The Week Ahead on Wall Street

Economic Data

Today, the Commerce Department releases its revised report on wholesale inventories for the month of November. This metric measures monthly changes in inventory held by wholesalers before they sell goods to retailers. Late last month, the initial snapshot showed a 1.2% increase in November after wholesale inventories rose by a record 2.5% in October. Dating back to August 2020, wholesalers have steadily increased stockpiles to keep pace with growing consumer demand.

Tomorrow, the National Federation of Independent Business will publish its small-business optimism index for December, which tracks the overall health of small businesses in the US. For perspective, the sector accounts for nearly 50% of all US private employees. The index increased by less than one percent in November, as many owners are struggling to find workers to fill vacant jobs.

Some key indicators on inflation are due on Wednesday, as December’s Consumer Price Index and Core CPI are set for release. In November, the Department of Labor and Statistics reported a CPI increase of 6.8% over the preceding 12 months — the highest such increase in almost 40 years. Also on Wednesday, the US Treasury will release the December federal budget, while the Federal Reserve will unveil its first Beige Book of Q1. The latter report gathers anecdotal information concerning economic conditions.

Thursday, the BLS will release the December Producer Price Index, which measures the average price fluctuation domestic producers receive for their sales. The previously released report showed a 9.6% year-over-year increase — the highest such number since changes were first tracked over a 12-month period. From a diagnostic standpoint, supply-chain issues and resulting bottlenecks are driving these increases. Officials will also release initial jobless claims Thursday.

Friday rounds out the week with a series of report releases, including December retail sales following the holiday shopping period. For a quick preview, Mastercard’s (MA) in-store and online sale data tracking suggests retail closed out 2021 on a high note. Later in the morning, the Fed will announce industrial production for December. The Import Price Index and business inventories also hit the market on Friday, as does the University of Michigan’s preliminary Consumer Sentiment Index for January.

Earnings

Today, Tilray (TLRY) reports quarterly earnings. The Canadian pharmaceutical and cannabis company is expected to show increased sales but not enough to post a profit. Zooming out, Tilray is the first major cannabis company to post quarterly results. Considered a pioneer in cannabis cultivation, distribution, and research, the company supports more than 20 brands in over 20 countries. This is an interesting company to watch, as laws and attitudes concerning marijuana are constantly in flux.

Tomorrow, Albertsons Companies (ACI) submits its report card. The grocery chain is North America’s second-largest grocer, behind number-one ranking Kroger (KR). Analysts predict Albertsons Companies will post earnings of $0.55 per share, which would represent a 16.67% decline dating back to January 2021. Within the past month, the Idaho-based grocery giant introduced a digital meal planning feature and automated replenishment services.

On Wednesday, KB Home (KBH) will publish its latest results. This homebuilding company constructs single-family homes, focusing on move-up and first-time homebuyers. Analysts say growth is driven by pent-up demand for housing, low inventory, and low interest rates.

On Thursday, Taiwan Semiconductor Manufacturing Co. Ltd. (TSM) will release its quarterly earnings. Investors and economists alike will closely monitor this news, as the recent semiconductor shortage is well documented. Taiwan Semiconductor Manufacturing had its best day since June 2020 last week, which some analysts tied to a fire in a rival German factory that produces chip-making equipment.

Finally, on Friday, JPMorgan Chase (JPM) will host a conference call to outline its Q4 and full-year earnings. Analysts increased their earnings estimates for the company last week, with J. Mitchell upping expectations from $14.90 per share to $15.04 for the year. Wells Fargo (WFC), Citigroup (C), First Republic Bank (FRC), and BlackRock (BLK) also report on this day.

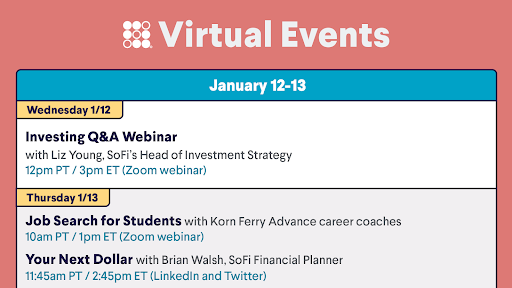

The Week Ahead at SoFi

Start your new year with webinars featuring the basics of investing and best practices for students looking to land the perfect job. Plus check out Your Next Dollar. Sign up in the SoFi app!

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

SOSS22011001