Free Nebraska HELOC Loan Payment Calculator

Nebraska HELOC Calculator

By SoFi Editors | Updated January 13, 2026

Tapping into your home equity is a significant financial step that needs careful planning. Our free Nebraska HELOC payment calculator helps you estimate the cost of borrowing. Before you apply for a home equity line of credit, use the Nebraska calculator to see your estimated monthly payments in the draw and repayment periods. This guide offers clear, step-by-step instructions on how to use the calculator so you can make a confident decision on whether a HELOC is right for your budget and goals.

- Key Points

- • A home equity line of credit (HELOC) is a revolving line of credit that allows you to use your home as collateral to secure funds for a major project or expense.

- • There are two payment periods to be aware of: the draw period and repayment period.

- • Most HELOCs feature a variable interest rate, meaning your monthly payments can change over time based on broader economic conditions.

- • To qualify, lenders generally require that homeowners have a minimum of 15% equity in their home.

- • Qualified borrowers may be able to access up to 90% of their home equity.

Calculator Definitions

• HELOC Balance: This term represents the total amount of money a borrower has currently withdrawn from their available credit line, or the amount a homeowner plans to borrow.

• Current Interest Rate: This is the rate at which interest accumulates on your outstanding HELOC balance.

• Draw Period: This is the specific time frame—often between 5 and 10 years—during which you can access funds from your HELOC, up to your approved credit limit.

• Repayment Period: This is the second phase—often 20 years—when the homeowner must pay back the full balance through combined principal and interest payments.

• Monthly Interest Payment: This is the monthly cost of borrowing funds based on the outstanding balance and the current variable interest rate. It does not contribute to reducing the original amount used.

• Monthly Principal and Interest Payment: This is the amount you’ll be required to pay monthly during the repayment period. Use the Nebraska HELOC payment calculator to get an estimate; your exact payment amount will be based on current rates.

How to Use the Nebraska HELOC Calculator

Follow these easy instructions to use the Nebraska HELOC payment calculator most effectively.

Step 1: Enter Your Planned or Actual HELOC Balance

Start with the total amount you plan to borrow from the line of credit.

Step 2: Estimate Your Interest Rate

Now, enter your desired annual interest rate. The rate can be from a prospective lender or an estimate based on your research.

Step 3: Choose the Length of the Draw Period

The draw period time frame is typically five to 10 years.

Step 4: Select Your Repayment Period

The repayment period timeframe is typically 10 to 20 years.

Step 5: Review Your Results

Analyze the results by looking closely at the potential monthly payments during both the draw and repayment periods.

Now that you are familiar with how to use the Nebraska calculator, let’s explore what is a home equity line of credit.

What Is a Home Equity Line of Credit?

A home equity line of credit, known as a HELOC, is a revolving line of credit that is secured by the equity in your home. Because your home serves as collateral, lenders typically offer more competitive interest rates compared to unsecured options like credit cards and personal loans. This also means that you risk foreclosure if you fail to make payments.

As you learn how a HELOC works, keep in mind that your home equity is the difference between your home’s current market value and the outstanding balance on your home loan and any other loans you might have where your home is used as collateral. The interest rate is usually variable (unlike a standard home equity loan, which usually offers a fixed interest rate) so it’s helpful to keep an eye on market movements and trends, like the U.S. Prime Rate.

There are two phases to the HELOC. First is the draw period, which is typically 5 to 10 years. This is when you can withdraw funds as needed, up to your approved credit limit. You are often required to make payments only on the interest that accrues on your outstanding balance. Our HELOC interest-only calculator can help you assess what your payment amounts for the draw period may be.

Then you begin the repayment period, usually 10 to 20 years, when your required monthly payments will increase significantly to cover both the principal balance and the interest. During this phase, you can use a HELOC repayment calculator to help you out.

If you are a Nebraska homeowner who has built up equity in your property, then you will want to use these tools to help you understand how to get equity out of your home.

Recommended: HELOC vs. Home Equity Loan

Home Equity Trends in Nebraska

With a HELOC, as with different types of home equity loans, the amount of equity a homeowner possesses is the key to your borrowing power.

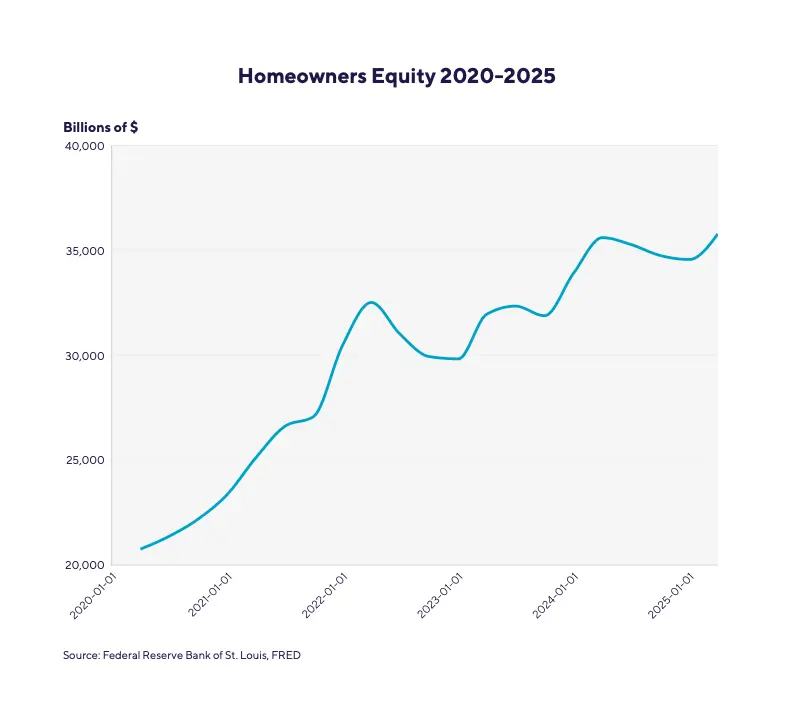

Since 2020, increasing home prices has led to a surge in home equity for existing homeowners (see chart). Nebraska home equity has increased by 104% over the past five years, with the average home equity level more than $96,000.

Lenders typically require that a homeowner maintain at least 15% equity to qualify for a HELOC, and you can borrow up to 90% of equity. For a home valued at $400,000, with a mortgage balance of $300,000, a homeowner would have $100,000 in total equity, and $90,000 in tappable equity.

Current HELOC rates by state.

Compare current home interest rates by state and find a HELOC rate that suits your financial goals.

Select a state to view current rates:

How to Use HELOC Calculator Data to Your Advantage

The Nebraska HELOC payment calculator allows you to experiment with different loan scenarios, budget effectively, and prepare for productive conversations with lenders. Follow these steps to get the most out of the calculator:

• Explore the estimates: One of the key functions of the Nebraska payment calculator is its ability to model scenarios. Since HELOC interest rates shift over time, experiment with different HELOC balances, interest rates, and repayment terms to see how each of these figures affects the monthly payment.

• Evaluate debt consolidation: If you’re managing high-interest credit card debt, you can add up the monthly payment amounts on your cards and compare that to the monthly payment you would have if you used a HELOC to pay off all that you owe at once. There’s a good chance your monthly payment with a HELOC would be lower than the sum of what you’re currently paying. And it would be one simple payment instead of multiple.

• Approach lender conversations more confidently: Use the Nebraska calculator ahead of time to run estimates and gain a clear understanding of your borrowing capacity. That way you can enter lender negotiations with more realistic expectations.

Tips on HELOCs

Here are some tips to act on before you apply for a HELOC:

- Strengthen your credit score: Lenders typically require a credit score of at least 640, but reserve the best rates and terms for scores of 700+.

- Shop around with different lenders: Don’t commit right away. Instead, compare annual fees, inactivity fees, and prepayment penalties from a variety of lenders.

- Prepare a budget: With the transition between the two HELOC phases (the draw period and repayment period), you’ll see your monthly payments increase from interest-only to principal-and-interest.

- Consider the risks: A HELOC uses your home as collateral. This means that the lender could foreclose on your home if you fail to make payments.

Alternatives to HELOCs

Even if you are confident that a HELOC is appropriate for your budget and goals, it’s a good idea to be aware of alternatives before making a final decision. Here are some options:

Home Equity Loan

For a single, fixed-cost project, a home equity loan may be a good choice because it provides the homeowner with a one-time, lump-sum disbursement secured by their home equity. The home equity loan typically has a fixed interest rate, which makes for consistent and predictable monthly payments. Use a home equity loan calculator to compare the cost of a home equity loan versus a HELOC.

Recommended: What Is a Home Equity Loan?

Home Improvement Loan

A home improvement loan is a personal loan designed to be used for renovations and repairs. It is similar to a home equity loan in that it is disbursed in a lump sum and repaid with fixed payments. But it is unsecured (it does not use your home as collateral), which typically results in a higher interest rate.

Personal Line of Credit

A personal line of credit (PLOC) is a revolving line of credit that is not secured by collateral. It functions similarly to a HELOC in that you can draw and repay funds as needed. Because it is unsecured, the PLOC holds less risk (because your home isn’t on the line) but usually means a higher interest rate. To qualify, a lender will look at your total financial picture, including your credit score and income. Your home equity doesn’t play a role.

Cash-Out Refinance

When a homeowner undertakes a cash-out mortgage refinance, they replace their primary mortgage with a new, larger mortgage. This process pays off the original mortgage debt, and the homeowner receives the remaining balance as cash. This move can be beneficial if current interest rates are significantly lower than the rate on the primary mortgage.

As you consider a cash-out refinance vs. home equity line of credit or home equity loan, a key difference is that the refinance consolidates all home debt into a single payment.

The Takeaway

Nebraska homeowners can use the HELOC payment calculator as a strategic first step when considering tapping into their home equity. Our online tool provides monthly payment estimates, giving the homeowner a clear idea of their borrowing power. Run scenarios with different borrowed amounts, interest rates, and repayment terms to find the right mix for your budget and goals.

SoFi now partners with Spring EQ to offer flexible HELOCs. Our HELOC options allow you to access up to 90% of your home’s value, or $500,000, at competitively lower rates. And the application process is quick and convenient.

Unlock your home’s value with a home equity line of credit from SoFi, brokered through Spring EQ.

FAQ

How much can I borrow with a HELOC?

Lenders typically allow you to borrow up to 90% of your equity. The exact amount you can borrow will depend on the equity in your home. (Your equity is equal to your home’s estimated value minus your outstanding mortgage balance.)

What can I use the money for from a HELOC?

Homeowners can put HELOC funds toward almost any purpose, including home renovations, debt consolidation, and medical expenses.

Is the interest on a HELOC tax-deductible?

The interest on a HELOC may be tax-deductible. Always consult a professional tax advisor.

What is the minimum credit score I need to qualify for a HELOC?

You will need to show a 640 credit score or higher to qualify for a HELOC. Some lenders require a 680 credit score. You may be able to land more favorable terms and interest rates by having a credit score in the 700s.

Learn more about mortgages:

SoFi Loan Products Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

Checking Your Rates: To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score. However, if you choose a product and continue your application, we will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull and may affect your credit.

²SoFi Bank, N.A. NMLS #696891 (Member FDIC), offers loans directly or we may assist you in obtaining a loan from SpringEQ, a state licensed lender, NMLS #1464945.

All loan terms, fees, and rates may vary based upon your individual financial and personal circumstances and state.You should consider and discuss with your loan officer whether a Cash Out Refinance, Home Equity Loan or a Home Equity Line of Credit is appropriate. Please note that the SoFi member discount does not apply to Home Equity Loans or Lines of Credit not originated by SoFi Bank. Terms and conditions will apply. Before you apply, please note that not all products are offered in all states, and all loans are subject to eligibility restrictions and limitations, including requirements related to loan applicant’s credit, income, property, and a minimum loan amount. Lowest rates are reserved for the most creditworthy borrowers. Products, rates, benefits, terms, and conditions are subject to change without notice. Learn more at SoFi.com/eligibility-criteria. Information current as of 06/27/24.In the event SoFi serves as broker to Spring EQ for your loan, SoFi will be paid a fee.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

SOHE-Q425-077

Get prequalified in minutes for a SoFi Home Loan.

Free Montana HELOC Payment Calculator

Montana HELOC Calculator

By SoFi Editors | Updated January 8, 2026

Using your home equity is a major financial decision that requires careful planning. A Montana HELOC payment calculator can help homeowners figure out their borrowing costs. Before applying for a home equity line of credit, use our calculator to estimate your monthly payments and total interest costs. This guide offers a wealth of information to get you started on your HELOC journey: definitions, steps to use the calculator, tips, and alternatives. You’ll come away with the knowledge to confidently decide if a HELOC fits your financial goals.

- Key Points

- • A home equity line of credit (HELOC) is a revolving line of credit that allows you to use your home as collateral to secure funds.

- • During the draw period (typically 10 years) you can withdraw and use funds up to a predetermined limit.

- • The repayment period (20 years) requires the repayment of principal and interest.

- • Lenders generally require that you have a minimum of 15% equity in the home, and homeowners can typically borrow up to 90% of their equity.

Calculator Definitions

• HELOC Balance: This is the amount of money a homeowner plans to draw with a HELOC or has currently drawn from their credit line.

• Current Interest Rate: This is the percentage the lender charges for the use of funds. Because it is usually variable, this rate can shift based on broader economic conditions.

• Draw Period: The draw period is the specific time frame, often lasting between 5 and 10 years, during which you can access funds from your HELOC up to your approved credit limit.

• Repayment Period: The repayment phase begins after the draw period. It is usually 10 to 20 years.

• Monthly Interest Payment: This refers to the minimum payment required during the draw period. Some HELOCs allow for interest-only payments during this phase, which cover the interest accrued on the borrowed amount but do not reduce the principal balance.

• Monthly Principal and Interest Payment: This is the standard payment made during the repayment period. It includes a portion of the principal balance and the accrued interest, and is designed to pay off the line of credit over the specified term.

How to Use the Montana HELOC Calculator

The Montana HELOC payment calculator is easy to use.

Step 1: Enter Your Planned or Actual HELOC Balance

Enter the total amount you plan to borrow from the line of credit.

Step 2: Estimate Your Interest Rate

Input the annual interest rate for your line of credit.

Step 3: Choose the Length of the Draw Period

Select the duration of the draw period (typically 10 years).

Step 4: Select Your Repayment Period

Now enter the repayment period (typically 10 to 20 years).

Step 5: Review Your Results

Review the outputs, which show you the potential monthly payments during the draw and repayment periods.

Now that you are familiar with how to use the Montana calculator, let’s explore what is a home equity line of credit.

What Is a Home Equity Line of Credit?

A home equity line of credit, commonly known as a HELOC, offers homeowners a revolving credit line that is secured by the equity in your home. If you are a Montana homeowner who has built up equity in your property, then you will want to understand how to get equity out of your home.

First, your home equity is the difference between your home’s current market value and the outstanding balance on your home loan and any other loans you might have where your home is used as collateral.

A HELOC has a draw period, usually 5 to 10 years and a repayment period, usually 10 to 20 years. During the draw period you can withdraw funds as needed, up to your approved credit limit. You are often required to make payments only on the interest that accrues on your outstanding balance. Use a HELOC interest-only calculator to help you figure out payment amounts for the draw period.

For the repayment period, you can no longer withdraw funds, and your required monthly payments will increase significantly to cover both the principal balance and the interest. The HELOC repayment calculator is a helpful tool for budgeting for this phase.

Variable interest rates are typical for a HELOC (unlike a standard home equity loan, which usually offers a fixed interest rate).

The biggest risk is that your home serves as collateral. If you fail to make payments, the lender could initiate foreclosure. On the other hand, because the HELOC is secured, lenders sometimes offer more competitive interest rates (compared to an unsecured option like a credit card).

Having a thorough understanding of a HELOC and how it works will help you use the Montana HELOC calculator to its potential.

Recommended: HELOC vs. Home Equity Loan

Home Equity Trends in Montana

With a HELOC, as with different types of home equity loans, the amount of equity a homeowner possesses is the key to borrowing power. As you assess the equity built up in your home, it’s helpful to monitor national and local housing trends. Since 2020, increasing home prices have led to a surge in tappable equity for homeowners (see chart below). In Montana, home equity increased by 137% from 2020 to 2025, with average home equity in the range of $216,000.

Current HELOC rates by state.

Compare current home interest rates by state and find a HELOC rate that suits your financial goals.

Select a state to view current rates:

How to Use the HELOC Calculator Data to Your Advantage

To get the most out of the Montana HELOC payment calculator, use the data to your advantage:

• Estimate monthly payments: As you prepare for a large-scale project, figure the estimated monthly payments for both the draw and repayment periods so you have no surprises.

• Budget within your means: Assess what you can afford by reviewing potential payments against your existing debt balances.

• Experiment with variables: The main feature of the Montana payment calculator is its ability to model different scenarios. Adjust the amount borrowed, for example, to see at what point the payments become untenable based on your budget.

• Prepare for lender discussions: Arrive at lender meetings armed with your estimated borrowing limit so your expectations are realistic.

Tips on HELOCs

HELOCs offer financial flexibility, but also come with risk. Use the following tips to help you approach applying for a HELOC wisely:

• Check different lenders: Shop around with lenders and compare annual fees, inactivity fees, and prepayment penalties, as these impact the overall cost of borrowing.

• Budget wisely: Prepare for the significant increase in monthly payments when transitioning from the interest-only draw period to the principal-and-interest repayment period.

• Weigh the risks: A HELOC is secured by your home. The lender could foreclose if you fail to make payments.

• Maintain your credit: Lenders typically require a credit score of 640 or higher.

Alternatives to HELOCs

A HELOC is one of many options for accessing home equity and securing major financing. Since the right choice depends on your financial situation, goals, and preferred repayment structure, review these alternatives before making a decision.

Home Equity Loan

Have a one-time project with a fixed cost? A home equity loan gives you a lump sum that you begin repaying immediately. The interest rate is typically fixed, which makes for consistent and predictable monthly payments. Refer to a home equity loan calculator to compare the cost of a home equity loan versus a HELOC.

Recommended: What Is a Home Equity Loan?

Home Improvement Loan

A home improvement loan is a personal loan for renovations and repairs. It is similar to a home equity loan in that it has predictable fixed payments. However, it is unsecured (does not use your home as collateral), which typically results in a higher interest rate.

Personal Line of Credit

A personal line of credit (PLOC) is an unsecured revolving line of credit, similar to a credit card. Because it does not use your home as collateral, a PLOC may have a higher interest rate and a lower credit limit compared to a HELOC.

Cash-Out Refinance

A cash-out mortgage refinance replaces a homeowner’s existing primary mortgage with a single, new loan for a larger amount. This process pays off the original mortgage debt, and the homeowner receives the remaining balance as cash. While this tool consolidates your debt into one new mortgage payment, it also resets your mortgage term. A cash-out refi is generally best when current market interest rates are lower than your existing mortgage rate, allowing you to access cash and potentially improve the terms of your primary debt.

If you are comparing a cash-out refinance vs. home equity line of credit, a cash-out refi leaves you with one payment. The HELOC gives you a second payment on top of your original mortgage payment.

The Takeaway

Montana homeowners can use the HELOC payment calculator to quickly estimate their borrowing power and projected monthly costs during the draw and repayment periods. Use the HELOC payment calculator to run scenarios with different borrowed amounts, interest rates, and repayment terms so you can find the right mix for your budget and goals.

SoFi now partners with Spring EQ to offer flexible HELOCs. Our HELOC options allow you to access up to 90% of your home’s value, or $500,000, at competitively lower rates. And the application process is quick and convenient.

Unlock your home’s value with a home equity line of credit from SoFi, brokered through Spring EQ.

FAQ

What happens when the draw period ends?

When the draw period ends, you enter the repayment period, typically lasting 10 to 20 years. You can no longer borrow from your credit line, and you must begin making regular monthly payments covering both principal and interest.

What is the benefit of having a variable interest rate?

The main benefit of a variable interest rate is that it may go down as market rates fall. However, this means your monthly payments could also increase, if benchmark rates rise.

Are there closing costs or fees for a HELOC?

Yes, HELOCs can have closing costs, typically ranging from 2% to 5% of the credit limit. Some lenders offer to reduce or waive the fees.

What is the minimum credit score I need to qualify for a HELOC?

Homeowners need to have a 640 credit score or higher (some lenders look for a 680 minimum). Having a credit score of 700 or higher is even more attractive, resulting in a lower interest rate and more favorable terms.

Learn more about mortgages:

SoFi Loan Products Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

Checking Your Rates: To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score. However, if you choose a product and continue your application, we will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull and may affect your credit.

²SoFi Bank, N.A. NMLS #696891 (Member FDIC), offers loans directly or we may assist you in obtaining a loan from SpringEQ, a state licensed lender, NMLS #1464945.

All loan terms, fees, and rates may vary based upon your individual financial and personal circumstances and state.You should consider and discuss with your loan officer whether a Cash Out Refinance, Home Equity Loan or a Home Equity Line of Credit is appropriate. Please note that the SoFi member discount does not apply to Home Equity Loans or Lines of Credit not originated by SoFi Bank. Terms and conditions will apply. Before you apply, please note that not all products are offered in all states, and all loans are subject to eligibility restrictions and limitations, including requirements related to loan applicant’s credit, income, property, and a minimum loan amount. Lowest rates are reserved for the most creditworthy borrowers. Products, rates, benefits, terms, and conditions are subject to change without notice. Learn more at SoFi.com/eligibility-criteria. Information current as of 06/27/24.In the event SoFi serves as broker to Spring EQ for your loan, SoFi will be paid a fee.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

SOHE-Q425-076

Get prequalified in minutes for a SoFi Home Loan.

Free Florida HELOC Payment Calculator

Florida HELOC Calculator

By SoFi Editors | Updated December 23, 2025

For many homeowners, the equity built up in their property represents a significant financial asset. A home equity line of credit (HELOC) calculator is an excellent tool for exploring how to leverage this asset because it translates abstract numbers into real-world borrowing scenarios. Using the HELOC payment calculator can allow users to estimate potential credit lines and understand the possible payment structure of a HELOC before engaging with lenders. This guide will walk you through what a home equity line of credit is, share how to use the calculator effectively, and

- Key Points

- • A HELOC is a revolving line of credit that is secured by the equity in your home.

- • HELOCs have two phases: a draw period where you can access funds as needed, followed by a repayment period where you pay back the principal and interest.

- • Most HELOCs feature variable interest rates, meaning your monthly payments can change over time based on broader economic conditions.

- • The amount you can borrow is typically based on your home equity.

- • Because your home is used as collateral, failing to make payments puts your property at risk of foreclosure.

Calculator Definitions

• HELOC Balance: The HELOC balance is the total amount you plan to draw from your line of credit or the amount you’ve already drawn. Interest is calculated based on this outstanding balance.

• Current Interest Rate: This is the rate at which interest accumulates on your outstanding HELOC balance. If you’re considering multiple HELOC offers from lenders, you can use the calculator to see how their rates would impact your payment amount.

• Draw Period: The draw period is a specific time frame, often up to 10 years, during which you can borrow funds from your HELOC as needed until you reach your credit limit. During this phase, you likely will only be required to pay interest on what you’ve borrowed.

• Repayment Period: The repayment period starts after the draw period concludes and generally lasts from 10 to 20 years. During this time, you can no longer borrow funds and must make regular payments that cover both principal and interest.

• Monthly Interest Payment: This is the portion of a monthly payment that covers the interest that has accrued on the borrowed amount.

• Monthly Principal and Interest Payment: This is the amount you’ll be required to pay monthly during the repayment period. It’s typically higher than the interest-only payment. Because HELOCs have variable interest rates, these HELOC payment calculator figures are estimates; your exact payment will be based on current rates.

• Total Interest: This figure is what you can expect to pay in interest over the life of the HELOC. Again, due to variable interest rates, this should be considered a rough estimate.

How to Use the Florida HELOC Calculator

Used correctly, a Florida HELOC calculator greatly simplifies the process of estimating your borrowing potential and payments. Follow these steps for the best results:

Step 1: Enter Your Planned or Actual HELOC Balance

Homeowners with an existing HELOC should type in their current outstanding principal balance. Those considering a new HELOC should estimate the amount you plan to draw for your intended purpose, such as a renovation or debt consolidation.

Step 2: Estimate Your Interest Rate

This input is the rate that will be applied to your outstanding balance. The majority of HELOC rates are variable and can fluctuate, but for the purpose of this calculator you’ll need to choose one rate. Try inputting the current rate a lender is offering, but also experiment with a higher and lower rate to see how payments might be affected by rate shifts in the future.

Step 3: Choose the Length of the Draw Period

Here, you select the duration — often up to 10 years — during which you can access funds from your line of credit. This decision is important because it determines how long you can borrow and when the transition to the repayment period will occur.

Step 4: Select Your Repayment Period

This step defines the timeframe, typically between 10 and 20 years, over which the entire borrowed balance must be paid off after the draw period ends. A longer repayment period generally results in lower monthly payments but more total interest paid over the life of the HELOC.

Step 5: Review Your Results

The calculator’s outputs will include an estimated monthly interest-only payment for the draw period and an estimated monthly principal and interest payment, which is required during the repayment period. These estimates can be helpful as you budget for a HELOC and think about what credit limit, interest rate, and term you feel is optimal.

What Is a Home Equity Line of Credit?

If using the calculator makes you think a HELOC could be a good fit, it’s important to understand how a line of credit works before you dive in. The amount you can borrow will depend on your home equity, which is the difference between your home’s current market value and the amount you owe on your home loan. Most lenders require a homeowner to have at least 15% equity in their home in order to obtain a HELOC, and the amount a lender will let you borrow typically tops out at 90% of equity. To determine your equity percentage, you can subtract your mortgage balance from your home’s estimated value. Then divide the answer by the home value to arrive at your percentage of equity.

A HELOC’s structure as a revolving line of credit offers flexibility similar to a credit card. Once approved for a specific credit limit, you can borrow funds as needed, repay the balance, and borrow again throughout a designated “draw period.” Or if you prefer, you can carry the balance and pay interest on it. You’ll only pay interest on the amount you actually withdraw, not the entire credit limit. This makes a HELOC suitable for ongoing projects or expenses where the total cost is uncertain.

A HELOC is secured by your home. This arrangement generally allows for more competitive interest rates compared to unsecured options like personal loans or credit cards. However, it also introduces risk: If you are unable to make your payments, the lender has the right to foreclose on your home to satisfy the debt.

As noted above, a HELOC is divided into two distinct phases. The first is the draw period, which typically lasts for 10 years. A HELOC interest-only calculator is useful during this time if you want to keep close tabs on how much your monthly might be.

Once the draw period ends, the HELOC enters the repayment period, which can last from 10 to 20 years. During repayment, borrowing is no longer permitted, and you must make regular payments that cover both principal and interest. (This is when a HELOC repayment calculator can be useful.) This transition often results in a substantial increase in the monthly payment amount, which borrowers must be prepared for.

Finally, most HELOCs come with a variable interest rate. As the index fluctuates with economic conditions, your HELOC’s interest rate — and consequently your monthly payment — can rise or fall. If this unpredictability doesn’t suit your style, you might want to look into what is a home equity loan.

Recommended: HELOC vs. Home Equity Loan

Home Equity Trends in Florida

If many of your neighbors are talking about HELOCs, it’s not surprising. Homeowners in Florida saw their home equity more than double, on average, over the last five years. The average Florida homeowner is now sitting on more than $135,000 in equity, more than enough to support a HELOC that could allow them to consolidate debt, make renovations, or cover other large expenses. And Florida is part of a national trend. Take a look at how equity has increased in the U.S. as a whole.

Current HELOC rates by state.

Compare current home interest rates by state and find a HELOC rate that suits your financial goals.

Select a state to view current rates:

How to Use the HELOC Calculator Data to Your Advantage

If you’re ready to translate the HELOC calculator’s estimates into concrete decisions about borrowing, here are three ways you can use the information it provides.

• Budgeting and affordability: Take a good look at the estimated monthly payments for the draw and repayment phases. Can your household budget accommodate these payments?

• Scenario planning: Use the calculator to model different scenarios. Adjust the amount borrowed to see at what point the payments become uncomfortable. Try tinkering with either the interest rate or the payment term to see if you can afford a higher interest rate, should you encounter one, or a shorter term.

• Long-term cost awareness: The “total Interest” figure helps you visualize the full financial impact of the HELOC over its entire life. If you are opening a HELOC to renovate your home, for example, the total interest number reveals the true cost of the project.

Tips on HELOCs

While a HELOC offers remarkable flexibility, it is a significant financial commitment. Here are several practical tips for homeowners considering or already using a HELOC.

• Manage with care: Remember that your home secures the HELOC. It is imperative not to fall behind on payments. It bears repeating: Defaulting on a HELOC can put your home at risk of foreclosure.

• Shop around: Lenders can vary significantly in the rates and terms they offer. Before committing, compare options from multiple institutions, including banks, credit unions, and online lenders.

• Have a repayment plan: It can be tempting to use home equity for short-term wants or lifestyle purchases, but this is a risky practice. Before you draw funds, have a clear plan for how you will repay the borrowed amount. In an ideal world, you use your HELOC to improve your financial stability (by paying down high-interest debt, perhaps) or add value to your home.

• Understand the fees: Be aware of the full cost of the loan. HELOCs can come with closing costs (potentially 2% to 5% of the credit limit), annual maintenance fees, inactivity fees if you don’t use the line of credit, and early termination penalties if you close the account within a certain timeframe.

• Prepare for the repayment period: One of the biggest financial shocks for HELOC borrowers is the transition from the draw period to the repayment period. If you have been making interest-only payments, your monthly obligation will increase significantly when principal payments are added. Plan for this well in advance.

Recommended: Different Types of Home Equity Loans

Alternatives to HELOCs

A HELOC is just one of several ways to get equity out of your home. And there are also ways to borrow that don’t involve facing the risk of foreclosure if you fail to make payments. Here’s a look at your options:

Home Equity Loan

Often confused with a HELOC, a home equity loan, like a HELOC, involves using your home as collateral. It is critically different in three ways: The funds are disbursed all at once, the interest rate is typically fixed, and repayment of both principal and interest begins immediately. This makes it a better choice for those who know the exact cost of a project upfront and prefer the stability of a fixed monthly payment amount. If you want to test the waters and see what payments might be like should you choose this option, use a home equity loan calculator.

Home Improvement Loan

A home improvement loan is a type of personal loan and is typically unsecured. It provides a lump sum of cash. Unlike a HELOC, it features a fixed interest rate and a predictable schedule of equal monthly payments. In that way, it is more similar to a home equity loan. But because a home improvement loan is unsecured, the interest rate is generally higher than that of a HELOC or home equity loan.

Personal Line of Credit

A personal line of credit (PLOC) is a revolving line of credit that is not secured by collateral. It functions similarly to a HELOC in that you can draw and repay funds as needed. The key differences are that a PLOC is unsecured, which poses less risk to your assets but results in a higher interest rate and, possibly, a lower credit ceiling. Approval is based solely on your creditworthiness and income rather than home equity.

Cash-Out Refinance

A cash-out mortgage refinance involves replacing your existing mortgage with a new, larger one and receiving the difference in cash. If you’re thinking about a cash-out refinance vs. a home equity line of credit there are a few important considerations: A refinance will leave you with one monthly payment instead of two (one for the primary mortgage and one for the HELOC). This can be appealing, but it only makes financial sense if you can also secure a lower interest rate than you have on your original mortgage. Another consideration is that with a refi, you’ll begin repaying the loan immediately, while with a HELOC you can delay repaying your principal as long as you make the interest payments. A cash-out refinance might have higher closing costs than a HELOC, but it likely also has a lower credit score threshold for qualification. Which path you choose will depend on these variables.

The Takeaway

A free HELOC calculator can help empower homeowners in their financial planning. It will help you understand what your payments on a HELOC would be, whether you’re in the draw or repayment phase. Testing different scenarios can help you get a sense of what credit line amount, interest rate, and repayment term will work best with your budget. And running interest rates offered by different lenders through the calculator can help you make a decision about which lender to partner with on this important HELOC journey.

SoFi now partners with Spring EQ to offer flexible HELOCs. Our HELOC options allow you to access up to 90% of your home’s value, or $500,000, at competitively lower rates. And the application process is quick and convenient.

Unlock your home’s value with a home equity line of credit from SoFi, brokered through Spring EQ.

FAQ

What is the difference between a HELOC and a home equity loan?

A HELOC is a revolving line of credit that works much like a credit card, and that has a variable interest rate. You can borrow and repay funds as needed and only pay interest on the amount of the credit line that you use. In fact, during the initial draw phase of the HELOC, you likely won’t have to repay the principal you’ve borrowed at all. In contrast, a home equity loan provides a single, lump-sum amount at a fixed interest rate. Repayment begins immediately, with monthly payments of equal installments. Both a HELOC and home equity loan use your home as collateral.

How much can I borrow with a HELOC?

The amount you can borrow depends on the equity in your home. Lenders typically allow you to borrow up to 90% of your equity. Your equity is equal to your home’s estimated value minus your outstanding mortgage balance. The final credit limit is also influenced by factors such as your credit score, income, and overall debt.

What can I use the money for from a HELOC?

Funds from a HELOC can be used for almost any purpose. Common uses include home renovations, debt consolidation, funding education, or covering major unexpected costs like medical bills. Some homeowners use HELOC funds to invest in a business. Remember that investments like this can be risky, and if an investment doesn’t pay off and you can’t make your HELOC payments, you risk losing your home.

Is a HELOC interest rate fixed or variable?

Most HELOCs have a variable interest rate that can change over time. This rate is typically tied to the U.S. prime rate, so you can keep an eye on the prime rate for a sense of where rates are headed.

Learn more about mortgages:

SoFi Loan Products Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

Checking Your Rates: To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score. However, if you choose a product and continue your application, we will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull and may affect your credit.

²SoFi Bank, N.A. NMLS #696891 (Member FDIC), offers loans directly or we may assist you in obtaining a loan from SpringEQ, a state licensed lender, NMLS #1464945.

All loan terms, fees, and rates may vary based upon your individual financial and personal circumstances and state.You should consider and discuss with your loan officer whether a Cash Out Refinance, Home Equity Loan or a Home Equity Line of Credit is appropriate. Please note that the SoFi member discount does not apply to Home Equity Loans or Lines of Credit not originated by SoFi Bank. Terms and conditions will apply. Before you apply, please note that not all products are offered in all states, and all loans are subject to eligibility restrictions and limitations, including requirements related to loan applicant’s credit, income, property, and a minimum loan amount. Lowest rates are reserved for the most creditworthy borrowers. Products, rates, benefits, terms, and conditions are subject to change without notice. Learn more at SoFi.com/eligibility-criteria. Information current as of 06/27/24.In the event SoFi serves as broker to Spring EQ for your loan, SoFi will be paid a fee.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

SOHE-Q425-059

Get prequalified in minutes for a SoFi Home Loan.

Free Delaware HELOC Payment Calculator

Delaware HELOC Calculator

By SoFi Editors | Updated December 30, 2025

A digital calculator can help Delaware homeowners who are interested in borrowing money based on their home equity to determine whether a home equity line of credit (HELOC) is the right move. Borrowing with a HELOC can be a flexible and cost-efficient way to obtain funds for home improvements, debt consolidation, or other big expenses. And a free HELOC calculator can show you what kind of monthly payments you can expect throughout the HELOC experience. This guide will show you how to use the calculator to best effect, and educate you about the ins and outs of HELOCs along the way.

- Key Points

- • A digital HELOC calculator helps Delaware homeowners estimate monthly payments during the draw and repayment phases of a home equity line of credit.

- • HELOCs are a revolving credit line secured by home equity, offering flexibility but requiring responsible use.

- • The calculator’s main inputs are the HELOC balance, interest rate, and the length of the draw and repayment periods.

- • Because a HELOC is secured by the home, it typically offers lower interest rates than unsecured debt such as credit cards.

- • Planning for the end of the interest-only draw period is crucial, as monthly payments often increase significantly during the principal and interest repayment phase.

Calculator Definitions

• HELOC Balance: This is the total amount you plan to draw from the credit line. If you already have a HELOC and are using the calculator to view payment estimates, input your current balance.

• Current Interest Rate: This is the percentage charged on the outstanding balance. HELOCs typically have a variable rate. You can use the calculator to see monthly payment estimates based on rates quoted by prospective lenders.

• Draw Period: This is the initial timeframe, usually five to 10 years, during which funds can be accessed, up to your credit limit. During this window, the credit line is revolving, meaning that if you repay what you borrow, you can borrow again. But you could also just pay interest on what you owe.

• Repayment Period: This phase begins once the draw period concludes, at which point no further withdrawals are permitted. Borrowers must pay back the outstanding principal and interest over a set number of years, often resulting in higher monthly obligations.

• Monthly Interest Payment: This figure represents the cost of carrying the current balance for one month, excluding any repayment of the principal. Many homeowners utilize this option during the draw period to maintain lower monthly costs.

• Monthly Principal and Interest Payment: THe HELOC payment calculator will show the total amount due each month during the repayment phase to fully retire the debt by the end of the term. It includes both a portion of the original amount borrowed (the principal) and the interest charged.

• Total Interest: The HELOC calculator will show the cumulative cost of borrowing over the entire life of the credit line, from the first withdrawal to the final payment.

How to Use the Delaware HELOC Calculator

The free HELOC calculator is easy to use. Just follow these simple steps:

Step 1: Enter Your Planned or Actual HELOC Balance

Enter the amount you have spent or plan to spend from the credit line — which may not be the entire amount you are permitted to borrow. This balance is the foundation of all subsequent calculations.

Step 2: Estimate Your Interest Rate

Input the rate a lender is offering or the rate you have already obtained for a HELOC. You can also use this opportunity to input rates that are 1.00% or 2.00% higher than the current rate, to see how payments would change if the HELOC’s variable rate adjusted upward.

Step 3: Choose the Length of the Draw Period

Specify the number of years you will have the ability to withdraw funds. While 10 years is standard, some agreements may offer a different window. A shorter draw period may lead to an earlier start for principal repayment, which accelerates debt retirement but places a more immediate demand on cash flow.

Step 4: Select Your Repayment Period

The length of the repayment period has a significant effect on the size of the monthly payment once the borrowing phase ends. A longer period, such as 20 years, will result in lower, more manageable monthly payments but will increase the total interest paid over the life of the account. Conversely, a shorter period — perhaps 10 years — means a higher monthly cash outlay.

Step 5: Review Your Results

The final output provides a comprehensive overview of the monthly payment obligations during both the early draw and later repayment phases of the HELOC. You’ll also see the total cost of borrowing.

Recommended: Different Types of Home Equity Loans

What Is a Home Equity Line of Credit?

Unlike other forms of financing that provide a lump-sum loan, a HELOC functions as a revolving credit line. What exactly does that mean and how does it work? Let’s examine what a home equity line of credit is, exactly.

First things first: Your ability to qualify for a HELOC will depend on the equity you have in your home. Most lenders require 15% equity, at minimum. To determine whether you meet this threshold, subtract your current home loan balance from your home’s estimated value, which you can find on a real estate web site. Then divide the answer by the home value to get your equity percentage. A lender will look at this number, as well as your credit score (which will need to be over 640 — or, for the most competitive interest rates — over 700).

If you’re approved for a HELOC, there will be two phases: a draw period, during which time you can draw on the credit line as needed, followed by a repayment phase. In the draw period you may only b e required to pay interest on the amount that you have borrowed. Once the draw period ends, you’ll may principal and interest payments each month until you have repaid all that you owe.

Because a HELOC is secured by your home, it typically has an interest rate that is lower than rates you’ll see on unsecured credit products like a personal line of credit or a credit card. This makes it a cost-effective alternative for financing major life priorities. However, having a revolving credit line requires some discipline. Much like a credit card, the borrower can pile up debt with a HELOC. It’s important to have a plan for repaying what you owe, and a HELOC calculator can show you what those payments would be before you sign on to this form of borrowing. A HELOC interest-only calculator can show you what you might owe during the draw phase, while a HELOC repayment calculator will give you a sense of what the payment will be when you are repaying the principal plus interest.

Remember as you get equity out of your home that if you don’t make HELOC payments, your credit score could suffer and, ultimately, you could face foreclosure.

Home Equity Trends in Delaware

The same market forces that have made it difficult for first-time homebuyers to find affordably priced homes have made borrowing against equity increasingly popular. As home prices have risen in Delaware in recent years, so have homeowners’ equity levels. So it’s no surprise that more people are looking into borrowing with a HELOC or its cousin, the home equity loan. The average Delaware homeowner has more than $179,000 in equity, and in the state as a whole, the average equity has almost doubled over the last five years. This is in keeping with the national equity trend, which has increased substantially, as shown in the graphic.

Current HELOC rates by state.

Compare current home interest rates by state and find a HELOC rate that suits your financial goals.

Select a state to view current rates:

How to Use the HELOC Calculator Data to Your Advantage

The calculations provided by a free HELOC calculator can be useful in your planning and decisionmaking process. Here are some ways you can use the calculator to plan for your future:

• Budgeting: The calculator will show you an estimate of your monthly costs, both during the draw and repayment periods. Looking at these numbers closely will help you determine if they fit into your monthly budget.

• Planning: Experimenting with different repayment terms using the calculator can help you determine whether a shorter or longer repayment term is best for you. And knowing roughly what your monthly payment could be during the repayment phase will help you plan for the point after the draw period when your payment amount will likely escalate. This ensures you won’t be surprised. Using the calculator to compute different payments according to different interest rates will help you test your comfort level with the HELOC’s variable rate.

• Motivating: Seeing how payments increase during the repayment phase can help prompt borrowers to pay down their HELOC balance during the draw phase so that they enter the repayment phase with a smaller amount due.

Recommended: HELOC vs. Home Equity Loan

Tips on HELOCs

Tapping into home equity is a big financial decision. These tips can help ensure that you optimize your HELOC experience.

• Compare lenders: Shop around and obtain rate quotes from multiple lenders before committing to a HELOC. Don’t just compare interest rates; also look at fees to find the most favorable option. Using the HELOC calculator can help you envision how the rates you’re seeing in the marketplace will affect your monthly bill in the real world.

• Use borrowed funds responsibly: Before you borrow, determine what is and isn’t a suitable use of your credit line. Use the calculator to see what your self-imposed HELOC spending limit should be so that you can manage monthly payments without stress.

• Plan for end of the draw phase: The beginning of the repayment period (when you will start making principal and interest payments) can cause a significant jump in your monthly HELOC bill. Budget for this increase to avoid “payment shock.”

• Pay down the principal when you can: Even if you aren’t required to pay down the principal during the draw period, making payments toward it can chip away at what you owe so that entering the repayment period doesn’t feel like a big bump up in your monthly bill.

• Watch interest rates: If you have a variable-rate HELOC, keep an eye on market interest rate trends so you can budget for larger or smaller monthly payments.

Alternatives to Home Equity Loans

Some borrowers explore a HELOC and find that they would prefer to borrow a lump sum with more consistent monthly payments. If that’s the case, then it’s time to consider one of these options:

Home Equity Loan

A home equity loan is, like a HELOC, a second mortgage because money is borrowed with your home as collateral. In contrast to a HELOC, though, a home equity loan delivers a single lump-sum payment. You’ll begin repaying what you have borrowed, with interest, immediately.

Other things about how a home equity loan works: Home equity loans usually have a fixed interest rate. So your monthly payment will usually stay the same through the life of the loan. Repayment terms can range from five to 30 years.

A home equity loan calculator can show you what monthly payments might be with this type of loan.

Home Improvement Loan

This unsecured personal loan provides a lump sum at a fixed interest rate. But unlike a HELOC or home equity loan, a home improvement loan does not require using your home as collateral. Home improvement loans often have a lower borrowing limit than HELOCs, and may have higher interest rates and shorter repayment terms as well.

Personal Line of Credit

A personal line of credit allows borrowers to access funds as needed, like a HELOC does, but without using the home as collateral. While opting for a personal line of credit protects the home from the risk of foreclosure, the interest rates are generally higher, and the credit limits are typically lower because the lender has no physical asset to secure the debt.

Cash-Out Refinance

A cash-out mortgage refinance involves replacing your existing primary mortgage with an entirely new, larger mortgage. You would receive the difference between the new mortgage and the old balance in cash. This is attractive, but a refinance is likely a smart move only if current market interest rates are lower than the rate on your original mortgage. A refi would also involve new closing costs, typically 2% to 5% of the loan amount.

As you consider a cash-out refinance vs. home equity line of credit, it’s important to realize that a refi consolidates your debt into a single monthly payment.

The Takeaway

The Delaware HELOC payment calculator is a useful tool to use as you explore whether a HELOC might be the right way to get equity out of your home and borrow money to fund a renovation or accomplish a debt consolidation, for example. Remember to seek out interest rates from several lenders as you explore HELOCs, and use the calculator to help identify the interest rate and repayment term that suit your needs.

SoFi now partners with Spring EQ to offer flexible HELOCs. Our HELOC options allow you to access up to 90% of your home’s value, or $500,000, at competitively lower rates. And the application process is quick and convenient.

Unlock your home’s value with a home equity line of credit from SoFi, brokered through Spring EQ.

FAQ

What is the difference between a HELOC and a home equity loan?

A HELOC is a revolving credit line that functions similarly to a credit card, allowing you to withdraw funds as needed. In contrast, a home equity loan provides a single lump sum upfront. A HELOC usually has a variable interest rate, while a home equity loan has a fixed rate. While both are second mortgages, the HELOC offers more flexibility in how and when you use the funds, while the home equity loan provides more predictability for budget planning.

What can I use the money for from a HELOC?

The funds from a home equity credit line can be used for virtually any purpose. Common uses include major home renovations, consolidating high-interest debt, or covering unexpected medical bills. Because the home serves as collateral, many homeowners like to use the funds for projects that increase the property’s market value or improve their long-term financial stability and overall household wealth.

What happens when the draw period ends?

Once the draw period ends, you can no longer withdraw funds from a HELOC. You enter the repayment phase, where you must pay back the outstanding principal and interest over a set timeframe, usually 10 to 20 years. Because you are now paying both principal and interest, your monthly payments will likely increase — sometimes significantly — compared to the interest-only payments often allowed during the draw period.

Are there closing costs or fees for a HELOC?

HELOCs often have lower upfront costs than home equity loans or refinances. But you will likely have to pay for an appraisal, and there may be other expenses such as annual maintenance fees, transaction fees, or inactivity fees if the credit line is not used. Some lenders charge an early closure fee if you pay off and close the account within the first 36 months of opening the credit line.

Learn more about mortgages:

SoFi Loan Products Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

Checking Your Rates: To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score. However, if you choose a product and continue your application, we will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull and may affect your credit.

²SoFi Bank, N.A. NMLS #696891 (Member FDIC), offers loans directly or we may assist you in obtaining a loan from SpringEQ, a state licensed lender, NMLS #1464945.

All loan terms, fees, and rates may vary based upon your individual financial and personal circumstances and state.You should consider and discuss with your loan officer whether a Cash Out Refinance, Home Equity Loan or a Home Equity Line of Credit is appropriate. Please note that the SoFi member discount does not apply to Home Equity Loans or Lines of Credit not originated by SoFi Bank. Terms and conditions will apply. Before you apply, please note that not all products are offered in all states, and all loans are subject to eligibility restrictions and limitations, including requirements related to loan applicant’s credit, income, property, and a minimum loan amount. Lowest rates are reserved for the most creditworthy borrowers. Products, rates, benefits, terms, and conditions are subject to change without notice. Learn more at SoFi.com/eligibility-criteria. Information current as of 06/27/24.In the event SoFi serves as broker to Spring EQ for your loan, SoFi will be paid a fee.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

SOHE-Q425-058

Get prequalified in minutes for a SoFi Home Loan.

Free Connecticut HELOC Payment Calculator

Connecticut HELOC Calculator

By SoFi Editors | Updated December 30, 2025

If you’re a Connecticut homeowner considering tapping into your home’s equity, a HELOC calculator can be a valuable planning tool. It helps estimate potential payments, interest costs, and how different borrowing scenarios could affect your budget. By adjusting key inputs, you can better understand what a home equity line of credit might look like before speaking with a lender.

Keep reading for more on home equity lines of credit in Connecticut, how to use the HELOC calculator, alternatives to HELOCs, and more.

- Key Points

- • A home equity line of credit (HELOC) is a revolving loan that lets homeowners borrow against their home’s equity as needed, typically with a variable interest rate and flexible repayment terms.

- • Borrowers navigate two distinct phases: an initial window for accessing capital and a subsequent period dedicated to the repayment of both principal and interest.

- • Eligibility is typically determined by a combination of the homeowner’s credit history, income stability, and the amount of equity currently held in the home.

- • A home equity line of credit calculator helps estimate monthly payments and total cost of borrowing, helping you determine affordability before speaking with a lender.

- • Missing payments can put your home at risk, as the lender may foreclose to recover the debt.

Calculator Definitions

• HELOC Balance: This figure represents the total amount of capital a homeowner has currently withdrawn from their revolving line of credit that has not yet been reimbursed to the lender.

• Current Interest Rate: This is the percentage charged on the outstanding balance, which typically fluctuates based on market indicators like the prime rate.

• Draw Period: This is the initial phase of the agreement, often lasting 10 years, during which the homeowner may access funds as needed up to a predetermined limit. During this window, the borrower is frequently only required to make interest payments on the amount used.

• Repayment Period: The repayment period typically lasts 20 years, during which no new withdrawals are allowed and higher monthly payments repay both principal and interest.

• Monthly Interest Payment: This represents the minimum amount due during the draw phase, covering only the interest charges for the specific funds that have been accessed.

• Monthly Principal and Interest Payment: This is the total monthly obligation required once the repayment phase begins, combining a portion of the borrowed principal with the interest charge. This structure is designed to bring the balance of the line of credit to zero by the end of the term.

• Total Interest: This refers to the cumulative amount of money paid to the lender in interest charges over the entire lifecycle of the credit agreement. It reflects the total cost of capital beyond the actual funds accessed and utilized by the homeowner.

Recommended: What Is a Home Equity Line of Credit?

How to Use the Connecticut HELOC Calculator

Using a Connecticut HELOC calculator is more than just a data entry task; it is a strategic exercise in household financial modeling. Each step provides a clearer picture of the long-term commitment involved in managing home-backed credit. Here’s exactly how to use it:

Step 1: Enter Your Planned or Actual HELOC Balance

The first step involves entering the total amount you have drawn or intend to withdraw from your revolving credit line. This input is the primary driver of the entire calculation, as it sets the baseline for interest accumulation.

Step 2: Estimate Your Interest Rate

Use the rate quoted by your lender or a current market estimate. Since HELOC rates are usually variable, test higher-rate scenarios in the calculator to understand how rising rates could change your monthly payments.

Step 3: Choose the Length of Your Draw Period

Inputting the length of the draw period — typically 10 years — defines the window of time you have to access your capital. A longer draw period provides more time to fund multi-stage projects, but it also delays the initiation of principal repayment.

Step 4: Specify Your Repayment Period

The repayment period is generally between 10 and 20 years long. It dictates the pace at which you must repay the principal debt. A shorter repayment period leads to higher monthly payments but results in significantly lower total interest costs over the life of the agreement. Conversely, a longer period reduces the immediate monthly burden but increases the total cost of the debt.

Step 5: Review Your Results

Reviewing these results allows you to decide if the proposed credit line is truly sustainable within your budget. You can assess the affordability of the HELOC at different stages and integrate these potential costs into your long-term financial plan.

Recommended: Different Types of Home Equity Loans

What Is a Home Equity Line of Credit?

A home equity line of credit is a revolving line of credit that allows homeowners to borrow against the equity in their home. It works similarly to a credit card, letting you draw funds as needed up to an approved limit and typically offering lower interest rates than unsecured loans because the home serves as collateral.

• Draw period: During the draw period, which often lasts up to 10 years, you can access funds as needed and may only be required to make interest-only payments on the amount you borrow. This phase offers flexibility for ongoing expenses like renovations or education costs. A HELOC interest-only calculator can show you what payments would be based on your balance.

• Repayment period: Once the draw period ends, the HELOC enters the repayment period, usually 10 to 20 years, when you can no longer withdraw funds. Monthly payments increase because you must repay both principal and interest on the outstanding balance. A HELOC repayment calculator can show you what those payments might be.

Because a HELOC is secured by your home, it’s important to borrow responsibly and plan for future payment changes. Used wisely, it can be a flexible and cost-effective financing option for homeowners.

Recommended: HELOC vs. Home Equity Loan

Home Equity Trends in Connecticut

From 2020 to 2025, average home equity increased 142% nationwide, accounting for about $11.5 trillion in value. In Connecticut, home equity has increased a whopping 297%. The average homeowner has $166,656 in equity as of 2025.

Equity is the difference between the current market value of a home and the remaining balance on any existing home loan. When property values rise, the gap between what is owed and what the home is worth widens, creating a larger reservoir of potential credit for the homeowner. This has been especially evident in the Connecticut market, where demand for residential property has remained steady, leading to increased valuations across many municipalities.

Here’s a look at how equity has risen nationwide between 2020 and 2025.

Current HELOC rates by state.

Compare current home interest rates by state and find a HELOC rate that suits your financial goals.

Select a state to view current rates:

How to Use the HELOC Calculator Data to Your Advantage

Understanding the results from a HELOC calculator goes beyond estimating a monthly payment — it helps you make smarter, more strategic borrowing decisions. By analyzing how changes in rates, balances, and timelines affect your costs, you can use this data to plan responsibly, reduce risk, and align your borrowing with long-term financial goals.

• Test different borrowing scenarios: Adjust interest rates, loan amounts, and repayment terms to see how market changes or larger withdrawals could affect your monthly payment and total interest.

• Plan for cash flow: Use the projected payments to confirm your budget can handle both the draw-period payments and the higher payments that often come later.

• Evaluate payoff strategies: Compare how making extra payments or choosing a shorter repayment period can lower total interest costs over time.

• Strengthen lender discussions: Bring realistic numbers to lender conversations so you can ask informed questions and negotiate terms with confidence.

Recommended: How to Get Equity Out of Your Home

Tips on HELOCs

Managing a revolving line of credit requires a high degree of discipline and a long-term perspective. Because this product provides easy access to large sums of money, it can be tempting to overspend on non-essential items. Below are six ways to use your HELOC wisely:

• Understand your variable rate risk: HELOC interest rates are usually tied to a market index, so your payment can rise over time. Use estimates to see how higher rates would affect your budget and avoid borrowing more than you can comfortably repay.

• Borrow only what you need: Just because a HELOC offers a high credit limit doesn’t mean you should use it all. Limiting withdrawals helps keep payments manageable and reduces total interest costs.

• Plan for the repayment period early: Payments often increase when the draw period ends and repayment begins. Preparing for this transition can prevent payment shock later on.

• Use the funds strategically: HELOCs work best for expenses that add long-term value, such as home improvements or consolidating high-interest debt. Avoid using them for short-term or discretionary spending.

• Track your balance and payments closely: Regularly monitoring your HELOC balance helps you stay aware of how much equity you’re using. Making extra payments when possible can significantly lower interest costs.

• Compare alternatives before committing: Depending on your goals, a home equity loan or personal loan may offer more predictable terms. Comparing options ensures the HELOC truly fits your financial strategy.

Alternatives to HELOCs

While a home equity line of credit offers great flexibility, it is not the only way to access capital. Depending on your specific goals and risk tolerance, other financing products might be a more strategic fit for your household.

Home Equity Loan

Often confused with a HELOC, a home equity loan is a second mortgage that provides a single lump-sum disbursement at the time of closing. Its strategic value is found in the fixed interest rate and the stability of fixed monthly payments that begin immediately. This is the ideal product for someone who knows exactly how much money they need — such as a specific $40,000 contractor bid — and wants the security of a payment that is immune to market fluctuations. It eliminates the uncertainty of variable rates and the temptation associated with revolving credit.

A home equity loan calculator can help you compare the cost of this product to that of a HELOC.

Recommended: What Is a Home Equity Loan?

Home Improvement Loan

A home improvement loan is typically an unsecured installment product where you receive a set amount of money and pay it back in fixed installments over a predetermined term. Since there is no collateral, interest rates may be higher than those of a home-secured line. This is an excellent choice for homeowners with smaller, well-defined projects who prefer the predictability of a payment that will never change.

Personal Line of Credit

This product functions similarly to a HELOC as a revolving line of credit, but it is usually unsecured. The strategic advantage here is the speed of approval and the absence of home-related fees such as appraisals or title searches. However, because there is no collateral, the interest rates are significantly higher, and the credit limits are generally lower.

Cash-Out Refinance

A cash-out mortgage refinance involves replacing your primary mortgage with a completely new, larger agreement. You pay off the old mortgage and take the remaining balance in cash. It is best suited for those who need a very large sum of money and can improve their primary mortgage terms.

When comparing a cash-out refinance vs. home equity line of credit, a cash-out refinance leaves you with one payment. A home equity line of credit, on the other hand, gives you a second payment on top of your original mortgage payment.

The Takeaway

Tapping into home equity can be a powerful way to achieve major financial goals, but it must be done with a clear understanding of the long-term obligations. By using the HELOC calculator data to drive decisions, you can leverage your home’s value to improve your financial health without entering a zone of high foreclosure risk.

SoFi now partners with Spring EQ to offer flexible HELOCs. Our HELOC options allow you to access up to 90% of your home’s value, or $500,000, at competitively lower rates. And the application process is quick and convenient.

Unlock your home’s value with a home equity line of credit from SoFi, brokered through Spring EQ.

FAQ

What is the difference between a HELOC and a home equity loan?

The primary difference is how the funds are delivered and repaid. A home equity line of credit is a revolving resource where you draw funds as needed and often pay a variable interest rate. A home equity loan is a one-time lump sum with a fixed interest rate and set monthly installments. One offers ongoing flexibility, while the other provides the stability of predictable payments from the start.

What happens when the draw period ends?

Once the draw period concludes, your ability to withdraw additional money from the credit line is terminated. You then enter the repayment period, which typically lasts 10 to 20 years. During this phase, you are required to make monthly payments that cover both the principal balance and the interest. These payments are usually significantly higher than the interest-only payments you may have made during the initial draw phase.

What is the benefit of having a variable interest rate?

The primary benefit is that variable rates often start lower than the fixed rates found on traditional installment agreements. This can result in lower initial monthly payments, providing better short-term cash flow for the homeowner. Additionally, if market interest rates decrease, your rate and monthly payment will also go down. This can make the financing more affordable during certain economic cycles.

What is the minimum credit score I need to qualify for a HELOC?

While requirements vary by lender, most institutions look for a credit score of at least 640, though some lenders prefer 680. Higher scores often lead to more favorable interest rates and higher borrowing limits.

Learn more about mortgages: