Preparing to buy a house? Call us for a complimentary mortgage consultation.

Compare mortgage rates in Nebraska.

Key Points

• Mortgage rates in Nebraska are sometimes slightly higher and sometimes slightly lower than the national average but the overall cost of living in the state is relatively low.

• Factors affecting mortgage rates in Nebraska include economic factors (inflation, unemployment rate, overall economy), consumer factors (credit score, down payment amount), and type of mortgage (fixed-rate or adjustable-rate).

• Nebraska offers various government-backed mortgage types, including FHA, VA, and USDA loans, each with its own benefits and requirements.

• To secure a competitive mortgage rate in Nebraska, compare interest rates and fees from multiple lenders and explore first-time homebuyer programs and down payment assistance programs.

Introduction to Mortgage Rates

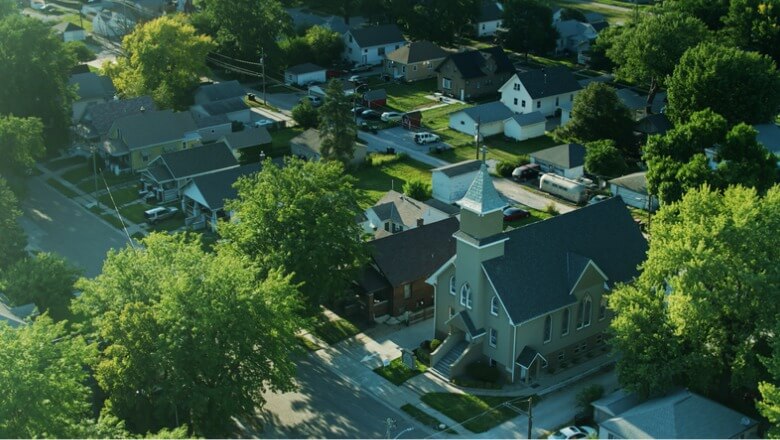

Nebraska’s mortgage landscape offers a range of options for homebuyers in search of a home loan. By staying informed about current mortgage rates, taking good care of their personal finances, and exploring homebuyer assistance programs, would-be homeowners can achieve successful homeownership in this friendly Midwestern state.

Where Mortgage Rates Come From

Mortgage rates are not set in stone but rather calculated using a complex combination of factors drawn from the state of the general economy and the borrower’s personal financial status.

How Interest Rates Affect Home Affordability

Mortgage rates have a noticeable impact on home affordability. For example, let’s say you’re looking to buy a $425,000 home with a 30-year fixed-rate mortgage and a down payment of 20%. If the interest rate is 5.50%, your monthly payment will be $1,930. But if the interest rate rises to 6.00%, your monthly payment will jump to $2,038. Over the life of the loan, you’ll pay almost $39,000 more interest for that half-percentage-point increase. That’s a significant amount of money that could be used for other things.

Should Homebuyers Wait for Interest Rates to Drop?

Particularly if you’re buying your first home, you may be wondering if you should buy now or wait for interest rates to come down. There’s no easy answer to this question. If you’re not in a hurry to buy a home, it may make sense to wait and see if interest rates drop. However, there’s no guarantee that rates will go down, and either interest rates or home prices (or both!) could even go up in the meantime.

If you’ve found a home that you love, it may be best to go ahead and buy it, even if the interest rate is a little higher than you’d like. You can always do a mortgage refinance later if rates come down.

Nebraska Mortgage Rate Trends

Understanding historical mortgage rates in the Cornhusker state can provide valuable insights. While rates nationwide have risen in recent years, they remain below historical highs. The average rate in Nebraska is sometimes slightly above the national average and sometimes below it, but it rarely deviates far from the national number. (The Federal Housing Finance Agency stopped tracking the state averages after 2018.)

Historical Interest Rates in Nebraska

| Year | Nebraska Rate | U.S. Rate |

|---|---|---|

| 2000 | 8.07 | 8.14 |

| 2001 | 6.96 | 7.03 |

| 2002 | 6.57 | 6.62 |

| 2003 | 5.79 | 5.83 |

| 2004 | 5.82 | 5.95 |

| 2005 | 5.91 | 6.00 |

| 2006 | 6.47 | 6.60 |

| 2007 | 6.35 | 6.44 |

| 2008 | 6.08 | 6.09 |

| 2009 | 5.14 | 5.06 |

| 2010 | 4.95 | 4.84 |

| 2011 | 4.62 | 4.66 |

| 2012 | 3.68 | 3.74 |

| 2013 | 3.83 | 3.92 |

| 2014 | 4.24 | 4.24 |

| 2015 | 3.92 | 3.91 |

| 2016 | 3.78 | 3.72 |

| 2017 | 3.98 | 4.03 |

| 2018 | 4.61 | 4.57 |

Historical U.S. Mortgage Rates

For a broader perspective, it’s beneficial to examine historical U.S. mortgage rates. Over the past several decades, mortgage rates have experienced periods of both highs and lows, influenced by the various economic factors we explained above.

Factors Affecting Mortgage Rates in Nebraska

Economic Factors

• The Federal Reserve:. The federal funds rate, governed by “the Fed”, serves as a benchmark for other interest rates, including mortgage rates. When the Fed’s interest rate is high, chances are mortgage rates will be too, as banks and other lenders use the federal funds rate as a benchmark when setting their own interest rates.

• Inflation: When inflation rises, the Fed purchasing power of money decreases, making it more expensive for lenders to lend money. As a result, they may increase interest rates to compensate.

• Unemployment: When unemployment is low, the Fed might raise its benchmark rate to help prevent inflation. Mortgage rates then tend to rise. (A low unemployment rate may also lead to increased demand for housing, which puts upward pressure on home prices, further complicating things for buyers.)

Consumer Factors

• Credit score: A higher credit score generally results in a lower mortgage interest rate.

• Down payment: Increasing the down payment can reduce the mortgage interest rate.

• Income and assets: A steady income is important to lenders, who will check your employment history as well as your salary. Assets like investments and emergency savings also reassure lenders that you could still pay your mortgage in the case of a job loss or other financial setback. To secure a borrower with solid income and assets, a lender might offer its most attractive rate.

• Type of mortgage loan: Certain types of mortgages tend to have lower rates. For instance, adjustable-rate mortgages typically offer lower initial rates than fixed-rate mortgages. Some government-backed loans, like VA mortgages, can also have lower rates. And shorter loan terms usually come with lower rates than longer terms (although the monthly payment may be higher with a shorter term).

Recommended: Average Monthly Expenses for One Person

Types of Mortgages Available in Nebraska

Various mortgage types — including fixed-rate, adjustable-rate, and government-backed loans — are available to meet the needs of different homebuyers in Nebraska.

Fixed-Rate Mortgage

Fixed-rate mortgages maintain the same interest rate throughout the life of the loan, ensuring that the principal and interest payments remain constant. Fixed-rate mortgages are available in terms of 10, 15, 20, or 30 years.Adjustable-Rate Mortgage (ARM)

Adjustable-rate mortgages (ARMs) initially tend to offer a lower rate than fixed-rate loans. This can be beneficial if you’re planning to sell before the fixed-rate period ends, or if you can handle the uncertainty associated with a rate that might rise after the first few years.

An ARM is labeled with two numbers, such as a 5/1 ARM. The first is the number of the years in the introductory period (5, 7, and 10 year ARMS are the most common). The second is the period when the interest rate will reset. So a 5/1 ARM has a 5-year introductory period, followed by one adjustment per year. A 7/6 ARM has a 7-year introductory period, followed by interest rate adjustments every 6 months.

FHA Loan

Backed by the Federal Housing Administration, FHA loans typically have more lenient eligibility requirements than conventional loans because the FHA’s backing helps reduce the risk to lenders.

VA Loan

VA loans, backed by the U.S. Department of Veterans affairs, are available to qualifying veterans, active-duty military members, Reserve and National Guard members, as well as surviving spouses. One of the most attractive things about VA loans is that they do not require a down payment.

USDA Loan

USDA loans are designed for borrowers who earn below a specific income limit and who are looking to purchase a home in a rural area. These loans are backed by the U.S. Department of Agriculture. If you are eligible, one perk of these mortgages is that private mortgage insurance (PMI) is not required.

Jumbo Loan

Conventional mortgage loans have a cap of $832,750 for a single-family home. Jumbo loans are conventional loans that exceed this amount. In very expensive markets, such as Hawaii, the conventional loan cap can be up to $1,249,125, but throughout Nebraska it is $832,750.

Current mortgage rates by state.

Compare current home interest rates by state and find a mortgage rate that suits your financial goals.

Select a state to view current rates:

Popular Places to Get a Mortgage in Nebraska

Securing a mortgage often depends on choosing the right location, where home prices are affordable, the cost of living is low, mortgage terms are favorable — or all of the above. In recent years, Nebraska has seen a growing population in the “exurbs” of large cities such as Omaha and Lincoln. Population growth was significant in Plattsmouth, Valley, Fremont, and Ashland, for example. Here are some of the least and most expensive places to get a mortgage in the state:

Least Expensive Locations

Nebraska’s place in the cost of living in the U.S. rankings is on the affordable side. The following are some of the least expensive places to get a mortgage in Nebraska:

• Kearney, with a cost of living 14 points below the national average, is also a good choice for those looking for an affordable home purchase.

• Lexington is not far from Kearney and is one of the most affordable places in the state, with a cost of living 20 points below the U.S. average.

Small cities tend to offer lower home prices and more affordable mortgage rates than the larger cities in Nebraska. However, they may have fewer housing options and less diverse economies.

Most Expensive Locations

The following are some of the most expensive places to get a mortgage in Nebraska:• Omaha ranks near the top of priciest cities in Nebraska but it is still below the U.S. national average cost of living.

• Lincoln, like Omaha, is more expensive by Nebraska standards but cheaper than the national average.

• Bellevue is the most expensive city in Nebraska.

These cities offer higher home prices and more expensive mortgage rates than the rest of the state. However, they also have strong economies and job markets, which makes them attractive places to live and work.

Recommended: Best Affordable Places in the U.S.

Tips for Securing a Competitive Mortgage Rate in Nebraska

A competitive mortgage rate is crucial for saving money over the life of a loan. Here are a few tips for securing a competitive mortgage rate in Nebraska:

Compare Interest Rates and Fees

Take the time to compare interest rates and fees from multiple lenders. Be sure to ask about any upfront costs or closing fees associated with the loan and factor those into your calculations.

Get Preapproved

Going through the mortgage preapproval process and getting an approval letter from a lender strengthens your position as a buyer and allows you to move quickly when you find the right property. If you’re worried about interest rates rising, you can pay a fee to the lender to lock in your rate for up to 90 days.

Nebraska Mortgage Resources

Nebraska offers various resources and programs to assist homebuyers, particularly first-time buyers and those with limited financial resources.

First-Time Homebuyer Programs

The First Home program can help those who qualify as a first-time homebuyer in Nebraska. The state’s Welcome Home program can help both first-time and repeat buyers who fall within certain income limits. First-timers will be required to take a homebuyer education program before the closing.

Down Payment Assistance

Down-payment assistance programs can give homebuyers in Nebraska a leg up as well. Check into the Nebraska Homebuyer Assistance Program .

Tools & Calculators

The following tools and calculators can help homebuyers in Nebraska:

Run the numbers on your home loan.

-

Mortgage calculator

Punch in your home loan amount and a new interest rate, and we’ll estimate your payoff date.

-

Down payment calculator

Enter a few details about your home loan and we’ll provide your monthly mortgage payment.

-

Home affordability calculator

Provide us with a few details and see how much you can afford to spend on a home purchase.

Using the free calculators is for informational purposes only, does not constitute an offer to receive a loan, and will not solicit a loan offer. Any payments shown depend on the accuracy of the information provided.

Refinancing Options in Nebraska

A mortgage refinance can be a smart way to lower your interest rate, reduce your monthly payments, or cash out some of your home equity. Here are a few refinancing options available in Nebraska:

FHA Streamline Refinance

The FHA Streamline Refinance allows FHA-insured homeowners to refinance into current mortgage rates with minimal hassle. This type of refinance does not require a new appraisal or credit check, making it a quick and easy way to lower your interest rate.

VA Streamline Refinance

This interest-rate reduction refinance loan (IRRRL) can reduce the monthly payments on VA loans by adjusting the APR. IRRRLs do not require a new appraisal or credit check, making them a convenient option for VA loan holders looking to lower their interest rate.

Cash-Out Refinance

With a cash-out refi, you take out a new mortgage for a larger amount than what you have left on your current mortgage and receive the excess as cash. You can use the cash for remodeling, debt consolidation, or paying for college costs.

Closing Costs, Taxes, and Fees in Nebraska

Buyers in Nebraska can expect to pay between 2%-6% of the home’s purchase price in closing costs. Closing costs include a variety of fees, such as the loan origination fee, appraisal fee, title insurance, and recording fees. These costs vary depending on the lender, the loan amount, and the property location.

The Takeaway

Nebraska’s mortgage landscape offers a range of options for homebuyers. By staying informed about current mortgage rates, exploring assistance programs, and carefully considering refinancing options, individuals can make informed decisions that align with their goals and feel comfortable about their finances while settling into a new home.

Looking for an affordable option for a home mortgage loan? SoFi can help: We offer low down payments (as little as 3% - 5%*) with our competitive and flexible home mortgage loans. Plus, applying is extra convenient: It's online, with access to one-on-one help.FAQ

Will mortgage rates drop in Nebraska?

It is difficult to predict whether mortgage rates will drop in Nebraska. Mortgage rates are influenced by a variety of factors, including the federal funds rate, inflation, and the unemployment rate — not to mention a borrower’s personal financial profile.

Will mortgage rates ever go back to normal?

Don’t focus on “normal” — just look for a home and a mortgage you can afford. Normal is a relative term, and mortgage rates have fluctuated significantly over the years.

Will Nebraska home prices ever drop?

It is difficult to predict whether Nebraska home prices will drop — so much depends on the local housing market, both supply and demand. If you truly need to move and you feel prices are high, search out a trusted real estate agent to ask for the inside scoop on the market you’re interested in.

Is it a good time to buy a house in Nebraska?

Whether it is a good time to buy a house in Nebraska depends on your individual circumstances. If you are financially stable and have a good credit score, you may be able to get a good interest rate on a mortgage. However, if you are not sure about your financial future, it may be best to wait before buying a house.

How do I lock in a mortgage rate?

You can lock in a mortgage rate by getting a mortgage rate lock from a lender. A mortgage rate lock guarantees that you will get a specific interest rate on your mortgage for a certain period of time. This can protect you from rising interest rates.

How do mortgage interest rates work?

Mortgage interest rates are determined by a variety of factors, including the federal funds rate, inflation, and the unemployment rate. When these factors change, mortgage interest rates could also change. Mortgage interest rates are also affected by the borrower’s credit score, down payment, and loan amount, among other personal factors.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

*SoFi requires Private Mortgage Insurance (PMI) for conforming home loans with a loan-to-value (LTV) ratio greater than 80%. As little as 3% down payments are for qualifying first-time homebuyers only. 5% minimum applies to other borrowers. Other loan types may require different fees or insurance (e.g., VA funding fee, FHA Mortgage Insurance Premiums, etc.). Loan requirements may vary depending on your down payment amount, and minimum down payment varies by loan type.

Non affiliation: SoFi isn’t affiliated with any of the companies highlighted in this article.Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

Qualifying for the reward requires using a real estate agent that participates in HomeStory’s broker to broker agreement to complete the real estate buy and/or sell transaction. You retain the right to negotiate buyer and or seller representation agreements. Upon successful close of the transaction, the Real Estate Agent pays a fee to HomeStory Real Estate Services. All Agents have been independently vetted by HomeStory to meet performance expectations required to participate in the program. If you are currently working with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®. A reward is not available where prohibited by state law, including Alaska, Iowa, Louisiana and Missouri. A reduced agent commission may be available for sellers in lieu of the reward in Mississippi, New Jersey, Oklahoma, and Oregon and should be discussed with the agent upon enrollment. No reward will be available for buyers in Mississippi, Oklahoma, and Oregon. A commission credit may be available for buyers in lieu of the reward in New Jersey and must be discussed with the agent upon enrollment and included in a Buyer Agency Agreement with Rebate Provision. Rewards in Kansas and Tennessee are required to be delivered by gift card.

HomeStory will issue the reward using the payment option you select and will be sent to the client enrolled in the program within 45 days of HomeStory Real Estate Services receipt of settlement statements and any other documentation reasonably required to calculate the applicable reward amount. Real estate agent fees and commissions still apply. Short sale transactions do not qualify for the reward. Depending on state regulations highlighted above, reward amount is based on sale price of the home purchased and/or sold and cannot exceed $9,500 per buy or sell transaction. Employer-sponsored relocations may preclude participation in the reward program offering. SoFi is not responsible for the reward.

SoFi Bank, N.A. (NMLS #696891) does not perform any activity that is or could be construed as unlicensed real estate activity, and SoFi is not licensed as a real estate broker. Agents of SoFi are not authorized to perform real estate activity.

If your property is currently listed with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®.

Reward is valid for 18 months from date of enrollment. After 18 months, you must re-enroll to be eligible for a reward.

SoFi loans subject to credit approval. Offer subject to change or cancellation without notice.

The trademarks, logos and names of other companies, products and services are the property of their respective owners.

SOHL-Q324-082

More home loan resources.

-

First-Time Homebuyer Guide

-

First-Time Homebuyer Programs and Loans

-

Mortgage Preapproval Process