Current Home Equity Loan Rates in Winston-Salem, NC Today

WINSTON-SALEM HOME EQUITY LOAN RATES TODAY

Current home equity loan

rates in Winston-Salem, NC.

Disclaimer: The prime rate directly influences the rates on HELOCs and home equity loans.

Turn your home equity into cash. Call us for a complimentary consultation or get prequalified online.

Compare home equity loan rates in Winston-Salem.

Key Points

• Home equity loan rates in Winston-Salem, North Carolina, are influenced by a variety of factors, including broad economic trends and the individual borrower’s financial standing,

• A fixed interest rate gives you the stability of predictable monthly payments.

• Home equity loans do carry risks, such as the possibility of foreclosure if you can’t make your payments.

• To get a good home equity loan rate, it helps to have a strong credit score and a low debt-to-income ratio.

• Comparing offers from several lenders will help you find the best terms available to you.

Introduction to Home Equity Loan Rates

Our guide to Winston-Salem home equity loan rates offers a thorough look at what you can expect when you’re looking for your best options for a home equity loan.

We’ll delve into the factors that play a role in determining these rates, from Federal Reserve policy to your credit score and the amount you want to borrow. You’ll also learn how to effectively compare offers from different lenders and what steps you can take to secure the most favorable rates. And you’ll find out about different types of home equity loans, like HELOCs and cash-out refis, so you can decide which one best fits your needs.

Whether you’re dreaming of home improvements, planning for your child’s education, or considering debt consolidation, being well-informed about your financial options and how to make the most of them is key to taking control of your future.

How Do Home Equity Loans Work?

What is a home equity loan? Simply put, it’s a way you can borrow money and secure your loan with the equity you’ve built up in your home. The amount of equity you have is the market value of your home minus the balance of your existing mortgage.

For instance, if your home is valued at $500,000 and you owe $350,000 on your mortgage, you have $150,000 in equity.

Lenders generally let you borrow up to 85%, or sometimes 90%, of your home equity. In this example, you might be able to borrow as much as $135,000.

A home equity loan calculator can help you determine your home equity and maximum loan amount in other scenarios.

Home equity loan rates are usually fixed and the loan term can be anywhere from five to 30 years. Because the loan is secured by your home, home equity loan rates are usually lower than rates for unsecured personal loans. If you’ve been wondering how to get equity out of your home, a home equity loan could be a good answer.

What Determines Home Equity Loan Interest Rates?

Interest rates for home equity loans are influenced by a variety of factors, including larger economic trends and the details of your own personal financial situation.

One of the most important factors is the Federal Reserve’s monetary policy, which includes changes to the federal funds rate. Lenders typically base their home equity loan rates on the prime rate, which is influenced by the federal funds rate, so if the funds rate and prime rate rise, typically you can expect to see home equity loan rates in Winston-Salem rise, too.

In terms of your personal finances, other factors that can impact your home equity loan rate include your credit score and your debt-to-income ratio (how much monthly debt you have compared to your monthly income). Additionally, the amount you borrow and the repayment term you choose can also affect your rate.

How Interest Rates Impact Affordability

The rates you secure for your home equity loan play a pivotal role in how affordable the loan will be for you over the long term. Even a seemingly small difference in interest rates can lead to significant savings or added costs over the life of the loan.

For instance, consider a $100,000 home equity loan with a 15-year repayment term. With a 8.50% interest rate, you’re looking at a $986 monthly payment and a total interest cost of $77,253. But if your interest rate is just one percentage point higher, at 9.50%, your monthly payment jumps to $1,044, and the total interest paid rises to $87,960. That’s a difference of more than $10,700 in interest over the loan’s life, which underscores the importance of hunting down the best home equity loan rates.

The chart below illustrates further how changes in your loan amount, interest rate, and term interact to result in different monthly payments.

| Loan Amount | Loan Term | Interest Rate | Monthly Payment |

|---|---|---|---|

| $100,000 | 20 years | 8.00% | $836 |

| 7.00% | $775 | ||

| 10 years | 8.00% | $1,213 | |

| 7.00% | $1,161 | ||

| $50,000 | 20 years | 8.00% | $418 |

| 7.00% | $388 | ||

| 10 years | 8.00% | $607 | |

| 7.00% | $581 | ||

| $25,000 | 20 years | 8.00% | $209 |

| 7.00% | $194 | ||

| 10 years | 8.00% | $303 | |

| 7.00% | $290 |

Fixed vs Adjustable Interest Rates

Home equity loans typically come with fixed interest rates, though they can occasionally have adjustable rates. Fixed interest rates offer a consistent monthly payment every time. That stability can help make budgeting a more straightforward task.

Other kinds of loans, including HELOCs, more typically have adjustable rates, which start out with a fixed rate for a defined period, and then adjust in accordance with the market. Once they start adjusting, the rates and payments can feel unpredictable.

If you’re deciding what kind of rate is right for you, think about how flexible your budget is likely to be in future years and also what your tolerance for risk and unpredictability is.

Home Equity Loan Rate Trends

Predicting what interest rates may be coming down the road is tricky at best — an enormous number of factors come into play to determine the trends. Still, there are some indicators that can be helpful.

Let’s take a look at the prime rate, which, as we’ve discussed, is a major factor in home equity loan interest rates. Its recent history shows just how variable the prime rate is. As you can see from the chart below, it plummeted to 3.25% in 2020 and rose to 8.50% in 2023.

Source: TradingView.com

| Date | Prime Rate |

|---|---|

| 9/19/2024 | 8.00% |

| 7/27/2023 | 8.50% |

| 5/4/2023 | 8.25% |

| 3/23/2023 | 8.00% |

| 2/2/2023 | 7.75% |

| 12/15/2022 | 7.50% |

| 11/3/2022 | 7.00% |

| 9/22/2022 | 6.25% |

| 7/28/2022 | 5.50% |

| 6/16/2022 | 4.75% |

| 5/5/2022 | 4.00% |

| 3/17/2022 | 3.50% |

| 3/16/2020 | 3.25% |

| 3/4/2020 | 4.25% |

| 10/31/2019 | 4.75% |

| 9/19/2019 | 5.00% |

| 8/1/2019 | 5.25% |

| 12/20/2018 | 5.50% |

| 9/27/2018 | 5.25% |

Source: St. Louis Fed

Fluctuations like these have an impact on Winston-Salem home equity loan rates, so it’s a good idea to stay on top of current market conditions. While nobody can predict the future with perfect accuracy, understanding past patterns as well as today’s trends may help you time your application to get a more favorable rate.

How to Qualify for the Lowest Rates

To be offered the most favorable home equity loan rates, you’ll need to meet your lender’s requirements, like an appropriate credit score and debt-to-income (DTI) ratio.

Here’s what lenders are generally looking for: a credit score of 700 or higher, a DTI ratio of no more than 50% (or better yet, 36% or less), and a combined loan-to-value ratio (what you’ll owe divided by the value of your home) that doesn’t top 80%.

Even if you haven’t decided yet on a HELOC vs. a home equity loan or maybe even a cash-out refinance, the strategies below can help you get your financial profile in shape to secure the most favorable interest rates and loan terms.

Maintain Sufficient Home Equity

Generally, you need to have at least 20% equity in your home to qualify for a home equity loan. Don’t know how much equity you have? Calculating it is easy. Just subtract your mortgage balance from your current home value. For example, if your mortgage balance is $400,000 and your home is now worth $550,000, you’ve got $150,000 in equity.

The amount of equity you have helps determine the maximum loan amount you can get and the rates you can secure. Most lenders let you borrow as much as 85%, or sometimes 90%, of your available equity. In the example above, that translates to a loan of up to $135,000.

A home equity loan calculator can help you evaluate exactly how large a loan you may be able to access.

Build a Strong Credit Score

For the most favorable home equity loan rates, you’ll probably need a credit score of 680 or higher. Many lenders are looking for 700 or above. The higher your score is, the greater the level of financial responsibility it signals. You can bolster your credit record by consistently making timely payments, keeping credit card balances in check, and not taking on major new debts.

Manage Debt-to-Income Ratio

Your debt-to-income (DTI) ratio is a critical factor when it comes to securing a home equity loan. Lenders generally look for a DTI ratio that’s under 50%, but the sweet spot is often 36% or lower. You can estimate your DTI ratio with a simple calculation: your total monthly debt payments divided by your gross monthly income.

A lower DTI ratio shows a lender that you’re in a better position to handle your monthly payments, and that reassurance can potentially lead them to offer you more attractive loan rates. To improve your DTI, work on paying down some of your existing debts, finding ways to boost your income, or a combination of both. A well-managed DTI could be the key to unlocking a home equity loan with favorable terms and lower interest rates.

Obtain Adequate Property Insurance

Property insurance is often a prerequisite for home equity loans, especially in areas susceptible to natural disasters. Sufficient insurance can save you from additional costs and complications if the unexpected occurs, of course. But it’s important for a home equity loan because lenders want to ensure that the property securing the loan is safeguarded against potential damage.

When you’re applying for a home equity loan, be ready to provide proof of insurance. This might include a policy covering the full value of your home and any additional coverage stipulated by the lender. Having the right insurance can also empower you to negotiate better rates and terms for your home equity loan.

Tools & Calculators

When it comes to making decisions about home equity loans, online tools and calculators are your best friends. A home equity loan calculator can give you a sense of your monthly payments based on the loan amount, interest rate, and term.

Run the numbers on your home equity loan.

-

Home Equity Loan Calculator

Enter a few details about your home loan and we’ll provide you your maximum home equity loan amount.

-

HELOC Payment Calculator

Punch in your HELOC amount and we’ll estimate your monthly payment amount for your HELOC.

-

HELOC Interest Only Calculator

Use SoFI’s HELOC interest calculator to estimate how much monthly interest you’ll pay .

Using the free calculators is for informational purposes only, does not constitute an offer to receive a loan, and will not solicit a loan offer. Any payments shown depend on the accuracy of the information provided.

Closing Costs and Fees

When it comes to making decisions about home equity loans, online tools and calculators are your best friends. A home equity loan calculator can give you a sense of your monthly payments based on the loan amount, interest rate, and term.

These costs can include a variety of different expenses, including home appraisals, credit reports, document preparation, loan origination fees, notary fees, and the costs associated with title searches and insurance. Here are some typical line items:

• Appraisal fee: $300-$500

• Credit report fee: $30-$50 or more

• Document preparation: $100-$500 (may also be billed on an hourly basis if an attorney is involved or be built into the loan origination fee)

• Loan origination fee: 0.5%-1.0% of the loan amount

• Notary fee: $20-$100

• Title insurance fee: 0.5%-1.0% of the loan amount

• Title search fee: $75-$250 or more

Some lenders may offer no-closing-cost home equity loans, but they often come with higher interest rates.

Tax Deductibility of Home Equity Loan Interest

If you’re considering a home equity loan, there may be another factor to consider. If you’re taking out the loan in order to improve your home, the interest on your home equity loan may be tax deductible. For single filers, interest is deductible on the first $375,000 of loan debt. Spouses filing together can deduct the interest on up to $750,000 of debt. But remember that you can’t take the standard deduction if you want to claim this – you’ll need to itemize. Consult your tax advisor to get the most up-to-date information and advice.

Alternatives to Home Equity Loans

Home equity loans are a popular choice among homeowners, but there are other options to consider if you’re in a position to draw on your home equity, and they’re worth considering to see if they’ll better meet your financial needs.

Home Equity Line of Credit (HELOC)

What is a home equity line of credit? A HELOC is somewhat like a credit card, but it’s backed by the equity you have in your home. It provides a flexible way to borrow funds up to a set limit, and interest payments are typically required only on the amount you withdraw. You generally start off with a “draw” period, during which you can borrow funds as needed. Following that is a period of years during which you pay back the principal you’ve borrowed plus interest. HELOCs usually come with variable interest rates, which can feel unpredictable, especially if you’re on a strict budget.

Lenders generally want to see a credit score of 680 or higher (700 is even better) and a debt-to-income ratio below 50% (though less than 36% is the sweet spot) when they’re evaluating a candidate for a HELOC . If you’re comfortable with the ebb and flow of variable rates, a HELOC could be a good choice, allowing you to borrow up to 90% of your home equity.

To figure out how much monthly payments for a HELOC would be, consider using a HELOC monthly payment calculator. And to calculate how much interest you pay during the “draw” period of a HELOC, try a HELOC interest-only calcuclator.

Cash-Out Refinance

This is a kind of mortgage refinance that allows you to replace your existing mortgage with a new home loan that has a higher balance.

If you’re considering the benefits of a cash-out refinance vs. a home equity line of credit, take into account the fact that requirements for borrowing tend to be different. It’s usually easier to qualify for a cash-out refi than for a home equity loan or a HELOC. Cash-out refinances typically require a minimum credit score of 620 and a DTI ratio of 43% or less. They may have either fixed or variable interest rates. One more advantage: a cash-out refi results in a single monthly payment, which can make it easier to manage.

The Takeaway

When you’re ready to pursue a home equity loan in Winston-Salem, remember to focus on preparing those key factors: your credit score, debt-to-income ratio, and property insurance. These will all play a part in influencing the rates you’re offered. Use the tools at your disposal to estimate payments and compare lenders. Understanding how the different types of home equity financing work and what affects their interest rates will help you find the best options and arrive at the right financial decision for you.

SoFi now offers home equity loans. Access up to 85%, or $750,000, of your home’s equity. Enjoy lower interest rates than most other types of loans. Cover big purchases, fund home renovations, or consolidate high-interest debt. You can complete an application in minutes.

Unlock your home’s value with a home equity loan from SoFi.

FAQ

What are the common uses for a home equity loan?

Home equity loans are often used to pay for big-ticket items, to make home improvements, or to consolidate higher-interest debt. These loans provide a way to access a substantial lump sum and pay the funds back over time. If you’re considering a home equity loan, be sure to weigh the benefits against the potential risks, like the possibility of foreclosure if you can’t make your payments.

Wondering about the monthly payments on a $50,000 home equity loan?

The monthly payment you’d see for a $30,000 home equity loan varies depending on your loan term and interest rate. A 7.00% interest rate over a 15-year term yields a payment of about $271 per month. If you get an 8.00% interest rate and a 20-year term, the monthly payment would be around $251. A home equity loan calculator can give you estimates customized to your situation.

So, what’s the monthly payment on a $25,000 home equity loan?

The payment on a $25,000 home equity loan will vary, depending on the interest rate and the term of the loan. For example, at an 8.00% interest rate over a 15-year term, the monthly payment would be approximately $239. If the interest rate is 9.00%, the monthly payment increases to about $254.

What might prevent you from qualifying for a home equity loan?

There are a few potential roadblocks to securing a home equity loan. For starters, lenders generally look for a minimum credit score of 700 for the most competitive rates, so a low credit score can be a red flag for lenders. A high debt-to-income ratio, generally more than 50%, may also create a problem. And of course, you’ll need to have a healthy amount of home equity, usually at least 20%. If you can, it’s a good idea to take some time to evaluate your financial picture, work on your credit score, and manage your debts before applying.

What are the advantages of a home equity loan?

Home equity loans have a number of advantages for homeowners. They typically come with fixed interest rates and therefore have predictable monthly payments. Because the loan is secured by your home, the interest rates are often lower than those for unsecured loans, such as credit cards or personal loans. This can be particularly helpful if you’re consolidating high-interest debt or financing a large expense.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

*SoFi requires Private Mortgage Insurance (PMI) for conforming home loans with a loan-to-value (LTV) ratio greater than 80%. As little as 3% down payments are for qualifying first-time homebuyers only. 5% minimum applies to other borrowers. Other loan types may require different fees or insurance (e.g., VA funding fee, FHA Mortgage Insurance Premiums, etc.). Loan requirements may vary depending on your down payment amount, and minimum down payment varies by loan type.

²SoFi Bank, N.A. NMLS #696891 (Member FDIC), offers loans directly or we may assist you in obtaining a loan from SpringEQ, a state licensed lender, NMLS #1464945.

All loan terms, fees, and rates may vary based upon your individual financial and personal circumstances and state.You should consider and discuss with your loan officer whether a Cash Out Refinance, Home Equity Loan or a Home Equity Line of Credit is appropriate. Please note that the SoFi member discount does not apply to Home Equity Loans or Lines of Credit not originated by SoFi Bank. Terms and conditions will apply. Before you apply, please note that not all products are offered in all states, and all loans are subject to eligibility restrictions and limitations, including requirements related to loan applicant’s credit, income, property, and a minimum loan amount. Lowest rates are reserved for the most creditworthy borrowers. Products, rates, benefits, terms, and conditions are subject to change without notice. Learn more at SoFi.com/eligibility-criteria. Information current as of 06/27/24.In the event SoFi serves as broker to Spring EQ for your loan, SoFi will be paid a fee.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

Checking Your Rates: To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score. However, if you choose a product and continue your application, we will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull and may affect your credit.

Disclaimer: Many factors affect your credit scores and the interest rates you may receive. SoFi is not a Credit Repair Organization as defined under federal or state law, including the Credit Repair Organizations Act. SoFi does not provide “credit repair” services or advice or assistance regarding “rebuilding” or “improving” your credit record, credit history, or credit rating. For details, see the FTC’s website .

Non affiliation: SoFi isn’t affiliated with any of the companies highlighted in this article.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

SOHL-Q225-275

More home equity resources.

-

What is a Home Equity Line of Credit

-

Different Types of Home Equity Loans

-

HELOC vs Home Equity Loan: How They Compare

Turn your home equity into cash. Call us for a complimentary consultation or get prequalified online.

Decoding Markets: Traffic Lights

Markets have spent much of the last few months trading on possibilities of what could happen with the economy. But what actually ends up happening will be the true decider of market direction.

To analyze what’s going on — and where things might be headed — we’ll focus on the labor market, residential construction, and consumer credit through the lens of a traffic light. Are signs looking good (green), cautionary (yellow), or bad (red)?

Labor Caution

On the surface, the U.S. labor market has mostly been a source of stability for the economy. The official unemployment rate has remained between 4.0% to 4.2% over the last 12 months, a condition that aligns well with the idea that the economy is at or near full employment. But underneath this top-line stability, some concerning signs are developing.

For one, while the headlines suggest unemployment hasn’t moved much over the last year, it had actually been drifting higher for much of 2025 before June data surprised to the downside. The official headline figure, because it is rounded to one decimal place, had been 4.2% for March, April, and May before falling to 4.1% in June. But a more granular calculation reveals 4.15%, 4.19%, 4.24%, and 4.12%, respectively.

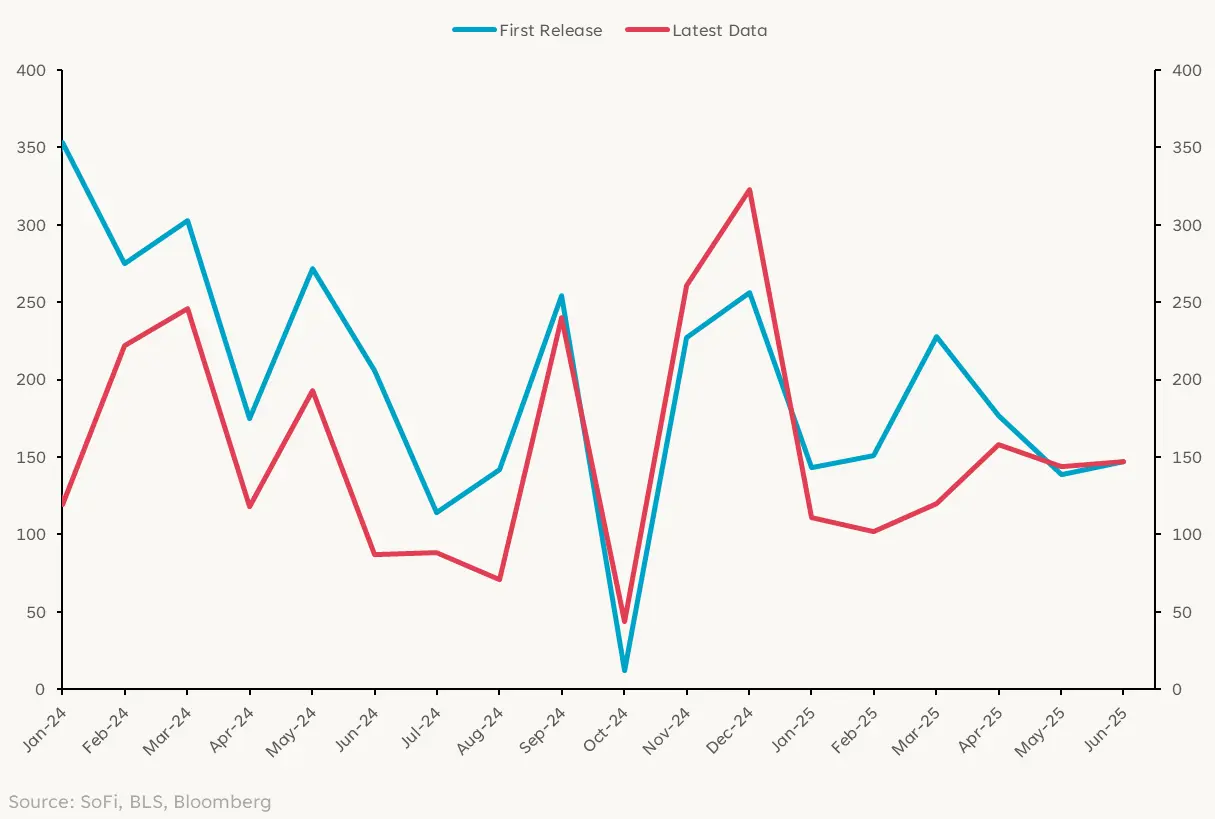

Beyond that, the pace of job creation has cooled noticeably with 147,000 jobs added in June — below the average monthly gain of the prior 12 months. Also telling is the recent pattern of significant downward revisions to prior months, which lowered 2025 figures by 203,000 jobs. Historically, downward revisions tend to cluster around downturns (the reasons are complicated but center around the availability of data on businesses being started and closing).

Job Growth Slowing

All in all, the labor market has clearly lost some of its forward momentum. The combination of decelerating job growth, downward revisions to past data, and a slowly rising unemployment rate (prior to the big drop last month) suggest that the labor market may be transitioning from an engine of growth to an idling motor. Things aren’t outright bad, however, since less hiring activity is being offset by a low layoff rate.

Overall, the labor market is flashing yellow.

Halting Construction

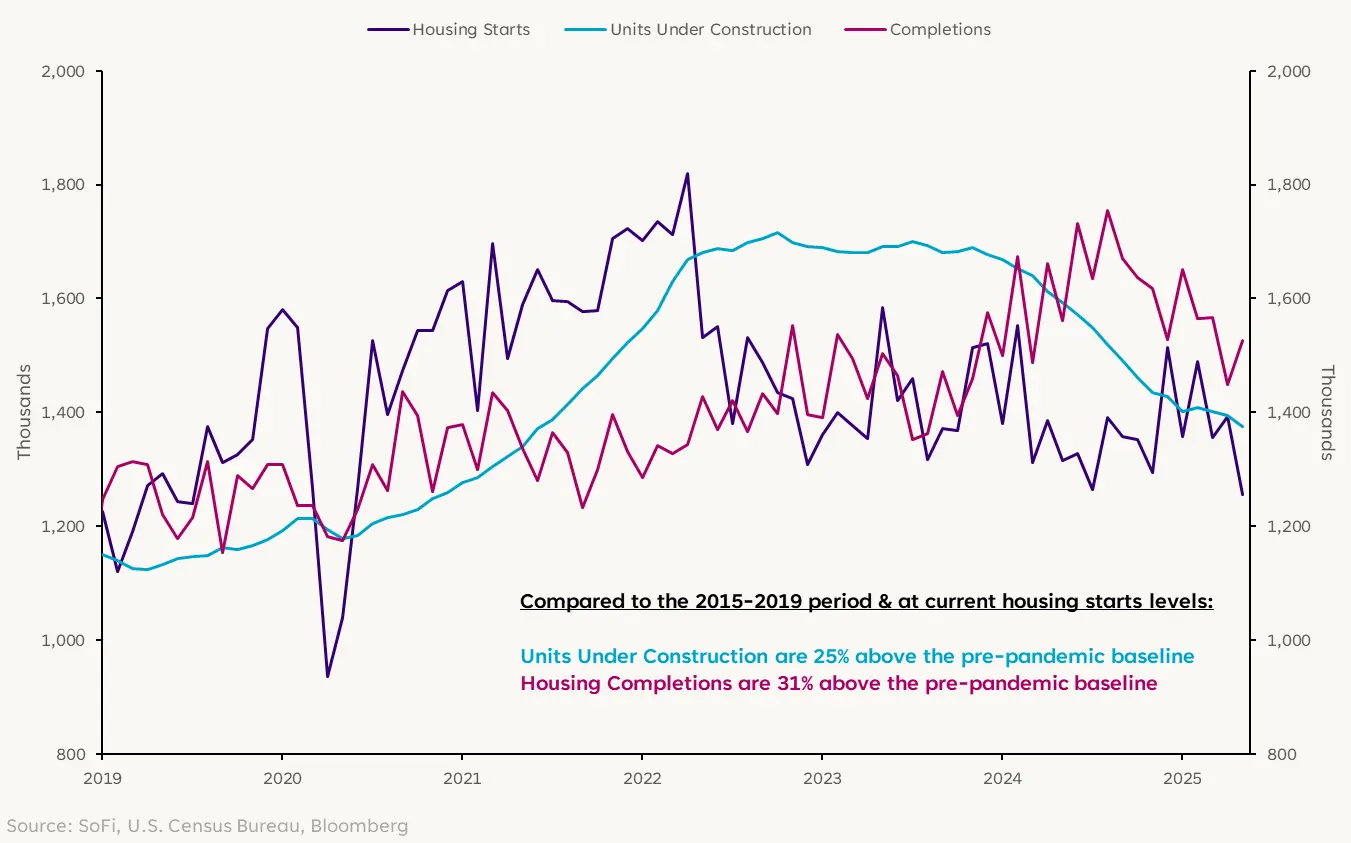

As many people know all too well, the U.S. is dealing with a major home affordability crisis. Home prices are at historic highs, while mortgage rates have remained stubbornly elevated — even though the Federal Reserve lowered interest rates late last year by 100 basis points. With the average 30-year fixed mortgage rate at 6.8% as of July 1, the cost of financing a home is prohibitive for a large swath of the American public.

This has pushed housing affordability to multi-decade lows, effectively freezing activity in what is normally a critical sector of the economy. Potential buyers are sidelined, and existing homeowners are locked in by low rates on their current mortgages, contributing to a stagnant market.

The hard data shows this affordability crisis has translated into a sharp and broad-based downturn in construction activity. In May, privately-owned housing starts plummeted by 9.8% to a seasonally adjusted annual rate of 1.256 million units, the weakest level since the early days of the COVID-19 pandemic in May 2020. And while there’s still a backlog of units currently under construction (a byproduct of the building boom and supply chain shortages from a few years ago), that has rapidly been declining.

Construction Activity Rapidly Slowing

On the transaction and listing side, the latest data shows new home sales declined by 13.7% m/m, while the inventory of unsold new homes climbed to an elevated 9.8 months’ worth of supply.

The construction market isn’t just slowing down, but actively contracting and starting to weigh on economic growth. Confirming the pessimism gripping the industry, the latest National Association of Home Builders (NAHB) Housing Market Index reading fell to a reading of 32, well below the neutral value of 50. It seems like the industry is reaching a tipping point, where an inventory glut and lack of interest rate relief may conspire to finally push home prices lower.

For investors, the residential construction light is clearly red.

Careful Credit

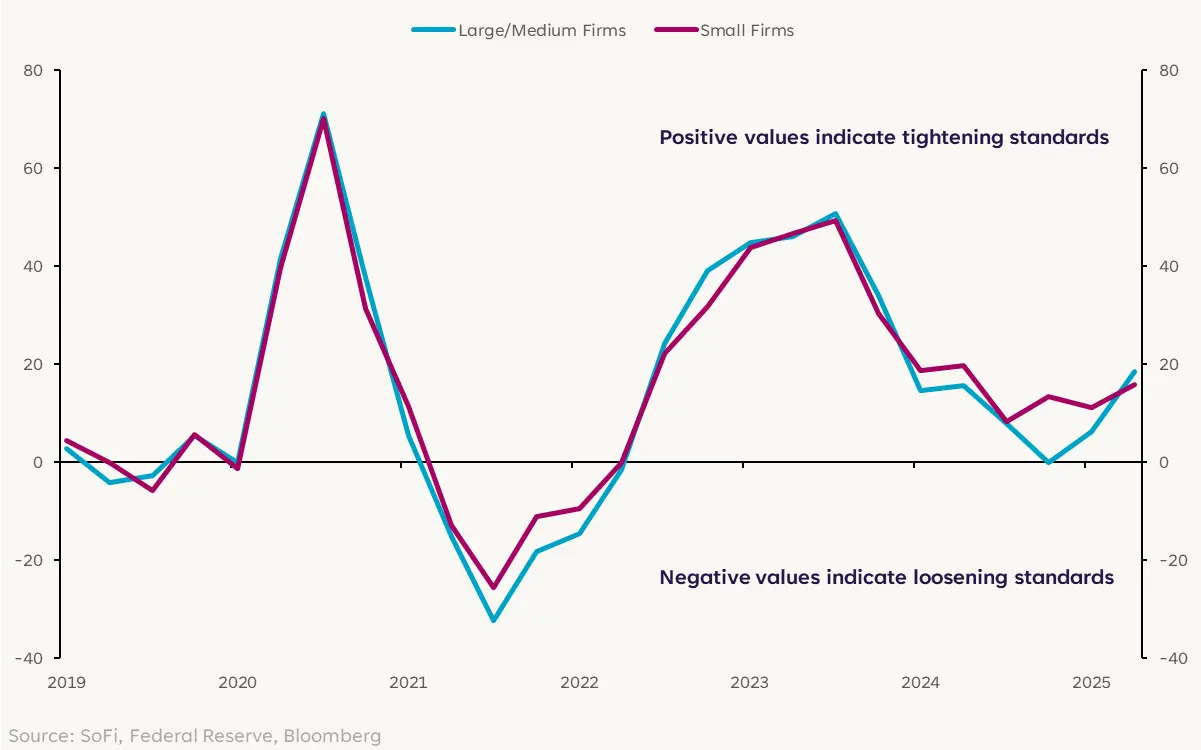

While less visible to the public than jobs or housing data, the flow of credit is the lifeblood of a modern economy. The willingness of banks to lend, and the appetite of businesses and households to borrow, are indicators of underlying economic health. When credit flows freely, it fuels business investment, home purchases, and consumer spending. When it tightens, it can weigh on economic activity. At the moment, both lenders and borrowers have been somewhat cautious.

The most compelling evidence for this caution comes from the Federal Reserve’s quarterly Senior Loan Officer Opinion Survey (SLOOS). The latest survey, from April 2025, showed that a significant share of banks maintained tight lending standards for most loan categories. For commercial and industrial (C&I) loans, banks reported tightening terms due to a less favorable economic outlook and a reduced tolerance for risk. Households also saw credit card standards tighten and requirements for most mortgages remain restrictive.

Percent of Banks Tightening Credit Standards for C&I Loans

Generally speaking, the survey showed that demand for loans was iffy across the board. Given all the economic and trade policy uncertainty, businesses pulled back on capital expenditures and consumers hesitated on big-ticket purchases. But iffy demand doesn’t mean nonexistent demand, and consumer credit data has been mostly steady over the last year or so (though lower than pre-pandemic levels and 2021-22).

All in all, credit gets a flashing yellow as well.

Facing the Light

With two yellow lights and one red, the economy is in a bit of a predicament. Just as it’s important for a driver to slow down when they see a traffic light flashing yellow, the same goes for investors. With stocks at record highs despite slowing economic conditions and major ongoing uncertainty, it could be prudent to ease off the accelerator.

Want more insights from SoFi’s Investment Strategy team? The Important Part: Investing With Liz Thomas, a podcast from SoFi, takes listeners through today’s top-of-mind themes in investing and breaks them down into digestible and actionable pieces.

SoFi can’t guarantee future financial performance, and past performance is no indication of future success. This information isn’t financial advice. Investment decisions should be based on specific financial needs, goals and risk appetite.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser. Information about SoFi Wealth’s advisory operations, services, and fees is set forth in SoFi Wealth’s current Form ADV Part 2 (Brochure), a copy of which is available upon request and at www.adviserinfo.sec.gov. Mario Ismailanji is a Registered Representative of SoFi Securities and Investment Advisor Representative of SoFi Wealth. Form ADV 2A is available at www.sofi.com/legal/adv.

Read moreNew Jersey First-Time Home Buying Assistance Programs & Grants for 2025

New Jersey First-Time Home-Buying Assistance Programs & Grants

(Last Updated – 06/2025)

The Garden State saw record real estate sales in the pandemic years as New York City dwellers fled to the suburbs. The market slowed after 2022, but in the year ending June 2025, home prices in New Jersey still continued to rise. Although the increase was less than in previous years, they increased 5.3% over the prior year, and the median sales price was $560,200. On average, the number of homes sold was down 2.3% year over year, and the median days on the market stayed steady at 32.

In New Jersey that translates into one of the country’s toughest markets for first-time homebuyers. All the more reason to explore programs that can help those who need help covering the cost of a home.

That translates into New Jersey being one of the country’s toughest markets for first-time homebuyers. All the more reason to explore programs that can help those who need help covering the cost of a home.

5 New Jersey Programs for First-Time Homebuyers

To help first-time homebuyers break into this expensive market, the New Jersey Housing and Mortgage Finance Agency (NJHMFA) offers a handful of statewide programs with competitive rates, down payment assistance, and relatively generous income and price limits. In addition, because many areas of New Jersey have robust real estate and first-time homebuyer markets — such as Jersey City and many of the seaside towns — borrowers will want to check for programs in the specific county or city they are considering. Not sure where you want to live in New Jersey? Explore a list of the state’s best, most affordable towns.

Here’s a closer look at the finance agency programs for first-time homebuyers looking for home mortgage loans and down payment assistance.

1. First-Time Homebuyer Mortgage Program

This program offers first-time homebuyers (meaning you haven’t owned a home in the past three years) government-backed 30-year fixed-rate mortgages at competitive interest rates. The loans can be combined with New Jersey’s down payment assistance program by prospective homeowners in the state.

Veterans and buyers in certain target areas need not be first-time homebuyers, but they must not own another primary residence at closing.

To qualify, first-time homebuyers must meet credit score and debt-to-income ratio requirements, which vary by location, and meet income and purchase price limits. The limits are set based on the number of people in your household and the location of the property you want to buy, but generally your income may not exceed 115% of the area median income. Price limits can be higher for houses in certain designated areas. In all cases, the property may be a single-family home, condominium, townhome, manufactured or mobile home, or a two- to four-unit dwelling where one unit is the principal residence of the borrower. See all the details in this fact sheet .

2. HFA Advantage Mortgage Program

Similar to the program above, this one provides homebuyers with a 30-year, fixed-rate conventional loan, affordable mortgage insurance, and low down payment requirements that can be coupled with NJHMFA down payment assistance. For buyers not using the agency’s down payment assistance, the first-time qualification may be waived, although there are income limits for borrowers that vary by county. Single-family homes, condominiums, townhomes, and planned unit developments are allowed.

Income limits for these loans are lower than for the First-Time Homebuyer Mortgage; income may not exceed 80% of the area median income. Learn more in this fact sheet .

3. Police and Firemen’s Retirement System Mortgage Program

New Jersey police officers, firefighters, and members of the Police and Firemen’s Retirement System may be eligible for a 30-year fixed-rate loan with competitive rates up to $766,550. Rates are set twice a year in February and August and are based on the 10-year Treasury bill plus 1%.

One- or two-family homes are allowed, as well as condos or land to build a home on, as long as it will be your primary residence. Lender and administrative fees apply. A 25% portion of the funds for this program is reserved for first-time homebuyers. Repeat buyers are also welcome. This fact sheet offers full details.

4. Homeward Bound Program

Like many of the other programs, Homeward Bound offers first-time homeowners a competitive 30-year fixed-rate government-insured loan that can be paired with New Jersey’s down payment assistance program.

The property must be the borrower’s primary residence and must be occupied within 60 days of closing. There are credit score and debt-to income requirements, which vary by purchase and lender. Income limits vary by location but may not exceed 140% of the area median income. In certain target areas, one need not be a first-time homebuyer to qualify, according to the fact sheet .

5. New Jersey Down Payment Assistance Program

Down payment assistance is available for prospective homebuyers who have qualified for any of the NJHMFA loans above. Residents may qualify for up to $15,000 to use toward a down payment or closing costs.

This is a five-year forgivable second mortgage. No interest is charged on the loan, and borrowers do not have to make monthly payments. Income restrictions and purchase price limits apply and vary by location.

Who Is Considered a First-Time Homebuyer in New Jersey?

NJHMFA defines a first-time homebuyer as someone who has not owned a primary residence in the past three years. For some of the agency programs, buyers in a targeted area or veterans may be repeat buyers as long as they do not currently own another primary residence.

Recommended: First-Time Homebuyer Guide

How to Apply to New Jersey Programs for First-Time Homebuyers

NJHMFA is not a lender, but it provides detailed information about each of the programs above, including location, price and income limits, and credit score requirements. The website also provides a list of approved lenders.

It’s especially important for first-time buyers, who may be unfamiliar with the mortgage borrowing process, to compare interest rates, fees, and terms among several lenders to make sure they’re getting the most affordable loan available.

It’s also a good idea to learn about mortgage insurance and guarantee fees.

Recommended: Understanding the Different Types of Mortgage Loans

Federal Programs for First-Time Homebuyers

Several federal government programs are designed for people who have low credit scores or limited cash to make a down payment. Although most of these programs are available to repeat homeowners, like state programs, they can be especially helpful to people who are buying a first home or who haven’t owned a home in several years.

The mortgages are usually for single-family homes, two- to four-unit properties that will be owner occupied, approved condos, townhomes, planned unit developments, and some manufactured homes.

Federal Housing Administration (FHA) Loans

The FHA is part of the U.S. Department of Housing and Urban Development (HUD), which insures mortgages for borrowers with lower credit scores. Homebuyers choose from a list of approved lenders participating in the FHA loan program. Loans offer competitive interest rates and require down payments of the purchase price for borrowers, who typically need FICO® credit scores of 580 or higher. Those with scores as low as 500 must put at least 10% down.

FHA loan limits in 2025 range from $524,225 for single units to $1,008,300 for four-unit properties, with limits being higher in the priciest areas.

In addition to examining your credit score, lenders will look at your debt-to-income ratio (DTI, or your monthly debt payments compared with your monthly gross income). FHA allows a DTI of up to 57%, vs. a typical 45% maximum for conventional loans.

Gift money for the down payment is allowed from certain donors and will be documented in a gift letter for the mortgage.

FHA loans always require mortgage insurance: a 1.75% upfront fee and annual premiums for the life of the loan, unless you make a down payment of at least 10%, which allows the removal of mortgage insurance after 11 years. As of 2025, monthly MIP for new homebuyers is 0.15% to 0.75%. A down payment of at least 10% allows the removal of mortgage insurance after 11 years. For a $300,000 mortgage balance, upfront MIP would be around $5,250 and monthly MIP, at a rate of 0.55%, would be about $137.

You can learn more about these loans, including FHA loans for refinance and rehab of properties, by reading up on FHA requirements, loan limits, and rates.

Freddie Mac Home Possible® Mortgages

Very low- and low-income borrowers may make just a 3% down payment on a Home Possible® mortgage. These loans allow various sources for down payments, including co-borrowers, family gifts, employer assistance, secondary financing, and sweat equity.

The Home Possible mortgage is for buyers with a credit score of at least 660. Once you pay 20% of your loan, the Home Possible mortgage insurance will be canceled, which will lower your mortgage payments./p>

Fannie Mae HomeReady Mortgages

Fannie Mae HomeReady® Mortgages allow down payments as low as 3% for low-income borrowers. Applicants generally need a credit score of at least 620; pricing may be better for credit scores of 680 and above. Like the Freddie Mac program, HomeReady loans allow flexibility for down payment financing, allowing gifts and grants.

For income limits, a comparison to an FHA loan, and other information, go to this Fannie Mae site.

Fannie Mae Standard 97 LTV Loan

The conventional 97 LTV loan is for first-time homebuyers of all income levels who have a credit score of 620 or higher and meet debt-to-income criteria. The 97% loan-to-value mortgage requires 3% down. Borrowers can get down payment and closing cost assistance from third-party sources.

Department of Veterans Affairs (VA) Loans

Active members of the military, veterans, reservists, and surviving spouses who are eligible may apply for loans backed by the Department of Veterans Affairs. VA loans, which can be used to buy, build, or improve homes, have lower interest rates than most other mortgages and don’t require a down payment. Most borrowers pay a one-time funding fee that can be rolled into the mortgage.

Another VA loan advantage is that they do not require PMI for borrowers who make a down payment of less than 20%. And they have more flexible credit score requirements. In some cases, even those who have previously been in foreclosure or bankruptcy can qualify.

Borrowers applying for a VA loan will need a Certificate of Eligibility from the VA so make sure to review a guide to qualifying for a VA loan as a first step in the process.

Native American Veteran Direct Loans (NADLs)

Native American veterans and their spouses who are eligible may use these no-down-payment mortgages to buy, improve, or build a home on federal trust land. The VA is the mortgage lender on NADLs. The funding fee applies.

US Department of Agriculture (USDA) Loans

No down payment is required on these loans to moderate-income borrowers that are guaranteed by the USDA in specified rural areas. Borrowers will pay an upfront guarantee fee and an annual fee that serves as mortgage insurance.

The USDA also issues direct loans to low- and very low-income people. Check out this USDA website for eligibility requirements.

HUD Good Neighbor Next Door Program

This program gives assistance to teachers, police officers, firefighters, and emergency medical technicians who qualify for mortgages in the areas they serve. Borrowers can receive 50% off a home in a HUD “revitalization area.” They must live in the home for at least three years.

HUD offers more information on programs designed for homebuyer affordability in New Jersey on its website .

New Jersey Homebuyer Stats for 2025

Here’s a snapshot of what the New Jersey homebuyer faces:

• Median home sale price in New Jersey: $560,200

• 3% down payment: $16,806

• 20% down payment: $112,040

• Percentage of buyers nationwide who are first-time buyers: 24%

• Median age of first-time homebuyers: 38

• Average credit score (vs. average U.S. score of 715): 724

Additional Financing Tips for First-Time Homebuyers

In addition to federal and state government-sponsored lending programs, other financial strategies may help you as a homebuyer in New Jersey. Some examples:

• Traditional IRA withdrawals. The IRS allows qualifying first-time homebuyers a one-time, penalty-free withdrawal of up to $10,000 from their IRA if the money is used to buy, build, or rebuild a home. A first-time homebuyer, where IRA withdrawals are concerned, is someone who has not owned a principal residence in the last two years. You will still need to pay income tax on the IRA withdrawal. If you’re married and your spouse has an IRA, they may also make a penalty-free withdrawal of $10,000 to purchase a home. The downside, of course, is that large withdrawals may jeopardize your retirement savings.

• Roth IRA withdrawals. Because Roth IRA contributions are made with after-tax money, the IRS allows tax- and penalty-free withdrawals of contributions for any reason, so long as you’ve held the account for five years. You may also withdraw up to $10,000 in earnings from your Roth IRA without paying taxes or penalties if you are a qualifying first-time homebuyer and you have had the account for five years. With accounts held for less than five years, homebuyers will pay income tax on earnings withdrawn.

• 401(k) loans. If your employer allows borrowing from the 401(k) plan that it sponsors, you may consider taking a loan against the 401(k) account to help finance your home purchase. With most plans, you’ll be able to borrow up to 50% of your 401(k) balance, up to $50,000, within a 12-month period without incurring any taxes or penalties. You pay interest on the loan, which is paid into your 401(k) account. You usually have to pay back the loan within five years, but if you’re using the money to buy a house, you may have up to 15 years to repay.

• State and local down payment assistance programs. Usually offered at the regional or county level, these programs provide flexible second mortgages for first-time buyers looking into how to afford a down payment.

• The mortgage credit certificate program. First-time homeowners and those who buy in targeted areas can claim a portion of their mortgage interest as a tax credit, up to $2,000. Any additional interest paid can still be used as an itemized deduction.

To qualify for this credit, you must be a first-time homebuyer, live in the home, and meet income and purchase price requirements, which vary by state. If you refinance, the credit disappears, and if you sell the house before nine years, you may have to pay some of the tax credit back. There are fees associated with applying for and receiving the mortgage credit certificate that vary by state. Often the savings from the lifetime of the credit can outweigh the fees.

• Your employer may offer access to lower-cost lenders and real estate agents in your area, as well as home buying education courses.

• Your lender is available to ask about any first-time homebuyer grant or down payment assistance programs available from government, nonprofit, and community organizations in your area.

The Takeaway

New Jersey offers a streamlined approach to first-time homebuyer mortgages along with a down payment assistance program. In addition to statewide programs, many localities offer initiatives that can help first-timers break into the New Jersey real estate market. Borrowers throughout the state may also find alternatives among the federal government’s first-time homebuyer programs.

Looking for an affordable option for a home mortgage loan? SoFi can help: We offer low down payments (as little as 3% - 5%*) with our competitive and flexible home mortgage loans. Plus, applying is extra convenient: It's online, with access to one-on-one help.

FAQ

Should I take first-time homebuyer classes?

You may have to. First-time homebuyer classes are actually required for some state and government-sponsored loan programs. But even if they aren’t mandatory, they can help demystify the homebuying process for first-timers. Check with your lender, real estate agent, local nonprofit housing advocacy groups, and state housing finance agency for programs in your area.

Do first-time homebuyers with bad credit qualify for homeownership assistance?

Oftentimes they do. Many government and nonprofit homeowner assistance programs are available to people with lower credit scores. And often, interest rates and other loan pricing are competitive with those of loans available to borrowers with higher credit scores. That said, almost any lending program has credit qualifications. That’s why it’s important to take all possible steps to improve your credit standing before you go house hunting.

Is there a first-time homebuyer tax credit in New Jersey?

No. New Jersey is not a state that offers the mortgage credit certificate program for first-time homebuyers.

Is there a first-time veteran homebuyer assistance program in New Jersey?

Most NJHMFA first-time buyer programs include veteran benefits. Many local and national programs do not require veterans to be first-time buyers to participate. New Jersey veterans may find options in the federal VA loan programs listed above.

What credit score do I need for first-time homebuyer assistance in New Jersey?

With most New Jersey housing agency programs, the lender determines the required credit score. In some cases, a credit score of 620 is required. But there are other private, state, local, and federal loan programs that borrowers with lower scores may be able to access.

What is the average age of first-time homebuyers?

The average age of a first-time homebuyer has increased to an all-time high of 38, according to data from the National Association of Realtors®.

Photo credit: iStock/Davel5957

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

*SoFi requires Private Mortgage Insurance (PMI) for conforming home loans with a loan-to-value (LTV) ratio greater than 80%. As little as 3% down payments are for qualifying first-time homebuyers only. 5% minimum applies to other borrowers. Other loan types may require different fees or insurance (e.g., VA funding fee, FHA Mortgage Insurance Premiums, etc.). Loan requirements may vary depending on your down payment amount, and minimum down payment varies by loan type.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

‡SoFi On-Time Close Guarantee: If all conditions of the Guarantee are met, and your loan does not close on or before the closing date on your purchase contract accepted by SoFi, and the delay is due to SoFi, SoFi will provide you $2,000.^ Terms and conditions apply. This Guarantee is available only for loan applications submitted after 6/15/22 for the purchase of a primary residence. Please discuss terms of this Guarantee with your loan officer. The property must be owner-occupied, single-family residence (no condos), and the loan amount must meet the Fannie Mae conventional guidelines. No bank-owned or short-sale transactions. To qualify for the Guarantee, you must: (1) Have employment income supported by W-2, (2) Receive written approval by SoFi for the loan and you lock the rate, (3) submit an executed purchase contract on an eligible property at least 30 days prior to the closing date in the purchase contract, (4) provide to SoFi (by upload) all required documentation within 24 hours of SoFi requesting your documentation and upload any follow-up required documents within 36 hours of the request, and (5) pay for and schedule an appraisal within 48 hours of the appraiser first contacting you by phone or email. The Guarantee will be void and not paid if any delays to closing are due to factors outside of SoFi control, including delays scheduling or completing the appraisal appointment, appraised value disputes, completing a property inspection, making repairs to the property by any party, addressing possible title defects, natural disasters, further negotiation of or changes to the purchase contract, changes to the loan terms, or changes in borrower’s eligibility for the loan (e.g., changes in credit profile or employment), or if property purchase does not occur. SoFi may change or terminate this offer at any time without notice to you. ^To redeem the Guarantee if conditions met, see documentation provided by loan officer.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

¹FHA loans are subject to unique terms and conditions established by FHA and SoFi. Ask your SoFi loan officer for details about eligibility, documentation, and other requirements. FHA loans require an Upfront Mortgage Insurance Premium (UFMIP), which may be financed or paid at closing, in addition to monthly Mortgage Insurance Premiums (MIP). Maximum loan amounts vary by county. The minimum FHA mortgage down payment is 3.5% for those who qualify financially for a primary purchase. SoFi is not affiliated with any government agency.

†Veterans, Service members, and members of the National Guard or Reserve may be eligible for a loan guaranteed by the U.S. Department of Veterans Affairs. VA loans are subject to unique terms and conditions established by VA and SoFi. Ask your SoFi loan officer for details about eligibility, documentation, and other requirements. VA loans typically require a one-time funding fee except as may be exempted by VA guidelines. The fee may be financed or paid at closing. The amount of the fee depends on the type of loan, the total amount of the loan, and, depending on loan type, prior use of VA eligibility and down payment amount. The VA funding fee is typically non-refundable. SoFi is not affiliated with any government agency.

Qualifying for the reward requires using a real estate agent that participates in HomeStory’s broker to broker agreement to complete the real estate buy and/or sell transaction. You retain the right to negotiate buyer and or seller representation agreements. Upon successful close of the transaction, the Real Estate Agent pays a fee to HomeStory Real Estate Services. All Agents have been independently vetted by HomeStory to meet performance expectations required to participate in the program. If you are currently working with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®. A reward is not available where prohibited by state law, including Alaska, Iowa, Louisiana and Missouri. A reduced agent commission may be available for sellers in lieu of the reward in Mississippi, New Jersey, Oklahoma, and Oregon and should be discussed with the agent upon enrollment. No reward will be available for buyers in Mississippi, Oklahoma, and Oregon. A commission credit may be available for buyers in lieu of the reward in New Jersey and must be discussed with the agent upon enrollment and included in a Buyer Agency Agreement with Rebate Provision. Rewards in Kansas and Tennessee are required to be delivered by gift card.

HomeStory will issue the reward using the payment option you select and will be sent to the client enrolled in the program within 45 days of HomeStory Real Estate Services receipt of settlement statements and any other documentation reasonably required to calculate the applicable reward amount. Real estate agent fees and commissions still apply. Short sale transactions do not qualify for the reward. Depending on state regulations highlighted above, reward amount is based on sale price of the home purchased and/or sold and cannot exceed $9,500 per buy or sell transaction. Employer-sponsored relocations may preclude participation in the reward program offering. SoFi is not responsible for the reward.

SoFi Bank, N.A. (NMLS #696891) does not perform any activity that is or could be construed as unlicensed real estate activity, and SoFi is not licensed as a real estate broker. Agents of SoFi are not authorized to perform real estate activity.

If your property is currently listed with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®.

Reward is valid for 18 months from date of enrollment. After 18 months, you must re-enroll to be eligible for a reward.

SoFi loans subject to credit approval. Offer subject to change or cancellation without notice.

The trademarks, logos and names of other companies, products and services are the property of their respective owners.

SOHL-Q225-241

June 2025 Market Lookback

Fastest Comeback Ever

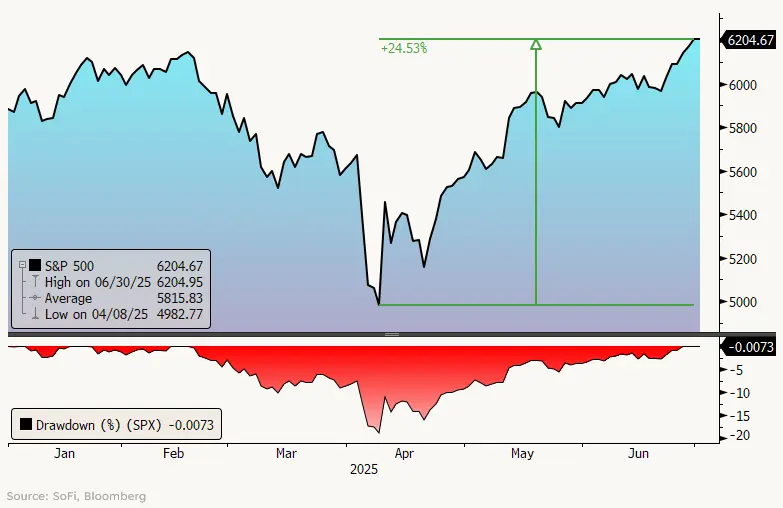

The second quarter of 2025 was a wild one. After peaking on February 19, markets began to slide because of trade policy fears. That decline accelerated into a nearly 20% correction following the April 2 “Liberation Day” tariff announcements. The sell-off was so sharp, in fact, that two of the worst 100 days in stock market history occurred in the two days post-announcement.

The Trump administration’s decision to delay tariff implementation played a big role in the market rebound, as evidenced by the nearly 10 percentage point bounce on April 9, which was one of the 100 best days in stock market history.

The de-escalation of trade tensions fueled a powerful, sentiment-driven recovery that lasted through June. The rally culminated in the S&P 500 setting a new all-time high, closing at 6,204.95 on June 30, an unthinkable accomplishment given where markets were at the start of the quarter.

To put it in perspective, the index rallied 24.5% from the April 8 bottom through quarter-end. In the history of corrections of at least 15%, that is the fastest rebound on record.

S&P 500 Year-to-Date

What Giveth Can Taketh Away

While stocks sit at all-time highs, the foundation of the recent rally is fragile. The factor that drove the sharp decline — acute fear over the future of U.S. trade policy — also enabled the powerful rebound once the immediate fear was postponed. This dynamic, however, can work in reverse.

The core risk hasn’t been eliminated, just delayed, and time is ticking on the tariff reprieves. As those pauses end and tariffs get implemented (or not), the same policy risks that previously roiled markets could be reintroduced.

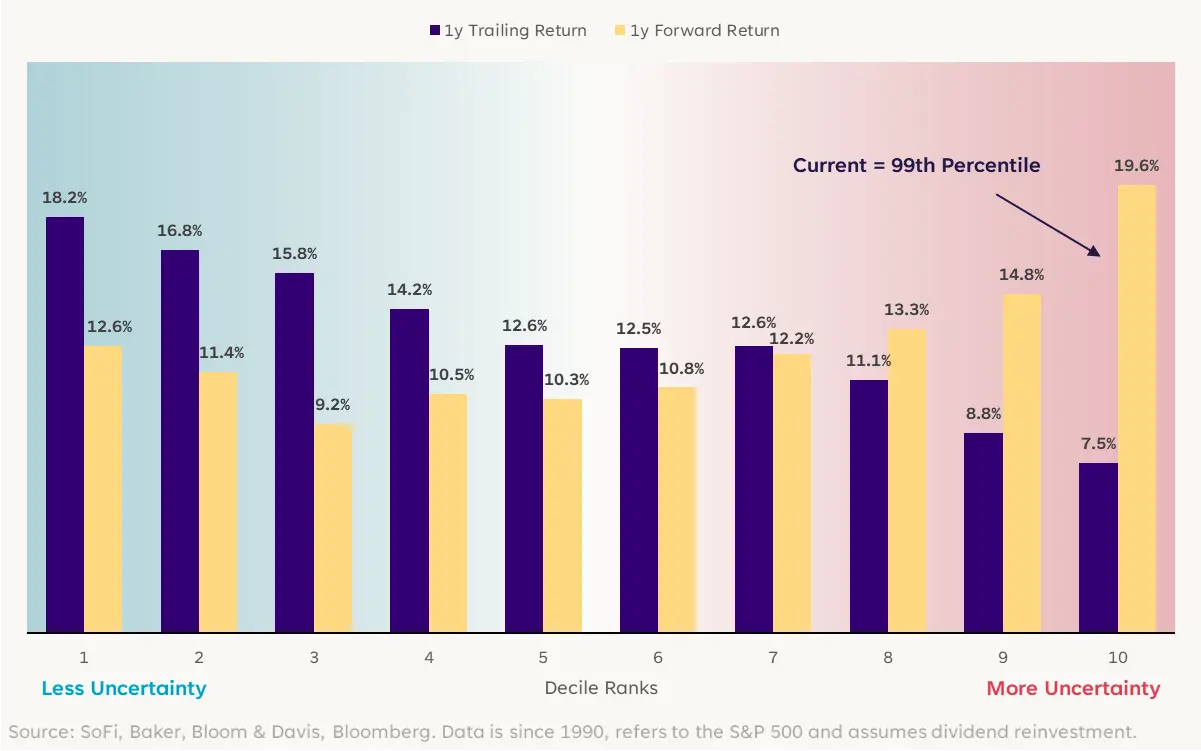

Historically, periods of high economic policy uncertainty are better for forward returns but worse for trailing returns. (The reverse is generally true for periods of low uncertainty).

Economic Policy Uncertainty Affects Stock Returns

In other words, it’s not that high uncertainty itself boosts returns, but that transitioning from higher to lower uncertainty enables investors to price out worst-case scenarios (which usually boosts returns). That only can happen if uncertainty dissipates, but that’s an open question.

Risks are compounded by stretched valuations, with the S&P 500’s forward price-to-earnings ratio near cycle highs, and a deteriorating earnings outlook. Ultimately, policy uncertainty continues to drive market volatility, and it doesn’t look like it’s going anywhere for now.

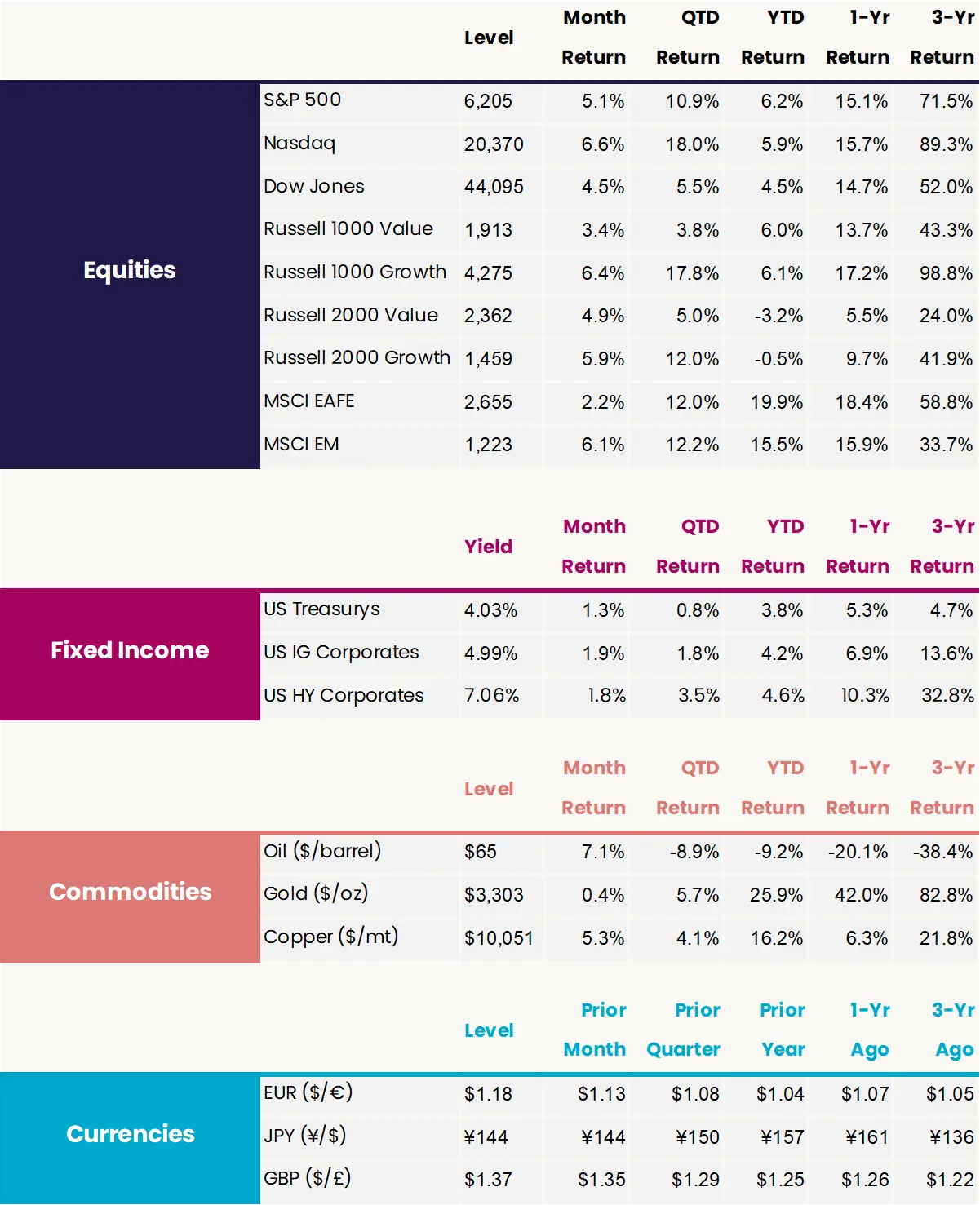

Market Recap

Asset Returns

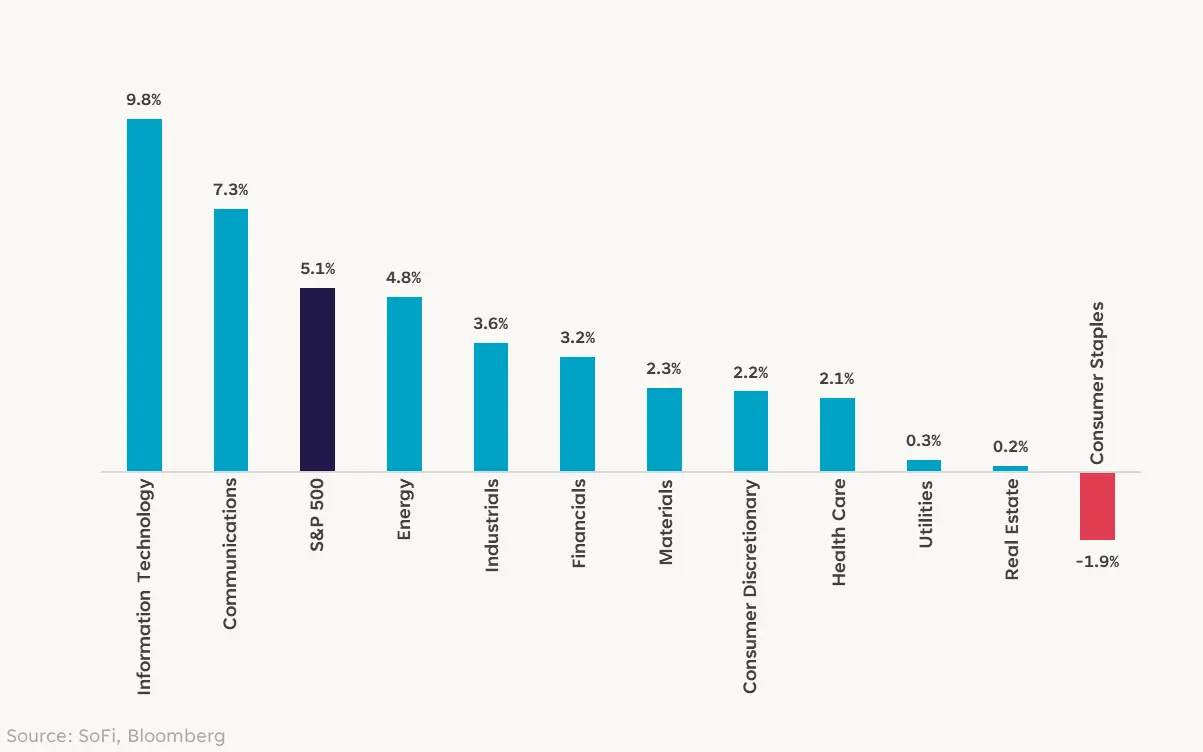

June 2025 Sector Total Returns

Macro

• The Federal Reserve left its benchmark interest rate unchanged at a target range of 4.25%-4.50%.

• The Fed’s Summary of Economic Projections were revised to show lower growth, higher unemployment, and higher inflation this year and next.

• May CPI (+0.1% m/m) and PPI (+0.1% m/m) both came in below expectations, the fourth such month in a row.

• Housing starts plunged to 1.256m in May (-9.8% m/m), the lowest level in five years.

• Continuing jobless claims rose to 1.974m as of mid-June, the highest since November 2021.

• Against expectations for a m/m increase of 0.3%, personal income declined 0.4% in May, the first decline since September 2021.

• Q1 GDP growth was revised down from -0.2% to -0.5%, driven by lower consumer spending.

• Fears of a potential disruption to oil supply in response to the conflict between Israel and Iran led to oil prices surging as much as 23.6%, before ending the month up 7.1%.

Equities

• The S&P 500 closed at a record high of 6,205 on June 30, eclipsing its prior all-time high set on February 19.

• The S&P 500 forward 12-month price/earnings ratio rose from 21.4x to 22.1x, representing multiple expansion of 3.5%, while forward EPS estimates rose 1.4% from $277 to $280.

• Growth stocks beat value stocks by 2.8 percentage points, the third straight month of outperformance.

• Defensive sectors handedly outperformed cyclicals and technology-exposed parts of the market.

Fixed Income

• 2- and 10-year Treasury yields fell 18 and 17 basis points, respectively, as weakening economic data boosted interest rate cut expectations for later in the year.

• Investment Grade and High Yield corporate bond spreads narrowed by 5 and 24 basis points, respectively.

Performance data quoted represents past performance. Past performance does not guarantee future results. Market returns will fluctuate, and current performance may be lower or higher than the standardized performance data quoted.

Read moreCurrent Home Equity Loan Rates in Phoenix, AZ Today

PHOENIX HOME EQUITY LOAN RATES TODAY

Current home equity loan

rates in Phoenix, AZ.

Disclaimer: The prime rate directly influences the rates on HELOCs and home equity loans.

Turn your home equity into cash. Call us for a complimentary consultation or get prequalified online.

Compare home equity loan rates in Phoenix.

Key Points

• Phoenix’s home equity loan rates tend to follow the prime rate.

• If you’re aiming for the best rates, keep your credit score at 680 or above, and your debt-to-income ratio close to 36%.

• Home equity loans offer fixed monthly payments over a term of 5 to 30 years, typically with lower interest rates than unsecured loans.

• The risk of foreclosure is a significant consideration when taking out a home equity loan.

• Interest on home equity loans may be tax-deductible if funds are used for home improvements.

Introduction to Home Equity Loan Rates

Welcome to our guide to home equity loan rates in Phoenix. We’re going to dive into the current pool of home equity loans, explaining how they work, what factors influence their interest rates, and how you can qualify for the best rates. Whether you’re looking to fund home improvements, consolidate debt, or cover other major expenses, understanding home equity loan rates can help you make an informed financial decision.

How Do Home Equity Loans Work?

Before you apply, it’s important to know the basics about what a home equity loan is, exactly. A home equity loan is a second mortgage that uses your home as collateral and provides a lump sum of money you can use for any purpose. You’ll begin repaying it immediately in equal monthly installments over a fixed term of five to 30 years. Because your home is the collateral for the loan, you’ll generally get a lower interest rate than you would with an unsecured personal loan. (This also means your home is at risk if you miss payments.) Most home equity loans have a fixed interest rate, so your payments will be predictable.

To qualify, you’ll need to have at least 20% equity in your home. Some lenders may allow you to borrow up to 85% of your equity. A home equity loan calculator can help you determine your home equity and how much you might borrow against it.

Where Do Home Equity Loan Interest Rates Originate?

Interest rates on different types of home equity loans are influenced by a variety of factors, including the economic environment and your financial situation. The Federal Reserve’s monetary policy has a significant impact on the lending market. Lenders typically tie home equity loan rates to the prime rate, which is influenced by the Fed’s policies. Changes in the prime rate often lead to corresponding adjustments in home equity loan rates. As with your original home loan, your credit score and debt-to-income (DTI) ratio also play a role in the rates you are offered. Additionally, the loan amount and repayment term can affect the interest rate. Competitive pressures among lenders can also lead to rate reductions. Understanding these factors can help you make informed decisions about your home equity loan.

How Interest Rates Impact Home Equity Loan Affordability

Your interest rate is a game-changer when it comes to making your loan affordable. Let’s look at an example of a $100,000 home equity loan with a 15-year repayment term. At an 8.50% interest rate, you would have a $984 monthly payment and $77,253 in total interest. Bump the interest up to 9.50% and suddenly you’re looking at a $1,044 monthly payment and $87,961 in total interest. That’s a $10,700 difference! Here are more examples of how your loan term and rate could affect payments.

| Loan Amount | Loan Term | Interest Rate | Monthly Payment |

|---|---|---|---|

| $100,000 | 20 years | 8.00% | $836 |

| 7.00% | $775 | ||

| 10 years | 8.00% | $1,213 | |

| 7.00% | $1,161 | ||

| $50,000 | 20 years | 8.00% | $418 |

| 7.00% | $388 | ||

| 10 years | 8.00% | $607 | |

| 7.00% | $581 | ||

| $25,000 | 20 years | 8.00% | $209 |

| 7.00% | $194 | ||

| 10 years | 8.00% | $303 | |

| 7.00% | $290 |

Home Equity Loan Rate Trends

As you’re thinking about how to get equity out of your home, you’ll probably consider trying to time your loan application to achieve the lowest possible rate. But predicting the prime rate is a bit like trying to forecast the weather, and not every borrower has time to wait for a low spot. The rate has seen its fair share of ups and downs, as you can see from the graphic and chart. Don’t beat yourself up if you can’t hold off on applying until rates are at their lowest. If you need a loan, focus on comparing offers from different lenders to get the best possible rate for you.

Source: TradingView.com

| Date | Prime Rate |

|---|---|

| 9/19/2024 | 8.00% |

| 7/27/2023 | 8.50% |

| 5/4/2023 | 8.25% |

| 3/23/2023 | 8.00% |

| 2/2/2023 | 7.75% |

| 12/15/2022 | 7.50% |

| 11/3/2022 | 7.00% |

| 9/22/2022 | 6.25% |

| 7/28/2022 | 5.50% |

| 6/16/2022 | 4.75% |

| 5/5/2022 | 4.00% |

| 3/17/2022 | 3.50% |

| 3/16/2020 | 3.25% |

| 3/4/2020 | 4.25% |

| 10/31/2019 | 4.75% |

| 9/19/2019 | 5.00% |

| 8/1/2019 | 5.25% |

| 12/20/2018 | 5.50% |

| 9/27/2018 | 5.25% |

Source: St. Louis Fed

How to Qualify for the Lowest Rates

To secure the most competitive home equity loan rates in Phoenix, there are a few factors you should keep in mind. By taking the following steps before you begin the application process, you’ll be better positioned to land a home equity loan with rates and terms that are not just favorable, but a smart and manageable choice.

Maintain Sufficient Home Equity

It’s a simple equation: you need at least 20% equity in your home to qualify for a home equity loan. To figure out your equity, simply subtract your outstanding mortgage balance from your estimated home value. Then divide the answer by the estimated home value to arrive at a percentage of equity. The higher it is, the better off you’ll be.

Build a Strong Credit Score

To land the best available home equity loan rate, a robust credit score is needed. Lenders are often looking for a score of 680 or higher, with many requiring a score over 700. A higher credit score is a sign of financial savvy and can open the door to more favorable loan terms. By focusing on timely payments, reducing credit card balances, and steering clear of new debt, you can boost your chances of qualifying for a home equity loan with a lower interest rate.

Manage Debt-to-Income Ratio

Your DTI ratio is an important factor when it comes to qualifying for a home equity loan and getting a good rate. Lenders typically want to see a DTI ratio of 50% or less, and 36% or lower will help you qualify for the lowest interest rates. To manage your DTI effectively, you can pay down your existing debt, increase your income, or do a combination of both.

Obtain Adequate Property Insurance

Property insurance is a must-have for home equity loans. This insurance is a safety net for both you and the lender should any damage occur. Make sure your coverage is up to snuff.

Useful Tools & Calculators

Before you take the leap and borrow against your home, it pays to do a little math to understand what your borrowing power will be and how much you can expect to spend for loan payments. Fortunately, online calculators can do that math for you. Here are three useful ones.

Run the numbers on your home equity loan.

-

Home Equity Loan

CalculatorEnter a few details about your home loan and we’ll provide you your maximum home equity loan amount.

-

HELOC Payment

CalculatorPunch in your HELOC amount and we’ll estimate your monthly payment amount for your HELOC.

-

HELOC Interest Only Calculator

Use SoFI’s HELOC interest calculator to estimate how much monthly interest you’ll pay .

Using the free calculators is for informational purposes only, does not constitute an offer to receive a loan, and will not solicit a loan offer. Any payments shown depend on the accuracy of the information provided.

Closing Costs and Fees

When it comes to closing costs for home equity loans, borrowers will usually pay between 2% and 5% of the loan amount. These costs cover things like an appraisal, credit reports, and origination fees. Title insurance and a title search are also on the fee list.

Tax Deductibility of Home Equity Loan Interest

If you use a home equity loan to buy, build, or significantly improve your home, the interest you pay may be tax deductible. This tax benefit is currently valid through 2025, and there’s a possibility it could be extended beyond that year. Married couples filing joint tax returns can deduct interest paid on up to $750,000 of qualified home equity loans, while single filers can deduct interest on loans up to $375,000. To claim the deduction, taxpayers must itemize deductions on their tax returns. Consulting a tax advisor can provide personalized advice based on your specific financial situation.

Recommended: HELOC vs. Home Equity Loan

Alternatives to Home Equity Loans

While home equity loans are a go-to for many, there are other ways to borrow against your equity that you might want to mull over. Let’s take a look at them, starting with a home equity line of credit.

Home Equity Line of Credit (HELOC)

A HELOC is like a credit card for homeowners, with the ability to borrow up to a certain limit and — during the initial “draw” period of the HELOC — only pay interest on the amount you’ve borrowed. During this time (usually 10 years) a HELOC interest-only calculator is useful.

HELOC interest rates are typically variable, so be prepared for potential fluctuations. You can always use a HELOC monthly payment calculator to compute payments as rates change. To qualify, a credit score of 680 or higher (ideally 700 or more) and a debt-to-income ratio of less than 50% (ideally 36% or lower) are generally required. HELOCs are great if you aren’t sure exactly how much you might need to borrow or when costs are spread out over time.

Cash-Out Refinance

A cash-out refinance is a special mortgage refinance that lets you replace your existing mortgage with a new, larger one and pocket the difference to use as you wish. The amount you can cash out is determined by your home equity, with most lenders allowing you to borrow up to 80%. Typically, you’ll need a credit score of 620 or higher and a debt-to-income ratio under 43% to qualify. The beauty of a cash-out refi is that you can choose between fixed or variable rates. Below, a quick guide to a home equity loan vs. a cash-out refinance vs. a home equity line of credit:

| Home Equity Loan | HELOC | Cash-Out Refinance | |

|---|---|---|---|

| Borrowing Limit | Up to 85% of borrower’s equity | Up to 90% of borrower’s equity | 80% of borrower’s equity for most loans |

| Interest Rate | Fixed | Generally variable | May be fixed or variable |

| Type of Credit | Installment loan: Borrowers get a specific amount of money all at once that they then immediately begin repaying, with interest, in regular installments. | Revolving credit: Borrowers receive a line of credit. They have a draw period (5-10 years) during which they borrow and can only pay interest, followed by a repayment period (10-20 years) to repay the principal plus interest. | Installment loan: Borrowers receive a lump sum payment from the excess funds of their new mortgage, which has a new rate and repayment terms. |

| Repayment Term | Generally 5-30 years | A draw period of 5-10 years, followed by a HELOC repayment period of 10-20 years | Generally 15-30 years |

| Fees | Closing costs (typically 2-5% of the loan amount) | Closing costs (typically 2%-5% of the loan amount), plus other possible costs, depending on the lender (annual fees, transaction fees, inactivity fees, early termination fees) | Closing costs (typically 2-5% of the loan amount) |

The Takeaway

When you’re thinking about a home equity loan in Phoenix, it’s wise to grasp the key factors that sway loan rates. Your credit score, DTI ratio, and equity level all play a part. But shopping around can also help you get the best available rate for you. And if a home equity loan isn’t quite the right fit, remember that HELOCs and cash-out refinances are there, each with their own unique benefits to consider.

SoFi now offers home equity loans. Access up to 85%, or $750,000, of your home’s equity. Enjoy lower interest rates than most other types of loans. Cover big purchases, fund home renovations, or consolidate high-interest debt. You can complete an application in minutes.

Unlock your home’s value with a home equity loan from SoFi.

FAQ

What can you use a home equity loan for?

Home equity loans are versatile, serving as a funding source for major expenses, home improvements, or the consolidation of high-interest debt. The adaptability of these loans makes them a valuable resource for homeowners who need a substantial sum but who don’t want to part with their property. When contemplating a home equity loan, it’s crucial to be smart about how you use the funds and to have a plan to pay the lender back.

What would the monthly payment be on a $50,000 home equity loan?

The monthly payment for a $50,000 home equity loan depends on the loan term and interest rate. For instance, a 15-year fixed-rate loan at 7.50% would mean a monthly payment of about $464. Opting for a 30-year term at the same rate would lower the monthly payment to roughly $350. The amount of interest paid over the life of the loan is usually higher with a longer term.

What would the monthly payment be on a $100,000 HELOC?

A $100,000 home equity line of credit often comes with a variable interest rate. During the draw period, you might only need to pay interest on the funds you use. Once the draw period concludes, you’ll pay both the principal and interest. If you were repaying the full $100,000 over a period of 20 years and the interest rate held steady at 8.00%, your monthly payment would be $836. But remember, the variable rate makes it hard to predict payments precisely.

What are the benefits of a home equity loan?

Home equity loans offer a fixed interest rate, which means the monthly payment amount is predictable. And because a home equity loan is secured by your home, it will typically have a lower interest rate than a personal loan, which is unsecured. Plus, the interest you pay may be tax-deductible if the funds you borrow are used for major home improvements (consult a tax advisor).

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

*SoFi requires Private Mortgage Insurance (PMI) for conforming home loans with a loan-to-value (LTV) ratio greater than 80%. As little as 3% down payments are for qualifying first-time homebuyers only. 5% minimum applies to other borrowers. Other loan types may require different fees or insurance (e.g., VA funding fee, FHA Mortgage Insurance Premiums, etc.). Loan requirements may vary depending on your down payment amount, and minimum down payment varies by loan type.

²SoFi Bank, N.A. NMLS #696891 (Member FDIC), offers loans directly or we may assist you in obtaining a loan from SpringEQ, a state licensed lender, NMLS #1464945.

All loan terms, fees, and rates may vary based upon your individual financial and personal circumstances and state.You should consider and discuss with your loan officer whether a Cash Out Refinance, Home Equity Loan or a Home Equity Line of Credit is appropriate. Please note that the SoFi member discount does not apply to Home Equity Loans or Lines of Credit not originated by SoFi Bank. Terms and conditions will apply. Before you apply, please note that not all products are offered in all states, and all loans are subject to eligibility restrictions and limitations, including requirements related to loan applicant’s credit, income, property, and a minimum loan amount. Lowest rates are reserved for the most creditworthy borrowers. Products, rates, benefits, terms, and conditions are subject to change without notice. Learn more at SoFi.com/eligibility-criteria. Information current as of 06/27/24.In the event SoFi serves as broker to Spring EQ for your loan, SoFi will be paid a fee.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

Checking Your Rates: To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score. However, if you choose a product and continue your application, we will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull and may affect your credit.

Disclaimer: Many factors affect your credit scores and the interest rates you may receive. SoFi is not a Credit Repair Organization as defined under federal or state law, including the Credit Repair Organizations Act. SoFi does not provide “credit repair” services or advice or assistance regarding “rebuilding” or “improving” your credit record, credit history, or credit rating. For details, see the FTC’s website .

Non affiliation: SoFi isn’t affiliated with any of the companies highlighted in this article.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

SOHL-Q324-298