Cost of Living in Idaho

Cost of Living in Idaho

(Last Updated – 03/2025)

People can’t seem to get enough of those Idaho potatoes. Why do we say that? According to the most recent U.S. Census Bureau data, Idaho’s population grew at a rate of 8.8% over the last four years. Compared to the percent population growth across the entire country, which was just 2.6% during that same period, Idaho is growing by leaps and bounds.

Even though it has just over 2 million residents, Idaho still only averages around 14 people per square mile. Compared to California, which hosts 253 residents per square mile on average, Idaho is roomy!

Let’s take a closer look at what it costs to build a life in the Gem State.

What’s the Average Cost of Living in Idaho?

Average Cost of Living in Idaho: $46,270 per year

If you move to Idaho, you won’t be looking at a particularly expensive or particularly affordable lifestyle. According to the most recent Missouri Economic Research and Information Center (MERIC) data collected from the annual Council for Community & Economic Research (C2ER) survey, Idaho has the 32nd-lowest cost of living in the United States — the 18th highest, in other words.

For a lower cost of living, you might want to head to Montana, which ranked 22nd on MERC’s list, or to Wyoming, which has the 25th lowest cost of living per the C2ER survey.

While these rankings give a general idea of how expensive a state is to live in, you may still wonder: What is the average cost of living in Idaho?

You can expect to spend about $46,270 a year on total personal consumption, according to recent data from the Bureau of Economic Analysis . This is how that lump sum breaks down.

|

Category |

Average Annual Per-Capita Cost in Idaho |

|

Housing and Utilities |

$9,309 |

|

Health Care |

$7,507 |

|

Food and Beverages (nonrestaurant) |

$3,813 |

|

Gasoline and Energy Goods |

$1,732 |

|

All Other Personal Expenditures |

$23,909 |

That’s about $3,856 in average monthly expenses for each Idahoan.

Housing Costs in Idaho

Average Housing Costs in Idaho: $963 to $1,772 per month

Housing is likely your biggest ongoing expense, no matter what state you live in. The typical Idaho home value was about $456,464 in February 2025, compared with a typical U.S. home value of $357,138 nationwide, according to Zillow.

Home sales in Idaho have settled down from a frenzied pace in 2021, when nearly 40% of homes sold above list price (an indicator that they received multiple offers). As of February 2025, just over 10% of homes sold above list price, showing a less competitive housing market per Redfin data.

Whether you own or rent, as well as how large your rental is, can affect how much you’ll spend monthly. Here’s what that spending might look like, according to the most recent census data:

• Median monthly mortgage cost: $1,610

• Median studio rent: $1,151

• Median one-bedroom rent: $963

• Median two-bedroom rent: $1,183

• Median three-bedroom rent: $1,558

• Median four-bedroom rent: $1,772

• Median five-bedroom (or more) rent: $1,748

• Median gross rent: $1,256

The specific area of Idaho you live in can also affect how much you’ll spend. These are the typical home values for some of Idaho’s major cities, according to recent Zillow data.

|

Idaho City |

Average Home Value |

|

Burley |

$314,106 |

|

Pocatello |

$326,957 |

|

Mountain Home |

$344,832 |

|

Blackfoot |

$347,015 |

|

Twin Falls |

$351,822 |

|

Lewiston |

$368,153 |

|

Idaho Falls |

$379,856 |

|

Rexburg |

$402,723 |

|

Moscow |

$456,182 |

|

Boise (Boise Housing Market Trends) |

$492,024 |

|

Coeur d’Alene |

$558,912 |

|

Sandpoint |

$601,235 |

|

Hailey |

$773,728 |

Utility Costs in Idaho

Average Utility Costs in Idaho: $299 per month

Another ongoing expense you need to budget for is utilities. This is what that spending may look like in an average month in Idaho.

|

Utility |

Average Idaho Bill |

|

Electricity |

$107 |

|

Natural Gas |

$40 |

|

Cable & Internet |

$101 |

|

Water |

$51 |

Sources: U.S. Energy Information Administration, Electric Sales, Revenue, and Average Price; Statista.com, “Average monthly residential utility costs in the United States, by state”; DoxoInsights, U.S. Cable & Internet Market Size and Household Spending Report; and Rentcafe.com, What Is the Average Water Bill?

Groceries & Food

Average Grocery & Food Costs in Idaho: $318 per person, per month

How much should you anticipate spending on food in Idaho?

The Bureau of Economic Analysis estimates that Idaho’s average annual (nonrestaurant) food cost is $3,813 per person, so that’s about $318 a month.

The Council for Community and Economic Research ranks the food costs in major American cities. The only Idaho city researchers examined was Boise. To put that data in some perspective, here are grocery item index scores from major cities in neighboring states. These are their respective grocery costs ranking using the most recent data.

|

City or Metro |

Grocery Items Index |

|

Casper, WY |

96.0 |

|

Provo-Orem, UT |

96.7 |

|

Ogden, UT |

98.0 |

|

Salt Lake City, UT |

98.1 |

|

Moses Lake, WA |

99.9 |

|

Yakima, WA |

101.4 |

|

Kennewick-Richland-Pasco, WA |

101.5 |

|

Reno-Sparks, NV |

102.9 |

|

Billings, MT |

103.5 |

|

Boise, ID |

103.7 |

|

Spokane, WA |

106.0 |

Transportation

Average Transportation Costs in Idaho: $10,849 to $20,188 per year

How much you’ll spend getting around each year is affected by where you live and what your or your family’s transportation needs are.

Here’s a glimpse at what it may cost to get from place to place in Idaho, according to the most recent data from MIT’s Living Wage Calculator.

|

Family Makeup |

Average Annual Transportation Cost |

|

One adult, no children |

$10,849 |

|

Two working adults, no children |

$12,555 |

|

Two working adults, three children |

$20,188 |

Health Care

Average Health Care Costs in Idaho: $7,507 per person, per year

Health care is a major expense in every state in the country. In Idaho, the average annual cost of health care is $7,507 per person, according to the most recent report of Bureau of Economic Analysis Personal Consumption Expenditures by State.

How much you would actually spend depends on location, medical needs, and coverage.

Child Care

Average Child Care Costs in Idaho: $728 to $1,002 or more per child, per month

Funding child care is a challenge for many parents, which isn’t surprising when you can spend around $1,000 a month on child care in states like Idaho.

Residents who need help financing child care in Idaho can look into the Idaho Child Care Program, which pays part of child care costs for eligible working families.

This is what the average child care costs are in Idaho, according to the most recent data from CostofChildCare.org.

|

Type of Child Care |

Average Cost Per Month, Per Child |

|

Infant Classroom |

$1,002 |

|

Toddler Classroom |

$865 |

|

Preschooler Classroom |

$728 |

|

Home-Based Family Child Care |

$892 |

Taxes

Highest Marginal Tax Rate in Idaho: 5.695%

As of January 1, 2025, Idaho assesses a flat rate of 5.695% on taxable income, according to the Tax Foundation’s State Individual Income Tax Rates and Brackets.

Idaho’s flat rate of 5.695% is the second highest among the current flat tax states, of which there are 15 states, including Idaho (Washington state topped the list with a rate of 7%). The most recent ranking of State Tax Competitiveness puts Idaho at 11th among the most competitive tax systems.

High taxes do compel folks to seek greener pastures. In fact, in the last fiscal year, Idaho was the second most popular destination for Americans moving to new states where the taxes were lower.

Miscellaneous Costs

Now that we know what it costs to live in Idaho, let’s dive into what it costs to have some fun in this state.

The Bureau of Economic Analysis says personal expenditures for the average Idahoan are $23,909 per year. Here’s where some of that spending may be going (costs are accurate as of March 2025).

• A family visit to Craters of the Moon National Monument & Preserve in Arco, Carey, and Rupert, Idaho: $20 a day, for seven consecutive days, for a group entering in a single private vehicle. Visit historic lava flow sites, caves, and more in this “weird and scenic landscape.”

• A 25-minute narrated ferry boat tour of the Snake River near Idaho Falls: $8-$40, varies by weight (kids under 30 lbs ride free).

• A trip to Zoo Boise to get up close with the animals: $0 to $13 depending on age.

• A single-day lift ticket at Schweitzer mountain near Sandpoint: $63 (ages 7-17), $105 (ages 18-64), $95 (ages 65-79).

• Trick a friend with an optical illusion for dessert and try an “ice cream potato” at the Westside Drive in located in Boise: $6.69

How Much Money Do You Need to Live Comfortably in Idaho?

What it means to live “comfortably” in Idaho will depend on your lifestyle, income, family size, and more. That said, you can get a general idea of how accessible living comfortably is in each state.

Idaho ranks 23rd on U.S. News & World Report’s Affordability Rankings, which measure the average cost of living in each state against the average amount of money most households have there. The state came out higher on the magazine’s overall ranking, however, as the 5th best state overall.

MERIC viewed the affordability in Idaho less favorably, ranking the state as having the 32nd lowest cost of living in the United States (or 18th highest).

What City Has the Lowest Cost of Living in and Around Idaho?

The Council for Community and Economic Research focused on just Boise in their affordability study, but here’s how the city stacks up to two other nearby cities with similar populations.

Spokane, WA

A similar population to Boise, and just 422 miles to the north, Spokane, Washington boasts around 229,400 residents. It’s also the more affordable choice, with a composite cost-of-living score of 96.4 on the CCER index. Spokane is an impressive outpost in the “inland empire” region, close to mountains, farmland, and several Indian Reservations. The Lilac City is also home to several colleges, museums, and many arts and cultural opportunities. Spokane sits along a major east-west highway, railroad systems, and waterways, which include a set of impressive waterfalls that split the city in two.

Boise

The housing market here is cooling off, but Boise’s cost-of-living index of 103.7 could be considered tame for a big city. Boise, the state capital, is a beautiful and outdoorsy city with around 235,400 residents, and downtown abounds with coffee shops, craft breweries, and trendy eateries. Beyond the business of state government, Boise also is home to historical sites, art museums, botanical gardens, and outdoor recreation in the mountains or on the Boise river, which runs through town.

Reno, Nevada

Just 335 miles from Boise, Reno is home to almost 275,000 people and is known as the Biggest Little City in the World. In terms of affordability, it’s more costly than Boise, coming in with a score of 104.0 on the composite index of cost of living. Like Las Vegas, Reno is known for its casinos and live entertainment, but also its outdoor recreation with close proximity to both Lake Tahoe and the Sierra Nevada mountains. Tech companies have taken an interest in the area, including Tesla, Switch, and Panasonic.

SoFi Home Loans

The Idaho cost of living is neither super high nor ultra low. Folks have been flocking to the rugged, scenic Gem State. Maybe you’re next.

Looking for an affordable option for a home mortgage loan? SoFi can help: We offer low down payments (as little as 3% - 5%*) with our competitive and flexible home mortgage loans. Plus, applying is extra convenient: It's online, with access to one-on-one help.

FAQ

Is it expensive to live in Idaho?

Idaho ranks near the middle in most affordability rankings, but certain cities and lifestyles might make it more or less expensive to live in. US News & World Report ranked the state as the 23rd most affordable in the nation. While MERIC data declared it less affordable, at 32nd on their most recent list.

How much money do you need to live comfortably in Idaho?

Your personal expenses and habits will determine what “comfortable” living means, but in Idaho, MIT’s Living Wage Calculator showed a livable wage in Idaho requires $23.18 an hour to make 48,214 per year. The average per capita personal consumption expenditures report for Idaho by the Bureau of Economic Affairs, however, notes that the average person spends $46,270 per year on essentials and other expenses.

What are the pros and cons of living in Idaho?

Idaho ranks near the middle of most affordability data, but it also has a strong economy, fiscal stability, infrastructure, education, health care, and opportunity rankings from US News & World Report. While it has a flat-rate income tax, that rate comes in as the second highest of the 15 states that offer a flat rate. If you’re looking to buy a home, you will have an easier time of it in Idaho, with a cooling housing market of late. The cost of living is still higher than average, per MERIC data, but not as high as many of Idaho’s neighbors to the south or west.

Is it cheaper to live in Idaho or Washington?

Depending on where you settle in Idaho or Washington, you could have a lower cost of living in either place. In Boise, Idaho, home values average $492,024, while in Spokane, Washington, the top average is $383,625. The two cities have similar populations, but Spokane offers a lower cost-of-living score per COLI data. Washington has higher taxes, but both states have a flat income tax rate.

Photo credit: iStock/Mike Worley

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

*SoFi requires Private Mortgage Insurance (PMI) for conforming home loans with a loan-to-value (LTV) ratio greater than 80%. As little as 3% down payments are for qualifying first-time homebuyers only. 5% minimum applies to other borrowers. Other loan types may require different fees or insurance (e.g., VA funding fee, FHA Mortgage Insurance Premiums, etc.). Loan requirements may vary depending on your down payment amount, and minimum down payment varies by loan type.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

Qualifying for the reward requires using a real estate agent that participates in HomeStory’s broker to broker agreement to complete the real estate buy and/or sell transaction. You retain the right to negotiate buyer and or seller representation agreements. Upon successful close of the transaction, the Real Estate Agent pays a fee to HomeStory Real Estate Services. All Agents have been independently vetted by HomeStory to meet performance expectations required to participate in the program. If you are currently working with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®. A reward is not available where prohibited by state law, including Alaska, Iowa, Louisiana and Missouri. A reduced agent commission may be available for sellers in lieu of the reward in Mississippi, New Jersey, Oklahoma, and Oregon and should be discussed with the agent upon enrollment. No reward will be available for buyers in Mississippi, Oklahoma, and Oregon. A commission credit may be available for buyers in lieu of the reward in New Jersey and must be discussed with the agent upon enrollment and included in a Buyer Agency Agreement with Rebate Provision. Rewards in Kansas and Tennessee are required to be delivered by gift card.

HomeStory will issue the reward using the payment option you select and will be sent to the client enrolled in the program within 45 days of HomeStory Real Estate Services receipt of settlement statements and any other documentation reasonably required to calculate the applicable reward amount. Real estate agent fees and commissions still apply. Short sale transactions do not qualify for the reward. Depending on state regulations highlighted above, reward amount is based on sale price of the home purchased and/or sold and cannot exceed $9,500 per buy or sell transaction. Employer-sponsored relocations may preclude participation in the reward program offering. SoFi is not responsible for the reward.

SoFi Bank, N.A. (NMLS #696891) does not perform any activity that is or could be construed as unlicensed real estate activity, and SoFi is not licensed as a real estate broker. Agents of SoFi are not authorized to perform real estate activity.

If your property is currently listed with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®.

Reward is valid for 18 months from date of enrollment. After 18 months, you must re-enroll to be eligible for a reward.

SoFi loans subject to credit approval. Offer subject to change or cancellation without notice.

The trademarks, logos and names of other companies, products and services are the property of their respective owners.

SOHL-Q125-147

Week Ahead on Wall Street: The Fog of Political War

The government shutdown continues this week and there’s little sign of a near-term resolution. With betting markets expecting it to drag on for weeks, investors will need to continue navigating through an economic data fog. Two important sources of clarity will help pierce through the cloud, however.

First and foremost: Though most government data is on hold during the shutdown, the Consumer Price Index (CPI) is a critical exception. Due to its importance in calculating annual cost-of-living adjustments for Social Security benefits, the Bureau of Labor Statistics (BLS) announced it’ll be releasing the report on Friday. Already the most tracked by market participants, this report is even more important while investors are making due without other economic data.

And we can’t forget about corporate America. The pace of third-quarter earnings reports picks up significantly this week, with a host of companies from various sectors set to share their results. These reports will provide a real-time, bottom-up perspective on the health of the economy, straight from those who are on the business front lines.

Economic and Earnings Calendar

Most releases involving government data will not be released while the shutdown is ongoing.

Monday

• September Leading Economic Index: This is an index composed of various economic indicators that have historically led changes in the broader economy.

• Earnings: Steel Dynamics (STLD), W R Berkley (WRB)

Tuesday

• October Philadelphia Fed Non-Manufacturing Activity: The Philadelphia Fed’s survey of services executives in the region on business conditions and their outlook.

• Earnings: Chubb (CB), Capital One Financial (COF), Quest Diagnostics (DGX), Danaher (DHR), Equifax (EFX), Elevance Health (ELV), EQT (EQT), General Electric (GE), General Motors (GM), Genuine Parts (GPC), Halliburton (HAL), Intuitive Surgical (ISRG), Coca-Cola (KO), Lockheed Martin (LMT), 3M (MMM), Nasdaq (NDAQ), Netflix (NFLX), Northrop Grumman (NOC), Omnicom Group (OMC), PACCAR (PCAR), PulteGroup (PHM), Philip Morris International (PM), Pentair (PNR), Raytheon Technologies (RTX), Texas Instruments (TXN)

Wednesday

• Weekly Mortgage Applications: Mortgage activity gives insight on demand conditions in the housing market.

• Earnings: Amphenol (APH), Avery Dennison (AVY), Boston Scientific (BSX), Crown Castle International (CCI), CME Group (CME), FirstEnergy (FE), Globe Life (GL), Hilton Worldwide Holdings (HLT), International Business Machines (IBM), Interpublic Group of Companies (IPG), Kinder Morgan (KMI), Lennox International (LII), Lam Research (LRCX), Southwest Airlines (LUV), Las Vegas Sands (LVS), Moody’s (MCO), Molina Healthcare (MOH), Northern Trust (NTRS), NVR (NVR), O’Reilly Automotive (ORLY), Packaging of America (PKG), Raymond James Financial (RJF), AT&T (T), Teledyne Technologies (TDY), Thermo Fisher Scientific (TMO), Tesla (TSLA), United Rentals (URI), Westinghouse Air Brake Technologies (WAB)

Thursday

• September Chicago Fed National Activity Index: This is a monthly index put together that incorporates 85 indicators from four categories: production and income; employment, unemployment, and hours; personal consumption and housing; and sales, orders, and inventories.

• September Existing Home Sales: Most home transactions in any given month tend to come from the existing market, and as a result set the tone for the broader housing market.

• October Kansas City Fed Manufacturing Activity: The Kansas City Fed’s survey of manufacturing executives in the region on business conditions and their outlook.

• Weekly Jobless Claims: This high frequency labor market data gives insight into filings for unemployment benefits.

• Earnings: Allegion (ALLE), Ameriprise Financial (AMP), Baker Hughes (BKR), Blackstone Group LP (BX), CBRE Group (CBRE), CenterPoint Energy (CNP), Deckers Outdoor (DECK), Digital Realty Trust (DLR), Physicians Realty Trust (DOC), Dover (DOV), Dow Inc (DOW), Ford (F), Freeport-McMoRan (FCX), GE Vernova (GEV), Hasbro (HAS), Honeywell International (HON), Intel (INTC), Mohawk Industries (MHK), Newmont Mining (NEM), Norfolk Southern (NSC), PG&E (PCG), Pool (POOL), Roper Technologies (ROP), T-Mobile US (TMUS), Tractor Supply Company (TSCO), Textron (TXT), Union Pacific (UNP), Valero Energy (VLO), VeriSign (VRSN), West Pharmaceutical Services (WST)

Friday

• September Consumer Price Index: The CPI is one of the most popular indicators for tracking consumer price trends and is a marquee release for market watchers.

• October S&P Global US PMIs: These indexes track how purchasing managers across different industries feel about the business environment.

• September New Home Sales: While only a minority of home transactions in any given month come from new constructions, these home prices tend to be more cyclical and give insight into developing trends.

• October University of Michigan Consumer Sentiment: How consumers feel about economic conditions affect their spending habits. This survey places a particular focus on inflation and its trajectory.

• October Kansas City Fed Non-Manufacturing Activity: The Kansas City Fed’s survey of services executives in the region on business conditions and their outlook.

• Earnings: Edwards Lifesciences (EW), General Dynamics (GD), HCA Healthcare (HCA), Illinois Tool Works (ITW), Procter & Gamble (PG)

Want to see more stories like this?

On the Money is SoFi’s flagship newsletter

for all things personal finance.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

SoFi isn't recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

Read moreDecoding Markets: A New Golden Rule

Oooh Shiny

Gold has always been synonymous with luxury. Jewelry, family heirlooms, treasure, you name it. In the distant past, it was even used as currency. Yet for many modern investors, gold occupies an uncertain space. Unlike stocks or bonds, it doesn’t offer cash flows or interest payments, and unlike many major commodities, it has few productive use-cases.

In markets, however, price is the ultimate arbiter of truth, and what’s been happening in gold markets has been a sight to behold. After steadily climbing in value in 2023 and 2024, price appreciation is now accelerating at a breakneck pace, naturally capturing headlines and intense interest among retail investors. Given this newfound attention, how should investors approach gold and its place within an investment portfolio? To get to the bottom of this, let’s start with the basics.

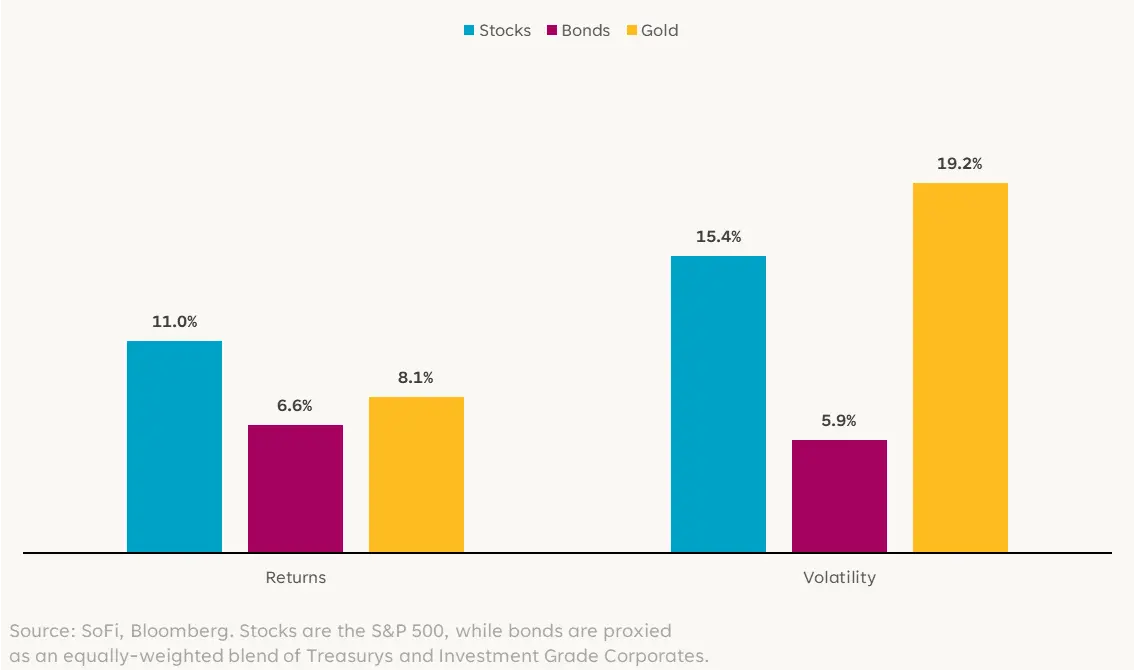

One common critique of gold is that it offers no real yield – “It’s just a shiny rock,” many say. That’s valid, and yet it’s averaged annual price appreciation of 8.1% since 1972. Clearly, there’s something about gold.

Of course, return is only one side of the equation. The other is risk, and another common critique is that gold is too unpredictable and volatile to warrant a meaningful allocation in an investment portfolio.

Gold certainly can exhibit significant price swings in the short term — especially considering the wonky supply-demand dynamics of commodity trading — but longer-term perspective provides crucial context. Since 1972, gold’s annualized volatility has been approximately 19.1%, somewhat higher than the S&P 500’s 15.4% over the same period.

Annualized Statistics

But even that isn’t the entire story. Diversifying is about allocating your money across sectors, geographies, and assets, but it’s not just about owning different assets. It’s also about owning assets that behave differently in different environments.

In other words, correlation. Two assets that have the same risk-return profile over the same period of time can actually have diversification benefits if they are weakly or negatively correlated to each other. On the other hand, two assets with wildly different risk-return profiles can have little diversification benefit if they have a strong positive correlation.

Gold has a famously unstable correlation to stocks (-0.01 since April 2021), which supports the idea that it adds a je ne sais quoi to portfolios. It has allowed gold to perform well across different macroeconomic environments, acting as a safe haven during periods of financial stress and as a hedge alongside other real assets during bouts of inflation.

Same Metal, Different Drivers

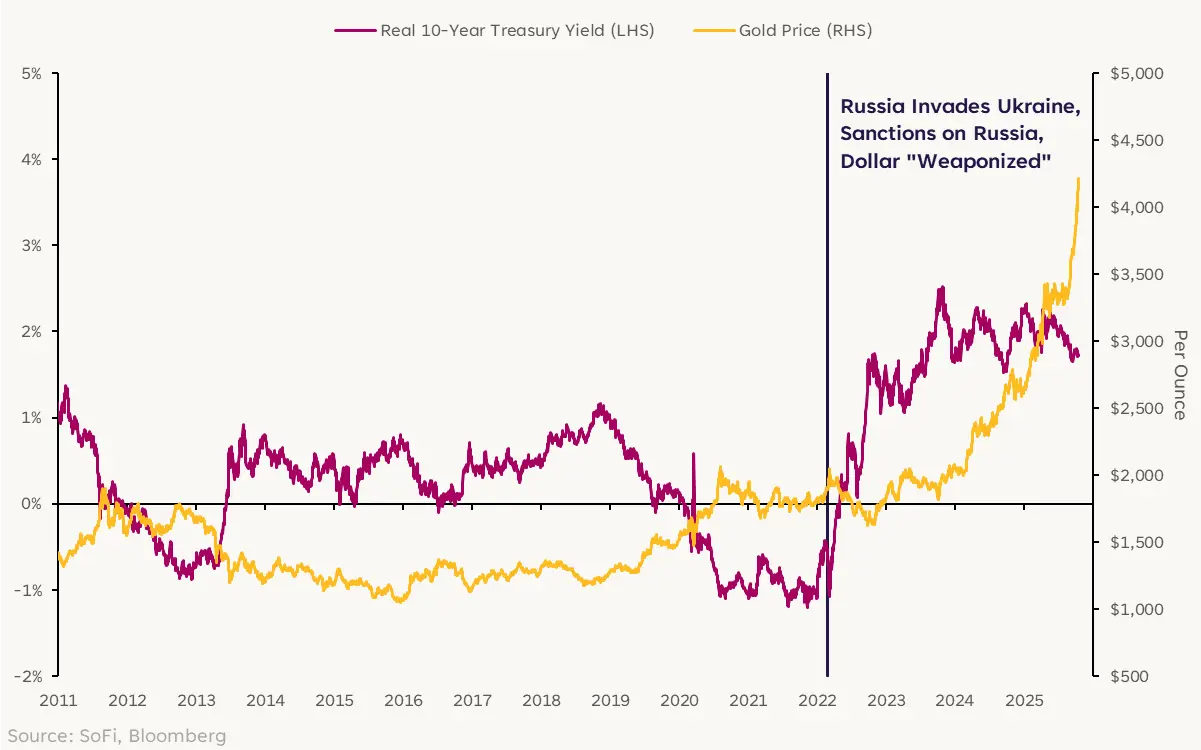

Over the past two decades, one of gold’s strongest drivers was its inverse correlation with real (i.e. inflation-adjusted) interest rates. The inverse correlation is because, as we’ve noted, gold is a non-yielding asset. In other words, its real yield is and always will be 0% (technically slightly negative due to storage costs, but that’s just being nitpicky). As interest rates decline, that 0% becomes incrementally more attractive, and as we saw in 2020, real Treasury yields can even fall into negative territory! That 0% starts to look a lot better in those situations, doesn’t it?

Gold Is Inversely Correlated With Interest Rates

This long-standing relationship has broken down in recent years, however. Even though real 10-year yields have increased to 1.73%, well above prior year levels, gold has rallied to all-time highs. The definitive break in this relationship can be traced to the fallout from Russia’s invasion of Ukraine in February 2022. The U.S. and its allies imposed sweeping financial sanctions, including freezing nearly half of the Central Bank of Russia’s foreign currency reserves.

This weaponization of the U.S. dollar triggered a strategic pivot among global central banks to reduce exposure to the dollar and its associated financial infrastructure. The drumbeat of global upheaval since then has only furthered that trend, with gold being the primary beneficiary. Unlike Treasuries or other foreign currency reserves, physical gold held in a country’s vaults can’t be easily frozen or seized. It’s a neutral, universally accepted store of value, which makes it attractive in an uncertain world.

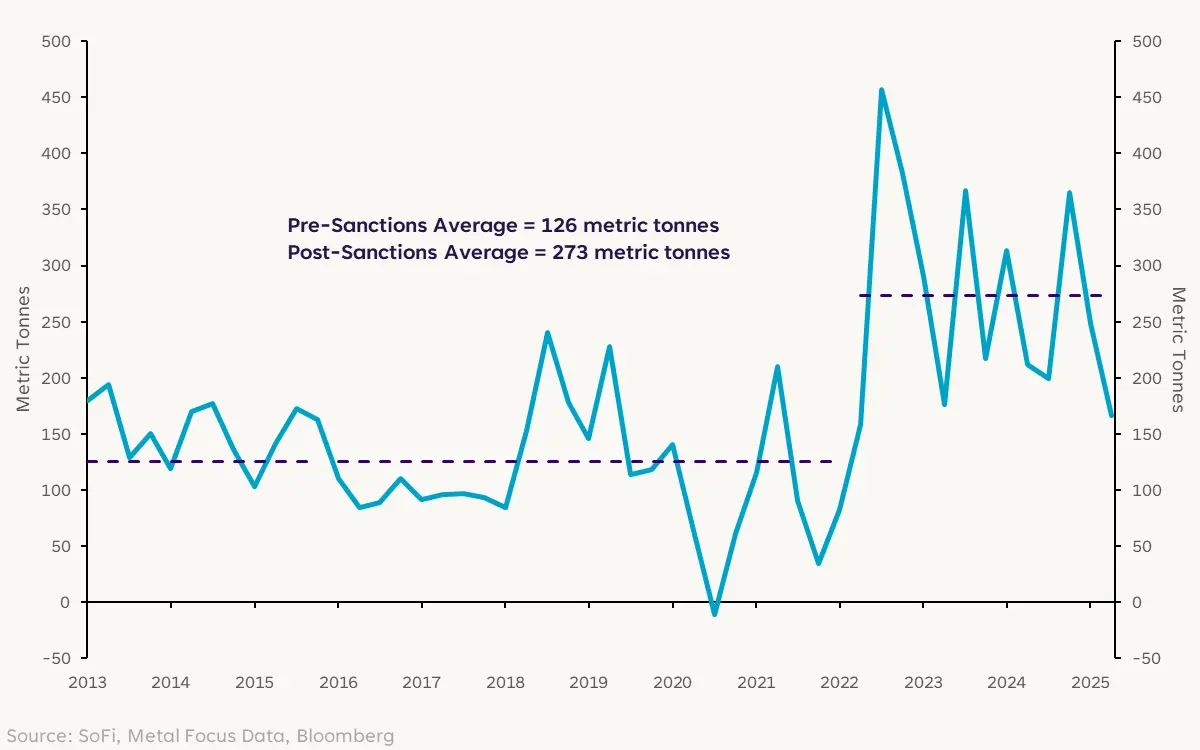

The scale of this shift is staggering. Before sanctions, central banks accounted for 11% of gold demand, but since then central bank demand for gold has doubled.

Quarterly Purchases of Gold by Central Banks

What’s most important about this shift is that unlike most buyers of gold (or really any commodity), central banks and government entities are fundamentally price-insensitive. They’re accumulating gold to buffer foreign reserves against perceived long-term geopolitical risks. This steady sovereign demand effectively has put more of a floor under gold prices, evidently more than offsetting the traditional headwind from high real yields.

Gold Rush

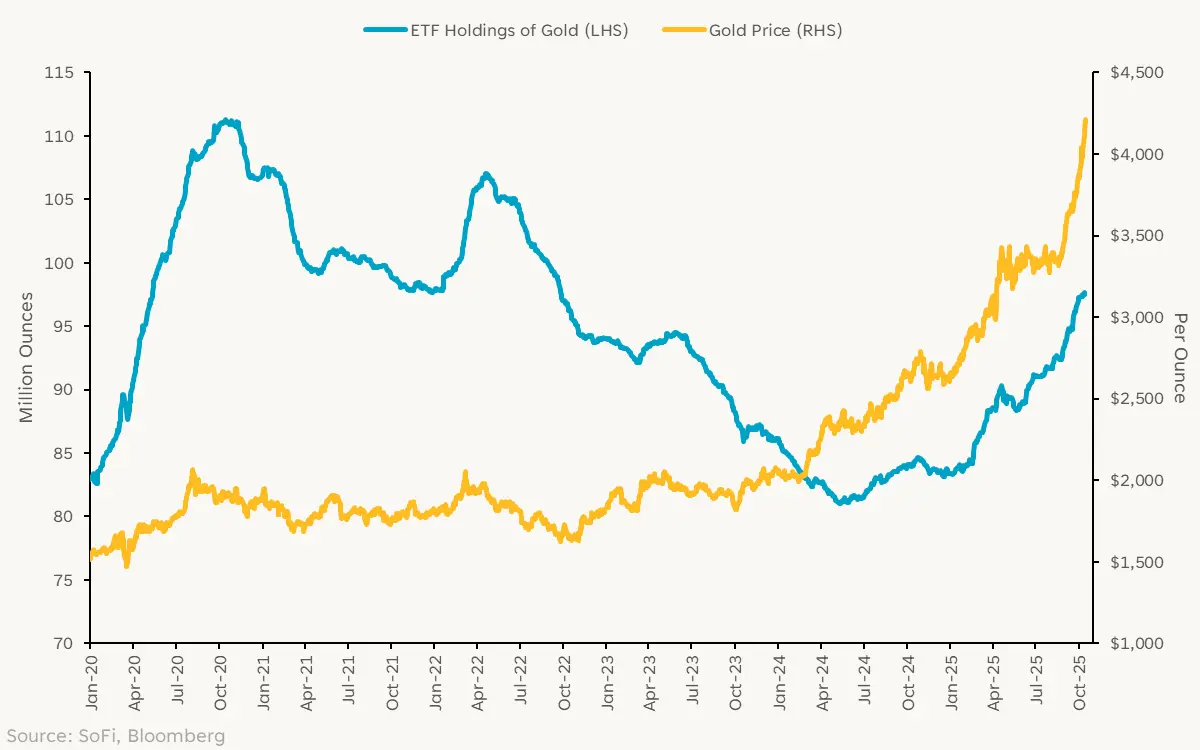

One would think that the increase in gold prices would have also enticed retail investors to increase their allocation to the asset, but ETF holdings of gold actually declined 24.3% in 2022 through mid-2024, likely driven in part by the old interest rate playbook.

With investors adapting to this new world, gold has hit a second gear with retail and institutional investors alike now seemingly returning in force. September marked the largest monthly inflow into global gold-backed ETFs on record, capping the strongest quarter for inflows.

Broadening of the buyer base from sovereign to financial participants has helped boost gold prices even further. Year-to-date price returns now stand at 59.9% as of October 15, one of the best years on record. Despite the strong price momentum, however, total holdings in gold ETFs are still 12.3% below their highest levels in 2020-21. A simple read here might suggest there could still be some room to run.

Investors Are Chasing Gold Prices

Looking at gold’s relationship to other assets can help provide some color on the character (for lack of a better word) of the market backdrop. One such relationship is the ratio between copper and gold prices. Comparing copper, an industrial metal that thrives when the global growth backdrop is strong, to the ultimate safe-haven asset can signal how market participants view things. The ratio is at its lowest levels ever, suggesting a decidedly fearful, risk-averse tone.

Copper/Gold Ratio

Of course, periods of major upheaval like the last few years can disrupt longstanding relationships, blurring the line between signal and noise. Nevertheless, a defensive message here makes sense given all that’s occurring in the world – ongoing global trade upheaval, raging budget deficits, and currency debasement, just to name a few.

To Allocate or Not to Allocate

We’re left with a few takeaways.

1. Gold’s long-time role as a portfolio diversifier not only remains intact, but might be more critical than ever in an era where inflation is sticky and stock-bond correlations might not be negatively correlated like in the last few decades.

2. Global central banks have emerged as a powerful and price-insensitive source of demand for gold that is likely not going away anytime soon.

3. Market signals suggest that investors have priced in, and are continuing to price in, the changing dynamics around gold.

Some of the best investments often involve stories where long-term trends collide with short-term catalysts. The secular story behind gold demand is clear enough, while the prospect for further interest rate cuts or a slowdown in GDP growth could push real Treasury yields lower, which (in a throwback to the old playbook) could be further fuel for the precious metal.

No one individual’s financial journey is identical. Risk tolerance differs. Life plans differ. But generally speaking, a strategic allocation to gold in investment portfolios just makes sense right now.

Want more insights from SoFi’s Investment Strategy team? The Important Part: Investing With Liz Thomas, a podcast from SoFi, takes listeners through today’s top-of-mind themes in investing and breaks them down into digestible and actionable pieces.

SoFi can’t guarantee future financial performance, and past performance is no indication of future success. This information isn’t financial advice. Investment decisions should be based on specific financial needs, goals and risk appetite.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser. Information about SoFi Wealth’s advisory operations, services, and fees is set forth in SoFi Wealth’s current Form ADV Part 2 (Brochure), a copy of which is available upon request and at www.adviserinfo.sec.gov. Mario Ismailanji is a Registered Representative of SoFi Securities and Investment Advisor Representative of SoFi Wealth. Form ADV 2A is available at www.sofi.com/legal/adv.

OTM2025101001

Read moreSuite Seats for Las Vegas vs. Los Angeles Chargers Form

SOFI PLUS EXPERIENCE GIVEAWAY

Suite Seats for Las Vegas vs. Los Angeles Chargers

This is your chance to experience game day like never before. Be one of 10 SoFi Plus members to win suite tickets for you and a guest when Las Vegas takes on the Los Angeles Chargers at SoFi Stadium in Los Angeles on Nov. 30.

The details:

• Exclusive suite tickets for you and a guest.

• Get on-site parking, awesome swag, and other exciting surprises.

• The food and drink’s on us too.

Only available to SoFi Plus members. Winners must provide their own travel and accommodations. Hurry and enter now—this SoFi Plus Experience is first come, first served!

Suite Seats for Las Vegas vs. Los Angeles Chargers Form

Jumbo Mortgage Rates in Florida

Florida Jumbo loan RATES TODAY

Current jumbo loan rates in

Florida.

Viewing your rate won’t affect your score.

Compare Jumbo loan rates in Florida.

Key Points

• Jumbo loan rates are influenced by economic factors such as inflation and bond market dynamics.

• A mere 1% drop in the Jumbo loan rate can translate to hefty savings on interest.

• Opting for a 15-year mortgage could be a smart move, helping you save on interest in the long run, even if the monthly payments are a bit steeper.

• Some borrowers refinance out of or into adjustable-rate mortgages. These typically have lower initial refinance rates and could be a good option for those who plan to move or refinance in the near future.

• Homeowners can request a mortgage recast to lower monthly payments without changing the Jumbo loan rate. The typical cost is $100 to $500.

Introduction to Jumbo loan Rates

A Jumbo loan is the process of replacing your existing home loan with a new one. The terms of the new mortgage can be different, but the most common goal is to secure a lower interest rate and reduced monthly mortgage payments. The type of refinance you choose will determine your interest rate. This guide will help you understand how current mortgage rates are set and how you can get the best available rate. By the end, you’ll have a better understanding of what to expect and how to make an informed decision about refinancing your home.

Where Do Mortgage Rates Come From?

The Federal Reserve, aka the Fed, sets the short-term interest rates that banks use. Although home loan rates aren’t directly tied to Fed rates, they follow the same economic trends. So when the Fed’s interest rate is high, chances are mortgage rates will be too.

Other mortgage rate influencers include the bond market, inflation, and the unemployment rate. We’ll get into those more below.

How Interest Rates Affect Home Affordability

Mortgage rates have a bigger impact on home affordability than you may realize. Consider the national median home price of $412,300 for Q2 2024. With a 30-year fixed mortgage at 3.00%, the monthly payment is approximately $1,390. However, if the interest rate increases to 6.00%, the monthly payment jumps to $1,977. Such an increase — more than 40% — can affect affordability for many buyers.

Should Homebuyers Wait for Interest Rates to Drop?

The burning question, especially if you’re buying your first home, is: Should I jump in now or wait? All else being equal, the answer is probably don’t wait. Although mortgage rates have been higher than they were during the pandemic, they’re actually close to the 50-year average. And when rates do drop, the housing market will be flooded by buyers who have been sitting on the sidelines.

While it’s always tempting to wait for lower rates, your personal circumstances are more important. If you’re ready financially and need a new home, higher interest rates shouldn’t deter you. After all, a mortgage refinance could still lower your rate later.

Understand Trends in Florida Mortgage Interest Rates

Understanding historical mortgage rate trends can provide valuable insights into the future. In Florida, mortgage rates have experienced significant fluctuations over the past two decades. From a high of 7.96% in 2000, rates steadily declined to 5.78% by 2003. While rates have risen in recent years, they remain below historical highs. Experts predict that Florida mortgage rates will likely stay above historical lows for the foreseeable future.

Below you’ll find the average annual interest rate for Florida and the United States for 2000 through 2018. (The FHFA stopped reporting the data in 2018.)

Historical U.S. Mortgage Interest Rates

Looking at a much longer span of time, a half-century, can give you perspective on the rates that are now available. As you can see from the graphic below, it’s pretty rare for rates to dip as low as they did in 2020 and 2021. By keeping an eye on these trends, you can make an informed decision about whether to pursue your Jumbo loan, and when.

Historical Interest Rates in Florida

Florida Jumbo loan rates have seen their share of ups and downs, for the most part trailing the national average just slightly. The chart below shows Florida rates from 2000 to 2018, when the Federal Housing Finance Agency stopped tracking state-specific averages.

| Year | Florida Rate | National Rate |

|---|---|---|

| 2000 | 8.03 | 8.14 |

| 2001 | 7.01 | 7.03 |

| 2002 | 6.61 | 6.62 |

| 2003 | 5.81 | 5.83 |

| 2004 | 5.94 | 5.95 |

| 2005 | 5.98 | 6.00 |

| 2006 | 6.71 | 6.60 |

| 2007 | 6.54 | 6.44 |

| 2008 | 6.15 | 6.09 |

| 2009 | 5.04 | 5.06 |

| 2010 | 4.76 | 4.84 |

| 2011 | 4.52 | 4.66 |

| 2012 | 3.59 | 3.74 |

| 2013 | 3.80 | 3.92 |

| 2014 | 4.08 | 4.24 |

| 2015 | 3.79 | 3.91 |

| 2016 | 3.66 | 3.72 |

| 2017 | 3.98 | 4.03 |

| 2018 | 4.57 | 4.57 |

Factors Affecting Mortgage Rates in Florida

As mentioned above, many factors influence mortgage rates in Florida and nationwide. Some of those are economic, but others are entirely within the homebuyer’s control. Here’s how they break down:

Economic Factors

• The Fed: The federal funds rate serves as a benchmark for other interest rates, including mortgage rates.

• Inflation: When inflation rises, the purchasing power of money decreases, making it more expensive for lenders to lend money. As a result, they may increase interest rates to compensate.

• Unemployment rate: Lower unemployment can result in higher mortgage rates. A low unemployment rate indicates a strong economy, which typically leads to increased demand for housing. This increased demand puts upward pressure on home prices and, not surprisingly, mortgage interest rates.

Consumer Factors

• Credit score: A higher credit score generally results in a lower mortgage interest rate. Lenders view borrowers with higher credit scores as less risky, making them more likely to offer favorable rates.

• Down payment: Increasing your down payment may reduce your mortgage rate. A larger down payment lowers the loan-to-value ratio (LTV), the portion of the home’s value financed by the loan. A lower LTV reduces the lender’s risk and may result in a lower interest rate.

• Income and assets: A steady income is important to lenders, who will check your employment history as well as your salary. Assets like investments and emergency savings also reassure lenders that you could still pay your mortgage in the case of a job loss or other financial setback.

• Type of mortgage loan: Certain types of mortgages tend to have lower rates. For instance, adjustable rate mortgages typically offer lower initial rates than fixed-rate mortgages. Some government-backed loans, like VA mortgages, can also have lower rates. And a shorter loan term usually comes with a lower rate than longer terms.

💡 Recommended: What Is the Average Down Payment On a House?

Mortgage Options for First-Time Homebuyers in Florida

An important step in deciding how to refinance your mortgage is selecting the type of loan you will refinance into. These are some of the most common types.

Conventional Refi

A conventional refinance, also known as a rate-and-term refinance, allows you to change your interest rate, loan term, or both. These loans typically offer higher rates than government-backed loans from the FHA or VA, for example. But a conventional refinance could be a good option if you’re looking to lower your interest rate, change your loan term, or both.

15-Year Mortgage Refi

Some people refinance into a loan with a shorter term than their original mortgage. It’s common to go from a 30-year term to a 15-year one. This means higher monthly payments in the short term, but it’s a savvy move that can slash the total interest you pay over the loan’s lifetime. And if you combine a shorter term with a lower interest rate, you might not even feel such a burden from the larger monthly payments. Some people like the fact that shortening the term helps them get rid of mortgage debt before retirement. (Of course other people might refi from a 15-year loan into a 30-year one. Choosing a term is based on your personal financial circumstances.)

Adjustable-Rate Mortgage Refi

Adjustable-rate mortgages (ARMs) offer a low initial interest rate and so might be attractive to some borrowers — especially those who know they plan to sell the home before the rate on their new loan begins to adjust. Some borrowers prefer to adjust out of an ARM and into a fixed-rate loan because they want their monthly payments to be steady and predictable.

Cash-Out Refi

This type of refinance is a powerful financial tool that allows you to leverage your home equity. By refinancing your mortgage for more than you currently owe, you can access a lump sum of cash that can be used for home improvements or debt consolidation, for example. Although a cash-out refinance typically carries a higher Jumbo loan rate than a traditional refinance, it’s one of the more cost-effective ways to borrow a large sum of money.

FHA Refi

FHA loans, backed by the Federal Housing Administration, often offer attractive Jumbo loan rates, making them a popular choice for homeowners. For those with existing FHA loans, the FHA Simple Refinance and FHA Streamline Refinance are designed to simplify the process and potentially reduce your rate. If you don’t have an FHA loan, you may still benefit from an FHA cash-out refinance or FHA 203(k) refinance. The latter is designed for home renovations.

VA Refi

VA loans, guaranteed by the United States Department of Veterans Affairs, are known for offering some of the best Jumbo loan rates. To refinance with a VA interest rate reduction refinance loan (IRRRL), you’ll need to have a VA loan in the first place. There is also a VA cash-out refinance, and anyone who qualifies for a VA loan can use this to take advantage of their home equity in a refinance.

Compare Mortgage Refi Interest Rates

Once you know what type of refinance you’re going to pursue, it’s time to secure a competitive Jumbo loan rate. Here’s what to do:

• Compare rates and fees from multiple lenders.

• Look at the loan’s annual percentage rate (APR), which includes interest and fees. These and other closing costs are part of the total picture of your mortgage refinancing costs.

• Weigh the cost of discount points against long-term savings, and decide whether or not you will purchase points.

A refinance calculator can help you estimate your savings and make an informed decision.

Use an Online Refinance Calculator

Online refinance calculators are a great way to get an estimate of what your new monthly payment may be and to compare different refinance options. You probably used a similar calculator during your home purchase process. Many online refinance calculators will also show you how much you could save by refinancing, which can help you decide if refinancing is the right choice for you.

Run the numbers on your home loan.

-

Mortgage calculator

Punch in your home loan amount and a new interest rate, and we’ll estimate your payoff date.

-

Down payment calculator

Enter a few details about your home loan and we’ll provide your monthly mortgage payment.

-

Home affordability calculator

Provide us with a few details and see how much you can afford to spend on a home purchase.

Using the free calculators is for informational purposes only, does not constitute an offer to receive a loan, and will not solicit a loan offer. Any payments shown depend on the accuracy of the information provided.

The Takeaway

Refinancing your mortgage can be a smart financial move, but it requires some careful consideration and planning. Whether you’re looking to get a lower Jumbo loan rate, tap into your home’s equity, or consolidate debt, it’s important to understand the different types of refinances and the requirements for each. By taking steps to strengthen your credit score and lower your debt-to-income ratio, and by comparing offers from multiple lenders, you can help ensure that you get the best rate and terms for your situation.

SoFi can help you save money when you refinance your mortgage. Plus, we make sure the process is as stress-free and transparent as possible. SoFi offers competitive fixed rates on a traditional mortgage refinance or cash-out refinance.

A mortgage refinance could be a game changer for your finances.

FAQ

How much would a 1% drop in interest rate affect your monthly payment?

You may be surprised at how much a 1% reduction in your Jumbo loan rate can impact your monthly budget. Let’s say you have a $300,000, 30-year mortgage. If you’re currently paying 7.00% interest and can refinance to 6.00%, you could see your monthly payment amount drop by $197. Over time, that seemingly small change can add up to big savings. And of course the larger your loan amount, the larger your savings as well.

Can I lower my interest rate without refinancing?

It might be difficult to lower your mortgage interest rate without refinancing, but you can reduce your monthly payments by undertaking a mortgage recast. A mortgage recast involves making a lump-sum payment toward your principal balance. (Make sure you tell your lender the money is to be credited to the principal you owe.) You can request that your lender then “recast” your monthly payment amount to reflect the reduced principal. Of course, this only works if you have a lump sum on hand. If you’re facing financial hardship, you could also ask your lender about a loan modification. Your lender will have a formal request process for this type of adjustment.

Is there a fee to recast your mortgage?

The fee to recast your mortgage ranges from $150 to $500, which is far less than the cost of a refinance. To determine if recasting your mortgage is worth it, look at how the interest saved over the remaining life of your loan compares to the earnings or savings you might enjoy if you used that lump sum in another way — for example, to pay off some other form of debt, or to make investments.

How many times can you refinance your home loan?

There’s no official rule on how many times you can refinance your home. But, each time you do, there are closing costs to consider and a potential impact on your credit score. Take a step back and weigh the benefits of a lower Jumbo loan rate against these costs and impacts. Before you make a decision, consider the current interest rate climate, your financial situation, and your long-term goals. Refinancing can be a savvy financial move, but it’s important to make sure it’s the right move for you.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

*SoFi requires Private Mortgage Insurance (PMI) for conforming home loans with a loan-to-value (LTV) ratio greater than 80%. As little as 3% down payments are for qualifying first-time homebuyers only. 5% minimum applies to other borrowers. Other loan types may require different fees or insurance (e.g., VA funding fee, FHA Mortgage Insurance Premiums, etc.). Loan requirements may vary depending on your down payment amount, and minimum down payment varies by loan type.

¹FHA loans are subject to unique terms and conditions established by FHA and SoFi. Ask your SoFi loan officer for details about eligibility, documentation, and other requirements. FHA loans require an Upfront Mortgage Insurance Premium (UFMIP), which may be financed or paid at closing, in addition to monthly Mortgage Insurance Premiums (MIP). Maximum loan amounts vary by county. The minimum FHA mortgage down payment is 3.5% for those who qualify financially for a primary purchase. SoFi is not affiliated with any government agency.

†Veterans, Service members, and members of the National Guard or Reserve may be eligible for a loan guaranteed by the U.S. Department of Veterans Affairs. VA loans are subject to unique terms and conditions established by VA and SoFi. Ask your SoFi loan officer for details about eligibility, documentation, and other requirements. VA loans typically require a one-time funding fee except as may be exempted by VA guidelines. The fee may be financed or paid at closing. The amount of the fee depends on the type of loan, the total amount of the loan, and, depending on loan type, prior use of VA eligibility and down payment amount. The VA funding fee is typically non-refundable. SoFi is not affiliated with any government agency.

Non affiliation: SoFi isn’t affiliated with any of the companies highlighted in this article.

Disclaimer: Many factors affect your credit scores and the interest rates you may receive. SoFi is not a Credit Repair Organization as defined under federal or state law, including the Credit Repair Organizations Act. SoFi does not provide “credit repair” services or advice or assistance regarding “rebuilding” or “improving” your credit record, credit history, or credit rating. For details, see the FTC’s website .

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

SOHL-Q125-198

More jumbo loan resources.

-

Jumbo Loan Requirements: How to Qualify for a Jumbo Loan

-

Pros and Cons of Jumbo Loans: What to Know

-

What Are Jumbo Loan Limits?