Free Florida HELOC Payment Calculator

Florida HELOC Calculator

By SoFi Editors | Updated December 23, 2025

For many homeowners, the equity built up in their property represents a significant financial asset. A home equity line of credit (HELOC) calculator is an excellent tool for exploring how to leverage this asset because it translates abstract numbers into real-world borrowing scenarios. Using the HELOC payment calculator can allow users to estimate potential credit lines and understand the possible payment structure of a HELOC before engaging with lenders. This guide will walk you through what a home equity line of credit is, share how to use the calculator effectively, and

- Key Points

- • A HELOC is a revolving line of credit that is secured by the equity in your home.

- • HELOCs have two phases: a draw period where you can access funds as needed, followed by a repayment period where you pay back the principal and interest.

- • Most HELOCs feature variable interest rates, meaning your monthly payments can change over time based on broader economic conditions.

- • The amount you can borrow is typically based on your home equity.

- • Because your home is used as collateral, failing to make payments puts your property at risk of foreclosure.

Calculator Definitions

• HELOC Balance: The HELOC balance is the total amount you plan to draw from your line of credit or the amount you’ve already drawn. Interest is calculated based on this outstanding balance.

• Current Interest Rate: This is the rate at which interest accumulates on your outstanding HELOC balance. If you’re considering multiple HELOC offers from lenders, you can use the calculator to see how their rates would impact your payment amount.

• Draw Period: The draw period is a specific time frame, often up to 10 years, during which you can borrow funds from your HELOC as needed until you reach your credit limit. During this phase, you likely will only be required to pay interest on what you’ve borrowed.

• Repayment Period: The repayment period starts after the draw period concludes and generally lasts from 10 to 20 years. During this time, you can no longer borrow funds and must make regular payments that cover both principal and interest.

• Monthly Interest Payment: This is the portion of a monthly payment that covers the interest that has accrued on the borrowed amount.

• Monthly Principal and Interest Payment: This is the amount you’ll be required to pay monthly during the repayment period. It’s typically higher than the interest-only payment. Because HELOCs have variable interest rates, these HELOC payment calculator figures are estimates; your exact payment will be based on current rates.

• Total Interest: This figure is what you can expect to pay in interest over the life of the HELOC. Again, due to variable interest rates, this should be considered a rough estimate.

How to Use the Florida HELOC Calculator

Used correctly, a Florida HELOC calculator greatly simplifies the process of estimating your borrowing potential and payments. Follow these steps for the best results:

Step 1: Enter Your Planned or Actual HELOC Balance

Homeowners with an existing HELOC should type in their current outstanding principal balance. Those considering a new HELOC should estimate the amount you plan to draw for your intended purpose, such as a renovation or debt consolidation.

Step 2: Estimate Your Interest Rate

This input is the rate that will be applied to your outstanding balance. The majority of HELOC rates are variable and can fluctuate, but for the purpose of this calculator you’ll need to choose one rate. Try inputting the current rate a lender is offering, but also experiment with a higher and lower rate to see how payments might be affected by rate shifts in the future.

Step 3: Choose the Length of the Draw Period

Here, you select the duration — often up to 10 years — during which you can access funds from your line of credit. This decision is important because it determines how long you can borrow and when the transition to the repayment period will occur.

Step 4: Select Your Repayment Period

This step defines the timeframe, typically between 10 and 20 years, over which the entire borrowed balance must be paid off after the draw period ends. A longer repayment period generally results in lower monthly payments but more total interest paid over the life of the HELOC.

Step 5: Review Your Results

The calculator’s outputs will include an estimated monthly interest-only payment for the draw period and an estimated monthly principal and interest payment, which is required during the repayment period. These estimates can be helpful as you budget for a HELOC and think about what credit limit, interest rate, and term you feel is optimal.

What Is a Home Equity Line of Credit?

If using the calculator makes you think a HELOC could be a good fit, it’s important to understand how a line of credit works before you dive in. The amount you can borrow will depend on your home equity, which is the difference between your home’s current market value and the amount you owe on your home loan. Most lenders require a homeowner to have at least 15% equity in their home in order to obtain a HELOC, and the amount a lender will let you borrow typically tops out at 90% of equity. To determine your equity percentage, you can subtract your mortgage balance from your home’s estimated value. Then divide the answer by the home value to arrive at your percentage of equity.

A HELOC’s structure as a revolving line of credit offers flexibility similar to a credit card. Once approved for a specific credit limit, you can borrow funds as needed, repay the balance, and borrow again throughout a designated “draw period.” Or if you prefer, you can carry the balance and pay interest on it. You’ll only pay interest on the amount you actually withdraw, not the entire credit limit. This makes a HELOC suitable for ongoing projects or expenses where the total cost is uncertain.

A HELOC is secured by your home. This arrangement generally allows for more competitive interest rates compared to unsecured options like personal loans or credit cards. However, it also introduces risk: If you are unable to make your payments, the lender has the right to foreclose on your home to satisfy the debt.

As noted above, a HELOC is divided into two distinct phases. The first is the draw period, which typically lasts for 10 years. A HELOC interest-only calculator is useful during this time if you want to keep close tabs on how much your monthly might be.

Once the draw period ends, the HELOC enters the repayment period, which can last from 10 to 20 years. During repayment, borrowing is no longer permitted, and you must make regular payments that cover both principal and interest. (This is when a HELOC repayment calculator can be useful.) This transition often results in a substantial increase in the monthly payment amount, which borrowers must be prepared for.

Finally, most HELOCs come with a variable interest rate. As the index fluctuates with economic conditions, your HELOC’s interest rate — and consequently your monthly payment — can rise or fall. If this unpredictability doesn’t suit your style, you might want to look into what is a home equity loan.

Recommended: HELOC vs. Home Equity Loan

Home Equity Trends in Florida

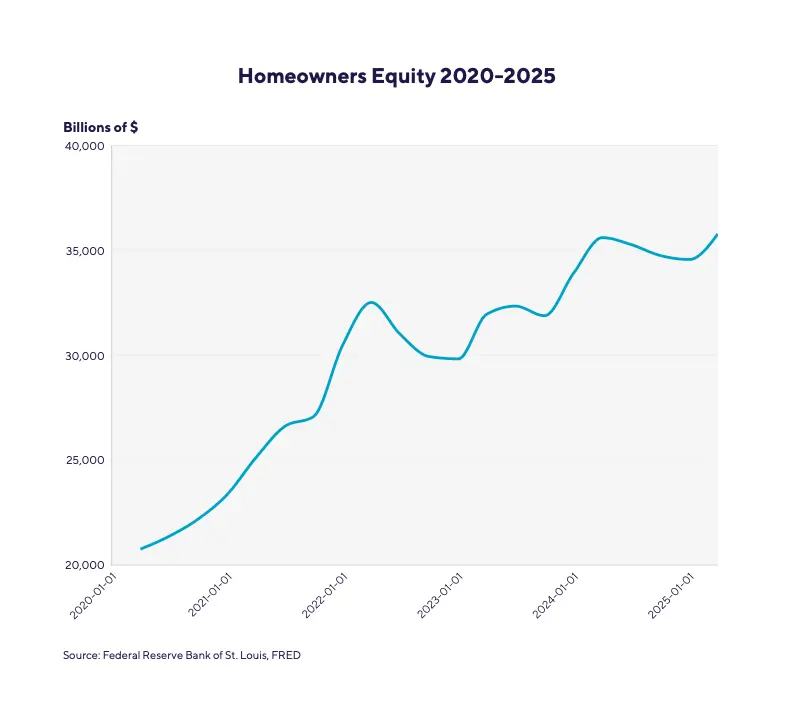

If many of your neighbors are talking about HELOCs, it’s not surprising. Homeowners in Florida saw their home equity more than double, on average, over the last five years. The average Florida homeowner is now sitting on more than $135,000 in equity, more than enough to support a HELOC that could allow them to consolidate debt, make renovations, or cover other large expenses. And Florida is part of a national trend. Take a look at how equity has increased in the U.S. as a whole.

Current HELOC rates by state.

Compare current home interest rates by state and find a HELOC rate that suits your financial goals.

Select a state to view current rates:

How to Use the HELOC Calculator Data to Your Advantage

If you’re ready to translate the HELOC calculator’s estimates into concrete decisions about borrowing, here are three ways you can use the information it provides.

• Budgeting and affordability: Take a good look at the estimated monthly payments for the draw and repayment phases. Can your household budget accommodate these payments?

• Scenario planning: Use the calculator to model different scenarios. Adjust the amount borrowed to see at what point the payments become uncomfortable. Try tinkering with either the interest rate or the payment term to see if you can afford a higher interest rate, should you encounter one, or a shorter term.

• Long-term cost awareness: The “total Interest” figure helps you visualize the full financial impact of the HELOC over its entire life. If you are opening a HELOC to renovate your home, for example, the total interest number reveals the true cost of the project.

Tips on HELOCs

While a HELOC offers remarkable flexibility, it is a significant financial commitment. Here are several practical tips for homeowners considering or already using a HELOC.

• Manage with care: Remember that your home secures the HELOC. It is imperative not to fall behind on payments. It bears repeating: Defaulting on a HELOC can put your home at risk of foreclosure.

• Shop around: Lenders can vary significantly in the rates and terms they offer. Before committing, compare options from multiple institutions, including banks, credit unions, and online lenders.

• Have a repayment plan: It can be tempting to use home equity for short-term wants or lifestyle purchases, but this is a risky practice. Before you draw funds, have a clear plan for how you will repay the borrowed amount. In an ideal world, you use your HELOC to improve your financial stability (by paying down high-interest debt, perhaps) or add value to your home.

• Understand the fees: Be aware of the full cost of the loan. HELOCs can come with closing costs (potentially 2% to 5% of the credit limit), annual maintenance fees, inactivity fees if you don’t use the line of credit, and early termination penalties if you close the account within a certain timeframe.

• Prepare for the repayment period: One of the biggest financial shocks for HELOC borrowers is the transition from the draw period to the repayment period. If you have been making interest-only payments, your monthly obligation will increase significantly when principal payments are added. Plan for this well in advance.

Recommended: Different Types of Home Equity Loans

Alternatives to HELOCs

A HELOC is just one of several ways to get equity out of your home. And there are also ways to borrow that don’t involve facing the risk of foreclosure if you fail to make payments. Here’s a look at your options:

Home Equity Loan

Often confused with a HELOC, a home equity loan, like a HELOC, involves using your home as collateral. It is critically different in three ways: The funds are disbursed all at once, the interest rate is typically fixed, and repayment of both principal and interest begins immediately. This makes it a better choice for those who know the exact cost of a project upfront and prefer the stability of a fixed monthly payment amount. If you want to test the waters and see what payments might be like should you choose this option, use a home equity loan calculator.

Home Improvement Loan

A home improvement loan is a type of personal loan and is typically unsecured. It provides a lump sum of cash. Unlike a HELOC, it features a fixed interest rate and a predictable schedule of equal monthly payments. In that way, it is more similar to a home equity loan. But because a home improvement loan is unsecured, the interest rate is generally higher than that of a HELOC or home equity loan.

Personal Line of Credit

A personal line of credit (PLOC) is a revolving line of credit that is not secured by collateral. It functions similarly to a HELOC in that you can draw and repay funds as needed. The key differences are that a PLOC is unsecured, which poses less risk to your assets but results in a higher interest rate and, possibly, a lower credit ceiling. Approval is based solely on your creditworthiness and income rather than home equity.

Cash-Out Refinance

A cash-out mortgage refinance involves replacing your existing mortgage with a new, larger one and receiving the difference in cash. If you’re thinking about a cash-out refinance vs. a home equity line of credit there are a few important considerations: A refinance will leave you with one monthly payment instead of two (one for the primary mortgage and one for the HELOC). This can be appealing, but it only makes financial sense if you can also secure a lower interest rate than you have on your original mortgage. Another consideration is that with a refi, you’ll begin repaying the loan immediately, while with a HELOC you can delay repaying your principal as long as you make the interest payments. A cash-out refinance might have higher closing costs than a HELOC, but it likely also has a lower credit score threshold for qualification. Which path you choose will depend on these variables.

The Takeaway

A free HELOC calculator can help empower homeowners in their financial planning. It will help you understand what your payments on a HELOC would be, whether you’re in the draw or repayment phase. Testing different scenarios can help you get a sense of what credit line amount, interest rate, and repayment term will work best with your budget. And running interest rates offered by different lenders through the calculator can help you make a decision about which lender to partner with on this important HELOC journey.

SoFi now partners with Spring EQ to offer flexible HELOCs. Our HELOC options allow you to access up to 90% of your home’s value, or $500,000, at competitively lower rates. And the application process is quick and convenient.

Unlock your home’s value with a home equity line of credit from SoFi, brokered through Spring EQ.

FAQ

What is the difference between a HELOC and a home equity loan?

A HELOC is a revolving line of credit that works much like a credit card, and that has a variable interest rate. You can borrow and repay funds as needed and only pay interest on the amount of the credit line that you use. In fact, during the initial draw phase of the HELOC, you likely won’t have to repay the principal you’ve borrowed at all. In contrast, a home equity loan provides a single, lump-sum amount at a fixed interest rate. Repayment begins immediately, with monthly payments of equal installments. Both a HELOC and home equity loan use your home as collateral.

How much can I borrow with a HELOC?

The amount you can borrow depends on the equity in your home. Lenders typically allow you to borrow up to 90% of your equity. Your equity is equal to your home’s estimated value minus your outstanding mortgage balance. The final credit limit is also influenced by factors such as your credit score, income, and overall debt.

What can I use the money for from a HELOC?

Funds from a HELOC can be used for almost any purpose. Common uses include home renovations, debt consolidation, funding education, or covering major unexpected costs like medical bills. Some homeowners use HELOC funds to invest in a business. Remember that investments like this can be risky, and if an investment doesn’t pay off and you can’t make your HELOC payments, you risk losing your home.

Is a HELOC interest rate fixed or variable?

Most HELOCs have a variable interest rate that can change over time. This rate is typically tied to the U.S. prime rate, so you can keep an eye on the prime rate for a sense of where rates are headed.

Learn more about mortgages:

SoFi Loan Products Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

Checking Your Rates: To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score. However, if you choose a product and continue your application, we will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull and may affect your credit.

²SoFi Bank, N.A. NMLS #696891 (Member FDIC), offers loans directly or we may assist you in obtaining a loan from SpringEQ, a state licensed lender, NMLS #1464945.

All loan terms, fees, and rates may vary based upon your individual financial and personal circumstances and state.You should consider and discuss with your loan officer whether a Cash Out Refinance, Home Equity Loan or a Home Equity Line of Credit is appropriate. Please note that the SoFi member discount does not apply to Home Equity Loans or Lines of Credit not originated by SoFi Bank. Terms and conditions will apply. Before you apply, please note that not all products are offered in all states, and all loans are subject to eligibility restrictions and limitations, including requirements related to loan applicant’s credit, income, property, and a minimum loan amount. Lowest rates are reserved for the most creditworthy borrowers. Products, rates, benefits, terms, and conditions are subject to change without notice. Learn more at SoFi.com/eligibility-criteria. Information current as of 06/27/24.In the event SoFi serves as broker to Spring EQ for your loan, SoFi will be paid a fee.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

SOHE-Q425-059

Get prequalified in minutes for a SoFi Home Loan.

Free Delaware HELOC Payment Calculator

Delaware HELOC Calculator

By SoFi Editors | Updated December 30, 2025

A digital calculator can help Delaware homeowners who are interested in borrowing money based on their home equity to determine whether a home equity line of credit (HELOC) is the right move. Borrowing with a HELOC can be a flexible and cost-efficient way to obtain funds for home improvements, debt consolidation, or other big expenses. And a free HELOC calculator can show you what kind of monthly payments you can expect throughout the HELOC experience. This guide will show you how to use the calculator to best effect, and educate you about the ins and outs of HELOCs along the way.

- Key Points

- • A digital HELOC calculator helps Delaware homeowners estimate monthly payments during the draw and repayment phases of a home equity line of credit.

- • HELOCs are a revolving credit line secured by home equity, offering flexibility but requiring responsible use.

- • The calculator’s main inputs are the HELOC balance, interest rate, and the length of the draw and repayment periods.

- • Because a HELOC is secured by the home, it typically offers lower interest rates than unsecured debt such as credit cards.

- • Planning for the end of the interest-only draw period is crucial, as monthly payments often increase significantly during the principal and interest repayment phase.

Calculator Definitions

• HELOC Balance: This is the total amount you plan to draw from the credit line. If you already have a HELOC and are using the calculator to view payment estimates, input your current balance.

• Current Interest Rate: This is the percentage charged on the outstanding balance. HELOCs typically have a variable rate. You can use the calculator to see monthly payment estimates based on rates quoted by prospective lenders.

• Draw Period: This is the initial timeframe, usually five to 10 years, during which funds can be accessed, up to your credit limit. During this window, the credit line is revolving, meaning that if you repay what you borrow, you can borrow again. But you could also just pay interest on what you owe.

• Repayment Period: This phase begins once the draw period concludes, at which point no further withdrawals are permitted. Borrowers must pay back the outstanding principal and interest over a set number of years, often resulting in higher monthly obligations.

• Monthly Interest Payment: This figure represents the cost of carrying the current balance for one month, excluding any repayment of the principal. Many homeowners utilize this option during the draw period to maintain lower monthly costs.

• Monthly Principal and Interest Payment: THe HELOC payment calculator will show the total amount due each month during the repayment phase to fully retire the debt by the end of the term. It includes both a portion of the original amount borrowed (the principal) and the interest charged.

• Total Interest: The HELOC calculator will show the cumulative cost of borrowing over the entire life of the credit line, from the first withdrawal to the final payment.

How to Use the Delaware HELOC Calculator

The free HELOC calculator is easy to use. Just follow these simple steps:

Step 1: Enter Your Planned or Actual HELOC Balance

Enter the amount you have spent or plan to spend from the credit line — which may not be the entire amount you are permitted to borrow. This balance is the foundation of all subsequent calculations.

Step 2: Estimate Your Interest Rate

Input the rate a lender is offering or the rate you have already obtained for a HELOC. You can also use this opportunity to input rates that are 1.00% or 2.00% higher than the current rate, to see how payments would change if the HELOC’s variable rate adjusted upward.

Step 3: Choose the Length of the Draw Period

Specify the number of years you will have the ability to withdraw funds. While 10 years is standard, some agreements may offer a different window. A shorter draw period may lead to an earlier start for principal repayment, which accelerates debt retirement but places a more immediate demand on cash flow.

Step 4: Select Your Repayment Period

The length of the repayment period has a significant effect on the size of the monthly payment once the borrowing phase ends. A longer period, such as 20 years, will result in lower, more manageable monthly payments but will increase the total interest paid over the life of the account. Conversely, a shorter period — perhaps 10 years — means a higher monthly cash outlay.

Step 5: Review Your Results

The final output provides a comprehensive overview of the monthly payment obligations during both the early draw and later repayment phases of the HELOC. You’ll also see the total cost of borrowing.

Recommended: Different Types of Home Equity Loans

What Is a Home Equity Line of Credit?

Unlike other forms of financing that provide a lump-sum loan, a HELOC functions as a revolving credit line. What exactly does that mean and how does it work? Let’s examine what a home equity line of credit is, exactly.

First things first: Your ability to qualify for a HELOC will depend on the equity you have in your home. Most lenders require 15% equity, at minimum. To determine whether you meet this threshold, subtract your current home loan balance from your home’s estimated value, which you can find on a real estate web site. Then divide the answer by the home value to get your equity percentage. A lender will look at this number, as well as your credit score (which will need to be over 640 — or, for the most competitive interest rates — over 700).

If you’re approved for a HELOC, there will be two phases: a draw period, during which time you can draw on the credit line as needed, followed by a repayment phase. In the draw period you may only b e required to pay interest on the amount that you have borrowed. Once the draw period ends, you’ll may principal and interest payments each month until you have repaid all that you owe.

Because a HELOC is secured by your home, it typically has an interest rate that is lower than rates you’ll see on unsecured credit products like a personal line of credit or a credit card. This makes it a cost-effective alternative for financing major life priorities. However, having a revolving credit line requires some discipline. Much like a credit card, the borrower can pile up debt with a HELOC. It’s important to have a plan for repaying what you owe, and a HELOC calculator can show you what those payments would be before you sign on to this form of borrowing. A HELOC interest-only calculator can show you what you might owe during the draw phase, while a HELOC repayment calculator will give you a sense of what the payment will be when you are repaying the principal plus interest.

Remember as you get equity out of your home that if you don’t make HELOC payments, your credit score could suffer and, ultimately, you could face foreclosure.

Home Equity Trends in Delaware

The same market forces that have made it difficult for first-time homebuyers to find affordably priced homes have made borrowing against equity increasingly popular. As home prices have risen in Delaware in recent years, so have homeowners’ equity levels. So it’s no surprise that more people are looking into borrowing with a HELOC or its cousin, the home equity loan. The average Delaware homeowner has more than $179,000 in equity, and in the state as a whole, the average equity has almost doubled over the last five years. This is in keeping with the national equity trend, which has increased substantially, as shown in the graphic.

Current HELOC rates by state.

Compare current home interest rates by state and find a HELOC rate that suits your financial goals.

Select a state to view current rates:

How to Use the HELOC Calculator Data to Your Advantage

The calculations provided by a free HELOC calculator can be useful in your planning and decisionmaking process. Here are some ways you can use the calculator to plan for your future:

• Budgeting: The calculator will show you an estimate of your monthly costs, both during the draw and repayment periods. Looking at these numbers closely will help you determine if they fit into your monthly budget.

• Planning: Experimenting with different repayment terms using the calculator can help you determine whether a shorter or longer repayment term is best for you. And knowing roughly what your monthly payment could be during the repayment phase will help you plan for the point after the draw period when your payment amount will likely escalate. This ensures you won’t be surprised. Using the calculator to compute different payments according to different interest rates will help you test your comfort level with the HELOC’s variable rate.

• Motivating: Seeing how payments increase during the repayment phase can help prompt borrowers to pay down their HELOC balance during the draw phase so that they enter the repayment phase with a smaller amount due.

Recommended: HELOC vs. Home Equity Loan

Tips on HELOCs

Tapping into home equity is a big financial decision. These tips can help ensure that you optimize your HELOC experience.

• Compare lenders: Shop around and obtain rate quotes from multiple lenders before committing to a HELOC. Don’t just compare interest rates; also look at fees to find the most favorable option. Using the HELOC calculator can help you envision how the rates you’re seeing in the marketplace will affect your monthly bill in the real world.

• Use borrowed funds responsibly: Before you borrow, determine what is and isn’t a suitable use of your credit line. Use the calculator to see what your self-imposed HELOC spending limit should be so that you can manage monthly payments without stress.

• Plan for end of the draw phase: The beginning of the repayment period (when you will start making principal and interest payments) can cause a significant jump in your monthly HELOC bill. Budget for this increase to avoid “payment shock.”

• Pay down the principal when you can: Even if you aren’t required to pay down the principal during the draw period, making payments toward it can chip away at what you owe so that entering the repayment period doesn’t feel like a big bump up in your monthly bill.

• Watch interest rates: If you have a variable-rate HELOC, keep an eye on market interest rate trends so you can budget for larger or smaller monthly payments.

Alternatives to Home Equity Loans

Some borrowers explore a HELOC and find that they would prefer to borrow a lump sum with more consistent monthly payments. If that’s the case, then it’s time to consider one of these options:

Home Equity Loan

A home equity loan is, like a HELOC, a second mortgage because money is borrowed with your home as collateral. In contrast to a HELOC, though, a home equity loan delivers a single lump-sum payment. You’ll begin repaying what you have borrowed, with interest, immediately.

Other things about how a home equity loan works: Home equity loans usually have a fixed interest rate. So your monthly payment will usually stay the same through the life of the loan. Repayment terms can range from five to 30 years.

A home equity loan calculator can show you what monthly payments might be with this type of loan.

Home Improvement Loan

This unsecured personal loan provides a lump sum at a fixed interest rate. But unlike a HELOC or home equity loan, a home improvement loan does not require using your home as collateral. Home improvement loans often have a lower borrowing limit than HELOCs, and may have higher interest rates and shorter repayment terms as well.

Personal Line of Credit

A personal line of credit allows borrowers to access funds as needed, like a HELOC does, but without using the home as collateral. While opting for a personal line of credit protects the home from the risk of foreclosure, the interest rates are generally higher, and the credit limits are typically lower because the lender has no physical asset to secure the debt.

Cash-Out Refinance

A cash-out mortgage refinance involves replacing your existing primary mortgage with an entirely new, larger mortgage. You would receive the difference between the new mortgage and the old balance in cash. This is attractive, but a refinance is likely a smart move only if current market interest rates are lower than the rate on your original mortgage. A refi would also involve new closing costs, typically 2% to 5% of the loan amount.

As you consider a cash-out refinance vs. home equity line of credit, it’s important to realize that a refi consolidates your debt into a single monthly payment.

The Takeaway

The Delaware HELOC payment calculator is a useful tool to use as you explore whether a HELOC might be the right way to get equity out of your home and borrow money to fund a renovation or accomplish a debt consolidation, for example. Remember to seek out interest rates from several lenders as you explore HELOCs, and use the calculator to help identify the interest rate and repayment term that suit your needs.

SoFi now partners with Spring EQ to offer flexible HELOCs. Our HELOC options allow you to access up to 90% of your home’s value, or $500,000, at competitively lower rates. And the application process is quick and convenient.

Unlock your home’s value with a home equity line of credit from SoFi, brokered through Spring EQ.

FAQ

What is the difference between a HELOC and a home equity loan?

A HELOC is a revolving credit line that functions similarly to a credit card, allowing you to withdraw funds as needed. In contrast, a home equity loan provides a single lump sum upfront. A HELOC usually has a variable interest rate, while a home equity loan has a fixed rate. While both are second mortgages, the HELOC offers more flexibility in how and when you use the funds, while the home equity loan provides more predictability for budget planning.

What can I use the money for from a HELOC?

The funds from a home equity credit line can be used for virtually any purpose. Common uses include major home renovations, consolidating high-interest debt, or covering unexpected medical bills. Because the home serves as collateral, many homeowners like to use the funds for projects that increase the property’s market value or improve their long-term financial stability and overall household wealth.

What happens when the draw period ends?

Once the draw period ends, you can no longer withdraw funds from a HELOC. You enter the repayment phase, where you must pay back the outstanding principal and interest over a set timeframe, usually 10 to 20 years. Because you are now paying both principal and interest, your monthly payments will likely increase — sometimes significantly — compared to the interest-only payments often allowed during the draw period.

Are there closing costs or fees for a HELOC?

HELOCs often have lower upfront costs than home equity loans or refinances. But you will likely have to pay for an appraisal, and there may be other expenses such as annual maintenance fees, transaction fees, or inactivity fees if the credit line is not used. Some lenders charge an early closure fee if you pay off and close the account within the first 36 months of opening the credit line.

Learn more about mortgages:

SoFi Loan Products Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

Checking Your Rates: To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score. However, if you choose a product and continue your application, we will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull and may affect your credit.

²SoFi Bank, N.A. NMLS #696891 (Member FDIC), offers loans directly or we may assist you in obtaining a loan from SpringEQ, a state licensed lender, NMLS #1464945.

All loan terms, fees, and rates may vary based upon your individual financial and personal circumstances and state.You should consider and discuss with your loan officer whether a Cash Out Refinance, Home Equity Loan or a Home Equity Line of Credit is appropriate. Please note that the SoFi member discount does not apply to Home Equity Loans or Lines of Credit not originated by SoFi Bank. Terms and conditions will apply. Before you apply, please note that not all products are offered in all states, and all loans are subject to eligibility restrictions and limitations, including requirements related to loan applicant’s credit, income, property, and a minimum loan amount. Lowest rates are reserved for the most creditworthy borrowers. Products, rates, benefits, terms, and conditions are subject to change without notice. Learn more at SoFi.com/eligibility-criteria. Information current as of 06/27/24.In the event SoFi serves as broker to Spring EQ for your loan, SoFi will be paid a fee.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

SOHE-Q425-058

Get prequalified in minutes for a SoFi Home Loan.

Free Connecticut HELOC Payment Calculator

Connecticut HELOC Calculator

By SoFi Editors | Updated December 30, 2025

If you’re a Connecticut homeowner considering tapping into your home’s equity, a HELOC calculator can be a valuable planning tool. It helps estimate potential payments, interest costs, and how different borrowing scenarios could affect your budget. By adjusting key inputs, you can better understand what a home equity line of credit might look like before speaking with a lender.

Keep reading for more on home equity lines of credit in Connecticut, how to use the HELOC calculator, alternatives to HELOCs, and more.

- Key Points

- • A home equity line of credit (HELOC) is a revolving loan that lets homeowners borrow against their home’s equity as needed, typically with a variable interest rate and flexible repayment terms.

- • Borrowers navigate two distinct phases: an initial window for accessing capital and a subsequent period dedicated to the repayment of both principal and interest.

- • Eligibility is typically determined by a combination of the homeowner’s credit history, income stability, and the amount of equity currently held in the home.

- • A home equity line of credit calculator helps estimate monthly payments and total cost of borrowing, helping you determine affordability before speaking with a lender.

- • Missing payments can put your home at risk, as the lender may foreclose to recover the debt.

Calculator Definitions

• HELOC Balance: This figure represents the total amount of capital a homeowner has currently withdrawn from their revolving line of credit that has not yet been reimbursed to the lender.

• Current Interest Rate: This is the percentage charged on the outstanding balance, which typically fluctuates based on market indicators like the prime rate.

• Draw Period: This is the initial phase of the agreement, often lasting 10 years, during which the homeowner may access funds as needed up to a predetermined limit. During this window, the borrower is frequently only required to make interest payments on the amount used.

• Repayment Period: The repayment period typically lasts 20 years, during which no new withdrawals are allowed and higher monthly payments repay both principal and interest.

• Monthly Interest Payment: This represents the minimum amount due during the draw phase, covering only the interest charges for the specific funds that have been accessed.

• Monthly Principal and Interest Payment: This is the total monthly obligation required once the repayment phase begins, combining a portion of the borrowed principal with the interest charge. This structure is designed to bring the balance of the line of credit to zero by the end of the term.

• Total Interest: This refers to the cumulative amount of money paid to the lender in interest charges over the entire lifecycle of the credit agreement. It reflects the total cost of capital beyond the actual funds accessed and utilized by the homeowner.

Recommended: What Is a Home Equity Line of Credit?

How to Use the Connecticut HELOC Calculator

Using a Connecticut HELOC calculator is more than just a data entry task; it is a strategic exercise in household financial modeling. Each step provides a clearer picture of the long-term commitment involved in managing home-backed credit. Here’s exactly how to use it:

Step 1: Enter Your Planned or Actual HELOC Balance

The first step involves entering the total amount you have drawn or intend to withdraw from your revolving credit line. This input is the primary driver of the entire calculation, as it sets the baseline for interest accumulation.

Step 2: Estimate Your Interest Rate

Use the rate quoted by your lender or a current market estimate. Since HELOC rates are usually variable, test higher-rate scenarios in the calculator to understand how rising rates could change your monthly payments.

Step 3: Choose the Length of Your Draw Period

Inputting the length of the draw period — typically 10 years — defines the window of time you have to access your capital. A longer draw period provides more time to fund multi-stage projects, but it also delays the initiation of principal repayment.

Step 4: Specify Your Repayment Period

The repayment period is generally between 10 and 20 years long. It dictates the pace at which you must repay the principal debt. A shorter repayment period leads to higher monthly payments but results in significantly lower total interest costs over the life of the agreement. Conversely, a longer period reduces the immediate monthly burden but increases the total cost of the debt.

Step 5: Review Your Results

Reviewing these results allows you to decide if the proposed credit line is truly sustainable within your budget. You can assess the affordability of the HELOC at different stages and integrate these potential costs into your long-term financial plan.

Recommended: Different Types of Home Equity Loans

What Is a Home Equity Line of Credit?

A home equity line of credit is a revolving line of credit that allows homeowners to borrow against the equity in their home. It works similarly to a credit card, letting you draw funds as needed up to an approved limit and typically offering lower interest rates than unsecured loans because the home serves as collateral.

• Draw period: During the draw period, which often lasts up to 10 years, you can access funds as needed and may only be required to make interest-only payments on the amount you borrow. This phase offers flexibility for ongoing expenses like renovations or education costs. A HELOC interest-only calculator can show you what payments would be based on your balance.

• Repayment period: Once the draw period ends, the HELOC enters the repayment period, usually 10 to 20 years, when you can no longer withdraw funds. Monthly payments increase because you must repay both principal and interest on the outstanding balance. A HELOC repayment calculator can show you what those payments might be.

Because a HELOC is secured by your home, it’s important to borrow responsibly and plan for future payment changes. Used wisely, it can be a flexible and cost-effective financing option for homeowners.

Recommended: HELOC vs. Home Equity Loan

Home Equity Trends in Connecticut

From 2020 to 2025, average home equity increased 142% nationwide, accounting for about $11.5 trillion in value. In Connecticut, home equity has increased a whopping 297%. The average homeowner has $166,656 in equity as of 2025.

Equity is the difference between the current market value of a home and the remaining balance on any existing home loan. When property values rise, the gap between what is owed and what the home is worth widens, creating a larger reservoir of potential credit for the homeowner. This has been especially evident in the Connecticut market, where demand for residential property has remained steady, leading to increased valuations across many municipalities.

Here’s a look at how equity has risen nationwide between 2020 and 2025.

Current HELOC rates by state.

Compare current home interest rates by state and find a HELOC rate that suits your financial goals.

Select a state to view current rates:

How to Use the HELOC Calculator Data to Your Advantage

Understanding the results from a HELOC calculator goes beyond estimating a monthly payment — it helps you make smarter, more strategic borrowing decisions. By analyzing how changes in rates, balances, and timelines affect your costs, you can use this data to plan responsibly, reduce risk, and align your borrowing with long-term financial goals.

• Test different borrowing scenarios: Adjust interest rates, loan amounts, and repayment terms to see how market changes or larger withdrawals could affect your monthly payment and total interest.

• Plan for cash flow: Use the projected payments to confirm your budget can handle both the draw-period payments and the higher payments that often come later.

• Evaluate payoff strategies: Compare how making extra payments or choosing a shorter repayment period can lower total interest costs over time.

• Strengthen lender discussions: Bring realistic numbers to lender conversations so you can ask informed questions and negotiate terms with confidence.

Recommended: How to Get Equity Out of Your Home

Tips on HELOCs

Managing a revolving line of credit requires a high degree of discipline and a long-term perspective. Because this product provides easy access to large sums of money, it can be tempting to overspend on non-essential items. Below are six ways to use your HELOC wisely:

• Understand your variable rate risk: HELOC interest rates are usually tied to a market index, so your payment can rise over time. Use estimates to see how higher rates would affect your budget and avoid borrowing more than you can comfortably repay.

• Borrow only what you need: Just because a HELOC offers a high credit limit doesn’t mean you should use it all. Limiting withdrawals helps keep payments manageable and reduces total interest costs.

• Plan for the repayment period early: Payments often increase when the draw period ends and repayment begins. Preparing for this transition can prevent payment shock later on.

• Use the funds strategically: HELOCs work best for expenses that add long-term value, such as home improvements or consolidating high-interest debt. Avoid using them for short-term or discretionary spending.

• Track your balance and payments closely: Regularly monitoring your HELOC balance helps you stay aware of how much equity you’re using. Making extra payments when possible can significantly lower interest costs.

• Compare alternatives before committing: Depending on your goals, a home equity loan or personal loan may offer more predictable terms. Comparing options ensures the HELOC truly fits your financial strategy.

Alternatives to HELOCs

While a home equity line of credit offers great flexibility, it is not the only way to access capital. Depending on your specific goals and risk tolerance, other financing products might be a more strategic fit for your household.

Home Equity Loan

Often confused with a HELOC, a home equity loan is a second mortgage that provides a single lump-sum disbursement at the time of closing. Its strategic value is found in the fixed interest rate and the stability of fixed monthly payments that begin immediately. This is the ideal product for someone who knows exactly how much money they need — such as a specific $40,000 contractor bid — and wants the security of a payment that is immune to market fluctuations. It eliminates the uncertainty of variable rates and the temptation associated with revolving credit.

A home equity loan calculator can help you compare the cost of this product to that of a HELOC.

Recommended: What Is a Home Equity Loan?

Home Improvement Loan

A home improvement loan is typically an unsecured installment product where you receive a set amount of money and pay it back in fixed installments over a predetermined term. Since there is no collateral, interest rates may be higher than those of a home-secured line. This is an excellent choice for homeowners with smaller, well-defined projects who prefer the predictability of a payment that will never change.

Personal Line of Credit

This product functions similarly to a HELOC as a revolving line of credit, but it is usually unsecured. The strategic advantage here is the speed of approval and the absence of home-related fees such as appraisals or title searches. However, because there is no collateral, the interest rates are significantly higher, and the credit limits are generally lower.

Cash-Out Refinance

A cash-out mortgage refinance involves replacing your primary mortgage with a completely new, larger agreement. You pay off the old mortgage and take the remaining balance in cash. It is best suited for those who need a very large sum of money and can improve their primary mortgage terms.

When comparing a cash-out refinance vs. home equity line of credit, a cash-out refinance leaves you with one payment. A home equity line of credit, on the other hand, gives you a second payment on top of your original mortgage payment.

The Takeaway

Tapping into home equity can be a powerful way to achieve major financial goals, but it must be done with a clear understanding of the long-term obligations. By using the HELOC calculator data to drive decisions, you can leverage your home’s value to improve your financial health without entering a zone of high foreclosure risk.

SoFi now partners with Spring EQ to offer flexible HELOCs. Our HELOC options allow you to access up to 90% of your home’s value, or $500,000, at competitively lower rates. And the application process is quick and convenient.

Unlock your home’s value with a home equity line of credit from SoFi, brokered through Spring EQ.

FAQ

What is the difference between a HELOC and a home equity loan?

The primary difference is how the funds are delivered and repaid. A home equity line of credit is a revolving resource where you draw funds as needed and often pay a variable interest rate. A home equity loan is a one-time lump sum with a fixed interest rate and set monthly installments. One offers ongoing flexibility, while the other provides the stability of predictable payments from the start.

What happens when the draw period ends?

Once the draw period concludes, your ability to withdraw additional money from the credit line is terminated. You then enter the repayment period, which typically lasts 10 to 20 years. During this phase, you are required to make monthly payments that cover both the principal balance and the interest. These payments are usually significantly higher than the interest-only payments you may have made during the initial draw phase.

What is the benefit of having a variable interest rate?

The primary benefit is that variable rates often start lower than the fixed rates found on traditional installment agreements. This can result in lower initial monthly payments, providing better short-term cash flow for the homeowner. Additionally, if market interest rates decrease, your rate and monthly payment will also go down. This can make the financing more affordable during certain economic cycles.

What is the minimum credit score I need to qualify for a HELOC?

While requirements vary by lender, most institutions look for a credit score of at least 640, though some lenders prefer 680. Higher scores often lead to more favorable interest rates and higher borrowing limits.

Learn more about mortgages:

SoFi Loan Products Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

Checking Your Rates: To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score. However, if you choose a product and continue your application, we will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull and may affect your credit.

²SoFi Bank, N.A. NMLS #696891 (Member FDIC), offers loans directly or we may assist you in obtaining a loan from SpringEQ, a state licensed lender, NMLS #1464945.

All loan terms, fees, and rates may vary based upon your individual financial and personal circumstances and state.You should consider and discuss with your loan officer whether a Cash Out Refinance, Home Equity Loan or a Home Equity Line of Credit is appropriate. Please note that the SoFi member discount does not apply to Home Equity Loans or Lines of Credit not originated by SoFi Bank. Terms and conditions will apply. Before you apply, please note that not all products are offered in all states, and all loans are subject to eligibility restrictions and limitations, including requirements related to loan applicant’s credit, income, property, and a minimum loan amount. Lowest rates are reserved for the most creditworthy borrowers. Products, rates, benefits, terms, and conditions are subject to change without notice. Learn more at SoFi.com/eligibility-criteria. Information current as of 06/27/24.In the event SoFi serves as broker to Spring EQ for your loan, SoFi will be paid a fee.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

SOHE-Q425-057

Get prequalified in minutes for a SoFi Home Loan.

Free Colorado HELOC Payment Calculator

Colorado HELOC Calculator

By SoFi Editors | Updated December 30, 2025

For those who have built up a solid ownership stake in their home, a home equity line of credit (HELOC) offers a way to get equity out of your home, allowing you to borrow money at a better interest rate than you’d find with a personal loan or credit card. Understanding how HELOCs work is the first step toward making an informed decision, and a free Colorado HELOC calculator can swiftly show you how much equity you have and what your monthly payments might be if you were to borrow against it. Take a few minutes to learn how to use this tool effectively, then try out the calculator for yourself.

- Key Points

- • A HELOC is a revolving credit line, allowing borrowers to draw, repay, and re-draw funds.

- • This financing option is secured by the homeowner’s property, which serves as collateral for the credit line.

- • A HELOC typically has two distinct phases: an initial draw period followed by a repayment period.

- • Lenders generally allow borrowers to access up to 90% of their home equity, which is the value of their home minus any mortgage balance.

- • Interest rates for this type of financing are generally variable and fluctuate based on economic indicators.

Calculator Definitions

• HELOC Balance: This term represents the total amount of money a borrower has currently withdrawn from their available credit line, or the amount a homeowner plans to borrow.

• Current Interest Rate: A lender will compute the interest you owe on a HELOC by multiplying the rate by the HELOC balance. HELOC rates are typically variable and can change over time based on market conditions.

• Draw Period: The draw period is the initial phase of the HELOC, during which time the homeowner can borrow up to the credit limit. In most cases, this stage lasts for a decade and borrowers may only be required to make monthly interest payments on the amount borrowed.

• Repayment Period: This phase begins once the draw period concludes. HELOC users will stop borrowing funds and begin making regular payments that cover both the principal balance and the interest.

• Monthly Interest Payment: This is the amount due each month during the draw period.

• Monthly Principal and Interest Payment: During the repayment period, the principal and interest will both be included in the homeowner’s monthly payments.

• Total Interest: The free HELOC calculator computes the total amount of interest you might pay based on your borrowed amount. Remember that because HELOC interest rates are variable, this number is only an estimate. But it’s helpful to have a sense of the total cost of borrowing.

How to Use the Colorado HELOC Calculator

When using a Colorado HELOC payment calculator, the quality of the output will depend on the accuracy of the numbers you provide. Follow these steps for the best results:

Step 1: Input Your Planned or Actual HELOC Balance

Record the amount you plan to spend with your HELOC, or enter your current balance if you already have a home equity line of credit.

Step 2: Select Your Interest Rate

The interest rate is the primary driver of your monthly carrying costs during the draw period. Enter a rate offer from a prospective lender or use an estimate based on your research.

Step 3: Choose the Length of Your Draw Period

This timeframe is important because it dictates when the transition to the more intensive repayment phase will occur. A typical draw period is five to 10 years.

Step 4: Specify Your Repayment Period

Choose a repayment period, which will typically be between 10 and 20 years. A longer period may lower your monthly payment, but will increase the total interest paid over the life of your HELOC.

Step 5: Review Your Results

Analyzing the calculator’s output allows you to see how both the short- and long-term costs of a HELOC fit into your budget. If you think a HELO might be a good fit, make sure you understand what a home equity line of credit is, exactly, before you proceed.

What Is a Home Equity Line of Credit?

A HELOC is a flexible financing option that allows homeowners to borrow against the value of their property. Unlike personal or home equity loans, which provide borrowers with funds in a single lump sum, a HELOC is a revolving credit account. In practice, using it is similar to using a credit card. However this line of credit is secured by your home, meaning interest rates tend to be lower than those found on credit cards, and borrowing limits may be higher.

HELOCs have two distinct phases: the draw period and the repayment period. The draw period typically lasts for 10 years. During this time, the homeowner has the freedom to access funds for various purposes, such as home upgrades, educational costs, or debt consolidation. Many lenders only require you to pay interest on what you have borrowed during the draw period, although you have the option to pay down the principal and then borrow again, up to the full credit limit. A HELOC interest-only calculator can show you what you might pay if you are only paying interest.

Once the draw period expires, the product enters the repayment period, which lasts for up to 20 years. At this point, you can no longer borrow and you must begin making payments that include both principal and interest to retire the balance. It’s important to be prepared for these payments, because they are usually higher than in the draw period. A HELOC repayment calculator can show you what you might need to pay based on your balance. HELOCs have variable interest rates, as well. So your payment could rise or fall periodically based on market rates.

Lenders typically require homeowners to have at least 15% equity in their home before greenlighting a HELOC. To determine your equity level, subtract your mortgage balance from your home’s estimated value. Then divide the answer by the home value to get a percentage.If approved, you may be able to borrow up to 90% of your equity. To gain approval, you’ll need a credit score of at least 640, though many lenders like to see 680 or more.

HELOCs are a great way to capitalize on the value you’ve built up in your home, but it’s important to remember that when your home is collateral, as it is in this case, you risk foreclosure if you can’t repay what you have borrowed.

Managing this type of credit line also requires a disciplined approach to budgeting and an understanding of variable interest rates. The most successful borrowers use the HELOC to their advantage by only drawing what is necessary and making principal payments during the draw period when possible. This strategy reduces the total debt that must be managed when the repayment phase begins.

Recommended: Different Types of Home Equity Loans

Home Equity Trends in Colorado

The equity you have in your home is not static; it fluctuates as you make your mortgage payments and your home value responds to local market conditions. When property values in a region like Colorado experience growth, the homeowner’s equity increases, even if the home loan balance changes only incrementally month to month. In Colorado over the past five years, owners have seen an average equity increase of 48% and the average owner now has more than $215,000 in equity — more than adequate to support a HELOC that would allow a renovation or debt consolidation.

This equity increase is part of a larger national trend, as shown in the graphic.

Current HELOC rates by state.

Compare current home interest rates by state and find a HELOC rate that suits your financial goals.

Select a state to view current rates:

How to Use the HELOC Calculator Data to Your Advantage

Using a HELOC payment calculator to generate estimates of your monthly HELOC payment, both during the draw phase and after you reach the repayment phase, is a smart way to determine if your budget can handle a HELOC. But there are other uses for the HELOC calculator.

• You can create “what-if” scenarios. Homeowners considering a HELOC can input different HELOC balances, interest rates, or repayment terms to see how each of these things will affect their monthly payment. This lets you see what a high or low monthly payment would be based on different interest rates. This is useful given that HELOC interest rates can shift over time.

• You can evaluate debt consolidation strategies. If you’re carrying balances on high-interest credit cards, you can add up the monthly payment amounts on your cards and compare that to the monthly payment you would have if you used a HELOC to pay off all that you owe at once. There’s a good chance your monthly payment with a HELOC would be lower than the sum of what you’re currently paying. And it would be one payment instead of multiple payments.

• You can avoid “payment shock”. Looking carefully at the monthly principal and interest payment during repayment will prepare you for how payments increase after the draw phase of a HELOC ends. By seeing these future figures today, a borrower can choose to limit their draws to what is truly necessary, maintaining a healthy debt-to-income ratio and avoiding so-called “payment shock.”

Tips on HELOCs

Being disciplined about making payments is key to having a happy HELOC experience. But there are other ways you can set yourself up for success:

• Before you apply: Strive for a healthy credit score by making all your payments on time. For the lowest HELOC interest rate, it helps to have a credit score of 700 or more. Avoid closing any credit accounts (or opening new ones), but do try to pay down your credit card debt in the months leading up to a HELOC application.

• Before you commit to a HELOC: Shop around and compare offers. Different lenders offer various terms and have different fee structures. Look at how each lender computes your interest rate as well. By comparing offers from multiple institutions using the free HELOC calculator, you can pinpoint the HELOC arrangement that works best for you.

• After you sign a HELOC agreement: While the draw period offers the convenience of interest-only payments, homeowners should be mindful that the full balance must eventually be repaid. Try to get in the habit of making payments toward the principal whenever possible during the draw phase to reduce the financial burden you’ll face during the repayment phase. And treat the revolving credit line with the same seriousness as you do your primary mortgage.

Recommended: HELOC vs. Home Equity Loan

Alternatives to HELOCs

Every homeowner’s financial situation is different, and a HELOC may not always be the most appropriate choice. Some homeowners will be better off with a home equity loan, for example. Make sure you are aware of all your borrowing options.

Home Equity Loan

Home equity loans provide a lump-sum loan all at once. A home equity loan is a second mortgage. It typically has a fixed interest rate and fixed monthly payments, which makes it an attractive choice for those who want predictability and who have a pretty solid idea of how much money they need to borrow. Unlike with a HELOC, which has a draw period, with a home equity loan the borrower begins to repay both principal and interest immediately after receiving funds, and the borrower cannot re-borrow funds as the balance is paid down.

A home equity loan calculator can show you what your payments might be based on your amount borrowed.

Home Improvement Loan

This installment loan is useful if you have a specific residential project with a known cost — often in the form of an estimate from a contractor. Unlike a revolving credit line, all funds are usually disbursed in a single payment. As with a home equity loan, you would begin to repay the principal plus interest immediately. Because a home improvement loan is not secured by your home, its interest rate could be higher and maximum loan amount lower than you’ll find with a HELOC or home equity loan.

Personal Line of Credit

A personal line of credit offers revolving access to funds similar to a HELOC but is another unsecured loan option. This means your property is not used as collateral. While this protects the home from foreclosure in the event of a default, the interest rates are generally higher because the lender is taking on more risk without a physical asset as security.

Cash-Out Refinance

This special mortgage refinance strategy involves replacing the primary mortgage with a new, larger mortgage. The homeowner receives the difference between the two as a lump-sum payment. This approach can be preferable to adding a second mortgage if current interest rates are significantly lower than the rate on the primary mortgage.

As you consider a cash-out refinance vs. home equity line of credit or home equity loan, a key difference is that the refinance consolidates all home debt into a single payment.

The Takeaway

The Colorado HELOC calculator is a helpful resource for any homeowner looking to borrow money based on their home equity. Having a clear and objective estimate of your projected payments, both during the draw and repayment phases, can make deciding on a HELOC easier. Use the calculator to compare costs when you obtain interest rates and HELOC terms from lenders and you’ll be taking an important step toward borrowing responsibly.

SoFi now partners with Spring EQ to offer flexible HELOCs. Our HELOC options allow you to access up to 90% of your home’s value, or $500,000, at competitively lower rates. And the application process is quick and convenient.

Unlock your home’s value with a home equity line of credit from SoFi, brokered through Spring EQ.

FAQ

What is the benefit of having a variable interest rate?

The primary benefit of a variable rate is that it often starts lower than the rates found on fixed installment products. This can lead to lower initial monthly costs, such as during the draw period of a home equity line of credit. If market interest rates decrease, your monthly payment and total interest costs could even go down when the rate adjusts. However, this flexibility comes with the risk that payments may increase if market rates rise in the future.

Are there closing costs or fees for a HELOC?

Yes, these financing options often include closing costs and fees, which can range from 2% to 5% of the credit limit. Fees may include application charges, home appraisal costs, and annual maintenance fees. Some lenders may offer to waive these costs if you keep the credit line open for a certain period, but it is important to compare different offers to understand the total cost over the life of the product.

What is the minimum credit score I need to qualify for a HELOC?

While requirements vary by lender, most institutions look for a credit score of at least 640, with many lenders preferring 680. Higher scores, typically 700 or above, generally help you qualify for the most competitive interest rates. Lenders also evaluate your debt-to-income ratio and the amount of equity in your home to determine your overall eligibility and ensure that the financing is a safe option for you.

Is the interest on a HELOC tax-deductible?

Interest paid on this credit line may be tax-deductible. You’ll need to itemize on your return in order to capture this deduction. It’s a good idea to consult with a professional tax advisor to understand the current rules and how they apply to your situation.

Learn more about mortgages:

SoFi Loan Products Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

Checking Your Rates: To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score. However, if you choose a product and continue your application, we will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull and may affect your credit.

²SoFi Bank, N.A. NMLS #696891 (Member FDIC), offers loans directly or we may assist you in obtaining a loan from SpringEQ, a state licensed lender, NMLS #1464945.

All loan terms, fees, and rates may vary based upon your individual financial and personal circumstances and state.You should consider and discuss with your loan officer whether a Cash Out Refinance, Home Equity Loan or a Home Equity Line of Credit is appropriate. Please note that the SoFi member discount does not apply to Home Equity Loans or Lines of Credit not originated by SoFi Bank. Terms and conditions will apply. Before you apply, please note that not all products are offered in all states, and all loans are subject to eligibility restrictions and limitations, including requirements related to loan applicant’s credit, income, property, and a minimum loan amount. Lowest rates are reserved for the most creditworthy borrowers. Products, rates, benefits, terms, and conditions are subject to change without notice. Learn more at SoFi.com/eligibility-criteria. Information current as of 06/27/24.In the event SoFi serves as broker to Spring EQ for your loan, SoFi will be paid a fee.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

SOHE-Q425-056

Get prequalified in minutes for a SoFi Home Loan.

Free Arkansas HELOC Payment Calculator

Arkansas HELOC Calculator

By SoFi Editors | Updated December 30, 2025

A home equity line of credit, or HELOC, can be a flexible way to borrow against your home’s equity, but understanding the potential costs is essential before you apply. Our free Arkansas HELOC loan payment calculator helps you estimate monthly payments, interest costs, and repayment timelines. Here’s an in-depth look on how to use the calculator, what a home equity line of credit is, alternatives to a HELOC, and more.

- Key Points

- • A HELOC is a revolving credit line that allows homeowners to access funds multiple times up to a predefined limit during a specific window of time.

- • The residential property serves as the underlying security for the financing vehicle, which often results in lower percentage-based costs compared to unsecured options.

- • Most agreements are divided into two distinct phases, starting with an initial period focused on the accessibility of funds.

- • A home equity loan calculator can help you estimate monthly payments and total interest costs before speaking with a lender.

- • Failure to meet the obligations of the agreement puts the property at risk of foreclosure since the home is used as collateral.

Calculator Definitions

• HELOC Balance: This is the total amount of money you’ve currently borrowed from your home equity line of credit, including any outstanding principal but not future available credit.

• Current Interest Rate: This is the percentage-based cost associated with the funds used. Because this figure is usually variable, it fluctuates in response to broader shifts in the financial landscape.

• Draw Period: This is the initial time frame — often spanning 10 years — during which the credit line remains open for withdrawals and fund access. During this stage, homeowners typically have the option to make payments that cover only the cost of borrowing.

• Repayment Period: This subsequent phase — frequently lasting 20 years — marks the end of fund accessibility and requires the homeowner to begin paying back the principal. Monthly obligations generally increase during this time to ensure the total balance is cleared by the end of the term.

• Monthly Interest Payment: This figure represents the cost of borrowing for a single month, calculated based on the outstanding balance and the applicable percentage-based charge. It does not include any reduction of the original amount borrowed.

• Monthly Principal and Interest Payment: This combined amount is the required monthly sum during the final phase of the agreement to satisfy the full obligation. It covers both the ongoing borrowing costs and the systematic reduction of the principal balance.

• Total Interest: This is the cumulative percentage-based cost paid to the lender over the duration of the credit line’s life. It accounts for the varying costs incurred during both the draw and repayment stages.

How to Use the Arkansas HELOC Calculator

Using the Arkansas HELOC calculator is straightforward and helps you estimate potential payments before you borrow. Simply follow the steps below to enter your loan details and see how your balance, interest, and payments may change over time.

Step 1: Enter the Amount You Plan to Borrow

First, enter the amount you hope to borrow with a home equity line of credit.

Step 2: Estimate Your Interest Rate

Enter the interest rate your lender offers or use the current market average. Because HELOCs typically have variable rates, try running the calculator with higher rates as well to see how changes in the market could affect your payments.

Step 3: Choose the Length of Your Draw Period

This step requires selecting the specific time frame during which the credit line remains open for new withdrawals. Standard agreements often set this at a decade, though variations exist.

Step 4: Specify Your Repayment Period

Enter the repayment term — typically 10 to 20 years — to see how quickly you’ll pay down the balance. Shorter terms mean higher monthly payments but much less interest overall, while longer terms lower your monthly bill at the cost of paying more interest over time.

Step 5: Review Your Results

The final step involves a thorough analysis of the generated output to understand the long-term impact on the household budget. Homeowners should look closely at the projected monthly obligations during the repayment phase and the total borrowing costs over the life of the agreement.

To fully understand the mechanics behind these numbers, let’s explore what a home equity line of credit is.

Recommended: Different Types of Home Equity Loans

What Is a Home Equity Line of Credit?

A home equity line of credit, commonly known as a HELOC, is a revolving financing vehicle that allows homeowners to borrow against the equity they have built in their residential property. It functions like a high-limit credit card, where funds can be withdrawn, repaid, and withdrawn again as needed.

The home itself serves as security for the credit line, which generally permits access to a more favorable percentage-based cost than unsecured products. Because the property is used as collateral, the lender has a high degree of confidence in repayment, but this also places the home at risk if the terms of the agreement are not met.

The lifecycle of a HELOC is divided into two operational phases. During the initial stage, known as the draw period, the homeowner enjoys the highest level of flexibility, often being required to cover only the costs of borrowing on the funds they have actually used. A HELOC interest-only calculator can give you the payment info for that first phase only.

Once this phase concludes, the product transitions into a repayment stage. At this point, new withdrawals are prohibited, and the homeowner must begin a structured schedule of payments that cover both the principal and the ongoing borrowing costs. Arkansas homeowners should use a HELOC repayment calculator to prepare for this transition, to ensure the new, larger payment fits their long-term budget.

Recommended: How to Get Equity Out of Your Home

Home Equity Trends in Arkansas

The Arkansas housing market has experienced significant shifts over the last several years, directly impacting the borrowing potential of homeowners across the state. As residential property values have climbed, the amount of equity available to many individuals has grown proportionally.