Preparing to buy a house? Call us for a complimentary mortgage consultation.

Compare mortgage rates in South Dakota.

Key Points

• Mortgage rates in South Dakota tend to trend below the U.S. average and the state has a low cost of living.

• Mortgage rates are influenced by economic conditions, consumer behavior, and Federal Reserve actions.

• Higher interest rates make homes less affordable, while lower rates make them more affordable.

• Economic factors (inflation, unemployment, housing market strength) and consumer factors (credit score, down payment, loan-to-value ratio) affect mortgage rates.

• South Dakota offers various mortgage types, including fixed-rate mortgages, adjustable-rate mortgages, FHA loans, VA loans, USDA loans, and jumbo loans.

Introduction to Mortgage Rates

Obtaining a mortgage is a crucial step in the homebuying process, and understanding how mortgage interest rates are determined is essential for making informed financial decisions. Mortgage rates are not static; they fluctuate based on various economic indicators and the borrower’s financial profile. Before you begin looking for a home and a mortgage in South Dakota, study this guide so you — and your finances — are prepared.

Where Do Mortgage Rates Come From?

Mortgage rates are determined by a complex interplay of factors that can be broadly categorized into two groups: the state of the economy and the individual borrower’s financial status. Economic factors include the Federal Reserve’s interest rate decisions, inflation, and unemployment rates.

While these economic factors are not within the individual borrower’s control, the borrower’s personal financial profile also plays a significant role in determining what mortgage interest rate they’re offered for their specific home loan. We’ll dig into that further below.

How Interest Rates Affect Home Affordability

Mortgage rates have a significant impact on home affordability, even more so than many people realize. Even a small change in the interest rate can make a substantial difference in the monthly mortgage payment and the overall cost of the loan. For many middle-income Americans in recent years, a combination of rising home prices and increasing mortgage rates has put homeownership out of reach.

Should Homebuyers Wait for Interest Rates to Drop?

Many homebuyers wonder whether they should get into the market or wait for interest rates to come down. While it’s tempting to wait for a more favorable rate, it’s important to remember that predicting interest rate movements is notoriously difficult. Rates can remain high for an extended period, or they may drop but then rise again.

Moreover, sitting out when you are buying your first home means you will delay building equity. You also risk the possibility that home prices could increase further while you are waiting for mortgage rates to drop.

If you are nervous about waiting, remember that you could always think about a mortgage refinance in the future. If rates drop after you purchase your home, you can work with a lender to determine whether refinancing would reduce your monthly payments.

Recommended: Average Monthly Expenses for One Person

South Dakota Mortgage Rate Trends

Taking a look at the historical mortgage rate trends in South Dakota and nationally can provide insights into present-day rates. As you can see below, South Dakota’s average rate is typically below the U.S. average. This is in keeping with the cost of living in the state, which is virtually the lowest in the country (only Arkansas has a lower cost of living).

| Year | Utah Rate | U.S. Rate |

|---|---|---|

| 2000 | 8.11 | 8.14 |

| 2001 | 6.91 | 7.03 |

| 2002 | 6.51 | 6.62 |

| 2003 | 5.56 | 5.83 |

| 2004 | 5.66 | 5.95 |

| 2005 | 5.72 | 6.00 |

| 2006 | 6.40 | 6.60 |

| 2007 | 6.30 | 6.44 |

| 2008 | 5.91 | 6.09 |

| 2009 | 4.94 | 5.06 |

| 2010 | 4.68 | 4.84 |

| 2011 | 4.41 | 4.66 |

| 2012 | 3.56 | 3.74 |

| 2013 | 3.79 | 3.92 |

| 2014 | 4.21 | 4.24 |

| 2015 | 3.93 | 3.91 |

| 2016 | 3.69 | 3.72 |

| 2017 | 3.99 | 4.03 |

| 2018 | 4.68 | 4.57 |

Historical U.S. Mortgage Rates

Looking at the average U.S. mortgage rate over several decades also provides perspective. Even if rates feel high in the present, they aren’t in the double-digit territory they were back in the 1980s.

Factors Affecting Mortgage Rates in South Dakota

Let’s take a look at the two buckets of factors that influence mortgage rates. As mentioned above, they are economic and consumer factors.

Economic Factors

The South Dakota mortgage market is influenced by the same economic factors that affect mortgage rates nationwide. These include:

• The Federal Reserve: The Fed’s monetary policy decisions have a direct impact on mortgage rates. When the Fed lowers rates, mortgage rates tend to follow.

• Inflation: Rising inflation can lead to higher mortgage rates, as lenders adjust their rates to compensate for the reduced purchasing power of money.

• Unemployment: High unemployment may lead the Fed to lower rates to try to spark job creation. (However, a low unemployment rate, indicative of a strong economy, can mean increased demand for housing.)

Consumer Factors

In addition to economic factors, several consumer-specific factors also influence mortgage rates in South Dakota:

• Credit score: A higher credit score generally results in a lower mortgage interest rate, as it indicates a lower risk of default for the lender.

• Down payment: Increasing the down payment can trigger a lower mortgage interest rate, as it reduces the loan amount and demonstrates the borrower’s financial commitment.

• Income and assets: A steady income and sufficient assets provide reassurance to lenders that the borrower can meet the mortgage payments even in challenging circumstances.

• Type of mortgage loan: Certain types of mortgages, such as adjustable-rate mortgages (ARMs) and government-backed loans, may have different interest rates compared to conventional fixed-rate mortgages.

Types of Mortgages Available in South Dakota

Homebuyers in South Dakota have access to various mortgage types, each with its own characteristics and benefits. These include:

Fixed-Rate Mortgage

A fixed-rate mortgage offers a consistent interest rate throughout the life of the loan, providing stability and predictability in monthly payments. Fixed-rate mortgages are available in terms of 10, 15, 20, or 30 years.

Adjustable-Rate Mortgage (ARM)

An adjustable-rate mortgage (ARM) initially offers a lower interest rate compared to a fixed-rate mortgage. However, the interest rate can fluctuate over time, typically based on a financial index. ARMs can be beneficial for borrowers who plan to sell their home before the fixed-rate period ends.

FHA Loans

Backed by the Federal Housing Administration (FHA), FHA loans are designed to make homeownership more accessible for borrowers with limited financial resources. FHA loans typically have more lenient credit and income requirements compared to conventional loans.

VA Loans

VA loans are available to eligible veterans, active-duty military members, Reserve and National Guard members, and surviving spouses. VA loans offer competitive interest rates and do not require a down payment, making them an attractive option for borrowers. To determine if they might be eligible for a VA loan, borrowers apply to the VA for a Certificate of Eligibility.

USDA Loans

USDA loans are designed for borrowers with income below a certain threshold who are looking to purchase a home in a rural area. USDA loans are backed by the U.S. Department of Agriculture (USDA) and offer competitive interest rates with no down payment requirement.

Jumbo Loans

Jumbo loans are conventional mortgage loans that exceed the conforming loan limit set by the Federal Housing Finance Agency (FHFA). In South Dakota, as in most of the U.S., the conforming loan limit for a single-family home is $832,750. Borrowers who need a mortgage above this limit should seek out a jumbo loan and may have to meet stricter eligibility requirements.

Current mortgage rates by state.

Compare current home interest rates by state and find a mortgage rate that suits your financial goals.

Select a state to view current rates:

Popular Places to Get a Mortgage in South Dakota

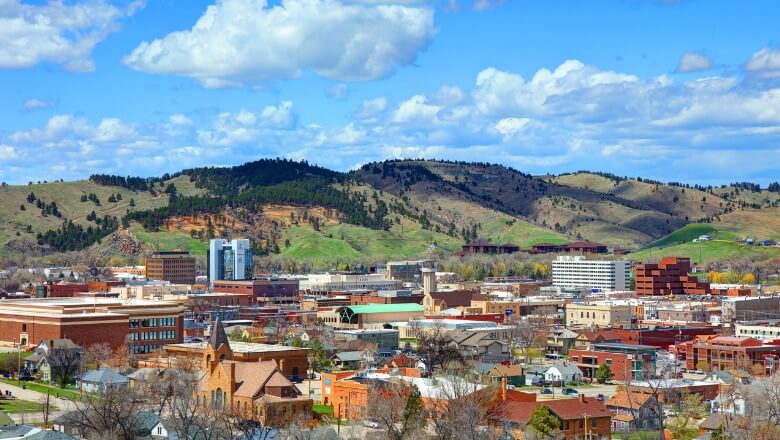

Securing a mortgage often depends on choosing the right location, where home prices are affordable. The average South Dakota home value is $307,799, according to Zillow. Popular places to get a mortgage are Sioux Falls (the largest city) and Rapid City (the second largest). Let’s look at where homes might be most affordable, as well as where the costs are highest:

Least Expensive Locations

For homebuyers looking for the best affordable places in the U.S., South Dakota offers many options. Here are some places where the costs of living and home values are both on the less-expensive side:

• Sioux Falls: The cost of living here is 16 points below U.S. average even though it’s a little above average for South Dakota. The city made SoFi’s list of best affordable places in South Dakota in part because its size offers many options for homebuyers. The average home value here is $325,716.

• Vermillion: Located near the banks of the Missouri River, it has a historic downtown district with specialty shops, galleries, dining and more. Vermillion is one of the lowest cost-of-living locations in this already-affordable state.

• Pierre: Pierre also has an affordable cost of living, even though it is the capital of South Dakota. Near the Missouri River, it’s still a relatively small town.

Most Expensive Locations

As mentioned above, South Dakota is one of the country’s more affordable places to put down roots. So even some of its more expensive home markets aren’t as high as those elsewhere.

• Keystone: The average home value here is $607,380.

• Colonial Pine Hills: The average home value in this Rapid City suburb is $581,468.

• Henry: Its average home value is $551,712.

Recommended: The Cost of Living in the U.S.

Tips for Securing a Competitive Mortgage Rate in South Dakota

Obtaining a competitive mortgage rate can save you thousands of dollars over the life of your loan. Here are some tips to help you secure the best possible rate in South Dakota:

Compare Interest Rates and Fees

Take the time to compare interest rates and fees from multiple lenders. Be sure to ask about any upfront costs or closing fees associated with the loan.

Get Preapproved

Going through the mortgage preapproval process will give you concrete details about how much house you can afford and what your monthly payments would look like. It also strengthens your position as a buyer and allows you to move quickly when you find the right property. If you’re worried about interest rates rising, you can pay a fee to the lender to lock in your rate for up to 90 days.

South Dakota Mortgage Resources

South Dakota offers resources to assist homebuyers, particularly those who qualify as a first-time-homebuyer and those with limited financial resources. These include:

First-Time Homebuyer Programs

South Dakota Housing offers a mortgage to first-time homebuyers (defined as those who have not owned a principal residence in three years) through participating lenders. There are income limits and a maximum purchase price of $385,000.

Down Payment Assistance

Buyers who struggle to save for a down payment or closing costs may find help from the South Dakota Housing Development Authority Fixed Rate Plus loan program, which provides 3% or 5% of the mortgage amount in down payment and closing cost assistance. This comes in the form of a second mortgage at 0% interest, due when the home is sold or the mortgage is paid off. Buyers should also look into local organizations in their area, as there are sometimes also local down payment assistance programs that can help.

Tools & Calculators

Using tools and calculators can help homebuyers estimate their monthly mortgage payments, determine how much house they can afford, and compare different loan options.

Run the numbers on your home loan.

-

Mortgage calculator

Punch in your home loan amount and a new interest rate, and we’ll estimate your payoff date.

-

Down payment calculator

Enter a few details about your home loan and we’ll provide your monthly mortgage payment.

-

Home affordability calculator

Provide us with a few details and see how much you can afford to spend on a home purchase.

Using the free calculators is for informational purposes only, does not constitute an offer to receive a loan, and will not solicit a loan offer. Any payments shown depend on the accuracy of the information provided.

Refinancing Options in South Dakota: Exploring Your Possibilities

Homeowners in South Dakota who have an existing mortgage may be able to benefit from refinancing their loan. Refinancing can help you lower your interest rate, reduce your monthly payments, or cash out some of your home’s equity. Most banks and other lenders will offer refinancing, and there are also government options, including these:

• FHA Streamline Refinance: The FHA Streamline Refinance allows FHA-insured homeowners to refinance into current mortgage rates with minimal hassle. This program is available to borrowers who have an existing FHA loan and are current on their payments.

• Interest-Rate Reduction Refinance Loan: An Interest-Rate Reduction Refinance Loan (IRRRL) can reduce the monthly payments on VA loans by adjusting the Annual Percentage Rate (APR). This program is available to veterans and active-duty military members who have an existing VA loan.

Closing Costs and Fees in South Dakota: What to Expect

When purchasing a home in South Dakota, buyers can expect to pay closing costs, which are fees associated with the mortgage loan and the sale of the property. These costs typically range between 3% and 6% of the home’s purchase price.

Factors that influence closing costs in South Dakota include the property value, location, and type of mortgage loan. Some common closing costs include:

• Loan origination fee

• Appraisal fee

• Credit report fee

• Title insurance fee

• Recording fee

• Transfer tax

The Takeaway

South Dakota’s mortgage landscape offers a range of options for homebuyers, from first-time buyers to those looking to refinance their existing loans. Staying informed about current mortgage rates, exploring assistance programs, and carefully considering refinancing options will help ensure homeowners a sound financial future in the Mount Rushmore State.

Looking for an affordable option for a home mortgage loan? SoFi can help: We offer low down payments (as little as 3% - 5%*) with our competitive and flexible home mortgage loans. Plus, applying is extra convenient: It's online, with access to one-on-one help.

FAQ

Will mortgage rates drop in South Dakota?

Rates are influenced by various economic factors and can fluctuate over time, so while they may drop in South Dakota, they may also rise — and there is no guarantee of the timing or extent of these changes.

Will mortgage rates ever go back to normal?

The definition of “normal” mortgage rates can vary depending on historical context. Mortgage rates have experienced periods of both highs and lows over the years. While rates may eventually return to a level that is considered normal based on historical averages, the timing and exact rate is impossible to predict.

Will South Dakota home prices ever drop?

Home prices in South Dakota are influenced by a combination of economic factors, housing demand, and supply. Your best bet is to check with one or more local real estate agents who may have a sense of what to expect in the specific market area you’re exploring.

Is it a good time to buy a house in South Dakota?

Determining the right time to buy a house involves considering personal financial circumstances, housing market conditions, and individual preferences. There is no universally good or bad time to buy a house.

How do I lock in a mortgage rate?

To lock in a mortgage rate, you can work with a lender to obtain a rate lock agreement. This agreement guarantees a specific interest rate for a certain period, typically ranging from 30 to 90 days. During this lock-in period, the agreed-upon interest rate will be honored, regardless of any fluctuations in market rates. However, rate lock agreements often come with a fee, so it’s important to weigh the cost against the potential benefits before locking in a rate.

How do mortgage interest rates work?

Mortgage interest rates represent the cost of borrowing money from a lender to finance a home purchase. They are expressed as a percentage of the loan amount and are used to calculate the monthly mortgage payments. Interest rates can be fixed, meaning they remain the same throughout the life of the loan, or adjustable, meaning they can change periodically based on a financial index.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

*SoFi requires Private Mortgage Insurance (PMI) for conforming home loans with a loan-to-value (LTV) ratio greater than 80%. As little as 3% down payments are for qualifying first-time homebuyers only. 5% minimum applies to other borrowers. Other loan types may require different fees or insurance (e.g., VA funding fee, FHA Mortgage Insurance Premiums, etc.). Loan requirements may vary depending on your down payment amount, and minimum down payment varies by loan type.

†Veterans, Service members, and members of the National Guard or Reserve may be eligible for a loan guaranteed by the U.S. Department of Veterans Affairs. VA loans are subject to unique terms and conditions established by VA and SoFi. Ask your SoFi loan officer for details about eligibility, documentation, and other requirements. VA loans typically require a one-time funding fee except as may be exempted by VA guidelines. The fee may be financed or paid at closing. The amount of the fee depends on the type of loan, the total amount of the loan, and, depending on loan type, prior use of VA eligibility and down payment amount. The VA funding fee is typically non-refundable. SoFi is not affiliated with any government agency.

¹FHA loans are subject to unique terms and conditions established by FHA and SoFi. Ask your SoFi loan officer for details about eligibility, documentation, and other requirements. FHA loans require an Upfront Mortgage Insurance Premium (UFMIP), which may be financed or paid at closing, in addition to monthly Mortgage Insurance Premiums (MIP). Maximum loan amounts vary by county. The minimum FHA mortgage down payment is 3.5% for those who qualify financially for a primary purchase. SoFi is not affiliated with any government agency.

Non affiliation: SoFi isn’t affiliated with any of the companies highlighted in this article.Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

Qualifying for the reward requires using a real estate agent that participates in HomeStory’s broker to broker agreement to complete the real estate buy and/or sell transaction. You retain the right to negotiate buyer and or seller representation agreements. Upon successful close of the transaction, the Real Estate Agent pays a fee to HomeStory Real Estate Services. All Agents have been independently vetted by HomeStory to meet performance expectations required to participate in the program. If you are currently working with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®. A reward is not available where prohibited by state law, including Alaska, Iowa, Louisiana and Missouri. A reduced agent commission may be available for sellers in lieu of the reward in Mississippi, New Jersey, Oklahoma, and Oregon and should be discussed with the agent upon enrollment. No reward will be available for buyers in Mississippi, Oklahoma, and Oregon. A commission credit may be available for buyers in lieu of the reward in New Jersey and must be discussed with the agent upon enrollment and included in a Buyer Agency Agreement with Rebate Provision. Rewards in Kansas and Tennessee are required to be delivered by gift card.

HomeStory will issue the reward using the payment option you select and will be sent to the client enrolled in the program within 45 days of HomeStory Real Estate Services receipt of settlement statements and any other documentation reasonably required to calculate the applicable reward amount. Real estate agent fees and commissions still apply. Short sale transactions do not qualify for the reward. Depending on state regulations highlighted above, reward amount is based on sale price of the home purchased and/or sold and cannot exceed $9,500 per buy or sell transaction. Employer-sponsored relocations may preclude participation in the reward program offering. SoFi is not responsible for the reward.

SoFi Bank, N.A. (NMLS #696891) does not perform any activity that is or could be construed as unlicensed real estate activity, and SoFi is not licensed as a real estate broker. Agents of SoFi are not authorized to perform real estate activity.

If your property is currently listed with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®.

Reward is valid for 18 months from date of enrollment. After 18 months, you must re-enroll to be eligible for a reward.

SoFi loans subject to credit approval. Offer subject to change or cancellation without notice.

The trademarks, logos and names of other companies, products and services are the property of their respective owners.

SOHL-Q324-096

More home loan resources.

-

First-Time Homebuyer Guide

-

First-Time Homebuyer Programs and Loans

-

Mortgage Preapproval Process