With a brokerage account, investors can invest in a variety of securities, including stocks, bonds, ETFs, and more. There are many brokerages, but the steps to open a brokerage account are similar among most of them.

Key Points

- Select a brokerage provider that aligns with your investment goals, considering services and fees.

- Complete the online account setup by submitting personal and financial information.

- Fund the account by transferring money, similar to a bank deposit.

- Start trading stocks, bonds, and ETFs once the account is funded.

- SIPC insurance protects up to $500,000 in cash and securities if the brokerage fails.[1] However, if the brokerage firm fails, the account fails, too.

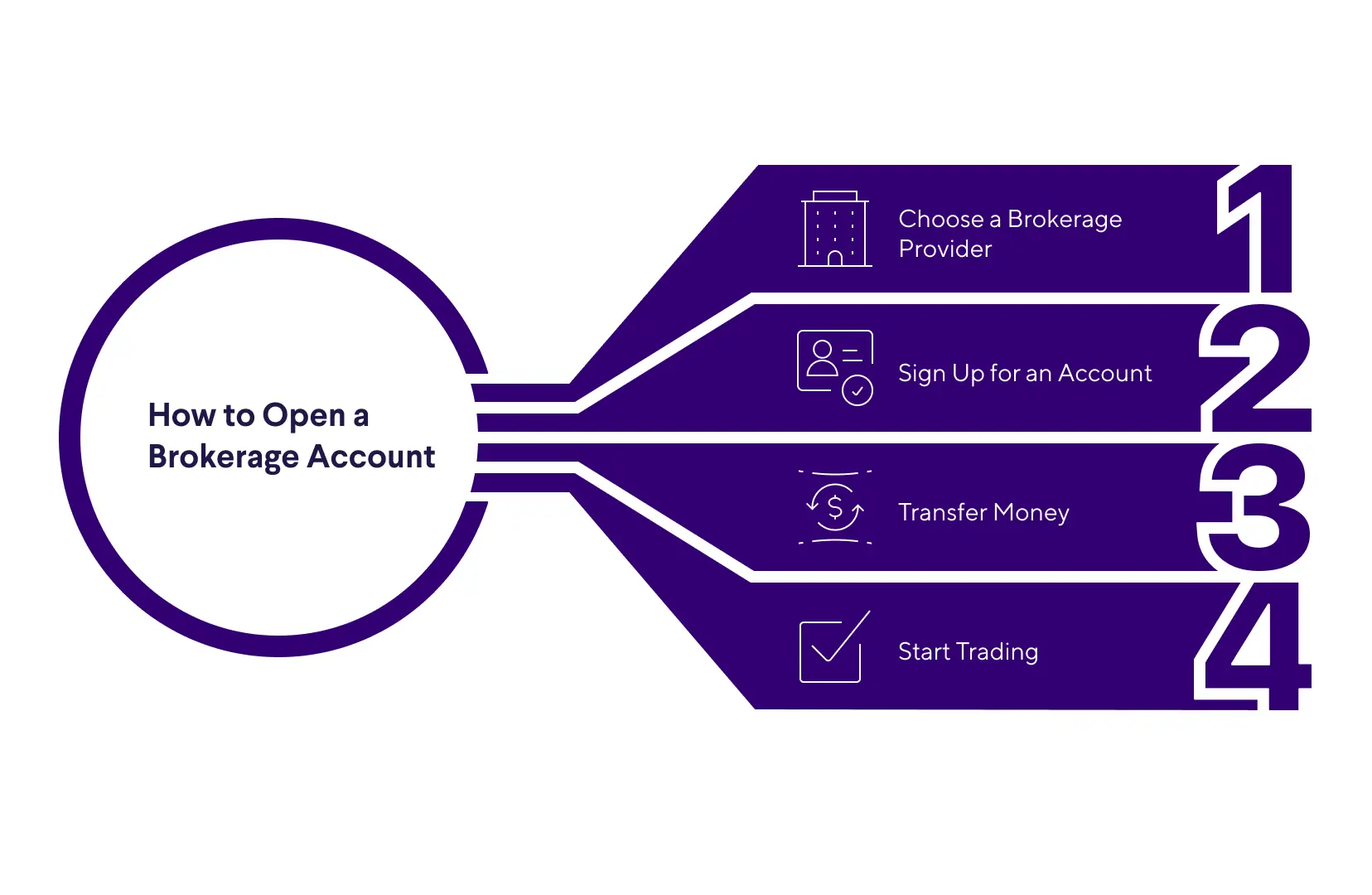

How to Open a Brokerage Account

There are a few simple steps to opening your first brokerage account. We’ll dive deep into each one below.

- Choose a brokerage provider.

- Sign up for an account.

- Transfer money.

- Start trading.

Step 1: Choose a Brokerage Provider

There are several types of brokerage accounts[2], and the type you choose will depend on what you’re trying to accomplish.

- Full-service brokerage firms not only allow clients to trade securities, they may also offer financial consulting and other services — though the price may be steep, compared to the other options here.

- Discount brokerage firms typically charge lower fees than full-service, but as a result clients don’t have access to additional financial consulting or planning services.

- Online brokerage firms are typically online-only, allowing clients to sign up, transfer money, and make trades through their website. These firms typically offer the lowest fees.

The accounts above are known as cash accounts: You must buy securities with funds you put in your account ahead of time.

You may also encounter other more complicated types of brokerage accounts known as margin accounts, which allow you to borrow money from your brokerage to make investments, using your case account as collateral. These accounts tend to be for sophisticated investors willing to shoulder the risk that investments bought with borrowed funds will lose value.

Before working with an individual investment advisor or a firm and opening a cash or margin account, it can be a good idea to run a check on their background. The Financial Industry Regulatory Authority (FINRA) offers online broker checks where you can enter a broker’s name, or the name of a firm, to learn whether a broker is registered to sell securities, offer investment advice, or both.[3]

And you can learn about a broker’s employment history, regulatory actions, and whether there are past or current arbitrations and complaints.

Step 2: Sign Up for a Brokerage Account

Most brokers of all kinds allow you to open and access your brokerage account online. When you open the account, you will likely be asked to provide your Social Security number or taxpayer identification number, your address, date of birth, driver’s license or passport information, employment status, annual income and net worth. You may also be asked about your investment goals and risk tolerance.

For the most part, they should not charge you a fee for opening an account. While some may require account minimums, others allow you to open an account with no minimum deposit. There is no limit on the number of brokerage accounts you can open, and you may be able to hold multiple accounts with multiple brokerage firms.

Step 3: Transfer Money

You will need to fund your new brokerage account before you can purchase any types of securities. You can deposit money in a brokerage account like you would in a traditional bank account.

Step 4: Start Trading

Many brokerage firms will offer a way for you to earn interest on uninvested funds so that your money continues to work for you even when not invested in the market.

How Do Brokerage Accounts Work?

The brokerage firm with which you hold your account maintains the account and acts as the custodian for the assets you hold. In other words, the custodian provides a space for investors to use their account in the way that it was intended.

However, you own the investments in the account and can buy and sell them as you wish. The brokerage firm acts as a middleman between you and the markets, matching you with buyers and sellers, and executing trades based on your instructions.

For example, if you place an order with your brokerage to buy a certain number of shares of stock, the brokerage will match you with a seller looking to sell those shares and make the trade for you.

What’s the Difference Between Brokerage Accounts and Retirement Accounts?

Brokerage accounts are also known as taxable accounts, because profits on sales of securities inside the account are potentially subject to capital gains taxes. Generally speaking, these accounts offer no tax advantages for investors.

Retirement accounts, on the other hand, offer a number of tax advantages that may make them preferable to taxable accounts if you’re planning to save for retirement. Retirement accounts place limits on how much money you can contribute and when you can withdraw funds.

If retirement planning is your main concern, you may consider saving as much as you can in both a 401(k) if your employer offers one, and a traditional or Roth IRA. If you have funds left over, you may choose to invest those in your taxable brokerage account.

Is My Money Safe in a Brokerage Account?

The money and securities held in a brokerage account are insured by the Securities Investor Protection Corporation (SIPC). The SIPC protects against the loss of cash and securities held at failing brokerage firms. If your brokerage firm goes bankrupt, the SIPC covers $500,000 worth of losses, including $250,000 in cash losses.

The SIPC only provides protection for the custody function of a brokerage firm. In other words, they work to restore the cash and securities that were in a customer’s account when the brokerage started its liquidation proceedings. The organization does not protect against declines in value of the securities you hold, nor does it protect against receiving and acting upon bad investment advice.

It is important that any investor realizes and accepts that investment comes with a certain amount of risk. While security prices may gain in value, it is also possible that you could lose some or all of your investment.

The Takeaway

Opening a brokerage account is a simple process that allows you to invest in securities. Effectively, you’re depositing money at a brokerage, which will allow you to buy investments such as stocks, bonds, or ETFs. There are numerous brokerages out there, and different types of brokerage accounts.

Invest in what matters most to you with SoFi Active Invest. In a self-directed account provided by SoFi Securities, you can trade stocks, exchange-traded funds (ETFs), mutual funds, alternative funds, options, and more — all while paying $0 commission on every trade. Other fees may apply. Whether you want to trade after-hours or manage your portfolio using real-time stock insights and analyst ratings, you can invest your way in SoFi's easy-to-use mobile app.

Opening and funding an Active Invest account gives you the opportunity to get up to $1,000 in the stock of your choice.¹

FAQ

How do I open a brokerage account?

Broadly speaking, you can open a brokerage account by choosing a broker or brokerage account provider, signing up, transferring money into the account, and then starting to trade or invest.

What are the different types of brokers?

There are several different types of brokerages, and those include full-service brokerage firms, discount brokerage firms, and online brokerage firms. Each type may offer different products and services, or levels of service.

Is money in a brokerage account safe?

While nothing is ever truly safe, money and securities that are held in brokerage accounts are insured by the Securities Investor Protection Corporation, or SIPC, for up to $500,000 in losses.

Article Sources

- SIPC. What SIPC Protects.

- FINRA. Investment Accounts: Brokerage Accounts.

- FINRA. BrokerCheck.

INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

For disclosures on SoFi Invest platforms visit SoFi.com/legal. For a full listing of the fees associated with Sofi Invest please view our fee schedule.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Disclaimer: The projections or other information regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results.

Exchange Traded Funds (ETFs): Investors should carefully consider the information contained in the prospectus, which contains the Fund’s investment objectives, risks, charges, expenses, and other relevant information. You may obtain a prospectus from the Fund company’s website or by emailing customer service at [email protected]. Please read the prospectus carefully prior to investing.

Fund Fees

If you invest in Exchange Traded Funds (ETFs) through SoFi Invest (either by buying them yourself or via investing in SoFi Invest’s automated investments, formerly SoFi Wealth), these funds will have their own management fees. These fees are not paid directly by you, but rather by the fund itself. these fees do reduce the fund’s returns. Check out each fund’s prospectus for details. SoFi Invest does not receive sales commissions, 12b-1 fees, or other fees from ETFs for investing such funds on behalf of advisory clients, though if SoFi Invest creates its own funds, it could earn management fees there.

SoFi Invest may waive all, or part of any of these fees, permanently or for a period of time, at its sole discretion for any reason. Fees are subject to change at any time. The current fee schedule will always be available in your Account Documents section of SoFi Invest.

Utilizing a margin loan is generally considered more appropriate for experienced investors as there are additional costs and risks associated. It is possible to lose more than your initial investment when using margin. Please see SoFi.com/wealth/assets/documents/brokerage-margin-disclosure-statement.pdf for detailed disclosure information.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

¹Probability of Member receiving $1,000 is a probability of 0.026%; If you don’t make a selection in 45 days, you’ll no longer qualify for the promo. Customer must fund their account with a minimum of $50.00 to qualify. Probability percentage is subject to decrease. See full terms and conditions.

Third Party Trademarks: Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®

SOIN-Q225-132