By Laurel Tincher

(Last Updated – 12/2025)

A 675 credit score is considered a good score, but it’s at the very low end of that range. This score can definitely be high enough to open some doors for you financially speaking, but it may not be high enough to get the most favorable terms for, say, a mortgage or car loan.

Read on to learn more about the answer to “Is 675 a good credit score?” and learn how to build that important three-digit number.

Key Points

• A 675 credit score is considered good but is at the lower end of this range.

• With this score, you can qualify for loans and credit cards, but with less favorable terms.

• Potential drawbacks include higher interest rates and fewer rewards on credit cards.

• To improve your credit score, pay bills on time and keep credit card balances low.

• Regularly check credit reports for errors and avoid multiple new credit applications.

What Does a 675 Credit Score Mean?

A FICO® Score of 675 falls into the low end of the good credit range, which typically runs from 670 to 739. Despite not fitting into the excellent or upper reaches of the good categories, a score of 675 indicates a responsible credit history. Here’s how FICO categorizes its scores:

• Excellent: 800 to 850

• Very Good: 740 to 799

• Good: 670 to 739

• Fair: 580 to 669

• Poor: 300 to 579

Credit score ranges are used by lenders to evaluate the risk involved in giving credit to someone. A score of 675 indicates that the applicant has exhibited a moderate degree of creditworthiness. This may indicate a track record of:

• On-time debt payments

• A manageable debt-to-income ratio

• Overall healthy financial standing

It’s important to remember that a credit score of 675 can be built. When applying for loans or credit cards, those in the 675 range can pay a little bit more in interest than people with higher scores. If you had a higher credit score, you might be offered a lower annual percentage rate, or APR.

Gaining a better understanding of the factors that impact credit scores (and making a concerted effort to build yours) can lead to better terms and financial prospects.

💡 Quick Tip: Before choosing a personal loan, ask about the lender’s fees: origination, prepayment, late fees, etc. One question can save you many dollars.

What Else Can You Get with a 675 Credit Score?

People with a credit score of 675 can qualify for a range of financial products, though there might be some restrictions. Even if they are eligible for credit cards, their interest rates and benefits might not be as good as those offered to those with better credit scores. For large expenditures like a home or car, lenders may grant loans, but the interest rates may be on the higher end.

Reducing outstanding debt, avoiding late payments or defaults, and making consistent, on-time payments are all critical steps that can build one’s score. People who work to keep or build their credit score put themselves in a better position to access a wider variety of financial products with better terms and conditions.

Can I Get a Credit Card with a 675 Credit Score?

It is possible to get a credit card with a 675 credit score, and you may have several solid options from which to choose. However, there are rewards if you build your score even higher, including possibly a lower APR and/or fees or access to enhanced rewards.

By using a credit card responsibly, you can work to build your score. It’s worth noting that the single biggest contributing factor to your score is your credit history, meaning on-time payments. Set up payment alerts or opt into automatic payments to help ensure that you pay your bill on time, every time.

💡 Quick Tip: Generally, the larger the personal loan, the bigger the risk for the lender — and the higher the interest rate. So one way to lower your interest rate is to try downsizing your loan amount.

Can I Get an Auto Loan with a 675 Credit Score?

You can get an auto loan with a credit score of 675, but the terms and interest rates might not be as good as what is available to people with higher credit scores. You will find that offers may well vary from lender to lender.

Worth noting: 690 was found to be the average score among those who get a used car loan. Those buying a new car typically have a score of 757 or above.

That said, those with a credit score of 675 should shop around. You may find that if you can make a higher down payment, you could be rewarded with terms you find more affordable.

Recommended: Why Your Debt-to-Income Ratio Matters

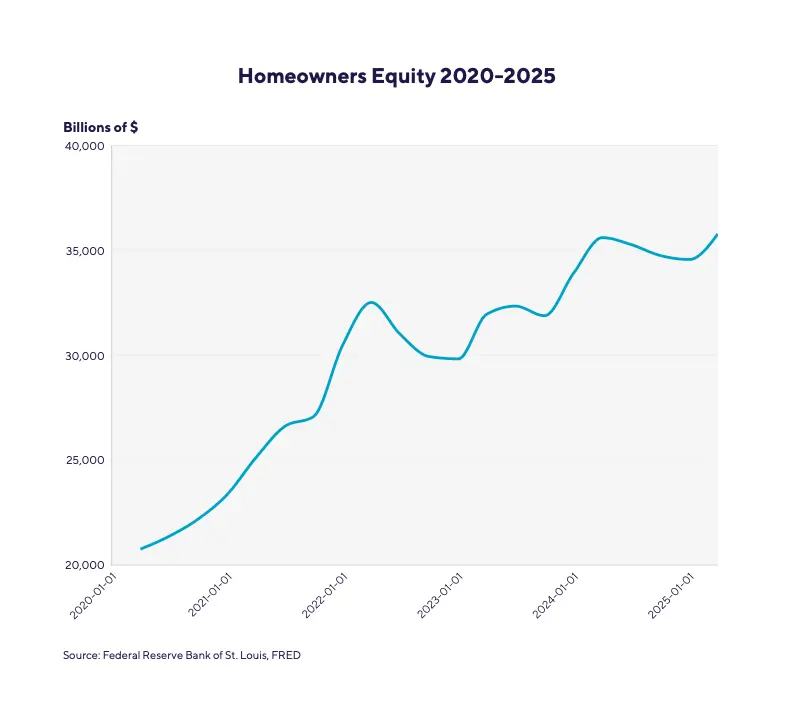

Can I Get a Mortgage with a 675 Credit Score?

With a credit score of 675, you will likely be approved by a mortgage lender with what’s considered a good interest rate. But you may not receive the best rate — that’s often reserved for those with high scores, such as 740 and above.

In order to improve your chances of getting approved for a mortgage with more favorable terms, you may want to think about other aspects that lenders take into account, like:

• A steady job history with a reliable income

• A larger down payment.

Also, know that if your credit score is below 675, there are still options to be found:

• You may be able to find a conventional loan with a score of 620 or higher.

• You may qualify for a FHA loan with a credit score of 500 or higher.

• You may qualify for a VA or USDA loan with a credit score of 640 or higher.

Can I Get a Personal Loan with a 675 Credit Score?

With a credit score of 675, you can usually qualify for a personal loan. This can be good news, since personal loans can be used in a variety of ways, such as debt consolidation, home renovations, or medical bills.

However, you may find that not all lenders approve you; some prefer prospective borrowers to have credit scores in the 700s. And those that do offer you a loan may not have the best terms, such as the lower APRs.

In other words, it’s in your best interests to shop around and see what offers are available. It can also help to follow the steps mentioned above to build your score, such as always paying bills on time, keeping your amounts owed low (under 30% of your credit limit), and not applying for too much new credit at the same time.

Recommended: Can You Refinance a Personal Loan?

Takeaway

Is a 675 credit score good? Yes. A FICO Score of 675, which is at the lower end of the good range, is typically high enough to qualify for loans and mortgages. However, you may have to pay a little bit more in interest and have less favorable terms than people with better scores. You also may benefit from building your score a bit higher before applying for a loan. You might qualify with more lenders and for better terms.

Think twice before turning to high-interest credit cards. Consider a SoFi personal loan instead. SoFi offers competitive fixed rates and same-day funding. See your rate in minutes.

SoFi’s Personal Loan was named NerdWallet’s 2024 winner for Best Personal Loan overall.

View your rate