The Week Ahead on Wall Street

Economic News

Today, the National Association of Home Builders index for September is released, which tracks sentiment among homebuilders in the United States. In August the index fell 5 points to 75. While a reading above 50 is positive, 75 was the lowest reading since July. If it improves in September it could be a sign the problems in the housing market such as tight labor, rising material costs, and a lack of inventory are starting to ease.

Tomorrow, housing starts for August are due. This tracks the number of new residential homes that begin construction during the month. In July construction of new homes declined 7% after two months of increases, which was steeper than what economists were expecting. A lack of inventory and higher material costs have been hurting builders’ ability to construct new homes, which is driving home prices up. It will be interesting to see if that trend continued into August. The Federal Reserve’s two-day meeting also begins tomorrow.

On Wednesday, Federal Reserve Chairman Jerome Powell makes a statement after the Federal Reserve’s meeting. The Fed is paying close attention to unemployment and inflation as it determines when to begin easing its pandemic emergency bond-buying program. Investors will be looking for any commentary on tapering and where the Fed thinks interest rates are heading.

Thursday, be on the lookout for initial unemployment claims. The number of people looking for work has been steadily falling despite rising cases of COVID-19. While the number of initial unemployment claims ticked up last week, it is still near pandemic lows. Investors will be paying close attention to this weekly reading to get a sense of whether or not the economy is recovering. Also Thursday, the Markit manufacturing and services PMIs are released for September.

Finally, on Friday, new home sales for August are released. This metric tracks how many consumers purchased a newly constructed home in the month. In July sales declined 27.2% year-over-year as the price of new homes jumped 18.4% from one year ago. New homes sales account for about 10% of the real estate sales in the US. A lack of inventory and rising home prices has prevented scores of people, especially younger shoppers, from buying a home. Investors will be paying close attention to see if the trend continued into August.

Earnings

On Monday, Cognyte (CGNT) reports quarterly earnings. The security analytics software company, which was recently spun off from Verint (VRNT), is off to a strong start as a standalone enterprise. Revenue in its first quarter jumped 12% year-over-year while gross profit increased over 18%. The company said in June it was seeing strong demand for its services. Investors will be paying close attention to see if the momentum continued into the second quarter.

Tomorrow, be on the lookout for home builder Lennar (LEN) to report quarterly earnings. Despite low interest rates and surging real estate demand, Lennar and other home builders have been hampered by rising material costs and labor shortages. With that said, Lennar announced earlier this month it plans to release over 1,000 homes on the market before the end of 2021. Investors will undoubtedly will want to hear more about those plans.

On Wednesday, General Mills (GIS) reports quarterly earnings. The food products maker is facing rising materials and transportation costs and a tight labor market, which is expected to weigh on its bottom line. General Mills has already raised prices to offset some of the costs, but Wall Street may expect more action. Investors will be paying close attention to what General Mills has to say about the supply-chain and labor issues when it reports.

On Thursday, Rite Aid (RAD) releases its latest results. The drugstore chain announced earlier this week it is moving its headquarters to Philadelphia in an effort to foster more in-person collaboration and company gatherings. The headquarters will have space for teams across the drugstore chain to meet and collaborate. Investors will likely want to hear how this office move will help the bottom line.

Also Thursday, be on the lookout for earnings from Nike (NKE). The sneaker and apparel maker is facing manufacturing slowdowns in Vietnam as cases of COVID-19 rise. One analyst estimates Nike is down 40 million pairs of shoes for the past two months. Investors will be paying close attention to how Nike is dealing with the production shutdown and what its backup plan is to ensure it has enough product during the holiday shopping season.

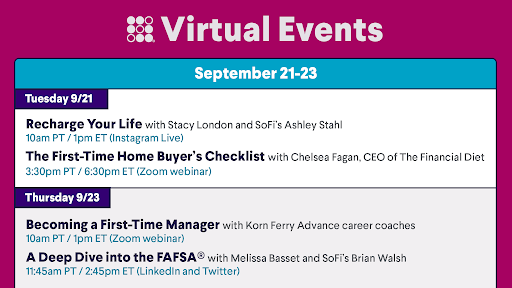

The Week Ahead at SoFi

This week’s sessions include discussions on recharging your career, developing a home buyer’s checklist, becoming a first-time manager, and understanding the FAFSA®. Save your seat!

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

SOSS21092001