Free Arizona Home Mortgage Loan Calculator

Arizona Mortgage Calculator

By SoFi Editors | Updated September 17, 2025

When you’re thinking about buying a home, you need clear, helpful information to make the best financial choices for your individual situation. Our Arizona mortgage calculator lets you find the monthly and overall costs for different mortgages in minutes so that you can compare and contrast your options effectively. Free and easy to use, the calculator can be one of the most important tools you’ll rely on during your search. Let’s take a closer look.

Key Points

• Mortgage calculators can help you determine monthly and overall costs for different mortgages when you input factors like home price, down payment, loan term, and interest rate.

• Lenders prefer your mortgage payments to be less than 28% of your gross monthly income.

• Mortgage payments may include principal, interest, property taxes, homeowners insurance, and potentially private mortgage insurance (PMI), or homeowners association (HOA) fees.

• Options that may help you reduce mortgage payments include dropping PMI once you reach 20% equity, appealing high property taxes, and refinancing to a lower rate, among others.

• First-time homebuyers in Arizona may be able to access a variety of financial assistance programs offered through the state and local organizations.

Arizona Mortgage Calculator

Calculator Definitions

• Home price: This is the purchase price for the property that you and the seller agree on. As the final price, it will probably differ from both the initial listing price and the amount of your first offer.

• Down payment: This is the amount that you pay upfront for the property, often expressed as a percentage of the total purchase price. Most buyers put down between 3% and 20%. A down payment of 20% or more will let you avoid paying private mortgage insurance (PMI). Down payment assistance programs may be available to help you cover this cost.

• Loan term: This is the length of time you have to repay your home loan, usually 15 or 30 years. A shorter term means higher monthly payments but less interest charged over the life of the loan. A longer term can make monthly payments more manageable but cost more in the long run.

• Interest rate: This is the cost of borrowing money and is typically expressed as a percentage of the total loan amount. The rate a lender offers you will depend on market trends and your personal financial situation, among other factors.

• Annual property tax: Property tax is levied by local governments on land and buildings and is generally expressed as a percentage of a property’s assessed value. Find your property tax rate by searching online for the town, county, or ZIP code where the property is located and “effective property tax rate.”

• Monthly payment: The amount you’ll pay your lender each month includes both mortgage principal and interest. It may also cover estimated property taxes, homeowners insurance, and possibly any homeowners association (HOA) fees. If your down payment was less than 20% and you need to pay for private mortgage insurance (PMI), that’s generally also part of the monthly payment.

• Total interest paid: This figure is the cumulative amount of interest you’ll pay over the entire duration of the loan. That amount can be substantial, especially with longer loan terms. Opting for a larger down payment or a shorter loan term can reduce the total interest paid over time.

• Total loan cost: This is the entire amount you’ll pay during the life of the loan, including the principal amount you borrowed and all the interest accrued throughout the loan term. Factors like loan term length, interest rate, and down payment amount all play into the total loan cost.

How to Use the Arizona Mortgage Calculator

Using the calculator is quick and easy. Just follow these step-by-step instructions. And don’t worry — the calculator is free, and accessing it won’t affect your credit rating.

Step 1: Enter your home price

Input the purchase price you’ve agreed on with the seller to generate an estimate of your monthly payments and overall loan costs.

Step 2: Select a down payment amount

Choose the down payment percentage you’d like to pay to see how it affects your monthly mortgage payment and total interest paid. A down payment calculator can help you decide.

Step 3: Choose a loan term

Select a 15- or 30-year term to see how it impacts your monthly payments and total interest costs.

Step 4: Enter an interest rate

Input your desired interest rate to the second or third decimal point to see its impact on your monthly payment and total loan cost. If you are purchasing a very expensive property, you may want to look specifically at rates likely to be available for a jumbo loan.

Step 5: Input your annual property tax

Enter the annual property tax rate percentage to get an accurate estimate of your monthly mortgage costs. For example, if your rate is 0.44%, input 0.44.

Benefits of Using a Mortgage Payment Calculator

A mortgage calculator can be extremely helpful as you determine how much house you can afford. It’s especially useful when you’re buying your first home. The calculator will show you an estimate of how much your monthly payments will be, depending on a specific mortgage amount, interest rate, and term. You can use the tool to compare different loan amounts and interest rates and how much impact each combination might have on your monthly budget.

This calculator is designed for fixed-rate mortgages, so if you choose a type of mortgage loan that has a variable interest rate, you can still estimate your costs with this calculator, but the results will be less precise due to the fluctuations of a variable rate.

Recommended: The Cost of Living in the U.S.

Deciding How Much House You Can Afford in Arizona

In Arizona, with a median home sale price of about $439,000 in late 2025, how affordable a home is for you depends in large part on your income. Lenders prefer that your mortgage payments are less than 28% of your gross monthly income.

For a $439,000 house with a 30-year mortgage term at a 7.00% interest rate, assuming a 20% down payment, you’d typically pay $2,337 per month. To follow the 28% rule, this would mean you’d need to make approximately $100,157 annually. Lenders would also like to know that your total debt will stay, ideally, below 36% of your gross income; Here, that will leave you just under $668 for other debts.

You can also try a home affordability calculator to get an estimate of how much house your income allows you to afford.

It may also be helpful to know that going through the mortgage preapproval process with a prospective lender is another way to get a clear picture of how large a loan you can afford.

Components of a Mortgage Payment

The major components your mortgage payment goes toward paying will be the principal amount you borrowed and the interest your lender charged. This Arizona home mortgage calculator also includes your property taxes, which are often part of the monthly payments you pay to your mortgage servicer. Potentially, the payment might also include homeowners insurance and private mortgage insurance (PMI) or homeowners association (HOA) fees, depending on what’s relevant.

If you’re looking at home loans guaranteed by the Federal Housing Administration (FHA), use an FHA mortgage calculator, which allows for that type of loan’s mortgage insurance premiums.

Similarly, a VA mortgage calculator may be useful if you’re looking at a loan backed by the U.S. Department of Veterans Affairs.

Current mortgage rates by state.

Compare current home interest rates by state and find a mortgage rate that suits your financial goals.

Select a state to view current rates:

Cost of Living in Arizona

The cost of living in Arizona can impact how much house you can afford. While Arizona is fairly expensive compared to the average cost of living in the U.S., it offers a range of housing options, even if it’s not one of the best affordable places in the U.S. You can see that in this breakdown of the cost of living in Arizona’s major metropolitan areas, according to the Council for Community and Economic Research’s Cost of Living Index (COLI).The COLI is measured on a scale on which 100 is the national average.

| Arizona Cities’ Cost-of-Living Stats | |

|---|---|

| Bullhead CIty | 92.8 |

| Flagstaff | 121.6 |

| Lake Havasu City | 125.2 |

| Phoenix | 106.3 |

| Prescott-Prescott Valley | 120.2 |

| Surprise | 102.9 |

Run the numbers on your home loan.

-

Mortgage calculator

Punch in your home loan amount and a new interest rate, and we’ll estimate your payoff date.

-

Down payment calculator

Enter a few details about your home loan and we’ll provide your monthly mortgage payment.

-

Home affordability calculator

Provide us with a few details and see how much you can afford to spend on a home purchase.

Using the free calculators is for informational purposes only, does not constitute an offer to receive a loan, and will not solicit a loan offer. Any payments shown depend on the accuracy of the information provided.

Tips on Reducing Your Mortgage Payment

There are steps you can take that may help lower your monthly mortgage payment, depending on your individual situation.

• Explore down payment assistance programs. Don’t be discouraged that many of these are specific to buyers who qualify as first-time homebuyers. In many cases that category includes people who haven’t owned a primary residence in the last three years. A larger down payment can mean lower monthly payments and even help you avoid paying mortgage insurance.

• Drop PMI as soon as possible. If you’re paying private mortgage insurance on your mortgage, once your home equity reaches 20%, you can request that your lender cancel it.

• Recast your mortgage with a lump sum payment. If you get a windfall and apply it toward your mortgage, you can request that your lender recast your loan, meaning that it will reamortize it while keeping your rate and term the same. This typically lowers your payments.

• Appeal high property taxes. If you believe your property was assessed at too high a value and you’re being taxed too much, you can appeal and ask that your property be reassessed.

• Consider a mortgage refinance. If you already have a mortgage, and rates drop significantly or your credit improves, you may be able to score a better rate and lower payments.

• Shop for cheaper homeowners insurance. You can look for a carrier who charges less, raise your deductible, or bundle policies to obtain a discount.

Recommended: Average Monthly Expenses for One Person

Arizona First-Time Homebuyer Assistance Programs

If you’re interested in purchasing your first home or if you haven’t owned a primary residence in the past three years, there’s a good chance you’ll be able to find some assistance in Arizona. In particular, the area has a number of down payment assistance programs that provide financial aid for your down payment, closing costs, or both.

Programs for first-time homebuyers in Arizona may be on the state level but are often local, so it’s worth investigating options in the county or town where you’d like to live. Some programs are restricted to first-timers and people with limited incomes, but others serve a wider audience.

The Takeaway

Using an Arizona mortgage calculator can be a smart strategic move when you’re planning your home purchase. The tool helps you estimate monthly payments, understand the impact of different down payments, and explore various loan terms. By factoring in local property taxes, it can give you a more comprehensive view of the financial obligations attached to different loans. Whether you’re a first-time homebuyer or a homeowner looking to refinance, this calculator can provide the valuable insights you need to help you make informed decisions and achieve your homeownership goals.

Looking for an affordable option for a home mortgage loan? SoFi can help: We offer low down payments (as little as 3% - 5%*) with our competitive and flexible home mortgage loans. Plus, applying is extra convenient: It's online, with access to one-on-one help.

FAQ

How does my credit score affect my mortgage loan interest rate?

Your credit score has a significant impact on your mortgage interest rate. Higher scores generally lead to lower rates, reducing the total cost of your loan.

What are principal and interest on a mortgage loan?

The principal is the original amount borrowed by the homebuyer, and the interest is the cost of borrowing that amount, usually expressed as a percentage of the principal.

How much should I put down on a mortgage?

Conventional home loans often require a minimum down payment of 3%, but putting down 20% can eliminate the need to pay private mortgage insurance (PMI).

How much is a $600,000 mortgage payment for 30 years?

A $600,000 mortgage with a 30-year fixed rate at 7.00% would result in a monthly payment of approximately $3,992. This estimate doesn’t include property taxes, homeowners insurance, or HOA fees.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

*SoFi requires Private Mortgage Insurance (PMI) for conforming home loans with a loan-to-value (LTV) ratio greater than 80%. As little as 3% down payments are for qualifying first-time homebuyers only. 5% minimum applies to other borrowers. Other loan types may require different fees or insurance (e.g., VA funding fee, FHA Mortgage Insurance Premiums, etc.). Loan requirements may vary depending on your down payment amount, and minimum down payment varies by loan type.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

¹FHA loans are subject to unique terms and conditions established by FHA and SoFi. Ask your SoFi loan officer for details about eligibility, documentation, and other requirements. FHA loans require an Upfront Mortgage Insurance Premium (UFMIP), which may be financed or paid at closing, in addition to monthly Mortgage Insurance Premiums (MIP). Maximum loan amounts vary by county. The minimum FHA mortgage down payment is 3.5% for those who qualify financially for a primary purchase. SoFi is not affiliated with any government agency.

†Veterans, Service members, and members of the National Guard or Reserve may be eligible for a loan guaranteed by the U.S. Department of Veterans Affairs. VA loans are subject to unique terms and conditions established by VA and SoFi. Ask your SoFi loan officer for details about eligibility, documentation, and other requirements. VA loans typically require a one-time funding fee except as may be exempted by VA guidelines. The fee may be financed or paid at closing. The amount of the fee depends on the type of loan, the total amount of the loan, and, depending on loan type, prior use of VA eligibility and down payment amount. The VA funding fee is typically non-refundable. SoFi is not affiliated with any government agency.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

Checking Your Rates: To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score. However, if you choose a product and continue your application, we will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull and may affect your credit.

SOHL-Q325-076

Get prequalified in minutes for a SoFi Home Loan.

Free Alaska Home Mortgage Loan Calculator

Alaska Mortgage Calculator

By SoFi Editors | Updated September 19, 2025

If you’re looking around in hopes of buying a home in Alaska, a mortgage calculator can be a useful tool for you. It will be particularly helpful if you’re a first-time homebuyer who’s never held a mortgage. Exploring how various home prices, interest rates, and loan terms may affect your monthly payments and the ultimate cost of your home loan can help you budget responsibly.

Key Points

• A mortgage calculator can help a homebuyer determine affordability and aid in their future finance management.

• Your mortgage payments in Alaska will include principal, interest, and taxes, and may also comprise insurance and other fees.

• Alaska ranked fifth in the U.S. among states with the highest cost of living in late 2025, and has higher than-average home prices and utility, maintenance, and transportation costs.

• Programs to assist first-time homebuyers with their down payments and closing costs are available.

• If you need to reduce your monthly mortgage payment, you can look into a recast or refinance, and also consider appealing property taxes.

Alaska Mortgage Calculator

Calculator Definitions

• Home price: The home price is the purchase amount a buyer and seller agree on. If you’re buying your first home in Alaska, it will be an important determiner of your mortgage loan amount and monthly payment.

• Down payment: The down payment is the first installment on a home purchase, usually from 3% to 20% of the home price. Down payment assistance programs can help you cover this cost, especially if you are a first-time homebuyer. A healthy down payment can help you avoid private mortgage insurance (PMI), too.

• Loan term: This is the time you can take to repay your home loan. A 15-year term will carry higher monthly payments — but in the end you’ll pay a lot less interest. A 30-year mortgage, generally the longest term, offers you lower monthly payments but you’ll rack up more interest over the life of the loan.

• Interest rate: The interest rate, expressed as a percentage of the loan amount, is the cost of borrowing the money to buy a home. Your rate can will based on the type of mortgage you apply for, market trends, and your qualifications.

• Annual property tax: Local governments levy property taxes on land and buildings based on guidelines set by your state. You can find your property tax rate by searching online for the town, county, or ZIP code where the property is located and “effective property tax rate.” Understanding rates in your area can help you plan your budget.

• Monthly payment: This is the amount you’ll pay toward your mortgage each month. It typically includes principal and interest, and may comprise property taxes and homeowners insurance. If a down payment is less than 20% of the home price, private mortgage insurance (PMI) may be a line item.

• Total interest paid: The cumulative amount of interest you’ll pay over your mortgage loan’s life is total interest paid. It’s influenced by loan term, interest rate, and down payment. A longer term or a higher rate will increase your total interest paid. A larger down payment can help reduce this amount.

• Total loan cost: This all-in amount is what your loan expense will be, including the principal and interest. A 30-year mortgage will have a higher total loan cost than a 15-year mortgage, due to its longer repayment period and more interest accrued.

How to Use the Alaska Mortgage Calculator

Step 1: Enter Your Home Price

Input the purchase price you and the seller have negotiated. Using this figure, the calculator can estimate both your monthly mortgage payment and total interest cost.

Step 2: Select a Down Payment Amount

Choose the percentage of the home price you’ll pay upfront from the menu. With a larger down payment, you can reduce your monthly mortgage payment as well as what you’ll pay in total interest. A down payment calculator can help you decide the ideal amount to put down.

Step 3: Choose a Loan Term

Select the amount of time you’ll need to pay off the mortgage, from 10 to 30 years. A longer home loan term means you’ll have lower monthly payments, but more interest paid in time.

Step 4: Enter an Interest Rate

Input your estimated interest rate. The number should be to the second or third decimal point. Remember that a lower rate may reduce monthly payments and the total interest you pay. Purchasing a pricey property? Look at rates that might be available for a jumbo loan.

Step 5: Add Your Annual Property Tax Rate

Enter the property tax rate for the new home as a percentage. For example, if the rate is 1.2%, input 1.2.

Benefits of Using a Mortgage Payment Calculator

Using a mortgage calculator, you can easily determine just how much house you can afford. This is particularly helpful if you are buying a home for the first time. You can see an estimate of your monthly payments based on loan amount, interest rate, and term, and compare different loan amounts and interest rates to see how they might bite into your budget.

If the type of mortgage loan you choose has a variable interest rate, estimate your costs using this calculator. But know that the estimate will be less precise due to variable rate fluctuations.

Recommended: The Cost of Living in the U.S.

Deciding How Much House You Can Afford in Alaska

In Alaska, the median home sale price in late 2025 is around $423,000. Lenders typically prefer a mortgage payment to be no more than 28% of your gross monthly income. The mortgage payment in this 28% equation will include principal, interest, taxes, and homeowner’s insurance, or PITI.

To afford a $423,000 home following this formula, you’d need to have an annual income of roughly $109,000, assuming you could make a 20% down payment ($97,290) and qualify for a 30-year mortgage at 7.00%. Your estimated monthly mortgage payment would be about $2,542. This equation does not account for other significant debts you may be carrying around, though. If you have a car or student loan payment, or you’re carrying credit card debt, you may not be able to afford this mortgage unless you have a higher income.

A home affordability calculator can help you create an estimate of how much house you can afford, based on your income. You can also participate in the mortgage preapproval process with a lender, which will give you a clear picture of the loan type and size you can afford.

Current mortgage rates by state.

Compare current home interest rates by state and find a mortgage rate that suits your financial goals.

Select a state to view current rates:

Components of a Mortgage Payment

Principal and the interest are a mortgage payment’s two primary parts. This mortgage calculator also factors in property taxes, which are often included in monthly loan payments. (It’s definitely in your lender’s interest to make sure you don’t lapse on tax bills.) Your monthly payment might also include private mortgage insurance (PMI, necessary if your down payment is under 20%) or homeowners association (HOA) fees, depending on your situation.

If you are considering a Federal Housing Administration (FHA)-guaranteed home loan, use an FHA mortgage calculator. It will factor in the loan’s upfront mortgage insurance premiums.

Looking at a loan backed by the U.S. Department of Veterans Affairs? A VA mortgage calculator is your best bet.

Recommended: Down Payment Calculator

Cost of Living in Alaska

The cost of living in your area affects how much you can afford when buying a home. Higher-cost areas, including Alaska — which had the fifth highest composite cost of living index in the U.S. in late 2025 — tend to have above-average home prices and higher-than-normal costs for utilities, maintenance, transportation, or all of the above.

Alaska’s biggest cities rank very high in the Cost of Living Index (COLI), with Anchorage at 122.8; Fairbanks at 121.5; and Juneau at 127.2. Needless to say, you won’t find many Alaska towns on a list of the best affordable places in the U.S..

Recommended: Average Monthly Expenses for One Person

Run the numbers on your home loan.

-

Mortgage calculator

Punch in your home loan amount and a new interest rate, and we’ll estimate your payoff date.

-

Down payment calculator

Enter a few details about your home loan and we’ll provide your monthly mortgage payment.

-

Home affordability calculator

Provide us with a few details and see how much you can afford to spend on a home purchase.

Using the free calculators is for informational purposes only, does not constitute an offer to receive a loan, and will not solicit a loan offer. Any payments shown depend on the accuracy of the information provided.

Tips on Reducing Your Mortgage Payment

Homebuyers in Alaska are smart to do whatever they can to lower their mortgage payment. Here are some possible ways to reduce the amount you have to come up with monthly to make your payment:

• Drop PMI as soon as you reach 20% home equity. (You will need to inform your lender when you’re ready to do this.)

• Recast your mortgage. You can do this by making a lump-sum payment toward the principal you still owe, and then asking the lender to recalculate your payment.

• Think about appealing your property taxes — though only if you can really determine that they are too high. Inviting scrutiny of a property’s worth can also result in a tax increase, which might increase your payment, so exercise caution here.

• Request that your lender modify your loan if you find yourself facing financial hardship.

• Extend your loan term, which can lower monthly payments.

• Shop around for a cheaper homeowners insurance policy.

• Consider a mortgage refinance if mortgage rates have dropped since you bought your home.

Alaska First-Time Homebuyer Assistance Programs

If you qualify as a first-time homebuyer in Alaska, you may be able to tap into programs that aid with down payments or closing costs to make homeownership accessible to people with limited savings. To top it off, you could get extra perks when you qualify as a new homebuyer — meaning you haven’t owned a primary residence in the last three years. The Alaska Housing Finance Corporation provides below-market-interest-rate loans and down payment help for eligible low- and middle-income buyers.

Consult a guide to first-time homebuying programs in Alaska for advice.

The Takeaway

Spending some time with the Alaska mortgage calculator is a great step to understanding the financial commitment you make when you take on a home loan. It can help you make an informed decision about how much house you can afford. Whether you’re a first-time homebuyer or a seasoned property owner, the calculator will provide valuable insights to ensure you’re well-prepared for your purchase.

Looking for an affordable option for a home mortgage loan? SoFi can help: We offer low down payments (as little as 3% - 5%*) with our competitive and flexible home mortgage loans. Plus, applying is extra convenient: It's online, with access to one-on-one help.

FAQ

What is a mortgage payment?

It’s typically a monthly payment including principal and interest, but it may include amounts for property taxes and homeowners insurance, ensuring that these expenses are covered throughout the loan term and that the home remains insured. If mortgage insurance is a requirement, that may also be in the total.

How does my credit score affect my mortgage loan interest rate?

Your credit score impacts your mortgage interest rate significantly. A lender may offer its most attractive interest rate to a borrower with a higher score, reducing the total cost of the mortgage. A lower score may result in a higher interest rate, not to mention stricter lending conditions — if you are approved at all.

What are principal and interest on a mortgage loan?

They are two key components of a mortgage payment. The principal is the original loan amount, while interest is the money you pay to the lender for the privilege of borrowing that amount. In time, as you pay off your loan, more of your payment will go toward the principal, reducing the loan balance and interest you will pay. Look for an amortization schedule with your loan documents; it will tell you how much of your payment each month goes into each bucket.

How much should I put down on a mortgage?

You should pay as much as you comfortably can toward a down payment on your home, while taking care not to pinch your finances to the point that you have no cushion. Don’t empty your emergency fund or stop paying on other debts, for example. One smart move would be to take advantage of low down payments available to first-time buyers. New homebuyers can put down as little as 3% in some cases, and repeat buyers may be able to contribute just 5%. Put down less than 20%, and you’ll likely have to add private mortgage insurance payments to your monthly bill. Always look at the entire financial picture to determine what makes sense.

Should I choose a 30-year or 15-year term for my mortgage?

A 30-year term will offer you lower monthly payments and make homeownership more accessible. A 15-year term will require a higher monthly payment but could save you thousands of dollars in interest. If your budget can accommodate a term of 15 or even 20 years, it’s a smart way to go. But don’t feel bad choosing to lock in 30 years, particularly if this is your first home purchase. It’s the most popular choice of mortgage term in the U.S.

How can I get a lower mortgage interest rate?

To gain access to the most desirable mortgage interest rates, work on cultivating a strong credit score (700 or higher, well over the 620 you’ll need to qualify for a home loan). Complete the prequalification process online with multiple lenders to see how low a rate you can get. Saving to make a higher down payment may help, too, if you can afford to. If you own your home already, explore a mortgage refinance and compare your old loan’s costs compared to those on a new one at a new, lower rate. Remember to consider the closing costs.

How much income do you need to get a $400,000 mortgage?

You’ll probably have to earn around $130,000 annually to qualify for a $400,000 mortgage with a 30-year term and a 7.00% interest rate. This assumes you aren’t burdened by other significant debts. One general rule to consider: Your home price shouldn’t be more than three times your gross income. Always adjust for other substantial debts you’re carrying.

Can I afford a $300K house on a $70K salary?

It would be a stretch. Buying a $300,000 property on a salary of $70,000 is going to be tough unless you can make a large down payment. Advisors suggest that the price of your house should not exceed three times your salary — which in this case should be $210,000. Crunch the numbers using a home affordability calculator to see how much down payment you’ll need to make a $300,000 home doable.

How much is the payment on a $600,000, 30-year mortgage?

What a $600,000 mortgage with a 30-year term will cost you monthly depends on your interest rate. At 6.00%, for example, you’d pay $3,597.30 per month. At 8.00%, your payment would rise to $4,402.59. This estimate includes principal and interest, but property taxes, insurance, and other fees will make it increase.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

*SoFi requires Private Mortgage Insurance (PMI) for conforming home loans with a loan-to-value (LTV) ratio greater than 80%. As little as 3% down payments are for qualifying first-time homebuyers only. 5% minimum applies to other borrowers. Other loan types may require different fees or insurance (e.g., VA funding fee, FHA Mortgage Insurance Premiums, etc.). Loan requirements may vary depending on your down payment amount, and minimum down payment varies by loan type.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

¹FHA loans are subject to unique terms and conditions established by FHA and SoFi. Ask your SoFi loan officer for details about eligibility, documentation, and other requirements. FHA loans require an Upfront Mortgage Insurance Premium (UFMIP), which may be financed or paid at closing, in addition to monthly Mortgage Insurance Premiums (MIP). Maximum loan amounts vary by county. The minimum FHA mortgage down payment is 3.5% for those who qualify financially for a primary purchase. SoFi is not affiliated with any government agency.

†Veterans, Service members, and members of the National Guard or Reserve may be eligible for a loan guaranteed by the U.S. Department of Veterans Affairs. VA loans are subject to unique terms and conditions established by VA and SoFi. Ask your SoFi loan officer for details about eligibility, documentation, and other requirements. VA loans typically require a one-time funding fee except as may be exempted by VA guidelines. The fee may be financed or paid at closing. The amount of the fee depends on the type of loan, the total amount of the loan, and, depending on loan type, prior use of VA eligibility and down payment amount. The VA funding fee is typically non-refundable. SoFi is not affiliated with any government agency.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

Checking Your Rates: To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score. However, if you choose a product and continue your application, we will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull and may affect your credit.

SOHL-Q325-075

Get prequalified in minutes for a SoFi Home Loan.

Free California Home Mortgage Loan Calculator

California Mortgage Calculator

By SoFi Editors | Updated September 15, 2025

Getting a mortgage in California is easier when you’ve done your homework in advance. Put a few basic facts into this California mortgage calculator and you’ll learn the monthly payment amount and total interest cost for your home purchase. You can also use the calculator to try out different scenarios to find the home price, down payment, and interest rate that are the best combo for you.

Key Points

• A mortgage loan calculator helps homebuyers quickly estimate the monthly and total costs of borrowing money to buy a home.

• Generally speaking, monthly mortgage payments should not exceed 28% of gross income.

• The calculator includes principal, interest, and estimated property tax.

• Extending the loan term can reduce monthly payments, making home buying more affordable.

• First-time homebuyer programs offer down payment and closing cost assistance.

Calculator Definitions

• Home price: The home price is the purchase price you’ve negotiated with the seller. This price may differ from the initial listing price and your first offer.

• Down payment: The down payment is the amount you plan to pay upfront. It’s often expressed as a percentage of the total home price. Buyers put down anywhere from 3% to 20%. Down payment assistance programs help some buyers pull together the necessary funds.

• Loan term: The loan term is the length of time you have to repay the home loan. Common terms are 15 or 30 years. A shorter term can reduce total interest paid but increases monthly payments. A longer term offers lower monthly payments but results in more interest overall.

• Interest rate: The interest rate is the cost of borrowing money, expressed as a percentage of the loan amount. Interest rates vary based on borrower qualifications, market trends, and loan type.

• Annual property tax: The annual property tax is levied by local governments on land and buildings within their jurisdiction, and is expressed as a percentage of a property’s assessed value. In California, property taxes are capped by state law and the effective tax rate is 0.7%.

• Monthly payment: The monthly payment represents what you would pay toward the loan’s principal and interest each month, plus a sum that goes toward your property taxes. It does not include home insurance, private mortgage insurance (PMI), or homeowners association (HOA) fees.

• Total interest paid: The total interest paid represents the amount of interest you will pay over the life of your home loan. A larger down payment, lower interest rate, or shorter loan term can reduce this amount.

• Total loan cost: The total loan cost represents the all-in amount you will pay for the loan, including both the principal borrowed and the accumulated interest.

How to Use the California Mortgage Calculator

Step 1: Enter Your Home Price

Type in the agreed-upon purchase price of the property.

Step 2: Select a Down Payment Amount

Choose the percent of the home price you will pay upfront. A larger down payment lowers your loan amount and also reduces your monthly payment and total interest paid.

Step 3: Choose a Loan Term

Select the length of time to repay the mortgage, anywhere from 10 to 30 years. A longer term lowers monthly payments but increases total interest.

Step 4: Enter an Interest Rate

Input your estimated interest rate to the second or third decimal point. Lower rates reduce monthly payments and total interest paid.

Step 5: Add Your Annual Property Tax Rate

Enter the percentage of your property’s market value for annual property tax. California’s effective property tax rate averages .7%. For the specific percentage in your area, search online for the property’s town, county, or ZIP code and “effective property tax rate.”

Recommended: Average Monthly Expenses for One Person

Benefits of Using a Mortgage Payment Calculator

A mortgage calculator estimates monthly payments based on loan amount, interest rate, and term. Using it can help you determine affordability before house hunting — it will be particularly helpful if you’re buying your first home, because having a mortgage may be entirely new to you.

Comparing rates and terms aids in choosing the type of mortgage loan you will pursue — for example, whether you will have a fixed or variable interest rate. The calculator shows how a down payment impacts your loan.

If you’re unsure of how much home you can afford, another helpful tool is a home affordability calculator.

Deciding How Much House You Can Afford

In California, the median home sale price in mid-2025 was just over $830,000, well above the national median of around $443,000, according to Redfin. Lenders suggest a mortgage payment shouldn’t exceed 28% of gross monthly income. To afford a $830,000 home with a 20% down payment, you’d need an annual income of $192,000 if you took out a 30-year mortgage at 7.00%. This assumes you pay the average California property taxes and have home insurance costs of $2,500. Your monthly mortgage payment, including taxes and insurance, would be $4,417.

Another way to get a handle on how much house you can afford is to go through the mortgage preapproval process with a lender. You’ll emerge with a clear picture of your borrowing capacity.

Components of a Mortgage Payment

The main components of a mortgage payment are the principal and the interest. This mortgage calculator also factors in property tax, because property taxes are often included as part of your monthly loan payment. (It’s in your lender’s interest to make sure you keep up on your tax bills, after all.) Your monthly payment could also include private mortgage insurance (PMI, necessary if your down payment is below 20%) or homeowners association (HOA) fees, depending on your specific situation.

If you’re considering a home loan guaranteed by the Federal Housing Administration (FHA), use an FHA mortgage calculator, which takes into consideration both the loan’s upfront and ongoing mortgage insurance premiums.

A VA mortgage calculator is your best bet if you’re looking at a loan backed by the U.S. Department of Veterans Affairs.

Recommended: Down Payment Calculator

Current mortgage rates by state.

Compare current home interest rates by state and find a mortgage rate that suits your financial goals.

Select a state to view current rates:

Cost of Living in California

California’s high cost of living impacts affordability, with higher home prices and expenses in many areas. As a whole, the state has a cost of living that is 42% above the U.S. national average. Properties in coastal areas might require a jumbo loan. For more affordable living, consider Stockton, Bakersfield, Chico, or another of the Golden State’s best affordable places in the U.S. A California mortgage calculator can estimate homebuying expenses.

There is a significant variation within California in terms of cost, as this cost-of-living index data shows. In the chart below, 100 equals the average cost of living in the U.S.

| California Cities’ Cost-of-Living Stats | |

|---|---|

| Bakersfield | 111.7 |

| Los Angeles-Long Beach | 149.4 |

| Oakland | 137.7 |

| Orange County | 156.3 |

| Redding | 110.5 |

| San Diego | 145.3 |

| San Francisco | 166.8 |

| San Jose | 180.7 |

Run the numbers on your home loan.

-

Mortgage calculator

Punch in your home loan amount and a new interest rate, and we’ll estimate your payoff date.

-

Down payment calculator

Enter a few details about your home loan and we’ll provide your monthly mortgage payment.

-

Home affordability calculator

Provide us with a few details and see how much you can afford to spend on a home purchase.

Using the free calculators is for informational purposes only, does not constitute an offer to receive a loan, and will not solicit a loan offer. Any payments shown depend on the accuracy of the information provided.

Tips on Reducing Your Mortgage Payment

Homebuyers in California are looking to do whatever they can to lower their mortgage payment. Here are some things you can do after purchasing a home to lower the payment:

• Drop private mortgage insurance (PMI) once you reach 20% home equity. (Reach out to your lender to do this.)

• Consider a mortgage recast. Make a lump-sum payment toward the principal that you owe and ask the lender to do a recast.

• Consider appealing your property taxes if you feel they are too high. Use caution, however: Inviting closer scrutiny of a property’s worth can sometimes result in a tax increase.

• Request that a lender modify your loan if you are facing financial hardship.

• Extend your loan term to lower monthly payments.

• Shop for cheaper homeowners insurance.

• If mortgage rates have dropped since you made your purchase, consider a mortgage refinance.

People who qualify as a first-time homebuyer in California may be able to utilize programs that aid with down payments or closing costs, making homeownership accessible to those with limited savings. Best of all, you could qualify as a newbie buyer if you haven’t owned a primary residence in the past three years. The California Housing Finance Agency provides below-market-interest-rate loans and down payment help for eligible low- and middle-income buyers.

Consult a guide to first-time homebuying programs in California for advice.

The Takeaway

Using a California mortgage calculator is a good first step in understanding the financial implications of homeownership. It helps you estimate monthly payments and total interest, and provides a clear picture of the overall cost of borrowing. Whether you’re a first-time homebuyer or considering refinancing, a mortgage calculator is an invaluable tool for planning and budgeting.

Looking for an affordable option for a home mortgage loan? SoFi can help: We offer low down payments (as little as 3% - 5%*) with our competitive and flexible home mortgage loans. Plus, applying is extra convenient: It's online, with access to one-on-one help.

FAQ

How does my credit score affect my mortgage loan interest rate?

Higher scores generally mean lower mortgage rates, as lenders see less risk.

What is the difference between principal and interest in a mortgage payment?

Principal repays the loan; interest is the lender’s fee. An amortization schedule details how much of each payment goes to each.

What is a recommended down payment for a mortgage?

A 20% down payment avoids PMI and secures better rates, but many buyers, especially first-timers, put down less. Explore assistance programs if needed.

Should I choose a 30-year or 15-year mortgage term?

A 30-year term has lower monthly payments but higher overall interest. A 15-year term has higher monthly payments but saves on interest. Choose the shortest affordable term; 30-year is most popular.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

*SoFi requires Private Mortgage Insurance (PMI) for conforming home loans with a loan-to-value (LTV) ratio greater than 80%. As little as 3% down payments are for qualifying first-time homebuyers only. 5% minimum applies to other borrowers. Other loan types may require different fees or insurance (e.g., VA funding fee, FHA Mortgage Insurance Premiums, etc.). Loan requirements may vary depending on your down payment amount, and minimum down payment varies by loan type.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

¹FHA loans are subject to unique terms and conditions established by FHA and SoFi. Ask your SoFi loan officer for details about eligibility, documentation, and other requirements. FHA loans require an Upfront Mortgage Insurance Premium (UFMIP), which may be financed or paid at closing, in addition to monthly Mortgage Insurance Premiums (MIP). Maximum loan amounts vary by county. The minimum FHA mortgage down payment is 3.5% for those who qualify financially for a primary purchase. SoFi is not affiliated with any government agency.

†Veterans, Service members, and members of the National Guard or Reserve may be eligible for a loan guaranteed by the U.S. Department of Veterans Affairs. VA loans are subject to unique terms and conditions established by VA and SoFi. Ask your SoFi loan officer for details about eligibility, documentation, and other requirements. VA loans typically require a one-time funding fee except as may be exempted by VA guidelines. The fee may be financed or paid at closing. The amount of the fee depends on the type of loan, the total amount of the loan, and, depending on loan type, prior use of VA eligibility and down payment amount. The VA funding fee is typically non-refundable. SoFi is not affiliated with any government agency.

SOHL-Q325-073

Get prequalified in minutes for a SoFi Home Loan.

5 Ways to Make the Most of Your Home While Waiting to Sell

Are you thinking that it might be worth waiting to sell your home?

With homes sitting on the market longer and prices starting to fall, more homeowners are becoming discouraged about their prospects for a successful sale. A growing number are delisting their properties, presumably holding out for a more favorable market.

Of course, delaying a sale doesn’t make sense if a shorter commute or room for a growing family is more important to you than maximizing your profits. And while the Federal Reserve is expected to resume interest rate cuts, there’s no guarantee you’d be better off waiting. If and when mortgage rates drop, it would have to be enough to draw out more buyers and higher offers.

But if you do decide to stay put — at least temporarily — you don’t have to just make do. Here are five ways to get the most out of your current home in the meantime.

1. Make your house more livable. If you have the means, key repairs or renovations may not only make you more comfortable, but boost the value of your home once you’re ready to sell. Choose projects that either have a high return on investment (like replacing a garage door or installing a new oven range and sink) or that will dramatically improve your quality of life. A home equity loan or line of credit (SoFi has both) can help cover the costs.

2. Turn your unused space into a side hustle. There’s nothing like earning some extra income to make delaying your move more bearable, especially if it’s low lift. Rent extra bedrooms to roommates or turn a garage or shed into an Airbnb rental. Or get creative by transforming a basement into something like a podcast studio.

3. Move anyway – and rent your home out for a while. If you can’t hold off on moving, consider whether it makes sense to rent your house out instead of selling it. Just be prepared for landlord duties, including screening tenants and abiding by local regulations and insurance requirements. If you move to a rental that costs less than your mortgage, you might even be able to pocket the difference.

4. Stage your space. Getting your house ready for a sale can make you feel less anxious and more prepared when the time is right. And it doesn’t have to cost a fortune. Get any necessary repairs out of the way or look to boost your curb appeal. (A fresh coat of paint or flowers in the front yard go a long way.) Even just decluttering and depersonalizing (think: adding shelves or storage furniture) can brighten your outlook while you’re living there and improve your chances of impressing potential buyers down the road.

5. Save aggressively. You can’t control mortgage rates or buyer demand. But you can put yourself in a stronger financial position when you decide to sell. Use the desire to make a fresh start in a new home as motivation to save your money or pay down debt so you’ve got a stronger financial footing when you make your next purchase. Creating a budget, opening a high-yield savings account, or “paying yourself first” are great ways to help jumpstart this effort.

SoFi Bank, N.A. NMLS #696891 (Member FDIC), offers loans directly or we may assist you in obtaining a loan from SpringEQ, a state licensed lender, NMLS #1464945.

All loan terms, fees, and rates may vary based upon your individual financial and personal circumstances and state.

You should consider and discuss with your loan officer whether a Cash Out Refinance, Home Equity Loan or a Home Equity Line of Credit is appropriate. Please note that the SoFi member discount does not apply to Home Equity Loans or Lines of Credit not originated by SoFi Bank. Terms and conditions will apply. Before you apply, please note that not all products are offered in all states, and all loans are subject to eligibility restrictions and limitations, including requirements related to loan applicant’s credit, income, property, and a minimum loan amount. Lowest rates are reserved for the most creditworthy borrowers. Products, rates, benefits, terms, and conditions are subject to change without notice. Learn more at SoFi.com/eligibility-criteria. Information current as of 09/12/25.

In the event SoFi serves as broker to Spring EQ for your loan, SoFi will be paid a fee.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

SoFi isn't recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

OTM2025091501

Read moreHome Equity $2k

{/*Hero 200*/}

Get an exclusive $2,000 bonus2 on a home equity loan.

✓ Access up to 85% or $350K of your home’s equity.

✓ Keep your current home loan interest rate.

✓ $0 origination fee options.1

✓ Fixed rates and flexible terms.

{/*Hero APR*/}

{/*trust pilot*/}

Received a mailer from us?

Enter confirmation #

{/*how it works*/}

How to apply for a

home equity loan online.

Help us understand your needs.

Answer a few questions online to help us

assist you better.

Get paired with a dedicated Mortgage

Loan Officer.

You’ll be connected with an experienced SoFi

Mortgage Loan Officer who’s ready to help you get

the best home equity loan for you.

Submit your application.

Your SoFi Mortgage Loan Officer will help you submit your home equity application so you can get access to your cash.

Get started

{/*what is a he loan*/}

What is a home

equity loan?

Home equity loans let you borrow money by leveraging the equity in your home. They’re one of the most affordable financing options since home equity rates are lower than interest rates for most other types of loans. These lower interest rates can help fund big purchases, home renovations, or consolidate high-interest debt.

Learn more

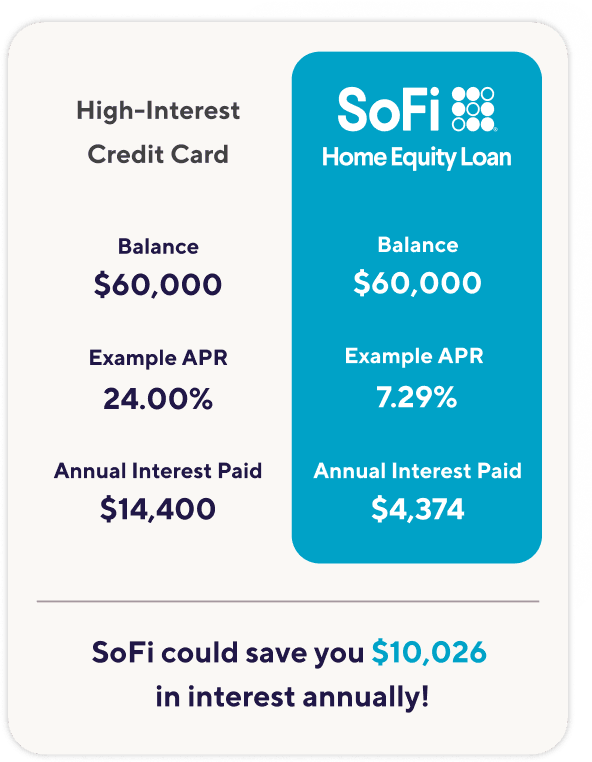

You could save thousands

with a SoFi home equity loan.

The savings claim above is based upon using a SoFi Home Equity Loan to pay-off credit card balance of $60,000. We assume a credit card APR of 24%. The savings shown assumed payments of only the interest due. We compare that against an assumed SoFi Home Equity Loan of $60,000 (to pay off the credit card) with an APR of 7.29%. Annual interest savings assumes you pay both loans on time. You might not be eligible for the home equity loan and, if you are eligible, your APR rate could be higher. Eligibility and the lowest APR rate depend on credit worthiness, income, and other factors. The 24% APR is the average credit card APR reported by Wallethub for Q1 March 2025 under their Good Credit category.

{/*requirements*/}

Home equity loan requirements:

View your rate

Checking won’t affect your credit score.†

{/*horizon*/}

{/*popular uses*/}

A home equity loan could

help with that.

-

Pay down high-interest debt.

You could save on your monthly payments

when you consolidate credit cards or

other unsecured loans into one lower rate. -

Fund home improvements.

Make your dream kitchen a reality without

having to take on high-interest debt. -

Make big purchases.

Tuition, weddings, and vacations can get

expensive. Instead of putting them on a

high-interest credit card, a home equity

loan could help you save on monthly payments.

{/*calculators*/}

Crunch the numbers on your

home equity loan.

HELOC monthly

payment calculator

Get help understanding your

monthly payments with a home

equity line of credit.

Learn more

HELOC repayment

calculator

Estimate how much you might be

paying with a home equity line of

credit.

Learn more

{/*why SoFi*/}

Why choose SoFi

for your home

equity loan?

No change to your existing mortgage rate.

Keep your current mortgage as is, no need to refinance. And for qualified borrowers, there are options to access your home’s equity.

Finance almost anything with up to $350K.

Access up to $350,000 of your home’s equity (up to 85%) to finance home improvements or consolidate debt.

Lower your monthly payment.

You could save compared to a high-interest credit card or unsecured personal loan.

Get dedicated one-on-one support.

You’ll have a dedicated SoFi Mortgage Loan Officer to help you find the right loan option for you.

“Austin and his team were awesome and easy to work with! Great communication and follow up. Kept us in the loop every step of the way! I would go back to Austin without question.”

“Spencer and his team totally went to bat for us and got our loan processed. Very happy with him and his teams efforts and follow up. Communication was excellent right up to the loan funding.”

“Mark and his team worked very closely with us to make sure that we were comfortable with the process, understood the expectations, timeline and overall schedule.”

300+ Reviews

Current home equity loan rates by state.

Compare current home equity loan rates by state and find a home equity loan rate that suits your financial goals.

Select a state to view current rates:

{/*learn more*/}

Learn more about home equity loans.

More resources on home equity

Get answers to questions like “What’s the difference between a home equity loan

and a HELOC (home equity line of credit)?”

FAQs

How does a home equity loan work?

To start, you’ll need to have sufficient home equity, which is the difference between the market value and what you owe. You may have built home equity by paying down your mortgage and by seeing your home appreciate. You’ll go through an application process, and the lender will likely order a home appraisal to ensure that there’s enough value there to lend against. You’ll have a lot more paperwork than some other loans and will sign mortgage lien documents that give the lender the right to start proceedings should you fail to make payments. After closing on the loan, you’ll receive all funds upfront. Repayment starts shortly after.

Learn more: What Is a Home Equity Loan?

How to apply for a home equity loan?

First, assess your financial situation – consider your income, how much equity you have available, if you have at least a “good” FICO® score, and your debt-to-income ratio. Exploring different loan options is encouraged!

Once you’ve found a fitting loan and are ready to apply, you’ll go through the application process, where you’ll submit information about your income, current mortgage, insurance, and other details the lender requests. If everything checks out, you’ll be able to close on your loan! Funds are disbursed around three business days after closing on the loan.

On a home equity loan where the funds are disbursed upfront and your interest rate is locked, the first payment will be due around 30 days after you close the loan.

How do I qualify for a home equity loan?

Home equity loans are contingent on income, credit history, and debt-to-income ratio. LTV is also considered. LTV compares the amount you owe against your home with its current value. Lenders usually want to see an LTV no higher than 80%. (LTV = Loan Value ÷ Property Value.) On a $400,000 home, for example, that means that you should owe no more than $320,000.

How long does it take to get a home equity loan?

It can take an estimated 30 days to close your loan. Funds are disbursed around three business days after closing on the loan. On a home equity loan where the funds are disbursed upfront and your interest rate is locked, the first payment will be due around 30 days after you close the loan.

What is the interest rate on a home equity loan?

A home equity loan offers a low interest rate because it uses your home’s equity to secure the loan. Because of the way it works, you may have access to a larger sum of money at a lower interest rate than you would if you used another source, such as a credit card. View your home equity rate here.

How much can I get with a home equity loan?

When it comes to how much home equity you can tap, many lenders allow a maximum of 90%, although some allow less, and some, more. In other words, your loan-to-value ratio shouldn’t exceed 90% in many cases.

If you’re taking out a second mortgage like a home equity loan or HELOC, your first mortgage and the equity loan compared with your home value is what is called the combined loan-to-value (CLTV) ratio. Most lenders will require a CLTV of 90% or less to obtain a home equity loan, although some will allow you to borrow 100% of your home’s value. For a better idea of exactly how much you can borrow, use SoFi’s Home Equity Loan Calculator.

Learn more: Ways to Pull Equity Out of Your Home

What is a home equity line of credit (HELOC)?

A home equity line of credit (HELOC) is a credit line secured by the value of your home, minus any existing mortgage owed. You can borrow against it, spend, repay, and borrow again using your home as collateral.

Learn more: What Is a Home Equity Line of Credit (HELOC)?

What is the difference between a HELOC vs home equity loan?

A HELOC is a revolving line of credit. You can take out money as you need it, up to your approved limit, during the draw period. You may be able to make interest-only payments on the amount you withdraw during that time, typically 10 years. A home equity loan is another type of second mortgage that uses your home as collateral, but in this case, the funds are disbursed all at once and repayment starts immediately. It is usually a fixed-rate loan of five to 30 years, and monthly payments remain the same until the loan is paid off.

Learn more: HELOC vs. Home Equity Loan

Can you have both a HELOC and home equity loan?

It is rare to have both a HELOC and a home equity loan. One would be a second mortgage and the other would be a third mortgage. Few banks are willing to lend money on a third mortgage, and for any that do, the interest rate would be high.

See more FAQs

Read more