SoFi Survey: Health and Immediate Financial Needs are Top of Mind for Most Americans

In a matter of weeks, the COVID-19 outbreak has changed nearly everyone’s day-to-day life.

Many states have ordered citizens to shelter in place as nonessential businesses shutter and many make the adjustment to work from home.

Amidst this time, we’ve seen an unprecedented drop in the stock market, and rapid congressional action to provide relief to those affected by the outbreak.

In a time of instability, it’s natural for anxieties to spike. SoFi surveyed over 1,000 consumers between the ages of 18 and 74 through SurveyMonkey® to capture their insights and perceptions when it comes to the market and financial volatility relating to COVID-19.

The Outbreak is the Primary Cause for Concern

There’s so much stress and uncertainty at this time, by far and away, respondents are most anxious about the COVID-19 outbreak itself.

65% of survey respondents said that the outbreak is giving the most stress, followed distantly by the stock market (14%) and job security (12%) anxieties.

Breaking it down further, nearly every subset feels the stress of COVID-19 equally. 67% of men and 63% of women rank COVID-19 as their primary stressor at the moment.

Age groups are all feeling the same stress around COVID-19: millennials (70%), boomers (69%), and Gen Z (67%) all say COVID-19 is causing them the most anxiety.

Financial Anxieties

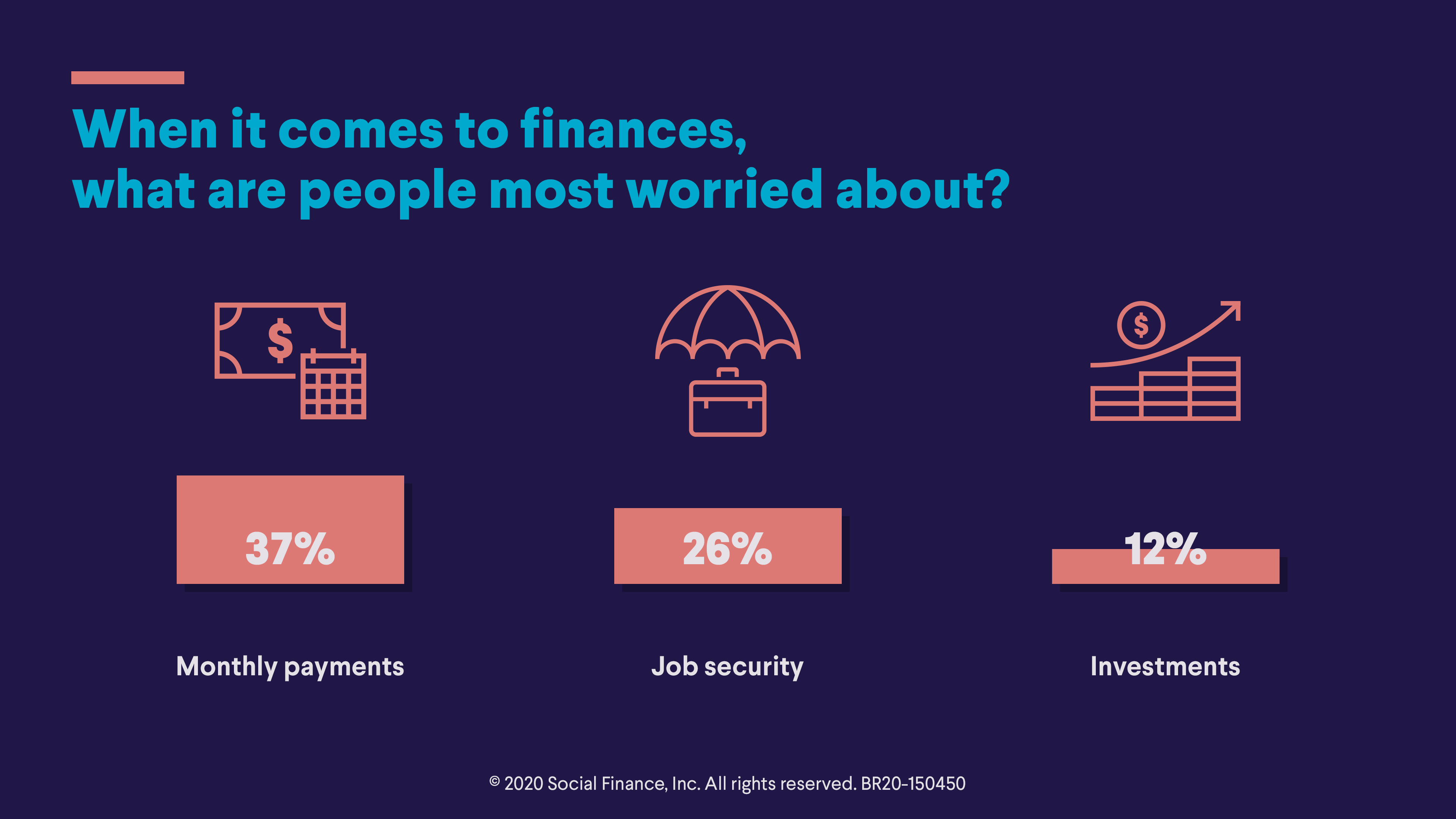

When it comes to fear around money, most respondents are thinking about it in the immediate sense. The market might be dropping, and the Federal Reserve is cutting rates, but most of those surveyed didn’t rank those developments as a primary concern.

According to those surveyed, day-to-day financial needs is the top concern. 37% of respondents are thinking about money in the immediate sense—they’re worried about making monthly payments, such as rent, mortgage, or car loans.

Gen Z is much more likely to be worried about their student loan debt (13%) than millennials (3%) or baby boomers (2%).

Stress around job security comes in a close second—26% of respondents said they were primarily worried about keeping their job.

Perhaps unsurprisingly, as many are climbing the corporate ladder while juggling parenting, millennials are the most worried about their job security (30%), followed closely by Gen Z (27%), and boomers (26%).

During this time of employment uncertainty, many might be reconsidering or restarting their job search. But, they don’t have to go at it alone. SoFi members have access to complimentary career coaching to figure out what comes next.

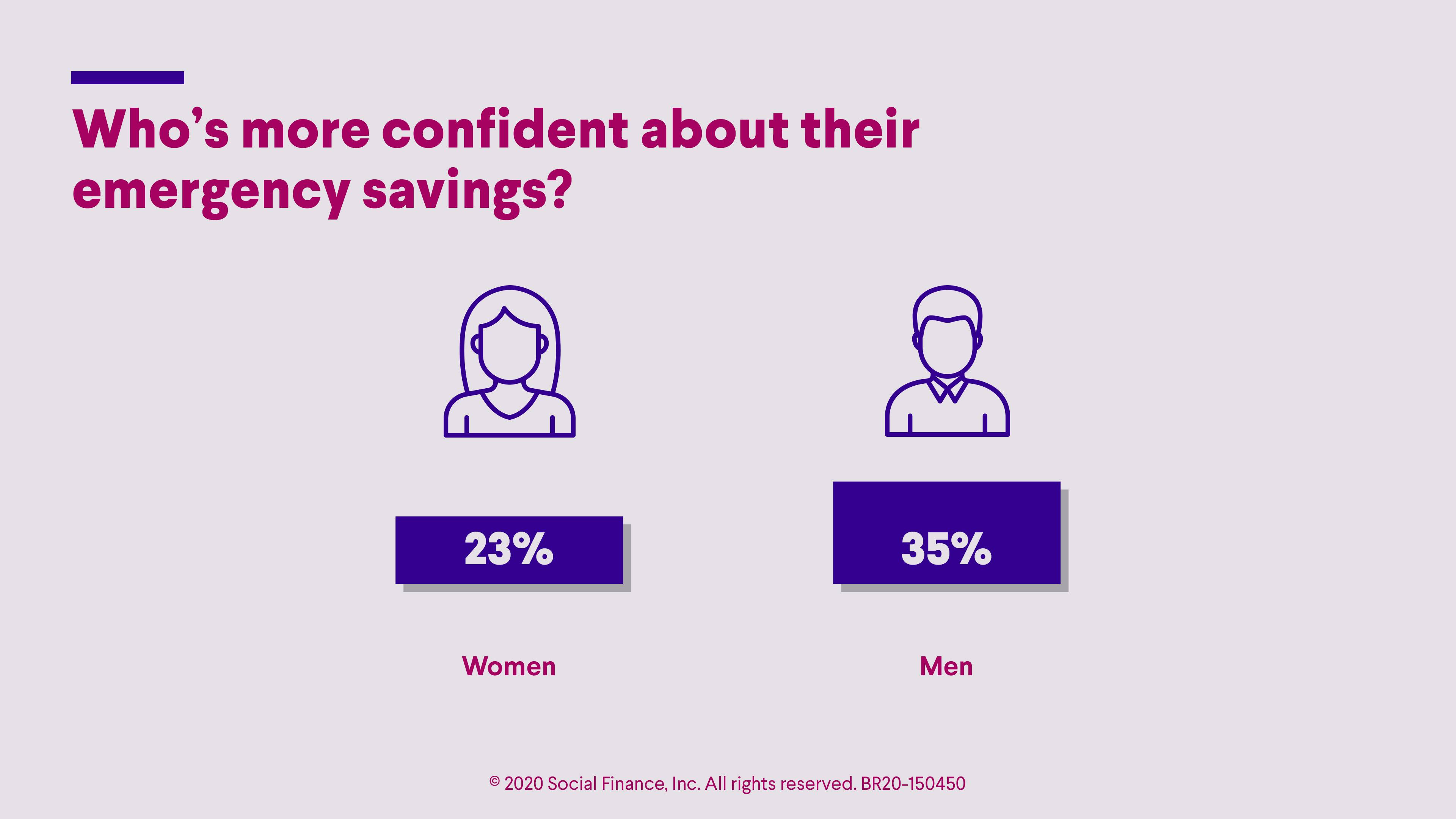

Hand in hand with job security comes worries about immediate emergency savings. Women were less likely to feel confident about relying on emergency savings (23%) than men.

35% of men said they’d feel confident that their savings would last during this period of uncertainty.

34% of respondents said they weren’t “at all confident” that they could financially weather the loss of a job or lack for pay for a 6-month duration at this time. Only 12% said they were “very confident” in their emergency savings safety net.

Only 12% of respondents rank the value of their investments as a primary financial concern at this time.

Most People Aren’t Changing Their Investment Strategy

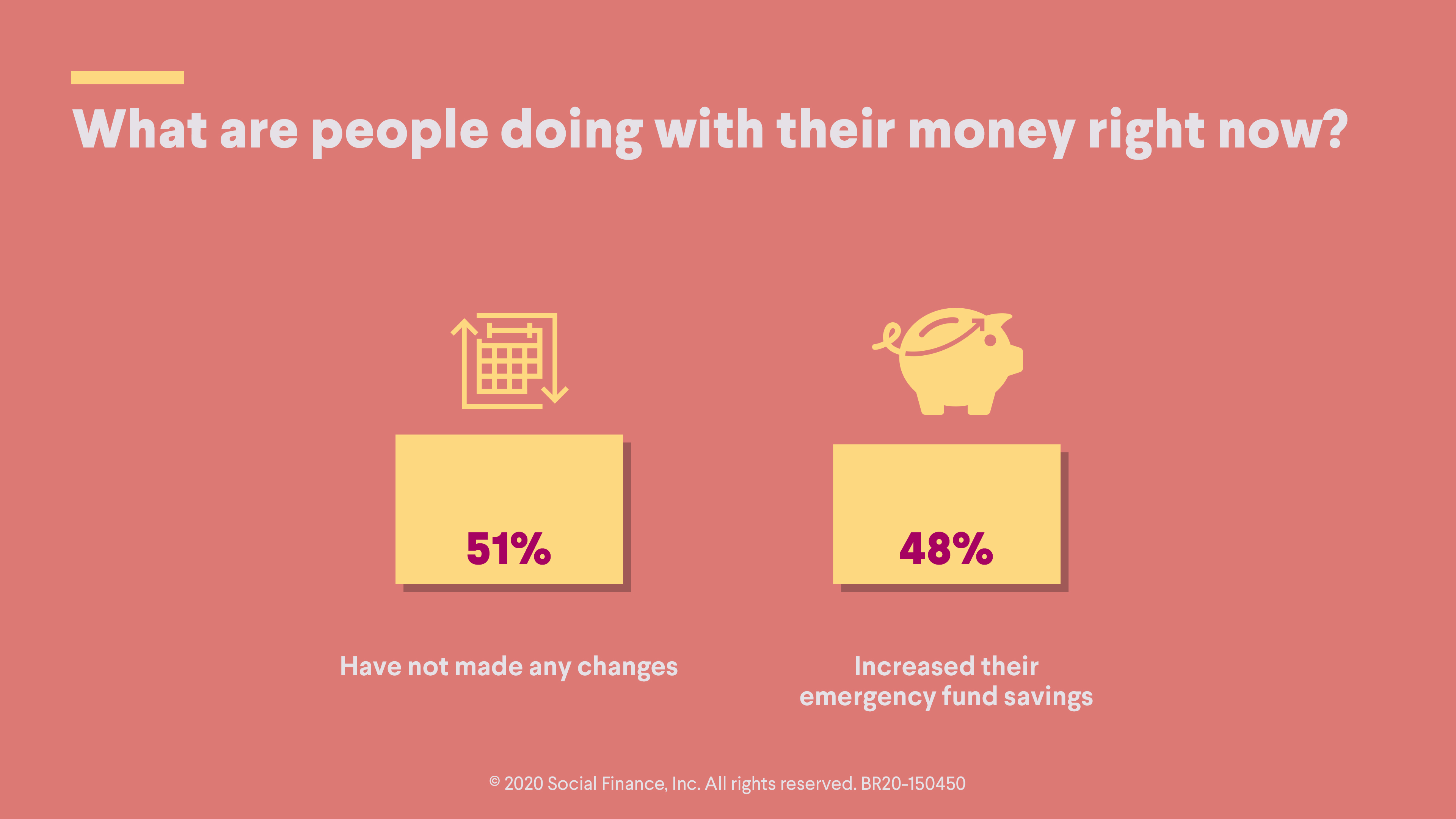

Market volatility has led to some, but not many, obsessively tracking investments and reworking their strategy.

The majority of respondents, 51%, haven’t made any changes to their finances in the past week or month. That includes:

• Increasing 401k contributions

• Decreasing 401k contributions

• Increasing investments

• Decreasing investments

• Pausing debt payments

• Decreasing student loan payments

• Increasing savings

Millennials, at 57%, are most likely to have made changes to their investment strategy at this time.

It seems that for most, immediate financial needs are top of mind, with investment strategies lagging behind. More respondents are thinking about what they need in the next few months, not their long term investments.

In fact, in the past weeks nearly half (48%) of those surveyed said they increased their emergency fund savings as a result of the market’s volatility.

An overwhelming 73% of respondents said they’re considering saving more cash going forward because of the current economic climate.

The Search for Financial Advice

Many might be looking at the market and scratching their heads. 37% of those surveyed expressed that they need help understanding the current market trends before changing any strategy.

Investing newbies, Gen Z, are most likely to need help (43%), compared to millennials (36%) and boomers (33%).

In this unprecedented time, many are unsure of where to turn for financial advice. 41% said they’ve turned to family for advice on their investment strategy, and 22% looked to financial experts.

Gen Zers are most likely to seek family advice (55%), and are much less likely, at 13%, to turn to a financial expert at this time.

Millennials and boomers are almost twice as likely to consult a financial expert than Gen Z, 26% and 29%, respectively.

This could have something to do with Gen Zers being newer to the investment and savings world, and feeling unsure of where to seek out advice at this time.

However, overall, women are much more likely to talk to family and seek out advice (43%), than men.

COVID-19 is Top of Mind, Money Worries Follow

At this time, the biggest stressor for most is the COVID-19 outbreak itself. Money worries fall further behind as health comes first for most respondents.

When it comes to financial stressors, most surveyed are thinking about the immediate future.

They’re concerned about paying bills and padding out savings to have a proper emergency fund in place.

They’re more worried about losing their job than their long term financial strategy. They’re planning to, or already have, started contributing more to their liquid savings as an emergency fund.

Many of the respondents might be watching their investments, but they haven’t made any significant changes since the COVID-19 outbreak in the US.

They’re looking for advice on what to do next, but immediate long term investment strategy and market volatility is not top of mind for most.

SoFi Invest®

The information provided is not meant to provide investment or financial advice. Investment decisions should be based on an individual’s specific financial needs, goals and risk profile. SoFi can’t guarantee future financial performance. Advisory services offered through SoFi Wealth, LLC. SoFi Securities, LLC, member FINRA / SIPC .

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

SOCO20015