What Are Stablecoins? Their Purpose and Different Types

Stablecoins are digital currencies that maintain a fixed value. They are designed to function like fiat currencies that exist on the blockchain. This brings with it several benefits in terms of usability, speed, and regulatory compliance. There are multiple types of stablecoins, each defined by the mechanism used to maintain the 1-to-1 peg to their respective fiat currencies.

Table of Contents

What Are Stablecoins?

Stablecoins are digital coins that maintain a stable value. Most stablecoins are pegged to popular fiat currencies like the U.S. Dollar, Chinese Yuan, or the Euro. Some are pegged to commodities like gold, too. In theory, a stablecoin could have its value linked to anything. However, coins pegged to a fiat currency are the most commonly used type. When someone uses the term “stablecoin,” they are most likely referring to fiat currency coins.

The most stable cryptocurrency will by definition be a stablecoin. Some of these coins see their values fluctuate by small amounts during times of intense cryptocurrency trading volume, but they tend to correct back to their normal value in short order.

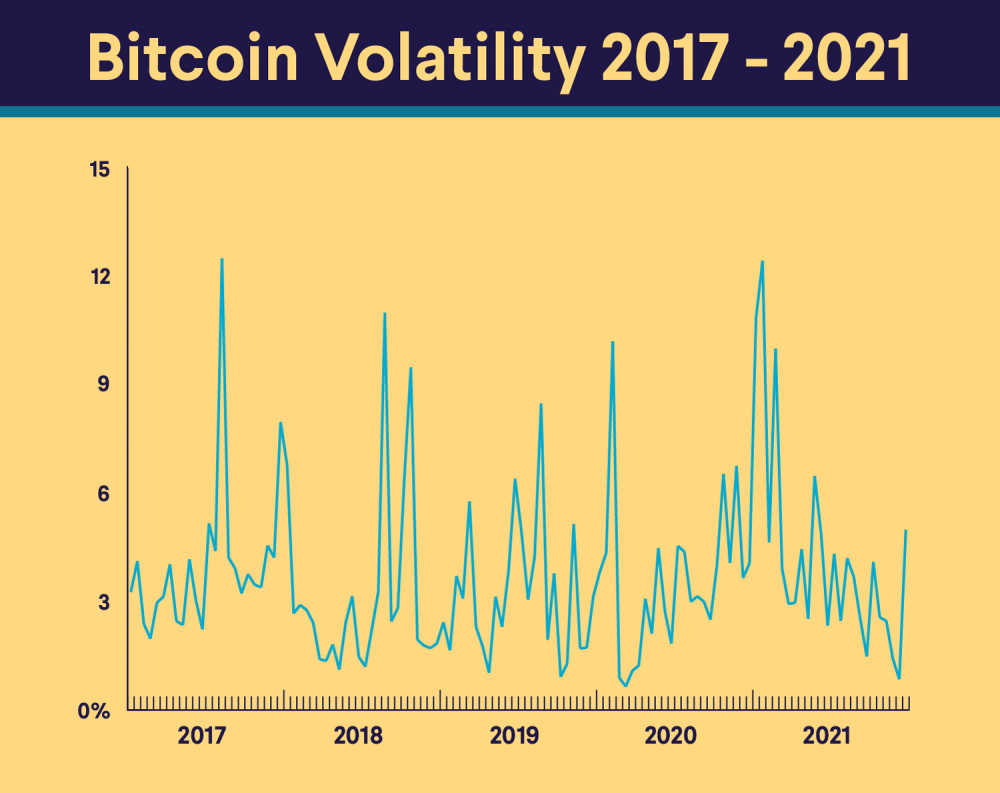

If there is any volatility in a stablecoin, it’s certainly much less than that seen in other types of cryptocurrencies.

What Is the Point of a Stablecoin?

Stablecoins have a variety of benefits and uses. The main idea is to have a cryptocurrency that is not subject to the volatility of other cryptos like Bitcoin and the many hundreds of altcoins.

Beyond that, there are other benefits that make using a stablecoin preferable to using regular fiat currency in some situations. Some of the most commonly cited reasons for creating and using stablecoins are:

• Regulatory compliance for crypto exchanges

• Utility in decentralized finance (DeFi)

• Ease of use for traders

• The ability to make fast cross-border payments with low fees

Let’s look at each of these in detail.

Stablecoins Make Things Easier for Crypto Exchanges

With stablecoins, cryptocurrency exchanges get to sidestep the complex financial regulations involved with institutions that deal with fiat currencies. (Crypto regulations are very different; and still evolving.) This gives their users the convenience of having stablecoin trading pairs while keeping everything within the cryptocurrency ecosystem.

Stablecoins Are Essential to Decentralized Finance (DeFi)

Stablecoins are becoming a necessary component of the decentralized finance (DeFi) space. Investors can make transactions like peer-to-peer lending — where people make direct loans to each other via blockchain — with stablecoins.

Some users might prefer this option to other cryptocurrencies, which could hurt their rate of return if the price goes down. A stablecoin adds an element of predictability to financial arrangements.

Stablecoins Make Trading Easier

One group of people who often use stablecoins to their advantage are cryptocurrency traders.

When moving money between multiple volatile cryptocurrencies, holding onto profits can be difficult. While traders can always put their gains into Bitcoin (BTC), the largest cryptocurrency by market cap, bitcoin itself has bouts of volatility.

Stablecoins can provide an easy solution to this problem. Traders can simply move into a stablecoin like USD Coin (USDC) or Tether (USDT) to immediately lock in gains. Or, they can take advantage of arbitrage opportunities when the same cryptocurrency has a different price on two different exchanges.

Crypto exchanges have begun offering more stablecoin/altcoin pairs to make things easier for traders.

Stablecoins Enable Fast, Cheap Cross-border Payments

Traditional bank transfers typically take anywhere from three-to-five business days and can cost anywhere from a few dollars to dozens of dollars. International transfers tend to be the most expensive.

Stablecoin transactions can be confirmed within minutes, or less, and at very little cost. Two people with stablecoin wallets can transact with each other from anywhere in the world at any time without the need for a bank or other third-party intermediary.

Different Types of Stablecoins

There are four basic types of stablecoins:

1. Centralized Coins Backed by Fiat Currency

The most popular stablecoins today use a centralized model and back new token issues with fiat currency at a one-to-one ratio. U.S. Dollar Coin (USDC) and Tether (USDT) are examples of this type of coin. In terms of real daily trading volume, USDT and USDC were the number-one and number-six most-traded cryptocurrencies, respectively, at the time of writing, according to data from Messari.

2. Decentralized Coins Backed by Cryptocurrency

Some other stablecoins that use a decentralized model, like DAI, have grown in popularity in the crypto community. Rather than maintaining their stable value through fiat reserves, users can lock up cryptocurrency as collateral for borrowing DAI on the Maker DAO platform. There are also a growing number of decentralized lending platforms that allow users to deposit DAI or other stablecoins and earn interest. Network consensus, rather than a centralized team, governs DAI (similar to how Bitcoin works), which maintains a value equal to one U.S. dollar.

3. Decentralized Algorithmic Coins

Decentralized algorithmic coins are a newer technology and differ from the other types of stablecoins in that they don’t involve any type of collateral backing. Instead, they rely on smart contracts to maintain their price.

4. Stablecoins Backed by Non-Currency Assets

Some stablecoins are backed by other assets, like gold. The overall functions remain the same, but the value is tied to the current price of gold, with physical gold used as collateral.

Are Stablecoins a Good Investment?

Because a stablecoin retains the same value as another asset, most often a fiat currency, asking if stablecoins are good investments is like asking if cash is a good investment.

Stablecoins might be best thought of as tools to use in an emerging DeFi system instead of other types of assets. These coins let traders and users of DeFi apps interact with a form of fiat currency directly on the blockchain. Stablecoins are an integral part of how DeFi works.

Benefits of Stablecoins

Stablecoin holders can use their stablecoins without needing to use a bank account, which increases access to financial services for some people. These coins also benefit from the security of blockchain technology.

One way stablecoins could be used as an investment is to earn interest on them. Some crypto exchanges and lending platforms offer higher interest rates on stablecoin deposits than most banks do on cash deposits.

Drawbacks of Stablecoins

Stablecoins also don’t have the same consumer protections in place that traditional banks do. Users will need to hold their stablecoin balance via any number of crypto storage methods and the cryptocurrency wallet of their choice.

Critics have cited a potential lack of transparency regarding their reserves of stablecoins. In other words, it can be difficult to know whether the company behind the coin actually holds one dollar for each dollar-backed stablecoin.

The Most Popular Stablecoins

A handful of stablecoins make up the lion’s share of market cap for this particular type of digital asset. Here’s a short list of stablecoins that are popular as of this writing.

1. DAI

DAI is a decentralized stablecoin governed by the Maker Protocol and its smart contracts, which in turn is governed by a community of MKR token holders. More than 400 apps and services have currently integrated DAI.

2. Tether

Tether (USDT) is the most popular stablecoin in terms of daily trading volume and the third largest cryptocurrency by market cap at the time of writing according to Coinmarketcap.com. Launched in 2014, USDT is one of the oldest stablecoins in the crypto market.

Tether is a fiat-collateralized stablecoin that trades on most cryptocurrency exchanges. Tether is also the fourth most valuable crypto by market capitalization and one of the most stable cryptocurrencies.

3. Binance

Binance USD (BUSD) is also pegged to the U.S. dollar. Binance is among the largest crypto exchanges in the world. And BUSD is the native coin of the Binance exchange. The company developed BUSD to enhance the speed of effecting crypto transactions on its own platform, as well as globally.

BUSD is approved by the New York State Department of Financial Services (NYDFS).

4. USD Coins

USD Coins (USDC) is backed by real dollars stored at financial institutions. USD Coins performs audits to ensure that each dollar backing each coin is accounted for on record. This helps to maintain the one-to-one relationship between USDC and the U.S. dollar.

USD Coin says it holds in reserve a mix of cash and cash equivalents, including U.S. Treasurys, to back every USDC in circulation. Like many other stablecoins, USDC runs on the Ethereum blockchain.

5. Paxos

Paxos Pax Dollar (USDP) is a financial technology (fintech) stablecoin. It’s distinguished as the first regulated blockchain infrastructure platform for financial services. Paxos’ products are helping to build the foundation for a decentralized financial system that can operate faster and more efficiently than the current legacy systems. Along with Binance and other cryptos, PAX is also approved by NYDFS.

Gaining New York state’s stamp of approval went a long way toward helping Paxos enter the crypto space. Its partnerships with payments giant, PayPal and behemoth, Bank of America, have brought digital assets to millions of people almost instantly.

What’s the Most Stable Cryptocurrency?

Theoretically, any stablecoin should be stable; most of them see their values fluctuate by no more than 1% or 2% daily. The decentralized and algorithmic stablecoins have experienced somewhat more volatility than the centralized coins, historically.

Stablecoins Wrap-Up

Stablecoins are cryptocurrencies that keep their value stable in relation to another asset — most commonly, an existing fiat currency, such as the U.S. dollar.

Issuing these coins on a permissionless blockchain removes the barriers to entry associated with banks and the legacy financial system at large; it provides greater access to financial services for those who may not otherwise have the opportunity to participate in the world of finance.

Everyone from the unbanked to day traders, and those braving the rough new world of decentralized finance, may have a potential use case for stablecoins.

Investment Risk: Diversification can help reduce some investment risk. It cannot guarantee profit, or fully protect in a down market.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Crypto: Bitcoin and other cryptocurrencies aren’t endorsed or guaranteed by any government, are volatile, and involve a high degree of risk. Consumer protection and securities laws don’t regulate cryptocurrencies to the same degree as traditional brokerage and investment products. Research and knowledge are essential prerequisites before engaging with any cryptocurrency. US regulators, including FINRA , the SEC , and the CFPB , have issued public advisories concerning digital asset risk. Cryptocurrency purchases should not be made with funds drawn from financial products including student loans, personal loans, mortgage refinancing, savings, retirement funds or traditional investments. Limitations apply to trading certain crypto assets and may not be available to residents of all states.

Non affiliation: SoFi isn’t affiliated with any of the companies highlighted in this article.

SoFi Invest®

INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

SoFi Invest encompasses two distinct companies, with various products and services offered to investors as described below:

Individual customer accounts may be subject to the terms applicable to one or more of these platforms.

1) Automated Investing and advisory services are provided by SoFi Wealth LLC, an SEC-registered investment adviser (“SoFi Wealth“). Brokerage services are provided to SoFi Wealth LLC by SoFi Securities LLC.

2) Active Investing and brokerage services are provided by SoFi Securities LLC, Member FINRA (www.finra.org)/SIPC(www.sipc.org). Clearing and custody of all securities are provided by APEX Clearing Corporation.

For additional disclosures related to the SoFi Invest platforms described above please visit SoFi.com/legal.

Neither the Investment Advisor Representatives of SoFi Wealth, nor the Registered Representatives of SoFi Securities are compensated for the sale of any product or service sold through any SoFi Invest platform.

Photo credit: iStock/tomap49

SOIN0422037