Dallas Housing Market: Trends & Prices

Dallas Housing Market: Trends & Prices (2025)

Dallas Real Estate Market Overview

(Last Updated – 4/2025)

Texas may be the Lone Star State, but it sure isn’t lonely. Over 31 million people live in Texas, and about 1.3 million of them reside in the city of Dallas. What’s the attraction?

First, if you like warmth, let’s talk about that. Dallas averages 232 sunny days a year. When it comes to snow, Dallas sees an average of 2.6 inches. (Snow skiers and boarders can get their fix not far away.)

But does the weather really matter if you have good grub? Dallas is known as one of the best cities in the country to find good barbecue.

Dallas is also fairly affordable, as big cities go. The cost of living is 1.8% higher than the national average, according to the Council for Community and Economic Research’s 2024 Cost of Living Index.

Recommended: Cost of Living in Texas

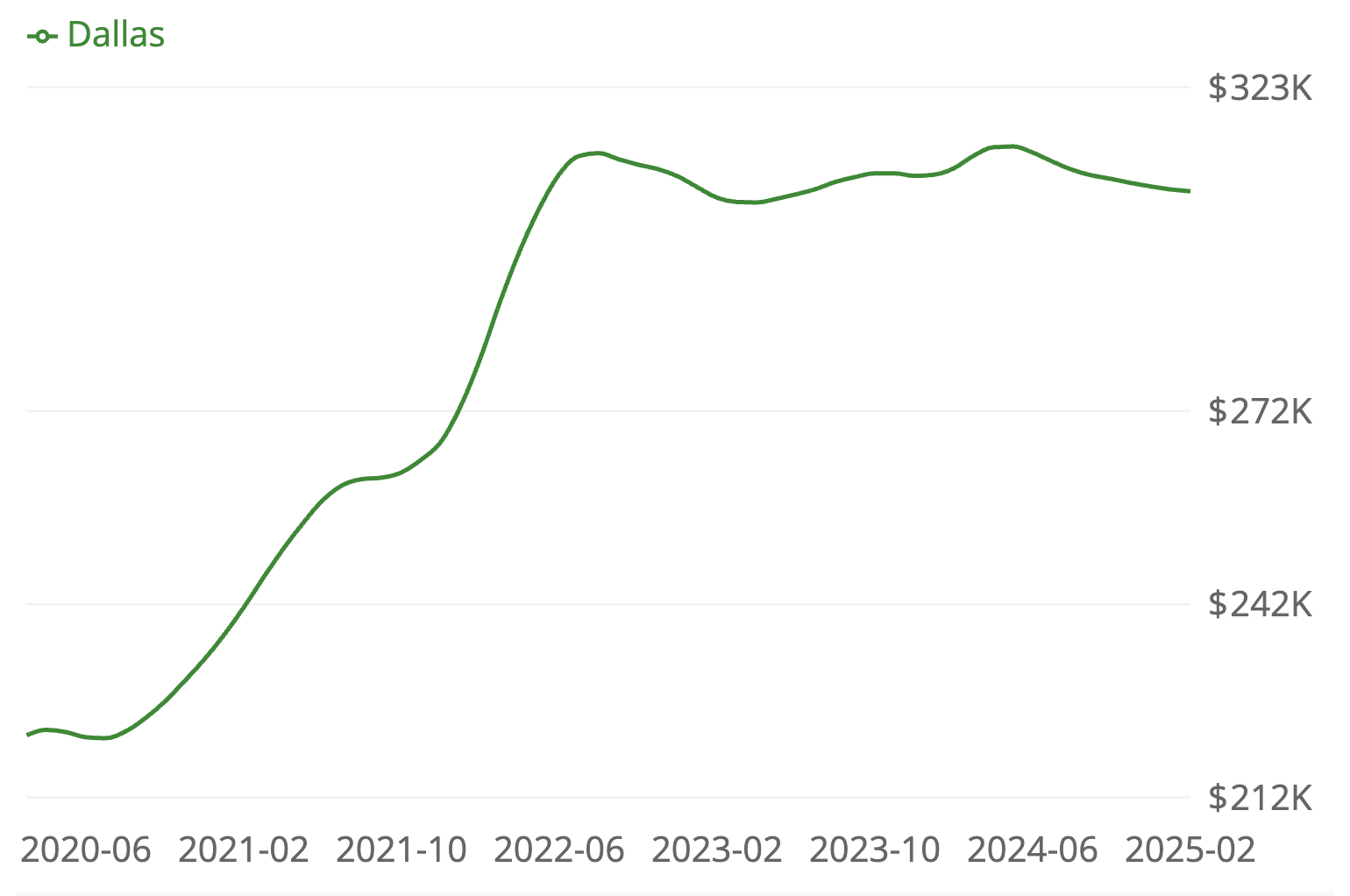

Dallas housing prices have gone down since last year. In April 2023, the average home sale price went down roughly 5.1% since last year, according to Redfin.

It can be informative to also look at price-to-rent ratios.

If you’re considering buying property in Dallas, saddle up and keep reading.

Recommended: Home Ownership

Dallas Real Estate Market Trends

While the median sale price for a Dallas home has remained essentially unchanged since last year, the market still looks to remain somewhat competitive.

The median sale price of $419,000 isn’t far above the national median for new homes of $414,500, as reported by FRED, the Federal Reserve Economic Data database, in February 2025, but the home values are almost as sprawling as the geography.

Dallas homes currently sell for about 3% below price, with an average of three offers per home. Homes that are more in demand can sell for roughly 2% above the list price.

Recommended: Local Housing Market Trends by City

$419,000

Median Sale Price

$239

Median Price Per Square Foot

55 days

Median Time on Market

Dallas Housing Market Forecast

If you’re looking to buy, you’ll want to know that experts predict that the Dallas metro area will be a hot housing market this year, as in recent years past.

Demographics of the Dallas Market

Why move to Dallas, besides the barbecue and a world of other cuisines? Let’s take a look at some of the top reasons you might want to consider a move to Dallas-Fort Worth.

Job-hunters will find that Dallas has one of the largest concentrations of big companies in the U.S., with AT&T, Energy Transfer, CBRE (a real estate company), and Southwest Airlines all employing a large workforce here. The top employment sectors here are Information Technology, Finance and Insurance, Manufacturing, Real Estate, and Professional and Technical Services.

Median Household Income: $70,121

Median Age: 33.5

College Educated: 38.7%

Homeowners: 42.4%

Married: 49%

Popular Dallas Neighborhoods

You know what they say: Everything is bigger in Texas. And that includes your options for great neighborhoods to live in.

Which is why we did some of the work for you and researched five of them.

Oak Lawn

Oak Lawn is known for its support of the LGBT community and every September hosts a large Pride event.

The neighborhood, just north of downtown Dallas, features tons of modern restaurants and shops, but nature lovers will probably prefer taking a stroll by Turtle Creek, which connects a number of parks.

Quick Facts

Population:

24,797

Median Age:

33.8

Housing Units:

19,273

Bike Score:

76/100

Walk Score:

85/100

Transit Score:

60/100

Median Household Income:

$127,896

Oak Lawn Market

The median home price in Oak Lawn is a bit above that of Dallas more generally, although it has dropped 1.7% in the last year.

Median Sale Price

$460,000

Median Price Per Sq. Foot

$347

Lake Highlands

The public schools in Lake Highlands may be one of the worst-kept secrets in all of Texas. Families flock to this neighborhood, consisting of dozens of subdivisions, because of the highly rated schools and easy access to big-city amenities. Getting preapproved for a home loan can help you compete if you’re looking to buy in this busy market.

Parkland and trails lead to White Rock Lake for those looking for an active lifestyle.

Quick Facts

Population:

48,148

Median Age:

35

Housing Units:

22,842

Bike Score:

46/100

Walk Score:

44/100

Transit Score:

41/100

Median Household Income:

$88,468

Lake Highlands Housing Market

The median home price is higher than what’s typical in Dallas, and prices rose 12.3% in February 2025 compared to the previous year.

Median Sale Price

$564,000

Median Price Per Sq. Foot

$242

Cedar Crest

Cedar Crest residents have access to the Trinity River greenbelt and, farther south, the Balcones Canyonlands National Wildlife Refuge.

But there are restaurants and shops to enjoy as well, and downtown Dallas is only 20 minutes away.

Quick Facts

Population:

3,330

Median Age:

33

Housing Units:

1,323

Bike Score:

45/100

Walk Score:

42/100

Transit Score:

45/100

Median Household Income:

$52,830

Cedar Crest Housing Market

This is an affordable, if somewhat competitive housing market. In February 2025, home prices were up 2.1% year over year, but the median sale price is still far below Dallas as a whole.

Median Sale Price

$245,000

Median Price Per Sq. Foot

$164

Wolf Creek

Only 21 minutes from downtown, Wolf Creek offers an easy commute. This family-friendly neighborhood has 22 schools and is known for its community spirit.

80% of locales reported the yards are well-kept in this area, and 66% feel there is plenty of holiday spirit.

Quick Facts

Population:

15,218

Median Age:

34

Housing Units:

5,657

Bike Score:

39/100

Walk Score:

29/100

Transit Score:

38/100

Median Household Income:

$62,806

Wolf Creek Housing Market

Current home prices in this neighborhood have risen more than 2% since last year, although the median home price is still well below that of the Dallas area.

Houses are spending more time on the market recently, with an average time of 76 days, according to Redfin.

Median Sale Price

$258,000

Median Price Per Sq. Foot

$161

Winnetka Heights

This small community peppered with historic homes is a dreamy place to raise a family or enjoy the single life. Food and art lovers can take advantage of the local restaurant scene and close proximity to the trendy Bishop Arts District.

The neighborhood is popular with visitors but is also the perfect place for locals to call home.

Quick Facts

Population:

29,992

Median Age:

35.5

Housing Units:

13,207

Bike Score:

54/100

Walk Score:

55/100

Transit Score:

47/100

Median Household Income:

$120,126

Winnetka Heights Housing Market

Home values in Winnetka Heights remain solid and well above the median home price for the Dallas area.

Listings are few but are lingering on the market for about 76 days.

Median Sale Price

$744,000

Median Price Per Sq. Foot

$314

SoFi Home Loans

It’s easy to see why the Dallas real estate market has been active. There are some amazing neighborhoods to choose from, whether you’re single or have a family to look after.

If you think Dallas could be your home sweet home, then you may need to consider your home loan options.

Looking for an affordable option for a home mortgage loan? SoFi can help: We offer low down payments (as little as 3% - 5%*) with our competitive and flexible home mortgage loans. Plus, applying is extra convenient: It's online, with access to one-on-one help.

FAQ

Is the Dallas housing market cooling?

Recent data from Redfin paints an interesting picture of the Dallas housing market. It seems the feverish pace of skyrocketing prices is starting to mellow. With a few more homes on the market and a slight deceleration in price hikes, the tide may be turning in favor of buyers. It’s a good time to keep your eyes on the market and be ready to make a move when you find the right place.

What’s the forecast for the Texas housing market?

The forecast for the Texas housing market remains one of steady growth. Recent real estate reports suggest that the Lone Star State is poised for a positive trajectory, thanks to a solid job market and population increases. While home prices are expected to climb, the pace may be more moderate than in previous years.

What’s the next hot neighborhood in Dallas?

The Cedars offers a vibrant, eclectic atmosphere with a growing arts scene, all convenient to downtown Dallas. Yet it still has a neighborhoody feel. Median home sale prices here are still well below the Dallas market generally, and community events and a strong sense of neighborhood pride make it an attractive place to call home.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

*SoFi requires Private Mortgage Insurance (PMI) for conforming home loans with a loan-to-value (LTV) ratio greater than 80%. As little as 3% down payments are for qualifying first-time homebuyers only. 5% minimum applies to other borrowers. Other loan types may require different fees or insurance (e.g., VA funding fee, FHA Mortgage Insurance Premiums, etc.). Loan requirements may vary depending on your down payment amount, and minimum down payment varies by loan type.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

Qualifying for the reward requires using a real estate agent that participates in HomeStory’s broker to broker agreement to complete the real estate buy and/or sell transaction. You retain the right to negotiate buyer and or seller representation agreements. Upon successful close of the transaction, the Real Estate Agent pays a fee to HomeStory Real Estate Services. All Agents have been independently vetted by HomeStory to meet performance expectations required to participate in the program. If you are currently working with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®. A reward is not available where prohibited by state law, including Alaska, Iowa, Louisiana and Missouri. A reduced agent commission may be available for sellers in lieu of the reward in Mississippi, New Jersey, Oklahoma, and Oregon and should be discussed with the agent upon enrollment. No reward will be available for buyers in Mississippi, Oklahoma, and Oregon. A commission credit may be available for buyers in lieu of the reward in New Jersey and must be discussed with the agent upon enrollment and included in a Buyer Agency Agreement with Rebate Provision. Rewards in Kansas and Tennessee are required to be delivered by gift card.

HomeStory will issue the reward using the payment option you select and will be sent to the client enrolled in the program within 45 days of HomeStory Real Estate Services receipt of settlement statements and any other documentation reasonably required to calculate the applicable reward amount. Real estate agent fees and commissions still apply. Short sale transactions do not qualify for the reward. Depending on state regulations highlighted above, reward amount is based on sale price of the home purchased and/or sold and cannot exceed $9,500 per buy or sell transaction. Employer-sponsored relocations may preclude participation in the reward program offering. SoFi is not responsible for the reward.

SoFi Bank, N.A. (NMLS #696891) does not perform any activity that is or could be construed as unlicensed real estate activity, and SoFi is not licensed as a real estate broker. Agents of SoFi are not authorized to perform real estate activity.

If your property is currently listed with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®.

Reward is valid for 18 months from date of enrollment. After 18 months, you must re-enroll to be eligible for a reward.

SoFi loans subject to credit approval. Offer subject to change or cancellation without notice.

The trademarks, logos and names of other companies, products and services are the property of their respective owners.

SOHL-Q125-233