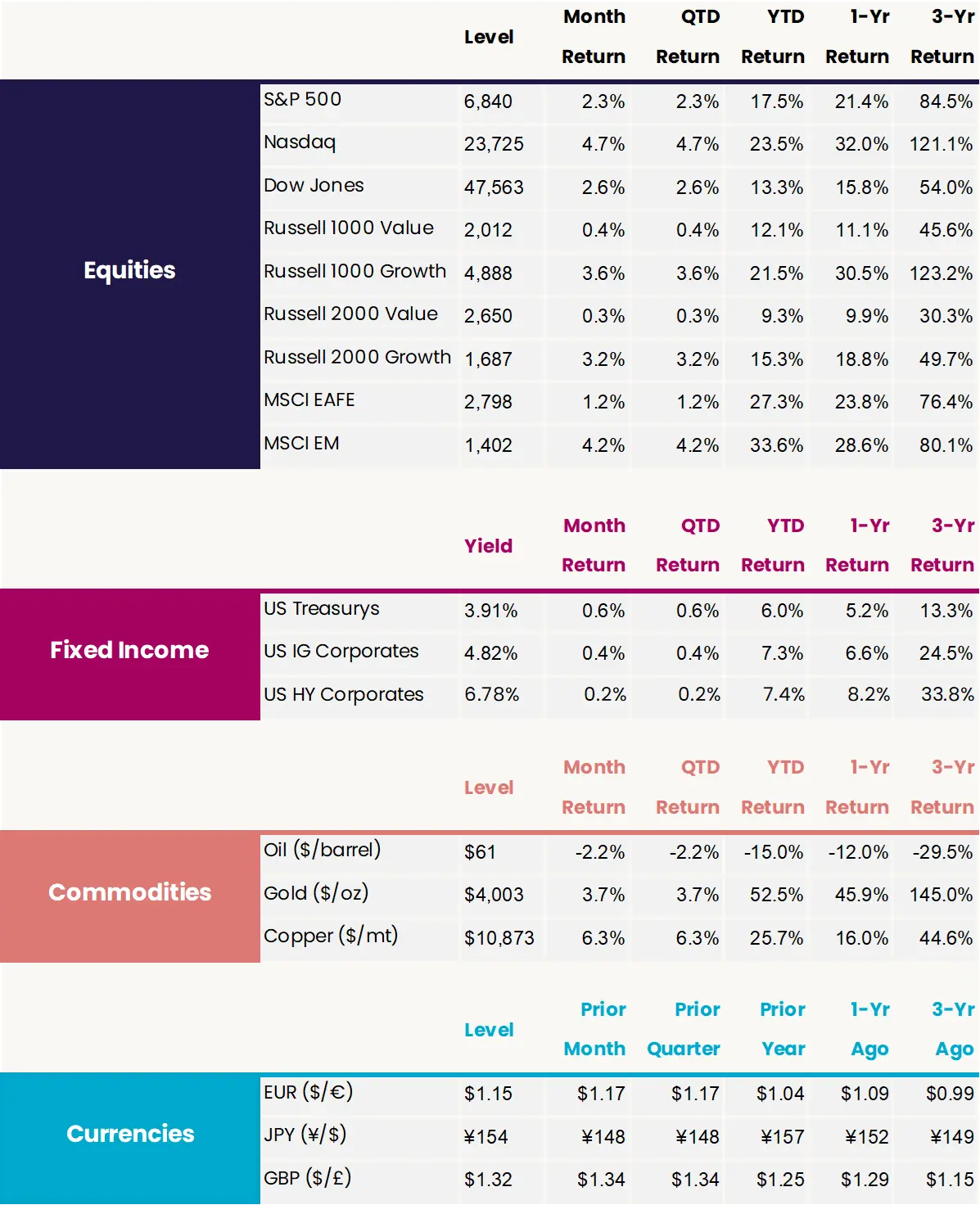

Market Recap

Asset Returns

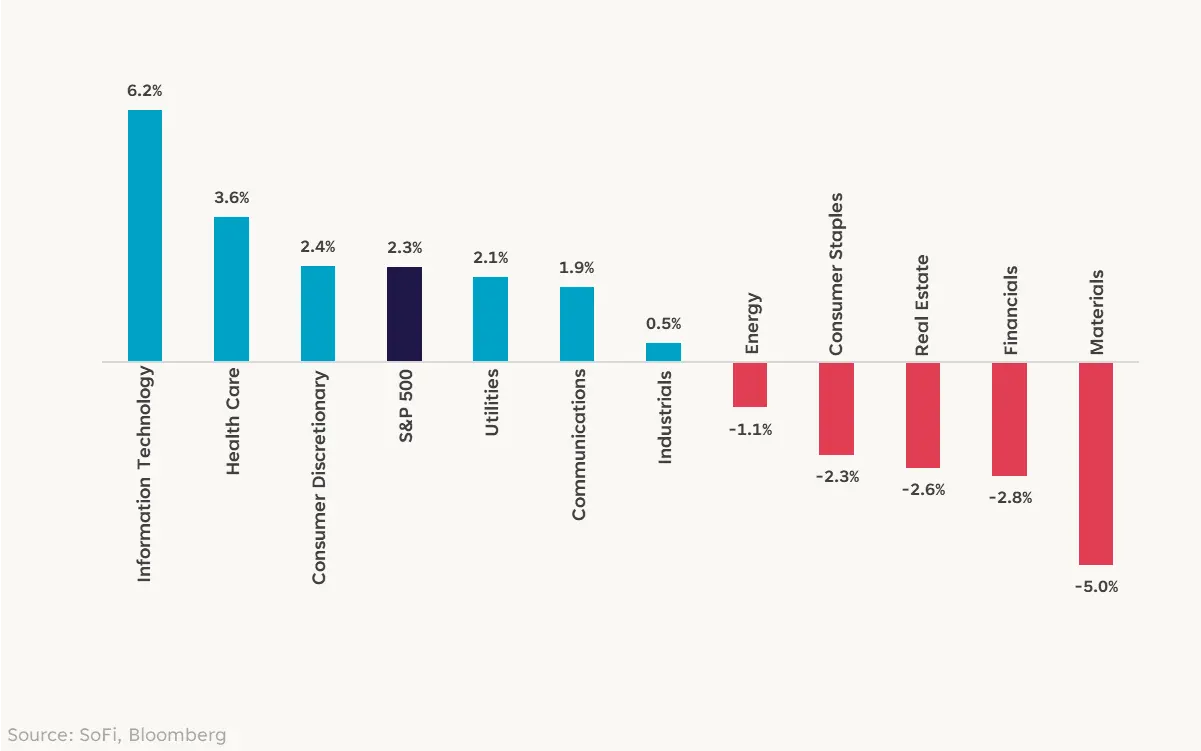

October 2025 Sector Total Returns

Macro

• Federal funding lapsed on October 1, the start of the fiscal year, leading to the U.S. government shutting down.

• The Federal Reserve lowered its benchmark interest rate by 25 basis points to a target range of 3.75%-4%. Two dissents to the decision were noted, with one official preferring a 50 basis point cut and the other preferring no cut.

• The Fed also announced it would end balance sheet runoff on December 1, reinvesting any proceeds from maturing Treasurys and mortgage-backed securities into Treasury bills.

• The September Employment Situation Report, in addition to most official economic data, was not released due to the ongoing government shutdown.

• September CPI came in at 0.3% m/m and 3.0% y/y, the highest annual rate since January.

• In one of its most volatile months ever, gold rose 14.3% to $4,381 on October 20 and then proceeded to decline 11.3% to $3,886 on October 28, before ending the month up 3.7%.

Equities

• With over 65% of the S&P 500 having reported results, the earnings surprise rate stands at 8.6%, in-line with the five-year average.

• The Information Technology sector beat the broader market by 3.9 percentage points, its sixth month of outperformance in the last seven.

• Emerging market stocks rose 4.2% despite dollar appreciation, powered by strong tech sector gains from Taiwan and South Korea.

• Cyclical stocks underperformed defensives by 2.1 percentage points through October 22, before then outperforming by 4.3 percentage points and finishing the month ahead, the sixth consecutive such month.

Fixed Income

• Though High Yield corporate bond spreads ended the month at 267 basis points (exactly where they began the month), they briefly widened to 304 basis points on October 10 after President Trump’s 100% tariff threat on China.

Performance data quoted represents past performance. Past performance does not guarantee future results. Market returns will fluctuate, and current performance may be lower or higher than the standardized performance data quoted.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser. Information about SoFi Wealth’s advisory operations, services, and fees is set forth in SoFi Wealth’s current Form ADV Part 2 (Brochure), a copy of which is available upon request and at www.adviserinfo.sec.gov. Mario Ismailanji is a Registered Representative of SoFi Securities and Investment Advisor Representative of SoFi Wealth. Form ADV 2A is available at www.sofi.com/legal/adv.

Read more