Investment Risk: What Every New Investor Should Know

Risk is a critical component of each and every investment, and there are several things about risk, and an individual’s ability to handle it, that investors need to know. Those include the types of risk involved in investing, the relationship between risk and potential returns, and how to effectively manage it.

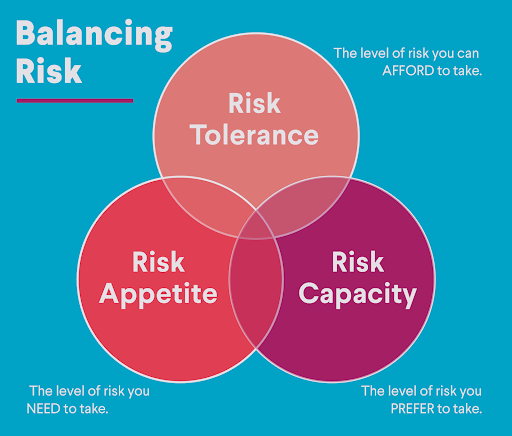

Investors should consider their appetite and tolerance for risk, and try to determine which assets are suitable for them. Investing involves understanding the risk profiles of the different assets, among other things, too.

Key Points

• Higher risk investments typically offer greater potential returns but also increase the potential for loss.

• Understanding risk tolerance helps align investments with financial goals and comfort levels.

• A longer time horizon allows for more risk, as there is more time to recover from market downturns.

• Various risks include market, business-specific, price volatility, and interest-rate risks.

• Diversification and asset allocation are key strategies for managing investment risk.

Higher Risk, Higher Potential Return

The most important thing to understand about risk is something you’ve probably heard before: Generally, the higher the risk of your investment, the greater return you should expect on your money. It is, however, the nature of risk that the return you expect might not be the return you actually get.

The concept of “Modern Portfolio Theory” emphasizes that risk and reward are linked. If you hope for a higher return, you should also expect higher volatility — the variability of actual returns. The returns on an exchange-traded fund (ETF) may be up one year and down the next.

Returns on a mutual fund of emerging market stocks will likely have much wider changes in returns from year-to-year, or even month-to-month. You might make a lot more money, but you also could lose much more.

💡 Quick Tip: When people talk about investment risk, they mean the risk of losing money. Some investments are higher risk, some are lower. Be sure to bear this in mind when investing online.

How Much Risk Should You Take?

When determining a level of risk that you’re comfortable with, you want to first look at the goals you have (buying a house, saving for college, and retiring, to name a few), as well as how many years will it be before you need the money for each goal. That’s called a “time horizon.”

As seen in the visual, an investor’s risk tolerance and risk capacity are important elements to take into consideration. Generally speaking, the longer the time horizon, the more risk you can afford to take, because you have more time to recover from market downturns. Both your tolerance and capacity can change over time, as your goals change as well.

This is why young people are advised to put their retirement savings in a more aggressive portfolio. As you get closer to retirement, you’ll generally want to be more conservative. You can also consult a retirement calculator to see where you stand on your retirement goals.

Recommended: Risk Tolerance Quiz: How Much Investment Risk Are You Comfortable With?

What Types of Risk Are There?

There are several types of risk that every investor should be aware of. Here are a few:

• market

• business-specific

• price volatility

• interest rate

• concentration

Some risks you can’t avoid, like market risk or beta. The market goes up and down, and this often affects all stocks. Investors can measure the risk in their stock holdings by finding their portfolio’s beta. This will show how sensitive one’s portfolio is to volatility in the market.

You can, however, reduce other risks. For example, if you buy individual stocks, you open yourself up to business-specific risk. But, if you buy an index fund, you are buying assets in multiple companies. If one of these companies falters, it will impact the index, but it won’t have the same harsh impact on your investment. This is why seasoned investors tend to emphasize portfolio diversification so much.

How Should You Manage Risk?

On a broad level, how do you use these concepts to manage your investing risk? One method is to utilize asset allocation strategies that map to your goals and risk profile.

For example, if you wanted to take a particularly low-risk, or conservative position, you could allocate your portfolio to contain more bonds than stocks. Bonds tend to be safer investments than stocks (though it’s important to remember that there’s no such thing as a “safe” investment), and as such, may be less volatile if the market experiences a downturn or correction.

If you still wanted to play it safe but allow for some risk (and potentially bigger returns), you could split your portfolio’s allocation — that could include 50% stocks, 50% bonds, or something along those lines. Further, if you feel like you have a high risk tolerance, you could take an aggressive position, and invest most of, or your entire portfolio in stocks.

💡 Quick Tip: How to manage potential risk factors in a self-directed investment account? Doing your research and employing strategies like dollar-cost averaging and diversification may help mitigate financial risk when trading stocks.

Managing Specific Types of Risk

If you want to get more granular, you can try to manage specific types of risk in your portfolio, such as interest rate risk, business-specific risk, etc.

Interest rate risk, for one, has to do with investment values fluctuating due to changing interest rates. This generally involves bond investments, and one way to try and manage it is through diversification, or even by participating in hedge funds — though that can be its own can of worms, so do your research before jumping into hedge funds.

Business-specific risk refers to specific or particular companies or industries. For example, the aerospace industry faces a different set of challenges and risks than the food production industry. So, changes to the Federal Aviation Administration could, as a hypothetical, cause price fluctuation to aerospace stocks, but not other types of stocks. Again, this can largely be addressed through diversification.

There are numerous other types of risks, too, and managing them all is difficult, if not impossible, for the typical investor. You can consider consulting a financial professional for further advice, however.

The Takeaway

Risk is unavoidable when investing, and as such, it’s important to understand the nature of the risk, avoid taking risks you can’t afford, and monitor and adjust your investments over time to align with your risk tolerance. Think about it like driving a car: It’s risky, but you understand that risk and mitigate it by maintaining your car, obeying traffic laws, and buying insurance. The return is the peace of mind of having your future destination in sight.

There are no guarantees in investing, but you can make an informed choice of the amount of risk you are willing to take and invest intelligently to reach your goals.

Invest in what matters most to you with SoFi Active Invest. In a self-directed account provided by SoFi Securities, you can trade stocks, exchange-traded funds (ETFs), mutual funds, alternative funds, options, and more — all while paying $0 commission on every trade. Other fees may apply. Whether you want to trade after-hours or manage your portfolio using real-time stock insights and analyst ratings, you can invest your way in SoFi's easy-to-use mobile app.

Opening and funding an Active Invest account gives you the opportunity to get up to $1,000 in the stock of your choice.¹

FAQ

What is risk tolerance?

Risk tolerance in investing refers to an investor’s appetite for risk, or how much risk they’re willing to assume in order to try and achieve higher returns. Some investors have higher risk tolerance than others.

What are common types of investing risk?

There are numerous types of investment risks, but some of the most common include market risk, business-specific risks, price volatility, interest rate risk, and concentration risk.

What strategies can be used to manage risk?

Some common strategies used to mitigate or manage portfolio risk include diversification and strategic asset allocation, and dollar-cost averaging.

INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

For disclosures on SoFi Invest platforms visit SoFi.com/legal. For a full listing of the fees associated with Sofi Invest please view our fee schedule.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

¹Probability of Member receiving $1,000 is a probability of 0.026%; If you don’t make a selection in 45 days, you’ll no longer qualify for the promo. Customer must fund their account with a minimum of $50.00 to qualify. Probability percentage is subject to decrease. See full terms and conditions.

Dollar Cost Averaging (DCA): Dollar cost averaging is an investment strategy that involves regularly investing a fixed amount of money, regardless of market conditions. This approach can help reduce the impact of market volatility and lower the average cost per share over time. However, it does not guarantee a profit or protect against losses in declining markets. Investors should consider their financial goals, risk tolerance, and market conditions when deciding whether to use dollar cost averaging. Past performance is not indicative of future results. You should consult with a financial advisor to determine if this strategy is appropriate for your individual circumstances.

Third Party Trademarks: Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®

SOIN-Q225-081

Read more