The Week Ahead on Wall Street

Economic Data

Today, the National Association of Homebuilders Index for July is released. This measures US homebuilders’ confidence in the single-family home market. In June the index unexpectedly fell to a reading of 81 from 83. Readings over 50 mean builders have a positive view of market conditions. In June the sector was hit by increasing housing costs and supply shortages for certain materials including lumber.

Tomorrow, housing starts for June are released jointly by the US Census Bureau and the US Department of Housing and Urban Development. This data point measures the number of new residential construction projects started in the month. It is viewed as a key indicator of the economy. In June, housing starts came in at 1.57 million—lower than the 1.630 million units economists were expecting.

There are no economic data scheduled to be released on Wednesday.

On Thursday, be on the lookout for initial unemployment claims. Initial jobless claims for the week ending July 10 totaled 360,000. Although still elevated, this is a new pandemic-era low for the weekly figure. Investors are paying close attention to unemployment as a way to track the economy’s rebound. Also Thursday, existing home sales for June are due.

On Friday, Markit manufacturing and services and PMI Flash surveys for July are released. These leading indicators give investors insight into the state of manufacturing and services. For June, the manufacturing PMI rose to 62.6, the highest level since the survey began tracking manufacturing 12 years ago. Investors will be looking to see if that strength carried into July.

Earnings Reports

Today, International Business Machines (IBM) reports quarterly earnings. Earlier this month, President Jim Whitehurst announced he is stepping down from his position. Whitehurst was CEO of RedHat before IBM acquired the company in a $34 billion deal in 2019. His departure poses a challenge to IBM which is relying on sales of RedHat products for growth. Investors will be paying close attention to what IBM has to say about Whitehurst’s departure.

Tomorrow, be on the lookout for earnings from Philip Morris International (PM). The tobacco company just inked a deal to buy asthma drug maker Vectura Group for $1.45 billion. Philip Morris is focusing on the heated tobacco device market as part of its efforts to generate $1 billion in sales from non-nicotine products by 2025. It will be interesting to hear what the company has to say about the deal and its efforts to diversify.

On Wednesday, Johnson & Johnson (JNJ) reports quarterly earnings. The company’s COVID-19 vaccine just got hit with another setback after the FDA warned it could lead to a slightly increased risk of Guillain-Barré syndrome, a rare neurological affliction. In a statement, the FDA said the data “suggests an association,” but not enough “to establish a causal relationship.” This is still a blow for public perception of the vaccine. Investors will be paying close attention to what J&J has to say about its COVID-19 vaccine when it reports earnings.

On Thursday, be on the lookout for earnings from AT&T (T). The company’s HBO Max streaming service is facing stiff competition from leaders like Netflix (NFLX) to upstarts like NBC’s (CMCSA) Peacock. The latter just signed a deal to license Universal films once they are released in theaters. The deal means HBO Max and Netflix lose those films. Investors will want to hear how AT&T plans to respond.

On Friday, Honeywell (HON) reports quarterly earnings. The company was able to blow past Wall Street expectations for the first quarter with growth coming from all its units including personal protective equipment and advanced materials. Investors will be paying close attention to see if that momentum continued in the second quarter.

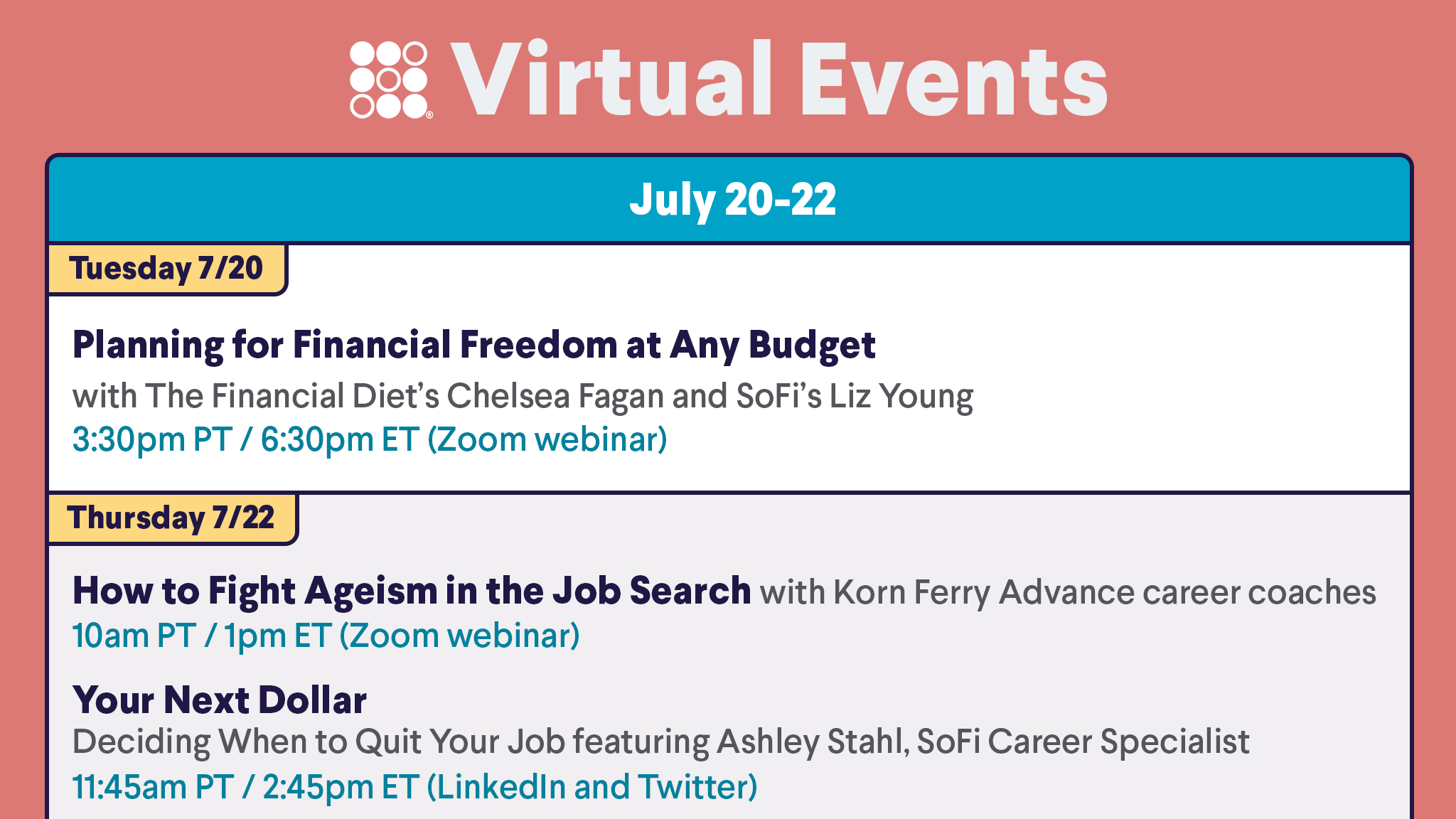

The Week Ahead at SoFi

Learn about planning for financial freedom at any budget, plus fighting ageism in your job search. Also, tune in to Your Next Dollar—LinkedIn, Twitter, and Zoom. RSVP in the SoFi app!

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

SOSS21071901