South Carolina: Best Affordable Places to Live

Best Affordable Places to Live in South Carolina in 2025

(Last Updated – 03/2025)

Located on the southeast coast, South Carolina offers a mild climate and charming historical towns that draw crowds of urbanites looking for better quality of life. The state is home to many respected universities, including Clemson, The Citadel (The Military College of South Carolina), and the University of South Carolina. Residents who enjoy outdoor activities have everything from subtropical beaches to the Blue Ridge Mountains in the “Upstate” region. The cost of living is lower than the national average, as are housing costs.

Best Places to Live in South Carolina

South Carolina offers many beautiful cities and towns that combine old-world charm with modern buildings and public spaces. The cost of living in South Carolina is reasonable, and affordable neighborhoods abound in the suburbs of inland cities such as Spartanburg and Batesburg-Leesville. Beach lovers often gravitate to Myrtle Beach, whereas culture buffs appreciate the history and amenities of Fountain Inn.

Make sure you look into first-time homebuyer programs in South Carolina to see how you can save money. And if you’re a newbie homebuyer, use our first-time homebuyer guide to learn more about the process before you start shopping.

💡 Quick Tip: When house hunting, don’t forget to lock in your home mortgage loan rate so there are no surprises if your offer is accepted.

Best Affordable Places to Live in South Carolina

Now, come see where some of the best deals are if you are thinking of settling down in South Carolina.

1. Spartanburg

Photo credit: iStock/Kruck20

Spartanburg offers a wealth of arts and cultural amenities, as well as proximity to the stunning Blue Ridge Mountains. Several colleges and universities are located in the area, and the city is known for its family-friendly vibe.

Population: 39,040

Median Household Income: $51,193

Cost of Living: 90

Average Rent Price: $1,470

Home Price-to-Income Ratio: 4.25

2. Fountain Inn

A former stagecoach stop, the Fountain Inn area is best known for historical buildings and a meandering waterfall in Cedar Falls Park. The town’s proximity to Greenville and Columbia makes it a good option for those looking to commute to these urban areas for work. Recent renovations to its downtown promise a good balance of preservation and growth.

Population: 13,027

Median Household Income: $72,021

Cost of Living: 91.3

Average Rent Price: $1,880

Home Price-to-Income Ratio: 4.06

Recommended: Tips to Qualify for a Mortgage

3. Batesburg-Leesville

Photo credit: Wikimedia Commons/

Bill Fitzpatrick , Creative Commons Attribution-ShareAlike 3.0 Unported

This town is less than an hour from Columbia, the state capital, making it a great commuter area for those who prefer to reside outside a city. Camping and golfing are just two of the area’s outdoor activities. Families are drawn to Batesburg-Leesville’s strong options for public and private schools.

Population: 5,297

Median Household Income: $53,102

Cost of Living: 90.4

Average Rent Price: $1,151

Home Price-to-Income Ratio: 2.85

Best Places to Live in South Carolina for Families

Families looking for good schools and easy access to shopping, dining, and activities for the kids may find these three South Carolina cities are a good fit.

1. Fort Mill

Close to Charlotte Douglas International Airport, Fort Mill offers a good balance of city conveniences and suburban hush. Parents will appreciate the area’s many top-rated schools, while kids will be delighted by the expansive nature preserves, minor league basketball team, and Carowinds amusement park.

Population: 33,626

Median Household Income: $127,537

Cost of Living: 100.4

Average Rent Price: $2,039

Home Price-to-Income Ratio: 4.05

2. Summerville

Photo credit: iStock/benedek

In the 1800s, Summerville’s mild, dry climate attracted visitors looking to improve their health. Today, the town offers families — who make up just over half of all residents — walkable communities and pine-scented parks near the water. Those who intend to commute to Charleston for work can do so easily; Summerville is close to Interstate 95 and other major roadways.

Population: 51,884

Median Household Income: $78,621

Cost of Living: 98.2

Average Rent Price: $2,250

Home Price-to-Income Ratio: 4.83

3. Greenville

Photo credit: iStock/Sean Pavone

Located “upstate” near the North Carolina border, Greenville has a bustling downtown area with many family-friendly restaurants, breweries, and shops. Outdoor activities include hiking, biking, and walking on the 20-mile Swamp Rabbit Trail, which hosts an annual half marathon.

Population: 72,824

Median Household Income: $68,460

Cost of Living: 90.7

Average Rent Price: $1,750

Home Price-to-Income Ratio: 4.50

Recommended: Refinance Your Mortgage and Save

Best Places to Live in South Carolina for Young Adults

1. Columbia

Photo credit: iStock/Sean Pavone

The capital city has much to draw young professionals, from job opportunities to post-work entertainment. You’ll find music venues, an opera house, a philharmonic orchestra, and a number of museums. The Congaree Vista, formerly a warehouse district, has been revitalized with art galleries, shops, and restaurants.

Population: 142,416

Median Household Income: $55,653

Cost of Living: 94.4

Average Rent Price: $1,550

Home Price-to-Income Ratio: 4.09

2. Socastee

Considered a suburb of Myrtle Beach, Socastee offers affordable housing and wild outdoor settings. The Intracoastal Waterway runs through the city, making the area a destination for water sports enthusiasts, and the Waccamaw National Wildlife Refuge draws hunters, fishers, and photographers to its wetlands. Downtown, you’ll find a wealth of casual restaurants and bars.

Population: 22,213

Median Household Income: $59,826

Cost of Living: 90.4

Average Rent Price: 1,584

Home Price-to-Income Ratio: 5.10

3. Greenville

Photo credit: iStock/Sean Pavone

Greenville has everything young adults could want, from jobs with high-profile companies to a great bar scene and outdoor activities galore. The median age in Greenville is currently 35. The city is around 60% white collar residents, with an average salary of approximately $85,000 for those who hold graduate degrees. Much of the action can be found on Main Street, but hotspots are popping up in less commercial areas all the time.

Population: 72,310

Median Household Income: $60,388

Cost of Living: 90.7

Median Rent Price: $1,750

Home Price-to-Income Ratio: 5.10

💡 Quick Tip: Your parents or grandparents probably got mortgages for 30 years. But these days, you can get them for 20, 15, or 10 years — and pay less interest over the life of the loan.

Best Places to Live in South Carolina for Retirees

If you want a gentle pace of life but with lots of activities and natural beauty, check out these options:

1. Murrells Inlet

Photo credit: iStock/digidreamgrafix

Murrells Inlet is several miles from Myrtle Beach, so retirees can enjoy the Coastal Grandma lifestyle without the attendant tourists. This quiet community also has some of the best seafood in the state and several assisted living facilities.

Population: 9,740

Median Household Income: $75,438

Cost of Living: 94.7

Average Rent Price: $1,800

Home Price-to-Income Ratio: 5.03

Recommended: Best States to Retire for Taxes

2. Anderson

Population: 29,980

Median Household Income: $44,321

Cost of Living: 90.7

Average Rent Price: $1,450

Home Price-to-Income Ratio: 5.76

3. Little River

Another suburb of Myrtle Beach, Little River is a quiet town that hosts many retirees. The picturesque fishing community is the oldest of the 14 villages along the Grand Strand. Thanks to a cluster of restaurants and shops on the riverfront — the Little River serves as a natural border between North and South Carolina — residents can stay local or drive over the bridge to Myrtle Beach for more action.

Population: 11,711

Median Household Income: $64,590

Average Rent Price: $1,747

Home Price-to-Income Ratio: 4.66

Best Places to Live in South Carolina Near the Beach

Ready for some sand between your toes and amazing views of the water? Consider these three towns in South Carolina:

1. Myrtle Beach

Photo credit: iStock/DenisTangneyJr

One of the best known beach areas in the south, Myrtle Beach has a lot to offer. Its best-of-both-worlds location means you’re near amenities like dinner theater and museums but just a short drive from quieter neighborhoods and natural settings (and golf!). A popular resort area, the coast features classic attractions like a boardwalk, aquarium, arcades, an amusement park, and a famous Ferris wheel.

Population: 39,697

Median Household Income: $53,679

Cost of Living: 90.4

Average Rent Price: $1,872

Home Price-to-Income Ratio: 5.58

2. Beaufort

Photo credit: iStock/Marcopolo74

Situated close to the Georgia border, Beaufort is a small town near the beach offering many restaurants and shopping options in the downtown area. You’ll find festivals and cultural events throughout the year, and families appreciate the highly rated public and private schools.

Population: 13,850

Median Household Income: $59,454

Cost of Living: 104.3

Average Rent Price: $2,100

Home Price-to-Income Ratio: 6.60

3. Murrells Inlet

Photo credit: iStock/digidreamgrafix

Torn between the beach and the inland countryside? This small coastal town has a decidedly rural feel. Plus, Murrells Inlet sits between urban Myrtle Beach and Georgetown, providing stimulating day trips. If your interests lean toward sunset cruises and walking trails, however, you may never feel the need to leave this town.

Population: 9,740

Median Household Income: $75,438

Cost of Living: 94.7

Average Rent Price: $1,800

Home Price-to-Income Ratio: 5.03

The Takeaway

From small coastal towns to urban cultural centers, South Carolina has a wealth of history, culture, and natural wonders. In the north you’ll find the Grand Strand, 60 miles of beaches that end at Myrtle Beach. If Southern hospitality, comfort food, and slow living are up your alley, you’ll find plenty to appreciate in the Palmetto state.

Looking for an affordable option for a home mortgage loan? SoFi can help: We offer low down payments (as little as 3% - 5%*) with our competitive and flexible home mortgage loans. Plus, applying is extra convenient: It's online, with access to one-on-one help.

Browse Other States

FAQ

Where is the cheapest and safest place to live in South Carolina?

Some of the cheapest and quietest places to live in South Carolina include Fountain Inn and Little River.

Where is the nicest place to live in South Carolina?

While of course this is a subjective topic, some of the nicest places to live in South Carolina include the towns and suburbs of Myrtle Beach, for its natural beauty among other features, and Columbia, the state capital, for its thriving cultural attractions.

How much money do you need to live comfortably in South Carolina?

The amount of money you’ll need depends on where you live in South Carolina. However, most areas in the state have a lower cost of living compared to national figures.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

*SoFi requires Private Mortgage Insurance (PMI) for conforming home loans with a loan-to-value (LTV) ratio greater than 80%. As little as 3% down payments are for qualifying first-time homebuyers only. 5% minimum applies to other borrowers. Other loan types may require different fees or insurance (e.g., VA funding fee, FHA Mortgage Insurance Premiums, etc.). Loan requirements may vary depending on your down payment amount, and minimum down payment varies by loan type.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

Qualifying for the reward requires using a real estate agent that participates in HomeStory’s broker to broker agreement to complete the real estate buy and/or sell transaction. You retain the right to negotiate buyer and or seller representation agreements. Upon successful close of the transaction, the Real Estate Agent pays a fee to HomeStory Real Estate Services. All Agents have been independently vetted by HomeStory to meet performance expectations required to participate in the program. If you are currently working with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®. A reward is not available where prohibited by state law, including Alaska, Iowa, Louisiana and Missouri. A reduced agent commission may be available for sellers in lieu of the reward in Mississippi, New Jersey, Oklahoma, and Oregon and should be discussed with the agent upon enrollment. No reward will be available for buyers in Mississippi, Oklahoma, and Oregon. A commission credit may be available for buyers in lieu of the reward in New Jersey and must be discussed with the agent upon enrollment and included in a Buyer Agency Agreement with Rebate Provision. Rewards in Kansas and Tennessee are required to be delivered by gift card.

HomeStory will issue the reward using the payment option you select and will be sent to the client enrolled in the program within 45 days of HomeStory Real Estate Services receipt of settlement statements and any other documentation reasonably required to calculate the applicable reward amount. Real estate agent fees and commissions still apply. Short sale transactions do not qualify for the reward. Depending on state regulations highlighted above, reward amount is based on sale price of the home purchased and/or sold and cannot exceed $9,500 per buy or sell transaction. Employer-sponsored relocations may preclude participation in the reward program offering. SoFi is not responsible for the reward.

SoFi Bank, N.A. (NMLS #696891) does not perform any activity that is or could be construed as unlicensed real estate activity, and SoFi is not licensed as a real estate broker. Agents of SoFi are not authorized to perform real estate activity.

If your property is currently listed with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®.

Reward is valid for 18 months from date of enrollment. After 18 months, you must re-enroll to be eligible for a reward.

SoFi loans subject to credit approval. Offer subject to change or cancellation without notice.

The trademarks, logos and names of other companies, products and services are the property of their respective owners.

SOHL-Q125-119

Montana: Best Affordable Places to Live in 2025

Best Affordable Places to Live in Montana in 2025

(Last Updated – 03/2025)

One of the least densely populated states in the country, Montana offers sweeping mountain vistas, pristine lakes, and plenty of appealing places to live. And with a cost-of-living index of 95% of the U.S. average, a graduated income tax, and no sales tax, Montana is an affordable option that provides a rich quality of life for those looking to live in the mountain west.

Interested in moving to Big Sky Country? In this guide, you’ll find the best places to live in Montana for young adults, families, and retirees. Whether you prefer a city or a small town, we’ve got all the information you need.

Best Places to Live in Montana

Montana is a nature lover’s paradise. Although it’s more expensive than neighboring North Dakota, the cost of living in Montana is lower than in nearby Wyoming. For families and individuals who want to live in the mountains, Montana has a lot to offer.

💡 Quick Tip: Buying a home shouldn’t be aggravating. SoFi’s online mortgage application is quick and simple, with dedicated Mortgage Loan Officers to guide you through the process.

Best Affordable Places to Live in Montana

Montana has a range of options, from small towns to big cities, that have a lower cost of living. You can choose a place with a quiet lifestyle, or something more bustling and active. If you’re hoping to buy in Montana, and this is your first-ever home, consulting a first-time homebuyer guide can give you options and ideas that could help you in your house shopping.

1. Butte

Photo credit: iStock/powerofforever

Once termed the “Richest Hill on Earth,” Butte was flooded with prospectors around the turn of the 20th century. They dug for copper, silver, and gold. These days the city offers a small-town feel with a charming western facade — and prices that will make you feel like you’ve found treasure. Newbie homebuyers may want to check out first-time homebuyer programs in Montana.

Population: 35,701

Median Household Income: $57,633

Cost of Living: 91% of U.S. average

Average Rent Price: $1,300

Home Price-to-Income Ratio: 4.6

2. Great Falls

Photo credit: iStock/leezsnow

Sharing a name with the gorgeous waterfall along the Missouri River — now towering 148 feet — Great Falls was an important stop along Lewis and Clark’s cross-country journey. Today, it’s home to a thriving cultural scene including the Lewis and Clark Interpretive Center, as well as many other museums and attractions. With a cost of living index that’s only 91% of the national average, this city is a great pick for those looking to find an affordable place to live. Ready to get serious about a home purchase in Great Falls? Going through the mortgage preapproval process could help you compete more effectively against other buyers.

Population: 60,422

Median Household Income: $63,934

Cost of Living: 91% of U.S. average

Average Rent Price: $1,350

Home Price-to-Income Ratio: 4.9

3. Billings

Photo credit: iStock/peeterv

The only city in Montana with a population of over 100,000, Billings offers cosmopolitan living with a gorgeous countryside backdrop — at a fraction of the price you’d pay in other big cities. With attractions including multiple museums, a world-class zoo, and several nearby state parks, Billings is also just a day’s drive from Yellowstone Park and the Beartooth Mountains. The different types of mortgage loans available could help make a home purchase more accessible for buyers. Prefer to rent? Rentals in the city are relatively affordable.

Population: 120,864

Median Household Income: $71,855

Cost of Living: 96% of U.S. average

Median Rent Price: $1,399

Home Price-to-Income Ratio: 5.3

Best Places to Live in Montana for Families

With its open spaces and incredible natural attractions, Montana is a great place to raise a family. The state’s relatively affordable prices can also make child-rearing more financially feasible. These kid-friendly towns and cities are the best places to live in Montana for families.

1. Kalispell

Photo credit: iStock/KenRinger

Situated within an easy drive of both Glacier National Park and the Flathead Valley, Kalispell offers city resources within proximity of some of the best outdoor playgrounds on earth. While housing prices are a little higher than in some other Montana cities, parents may be drawn to the area because the Kalispell public school system is well regarded. If you’re looking to buy, these tips to qualify for a mortgage could help set you up for success.

Population: 29,886

Median Household Income: $61,590

Cost of Living: 95% of U.S. average

Average Rent Price: $1,675

Home Price-to-Income Ratio: 8.7

2. Helena

Photo credit: iStock/DenisTangneyJr

Montana’s capital city is filled with natural and manmade attractions, and it’s well situated for an easy day trip to other Montana cities like Bozeman and Missoula. Plus Helena’s downtown is lined with well-preserved Victorian architecture. It’s an affordable and picturesque place for parents to raise their kids. And the small-town vibe means children can experience a world where they actually know their neighbors.

Population: 34,464

Median Household Income: $69,341

Cost of Living: 100% of U.S. average

Average Rent Price: $1,600

Home Price-to-Income Ratio: 6.6

3. Great Falls

Photo credit: iStock/shanecotee

In this city, your kids can take after Lewis and Clark and explore the world around them. As a bonus, the city is also home to the Children’s Museum of Montana. Parents will enjoy the lower-than-American-average cost of living. Thinking of purchasing in Great Falls? Make visiting a home loan help center one of your prep steps.

Population: 60,422

Median Household Income: $63,934

Cost of Living: 91% of U.S. average

Median Rent Price: $1,350

Home Price-to-Income Ratio: 4.9

💡 Quick Tip: Lowering your monthly payments with a mortgage refinance from SoFi can help you find money to pay down other debt, build your rainy-day fund, or put more into your 401(k).

Best Places to Live in Montana for Young Adults

For adults in their 20s and 30s looking to establish their careers, make friends, and maybe even meet their future partner, Montana has plenty to offer. That includes towns and cities that balance outdoor adventures with nightlife. Check out these best places to live in Montana for young adults.

1. Missoula

Photo credit: iStock/DenisTangneyJr

Known as the setting of A River Runs Through It — though the film was actually shot in Livingston, several hours further east — Missoula’s status as the home of the University of Montana means it sees more than its fair share of cultural events for a mid-sized city tucked into the mountains. And yes, a river really does run through it — three rivers, in fact, and one of them, the Clark Fork, has a man-made wave that people surf on. Missoula is an option for young adults hoping to find themselves and meet others along the way. Although the city’s median age is higher than the others on this list, job prospects in the education and health care fields mean plenty of opportunities for younger folks to meet.

Population: 77,757

Median Household Income: $65,329

Cost of Living: 107% of U.S. average

Average Rent Price: $1,325

Home Price-to-Income Ratio: 8.3

2. Billings

Photo credit: iStock/peeterv

For those who want to be where the action is, Billings is the place. The most populous city in Montana, it’s the perfect launching point for adventurous outings in nearby state forests, or refined evenings at the Alberta Bair Theater.

Population: 120,864

Median Household Income: $71,855

Cost of Living: 96% of U.S. average

Average Rent Price: $1,399

Home Price-to-Income Ratio: 5.3

3. Helena

Photo credit: iStock/ChrisBoswell

Yet again, Montana’s capital makes the list! With stunning landscapes in every direction, and lots of social activities to choose from, adventurous young adults will find plenty to do. Helena also offers job opportunities for those looking to break into the political scene.

Population: 34,464

Median Household Income: $69,341

Cost of Living: 100% of U.S. average

Median Rent Price: $1,600

Home Price-to-Income Ratio: 6.6

Best Places to Live in Montana for Retirees

What better way to spend one’s golden years than surrounded by glorious natural landscapes? Montana boasts plenty of communities that champion a low-stress lifestyle with abundant cultural activities, gorgeous parks, and opportunities for socializing.

1. Polson

Photo credit: iStock/gjohnstonphoto

Tucked along the shores of Polson Bay at the southernmost end of Flathead Lake, Polson is about as picturesque as it gets. The town’s population of just over 5,000 means a relaxed pace of life along with the chance to know all your neighbors. And with almost a quarter of the population age 65 or over, retirees can look forward to plenty of get-togethers with their peers. If you’re considering buying a home that’s on the pricier side, you may want to explore jumbo mortgage loans as you’re navigating the home-buying process.

Population: 5,613

Median Household Income: $51,463

Cost of Living: 105% of U.S. average

Median Rent Price: $1,499

Home Price-to-Income Ratio: 10.7

2. Missoula

Photo credit: iStock/James Griffiths Photography

As hip as Missoula is, it’s also a great option for retirees. For one thing, the University of Montana provides plenty of cultural attractions. In addition, summer farmers markets, community game nights, and other organized opportunities for building connections abound. Costs in Missoula remain fairly reasonable considering this is one of the state’s largest and most vibrant communities.

Population: 77,757

Median Household Income: $65,329

Cost of Living: 107% of U.S. average

Median Rent Price: $1,325

Home Price-to-Income Ratio: 8.3

3. Hamilton

Photo credit: iStock/johnrandallalves

Thanks to its location in the Bitterroot Valley, Hamilton has the lucky distinction of getting far less snow than other Montana cities in the winter. The town is also well known for its relaxed pace of life and proximity to hiking trails and hot springs.

Population: 5,268

Median Household Income: $52,917

Cost of Living: 98% of U.S. average

Median Rent Price: $1,900

Home Price-to-Income Ratio: 9.4

Best Places to Live in Montana Near the Mountains

You’ll find natural beauty in Montana, no matter where you go. But for climbers, skiers, snowboarders, and others who hear the mountains calling, these three cities will hold special appeal.

1. Kalispell

Photo credit: iStock/jodiecoston

Looking to balance proximity to Glacier National Park with reasonable prices? Chances are, you’ll find it here. Located in the midst of some of the very best parts of Montana, including Flathead Lake and the Kootenai National Forest, Kalispell offers a relatively affordable cost of living compared to nearby cities like Whitefish.

Population: 29,886

Median Household Income: $61,590

Cost of Living: 95% of U.S. average

Average Rent Price: $1,675

Home Price-to-Income Ratio: 8.7

2. Missoula

Photo credit: iStock/Montana Mermaid

This city is home to the Rattlesnake National Recreation Area, the Pattee Canyon Recreation Area, and the famous Mount Sentinel M Trail. Plus, the Clark Fork River that runs through town is great for fly fishing, kayaking, paddle boarding, surfing, and more.

Population: 77,757

Median Household Income: $65,329

Cost of Living: 107% of U.S. average

Average Rent Price: $1,325

Home Price-to-Income Ratio: 8.3

3. Bozeman

Photo credit: iStock/Lisa5201

Bozeman is the perfect solution for those who want it all: mountains, city life, community, and convenience. Here, you’re within easy proximity of the Bridger Range, Gallatin Range, Madison Range, Spanish Peaks, Beartooth Mountains, Crazy Mountains, and Tobacco Root Mountains — to name a few. And Yellowstone National Park is just an hour’s drive south.

Population: 57,305

Median Household Income: $79,903

Cost of Living: 111% of U.S. average

Average Rent Price: $2,500

Home Price-to-Income Ratio: 9

The Takeaway

Montana offers affordability for those who dream of living in the mountains. And it provides residents with endless recreational opportunities all year long. For families, young adults, and retirees who are considering moving to the state, Montana has a variety of options to explore — from tiny communities, to small cities, to robust college towns. Butte and Bozeman are just some of the top affordable cities on our list.

Looking for an affordable option for a home mortgage loan? SoFi can help: We offer low down payments (as little as 3% - 5%*) with our competitive and flexible home mortgage loans. Plus, applying is extra convenient: It's online, with access to one-on-one help.

Browse Other States

FAQ

Is Montana an affordable place to live?

With a state-wide cost of living about 5% lower than the U.S. average, Montana is relatively affordable. Other states known for their natural beauty such as Oregon, Maine, and Washington are significantly more costly.

Where is the cheapest place to live in Montana with mountain views?

While affordability is relative, one of the most affordable places to live in Montana with magnificent mountain views is Butte.

What is the best city to move to in Montana?

It depends on what you’re looking for. For affordability, Butte and Great Falls are great contenders; for proximity to stunning natural beauty, Kalispell or Bozeman are good bets. For those looking for a bigger-city lifestyle, Billings is the most populous community to consider.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

*SoFi requires Private Mortgage Insurance (PMI) for conforming home loans with a loan-to-value (LTV) ratio greater than 80%. As little as 3% down payments are for qualifying first-time homebuyers only. 5% minimum applies to other borrowers. Other loan types may require different fees or insurance (e.g., VA funding fee, FHA Mortgage Insurance Premiums, etc.). Loan requirements may vary depending on your down payment amount, and minimum down payment varies by loan type.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

Qualifying for the reward requires using a real estate agent that participates in HomeStory’s broker to broker agreement to complete the real estate buy and/or sell transaction. You retain the right to negotiate buyer and or seller representation agreements. Upon successful close of the transaction, the Real Estate Agent pays a fee to HomeStory Real Estate Services. All Agents have been independently vetted by HomeStory to meet performance expectations required to participate in the program. If you are currently working with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®. A reward is not available where prohibited by state law, including Alaska, Iowa, Louisiana and Missouri. A reduced agent commission may be available for sellers in lieu of the reward in Mississippi, New Jersey, Oklahoma, and Oregon and should be discussed with the agent upon enrollment. No reward will be available for buyers in Mississippi, Oklahoma, and Oregon. A commission credit may be available for buyers in lieu of the reward in New Jersey and must be discussed with the agent upon enrollment and included in a Buyer Agency Agreement with Rebate Provision. Rewards in Kansas and Tennessee are required to be delivered by gift card.

HomeStory will issue the reward using the payment option you select and will be sent to the client enrolled in the program within 45 days of HomeStory Real Estate Services receipt of settlement statements and any other documentation reasonably required to calculate the applicable reward amount. Real estate agent fees and commissions still apply. Short sale transactions do not qualify for the reward. Depending on state regulations highlighted above, reward amount is based on sale price of the home purchased and/or sold and cannot exceed $9,500 per buy or sell transaction. Employer-sponsored relocations may preclude participation in the reward program offering. SoFi is not responsible for the reward.

SoFi Bank, N.A. (NMLS #696891) does not perform any activity that is or could be construed as unlicensed real estate activity, and SoFi is not licensed as a real estate broker. Agents of SoFi are not authorized to perform real estate activity.

If your property is currently listed with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®.

Reward is valid for 18 months from date of enrollment. After 18 months, you must re-enroll to be eligible for a reward.

SoFi loans subject to credit approval. Offer subject to change or cancellation without notice.

The trademarks, logos and names of other companies, products and services are the property of their respective owners.

SOHL-Q125-105

Cost of Living in Colorado

Cost of Living in Colorado

(Last Updated – 03/2025)

If you love to hit the slopes, you’ll love living in Colorado. Maybe the access to so much nature and so many outdoor activities is why Colorado is the state ranked ninth for overall health, according to U.S. News & World Report.

To better understand if living in the Centennial State is the right fit for you, keep reading to learn more about the cost of living in Colorado.

What’s the Average Cost of Living in Colorado?

Average Cost of Living in Colorado: $63,781 per year

Take a closer look at your budget before you decide to move to Colorado. MERIC data gathered in 2024 found that Colorado tied with Idaho and Puerto Rico for the 32nd best cost-of-living in the country. The neighboring state of Nebraska (No. 18) would be a better fit for those looking to save on living expenses. Kansas (No. 3) is an even bigger bargain. What does the Colorado cost of living look like? According to data from the Bureau of Economic Analysis, the average total personal consumption cost in Colorado is $63,781 per year. This is what the average spending looks like across a variety of categories.

|

Category |

Average Annual Per-Capita Cost in Colorado |

|

Housing and Utilities |

$12,600 |

|

Health Care |

$8,415 |

|

Food and Beverages (nonrestaurant) |

$4,922 |

|

Gasoline and Energy Goods |

$1,383 |

|

All Other Personal Expenditures |

$36,462 |

Housing Costs in Colorado

Average Housing Costs in Colorado: $1,496 to $2,732 per month

Colorado is home to more than 2.6 million housing units, which means you’ll have plenty of options. The big question is, can you afford rent or a mortgage in Colorado? Zillow reported Colorado’s typical home price as $543,106 in December 2024.

How much you’ll pay for housing will depend on if you’re renting or buying and how large your rental is. Here’s what those prices look like according to census data:

• Median monthly mortgage cost: $2,231

• Median studio rent: $1,496

• Median one-bedroom rent: $1,546

• Median two-bedroom rent: $1,810

• Median three-bedroom rent: $2,083

• Median four-bedroom rent: $2,305

• Median five-bedroom (or more) rent: $2,732

• Median gross rent: $1,771

Recommended: Denver Housing Market: Trends & Prices

Because prices can vary so much throughout the state, take a look at the typical home price in some of Colorado’s major cities, sourced from Zillow in December 2024:

|

Colorado City |

Typical Home Price |

|

Denver |

$578,381 |

|

Colorado Springs |

$454,606 |

|

Fort Collins |

$550,481 |

|

Greeley |

$497,199 |

|

Boulder |

$728,257 |

|

Pueblo |

$284,051 |

|

Grand Junction |

$406,092 |

|

Glenwood Springs |

$913,075 |

|

Durango |

$656,343 |

|

Edwards |

$1,333,925 |

|

Montrose |

$465,443 |

|

Cañon City |

$333,850 |

|

Breckenridge |

$960,807 |

|

Fort Morgan |

$337,997 |

|

Steamboat Springs |

$1,096,318 |

|

Sterling |

$245,944 |

|

Craig |

$284,107 |

Utility Costs in Colorado

Average Utility Costs in Colorado: $296 per month

It can get bone-chilling in Colorado, so you need to budget enough to keep the heat pumping in the winter. Here’s what the average utility spending looks like.

|

Utility |

Average Colorado Bill |

|

Electricity |

$95 |

|

Natural Gas |

$47 |

|

Cable & Internet |

$110 |

|

Water |

$44 |

Sources: U.S. Energy Information Administration, Electric Sales, Revenue, and Average Price; Statista.com, Average monthly residential utility costs in the United States, by state; DoxoInsights, U.S. Cable & Internet Market Size and Household Spending Report; and Rentcafe.com, What Is the Average Water Bill?

Groceries & Food

Average Grocery & Food Costs in Colorado: $410 per person, per month

We all need to eat, so it’s fair to wonder how much you should expect to spend on food in Colorado.

The Bureau of Economic Analysis estimates Colorado’s average annual nonrestaurant food cost per person to be $4,922, or about $410 per month. For a family of four, the grocery bill could be about $1,641 per month.

Where you live will play a role in how much you spend on food. The Council for Community and Economic Research ranks food costs in major cities. These are the rankings for grocery costs for 2024.

|

Colorado City |

Grocery Items Index |

|

Denver |

101.3 |

|

Colorado Springs |

101.9 |

|

Pueblo |

98.3 |

|

Grand Junction |

101.4 |

Transportation

Average Transportation Costs in Colorado: $9,550 to $17,771 per year

Daily commutes, weekend ski trips with the family, and getting from place to place all cost money. How much you’ll spend on transportation in Colorado depends greatly on how many working adults are in your family and how many children you have.

This basic breakdown from MIT’s Living Wage Calculator data as of February 2025 gives you an idea of what you might spend on transportation.

|

Family Makeup |

Average Annual Transportation Cost |

|

One adult, no children |

$9,550 |

|

Two working adults, no children |

$11,053 |

|

Two working adults, three children |

$17,771 |

Health Care

Average Health Care Costs in Colorado: $8,415 per person, per year

Colorado residents spend an average of $8,415 a year on health care, according to the Bureau of Economic Analysis Personal Consumption Expenditures by State report.

Of course that average can vary, depending on individuals’ coverage and needs.

Child Care

Average Child Care Costs in Colorado: $1,000 to $1,446 or more per child, per month

Child care can really eat up your budget, no matter where you live. The Colorado Child Care Assistance Program helps families who need child care so they can work, search for employment, or go through employment training in order to become self-sufficient.

These are the average child care costs you can expect to encounter in Texas, according to data from costofchildcare.org .

|

Type of Child Care |

Average Cost Per Month, Per Child |

|

Infant Classroom |

$1,446 |

|

Toddler Classroom |

$1,191 |

|

Preschooler Classroom |

$1,000 |

|

Home-Based Family Child Care |

$1,190 |

Taxes

Tax Rate in Colorado: 4.40%

No matter what state we live in, we all follow the same format when it comes to federal income taxes. However, states have different state income tax rates (if any) and varying ways of calculating how much is owed.

In Colorado, calculating how much you owe is simple, as Colorado has a flat income tax of 4.40%, according to the Tax Foundation’s State Individual Income Tax Rates and Brackets for 2025. Utah, a neighbor, also has a flat income tax rate: 4.55% as of 2025.

Miscellaneous Costs

If, as the Bureau of Economic Analysis estimates, other personal consumption expenditures (outside of the necessities like housing, transportation, and health care) total $36,462 a year, this is where some of that spending may be going (costs are accurate as of February 2025):

• If you want to practice rock climbing safely indoors before heading outside, check out the Boulder Rock Club, a popular local rock climbing gym: $28 for your first visit or $91 monthly membership for adults

• The Glenwood Caverns Adventure Park in Glenwood Springs offers a wide variety of family fun: $35 for a gondola ride to the top of the mountain ($30 online); $55 for a gondola ride and cave tours ($50 online).

• For a fun and educational family day in Denver, stop by the Denver Museum of Nature and Science: Youth tickets (ages 3-18) are $20.95, adult tickets are $25.95, and senior tickets are $22.95.

• Or catch a live concert at Red Rocks Park and Amphitheatre in Morrison, Colorado. This unique outdoor venue opened in 1941 and has been designated a National Historic Landmark. Admission is free to the 738 acre park for visitors from sunrise to sunset (on nonevent days). You can also grab a ticket to a concert (starting around $40, depending on the artist), to sunrise yoga ($19), or even to a movie ($20) “on the rocks.

How Much Money Do You Need to Live Comfortably in Colorado?

How obtainable it is to live comfortably in a specific state will depend greatly on your family size and other factors. That said, don’t expect to get off easy in Colorado.

Colorado rose slightly to the 41st spot in the 2024 U.S. News & World Report’s Affordability Rankings, which compare the average cost of living in each state with the average household income. Colorado fared much better in the previously mentioned MERIC study, where the state ranked 32nd.

What City Has the Lowest Cost of Living in Colorado?

Looking for an affordable place to live in Colorado? Take some time getting to know the two major cities with lower cost of living from the Council for Community and Economic Research’s Cost of Living Index for 2024.

Pueblo

The most affordable major city in Colorado is Pueblo, with a cost-of-living index of just 92.7. Enjoy strolls on the stunning Riverwalk, and take a break to enjoy one of the many local cafes or breweries.

Colorado Springs

With a cost-of-living index of 101.9, Colorado Springs is the third most affordable major city in Colorado. This city is a nature lover’s dream, and there is no shortage of hiking opportunities to help you blow off steam after work, perhaps at the nearby Peterson Space Force Base. On the weekends, enjoy some family time at the local zoo, museums, and parks. Colorado Springs is home to more than 60 attractions, so there’s no shortage of fun to be had!

Recommended: Colorado Springs Housing Market: Trends & Prices

SoFi Home Loans

Nature lovers will appreciate all the hiking, skiing, rafting, and biking Colorado affords. The cost of living in Colorado may be relatively steep, but it’s easy to see why you might want to move there and enjoy all that fresh mountain air.

Looking for an affordable option for a home mortgage loan? SoFi can help: We offer low down payments (as little as 3% - 5%*) with our competitive and flexible home mortgage loans. Plus, applying is extra convenient: It's online, with access to one-on-one help.

Photo credit: iStock/miroslav_1

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

*SoFi requires Private Mortgage Insurance (PMI) for conforming home loans with a loan-to-value (LTV) ratio greater than 80%. As little as 3% down payments are for qualifying first-time homebuyers only. 5% minimum applies to other borrowers. Other loan types may require different fees or insurance (e.g., VA funding fee, FHA Mortgage Insurance Premiums, etc.). Loan requirements may vary depending on your down payment amount, and minimum down payment varies by loan type.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

Qualifying for the reward requires using a real estate agent that participates in HomeStory’s broker to broker agreement to complete the real estate buy and/or sell transaction. You retain the right to negotiate buyer and or seller representation agreements. Upon successful close of the transaction, the Real Estate Agent pays a fee to HomeStory Real Estate Services. All Agents have been independently vetted by HomeStory to meet performance expectations required to participate in the program. If you are currently working with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®. A reward is not available where prohibited by state law, including Alaska, Iowa, Louisiana and Missouri. A reduced agent commission may be available for sellers in lieu of the reward in Mississippi, New Jersey, Oklahoma, and Oregon and should be discussed with the agent upon enrollment. No reward will be available for buyers in Mississippi, Oklahoma, and Oregon. A commission credit may be available for buyers in lieu of the reward in New Jersey and must be discussed with the agent upon enrollment and included in a Buyer Agency Agreement with Rebate Provision. Rewards in Kansas and Tennessee are required to be delivered by gift card.

HomeStory will issue the reward using the payment option you select and will be sent to the client enrolled in the program within 45 days of HomeStory Real Estate Services receipt of settlement statements and any other documentation reasonably required to calculate the applicable reward amount. Real estate agent fees and commissions still apply. Short sale transactions do not qualify for the reward. Depending on state regulations highlighted above, reward amount is based on sale price of the home purchased and/or sold and cannot exceed $9,500 per buy or sell transaction. Employer-sponsored relocations may preclude participation in the reward program offering. SoFi is not responsible for the reward.

SoFi Bank, N.A. (NMLS #696891) does not perform any activity that is or could be construed as unlicensed real estate activity, and SoFi is not licensed as a real estate broker. Agents of SoFi are not authorized to perform real estate activity.

If your property is currently listed with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®.

Reward is valid for 18 months from date of enrollment. After 18 months, you must re-enroll to be eligible for a reward.

SoFi loans subject to credit approval. Offer subject to change or cancellation without notice.

The trademarks, logos and names of other companies, products and services are the property of their respective owners.

SOHL-Q125-150

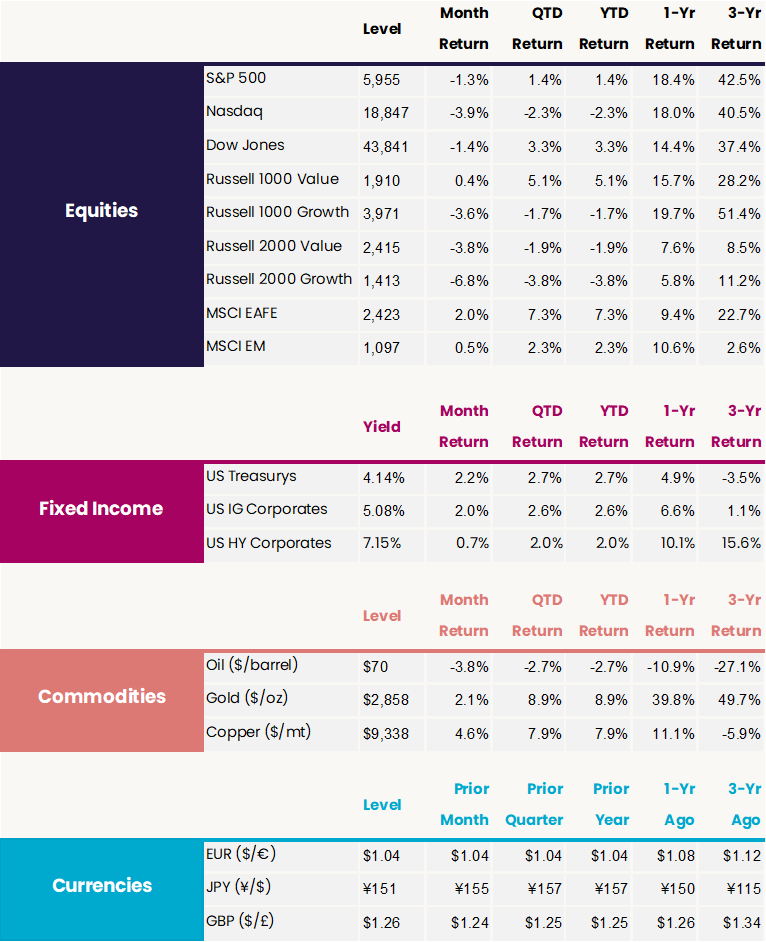

February 2025 Market Lookback

Any hopes that the volatility of late January would dissipate were dashed in February. Uncertainty surrounding domestic and international political headlines weighed on consumer confidence, with inflation expectations surging in response to the administration’s tariff threats. Individual investor sentiment, meanwhile, turned the most bearish it has been since September 2022. Growing economic fears pushed yields markedly lower, with Treasurys and Investment Grade bonds both returning over 2% in their best month since July.

Macro

• Unemployment declined from 4.1% to 4.0% in January, below expectations.

• The January Consumer Price Index rose 0.5% m/m and 3.0% y/y, both notably above expectations.

• January retail sales declined 0.9% m/m, below all forecasts, as a seasonally cold month weighed on spending habits.

• The Conference Board’s Consumer Confidence Index declined to 98.3 in February, driven by trade uncertainty and inflation fears.

• The National Association of Homebuilders’ measure of homebuilder sentiment fell from an index value of 47 to 42 (neutral = 50), as present sales and future expectations both worsened.

• The Japanese Yen appreciated from 155 to 151 versus the U.S. Dollar, its strongest level since the beginning of December.

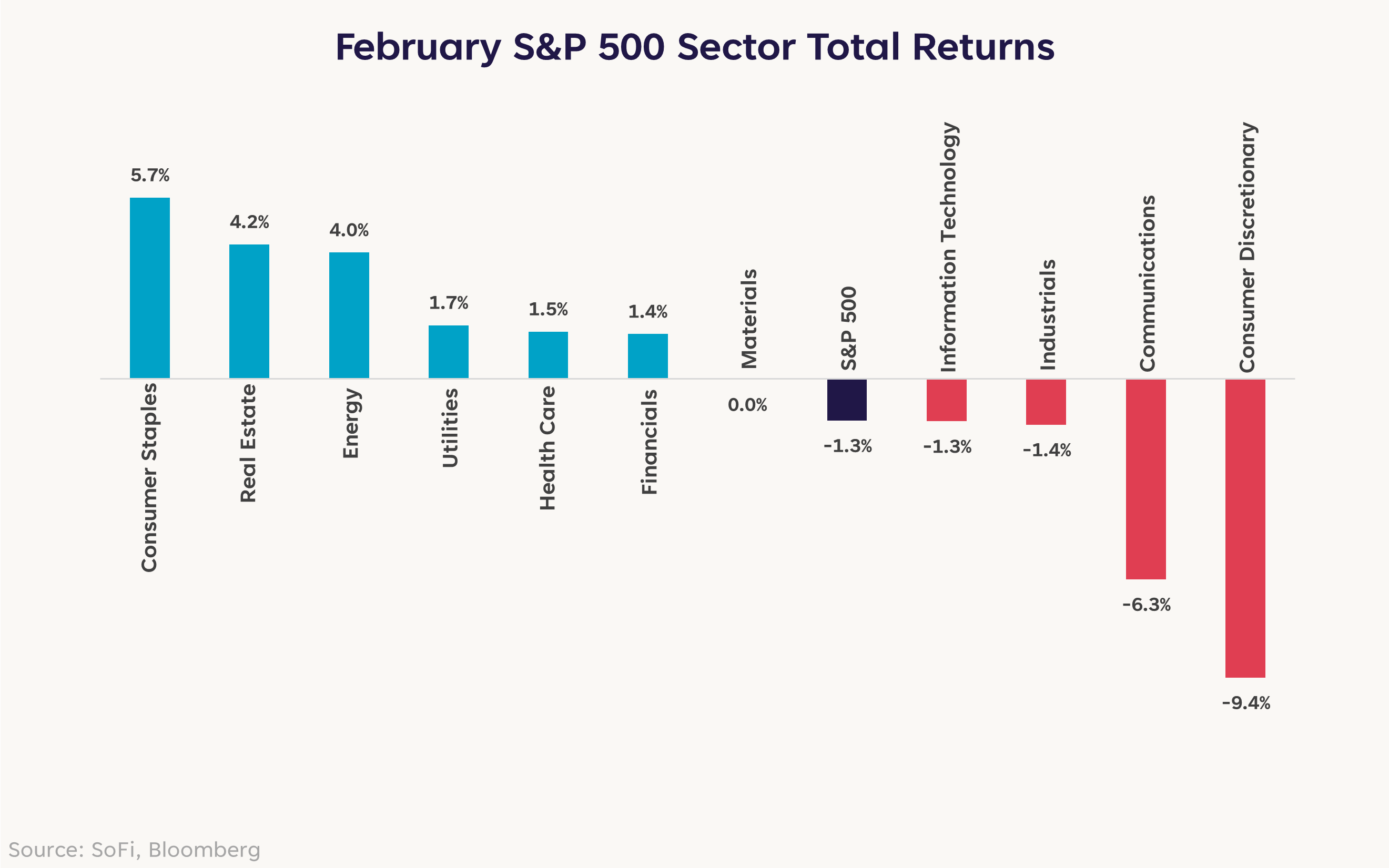

Equities

• Consumer Staples outperformed Consumer Discretionary by 15.0 percentage points, the most since April 2022 and the second-largest outperformance on record.

• According to the American Association of Individual Investors, bearish investors outnumbered bullish investors by 41.2 percentage points, the widest such gap since September 2022.

• While forward 12-month earnings expectations rose 0.5% in February, the forward P/E ratio contracted by 1.9%.

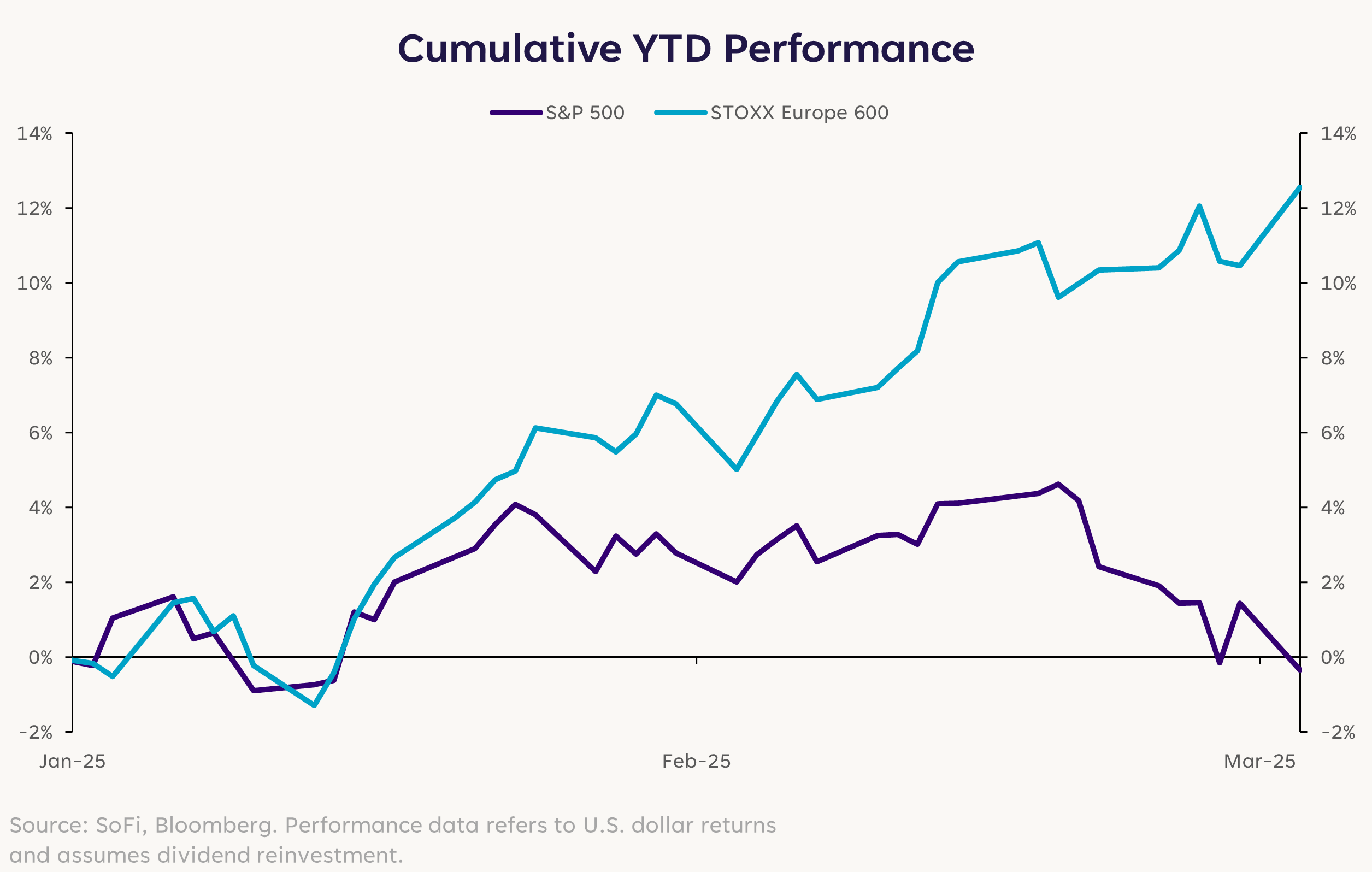

• Buoyed by expectations for greater defense spending, European stocks outperformed U.S. stocks by 4.8 percentage points, the most since December 2022 and a continuation of the prior month’s relative strength.

Fixed Income

• Treasury yields fell 20-35 basis points in February, with longer-term yields declining more sharply on economic growth fears.

• Nearly 80% of the decline in the 10-year yield was driven by lower real (i.e. inflation-adjusted) yields, while the rest was driven by lower inflation expectations.

• The spread between U.S. and Japanese 10-year yields fell from 3.30% to 2.84%, the narrowest level since September 13, driven in part by the Bank of Japan’s rate hiking cycle.

Ongoing Geopolitical Uncertainty

February marked the first full month of the new presidency, and not only did the uncertainty of the first days of the administration continue, it intensified. A chief reason why is that the sometimes-unpredictable policy shifts that characterized the previous Trump administration are back.

Any one of the rapidly evolving developments on Department of Government Efficiency (DOGE) cuts, fluctuating tariff threats, or major foreign policy shifts (e.g. a possible ceasefire between Russia and Ukraine) would be enough to muddy the trajectory of the economy. Altogether, however, they could ensure a market environment of persistently elevated volatility.

Market performance in 2025 has been telling so far: European and international markets more broadly have demonstrated remarkable resilience and returns given the geopolitical backdrop, while U.S. markets have underperformed. Reasons why are complex, but one factor has been expectations for higher fiscal spending (i.e. defense) from European governments.

This all stands in stark contrast to the initial post-election market narrative, when investors believed widespread deregulation and accelerated domestic growth would position the U.S. favorably.

Vibes Affect Reality

There can often be a disconnect between financial market movements and the broader economy, but that was clearly not the case this past month. The ongoing media headlines and market volatility began to bleed through to consumers and businesses alike.

Sentiment metrics have deteriorated in recent months, with The Conference Board’s data showing consumer confidence at four-year lows and trending downward. Additionally, the steady drumbeat of tariff news has also pushed inflation expectations higher.

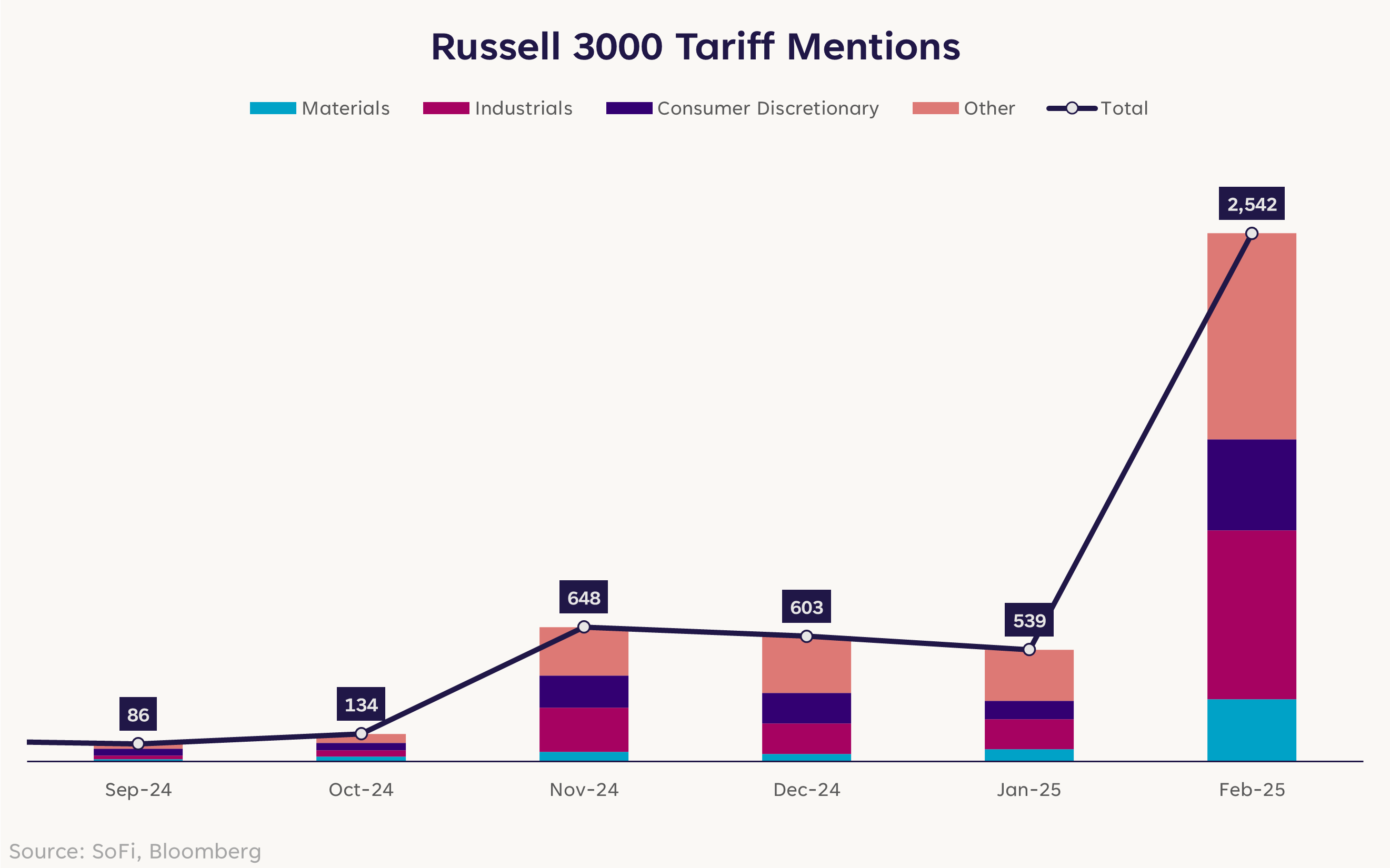

Corporate America isn’t unscathed in all of this: Russell 3000 transcript mentions of tariffs have skyrocketed. Businesses often plan out quarters – if not years – in advance, so when there’s little visibility on fundamental aspects such as input costs, companies often adopt a cautious stance.

If sustained, this environment of diminished certainty could impact economic growth, and higher costs could compress corporate profit margins. And while in the past the Federal Reserve was there to save the economy, inflation risks suggest that the central bank will be slow to lower interest rates this time. All of these factors result in a challenging combination for economic stability—one that could hurt investor returns.

Performance data quoted represents past performance. Past performance does not guarantee future results. Market returns will fluctuate, and current performance may be lower or higher than the standardized performance data quoted.

photo credit: iStock/phototechno

Read moreCK SoFi Everyday Cash Rewards Credit Card

{/* CK CC Everday Cash Reward 7/16/24*/}

{/* https://www.sofi.com/credit-card/ck-ecr-15tt200/ */}

{/* Hero */}

Earn up to 3% cash back rewards toward your money goals.

Plus, get 0% Intro APR for 15 months2 and $200 when you spend $1,000 in 90 days.3

Apply now

See Pricing, Terms & Conditions

*

See Rewards Details

{/* 0% Intro APR for 15 months and $200 */}

0% Intro APR for 15 months and $200? Yes, please.

Get 0% Intro APR on balance transfers and purchases for 15 months.2 After 15 months, your APR will change to 18.49% to 28.99% based on your credit worthiness. Balance transfers must be completed within 60 days of account opening. Plus, earn $200 for spending $1,000 within 90 days.3

Apply now

{/* Your cash back rewards are as simple as 3-2-1. */}

Your cash back rewards

are as simple as 3-2-1.

-

-

Fewer restrictions

Enjoy no limits or caps on earnings, or minimum to redeem your cash back rewards.

-

Earn toward your money goals

Redeem as statement credit—or toward saving, investing, and paying down eligible SoFi debt.*

Apply now

{/* Fewer fees. More benefits */}

Fewer fees.

More benefits.

No annual fee†

You read that right, pay no annual fee. Period.

No foreign transaction fees

Don’t worry about credit statement shock from international surcharges.

Zero Fraud Liability4

Don’t worry about paying for fraudulent transactions thanks to Zero Fraud Liability.

Mastercard World Benefits4

Enjoy monthly $5 credits for Lyft, free 2-day shipping from ShopRunner, and more.

ID Theft Protection5

Your identity is safe with us thanks to enhanced security.

SoFi Travel rewards6

Earn 3% cash back rewards when you book trips through SoFi Travel.

{/* Consider this your credit card cheat sheet */}

Consider this your

credit card cheat sheet.

See more articles

{/*FAQs*/}

FAQs

The initial SoFi credit card application is a soft credit pull, which will bring no impact to your credit score if you get declined. However if you’re accepted – we will run a hard pull which may impact your credit score.

You will earn unlimited 3% cash back rewards on a wide variety of dining out and dining in options:

Dining out includes a wide variety of categories like restaurants, cafes, bars, lounges, fast food chains, and bakeries. Dining in includes food delivery platforms like DoorDash and UberEats.

You will earn unlimited 2% cash back rewards on everyday grocery shopping at a wide variety of grocery stores, online grocery delivery, and convenience stores nationwide.

You will earn unlimited 1% cash back on all other purchases. This is automatically applied to every purchase you make – whether you swipe, dip, tap, or pay online. See more details at https://www.sofi.com/card/rewards?cardType=h

To be eligible for a SoFi credit card, you must be at least 18 years old (or the legal age required by your state of residence), have a physical U.S. mailing address, and possess a valid Social Security number. The SoFi Everyday Cash Rewards card is designed for those with good to excellent credit.

If you’re not currently a SoFi member, the Apply Now button above will prompt you to create a SoFi account. If you are already a member, you’ll be asked to log in before applying. In either case, your online application can be completed in less than 2 minutes!

You can redeem rewards as statement credits or distribute them in other SoFi products including SoFi Checking & Savings, Invest, and eligible SoFi loan payment products.

At SoFi, the protection of our members is of the utmost importance. Click here to learn more about how we protect you against identity theft and fraud.

See all FAQs