SoFi Blog

Tips and news—

for your financial moves.

Mortgage Preapproval | SoFi

Online mortgage preapproval

Get on the fast track to home ownership with mortgage pre-approval.

Don’t miss out on your dream home. Get preapproved for a mortgage with SoFi and stand out from other buyers with a Verified Preapproval Letter.

View your rate

Why choose SoFi for your mortgage preapproval?

-

Simple and online.

You don’t need to head to the bank to get preapproved for a home loan—you don’t even need to leave your couch.

-

Quick and easy preapproval.

Receive your Verified Preapproval Letter and know exactly how much you’re approved for.

-

Self-serve access.

Access, customize and download your Verified Preapproval Letter online at any time.

-

Streamlined process.

Having a SoFi Verified Preapproval will speed up your mortgage process once you find your dream home.

What is a mortgage preapproval?

A mortgage preapproval helps you understand your home buying budget. You provide detailed information about yourself and your finances, and the home mortgage lender reviews it and comes back with a Verified Preapproval Letter which indicates the mortgage amount you’re approved for. A Verified Preapproval Letter can provide you with a competitive advantage as it shows sellers you’re serious and financially able to close the deal.

Learn more

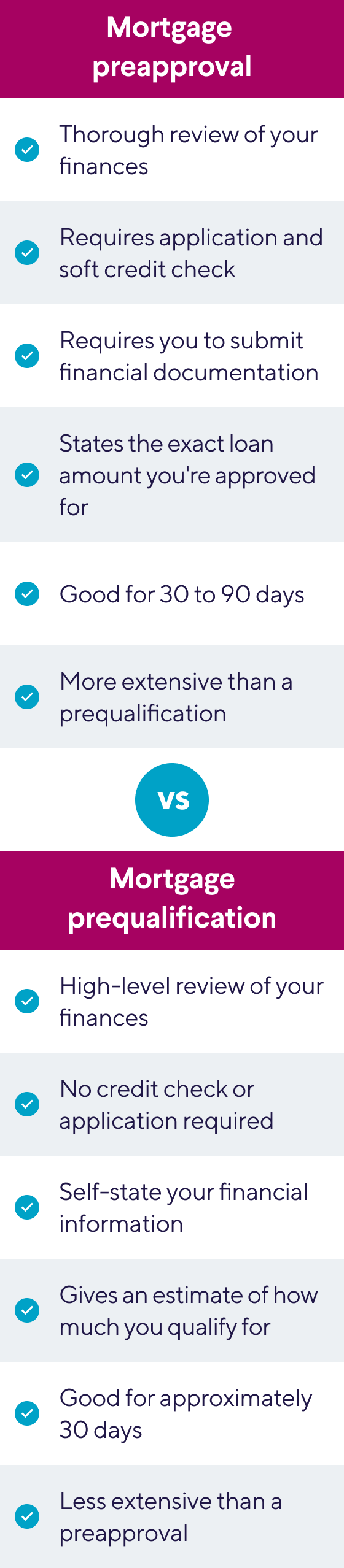

Preapproval vs. prequalification.

Prequalification is a great way to start your house-hunting journey because it’s a quick and easy way to get an idea of how much of a loan you can get. Mortgage preapproval takes it to the next level and is a good idea if you’re ready to start looking at homes.

Benefits of a SoFi Verified Preapproval:

Get budget clarity.

Better understand your home buying budget to know what you can afford.

Know exactly how much you’re approved for.

Find out the exact amount you’d be able to secure for your home loan.

Strengthen your offer.

Show sellers you’re serious about buying. A SoFi Verified Preapproval Letter can help you stand out from other interested buyers and increase your negotiation power.

Speed up the process.

When you’re ready to buy a home, a mortgage preapproval can help make your final mortgage application process quicker.

How to get preapproved for a mortgage with SoFi:

-

Tell us about yourself.

Share a bit about yourself and your home loan goals.

-

Provide details about your financial situation.

Submit financial documents like pay stubs, tax returns and bank statements.

-

Wait for review.

Your information will be reviewed by an underwriter.

-

Access your SoFi Verified Preapproval Letter.

Your SoFi Verified Preapproval Letter will be available to you online, in your portal where you’ll be able to download or access at anytime. The letter is valid for 90 days.

View your rate

What happens after preapproval?

Once you have a mortgage preapproval letter, you’re ready to start home shopping! With your letter in hand, you can begin looking at properties in your preapproved price range. When you find a home you love, you can make an offer—standing out from the crowd because you have proof you can afford the home. Once you have an accepted offer, you’ll formally apply for a mortgage loan.

Remember, your preapproval is valid for 90 days, so if you don’t purchase a home in that timeframe, you’ll need to apply for a new preapproval.

Learn more about getting preapproved for a mortgage.

FAQs

How far in advance should I get preapproved for a mortgage?

The ideal time to get preapproved for a home loan is right before you begin your home search. This lets you know exactly how much you can afford and demonstrates to a seller you can be approved for a mortgage.

How long is my preapproval valid for?

Your SoFi Verified Preapproval Letter is valid for 90 days.

What documents do I need for preapproval?

You’ll typically be asked for two years of residency history, two years of employment history, and income and credit documents (paystubs, W-2s, property documentation, etc.)

What is the minimum credit score for a SoFi mortgage?

To be preapproved for a SoFi home mortgage, you’re required to have a minimum credit score of 600. Unsure of your credit score? Check it now.

Does preapproval guarantee a mortgage?

No. However, it does indicate a lender reviewed your financial information and determined you’ll likely be approved for a mortgage loan for a specific amount.

Is it better to be prequalified or preapproved?

Because preapproval requires a deeper dive into your financials, a preapproval is generally better when you’re shopping for a new home. However, prequalification is a great starting point if you’re just starting to consider buying a new home.

Can I use my SoFi Verified Preapproval for a different property?

Yes, you can use your preapproval for various properties. A preapproval isn’t limited to a single property.

How do I contact a SoFi mortgage specialist?

To speak with a SoFi mortgage loan officer, call 833-408-7634.

See more FAQs

Terms and conditions apply. Before you apply for a SoFi Mortgage, please note that not all products are offered in all states, and all loans are subject to eligibility restrictions and limitations, including requirements related to loan applicant’s credit, income, property, and loan amount. Minimum loan amount is $75,000. Lowest rates are reserved for the most creditworthy borrowers. Products, rates, benefits, terms, and conditions are subject to change without notice. Learn more at SoFi.com/eligibility-criteria. Information current as of 2/8/26.

SoFi Mortgages originated through SoFi Bank, N.A., NMLS #696891 (Member FDIC), (www.nmlsconsumeraccess.org). Equal Housing Lender. SoFi Bank, N.A. is currently able to issue and refinance mortgages in all states except purchase only for New York.

Verified Preapproval Letter: Terms apply. See conditional preapproval letter for details. Not a final loan approval and not a commitment to lend.

$60000 salary converter

$60,000 a Year Is How Much an Hour?

If your annual salary is $60,000, you’re making $28.85 an hour before taxes. Use this calculator to quickly find out how much you’re making a day, week, or monthly based on a $60,000 a year salary and a standard work schedule.

*The information provided by this calculator is for illustrative purposes only. These figures assume full-time employment and do not include deductions like taxes.

FAQ

How much is a $60,000 annual salary per hour, week, and month?

If you’re earning $60,000 a year and working a standard 40-hour workweek, your pay breaks down to approximately $29 per hour, $1,154 per week, and $5,000 a month. These calculations assume you work 52 weeks a year, including any paid time off. If you work schedule differs, the amounts may vary.

Is a $60,000 annual salary above or below the average salary in the U.S.?

A $60,000 salary is close to the national average salary in the U.S., though this can vary based on the year and the source of the data. According to recent reports, the median individual income in the U.S. tends to range between $55,000 and $65,000 annually. So, earning $60,000 a year would place you right around the average, with slight variations depending on your location and industry.

What is the annual take-home pay for someone earning $60,000 a year after taxes?

The take-home pay for someone earning $60,000 a year will vary depending on factors like their tax bracket, state taxes, and any deductions for benefits or retirement contributions. On average, after federal taxes and other typical deductions, take-home pay might be around $45,000 to $50,000 per year. This estimate can change based on where you live and your individual financial situation.

Helpful salary resources:

Other popular salary conversions

Your hard-earned cash deserves better banking.

When you bank with SoFi, you’ll get up to 3.30% APY1, pay no account fees2,

and earn up to $300 with direct deposit†.

SoFi Checking and Savings is offered through SoFi Bank, N.A. Member FDIC. The SoFi® Bank Debit Mastercard® is issued by SoFi Bank, N.A., pursuant to license by Mastercard International Incorporated and can be used everywhere Mastercard is accepted. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

1

Annual percentage yield (APY) is variable and subject to change at any time. Rates are current as of 12/23/25. There is no minimum balance requirement. Fees may reduce earnings. Additional rates and information can be found at http://www.sofi.com/legal/banking-rate-sheet.

SoFi Bank assesses Eligible Direct Deposit or Qualifying Deposits based on a rolling 31-calendar day period and may request additional information for verification of eligibility. A rolling 31-calendar day period means that each time you receive an Eligible Direct Deposit or $5,000 in Qualifying Deposits, a new 31-day period begins, during which you will earn the interest rates and APYs for account holders with Eligible Direct Deposit or Qualifying Deposits. If you receive another Eligible Direct Deposit or $5,000 in Qualifying Deposits during the current 31-day period, the period will reset, and a new 31-day period will begin from the date the criteria are met. You can view the end date of your current 31-day period, based on your most recent deposit activity, by visiting the APY details page within your account.

SoFi Bank reserves the right to grant a grace period to account holders following a change in Eligible Direct Deposit or Qualifying Deposit activity before adjusting interest rates and APYs. If SoFi Bank grants you a grace period, the dates for such grace period will be reflected on the APY Details page of your account. If SoFi Bank determines that you did not have Eligible Direct Deposit activity or $5,000 in Qualifying Deposits within a rolling 31-day period, or did not pay the SoFi Plus Subscription Fee every 30 days, and, if applicable, the grace period, then you will begin earning the interest rates and APYs earned by members without Eligible Direct Deposit, $5,000 in Qualifying Deposits or SoFi Plus Paid Subscription.

As long as you receive an Eligible Direct Deposit or $5,000 in Qualifying Deposits every 31 calendar days, or pay the SoFi Plus Subscription Fee every 30 calendar days, you will continue earning the interest rates and APYs earned by account holders with Eligible Direct Deposit, $5,000 in Qualifying Deposits or SoFi Plus Paid Subscription. See additional details at http://www.sofi.com/legal/banking-rate-sheet

2 No Account Fees

We do not charge any account, service or maintenance fees for SoFi Checking and Savings. We do charge a transaction fee to process each outgoing wire transfer. SoFi does not charge a fee for incoming wire transfers, however the sending bank may charge a fee. Our fee policy is subject to change at any time. See the SoFi Bank Fee Sheet for details at sofi.com/legal/banking-fees/.

†

Who is eligible for a Direct Deposit Bonus?

How do I earn the Direct Deposit Bonus?

3. You will receive the bonus amount in your SoFi Checking account within 7 business days of completing all requirements listed above. You are only eligible to receive one bonus amount. You must have an open SoFi Checking account in good standing at the time of the bonus payment.

What is an Eligible Direct Deposit?

Not Eligible Deposits that are not from an employer, payroll or benefits provider or government agency and deposits that are non-recurring in nature are not eligible. Examples of deposits that are not eligible include check deposits, peer-to-peer transfers (e.g., transfers from Zelle, PayPal, Venmo, Wise, etc.), merchant transactions (e.g., transactions from PayPal, Stripe, Square, etc.), bank ACH funds transfers, wire transfers from external accounts, and IRS tax refunds. SoFi Bank shall, in its sole discretion, assess your Eligible Direct Deposit activity to determine eligibility and may require additional documentation to complete this verification.

Although we do our best to recognize all Eligible Direct Deposits, a small number of employers, payroll providers, benefits providers, or government agencies do not designate payments as direct deposit. If you have satisfied the Eligible Direct Deposit requirements but have not received a cash bonus in your Checking account, please contact us at 855-456-7634 with the details of your initial Eligible Direct Deposit. After SoFi validates the details of your Eligible Direct Deposit, your Direct Deposit Bonus will be based on the date we received your initial Eligible Direct Deposit.

What else is important to know?

New and existing SoFi members who have never set up direct deposit with SoFi are eligible for the Direct Deposit Bonus. Bonuses are limited to one bonus per SoFi member. In the case of a joint account, direct deposit activity will only be counted towards the primary account holder’s eligibility for the bonus (the primary account holder is the member who opened the joint account first).

1. Set up your first Eligible Direct Deposit. SoFi must receive it on or before 12/31/26.

2. Once SoFi receives and recognizes your first Eligible Direct Deposit, we will add up the Total Eligible Direct Deposits received over the next 25 calendar days. This total will determine the bonus amount.

Total Eligible Direct Deposit

Bonus Amount

Timing

$1.00 - $999.99

$0

To determine your bonus amount, SoFi will add up all your Eligible Direct Deposits received within 25 calendar days of your first Eligible Direct Deposit.

$1,000.00 - $4,999.99

$50

$5,000.00 or more

$300

Eligible: Recurring ACH deposit of regular income to your SoFi Checking or Savings account, including payroll, pension, or government benefit payments (e.g., Social Security), made by your employer, payroll or benefits provider or government agency (“Eligible Direct Deposit”)

•This promotion is available between 12/7/2023 at 12:01AM ET and 12/31/2026 at 11:59PM ET. SoFi reserves the right to modify or end the promotion at any time without notice. The terms of this promotion take precedence over the terms of any prior Direct Deposit promotion.

•SoFi reserves the right to exclude any members from participating in this promotion for any reason, such as suspected fraud, misuse, or suspicious activity.

•SoFi members with Eligible Direct Deposit activity can earn 3.30% annual percentage yield (APY) on savings balances. Interest rates are variable and subject to change at any time. These rates are current as of 12/23/25. There is no minimum balance requirement. Fees may reduce earnings. Additional rates and information can be found at http://www.sofi.com/legal/banking-rate-sheet.

•Bonuses are considered miscellaneous income, and may be reportable to the IRS on Form 1099-MISC (or Form 1042-S, if applicable). SoFi is required to do this reporting in compliance with the applicable federal and state reporting requirements. Recipient is responsible for any applicable federal, state or local taxes associated with receiving the bonus offer; consult with your tax advisor to determine applicable tax consequences.

•This promotion is offered by SoFi Bank, N.A, Member FDIC (“SoFi”)

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

New Study Looks at Student Debt and the Workplace

Employers can play a crucial role in alleviating this burden by offering student loan repayment benefits programs.

Read moreNavigating Marriage and Money

Marriage and Money: Resources and Tools for Your Financial Union

If you’re puzzled by the financial dynamics of marriage, you’re not alone. Countless couples face these challenges, so we’ve crafted a comprehensive guide to help the two of you manage your finances together. Whether you’re in a serious relationship or recently married, we’re here to help guide your financial conversations.

“We need to talk…money.”

Before saying “I do,” — and throughout the years that follow — it’s essential to have some important conversations about money. While the phrase “we need to talk” often carries a serious tone, these discussions are a proactive step toward a successful financial partnership. By addressing key topics like debt, financial goals, and budgeting, you can turn potential challenges into opportunities for growth.

-

Talk #1:

Debt and

credit historyTalk #1: Debt and credit history

Why it’s important:

Understanding each other’s debt and credit history is crucial for avoiding surprises and ensuring you’re both on the same page financially. It helps build trust and prepares you to tackle financial challenges as a team.

Goal of the convo:

The goal is to openly discuss existing debts and credit scores, understand each other’s financial situation, and create a plan for managing and improving your finances jointly.

Questions to ask:

• What types of debt do you have (e.g., student loans, credit cards, mortgages)?

• What is your credit score, and how do you manage your credit? Do you carry a balance or do you pay it off?

• Do you have any outstanding loans or financial obligations?

• How do you handle debt repayment and credit monitoring?

How to prepare:

• Review your own credit report and debt situation before the conversation. Determine if you’re responsible for your spouse’s debt.

• Gather any relevant documents, such as loan statements or credit reports.

• Be ready to discuss how you’ve managed debt in the past and your strategies for the future.

• Approach the conversation with openness and a willingness to collaborate on solutions.

-

Talk #2:

Financial goals and prioritiesTalk #2: Financial goals and priorities

Why it’s important:

Discussing your financial goals and priorities ensures that you and your partner are aligned on what you want to achieve. It helps prevent conflicts and enables you to work effectively together.

Goal of the convo:

The goal is to identify and align on both short-term and long-term financial goals, such as buying a home, saving for retirement, or starting a family. This can help you create a cohesive financial plan.

Questions to ask:

• What are your top financial goals for the next 5-10 years?

• What long-term financial dreams do you have, such as retirement plans or major purchases?

• How do you prioritize these goals (e.g., saving for a home versus investing for retirement)?

• Are there any financial goals you’ve already started working on?

How to prepare:

• Reflect on your own financial goals and priorities before the discussion.

• Consider personal and joint aspirations you’d like to achieve.

• Be ready to discuss how you envision achieving these goals.

• Approach the conversation with a willingness to compromise and align your objectives.

-

Talk #3:

Budgeting and spending habitsTalk #3: Budgeting and spending habits

Why it’s important:

Discussing budgeting and spending habits can prevent conflicts over money from arising and help both partners feel comfortable with how their finances are managed. It creates a unified approach to spending and saving.

Goal of the convo:

The goal is to understand each other’s spending habits, agree on a budgeting strategy, and establish how to effectively manage household expenses.

Questions to ask:

• What are your current spending habits, and how do you manage your money?

• Do you follow a budget, and if so, what does it look like?

• How do you handle discretionary spending versus essential expenses?

• Are there any specific spending areas you think we should adjust or prioritize?

How to prepare:

• Review your own budgeting and spending practices beforehand. Using SoFi’s 50/30/20 monthly budget calculator may help.

• Gather information on your monthly expenses, and think about any changes you might want to make.

• Approach the discussion with an open mind and a willingness to adapt to a joint budget plan.

-

Talk #4:

Savings and emergency fundsTalk #4: Savings and emergency funds

Why it’s important:

Discussing savings, including having an emergency fund, is vital for financial security. It ensures that you both understand how to handle unexpected expenses and have a plan for saving towards future goals.

Goal of the convo:

The goal is to agree on how much to save regularly, establish an emergency fund, and create a strategy for saving for future needs and goals.

Questions to ask:

• How much do you think we should have in our emergency fund?

• What is our target savings amount for each month or year?

• How do you envision dividing savings between an emergency fund and other goals?

• Do we need to adjust our current savings strategies to meet our goals more effectively?

How to prepare:

• Review your current savings and emergency fund status before the conversation.

• Determine your monthly or annual savings capacity and goals. SoFi’s emergency fund calculator can help with this.

• Consider any unexpected expenses you’ve faced in the past and how you managed them.

• Approach the discussion with a plan to set specific savings goals and agree on contribution amounts.

-

Talk #5:

Financial roles and responsibilitiesTalk #5: Financial roles and responsibilities

Why it’s important:

Clarifying financial roles and responsibilities helps prevent misunderstandings so that both partners are on the same page about who handles what. This can lead to a smoother financial management process.

Goal of the convo:

The goal is to define and agree on how to divide financial tasks and responsibilities, such as bill payments, financial planning, and investment management.

Questions to ask:

• How should we divide responsibilities for paying bills and managing expenses?

• Who will handle budgeting, and how will we track our spending?

• Are there specific financial tasks or decisions you prefer to handle individually or together?

• Do we want to have joint bank accounts, separate accounts, or a combination of both?

• How will we make financial decisions and resolve disagreements about money?

How to prepare:

• Reflect on your own strengths and preferences for managing finances.

• Consider the existing financial responsibilities you already handle and how they might be shared.

• Think about how you prefer to make joint financial decisions and address potential conflicts.

• Approach the discussion with a readiness to balance responsibilities and collaborate effectively.

“It’s important to remember that ‘money talks’ are as much about listening as talking. Understanding each other’s values, goals, fears—and just getting on the same page—can help couples literally build their future together.”

Know these finance terms like you know your partner.

Asset allocation

The strategy of dividing investments among different asset classes (e.g. stocks, bonds, etc.) to help manage risk.

Learn more: Asset Allocation by Age: 20s and 30s, 40s and 50s, 60s

Budget

A plan for managing income and expenses to meet financial goals.

Learn more: How to Make a Budget in 5 Steps

Credit score

A numerical representation of your creditworthiness, based on your credit history.

Learn more: How To Check Your Credit Score for Free

Debt-to-income ratio

A measure of how much of your income goes toward paying debts, which is used to assess financial health.

Learn more: Why Your Debt to Income Ratio Matters

Emergency fund

Savings set aside for unexpected expenses or financial emergencies.

Learn more: How to Build an Emergency Fund in 6 Steps

Estate planning

The process of arranging how your assets will be distributed after your death, including wills and trusts.

Learn more: Does Everyone Need an Estate Plan?

Net worth

The total value of your assets minus your liabilities, indicating overall financial health.

Learn more: How to Calculate Your Net Worth

Calculate your way to financial harmony.

Explore these calculators designed to help you and your partner manage your finances effectively and plan for a successful future together.

-

50/30/20 monthly budget calculator

Effortlessly split your income into needs, wants, and savings for balanced budgeting.

-

Emergency fund calculator

Determine how much you should save to cover unexpected expenses and maintain financial security.

-

Savings account calculator

Estimate how much your money can grow in a savings account by factoring in APY, contributions, and time.

Using the free calculators is for informational purposes only.

Say “we do” to a joint bank account with SoFi.

Opening a joint bank account with SoFi is a great way to streamline your finances and work towards shared goals – plus, get access to: