The Week Ahead on Wall Street

Economic Data

No economic data is scheduled to be released today.

December’s NFIB small-business index and November’s job openings figures are published tomorrow. In November the National Federation of Independent Business (also known as NFIB) report showed that small-business owners’ confidence in the United States economy fell. Economists typically refer to the NFIB report so they can measure domestic demand and forecast hiring and wage trends.

The December consumer price index, December core CPI, December Federal Budget, and Beige Book will be released on Wednesday. The consumer price index, also known as the CPI, measures the weighted average of prices for consumer goods and services. Transportation, medical care, and food are all included in the CPI. Economists use CPI to track shifts in cost of living. It can also be used to track periods of inflation or deflation.

Initial jobless claims will be released on Thursday. First-time filings totaled 787,000 for the week ending January 2, which was below economist expectations of 815,000. Claims remain well above pre-pandemic levels.

November Business inventories, December retail sales, the December producer price index, December industrial production, December capacity utilization, January Consumer sentiment index (preliminary), and the January empire state index will be released on Friday. The preliminary reading of the consumer sentiment index for January will help economists measure consumer confidence in the economy. Consumer sentiment dipped in December as coronavirus cases spiked around the United States.

Earnings

With the first trading week of the new year in the history books, a few well-known firms will begin to report their latest quarterly results. Most of the focus will be on how asset managers and banks performed over the past three months with a string of reports toward the end of the week.

Tomorrow Albertsons Companies Inc (ACI) will report earnings. The company made headlines last week when it announced a “strategic decision” to shift away from its in-house fleet of grocery deliverers and transition to a third-party delivery app. Albertsons has been criticized by employees for halting pandemic pay raises and increasing healthcare costs.

On Thursday Blackrock (BLK) will report earnings. Wall Street expects BlackRock to continue organic growth. The world’s largest asset manager has $7 trillion under management and is leading the way in the ESG space, or Environmental, Social, and Corporate Governance. Over the past year, nearly 80% of institutional investors said they will halt investing in firms that aren’t considered sustainable. Blackrock has been at the forefront of this trend.

On Friday JPMorgan Chase (JPM) and Citigroup (C) will report earnings. Wall Street expects JPMorgan to announce lower revenue but increased profitability in 2021, which could be the case for many large banks. For its part, Citigroup appears to be investing heavily in modernization and digitization. The bank has also started a $1 billion initiative aimed at closing “the racial wealth gap and [increasing] economic mobility.”

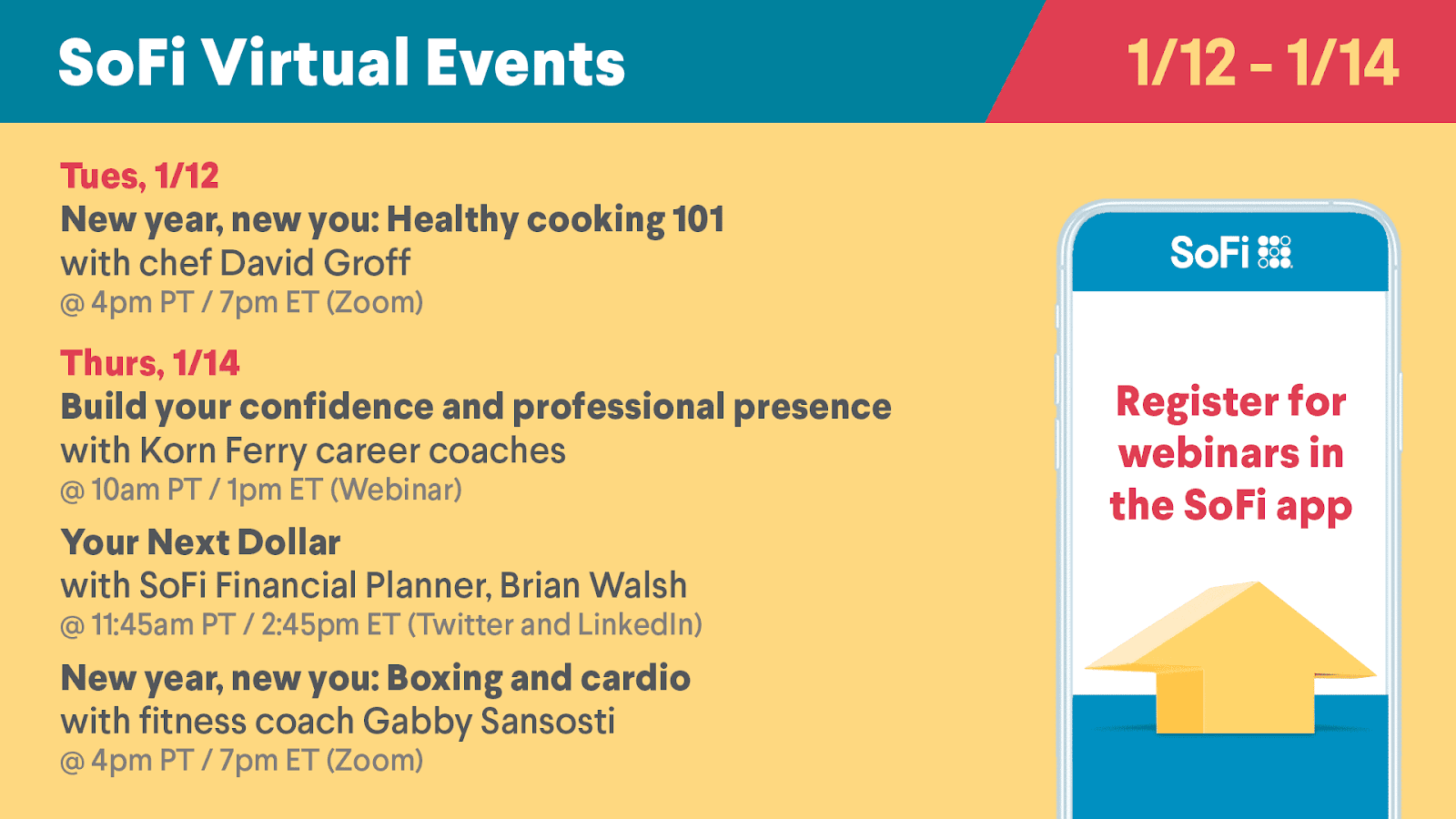

The Week Ahead at SoFi

It’s a new year and you probably have new questions about your finances and career. Bring them all to this week’s events. Reserve your seat today in the SoFi app, and catch up on past events on our YouTube channel.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Advisor

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

SOSS21011101