The Week Ahead on Wall Street

Economic Data

The October Chicago Fed National Activity Index is released this morning along with preliminary manufacturing and service PMI figures for November. Between September and October, the IHS Services PMI climbed from 54.6 to 56.9, marking the third consecutive quarter of expansion. The markit manufacturing PMI also rose between September and October. These numbers may show a decline as COVID-19 cases as well as shutdowns have been on the rise in recent weeks.

Tomorrow, the Case-Shiller National Home Price Index will be released along with the November Consumer Confidence Index. This metric measures how optimistic consumers feel about the country’s economic health based on their saving and spending activity. The index hit a pandemic high of 101.3 in September, but fell to 100.3 in October.

On Wednesday, October durable goods orders, October core capital goods orders, the October advance report on trade in goods, October core inflation, and October new home sales are released. Initial jobless claims data will also be made available. Last week, unfortunately this metric rose to 742,000, up from 711,000 the week prior, as rising COVID-19 cases forced states to implement new restrictions on businesses. The final November Consumer Sentiment Index, showing how confident consumers feel about the economy’s health, will also come out a few days after the preliminary data. Also look for October personal income and October consumer spending on Wednesday. These metrics rose by 0.9% and 1.4% in September.

There will be no economic data released on Thursday and Friday because of Thanksgiving.

Earnings Reports

Today Urban Outfitters (URBN) reports its earnings. The clothing brand, which is known for its in-store experience, has suffered due to store closures. However, the company saw 76% growth in new digital customers across its brands. Investors are hopeful that the holidays season will give Urban Outfitters a boost, even if customers are shopping digitally instead of in stores.

Tomorrow Gap (GPS) will report earnings. The company owns its namesake Gap brand along with Old Navy, Athleta, and Banana Republic. Like many retailers, the clothing brand abruptly lost significant revenue when the pandemic set in. The company’s Q1 sales tumbled 43%. However, it has taken significant steps to cut costs, and raised $2.25 billion in capital. The company also named Sonia Syngal as its new CEO to help the company navigate the COVID-era market.

Dell (DELL) will also report earnings tomorrow. There has been robust demand for the company’s cloud services as many consumers continue to study and work online. However, Dell seems to have lost market share in the personal computer landscape to companies like Levano (LNVGY) and HP (HP).

Dick’s Sporting Goods (DKS) will also hand in its report card tomorrow. The company saw surging sales over the summer as consumers looked for COVID-safe ways to entertain themselves and stay in shape. The company could see another sales spike this winter as people buy holiday gifts and equipment for cold weather sports.

On Wednesday Deere & Co (DE), the agricultural, construction, and forestry machinery company reports earnings. Because of economic uncertainty, some companies are putting off investments in large machinery, which has hurt the company’s sales. However, investors are hopeful about Deere’s recent purchase of 5G licenses for its factories in Illinois and Iowa.

There are no reports scheduled for Thursday and Friday due to Thanksgiving.

The Week Ahead at SoFi

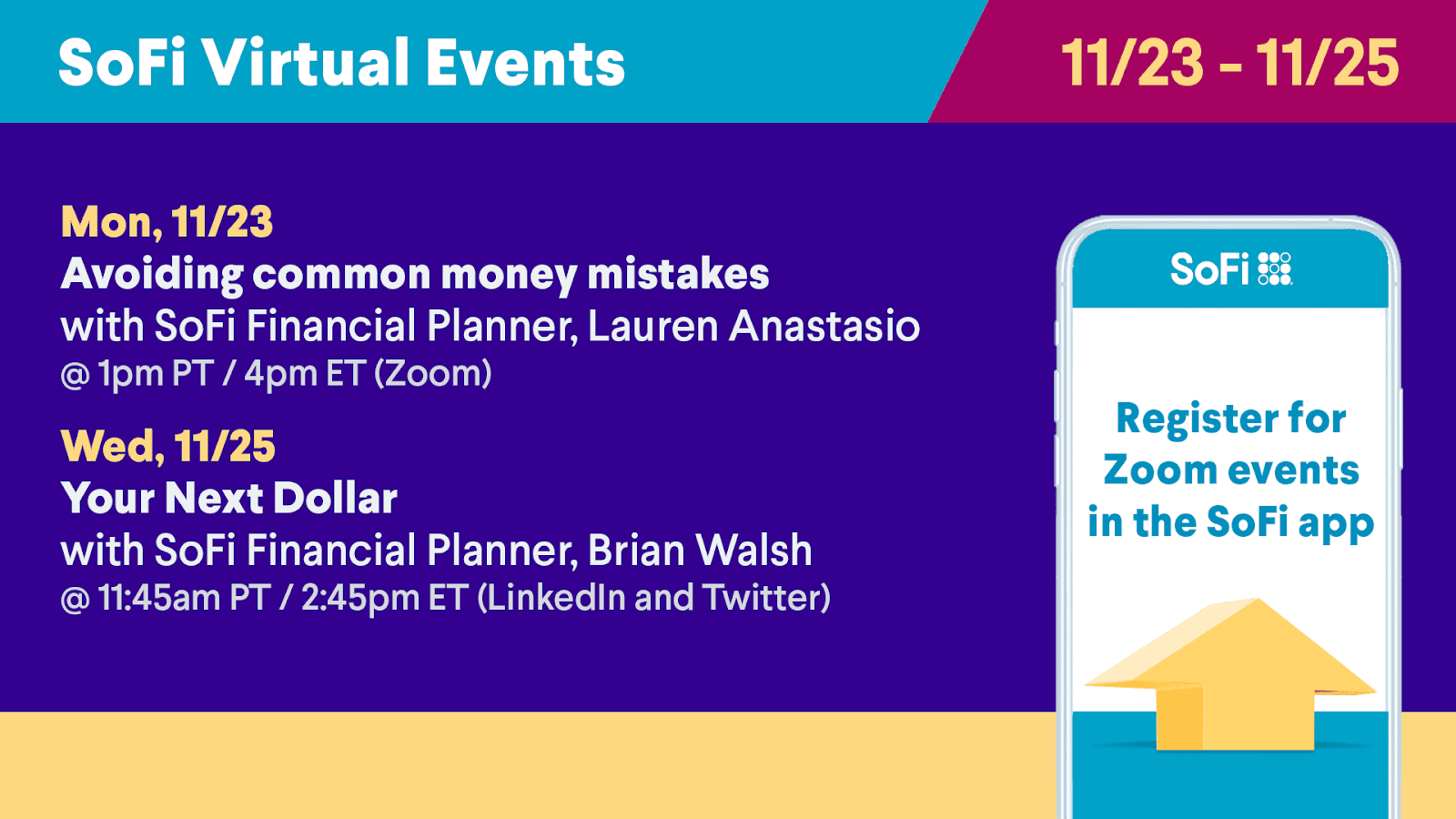

A holiday week can’t stop us from offering our members memorable events. Learn how to avoid common money mistakes, and enjoy the latest Your Next Dollar series. Register today in the SoFi app! Want to catch up on an event you missed? Watch past events on our YouTube channel.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Advisor

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

SOSS112301