The Semiconductor Shortage Continues

Causes and Effects of the Chip Shortage

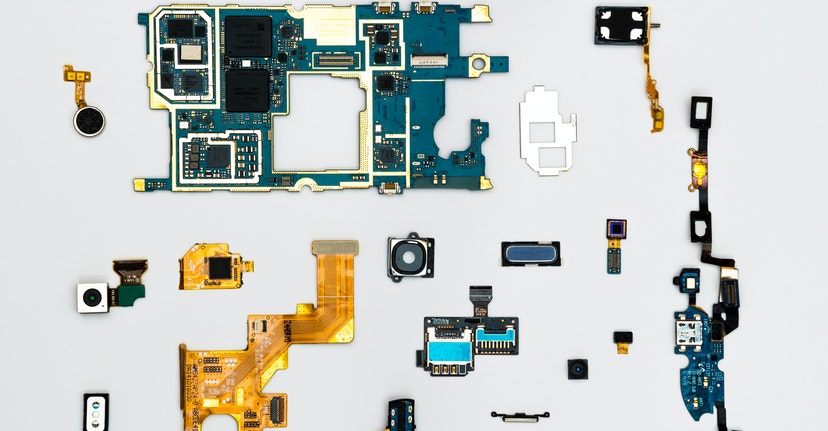

The global semiconductor industry is facing widespread shortages. This is causing ripple effects across a variety of industries and impacting everything from car manufacturing to the price of smartphones.

The imbalance between supply and demand is the result of several factors which played out during the COVID-19 pandemic. Vehicle manufacturers were forced to shut down their plants early in the pandemic and chip makers shifted their supply chains away from the auto industry to meet the needs of consumer electronics companies. As car makers have tried to ramp up production, they have had to compete with consumer electronics companies for a limited amount of semiconductors. As a result, several major car companies including Toyota (TM) and General Motors (GM) have paused production of some vehicles.

Meanwhile, during the pandemic, consumers and businesses stocked up on electronics as remote work became a mainstay and pandemic boredom sunk in. US sanctions against Chinese technology firms and stockpiling by some companies that need semiconductors has also impacted semiconductor supply chains. The shortage has created an opportunity for some companies, however. A few manufacturers are now investing in production to capitalize on the demand.

TSMC Makes $100 Billion Chip Investment

Taiwan Semiconductor Manufacturing Co. (TSM), the world’s largest contract chip manufacturer, is planning to invest $100 billion over a three-year period to shore up production and meet demand for its products. TSMC is one of Apple’s (AAPL) main chip suppliers.

The company expects red-hot demand for chips to continue in the coming years driven by the 5G rollout and advanced computing capabilities. TSMC’s $100 billion investment is more than double its chip investments over the past three years. Currently TSMC has not been able to meet the demand during the past year even with its plants running at more than 100% utilization.

Micron and Western Digital Chase Memory Chip Maker

Micron Technology Inc. (MU) and Western Digital Corp. (WDC) are both considering deals to acquire Kioxia Holdings Corp., a Japanese semiconductor company which makes memory chips for smartphones and other electronics. Kioxia could be valued at about $30 billion if a deal is reached. Kioxia is currently owned by PE firm, Bain Capital.

Prior to the talks with Micron and Western Digital, Kioxia had been gearing up for an initial public offering which it canceled in September, citing the impact from the pandemic and volatility in the markets. Kioxia could still go public if it does not reach an agreement with one of the companies looking to acquire it.

It has been an unpredictable year for the semiconductor industry. A number of changes are likely coming for the sector as companies work to respond to surging demand.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Advisor

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

SOSS21040202