Washington Student Loan & Scholarship Information

The coast, the mountains – if you choose to go to school in Washington, you’ll have access to the best of what the Pacific Northwest has to offer. First, though, you might want to take some time to research Washington scholarships and college grants, as well as student loans and student loan forgiveness programs. Here’s a guide to all the different options to help pay for school in Washington state.

Average Student Loan Debt in Washington

Students and parents probably want to know what the average Washington student loan debt is. According to a 2023 report, 47% of Washington college attendees have student loan debt, with an average balance of $23,993.

47%

of Washington college

attendees have

student loan debt.

SoFi offers simple student loans that work for you.

Washington Student Loans

Federal Student Loans

Federal student loans are provided by the U.S. Department of Education’s Direct Loan Program. If you take out a federal loan, the DOE is your lender. All federal student loans have fixed interest rates — which are generally lower than private loans’ — and carry fees between 1.057% and 4.228% that are deducted from the loan amount before disbursement.

To see which type of loans you may qualify for, you’ll need to fill out the Free Application for Federal Student Aid (FAFSA®) to apply for financial aid for college or grad school. Be aware of your state’s deadline as well as the federal FAFSA deadline.

You should also review the deadlines for each college to which you are applying, as one college may define their deadline as the date you submit your FAFSA form, while another considers it to be the date on which your FAFSA is actually processed. FAFSA will then offer you a financial aid package, dependent on your college, that may include grants, work-study opportunities, and federal student loan options. It is important to note that not every student will qualify to receive federal aid.

Recommended: FAFSA Guide

Direct Subsidized Loans: These are for eligible undergraduate students who demonstrate financial need, and they help cover the costs of higher education at a college or career school. The federal government pays the interest on Direct Subsidized Loans while a student is in school at least half-time. Interest starts accruing on these loans after a six-month grace period once students graduate or if they drop below half-time enrollment.

Direct Unsubsidized Loans: Eligible undergraduate, graduate, and professional students may qualify for these loans. Eligibility is not based on financial need. The interest on these loans begins accruing immediately after funds are disbursed (meaning paid out).

Direct PLUS Loans: These loans are for parents of dependent undergraduate students who need help paying for education expenses not covered by other financial aid. Eligibility for this loan is not based on financial need, but it does require a credit check.

PLUS loans for graduate and professional students are being phased out. Only borrowers who already received these loans before June 30, 2026, can continue to borrow under their current terms through the 2028-29 academic year.

Recommended: Types of Federal Student Loans

Private Student Loans

Private loans are funded by private organizations such as banks, online lenders, credit unions, some schools, and state-based or state-affiliated organizations. A key point to note: Private lenders follow a different set of regulations than federal loans, so their interest rates can vary widely. What’s more, private loans have variable or fixed interest rates that may be higher than federal loan interest rates, which are always fixed.

Private lenders may require you to make payments on your loans while you are still in school. On the other hand, you don’t have to start paying back federal student loans until after you graduate, leave school, or change your enrollment status to less than half-time.

Unlike federal loans which can only be applied for within certain deadlines (once a year, and states have their own deadlines), private loans can be applied for on an as-needed basis. Even if you suspect you may need to take out a private loan, it’s still a smart move to submit your FAFSA before applying. That way, you can see what federal aid you may qualify for first.

If you’ve missed the FAFSA deadline and you’re struggling to pay for school throughout the year, private loans can potentially help you make your education payments. Just keep in mind that you will need enough lead time for your loan to process and for your lender to send money to your school.

Scholarships & Grants

Who doesn’t love a gift? You may sometimes hear grants and scholarships referred to as gift aid. That’s because while grants or scholarships may have certain academic or other requirements to keep them, you usually don’t have to pay them back as you would with a loan. Whether you call that a gift, a windfall, or free money, it’s a huge help when it comes time to pay for higher education.

There are a few instances where you may have to pay back grant money, but typically only if certain requirements aren’t met. Generally, grants are need-based (meaning they are distributed due to your financial need), while scholarships are awarded based on merit (such as academic, athletic, or artistic achievement).

There is no one-size-fits-all grant or scholarship amount or requirements, and both scholarships and grants can come from a variety of entities (including private organizations and federal or state governments).

Some scholarships or grants can be for a small amount that may help you pay for your books or research supplies, but others can cover the entire cost of your education. That means tuition, room and board, and the extras. Which is a very good thing. Who knew parking passes could be so expensive?

Washington Scholarships & Grants

If you’re attending school in the great state of Washington, there are plenty of scholarships and grants that can help you fully or partially fund your education. Check out these options.

Washington College Grant

This is a need-based financial aid program that assists resident students pursuing a postsecondary education. Recipients must attend one of Washington’s eligible two- and four-year public or private institutions or technical schools to qualify. Award amounts vary based on the type of school and other factors.

Passport to Careers

This program assists with the costs of attending college and is designed for former foster children and those who are homeless in Washington. Through Passport to College, eligible students get a scholarship that covers tuition, books, housing, fees, transportation, and even some personal expenses and also provides support services from college staff.

American Indian Endowed Scholarship

Recipients of this renewable scholarship must be Washington residents and have close social and cultural ties to an American Indian tribe or community within Washington, and they must attend a public or independent college in the state. Academic achievements and the financial need of applicants are also considered when allocating this scholarship. Upper-division and graduate students will receive funding priority. Award amounts range from $500 to $2,000.

Baccalaureate Washington State Opportunity

Eligible students may receive up to $22,500 if they are pursuing an education in science, technology, engineering, math (STEM), or health care majors at eligible public or private colleges or universities in the state. Students must be Washington state residents to apply.

Career and Technical Scholarship

Students at one of Washington’s 34 community and technical colleges may apply for this scholarship, which helps eligible students who are Washington residents pursue a career path in high-demand trade, health care, and STEM occupations. Award amounts go as high as $1,500 each quarter while enrolled in the program.

Get low-rate in-school loans that work for you.

Washington Student Loan Repayment & Forgiveness Programs

If you’ve taken out student loans to attend a school in Washington, it is never too early to start thinking about your repayment plan. And guess what? You have a few repayment options at your disposal.

Under the 2025 domestic policy bill, the standard student loan repayment term is between 10 and 25 years, based on the loan amount. Federal student loan interest rates vary based on what year you receive the loan.

For the 2025-2026 school year, the federal student loan interest rate is 6.39% for Direct Subsidized and Unsubsidized Loans for undergraduates, 7.94% for Direct Unsubsidized Loans for graduate and professional students, and 8.94% for Direct PLUS loans for parents and graduate or professional students.

For private loans, terms and conditions such as interest rates are set by the lender and vary due to many factors. Federal student loans typically offer the lowest interest rates and more flexible repayment options as compared to private student loans.

10-30

Years

New federal student loan repayment terms,

depending on the loan amount,

beginning July 2026.

Federal Student Loan Repayment Options

The U.S. domestic policy bill that was passed in July 2025 eliminates a number of federal repayment plans. Because current borrowers may remain in the plans, we are including them here. But for borrowers taking out their first loans on or after July 1, 2026, there will be only two repayment options: The Standard and an income-driven plan. You can learn more about your repayment options for federal student loans here.

Standard Repayment Plan

This plan will continue to be available in a modified form. Most borrowers were eligible for the original plan, which had a 10-year repayment period. Borrowers often paid less over time than with other plans because the loan term was shorter. (Typically, less interest accrues over shorter loan terms than longer ones if payments are made in full and on-time.) For loans taken out on or after July 1, 2026, the repayment term will range from 10 to 25 years based on the loan amount.

Repayment Assistance Program

This new program is similar to previous income-driven plans, which tied payments to income levels and household size. Payments range from 1% to 10% of adjusted gross income over a term up to 30 years. At that point, any remaining debt will be forgiven. If your monthly payment doesn’t cover the interest owed, the interest will be cancelled.

Graduated Repayment Plan

This plan will be closed to new loans made on or after July 1, 2026. Most borrowers were eligible for this plan, which allowed them to pay their loans off over 10 years. Payments started relatively low, then increased over time (usually every two years). Current borrowers in this plan will continue to make payments according to the plan’s graduated structure.

Extended Repayment Plan

This plan will be closed to new loans made on or after July 1, 2026. To qualify for this plan, you must have had more than $30,000 in outstanding Direct or FFEL loans. Monthly payments on the Extended Repayment Plan were typically lower than under the 10-year Standard Plan or the Graduated Repayment Plan, because borrowers had a longer period to pay them off (and therefore made more interest payments). Current borrowers in this plan will continue to make payments according to the plan’s extended term.

Saving on a Valuable Education (SAVE)

This plan is scheduled to be eliminated by June 30, 2028. Most student borrowers were eligible for this plan. The SAVE Plan lowered payments for almost all borrowers compared to other income-driven plans because payments were based on a smaller portion of your adjusted gross income (AGI). In addition, any remaining balance would be forgiven after 20 years. Current borrowers in this plan may transition into the new Standard Repayment Plan or Repayment Assistance Program (RAP) beginning July 1, 2026.

Income-Based Repayment (IBR)

IBR is available to anyone currently in an income-driven plan that’s scheduled to close. It was designed for borrowers who have a high debt relative to their income. Monthly payments were never higher than the 10-year Standard Plan amount. Generally, however, borrowers paid more over time than under the Standard Plan.

Still not sure which payment plan is right for you?

For more information on repayment plans, check out our Student Loan Repayment Options article to help add some clarity.

Granted, it’s not always easy to pay loans back on time. When it comes to student loan default, 10% to 20% of student loans are typically in default. To help you avoid being among those who default on your student loans, let’s take a look at refinancing options.

Student Loan Refinancing

One option to potentially help accelerate student loan repayment is to refinance your student loans with a private lender. Some private lenders, like SoFi, will let you consolidate and refinance both your federal and private student loans into one loan and a single interest rate. It’s a great way to streamline your bill paying and financial life in general.

Consolidating your loans (aka combining them) under one lender gives you the opportunity to refinance your loan and get a new term and interest rate. If you have an improved financial profile compared to when you took out your original loan, you may be able to lower your interest rate when you refinance, or shorten your term to pay off your loan more quickly.

But it is important to remember that if you refinance federal student loans with a private lender, you will lose access to federal programs such as the income-driven repayment plans mentioned above, as well as student loan forgiveness and forbearance options.

Student Loan Forgiveness

At first glance, student loan forgiveness looks appealing, but it is not easily attainable. That being said, there are state-specific and federal Public Service Loan Forgiveness programs that certain student loan borrowers may be eligible for.

Before you review your options, it’s important to know that the terms forgiveness, cancellation, and discharge essentially mean the same thing when it comes to federal student loans, but are applied in different scenarios. For example, if you are no longer required to make loan payments due to your job, that could fall under forgiveness or cancellation.

Or, if the school you received your loans at closed before you graduated, this situation would generally be called a discharge.

Even if you don’t complete your education, can’t find a job, or are unhappy with the quality of your education, you must repay your loans. But there are circumstances that may lead to federal student loans being forgiven, canceled, or discharged. Here are some of those options:

Public Service Loan Forgiveness (PSLF)

The PSLF Program may forgive the remaining balance on eligible Direct Loans, after 120 qualified monthly payments are made under a repayment plan (and working with a qualifying employer).

Teacher Loan Forgiveness

Those who teach full-time for five complete and consecutive academic years in a low-income school or educational service agency may be eligible for forgiveness of up to $17,500 on select federal loans.

Perkins Loan Cancellation

Cancellation for this specific loan is based on eligible employment or volunteer service and length of service, among other factors.

Total and Permanent Disability Discharge

Qualification may relieve eligible borrowers from repaying a qualifying Direct Loan, a Federal Family Education Loan (FFEL) Program loan, and/or a Federal Perkins Loan or a TEACH Grant service obligation.

Death Discharge

Due to the death of the borrower or of the student on whose behalf a PLUS loan was taken out, federal student loans may be discharged.

Bankruptcy Discharge

Certain eligible borrowers may have federal student loans discharged if they file a separate action during bankruptcy, known as an “adversary proceeding.”

Closed School Discharge

Borrowers who were unable to complete an academic program because their school closed might be eligible for a discharge of Direct Loans, Federal Family Education Loan (FFEL) Program loans, or Federal Perkins Loans.

Washington Specific Student Loan Forgiveness Programs

Federal loan forgiveness programs are a logical place to start, but it can be smart to also consider other student loan forgiveness programs. There are forgiveness programs tailored to loan borrowers who live in certain locations, or have an in-demand and service-based vocation.

Health Professional Loan Repayment Program

This loan repayment program, through the Washington Health Corps, is for licensed health professionals who provide primary care at approved sites for a set amount of time in rural or underserved areas. Loan repayment options are available to eligible providers such as doctors, dentists, nurses, pharmacists, and others.

SoFi Private Student Loans

In the spirit of transparency, we want you to know that you should exhaust all of your federal grant and loan options before you consider a SoFi private student loan.

We believe that it is in each student’s best interest to look at federal financing options first in order to find the right financial aid package for them.

If you do decide a private student loan is the right fit for your educational needs, we’re happy to help! SoFi’s private student loan application process is easy and fast. We offer flexible payment options and terms, and there are no origination or late fees.

Read more

New Hampshire Student Loan & Scholarship Information

Many students dream of heading east for college. If you are one of them, you might consider the White Mountain State. New Hampshire, with its mountains, forests, and coastal views, is home to many good colleges. To help afford your education, learn about the scholarships, grants, and student loan forgiveness options in New Hampshire.

Average Student Loan Debt in New Hampshire

As you’re thinking about New Hampshire for college, it’s smart to learn about the state’s average student loan debt. According to a 2023 report, 70% of New Hampshire college attendees have student loan debt, with an average balance of $39,928.

70%

of New Hampshire college

attendees have

student loan debt.

SoFi offers simple student loans that work for you.

New Hampshire Student Loans

Federal Student Loans

Federal student loans are provided by the U.S. Department of Education’s Direct Loan Program. If you take out a federal loan, the DOE is your lender. All federal student loans have fixed interest rates — which are generally lower than private loans’ — and carry fees between 1.057% and 4.228% that are deducted from the loan amount before disbursement.

To see which type of loans you may qualify for, you’ll need to fill out the Free Application for Federal Student Aid (FAFSA®) to apply for financial aid for college or grad school. Be aware of your state’s deadline as well as the federal FAFSA deadline.

You should also review the deadlines for each college to which you are applying, as one college may define their deadline as the date you submit your FAFSA form, while another considers it to be the date on which your FAFSA is actually processed. FAFSA will then offer you a financial aid package, dependent on your college, that may include grants, work-study opportunities, and federal student loan options. It is important to note that not every student will qualify to receive federal aid.

Recommended: FAFSA Guide

Direct Subsidized Loans: These are for eligible undergraduate students who demonstrate financial need, and they help cover the costs of higher education at a college or career school. The federal government pays the interest on Direct Subsidized Loans while a student is in school at least half-time. Interest starts accruing on these loans after a six-month grace period once students graduate or if they drop below half-time enrollment.

Direct Unsubsidized Loans: Eligible undergraduate, graduate, and professional students may qualify for these loans. Eligibility is not based on financial need. The interest on these loans begins accruing immediately after funds are disbursed (meaning paid out).

Direct PLUS Loans: These loans are for parents of dependent undergraduate students who need help paying for education expenses not covered by other financial aid. Eligibility for this loan is not based on financial need, but it does require a credit check.

PLUS loans for graduate and professional students are being phased out. Only borrowers who already received these loans before June 30, 2026, can continue to borrow under their current terms through the 2028-29 academic year.

Recommended: Types of Federal Student Loans

Private Student Loans

Private loans are funded by private organizations such as banks, online lenders, credit unions, some schools, and state-based or state-affiliated organizations. A key point to note: Private lenders follow a different set of regulations than federal loans, so their interest rates can vary widely. What’s more, private loans have variable or fixed interest rates that may be higher than federal loan interest rates, which are always fixed.

Private lenders may require you to make payments on your loans while you are still in school. On the other hand, you don’t have to start paying back federal student loans until after you graduate, leave school, or change your enrollment status to less than half-time.

Unlike federal loans which can only be applied for within certain deadlines (once a year, and states have their own deadlines), private loans can be applied for on an as-needed basis. Even if you suspect you may need to take out a private loan, it’s still a smart move to submit your FAFSA before applying. That way, you can see what federal aid you may qualify for first.

If you’ve missed the FAFSA deadline and you’re struggling to pay for school throughout the year, private loans can potentially help you make your education payments. Just keep in mind that you will need enough lead time for your loan to process and for your lender to send money to your school.

Scholarships & Grants

Who doesn’t love a gift? You may sometimes hear grants and scholarships referred to as gift aid. That’s because while grants or scholarships may have certain academic or other requirements to keep them, you usually don’t have to pay them back as you would with a loan. Whether you call that a gift, a windfall, or free money, it’s a huge help when it comes time to pay for higher education.

There are a few instances where you may have to pay back grant money, but typically only if certain requirements aren’t met. Generally, grants are need-based (meaning they are distributed due to your financial need), while scholarships are awarded based on merit (such as academic, athletic, or artistic achievement).

There is no one-size-fits-all grant or scholarship amount or requirements, and both scholarships and grants can come from a variety of entities (including private organizations and federal or state governments).

Some scholarships or grants can be for a small amount that may help you pay for your books or research supplies, but others can cover the entire cost of your education. That means tuition, room and board, and the extras. Which is a very good thing. Who knew parking passes could be so expensive?

New Hampshire Scholarships & Grants

If you are looking for scholarships for New Hampshire students, look no further. Here is a list of scholarship opportunities in the state that could help you pay for college.

New Hampshire Charitable Foundation Scholarships

The New Hampshire Charitable Foundation offers a variety of scholarship opportunities and is the largest provider of publicly available scholarships in New Hampshire. They award more than $8 million to more than 1,800 promising students each year. Applicants fill out one application and are matched with all scholarship opportunities for which they qualify.

Raymond K. Conley Memorial Scholarship

Students pursuing a career in physical or mental rehabilitation may want to apply for this $500 scholarship from the New Hampshire American Legion. They must have been a resident of New Hampshire for at least three years in order to qualify and be able to prove acceptance to a four-year college or two-year vocational school.

Presidential Scholarship

If you attend the University of New Hampshire you can apply for this merit-based renewable scholarship that awards $5,000 annually to eligible first-year New Hampshire residents, and $9,000 annually to eligible non-residents.

Dean’s Scholarship

First-year applicants at the University of New Hampshire may be eligible for this renewable merit-based scholarship that awards $3,000 to qualifying New Hampshire residents and $7,000 to qualifying non-residents.

ACEC-NH Scholarship Program

This is a scholarship program from the American Council of Engineering Companies of New Hampshire for children of employees of member firms who plan to pursue an education in engineering, geology or a related program. Eligible students must be New Hampshire residents, and if selected, they can use the $2,000 award at any four-year college or graduate school of their choosing.

New Hampshire Society of Professional Engineers (NHSPE) State Scholarship Program

Scholarships through the NHSPE State Scholarship program are designed for eligible engineering students in order to encourage career development at the state level in the disciplines of general civil, structural, mechanical, and electrical engineering. Applicants must be residents of New Hampshire. The awards, which are based on financial need, academic achievement, and community involvement, have a minimum value of $1,000.

Get low-rate in-school loans that work for you.

New Hampshire Student Loan Repayment & Forgiveness Programs

If you’ve taken out student loans to attend a school in New Hampshire, it is never too early to start thinking about your repayment plan. And guess what? You have a few repayment options at your disposal.

Under the 2025 domestic policy bill, the standard student loan repayment term is between 10 and 25 years, based on the loan amount. Federal student loan interest rates vary based on what year you receive the loan.

For the 2025-2026 school year, the federal student loan interest rate is 6.39% for Direct Subsidized and Unsubsidized Loans for undergraduates, 7.94% for Direct Unsubsidized Loans for graduate and professional students, and 8.94% for Direct PLUS loans for parents and graduate or professional students.

For private loans, terms and conditions such as interest rates are set by the lender and vary due to many factors. Federal student loans typically offer the lowest interest rates and more flexible repayment options as compared to private student loans.

10-30

Years

New federal student loan repayment terms,

depending on the loan amount,

beginning July 2026.

Federal Student Loan Repayment Options

The U.S. domestic policy bill that was passed in July 2025 eliminates a number of federal repayment plans. Because current borrowers may remain in the plans, we are including them here. But for borrowers taking out their first loans on or after July 1, 2026, there will be only two repayment options: The Standard and an income-driven plan. You can learn more about your repayment options for federal student loans here.

Standard Repayment Plan

This plan will continue to be available in a modified form. Most borrowers were eligible for the original plan, which had a 10-year repayment period. Borrowers often paid less over time than with other plans because the loan term was shorter. (Typically, less interest accrues over shorter loan terms than longer ones if payments are made in full and on-time.) For loans taken out on or after July 1, 2026, the repayment term will range from 10 to 25 years based on the loan amount.

Repayment Assistance Program

This new program is similar to previous income-driven plans, which tied payments to income levels and household size. Payments range from 1% to 10% of adjusted gross income over a term up to 30 years. At that point, any remaining debt will be forgiven. If your monthly payment doesn’t cover the interest owed, the interest will be cancelled.

Graduated Repayment Plan

This plan will be closed to new loans made on or after July 1, 2026. Most borrowers were eligible for this plan, which allowed them to pay their loans off over 10 years. Payments started relatively low, then increased over time (usually every two years). Current borrowers in this plan will continue to make payments according to the plan’s graduated structure.

Extended Repayment Plan

This plan will be closed to new loans made on or after July 1, 2026. To qualify for this plan, you must have had more than $30,000 in outstanding Direct or FFEL loans. Monthly payments on the Extended Repayment Plan were typically lower than under the 10-year Standard Plan or the Graduated Repayment Plan, because borrowers had a longer period to pay them off (and therefore made more interest payments). Current borrowers in this plan will continue to make payments according to the plan’s extended term.

Saving on a Valuable Education (SAVE)

This plan is scheduled to be eliminated by June 30, 2028. Most student borrowers were eligible for this plan. The SAVE Plan lowered payments for almost all borrowers compared to other income-driven plans because payments were based on a smaller portion of your adjusted gross income (AGI). In addition, any remaining balance would be forgiven after 20 years. Current borrowers in this plan may transition into the new Standard Repayment Plan or Repayment Assistance Program (RAP) beginning July 1, 2026.

Income-Based Repayment (IBR)

IBR is available to anyone currently in an income-driven plan that’s scheduled to close. It was designed for borrowers who have a high debt relative to their income. Monthly payments were never higher than the 10-year Standard Plan amount. Generally, however, borrowers paid more over time than under the Standard Plan.

Still not sure which payment plan is right for you?

For more information on repayment plans, check out our Student Loan Repayment Options article to help add some clarity.

Granted, it’s not always easy to pay loans back on time. When it comes to student loan default, 10% to 20% of student loans are typically in default. To help you avoid being among those who default on your student loans, let’s take a look at refinancing options.

Student Loan Refinancing

One option to potentially help accelerate student loan repayment is to refinance your student loans with a private lender. Some private lenders, like SoFi, will let you consolidate and refinance both your federal and private student loans into one loan and a single interest rate. It’s a great way to streamline your bill paying and financial life in general.

Consolidating your loans (aka combining them) under one lender gives you the opportunity to refinance your loan and get a new term and interest rate. If you have an improved financial profile compared to when you took out your original loan, you may be able to lower your interest rate when you refinance, or shorten your term to pay off your loan more quickly.

But it is important to remember that if you refinance federal student loans with a private lender, you will lose access to federal programs such as the income-driven repayment plans mentioned above, as well as student loan forgiveness and forbearance options.

Student Loan Forgiveness

At first glance, student loan forgiveness looks appealing, but it is not easily attainable. That being said, there are state-specific and federal Public Service Loan Forgiveness programs that certain student loan borrowers may be eligible for.

Before you review your options, it’s important to know that the terms forgiveness, cancellation, and discharge essentially mean the same thing when it comes to federal student loans, but are applied in different scenarios. For example, if you are no longer required to make loan payments due to your job, that could fall under forgiveness or cancellation.

Or, if the school you received your loans at closed before you graduated, this situation would generally be called a discharge.

Even if you don’t complete your education, can’t find a job, or are unhappy with the quality of your education, you must repay your loans. But there are circumstances that may lead to federal student loans being forgiven, canceled, or discharged. Here are some of those options:

Public Service Loan Forgiveness (PSLF)

The PSLF Program may forgive the remaining balance on eligible Direct Loans, after 120 qualified monthly payments are made under a repayment plan (and working with a qualifying employer).

Teacher Loan Forgiveness

Those who teach full-time for five complete and consecutive academic years in a low-income school or educational service agency may be eligible for forgiveness of up to $17,500 on select federal loans.

Perkins Loan Cancellation

Cancellation for this specific loan is based on eligible employment or volunteer service and length of service, among other factors.

Total and Permanent Disability Discharge

Qualification may relieve eligible borrowers from repaying a qualifying Direct Loan, a Federal Family Education Loan (FFEL) Program loan, and/or a Federal Perkins Loan or a TEACH Grant service obligation.

Death Discharge

Due to the death of the borrower or of the student on whose behalf a PLUS loan was taken out, federal student loans may be discharged.

Bankruptcy Discharge

Certain eligible borrowers may have federal student loans discharged if they file a separate action during bankruptcy, known as an “adversary proceeding.”

Closed School Discharge

Borrowers who were unable to complete an academic program because their school closed might be eligible for a discharge of Direct Loans, Federal Family Education Loan (FFEL) Program loans, or Federal Perkins Loans.

New Hampshire Specific Student Loan Forgiveness Programs

Federal loan forgiveness programs are a logical place to start, but it can be smart to also consider other student loan forgiveness programs. There are forgiveness programs tailored to loan borrowers who live in certain locations, or have an in-demand and service-based vocation.

Law School Loan Repayment Assistance Program

Eligible attorneys with outstanding law school loans may apply for this forgiveness program. They must practice at NH Legal Assistance, 603 Legal Aid, or the Disabilities Rights Center (DRC) to qualify. Recipients may receive a maximum amount of $8,000 annually.

New Hampshire State Loan Repayment Program

This repayment program provides money to eligible health care professionals who work in areas of New Hampshire that are determined to be medically underserved. Recipients must commit to work for a minimum of three years (or two years if part-time) in those areas in order to receive funding. Award amounts vary based on the type of healthcare provider and length of service.

SoFi Private Student Loans

In the spirit of transparency, we want you to know that you should exhaust all of your federal grant and loan options before you consider a SoFi private student loan.

We believe that it is in each student’s best interest to look at federal financing options first in order to find the right financial aid package for them.

If you do decide a private student loan is the right fit for your educational needs, we’re happy to help! SoFi’s private student loan application process is easy and fast. We offer flexible payment options and terms, and there are no origination or late fees.

Read more

Vermont Student Loan & Scholarship Information

It’s no surprise that students from around the country flock to schools in The Great Mountain State. Vermont may be known for its great outdoors and delicious maple syrup, but in addition, the state has some great financial aid opportunities for college students. Learn about the Vermont grants, student loans, and scholarships that could make paying for college easier.

Average Student Loan Debt in Vermont

You may be curious about the average student loan debt in Vermont. According to a 2023 report, 57% of Vermont college attendees have student loan debt, with an average balance of $34,866.

57%

of Vermont college attendees

have student debt.

SoFi offers simple student loans that work for you.

Vermont Student Loans

Federal Student Loans

Federal student loans are provided by the U.S. Department of Education’s Direct Loan Program. If you take out a federal loan, the DOE is your lender. All federal student loans have fixed interest rates — which are generally lower than private loans’ — and carry fees between 1.057% and 4.228% that are deducted from the loan amount before disbursement.

To see which type of loans you may qualify for, you’ll need to fill out the Free Application for Federal Student Aid (FAFSA®) to apply for financial aid for college or grad school. Be aware of your state’s deadline as well as the federal FAFSA deadline.

You should also review the deadlines for each college to which you are applying, as one college may define their deadline as the date you submit your FAFSA form, while another considers it to be the date on which your FAFSA is actually processed. FAFSA will then offer you a financial aid package, dependent on your college, that may include grants, work-study opportunities, and federal student loan options. It is important to note that not every student will qualify to receive federal aid.

Recommended: FAFSA Guide

Direct Subsidized Loans: These are for eligible undergraduate students who demonstrate financial need, and they help cover the costs of higher education at a college or career school. The federal government pays the interest on Direct Subsidized Loans while a student is in school at least half-time. Interest starts accruing on these loans after a six-month grace period once students graduate or if they drop below half-time enrollment.

Direct Unsubsidized Loans: Eligible undergraduate, graduate, and professional students may qualify for these loans. Eligibility is not based on financial need. The interest on these loans begins accruing immediately after funds are disbursed (meaning paid out).

Direct PLUS Loans: These loans are for parents of dependent undergraduate students who need help paying for education expenses not covered by other financial aid. Eligibility for this loan is not based on financial need, but it does require a credit check.

PLUS loans for graduate and professional students are being phased out. Only borrowers who already received these loans before June 30, 2026, can continue to borrow under their current terms through the 2028-29 academic year.

Recommended: Types of Federal Student Loans

Private Student Loans

Private loans are funded by private organizations such as banks, online lenders, credit unions, some schools, and state-based or state-affiliated organizations. A key point to note: Private lenders follow a different set of regulations than federal loans, so their interest rates can vary widely. What’s more, private loans have variable or fixed interest rates that may be higher than federal loan interest rates, which are always fixed.

Private lenders may require you to make payments on your loans while you are still in school. On the other hand, you don’t have to start paying back federal student loans until after you graduate, leave school, or change your enrollment status to less than half-time.

Unlike federal loans which can only be applied for within certain deadlines (once a year, and states have their own deadlines), private loans can be applied for on an as-needed basis. Even if you suspect you may need to take out a private loan, it’s still a smart move to submit your FAFSA before applying. That way, you can see what federal aid you may qualify for first.

If you’ve missed the FAFSA deadline and you’re struggling to pay for school throughout the year, private loans can potentially help you make your education payments. Just keep in mind that you will need enough lead time for your loan to process and for your lender to send money to your school.

Scholarships & Grants

Who doesn’t love a gift? You may sometimes hear grants and scholarships referred to as gift aid. That’s because while grants or scholarships may have certain academic or other requirements to keep them, you usually don’t have to pay them back as you would with a loan. Whether you call that a gift, a windfall, or free money, it’s a huge help when it comes time to pay for higher education.

There are a few instances where you may have to pay back grant money, but typically only if certain requirements aren’t met. Generally, grants are need-based (meaning they are distributed due to your financial need), while scholarships are awarded based on merit (such as academic, athletic, or artistic achievement).

There is no one-size-fits-all grant or scholarship amount or requirements, and both scholarships and grants can come from a variety of entities (including private organizations and federal or state governments).

Some scholarships or grants can be for a small amount that may help you pay for your books or research supplies, but others can cover the entire cost of your education. That means tuition, room and board, and the extras. Which is a very good thing. Who knew parking passes could be so expensive?

Vermont Scholarships & Grants

There are grants for college students in Vermont to consider before taking out loans. There are even specific Vermont scholarships you can apply for if you’re a Vermont resident. Here are a few of those options.

VSAC-Assisted Scholarships

More than 150 scholarships are available to qualifying Vermont residents thanks to these scholarships from the Vermont Student Assistance Corporation. For a start, recipients must be Vermont residents, but they don’t have to attend school in Vermont to qualify.

Vermont John H. Chafee Education and Training Scholarship

Young adults who have been in the foster care system may apply for this scholarship which helps students prepare for job training programs or college. There are no number of credit requirements for this scholarship and eligible students can be enrolled in any program. Scholarship amounts typically range from $1,000 to $3,000.

Armed Services Scholarship

Two scholarships are offered to members of the armed services and their family members. This program provides free tuition to Vermont colleges for the families of Vermont National Guard (VTNG), U.S. active reserve, or active armed services members who have died while on either active or inactive duty.

Vermont Grant

This grant for undergraduate study is awarded to eligible full-time or part-time students in Vermont. Award amounts depend on available funding and the recipient’s financial situation.

Advancement Grant

Students who are attending a non-degree course or program in Vermont may be eligible, as long as their current studies improve their ability to get a job or encourage further study. Grant amounts vary by student and by year based on available funding.

Get low-rate in-school loans that work for you.

Vermont Student Loan Repayment & Forgiveness Programs

If you’ve taken out student loans to attend a school in Vermont, it is never too early to start thinking about your repayment plan. And guess what? You have a few repayment options at your disposal.

Under the 2025 domestic policy bill, the standard student loan repayment term is between 10 and 25 years, based on the loan amount. Federal student loan interest rates vary based on what year you receive the loan.

For the 2025-2026 school year, the federal student loan interest rate is 6.39% for Direct Subsidized and Unsubsidized Loans for undergraduates, 7.94% for Direct Unsubsidized Loans for graduate and professional students, and 8.94% for Direct PLUS loans for parents and graduate or professional students.

For private loans, terms and conditions such as interest rates are set by the lender and vary due to many factors. Federal student loans typically offer the lowest interest rates and more flexible repayment options as compared to private student loans.

10-30

Years

New federal student loan repayment terms,

depending on the loan amount,

beginning July 2026.

Federal Student Loan Repayment Options

The U.S. domestic policy bill that was passed in July 2025 eliminates a number of federal repayment plans. Because current borrowers may remain in the plans, we are including them here. But for borrowers taking out their first loans on or after July 1, 2026, there will be only two repayment options: The Standard and an income-driven plan. You can learn more about your repayment options for federal student loans here.

Standard Repayment Plan

This plan will continue to be available in a modified form. Most borrowers were eligible for the original plan, which had a 10-year repayment period. Borrowers often paid less over time than with other plans because the loan term was shorter. (Typically, less interest accrues over shorter loan terms than longer ones if payments are made in full and on-time.) For loans taken out on or after July 1, 2026, the repayment term will range from 10 to 25 years based on the loan amount.

Repayment Assistance Program

This new program is similar to previous income-driven plans, which tied payments to income levels and household size. Payments range from 1% to 10% of adjusted gross income over a term up to 30 years. At that point, any remaining debt will be forgiven. If your monthly payment doesn’t cover the interest owed, the interest will be cancelled.

Graduated Repayment Plan

This plan will be closed to new loans made on or after July 1, 2026. Most borrowers were eligible for this plan, which allowed them to pay their loans off over 10 years. Payments started relatively low, then increased over time (usually every two years). Current borrowers in this plan will continue to make payments according to the plan’s graduated structure.

Extended Repayment Plan

This plan will be closed to new loans made on or after July 1, 2026. To qualify for this plan, you must have had more than $30,000 in outstanding Direct or FFEL loans. Monthly payments on the Extended Repayment Plan were typically lower than under the 10-year Standard Plan or the Graduated Repayment Plan, because borrowers had a longer period to pay them off (and therefore made more interest payments). Current borrowers in this plan will continue to make payments according to the plan’s extended term.

Saving on a Valuable Education (SAVE)

This plan is scheduled to be eliminated by June 30, 2028. Most student borrowers were eligible for this plan. The SAVE Plan lowered payments for almost all borrowers compared to other income-driven plans because payments were based on a smaller portion of your adjusted gross income (AGI). In addition, any remaining balance would be forgiven after 20 years. Current borrowers in this plan may transition into the new Standard Repayment Plan or Repayment Assistance Program (RAP) beginning July 1, 2026.

Income-Based Repayment (IBR)

IBR is available to anyone currently in an income-driven plan that’s scheduled to close. It was designed for borrowers who have a high debt relative to their income. Monthly payments were never higher than the 10-year Standard Plan amount. Generally, however, borrowers paid more over time than under the Standard Plan.

Still not sure which payment plan is right for you?

For more information on repayment plans, check out our Student Loan Repayment Options article to help add some clarity.

Granted, it’s not always easy to pay loans back on time. When it comes to student loan default, 10% to 20% of student loans are typically in default. To help you avoid being among those who default on your student loans, let’s take a look at refinancing options.

Student Loan Refinancing

One option to potentially help accelerate student loan repayment is to refinance your student loans with a private lender. Some private lenders, like SoFi, will let you consolidate and refinance both your federal and private student loans into one loan and a single interest rate. It’s a great way to streamline your bill paying and financial life in general.

Consolidating your loans (aka combining them) under one lender gives you the opportunity to refinance your loan and get a new term and interest rate. If you have an improved financial profile compared to when you took out your original loan, you may be able to lower your interest rate when you refinance, or shorten your term to pay off your loan more quickly.

But it is important to remember that if you refinance federal student loans with a private lender, you will lose access to federal programs such as the income-driven repayment plans mentioned above, as well as student loan forgiveness and forbearance options.

Student Loan Forgiveness

At first glance, student loan forgiveness looks appealing, but it is not easily attainable. That being said, there are state-specific and federal Public Service Loan Forgiveness programs that certain student loan borrowers may be eligible for.

Before you review your options, it’s important to know that the terms forgiveness, cancellation, and discharge essentially mean the same thing when it comes to federal student loans, but are applied in different scenarios. For example, if you are no longer required to make loan payments due to your job, that could fall under forgiveness or cancellation.

Or, if the school you received your loans at closed before you graduated, this situation would generally be called a discharge.

Even if you don’t complete your education, can’t find a job, or are unhappy with the quality of your education, you must repay your loans. But there are circumstances that may lead to federal student loans being forgiven, canceled, or discharged. Here are some of those options:

Public Service Loan Forgiveness (PSLF)

The PSLF Program may forgive the remaining balance on eligible Direct Loans, after 120 qualified monthly payments are made under a repayment plan (and working with a qualifying employer).

Teacher Loan Forgiveness

Those who teach full-time for five complete and consecutive academic years in a low-income school or educational service agency may be eligible for forgiveness of up to $17,500 on select federal loans.

Perkins Loan Cancellation

Cancellation for this specific loan is based on eligible employment or volunteer service and length of service, among other factors.

Total and Permanent Disability Discharge

Qualification may relieve eligible borrowers from repaying a qualifying Direct Loan, a Federal Family Education Loan (FFEL) Program loan, and/or a Federal Perkins Loan or a TEACH Grant service obligation.

Death Discharge

Due to the death of the borrower or of the student on whose behalf a PLUS loan was taken out, federal student loans may be discharged.

Bankruptcy Discharge

Certain eligible borrowers may have federal student loans discharged if they file a separate action during bankruptcy, known as an “adversary proceeding.”

Closed School Discharge

Borrowers who were unable to complete an academic program because their school closed might be eligible for a discharge of Direct Loans, Federal Family Education Loan (FFEL) Program loans, or Federal Perkins Loans.

Vermont Specific Student Loan Forgiveness Programs

Federal loan forgiveness programs are a logical place to start, but it can be smart to also consider other student loan forgiveness programs. There are forgiveness programs tailored to loan borrowers who live in certain locations, or have an in-demand and service-based vocation.

Vermont Educational Loan Repayment Program

In exchange for service commitments in Vermont by eligible health care professionals, including physicians, dentists, physician assistants, those who qualify can receive loan repayment assistance. Recipients must have outstanding educational debt that they acquired while pursuing an undergraduate or graduate degree from an accredited college or university that exceeds the amount of the loan repayment award.

Vermont Educational Loan Repayment Program for Dentists

This repayment program focuses on eligible dentists, but similarly to other programs mentioned is funded by federal State Loan Repayment Program (SLRP), state, and local funds. Award amounts can go as high as $20,000 a year.

The Student Loan Repayment Assistance Program for Early Childhood Educators

This program provides up to $4,000 a year to reduce the student loan debt of full-time educators in Vermont who earned an early childhood-related degree and commit to working in an early childhood education program in the state for at least 12 months.

SoFi Private Student Loans

In the spirit of transparency, we want you to know that you should exhaust all of your federal grant and loan options before you consider a SoFi private student loan.

We believe that it is in each student’s best interest to look at federal financing options first in order to find the right financial aid package for them.

If you do decide a private student loan is the right fit for your educational needs, we’re happy to help! SoFi’s private student loan application process is easy and fast. We offer flexible payment options and terms, and there are no origination or late fees.

Read more

Home Equity $2k

{/*Hero 200*/}

Get an exclusive $2,000 bonus2 on a home equity loan.

✓ Access up to 85% or $350K of your home’s equity.

✓ Keep your current home loan interest rate.

✓ $0 origination fee options.1

✓ Fixed rates and flexible terms.

{/*Hero APR*/}

{/*trust pilot*/}

Received a mailer from us?

Enter confirmation #

{/*how it works*/}

How to apply for a

home equity loan online.

Help us understand your needs.

Answer a few questions online to help us

assist you better.

Get paired with a dedicated Mortgage

Loan Officer.

You’ll be connected with an experienced SoFi

Mortgage Loan Officer who’s ready to help you get

the best home equity loan for you.

Submit your application.

Your SoFi Mortgage Loan Officer will help you submit your home equity application so you can get access to your cash.

Get started

{/*what is a he loan*/}

What is a home

equity loan?

Home equity loans let you borrow money by leveraging the equity in your home. They’re one of the most affordable financing options since home equity rates are lower than interest rates for most other types of loans. These lower interest rates can help fund big purchases, home renovations, or consolidate high-interest debt.

Learn more

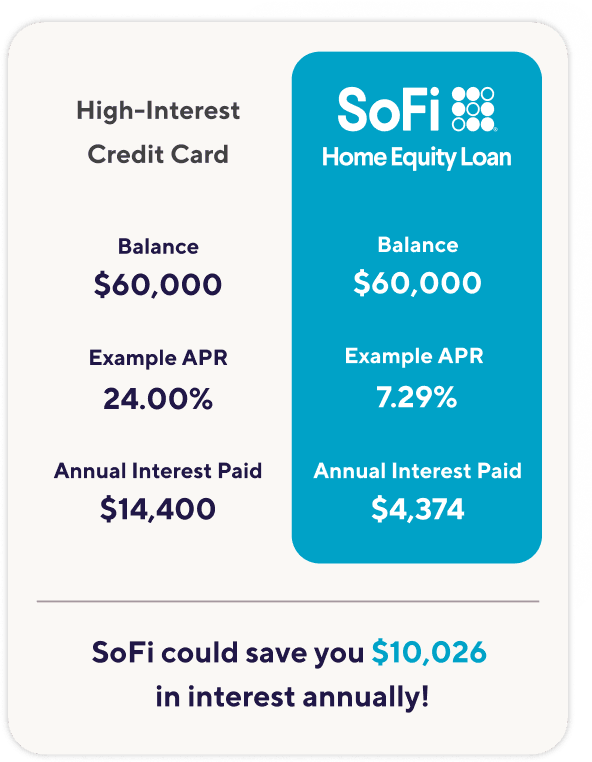

You could save thousands

with a SoFi home equity loan.

The savings claim above is based upon using a SoFi Home Equity Loan to pay-off credit card balance of $60,000. We assume a credit card APR of 24%. The savings shown assumed payments of only the interest due. We compare that against an assumed SoFi Home Equity Loan of $60,000 (to pay off the credit card) with an APR of 7.29%. Annual interest savings assumes you pay both loans on time. You might not be eligible for the home equity loan and, if you are eligible, your APR rate could be higher. Eligibility and the lowest APR rate depend on credit worthiness, income, and other factors. The 24% APR is the average credit card APR reported by Wallethub for Q1 March 2025 under their Good Credit category.

{/*requirements*/}

Home equity loan requirements:

View your rate

Checking won’t affect your credit score.†

{/*horizon*/}

{/*popular uses*/}

A home equity loan could

help with that.

-

Pay down high-interest debt.

You could save on your monthly payments

when you consolidate credit cards or

other unsecured loans into one lower rate. -

Fund home improvements.

Make your dream kitchen a reality without

having to take on high-interest debt. -

Make big purchases.

Tuition, weddings, and vacations can get

expensive. Instead of putting them on a

high-interest credit card, a home equity

loan could help you save on monthly payments.

{/*calculators*/}

Crunch the numbers on your

home equity loan.

HELOC monthly

payment calculator

Get help understanding your

monthly payments with a home

equity line of credit.

Learn more

HELOC repayment

calculator

Estimate how much you might be

paying with a home equity line of

credit.

Learn more

{/*why SoFi*/}

Why choose SoFi

for your home

equity loan?

No change to your existing mortgage rate.

Keep your current mortgage as is, no need to refinance. And for qualified borrowers, there are options to access your home’s equity.

Finance almost anything with up to $350K.

Access up to $350,000 of your home’s equity (up to 85%) to finance home improvements or consolidate debt.

Lower your monthly payment.

You could save compared to a high-interest credit card or unsecured personal loan.

Get dedicated one-on-one support.

You’ll have a dedicated SoFi Mortgage Loan Officer to help you find the right loan option for you.

“Austin and his team were awesome and easy to work with! Great communication and follow up. Kept us in the loop every step of the way! I would go back to Austin without question.”

“Spencer and his team totally went to bat for us and got our loan processed. Very happy with him and his teams efforts and follow up. Communication was excellent right up to the loan funding.”

“Mark and his team worked very closely with us to make sure that we were comfortable with the process, understood the expectations, timeline and overall schedule.”

300+ Reviews

Current home equity loan rates by state.

Compare current home equity loan rates by state and find a home equity loan rate that suits your financial goals.

Select a state to view current rates:

{/*learn more*/}

Learn more about home equity loans.

More resources on home equity

Get answers to questions like “What’s the difference between a home equity loan

and a HELOC (home equity line of credit)?”

FAQs

How does a home equity loan work?

To start, you’ll need to have sufficient home equity, which is the difference between the market value and what you owe. You may have built home equity by paying down your mortgage and by seeing your home appreciate. You’ll go through an application process, and the lender will likely order a home appraisal to ensure that there’s enough value there to lend against. You’ll have a lot more paperwork than some other loans and will sign mortgage lien documents that give the lender the right to start proceedings should you fail to make payments. After closing on the loan, you’ll receive all funds upfront. Repayment starts shortly after.

Learn more: What Is a Home Equity Loan?

How to apply for a home equity loan?

First, assess your financial situation – consider your income, how much equity you have available, if you have at least a “good” FICO® score, and your debt-to-income ratio. Exploring different loan options is encouraged!

Once you’ve found a fitting loan and are ready to apply, you’ll go through the application process, where you’ll submit information about your income, current mortgage, insurance, and other details the lender requests. If everything checks out, you’ll be able to close on your loan! Funds are disbursed around three business days after closing on the loan.

On a home equity loan where the funds are disbursed upfront and your interest rate is locked, the first payment will be due around 30 days after you close the loan.

How do I qualify for a home equity loan?

Home equity loans are contingent on income, credit history, and debt-to-income ratio. LTV is also considered. LTV compares the amount you owe against your home with its current value. Lenders usually want to see an LTV no higher than 80%. (LTV = Loan Value ÷ Property Value.) On a $400,000 home, for example, that means that you should owe no more than $320,000.

How long does it take to get a home equity loan?

It can take an estimated 30 days to close your loan. Funds are disbursed around three business days after closing on the loan. On a home equity loan where the funds are disbursed upfront and your interest rate is locked, the first payment will be due around 30 days after you close the loan.

What is the interest rate on a home equity loan?

A home equity loan offers a low interest rate because it uses your home’s equity to secure the loan. Because of the way it works, you may have access to a larger sum of money at a lower interest rate than you would if you used another source, such as a credit card. View your home equity rate here.

How much can I get with a home equity loan?

When it comes to how much home equity you can tap, many lenders allow a maximum of 90%, although some allow less, and some, more. In other words, your loan-to-value ratio shouldn’t exceed 90% in many cases.

If you’re taking out a second mortgage like a home equity loan or HELOC, your first mortgage and the equity loan compared with your home value is what is called the combined loan-to-value (CLTV) ratio. Most lenders will require a CLTV of 90% or less to obtain a home equity loan, although some will allow you to borrow 100% of your home’s value. For a better idea of exactly how much you can borrow, use SoFi’s Home Equity Loan Calculator.

Learn more: Ways to Pull Equity Out of Your Home

What is a home equity line of credit (HELOC)?

A home equity line of credit (HELOC) is a credit line secured by the value of your home, minus any existing mortgage owed. You can borrow against it, spend, repay, and borrow again using your home as collateral.

Learn more: What Is a Home Equity Line of Credit (HELOC)?

What is the difference between a HELOC vs home equity loan?

A HELOC is a revolving line of credit. You can take out money as you need it, up to your approved limit, during the draw period. You may be able to make interest-only payments on the amount you withdraw during that time, typically 10 years. A home equity loan is another type of second mortgage that uses your home as collateral, but in this case, the funds are disbursed all at once and repayment starts immediately. It is usually a fixed-rate loan of five to 30 years, and monthly payments remain the same until the loan is paid off.

Learn more: HELOC vs. Home Equity Loan

Can you have both a HELOC and home equity loan?

It is rare to have both a HELOC and a home equity loan. One would be a second mortgage and the other would be a third mortgage. Few banks are willing to lend money on a third mortgage, and for any that do, the interest rate would be high.

See more FAQs

Read more

Current Home Equity Loan Rates in Honolulu, HI Today

HONOLULU HOME EQUITY LOAN RATES TODAY

Current home equity loan

rates in Honolulu, HI.

Disclaimer: The prime rate directly influences the rates on HELOCs and home equity loans.

Turn your home equity into cash. Call us for a complimentary consultation or get prequalified online.

Compare home equity loan rates in Honolulu.

Key Points

• Interest rates on home equity loans are influenced by the prime rate and, from a distance, the Federal Reserve’s monetary policy. The borrower’s financial profile also brings important factors to the equation.

• Comparing rates from multiple lenders is a smart move, and the only way to find the best deal and loan terms.

• Boost your credit score and reduce your debt-to-income (DTI) ratio, and you may see the rates lenders offer you drop.

• You’ll need to have 20% equity or more in your home to qualify for a home equity loan.

• Go for a fixed-rate loan if you are looking for predictable monthly payments. Consider an adjustable rate for flexibility, though it may result in higher payments later.

• Interest on home equity loans may be tax-deductible if you use the funds to cover the costs of home-related expenses.

Introduction to Home Equity Loan Rates

Beginning with the basics: What is a home equity loan? It’s a great way for Honolulu homeowners to access the value they have built in their homes, and an option people with equity can use when they need to source cash. In this article, we will cover everything you should know if you’re considering pursuing a home equity loan. We will discuss factors impacting loan rates and give you tips to help you secure the best rates out there.

We’ll also define different types of home equity loans, including options like home equity lines of credit (HELOCs) and cash-out refinances, and explain how they work. This will make you aware of available alternatives, along with the pros and cons of each. Whether you are thinking about embarking on a home renovation, consolidating high-interest debt, or giving yourself permission (finally) to make a major purchase, understanding home equity loan rates in Honolulu will help you to make smart, successful financial decisions.

How Do Home Equity Loans Work?

If you’re still paying off your original mortgage — like most people — a home equity loan is considered a second mortgage. It’s a product that lets you tap your home’s equity and withdraw a lump sum of cash to use as you need.

You will immediately begin repaying that loan, usually in fixed monthly installments. You’ll decide how long you should take to pay it off, usually over a 5- to 30-year term. The loan is secured by your home, and that means you’ll most likely have access to a lower interest rate than you’d be able to get on an unsecured personal loan.

One important thing to know: In order to draw on the equity in your home, you have to actually have equity in your home. Lenders will typically want you to have built a minimum of 20% equity in order to qualify for a home equity loan. If you are still in the process of paying off your mortgage, the money you owe should not be more than your house is worth.

HELOCs vs. Home Equity Loans

Many homeowners begin weighing options for drawing equity from their homes by looking at a HELOC vs. a home equity loan. Here’s a comparison of the two, so you can see how they measure up side-by-side.

Finding the right loan to pull equity from your home is a matter of priorities — including whether you care more about flexibility or long-term stability. A home equity loan’s interest rate is generally fixed, and that can give you the peace of mind of predictable payments during the life of the loan. Many borrowers choose the no-surprises fixed rate over a variable one for exactly that reason.

| HELOC | Home Equity Loan | |

|---|---|---|

| Type | Revolving line of credit | Installment loan |

| Interest Rate | Usually variable-rate | Usually fixed-rate |

| Repayment | Repay only what you borrow plus interest; you may have the option to make interest-only payments during the draw period. | Starts immediately at a set monthly payment |

| Disbursement | Charge only the amount you need | Lump sum |

Both loans have benefits, but if you are wondering how to get equity out of your home, and you’ve been making a concerted effort to pay down your mortgage and want a predictable payment for your new loan, a home equity loan may be a compatible choice.

The Origin of Home Equity Loan Interest Rates

Multiple factors help determine what home equity loan rates in and near Honolulu will look like. They include some big-picture economic conditions — but also the details of your individual financial profile, which you’ll always have a lot more control over.

Let’s look at the factors you can’t influence, first. Increases in the federal funds rate and the prime rate, for example, can lead to home equity loan rates rising —but it’s not a simple, cause-and-effect relationship. Federal Reserve policies don’t directly impact home equity loan interest rates. But they can prompt lenders’ base rates to move up or down, and thus, down the line, the rates they charge their borrowers when they offer loans.

Understanding influences like these will help you anticipate rate fluctuations as a borrower, and make the most informed decisions about different home loans, including home equity loans.

Then there are the factors you can control, at least to a certain extent. Your credit score and DTI ratio will definitely be a consideration when lenders offer you a loan at a certain interest rate. The amount of the loan and the length of your repayment term will impact your rate, too. Larger loans and longer terms, as a rule, are subject to higher rates — this is due to risk factors for lenders and the amount of time they will need to wait for full repayment.

Your credit score and DTI truly are in your hands, as both reflect your fiscal choices and behavior. Caring for both is essential in preparing to apply for any loan.

How Does the Interest Rate Impact a Home Equity Loan’s Affordability?

You’re probably already seeing why qualifying for the best interest rates pays off, no matter what loan you are shopping for. No question: Your interest rate will be a big factor in the affordability of your financing, whether you go for a home equity loan or a HELOC. As of late July 2025, the average home equity loan interest rate was 8.25%.

Here is a chart detailing key numbers for a $75,000 home equity loan with a 20-year repayment term. We’ve calculated the payments and the total interest at various interest rates. If you have an 8.00% interest rate, for example, your monthly payment is $627, and you’ll pay $75,559 in interest over the loan’s term. Get a 7.00% rate — one full percentage point lower — and your payment will be $581, with total interest over the life of the loan adding up to $64,554. The lower rate would end up saving you $11,005 over the loan term. As you can see, even if you get a 7.50% rate, you’ll still pay $5,552 less in interest than you would with the 8.00% rate.

| Interest Rate | Monthly Payment | Total Interest Paid |

|---|---|---|

| 8.00% | $627 | $75,559 |

| 7.50% | $604 | $70,007 |

| 7.00% | $581 | $64,554 |

Fixed vs Adjustable Interest Rates

When you compare a home equity loan with a HELOC, you’ll notice that the second option most often has a fixed interest rate. With a home equity loan, monthly payments generally won’t change — they will stay the same for the loan’s whole term. Rates like to try to trick you, though. Fixed rates very often start off higher than adjustable ones that are advertised in close proximity. Despite that initially lower variable, or adjustable, rate, a fixed option is usually a better choice for borrowers as payments won’t rise down the road.

Adjustable rates really do appear attractive at first glance, but keep in mind why they are called that. After a defined period, the lender can “adjust” your interest rate to follow a market index. Your rate could easily jump higher than the initial rate you signed up for, and continue to fluctuate. Payments over the life of an adjustable-rate loan can feel totally unpredictable.

If you’re deciding between the two types of rates, think about your financial goals and budget flexibility. Most importantly, consider the amount of risk you feel comfortable with in terms of making payments in the future.

Home Equity Loan Rate Trends

As you look at options for getting equity out of your home, you may think about attempting to perfectly time your loan application. Is there a strategy for achieving the lowest possible rate with good forecasting or timing? Possibly. But the prime rate is a lot like the weather — nobody knows exactly what it will do. Unfortunately, not all borrowers will have time to wait for the prime rate to dip to their advantage. As you can see from the graphic below, it can change direction without much notice.

Source: TradingView.com

| Date | Prime Rate |

|---|---|

| 9/19/2024 | 8.00% |

| 7/27/2023 | 8.50% |

| 5/4/2023 | 8.25% |

| 3/23/2023 | 8.00% |

| 2/2/2023 | 7.75% |

| 12/15/2022 | 7.50% |

| 11/3/2022 | 7.00% |

| 9/22/2022 | 6.25% |

| 7/28/2022 | 5.50% |

| 6/16/2022 | 4.75% |

| 5/5/2022 | 4.00% |

| 3/17/2022 | 3.50% |

| 3/16/2020 | 3.25% |

| 3/4/2020 | 4.25% |

| 10/31/2019 | 4.75% |

| 9/19/2019 | 5.00% |

| 8/1/2019 | 5.25% |

| 12/20/2018 | 5.50% |

| 9/27/2018 | 5.25% |

Source: St. Louis Fed

How to Qualify for the Best Rates

Take a few key steps in the years or months before you apply, and you can better position yourself to land a home equity loan — even a loan with a rate and term that is manageable and beneficial.

Here’s what to do:

Build Sufficient Home Equity

You’re going to need at least 20% equity in your home in order to qualify for a home equity loan. Calculate what you’ve got now with this simple equation: Subtract your outstanding mortgage balance from your home’s estimated value. Take the answer and divide it by that same estimated value figure. You’ll arrive at your percentage of equity. (The higher the better!)

Strive for a Strong Credit Score

A top credit score is another good thing to possess when you’re trying to land a great home equity loan interest rate. Lenders look for scores of 680 or higher, and the higher your credit score, the more easily you can access the most advantageous loan terms. Borrowers with credit scores above 700 tend to score the best rates.

You can improve your score by making timely payments on your bills, reducing your credit card balances, and steering clear of new debt. Your chances to qualify for a home equity loan with a favorable interest rate will grow as you become more in control of your own financial security.

Manage Debt-to-Income Ratio

Another essential strategy for getting beneficial loan terms is to improve your DTI ratio. You can do this by working to pay down your existing debt, increasing your income, or both.

Lenders like DTI ratios of 50% or less, and will look at you longingly if you have one that is 36% or lower. Managing your DTI effectively comes with a big payoff. You’ll easily qualify for a loan you want and increase your chances of getting a great interest rate.

Secure an Adequate Property Insurance Policy

Nailing down solid insurance on your property is a must-do if you want to qualify for a home equity loan. Your coverage needs to be active and comprehensive, so keep it up to date. This is not a factor you want to take risks with. Your property insurance is the safety net that will protect both you and your lender should damage strike your home.

Closing Costs and Fees

If you’re thinking about the closing costs on home equity loans, you’re right — they do add to your costs when you take out a loan. You’re likely to pay 2% to 5% of the loan amount by the time your loan closes. This table shows you how typical loan closing costs break down.

| Service | Typical Fees |

|---|---|

| Appraisal | $300-$500 |

| Credit report | $30-$50 or more |

| Document prep | $100-$500 |

| Loan origination | 0.5%-1.0% of the loan amount |

| Notary | $20-$100 |

| Title insurance | 0.5%-1.0% of the loan amount |

| Title search | $75-$250 or more |

Lenders do sometimes offer no-closing-cost loans, but these frequently come with higher interest rates. Do the math and see how much interest you will pay over the life of any potential loan before you spend time on the application.

Tools & Calculators

Online tools and calculators can make your life easier as you look for the best home equity loan rates. Try out multiple tools, including a home equity loan calculator — it will figure out the maximum loan amount you’re likely to qualify for.

Run the numbers on your home equity loan.

-

Home Equity Loan Calculator

Enter a few details about your home loan and we’ll provide you your maximum home equity loan amount.

-

HELOC Payment Calculator

Punch in your HELOC amount and we’ll estimate your monthly payment amount for your HELOC.

-

HELOC Interest Only Calculator

Use SoFI’s HELOC interest calculator to estimate how much monthly interest you’ll pay .

Using the free calculators is for informational purposes only, does not constitute an offer to receive a loan, and will not solicit a loan offer. Any payments shown depend on the accuracy of the information provided.

Tax Deductibility of Home Equity Loan Interest

Is the interest you pay on your home equity loan tax-deductible? It may be in 2025, as long as you use the funds to improve your home. Single filers can deduct the interest they pay on the first $375,000 of loan debt. Married couples filing jointly can deduct interest on up to $750,000 of loan debt. You’ll need to itemize your expenditures if you want to take advantage of these deductions. A tax advisor can help you figure out what makes sense for you.

Home Equity Loan Alternatives

If you are not sure you’re sold on a home equity loan, stick with us. You can consider a cash-out refinance or a home equity line of credit (HELOC), too. A cash-out refinance lets you take out a new mortgage for a sum larger than what you owe on your existing home loan, and you receive the difference as a lump sum to use as you wish. A HELOC lets you apply for a credit limit secured by your home and borrow against as you need to. You pay interest only on the cash you draw out.