Small Business Loans in Colorado

Learn All About Small Business Loans in Colorado

Colorado is home to more than 730,000 small businesses, which account for 99.5% of all enterprises in the state. From the booming tech hubs along the Front Range to the outdoor recreation industries in the high country, these companies employ nearly half of the state’s workforce.

Whether you’re launching a startup in Denver or expanding a family-owned business in Grand Junction, finding small business loans in Colorado is a key step. Here’s what you need to know about securing financing for your company.

Key Points

• The Colorado Startup Loan Fund provides capital to mission-based lenders to support entrepreneurs who may not qualify for traditional bank financing.

• The Cash Collateral Support (CCS) program offers support for businesses with collateral shortfalls.

• Business lines of credit may be useful for outdoor recreation and seasonal tourism businesses that need to bridge cash flow gaps during shoulder seasons.

• Advanced Industry Accelerator Grants are a potential funding source for Colorado companies innovating in areas such as aerospace, bioscience, and technology.

• Having a strong credit score and a thoughtful, realistic business plan may help you get your funding application approved.

Popular Types of Small Business Loans in Colorado

Entrepreneurs in the Centennial State have access to a diverse array of financing types tailored to Colorado’s unique mix of urban innovation and rural resilience. The following sections outline the most common funding options available to business owners across Colorado.

Colorado Small Business Loan Programs

Colorado’s

Office of Economic Development and International Trade (OEDIT) works with other agencies to actively support economic growth through a wide variety of specialized lending initiatives. A few of the most notable include:

• The Colorado Startup Loan Fund provides capital to nonprofit lenders, allowing them to offer smaller startup loans with flexible terms to newer businesses.

• The Cash Collateral Support (CCS) program, managed by the Colorado Housing and Finance Authority (CHFA), helps small businesses secure loans by providing cash deposits to lenders when the borrower lacks sufficient collateral.

• The Colorado Credit Reserve similarly assists businesses that might have difficulty accessing conventional loans by establishing loan loss reserve accounts with lenders to provide them with additional security.

• The Venture Capital Authority helps startups, especially those in expanding industries and/or underserved communities, get venture capital funding.Though it’s an investment, not a loan, this capital can be invaluable for young companies.

Term Loans

A term loan provides a lump sum of capital that is repaid over a specific period in regular, often fixed payments. This structure makes these small business loans an excellent choice for financing large, one-time investments where costs are predictable.

For example, a craft brewery in Fort Collins might use a term loan to purchase new fermentation tanks and expand its taproom.

Business Lines of Credit

Unlike a term loan, a business line of credit gives you access to a revolving pool of funds that you can draw from as you need. Typically, you pay interest only on the money you actually use, and as you repay the balance, your credit becomes available again.

A ski shop in Vail might use a line of credit to stock up if it finds it needs winter gear before the busy tourist season begins.

Equipment Financing

Equipment financing refers to a loan designed specifically to help you purchase physical assets, such as machinery, vehicles, or technology. Because the equipment itself serves as collateral, these loans often come with more accommodating approval standards.

A tech company in Boulder could use an equipment loan to finance specialized servers, while a construction firm in Colorado Springs might use one to acquire a new loader.

Small Business Administration (SBA) Loans

SBA loans are issued by private lenders but are partially guaranteed by the U.S. Small Business Administration. This federal backing can help reduce your lender’s risk, which can lead to lower down payment requirements and longer repayment terms. These Colorado business loans are widely available through approved banks and credit unions.

The most common types of SBA loans are the SBA 7(a) and 504 loans. The 7(a) program is highly versatile, suitable for financing your company’s working capital, refinancing debt, or purchasing supplies. The 504 loan is used for major fixed assets, such as purchasing commercial real estate or heavy equipment that promotes business growth and job creation. As a smaller loan, microloans (which are available up to $50,000) may be especially useful for new business owners who don’t yet need large amounts of capital.

Using an SBA loan calculator can help you estimate what your monthly payments would be for an SBA loan, as well as what you’d pay in interest over the lifespan of the loan.

Recommended: Small Business Financing Guide

How to Apply for a Small Business Loan in Colorado

When you apply for Colorado small business loans, potential lenders will want a clear picture of your company’s financial health and a well-thought-out plan for how those funds will be used. By organizing your documents in advance, you can present a professional application that stands out during the underwriting process. Read on to find out more about how to apply for a small business loan, step by step.

Define Your Loan Purpose and Amount

Before contacting lenders, you’ll want to have a precise understanding of your funding needs. You should be able to articulate exactly how much money you need and how it will generate a return. A specific proposal — such as “$50,000 to upgrade our roasting equipment” — demonstrates strategic thinking and financial discipline to your potential lenders.

Know Your Credit Score

Your credit profile is one of the first things a lender will typically review. Traditional banks often want to see a personal credit score for a business loan of 680 or higher, though online lenders may be willing to look at lower scores. It’s smart to check your reports before submitting a loan application to identify any errors and understand where you stand.

Gather Your Key Documents

Providing your lender with a complete application package can speed up the review process and signal reliability. This typically includes not only the application, but also supporting documents. While requirements vary by lender, you should generally be prepared to show the following:

• Credit report

• Income statement

• Bank statements

• Budget

• Income tax returns (both business and personal)

• Business plan

• Collateral valuation and supporting documents (which may include titles, deeds, or invoices)

Compare Lenders and Loan Offers

Different lenders will likely make different offers, so shopping around can go a long way toward helping you find the financing that best fits your needs. It can be a good idea to compare offers from multiple sources, including local community banks, large national institutions, and online lenders.

As you’re evaluating proposals, a business loan calculator can help you estimate what your payments will be. You can also look closely at the Annual Percentage Rate (APR) to better understand the true cost of the loan.

Submit Your Application and Await Approval

Once you’ve filled out your application and gathered any necessary documents, you’re ready to submit your application. Timeframes for your answer can vary by lender, but you’ll usually hear fairly quickly from many lenders, but you may have to wait a little longer to hear about an SBA loan.

Tips for Improving Your Loan Approval Chances

Lenders are generally looking for evidence of your company’s stability and ability to repay. Presenting a strong, low-risk profile may help to win their confidence. Here are a few steps you can take:

• Ensure that your business plan is realistic and includes detailed financial projections.

• Work on improving your personal and business credit scores by paying down existing balances and making all payments on time.

• If you have it available, offering collateral can also strengthen your application for certain Colorado business loans.

Other Funding Options for Colorado Small Businesses

If a traditional loan isn’t the right fit, there are other ways you may be able to fund your business. Colorado’s entrepreneurial ecosystem offers several alternative paths for acquiring capital. Depending on your situation, one of these options may align better with your specific stage of growth or industry.

Small business grants are a highly sought-after option because they don’t require repayment. The

Advanced Industries Accelerator Grant program awards funding to companies in sectors like aerospace, energy, and bioscience to foster innovation.

Crowdfunding is another viable route, allowing you to raise smaller amounts of capital from a broad base of supporters online.

Additional Business Resources in Colorado

Success in business often requires guidance and community as well as capital. Fortunately, Colorado has a robust network of resources designed to help small business owners navigate challenges.

The

Colorado Small Business Development Center (SBDC) can be a useful resource for business owners, offering no-cost confidential advising at 14 locations across the state.

For mentorship, local SCORE (Service Corps of Retired Executives) chapters connect entrepreneurs with experienced business leaders who volunteer their time. Additionally, the

Minority Business Office of Colorado provides specialized assistance to minority, women, and veteran-owned enterprises. Engaging with your local Chamber of Commerce can also provide valuable networking opportunities.

The Takeaway

Securing a Colorado small business loan can be the decisive factor that allows your company to expand. While the process involves careful planning, it is generally an achievable step for most focused entrepreneurs. By defining your goals, preparing your application carefully, and utilizing state resources, you should be able to find the right financing solution for your company.

If you’re seeking financing for your business, SoFi is here to support you. On SoFi’s marketplace, you can shop and compare financing options for your business in minutes.

(without impacting your credit score)†

FAQ

How do I get a small business loan in Colorado?

Start by defining your funding needs and checking your credit scores. Gather essential documents like your business plan, tax returns, and bank statements. Finally, compare offers from various lenders to find the best terms among your potential Colorado small business loans.

Can I get a startup business loan with no money?

This may be challenging, as most lenders require an owner’s investment. However, some SBA microloans are designed for startups with lower capital requirements. Another option is to research business grants, which provide funding that does not need to be repaid. Applying for your financing through a small business loan marketplace may help by narrowing down your search to lenders willing to work with startups.

How hard is it to get a small business loan in Colorado?

The difficulty depends on factors such as your business’s financial health, time in operation, and credit history. Traditional bank loans can be competitive and have strict requirements. Online lenders often have more flexible requirements, making them more accessible options for many Colorado businesses.

What is the easiest type of business loan to get approved for?

Loans secured by collateral, such as equipment financing, are generally easier to obtain because having the asset as security lowers the lender’s risk. Short-term loans and invoice financing from online lenders also typically have less stringent requirements.

What credit score do I need for a small business loan?

Requirements vary, but for traditional bank and SBA loans, a personal credit score of 680 or higher is often preferred. Some online lenders may approve applicants with scores in the low 600s. Higher scores generally lead to better approval odds and lower interest rates.

What can I use a Colorado small business loan for?

You can use a small business loan for almost any legitimate business purpose. Common uses include purchasing inventory, buying equipment, funding marketing campaigns, or refinancing debt.

Are there any small business grants available in Colorado?

Yes, grants are available from federal, state, and private sources. The Colorado Office of Economic Development and International Trade (OEDIT) can be an excellent resource for finding state-level opportunities like the Advanced Industries Accelerator Grant. You can also search national databases like Grants.gov for federal programs relevant to your industry.

SoFi's marketplace is owned and operated by SoFi Lending Corp.

Advertising Disclosures: The preliminary options presented on this site are from lenders and providers that pay SoFi compensation for marketing their products and services. This affects whether a product or service is presented on this site. SoFi does not include all products and services in the market. All rates, terms, and conditions vary by provider. See SoFi Lending Corp. licensing information below.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

SoFi receives compensation in the event you obtain a loan, financial product, or service through SoFi’s marketplace. This webpage is owned and operated by SoFi Lending Corp., licensed by the Department of Financial Protection and Innovation under the California Financing Law, license number 6054612; NMLS number 1121636. ((www.nmlsconsumeraccess.org)). This page is NOT operated by SoFi Bank. Loans, financial products, and services may not be available in all states. All loan terms, including interest rate, and Annual Percentage Rate (APR), and monthly payments shown through SoFi’s marketplace are from providers and are estimates based upon the limited information you provided and are for informational purposes only. All rates, fees, and terms are presented without guarantee and are subject to change pursuant to each provider’s discretion. The actual loan terms you receive, including APR, will depend on the provider you select, their underwriting criteria, and your personal financial factors. The loan terms and rates presented are provided by the providers and not by SoFi Lending Corp. Please review each provider’s Terms and Conditions for additional details.

*Small Business Loans: Reference to “same day funding” or “funding within 24 hours” describes a general capability of many lenders you can reach through SoFi’s marketplace. Funding or funding timing is not guaranteed. Your experience with any lender will vary based on requirements of the lender and the loan you apply for. To determine the timing of funds availability, you must inquire directly with any lender. In addition, your access to any funds from a loan may be dependent on your bank’s ability to clear a transfer and make funds available.

†Credit score impact: To check the options, terms, and/or rates you may qualify for, SoFi and/or its network providers will conduct a soft credit pull that will not affect your credit score. However, if you choose a product and continue your application, the provider(s) you choose will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull and may affect your credit. Rates may not be available from all providers.

©2025 SoFi Lending Corp. All rights reserved.

SOSMB-Q425-053

More Small Business Financing Resources

Business loans don’t have to be complicated. Get clear answers on applications, learn what providers really look for, and understand popular loan options.

Search for small business funding in minutes.

Your time matters. So we’re making business loans as easy as possible by helping you find small business funding fast.

(without impacting your credit score)†

Small Business Loans in New Mexico

Small Business Loans in New Mexico

There are more than 172,000 small businesses that call New Mexico home. Together, they account for around 99% of all enterprises in the state. From the vibrant art markets of Santa Fe to the oil-rich Permian Basin and the agricultural valleys of the Rio Grande, these companies are the backbone of the local economy.

Whether you’re launching a film production service in Albuquerque or expanding a chile farm in Hatch, finding small business loans in New Mexico can be a key step in building your company. Here’s what you should know about securing financing.

Key Points

• The New Mexico Finance Authority (NMFA) manages the Smart Money Loan Participation Program, purchasing portions of bank loans to help lower interest rates for underserved and rural borrowers.

• The New Mexico Collateral Assistance Program (CAP) 2.0 pledges cash to cover collateral shortfalls, with a special focus on industries like outdoor recreation, film, and sustainable agriculture.

• The Loan Fund, a nonprofit organization certified as a Community Development Financial Institution (CDFI), provides small business loans up to $350,000 to entrepreneurs who may find it difficult to qualify for traditional bank credit.

• The Women’s Economic Self-Sufficiency Team (WESST) offers specialized microloans and training to women- and minority-owned businesses that need smaller amounts of capital.

• Nonprofit Elevated Lending Certified Development Company (ELCDC) is a key partner for SBA 504 loans, helping businesses finance major real estate and heavy equipment purchases.

Popular Types of Small Business Loans in New Mexico

Entrepreneurs in the Land of Enchantment may benefit from a financial ecosystem that blends federal support with robust non-profit lending networks. The following sections describe the most common funding options available to business owners across New Mexico.

New Mexico Small Business Loan Programs

The state encourages economic growth through the

New Mexico Economic Development Department (EDD) and the NMFA. They administer initiatives like the

Collateral Assistance Program, which helps businesses secure financing even if they lack sufficient assets, and the Smart Money Loan Participation Program, which allows the state to purchase up to 49% of a loan, reducing the risk for local banks and encouraging them to lend to smaller and rural businesses.

There are also nonprofit programs that can be helpful. Entrepreneurs who may have difficulty qualifying for traditional loans can try the Loan Fund, a nonprofit Community Development Financial Institution (CDFI), which provides loans up to $350,000. Elevated Lending Certified Development Company (ELCDC) helps companies interested in SBA 504 loans. And the Women’s Economic Self-Sufficiency Team (WESST) makes specialized microloans and training available to businesses owned by women or minorities.

Term Loans

A term loan provides a small business with an upfront lump sum of capital. The business then repays the principal, along with interest, which is usually charged at a fixed rate, in regular payments over a specific period of time (the term). Since the funds come all at once, this kind of loan can be especially well-suited to funding large one-time investments. For example, a brewery in Las Cruces might use a term loan to expand its taproom.

Recommended: Small Business Loans

Business Lines of Credit

Unlike a term loan, a business line of credit can provide access to a pool of funds that you can draw from whenever you need to, up to a limit predetermined by your lender. Typically, you’ll pay interest only on the money you actually withdraw, and as you repay the balance, you’ll replenish the pool of funds so the money becomes available for you to withdraw again.

Lines of credit can be helpful for businesses that have seasonal lulls or uneven cash flow. A gift shop in Taos, for example, could use a line of credit to purchase inventory ahead of the summer tourist rush.

Equipment Financing

If your company needs a specific physical asset, like machinery, vehicles, or technology, you might want to think about applying for equipment financing. An oil field service company in Hobbs could use an equipment financing loan to acquire a new drilling rig, for instance, while a rancher near Roswell might use one to purchase a new cattle trailer.

Because the equipment itself acts as collateral for the loan, reducing the lender’s risk, equipment financing loans tend to be easier to obtain than unsecured loans. Additionally, they often come with more favorable terms.

Small Business Administration (SBA) Loans

Small businesses can obtain SBA loans from approved private lenders, but these lending staples are partially guaranteed by the U.S. Small Business Administration. This federal backing generally lowers risk for the lender, which may permit lower down payments and longer repayment terms. If you qualify, these New Mexico business loans are available through many banks and credit unions.

Below are the types of SBA loans that may be the most useful for small businesses.

• The SBA 7(a) loan is extremely flexible: Amounts range from $500 to $5 million. It’s suitable for covering working capital, refinancing debt, or purchasing supplies.

• The SBA 504 loan is specifically intended for companies to use to acquire major fixed assets, such as commercial real estate or heavy equipment. The maximum amount is between $5 million and $5.5 million.

• The SBA Microloan is meant to help with short-term needs and can be useful to companies that need startup loans. You can borrow up to $50,000 and the maximum repayment term is seven years.

An SBA loan calculator can help you estimate what your loan costs might be for different kinds of SBA funding.

How to Apply for a Small Business Loan in New Mexico

Applying for a New Mexico small business loan can require preparation and attention to detail. You’ll need to show lenders a clear picture of your company’s robust financial health and a well-thought-out plan for how you would use their funds.

Here’s a step-by-step breakdown of how to apply for a small business loan in New Mexico.

Define Your Loan Purpose and Amount

Before you start contacting lenders, it may be a good idea to have a precise understanding of your funding needs and goals. You should be able to articulate exactly how much money your business requires and how it will generate a return.

A specific proposal, such as “$50,000 to install solar panels to improve energy efficiency,” demonstrates strategic thinking and financial planning.

Know Your Credit Score

Prospective lenders may pay particular attention to your credit profile when reviewing your New Mexico business loan application, likely scrutinizing your personal credit scores: Traditional banks often require a credit score for a business loan in the range of 680 or higher. Other kinds of lenders, such as online banks, may be willing to consider slightly lower scores.

Because your scores are so important, it can be a practical idea to review your credit reports before you apply so that you can spot any inaccuracies and have them corrected. It can also help you be sure you fully understand your financial situation before you submit your application for a New Mexico small business loan.

Gather Your Key Documents

Providing a potential lender with a loan application package that’s organized and complete may speed up the review process and demonstrate to a potential lender that you’re reliable, efficient, and motivated. While requirements vary by lender, you should generally be prepared to provide the following:

• Credit report

• Income statement

• Bank statements

• Budget

• Income tax returns (both business and personal)

• Business plan

• Collateral valuation and supporting documents (which may include titles, deeds, or invoices)

Compare Lenders and Loan Offers

When you’re considering New Mexico small business loans, it could be helpful to shop around to find the funding that best suits your needs. That’s because different banks may offer very different options on the same products. It may also be a good idea to compare offers from multiple kinds of sources, including small local banks, large national institutions, and online lenders.

As you evaluate financing proposals, it can be helpful to use a business loan calculator to estimate the monthly payments for different options. It can also be smart to look closely at the Annual Percentage Rate (APR) of each loan to understand its true cost.

Submit Your Application and Await Approval

After you’ve filled out the application form and have your supporting documentation organized, you should be ready to submit the application package. Once that’s done, you’ll have to wait for the lender’s response. This can take as little as two days in some cases, but may require several weeks in others.

Tips for Improving Your Loan Approval Chances

Lenders typically want to see evidence of your business’s stability as well as its ability to repay the loan. Taking steps to strengthen your business’s financial profile before you apply may help you increase your chances of securing a loan. Here are some strategies to consider trying:

• Make sure you have a realistic business plan with detailed financial projections.

• Work to build your business and personal credit scores by paying down your current balances and making timely payments.

• If you have collateral available, consider offering it as security to potentially bolster your application’s chance for approval with certain New Mexico business loans.

Recommended: Small Business Financing Guide

Other Funding Options for New Mexico Small Businesses

If a traditional loan isn’t a good fit for your company right now, there may be other ways to fund your business. New Mexico’s entrepreneurial ecosystem offers several alternative paths to capital. One or more of these options could align better with your company’s specific stage of growth or industry.

Small business grants are highly sought after because the funds don’t have to be repaid, and grants are available in New Mexico. The

Job Training Incentive Program (JTIP) offers to reimburse part of the cost of eligible workforce training, while the Women’s Economic Self-Sufficiency Team (WESST) helps entrepreneurs connect with various grant opportunities. National databases like

Grants.gov can also be a source for federal programs relevant to your industry.

Crowdfunding may be another viable route. Crowdfunding platforms allow you to raise smaller amounts of capital online from a broad base of supporters.

Additional Business Resources in New Mexico

Business success often requires more than just capital. Typically, it also takes guidance and help from a supportive community. Fortunately, New Mexico has a healthy network of resources designed to help small business owners navigate their challenges. The

New Mexico Small Business Development Center (NMSBDC) is a major resource, offering no-cost advising and low- or no-cost training at locations statewide.

For mentorship, local SCORE chapters can connect you with experienced business leaders who volunteer their time. Additionally, nonprofits The Loan Fund and DreamSpring both provide specialized consulting alongside their lending products. Engaging with your local Chamber of Commerce can also provide valuable networking opportunities.

The Takeaway

Securing a New Mexico small business loan can be an important factor that allows your company to expand and prosper. The process can seem daunting, but by defining your goals and utilizing state resources, you should be able to find the right financing solution for your company.

If you’re seeking financing for your business, SoFi is here to support you. On SoFi’s marketplace, you can shop and compare financing options for your business in minutes.

(without impacting your credit score)†

FAQ

How do I get a small business loan in New Mexico?

To apply for a New Mexico business loan, you can begin by defining what you need the funding for and checking your credit scores. Next, gather essential documents like your business plan, tax returns, and bank statements to help you complete your application for submission. Finally, compare offers from various lenders to find the best terms available to you for your New Mexico small business loan.

Can I get a startup business loan with no money?

Obtaining a startup business loan with no money can be challenging, since most lenders require an owner’s investment. However, some SBA microloans are designed for startups and may be more lenient on approval status. Another option is to research business grants, which provide funding that doesn’t have to be repaid.

How hard is it to get a small business loan in New Mexico?

The degree of difficulty tends to depend on your business’s financial health, time in operation, and credit history. Requirements for traditional bank loans can be rigorous, but online lenders are often more flexible, making them a potentially more accessible option for many New Mexico businesses.

What is the easiest type of business loan to get approved for?

Loans secured by collateral, such as equipment financing, are generally easier to obtain because the asset lowers the lender’s risk. Short-term loans and invoice financing from online lenders also typically have less stringent requirements than unsecured loans.

What credit score do I need for a small business loan?

Requirements vary, but for traditional bank and SBA loans, a personal credit score of 680 or higher is generally preferred. Some online lenders may approve applicants with scores in the low 600s. Bear in mind that higher scores can often result in better approval odds and lower interest rates.

What can I use a New Mexico small business loan for?

You can use a small business loan for almost any legitimate business purpose, but not for personal expenses. Common uses include purchasing inventory, buying equipment, funding marketing campaigns, or refinancing debt.

Are there any small business grants available in New Mexico?

Yes, grants are available from a variety of sources. The New Mexico Economic Development Department can be an excellent resource for finding state-level opportunities like the Job Training Incentive Program. You can also search national databases like Grants.gov for federal programs relevant to your industry.

SoFi's marketplace is owned and operated by SoFi Lending Corp.

Advertising Disclosures: The preliminary options presented on this site are from lenders and providers that pay SoFi compensation for marketing their products and services. This affects whether a product or service is presented on this site. SoFi does not include all products and services in the market. All rates, terms, and conditions vary by provider. See SoFi Lending Corp. licensing information below.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

SoFi receives compensation in the event you obtain a loan, financial product, or service through SoFi’s marketplace. This webpage is owned and operated by SoFi Lending Corp., licensed by the Department of Financial Protection and Innovation under the California Financing Law, license number 6054612; NMLS number 1121636. ((www.nmlsconsumeraccess.org)). This page is NOT operated by SoFi Bank. Loans, financial products, and services may not be available in all states. All loan terms, including interest rate, and Annual Percentage Rate (APR), and monthly payments shown through SoFi’s marketplace are from providers and are estimates based upon the limited information you provided and are for informational purposes only. All rates, fees, and terms are presented without guarantee and are subject to change pursuant to each provider’s discretion. The actual loan terms you receive, including APR, will depend on the provider you select, their underwriting criteria, and your personal financial factors. The loan terms and rates presented are provided by the providers and not by SoFi Lending Corp. Please review each provider’s Terms and Conditions for additional details.

*Small Business Loans: Reference to “same day funding” or “funding within 24 hours” describes a general capability of many lenders you can reach through SoFi’s marketplace. Funding or funding timing is not guaranteed. Your experience with any lender will vary based on requirements of the lender and the loan you apply for. To determine the timing of funds availability, you must inquire directly with any lender. In addition, your access to any funds from a loan may be dependent on your bank’s ability to clear a transfer and make funds available.

†Credit score impact: To check the options, terms, and/or rates you may qualify for, SoFi and/or its network providers will conduct a soft credit pull that will not affect your credit score. However, if you choose a product and continue your application, the provider(s) you choose will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull and may affect your credit. Rates may not be available from all providers.

©2025 SoFi Lending Corp. All rights reserved.

SOSMB-Q425-077

More Small Business Financing Resources

Business loans don’t have to be complicated. Get clear answers on applications, learn what providers really look for, and understand popular loan options.

Search for small business funding in minutes.

Your time matters. So we’re making business loans as easy as possible by helping you find small business funding fast.

(without impacting your credit score)†

Dental School Loans | SoFi

DENTAL SCHOOL LOANS

Dental student loans you can smile about.

Federal graduate loan programs are changing. SoFi is here with graduate loans to help fund you through dental school—covering DMD and DDS educations.

Received a mailer from us?

Your dental school loan comes with benefits.

Our graduate student loans are designed to give you peace of mind so you can focus on your studies.

All online. All easy.

Finish our online application in minutes—and adding a cosigner is just as easy.

Competitive rates.

A lower interest rate could now translate to a smaller debt burden after graduation.

No fees required.

That means no origination fees, no late fees, and no insufficient funds fees. Period.

View your rate

Checking your rate will not affect your credit score.†

Rates on graduate school loans for dental students.

Choose from a fixed or variable graduate student loan.

Not sure which to choose?

Learn more →

SoFi’s dental school graduate loans are tailored to fit your needs.

Get up to 100% of your school-certified costs covered.

Earn a 3.0 GPA or higher and get a cash bonus up to $250.3

SoFi gives you 12 months of a grace period to account for your residency programs.

Repayment options include our newest offering, a 20-year term.

View your rate

Checking your rate will not affect your credit score.†

Our dental student loan application process is fast, simple, and won’t hurt a bit.

Screen images simulated.

-

Apply online in just minutes.

Get your rate fast and find out if you’re pre-qualified before you even finish your application. Easily add a cosigner in just a few clicks.

-

Select your rate and repayment option.

Choose from fixed or variable rates. Then, pick from four repayment options.

-

Sign and accept your loan.

Upload screenshots of your info, sign your paperwork electronically, and boom—it’s done. We’ll handle it from here.

View your rate

Checking your rate will not affect your credit score.†

Make repayment fit into your life.

Our repayment options allow you to choose what will work with your budget and lifestyle.

Deferred

Start paying principal and interest payments six months after you leave school.

- No payments while in school

- Highest overall cost option

Interest only

Pay only interest payments while you’re in school.

- Moderate payment while in school

- Reduces overall cost

Partial

Pay a $25 fixed monthly payment while you’re in school.

- Lowest payment option while in school

- Reduces some of the overall cost

Immediate

Start paying principal and interest payments right away.

- Highest payment option while in school

- Lowest overall cost option

View repayment examples

Dental graduate student loan FAQs

SoFi’s dental school loans can be used for up to 100% coverage of school-certified expenses. This includes tuition, fees, technology, housing, and more.

SoFi’s dental school loans allow you to defer up to 12 months to account for your residency program. Please keep in mind that interest continues to accrue during this time. SoFi has no penalties for prepayment or beginning full principal and interest payments prior to the end of school or the grace period which may reduce the overall cost of the loan.

SoFi’s dental school loans can be used for up to 100% coverage of school-certified expenses.

No, you do not need a cosigner to qualify for a SoFi dental school loan. However, cosigners could help you get a lower rate and/or increase your chances of approval. With SoFi’s online application process, you and your cosigner can see what rates and terms you pre-qualify for before submitting your full loan application—and it won’t impact your credit score.

The Federal Direct Grad PLUS loan program is being eliminated for new borrowers of all types starting July 1, 2026. SoFi’s dental school loans are an option to consider for students who can no longer use Federal Grad PLUS loans.

Key differences between Federal Grad PLUS and SoFi’s dental school loans include: interest rate options, origination fees (which SoFi does not have), term and repayment options. Federal Grad PLUS loans have fixed interest rates for the life of the loan with limited term and repayment options. SoFi’s dental loans offer both fixed and variable rate types to select from, as well as five repayment term options. Additionally, Federal Grad PLUS loans have origination fees.

Federal loans allow you to be eligible for certain types of forgiveness and unique income-based repayment plans. Please carefully consider all of your borrowing options at both a federal and private level.

This will depend on the loan terms that are selected. If you choose the deferred repayment option, full principal and interest payments can be deferred as long as the student remains enrolled at an eligible school at least half-time. Full principal and interest payments would begin 36 months after the student graduates or drops below half-time enrollment. Borrowers who have selected immediate repayment will begin full principal and interest payments upon full disbursement of the loan. Medical and veterinary school loans are also eligible for a 20-year repayment term.

See more FAQs

5 Money Moves to Start the Year Off Strong

New Year’s resolutions often address the parts of our lives we’re desperate to improve — our diet, our health, our endless scrolling.

So should we skip over our finances if there’s nothing all that wrong?

No way. Whether you’re struggling or thriving, a single conscious change always beats a bunch of good but vague intentions. And a smart money move now can pay dividends for years.

All you need is a specific goal to work toward. Here are five ideas to get the juices flowing.

✅ Pick one thing to save for

People tend to save “in general.” But that’s kind of like working out “to get healthier.” This year, focus on a specific goal, setting a dollar amount and timeline to keep you motivated.

If you don’t already have an emergency savings, pick that. This money will be your safety net if life throws you a curveball (job loss, major repair, health crisis). Commit to saving enough to cover three to six months’ worth of essential living expenses (rent, utilities, food, etc.) by a certain deadline.

If you’ve got an emergency savings covering six months’ worth of expenses, target another goal. Need another $10,000 for a down payment on a house by this time next year? That’s $833 a month. Want to take a $4,000 vacation this fall? That’s $444 a month, starting now.

To make it happen:

1. Use a free spending tracker to tally your basic monthly expenses. (SoFi has Relay.)

2. Multiply that number by 3 and then divide by 12. Can you realistically save that much each month this year? If not, divide by a bigger number (like 18 or 24) to extend your timeline into 2027.

OR

1. Use SoFi’s Sinking Fund Calculator to reverse-engineer a monthly number for another savings goal.

2. Add each month’s contribution to a high-yield savings account to earn a little extra. Keep the money separated. A SoFi Vault is good for this.

Additional resources:

• How Sinking Funds Can Lift Revenge Savers

• How To Build an Emergency Fund in 6 Steps

• Is $5,000 Enough for An Emergency Fund?

✅ Attack one recurring bill

The average American estimates they waste more than $200 a year on subscriptions they don’t use, according to a CNET survey. (No judgment — we live in the recurring charge era.) And then there are the bills you keep meaning to call about — or shop around for: car insurance, internet, phone plans. Sometimes one phone call can save you hundreds a year.

To make it happen:

1. Find the recurring charges on your last three bank statements. (Or just scroll to the ‘recurring activity’ on your SoFi Relay spending dashboard.)

2. Cancel any subs or memberships you don’t use.

3. Zero in on a utility, phone plan, or insurance premium that has gone up this past year, and carve out a half hour to call the provider. Maybe you’re paying for unlimited data but using only a fraction. Or you might be eligible for a new promotion or bundling discount. (Be polite, but if you’re not getting anywhere, it never hurts to ask for a manager because you’re “thinking of cancelling.”)

4. If you’ve trying to lower the cost of insurance, an independent agent or online platform can make it easier to shop around. (You can compare quotes for home, auto and life insurance on the SoFi app.)

Additional Resources:

• Do You Know What You’re Spending on Subscriptions?

• Are Internet and Cable Busting Your Budget? Take Control

• As Home Insurance Rates Rise, When and How to Shop Around

• We Spend Hundreds on Food We Throw Out. How to Cut Waste

• A Surprisingly Easy Way to Take the Bite Out of Big Bills

✅ Pay down one “bad” debt

A mortgage with a 6.5% interest rate is very different from a credit card charging you a 24.99% APR. One builds equity in an appreciating asset. The other gets you nowhere fast.

That’s why paying off a high-interest credit card balance is one of the best ways to improve your financial situation. When interest compounds daily, it literally costs you more with each passing day. And if you’re paying only the monthly minimum, the hole just gets deeper.

To make it happen:

1. List your debts by interest rate.

2. Pick the one with the highest rate.

3. Commit to paying it down with all your 2026 “found” money — including tax refunds, credit card cash-back rewards, and that $200 birthday check from your aunt.

Additional Resources:

• Are You Stuck on a Credit Card Treadmill?

• Is Credit Card Debt Sabotaging Your Retirement?

• Beginners Guide to Good and Bad Debt

• Debt Avalanche Method: A Smart Strategy for Paying Off Debt

• Debt Consolidation Calculator

✅ Max out one tax-advantaged account

Tax-advantaged accounts — 401(k)s, IRAs, Health Savings Accounts (HSA) — offer more than a tax break. They harness the power of compound growth.

If you max out a traditional IRA, contributing the entire $7,500 you’re allowed for 2026, it has the opportunity to grow tax-free for decades — and, depending on your tax bracket, could save you $1,000+ in taxes this year.

To make it happen:

1. If you don’t already have a tax-advantaged account, open one. (A 401(k) is the best place to start if your employer offers matching contributions.)

2. If you already have one, check your contribution rate. If you’re at 6% of salary, can you bump it to 8% or 10%? For 401(k)s, use Finra’s Save the Max calculator to see how much you’d need to carve out from each paycheck to reach this year’s $24,500 limit.

3. If you’re already maxing out one account, target another.

Additional Resources:

• Generation Roth: Why Young Savers Love These IRAs

• Don’t Have Access to a 401(k)? How to BYO Retirement Savings

• Leaving a Job? Think Twice Before Cashing Out Your 401(k)

• The Stealth Retirement Account You Should Know About

• Benefits of Using a Health Savings Account (HSA)

✅ Save half of a raise

A raise can feel like a windfall — and quickly get absorbed by lifestyle inflation.

The counter-move? Add half of it to a retirement savings or other type of investment account. That way you’re not depriving yourself of the fruits of your labor, but future-you gets a raise, too.

To make it happen:

1. As soon as you get your raise, increase the automatic contribution to your investment account. Do it before the money even hits your paycheck so you’ll never “miss” what you’re saving. (If you get a 4% raise, bump your contribution from 6% to 8%.)

2. Then celebrate with dinner out, a new gadget, or a weekend away.

Additional Resources:

• 5 Ways to Milk Your Year-End Bonus

• Do You Have Too Much Cash in Your Bank Account?

• What Is Automated Investing?

• The Risk of Not Investing Enough: Gauging Your Cash Holdings

• You Don’t Have to Be Jim Cramer to Start Investing

INVESTMENTS AND DIGITAL ASSETS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

SoFi Checking and Savings accounts are offered by SoFi Bank, N.A., Member FDIC.

SoFi Credit Cards are issued by SoFi Bank, N.A. pursuant to license by Mastercard® International Incorporated.

Sofi Crypto products and services are offered by SoFi Bank, N.A.

Loans originated by SoFi Bank, N.A., NMLS #696891 (www.nmlsconsumeraccess.org). Equal Housing Lender.

Brokerage products offered through SoFi Securities LLC, member FINRA/SIPC.

Advisory services are offered through SoFi Wealth LLC, an SEC-registered investment adviser. Information as of [January 2026] and is subject to change. Screen images simulated. [3393750]

1 When you open a SoFi Savings Account, SoFi Bank will also automatically open a SoFi Checking Account in your name. See the SoFi Bank Deposit Account Agreement for details.

2 SoFi Relay offers users the ability to connect both SoFi accounts and external accounts using Plaid, Inc.’s service and for SoFi to present to you data we have received from the credit bureau. The credit score and associated data provided to you is a VantageScore® based on TransUnion® (the “Processing Agent”) data. See SoFi Relay for more information.

3 To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score. However, if you choose a product and continue your application, we will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull and may affect your credit.

4 Terms and conditions apply\*. For 401k rollovers, existing SoFi IRA members must complete 401k rollovers via this link For SoFi members without a SoFi IRA, a SoFi IRA must first be opened, and 401k rollover must be completed utilizing Capitalize via this link. SoFi and Capitalize will charge no additional fees to process a 401(k) rollover to a SoFi IRA. SoFi is not liable for any costs incurred from the existing 401k provider for rollover. Please check with your 401k provider for any fees or costs associated with the rollover. For IRA contributions, only deposits made via ACH and cash transfer from SoFi Bank accounts are eligible for the match. Click here for the 1% Match terms and conditions.

5 Robo investing and advisory services are offered by SoFi Wealth LLC, an SEC-registered investment adviser.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

SoFi isn't recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

OTM2026010501

Read moreRaleigh Housing Market: Trends & Prices (2025)

Raleigh Housing Market: Trends & Prices (2025)

Raleigh Real Estate Market Overview

By Kenny Zhu

(Last Updated – 1/2026)

Raleigh — the City of Oaks — is one to watch on the housing market scene. With its job opportunities and quality of life, people are choosing to move there, driving up housing demand in recent years.

Raleigh is the second-most populous city in North Carolina — with a population of about 482,295 residents — and also happens to be one of the fastest-growing cities in the United States. In 2024, Raleigh was also named the fifth-most educated city in America, with over half of its residents holding at least a bachelor’s degree.

Those who call Raleigh a college town are spot-on, as Raleigh is home to at least 10 major colleges, including North Carolina State University. The city is within an hour’s drive of both Duke University and the University of North Carolina at Chapel Hill, making it neutral ground for Blue Devils and Tar Heels fans alike.

Raleigh, though, is known for more than just brains and basketball; it’s also a great place to find smoked “whole hog” barbecue, complete with signature vinegar and pepper-based glaze.

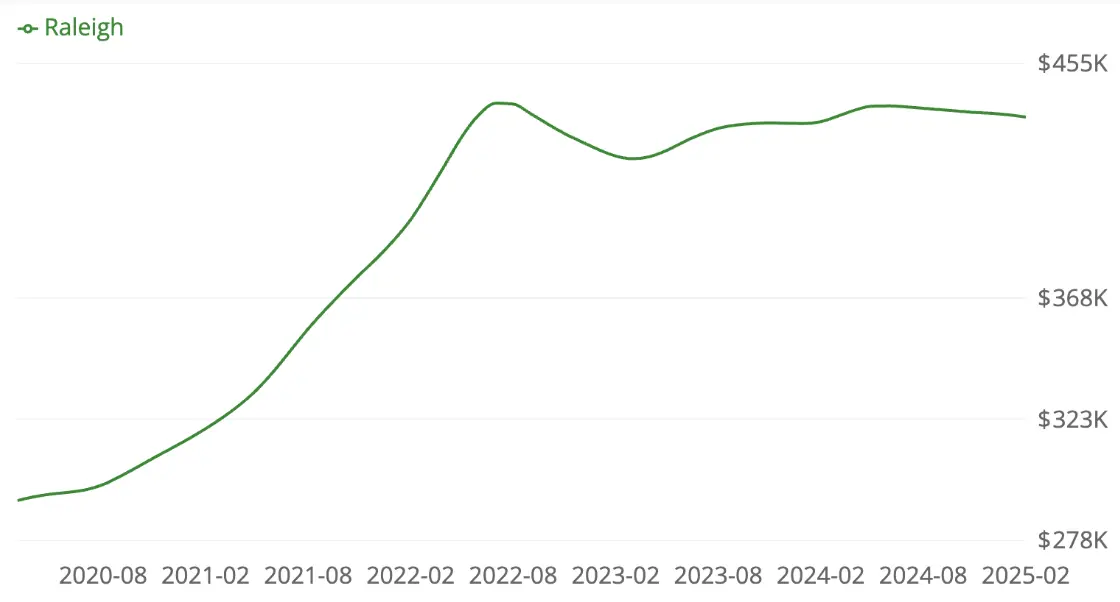

Home values in the area are up 0.4% over the past year, slower than the national growth rate of 2.6%, according to Zillow. Factors for this include already somewhat high home prices and a more steady supply and demand in the city.

If you’re thinking of buying property in Raleigh, you’ll want to check out our assessment of the homebuying, demographic, and market trends in the area.

Raleigh Real Estate Market Trends

While the Raleigh housing market may not be as hot as it was in 2022 to 2023, when the U.S. News & World Report ranked it the #1 hottest real estate market in the nation, it still remains a strong market with high demand and rising prices.

Raleigh’s home prices are projected to continue to rise slightly in the coming year, according to forecasting real estate trends from Norada Real Estate Investments.

Despite a decline in home sales since last year and an increase in the average amount of days listings spend on the market, the steady rise in home prices may signal a housing market that has more room to run.

Homes sold on the real estate market in Raleigh typically close around 1% below the listing price and typically spend around 45 days on the market before an offer is accepted.

$436,250

Median Sale Price

$234

Median Price Per Square Foot

45 days

Median Time on Market

Raleigh Housing Market Forecast

Prospective homebuyers may not need to be vigilant if they hope to buy a house in 2025, as data from Zillow shows that home prices are likely to only gently uptick in the coming year, if at all.

Currently, the average home in Raleigh spends around 45 days on the market before it’s snapped up, so homebuyers shopping for a house in the interim may have some breathing room.

Demographics of the Raleigh Market

Raleigh households tend to be wealthier and more educated than the United States as a whole. This is possibly due to its proximity to some of the most prestigious educational institutions in the South.

In fact, UNC, North Carolina State University, Duke University, and their affiliate health systems all rank among the top 10 employers in the greater Raleigh-Wake County metropolitan area.

As part of the Research Triangle, the city and its surrounding areas have seen major growth in professional services over recent years, including in the tech, healthcare, financial services, education, and government sectors.

In fact, Raleigh has developed a reputation as a rapidly developing tech hub in the South, ranking 6th among the top cities in the U.S. for tech professionals in 2024.

Major tech companies like International Business Machines, Red Hat Inc. (a subsidiary of IBM) and Cisco Systems all house major branches in and around Raleigh, and each location employs thousands of Raleigh residents.

Median Household Income: $82,424

Median Age: 34.6

College Educated: 52.9%

Homeowners: 51.2%

Married: 42%

Popular Raleigh Neighborhoods

The capital of the Tar Heel State isn’t just a great place for basketball, tailgating, and barbecue; it’s also an excellent place to live.

Based on key characteristics, including home values, growth in home prices, and population, we’ve isolated five popular Raleigh neighborhoods to help you on your home shopping journey.

North Raleigh

Without a doubt, North Raleigh is a popular neighborhood in the city; it encompasses a number of growing residential enclaves, including the quaint Falls River community as well as the posh North Ridge area.

North Raleigh is an excellent area for any family looking to put down roots. There’s a variety of activities, restaurants, and parks in the area for families to enjoy, including the scenic Shelley Lake Park and the 237-acre Durant Nature Preserve.

Quick Facts

Population:

76,649

Median Age:

43.1

Housing Units:

34,422

Bike Score:

52

Walk Score:

28

Transit Score:

31

Median Household Income:

$80,005

North Raleigh Housing Market

The North Raleigh neighborhood is split into several distinct residential enclaves and features homes across a variety of price points, ranging from entry level to high end.

On a relative basis, home prices in North Raleigh are somewhat more expensive than the city overall, by about 4.3%.

Median Home Price

$455,000

Median Price Per Square Ft.

$224

North Hills

Also known as “Raleigh’s Midtown,” fast-growing North Hills is located north of Raleigh’s downtown and features fine dining, live entertainment, and bustling shopping districts.

The North Hills area features a large number of luxury apartments for rent. The neighborhood is known to be generally walkable, quiet on residential streets, and close to amenities.

Recommended: Price-to-Rent Ratio in 50 Cities

Quick Facts

Population:

3,479

Median Age:

38

Housing Units:

1,927

Bike Score:

43

Walk Score:

30

Transit Score:

30

Median Household Income:

$86,414

North Hills Housing Market

Homes in North Hills typically sit on the high end of the market and many of the properties located within its residential districts fall within the category of upscale or luxury homes.

North Hill’s growth rate in home prices (31.4% since last year) more than doubles that of the state of Raleigh as a whole (14.5% compared to last year), according to February 2025 data from Redfin.

While North Hill ranks higher on the list in terms of median listing home prices in the Raleigh real estate market, there are other neighborhoods with homes in the million dollar average range, like Glenwood and Five Points East.

Median Home Price

$920,000

Median Price Per Square Foot

$345

Five Points

Situated right below North Hills, Five Points will take you “inside the beltline,” a saying locals use for neighborhoods within the I-440 loop. A historic neighborhood that was developed in the 1910s to 1920s, Five Points is so called as it includes five smaller neighborhoods: Hayes Barton, Vanguard Park, Bloomsbury, Georgetown, and Roanoke Park.

Within the Raleigh beltway, the area is known for its tree-lined streets, boutique shops, and even its breweries.

Quick Facts

Population:

8,669

Median Age:

42.3

Housing Units:

3,508

Bike Score:

66

Walk Score:

44

Transit Score:

39

Median Household Income:

$148,413

Five Points Housing Market

Homes in the Five Points neighborhood range in price; you’ll find properties from $250,000 to over a million here. A smaller neighborhood, the area features a blend of charming historic properties to some newly constructed homes.

Five Points shares many characteristics with its North Hills neighbor, including its high growth rate and above-average home prices, which stand at 35.9% and $905,000, respectively, per Redfin data from February 2025.

Five Points median home prices and growth rate since last year sit well above Raleigh real estate trends overall.

Median Home Price

$905,000

Median Price Per Square Foot

$410

Oakwood

Another historic neighborhood, Oakwood sits right on the edge of downtown Raleigh. With its Victorian-era homes and tree-lined streets, this area has a lot of character and unique architecture. North Carolina’s largest, intact nineteenth-century neighborhood, Historic Oakwood has become a coveted area, and many residents have been there for a long time.

Similar to North Hills and Five Points, home prices in Five Points are generally on the higher end, at the $1 million median price point for Oakwood, with a high growth rate compared to last year.

Quick Facts

Population:

1,708

Median Age:

35

Housing Units:

791

Bike Score:

84

Walk Score:

68

Transit Score:

65

Median Household Income:

$68,458

Oakwood Housing Market

Homes in Oakwood are generally more than double the average when it comes to the real estate market in Raleigh, NC. The area has also seen well above-average growth in home prices in February 2025 compared to last year.

Home prices in Oakwood are up a drastic 45.1% since last year, relative to the Raleigh housing price growth of 14.5%, per Redfin. However, homes in Oakwood can stay on the market for much longer than last year, at a median of 92 days currently.

Median Home Price

$1,000,000

Median Price Per Square Foot

$447

Northwest Raleigh

Northwest Raleigh is a populous neighborhood in the city that is home to the prestigious Brier Creek Country Club and borders key landmarks like William B. Umstead State Park and the Raleigh-Durham International Airport.

Northwest Raleigh’s prime location also puts it within driving distance of both Downtown Raleigh and North Carolina State University. The area is known for its low crime rates and quality school districts.

Quick Facts

Population:

81,974

Median Age:

37.3

Housing Units:

28,556

Bike Score:

44

Walk Score:

76

Transit Score:

29

Median Household Income:

$78,719

Northwest Raleigh Housing Market

Home prices in Northwest Raleigh generally sit above the city average, at about 14% higher. Northwest Raleigh homes are also up about 11.7% in price compared to last year.

Median Home Price

$497,000

Median Price Per Square Foot

$239

SoFi Home Loans

It’s easy to see why the Raleigh real estate market has been active. There are some amazing neighborhoods to choose from, whether you’re single or have a family to look after.

If you think Raleigh could be your home sweet home, then you may need to consider your mortgage financing options.

Looking for an affordable option for a home mortgage loan? SoFi can help: We offer low down payments (as little as 3% - 5%*) with our competitive and flexible home mortgage loans. Plus, applying is extra convenient: It's online, with access to one-on-one help.

View your rate

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

SOHL-Q425-208