Liz Looks at: Q2 Earnings Season

The Earnings Engine that Could

With roughly 65% of S&P 500 companies having now reported their Q2 results, the verdict is nearly in and earnings season hasn’t been as terrible as feared. It certainly hasn’t set record highs, but on balance, it hasn’t been nearly as painful as markets suggested it could be during the quarter.

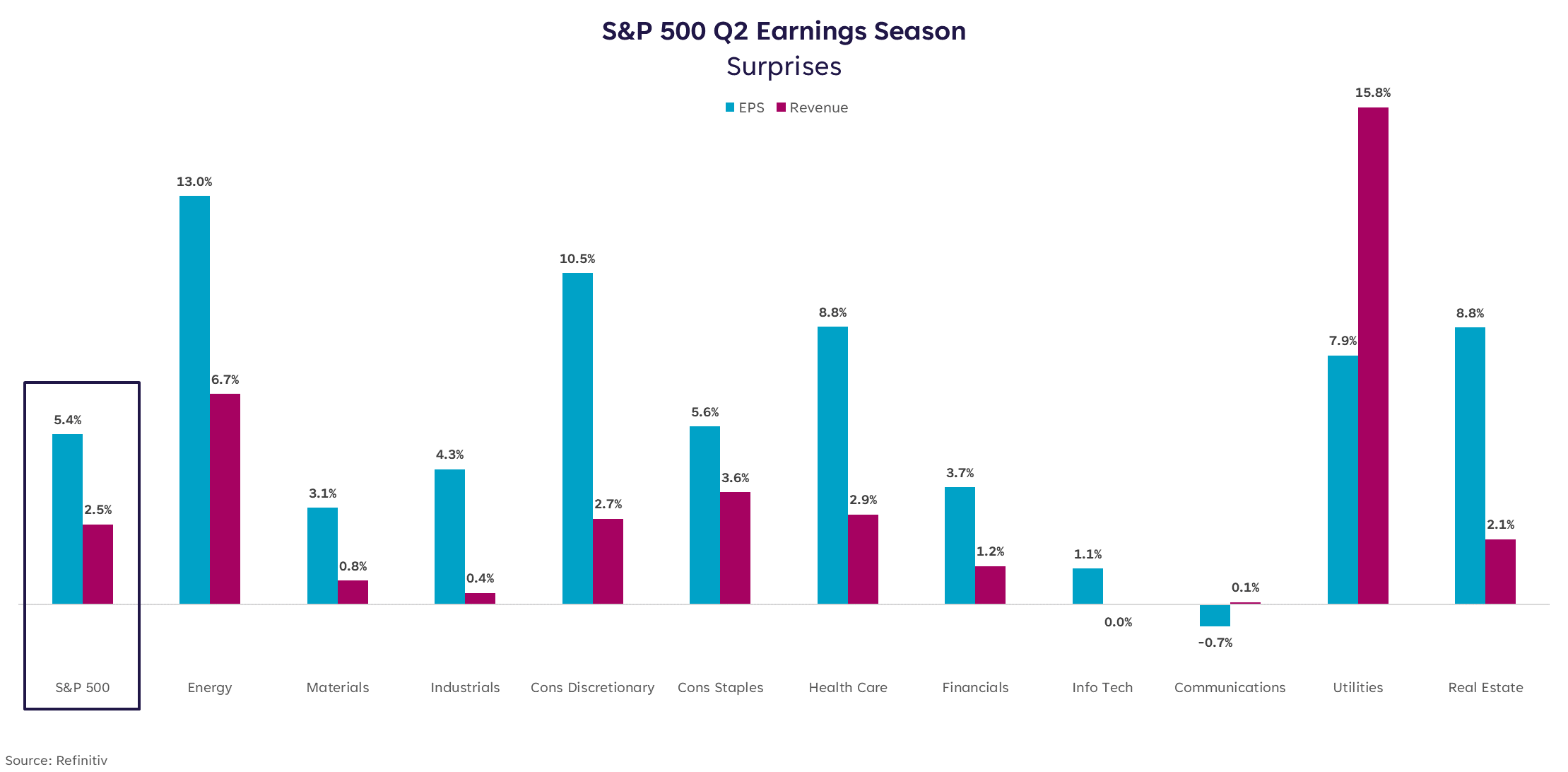

As of this writing, 77% of companies that reported have beat earnings estimates. That’s in-line with the 5-year average, although the average earnings surprise has been only +5.4% vs. the 5-year average of +8.8%. Revenues were more positive (note: inflation helps revenue numbers because as prices rise, so does the top line) with an average surprise of +2.5% vs. the 5-year average of +1.8%.

Markets have responded with a ringing endorsement so far, with the S&P up nearly 8% since the week of July 11 when earnings season really kicked off.

Do you feel the “but” coming? Here it is: But looking only at these numbers can create a false sense of optimism that corporations are, and will be, able to weather the inflation storm with limited damage. The reality is, this environment is challenging for most businesses and we likely haven’t seen the end of downward revisions.

Turning Down the Torque

Even if downward earnings revisions continue, it’s important to note that we entered this slowdown with record high profit margins, meaning companies had more of a buffer to work with than in prior cycles.

In the prior four recessions, earnings have seen an average peak-to-trough contraction of roughly 40%, which is a far cry from what we’re seeing now. This could mean we aren’t headed for the classic recession scenario, or we just haven’t seen it yet. After all, the double dip recession in the early 80s saw an earnings contraction of just 4.6% in 1980, but the second dip brought with it an earnings contraction of 19% in 1982.

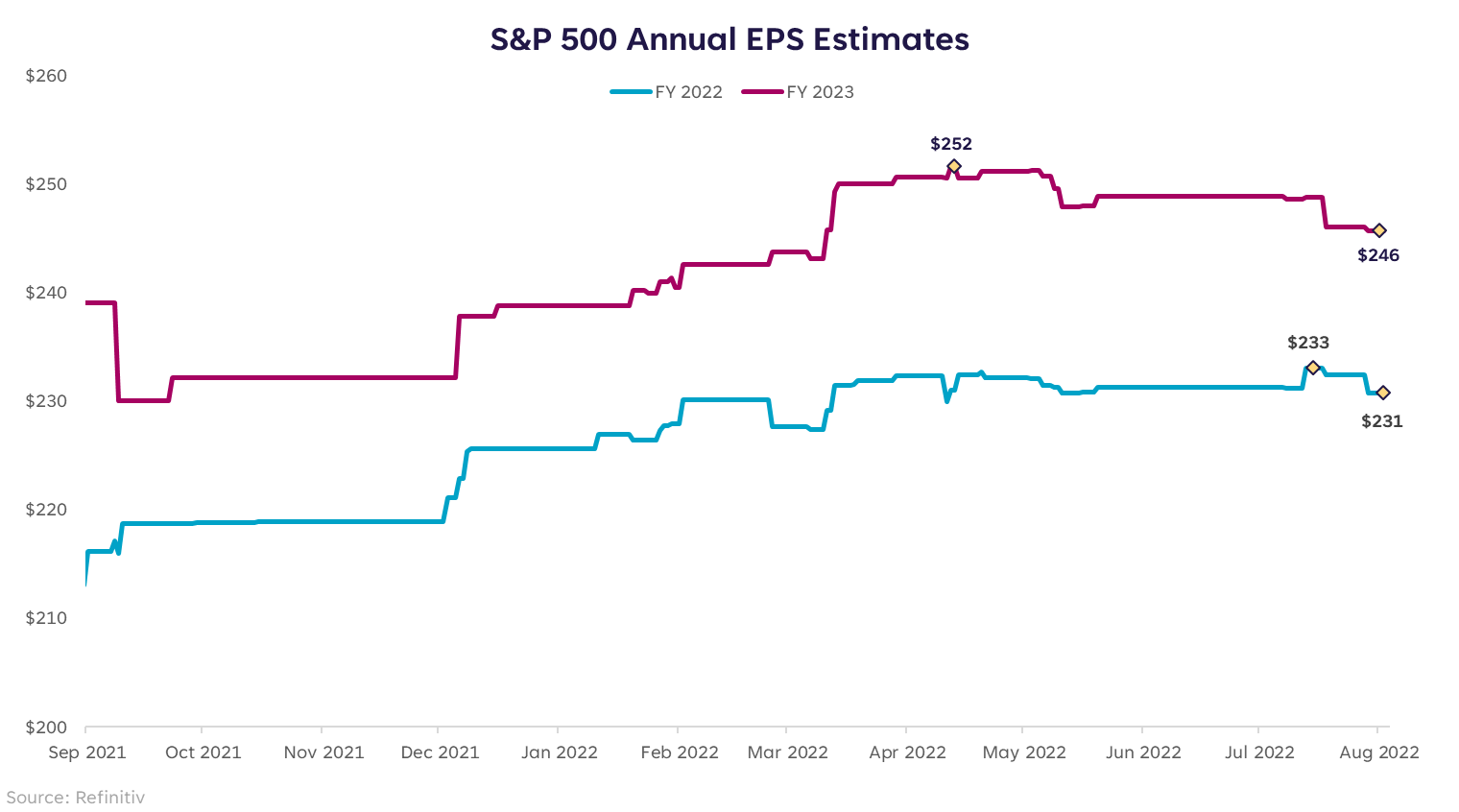

So far, earnings expectations for 2022 are only 1.0% off their highs, and 2023 estimates are only 2.4% off theirs. I still think it’s reasonable to see a 5% reduction in earnings estimates for the remainder of this year, and somewhere between 5-10% shaved off of 2023 expectations before we ring in the new year.

Those revisions could bring with them more negative headlines about consumer spending shifts, reductions in headcount, or a variety of other capital preservation moves by companies while they protect their bottom line.

The saving grace is earnings don’t usually trough until the end of the recession or after the recession is over. This means we may continue to hear about downward revisions until well after the market has bottomed and the worst is behind us. The moral of the story is, don’t use earnings revisions as a market timing mechanism.

Revving the Ratios

Mathematically, since the S&P 500 index has risen and earnings estimates have come down, the price-to-earnings multiple has increased from 15.8x on June 30 to 17.1x today. That feels a bit high to me given where inflation is and my expectation that the Fed is still hiking for the foreseeable future.

That means I won’t be surprised if we give some of this recent rally back in August, but I would view those dips as buying opportunities. I still believe the second half of 2022 can bring upside opportunities in equities as the economic data continues to cool and the Fed slows down its hiking cycle.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser. Information about SoFi Wealth’s advisory operations, services, and fees is set forth in SoFi Wealth’s current Form ADV Part 2 (Brochure), a copy of which is available upon request and at www.adviserinfo.sec.gov. Liz Young Thomas is a Registered Representative of SoFi Securities and Investment Advisor Representative of SoFi Wealth. Her ADV 2B is available at www.sofi.com/legal/adv.

SOSS22080403