Personal Loans

Low rates.

No fees

required.

Personal loans

made

easy online.

View your rate

Checking your rate will not affect your credit score.

Get funds as soon as the same day you sign‡

with our quick, easy application process.

View your rate

Checking your rate will not affect your credit score.

✅

19,419

SoFi Personal Loans were funded this week.*

*Number of members as of 02/07/2026

-

Low monthly payments

Save big by consolidating high-rate debt to one fixed payment.

-

Get $5K to $100K

Get funds as soon as the same day you sign‡ or we can pay off your credit card directly.

-

Direct Pay

We’ll pay your credit card lender so you don’t have to.

-

See rates now

No impact to your credit score.† No commitment.

We’ve helped members pay off over $33B in debt with a SoFi Personal Loan.

The savings and experiences of members herein may not be representative of the experiences of all members.

Savings are not guaranteed and will vary based on your unique situation and other factors.

We’ve helped members like these pay off over $33B in debt with a SoFi Personal Loan.

The savings and experiences of members herein may not be representative of the experiences of all members. Savings are not guaranteed and will vary, based on your unique situation and other factors.

Received a mailer from

us?

(window.sofiUtils.triggerModalById(‘dm-confirmation-offer-landing’, this))}

>

Enter confirmation #

Online personal loan options for what you

need—and when you need them.

Combine your debt into one payment and you could reduce your monthly payments. Learn more.

}

heading=”Credit Card Consolidation”

topLeftImg={{

alt: ‘Credit Card Visual Effect’,

src: ‘https://d32ijn7u0aqfv4.cloudfront.net/wp/wp-content/uploads/raw/elipse-dot-pattern_desktop%402x.webp’,

srcSet: ‘https://d32ijn7u0aqfv4.cloudfront.net/wp/wp-content/uploads/raw/elipse-dot-pattern_mobile%402x.webp 104w, https://d32ijn7u0aqfv4.cloudfront.net/wp/wp-content/uploads/raw/elipse-dot-pattern_desktop%402x.webp 274w’

}}

topRightPillClassName=””

topRightPillText=”1 / 5″

/>

Pay for home repairs or renovations without using your home as collateral. Learn more.

}

heading=”Home Improvements”

topLeftImg={{

alt: ”,

src: ”,

srcSet: ”

}}

topRightPillClassName=””

topRightPillText=”2 / 5″

/>

Cover pregnancy, adoption, IVF or surrogacy costs with manageable monthly payments. Learn more.

}

heading=”IVF Loans”

topLeftImg={{

alt: ”,

src: ”,

srcSet: ”

}}

topRightPillClassName=””

topRightPillText=”3 / 5″

/>

With low fixed rates, steady monthly payments, and no fees required, our personal loan travels well. Learn more.

}

heading=”Travel and Vacation”

topLeftImg={{

alt: ‘Car Visual Effect’,

src: ‘https://d32ijn7u0aqfv4.cloudfront.net/wp/wp-content/uploads/raw/ring-circle_desktop%402x.webp’,

srcSet: ‘https://d32ijn7u0aqfv4.cloudfront.net/wp/wp-content/uploads/raw/ring-circle_mobile%402x.webp 127w, https://d32ijn7u0aqfv4.cloudfront.net/wp/wp-content/uploads/raw/ring-circle_desktop%402x.webp 254w’

}}

topRightPillClassName=”border-color-white”

topRightPillText=”4 / 5″

/>

From engagement ring to honeymoon—you could save money compared to a high-rate credit card. Learn more.

}

heading=”Weddings”

topLeftImg={{

alt: ”,

src: ”,

srcSet: ”

}}

topRightPillClassName=””

topRightPillText=”5 / 5″

/>

Why apply online with SoFi?

-

Low rates

Low fixed rates that won’t change over time, protecting you from rising interest rates.

-

No fees required

That means no origination fees required, no prepayment penalty fees and no late fees whatsoever.

-

Same-day funding‡

Your funds could be available as quickly as the same day your loan is approved.

Expand to see how SoFi stands out from the rest.

} />}

expand={} />}

/>

✓‘,

‘✓‘,

‘✓‘,

]}

competitorCards={[

[

‘Best Egg’,

”,

”,

”,

],

[

‘Upstart’,

”,

”,

”,

],

[

‘LendingClub’,

”,

”,

”,

],

]}

/>

How do loans work? A

loan is a borrowed sum

of money that is paid

back with interest in

installments. With SoFi,

you can borrow

between $5,000 and

$100,000 for various

expenditures such as

home improvements,

credit card

consolidation, medical

bills, IVF, or even

unexpected life events

that call for emergency

funds. You can also

check your rate in

minutes without

affecting your credit

score†, and get your

funds as soon as the

same day you’re

approved.‡

Learn more

{/* Horizon */}

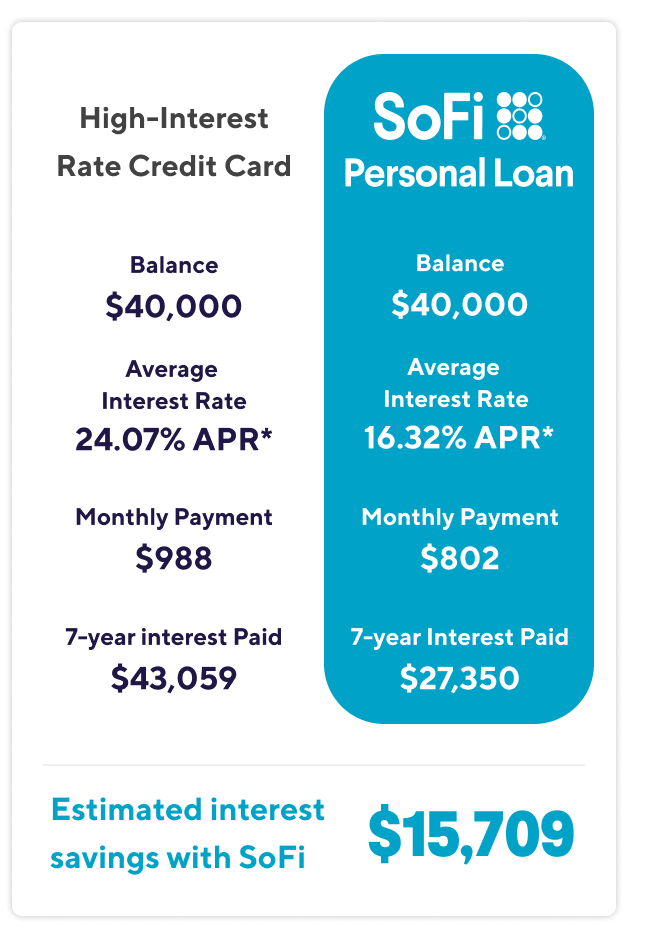

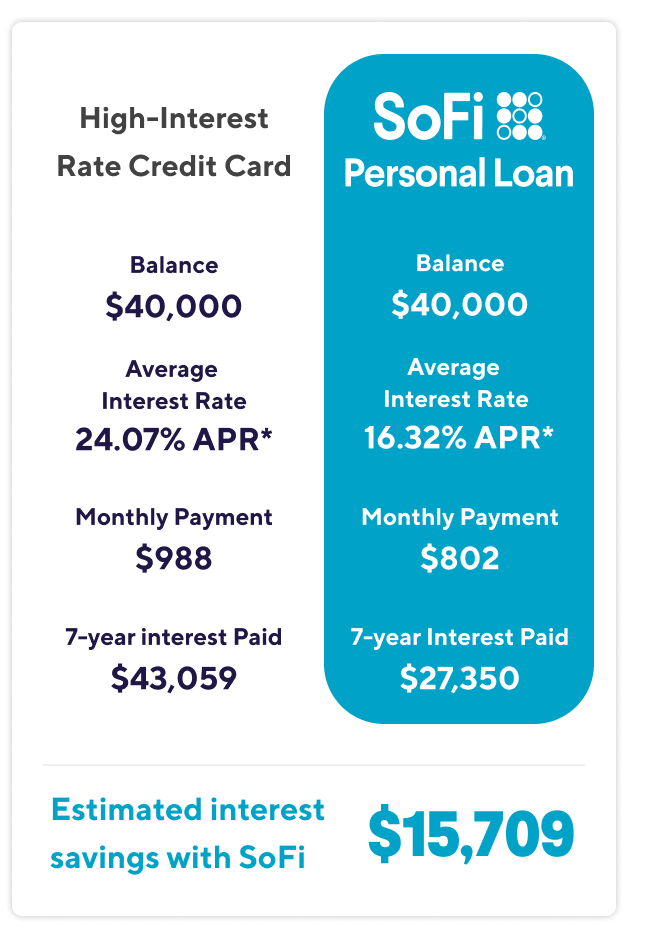

Save thousands with a low-interest personal loan.

With credit card rates on the rise, see how you could save thousands on interest by consolidating

existing debt into a low fixed monthly payment.

View your rate

Checking won’t affect your credit score..

Example chart shows calculations based on a 7 year SoFi Personal Loan with a fixed rate of 16.32% APR, which is the median funded APR for SoFi Personal Loan borrowers who took out a loan with a 7 year term” from January 1, 2024 – January 1, 2025. Lowest rates are reserved for the most qualified borrowers. The ‘High-Interest Rate Credit-Card’ APR shown is the average credit card APR reported by Wallethub for Q4 2024 under their Good Credit category. The savings estimate also assumes that the borrower doesn’t take out any additional credit card debt during the same period. Both calculations assume 84 total monthly payments, no origination fee option selected and no pre-payment amounts.

Get a more precise estimate of how a SoFi Personal Loan could save you money.

Personal Loan Calculator

}

headingText=”Run the numbers with our personal loan calculator.”

imgAlt=”Personal loans calculator illustration”

imgSrc=”https://d32ijn7u0aqfv4.cloudfront.net/wp/wp-content/uploads/raw/pl-calculator.webp”

/>

Easily apply in 3 steps.

-

Prequalify online

Find the rate that you qualify for in minutes with no commitment.

-

Choose your terms

Choose from 2-7 year terms and finish your application online.

-

Receive your funds

Sign your documents and funds will be wired to your account—as quickly as the same day.‡

View your rate

Checking your rate will not affect your credit score.

Learn More.

We have over 500 articles, budgeting tools, and guides—all with the goal of helping you Get Your Money Right®.

Visit SoFi Learn

FAQs

What can I use a personal loan for?

Many borrowers use this option to consolidate high-interest credit card balances. It can also help cover major life expenses such as home improvements, weddings, unexpected medical bills, moving costs, or funeral expenses.

What is a personal loan?

This is an unsecured borrowing option offered by banks, credit unions, and online lenders, typically ranging from $5,000 to $100,000. Unlike financing that restricts how funds are used, this option offers flexibility to cover large expenses or combine high-interest debt into a single payment with a low fixed rate.

Should I take out a personal loan to pay off my credit cards?

This type of financing is commonly used for debt consolidation. In this scenario, the funds are used to pay down outstanding credit card balances. If the new rate is lower, this approach may help reduce interest costs or make monthly payments more manageable. As with any financial decision, it’s important to weigh the potential pros and cons.

How can I calculate my expected monthly payments for a personal loan?

The monthly payment for a personal loan is determined by a variety of factors, including your interest rate, loan amount, loan term, and more. Our Personal Loan Calculator can help you figure out your monthly payments and decide whether applying for a personal loan is the right move for you.

Do down payments apply?

No. Because this option is unsecured, a down payment is not required, unlike certain secured loans such as mortgages.

What credit score is needed to qualify?

Applying online or at your financial institution will require meeting your lender’s criteria. Since most personal loans are unsecured (meaning they don’t require collateral) this criteria assures the lender that you can repay the loan. Lenders will typically evaluate your credit score, income, and debt-to-income ratio, among other factors. Lower credit scores could affect your eligibility, terms or rate for a SoFi Personal Loan.

Are SoFi loans fixed interest rate or variable interest rate loans?

SoFi offers fixed-rate options, meaning your monthly payment stays the same throughout the repayment period. This can be appealing if you prefer predictable payments or want to avoid the risk of rate changes over time.

Does SoFi require collateral?

No. SoFi offers unsecured options, which means you do not need to provide assets as collateral.

How much can I borrow?

The amount you may qualify for depends on several factors, including lender policies and your credit profile. With SoFi, eligible applicants may borrow between $5,000 and $100,000.

Will applying affect my credit?

Checking your rate with SoFi involves a soft credit pull, which does not impact your credit score. If you move forward with an application, a hard credit inquiry will be required and may affect your score.

How long do I need to wait before reapplying after a decline?

If your application is declined, you’ll need to wait at least 30 days before reapplying with the same borrower(s). You may reapply sooner by adding a co-borrower, switching from a joint application to a single borrower, or applying with a different co-borrower.

See all FAQs

View your rate now.

Your time matters—so we made it fast to get started.

View your rate

BTW it’s a soft inquiry, so it won’t affect your credit score.†

† To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score. However, if you choose a product and continue your application, we will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull and may affect your credit.

Terms and conditions apply. SOFI RESERVES THE RIGHT TO MODIFY OR DISCONTINUE PRODUCTS AND BENEFITS AT ANY TIME WITHOUT NOTICE. To qualify, a borrower must be a U.S. citizen or other eligible status, be residing in the U.S., and meet SoFi’s underwriting requirements. Not all borrowers receive the lowest rate. Lowest rates reserved for the most creditworthy borrowers. If approved, your actual rate will be within the range of rates at the time of application and will depend on a variety of factors, including term of loan, evaluation of your creditworthiness, income, and other factors. If SoFi is unable to offer you a loan but matches you for a loan with a participating bank, then your rate may be outside the range of rates listed above. Rates and Terms are subject to change at any time without notice. SoFi Personal Loans can be used for any lawful personal, family, or household purposes and may not be used for post-secondary education expenses. Minimum loan amount is $5,000. The average of SoFi Personal Loans funded in 2023 was around $33K. Information current as of 2/21/24. SoFi Personal Loans originated by SoFi Bank, N.A. Member FDIC. NMLS #696891 (www.nmlsconsumeraccess.org). See SoFi.com/legal for state-specific license details. See SoFi.com/eligibility for details and state restrictions.

Fixed rates from 7.74% APR to 35.49% APR reflect the 0.25% autopay interest rate discount and a 0.25% direct deposit interest rate discount. SoFi rate ranges are current as of 2/8/26 and are subject to change without notice. The average of SoFi Personal Loans funded in 2023 was around $33K. Not all applicants qualify for the lowest rate. Lowest rates reserved for the most creditworthy borrowers. Your actual rate will be within the range of rates listed and will depend on the term you select, evaluation of your creditworthiness, income, and a variety of other factors.

Loan amounts range from $5,000– $100,000. The APR is the cost of credit as a yearly rate and reflects both your interest rate and an origination fee of 0%-7%, which will be deducted from any loan proceeds you receive.

5 Autopay: The SoFi 0.25%autopay interest rate reduction requires you to agree to make monthly principal and interest payments by an automatic monthly deduction from a savings or checking account. The benefit will discontinue and be lost for periods in which you do not pay by automatic deduction from a savings or checking account. Autopay is not required to receive a loan from SoFi.

7 Direct Deposit Discount: To be eligible to potentially receive an additional (0.25%) interest rate reduction for setting up direct deposit with a SoFi Checking and Savings account offered by SoFi Bank, N.A. or eligible cash management account offered by SoFi Securities, LLC (“Direct Deposit Account”), you must have an open Direct Deposit Account within 30 days of the funding of your Loan. Once eligible, you will receive this discount during periods in which you have enabled payroll direct deposits of at least $1,000/month to a Direct Deposit Account in accordance with SoFi’s reasonable procedures and requirements to be determined at SoFi’s sole discretion. This discount will be lost during periods in which SoFi determines you have turned off direct deposits to your Direct Deposit Account. You are not required to enroll in direct deposits to receive a Loan.

§ Awards or rankings are not indicative of future success or results. Neither SoFi Bank, N.A. nor its employees paid a fee in exchange for ratings. Awards and ratings are independently determined and awarded by their respective publications.

‡ Same-Day Personal Loan Funding: Same Day Funding means that most borrowers receive funds the same day when loan is approved and the loan agreement is signed by 5:30 PM ET on a business day. SoFi does not guarantee this, and delays may occur outside of our control, such as if inaccurate information is submitted, the receiving bank declines the transfer. Your bank may have rules on when the funds become available. Does not include personal loans originated with a SoFi partner bank.

^ Direct Pay: Terms and conditions apply. Offer good for new personal loan customers with credit cards in their name only and subject to lender approval. To receive the offer, you must: (1) register and/or apply through this landing page; (2) complete a loan application with SoFi within 90 days of your application submit date; (3) meet SoFi’s underwriting criteria; (4) apply 50% or more of your loan proceeds directly to your creditors. Once conditions are met and the loan has been disbursed, the interest rate shown in the Final Disclosure Statement will include an additional 0.25% rate discount. Offer good for new customers only. Cannot be combined with other rate discounts with the exception of the 0.25% autopay rate discount, 0.25% direct deposit discount. SoFi reserves the right to change or terminate the Rate Discount Program to unenrolled participants at any time with or without notice. It takes about 3 business days for your credit card lender to receive payment after your loan is signed. You will be responsible for making all required payments to avoid credit card fees.

Excellent/4.1/5 star rating based on 10,538 reviews as of February 2, 2026. © 2025 Trustpilot, Inc. All rights reserved.

How long do I need to wait to reapply after my Personal Loan application has been declined?

You will need to wait at least 30 days before re-applying for a Personal Loan with the same borrower(s). You are welcome to retry at any time with a co-borrower, if the previous application was as a single borrower. If you initially applied with a co-borrower, you can retry as a single borrower or with a different co-borrower.

Returning Borrower Pricing: Former SoFi Personal Loan customers who have paid their previous personal loan in full may be eligible for Returning Borrower special pricing on another personal loan if they meet the eligibility criteria and any other applicable terms and conditions. The pricing special does not apply to new Personal Loan customers or existing Personal Loan customers who are currently in repayment. To receive this offer you must (1) apply for a new personal loan and submit your application; (2) complete a loan application with SoFi within 90 days of your application submit date; (3) and meet SoFi’s underwriting criteria. A 0.50% interest rate reduction will automatically be reflected in the rate offered at time of application. SoFi reserves the right to discontinue or modify the Returning Borrower Rate Discount at any time and without notice. Such changes or modifications will only apply to applications begun after the effective date of the change.

Read more