Liz Looks at: Housing

No Place Like Home

There’s been a lot of chatter about the housing market. We saw mortgage rates rise swiftly from 3.3% on Jan 3 to 4.9% on Mar 29, and that came on the heels of the hottest housing market we’ve ever seen (as measured by average home prices).

Aside from the obvious impact this has on consumer borrowing activity and spending levels, one of the reasons we look to the housing market as investors is to gauge where we might be in the economic cycle and what that could mean for stocks.

It’s a Twister

The beginning of the current tightening cycle came in like a twister and changed our surroundings. When we look back on this in charts at a later date, it will be much more clear than it is today. But right now it still feels as if pieces of the market are flying around in the air searching for the right direction.

When the Fed starts raising rates, it generally signals a move to later in the cycle when we need to cool things off from a strong rebound. After all, overheating can be just as detrimental as the inability to warm up.

If we had clear signals that lined up telling us this is in fact “late cycle,” it would be easier to make investing decisions. Late cycle investor behavior usually favors more defensive sectors (Utilities, Consumer Staples, Healthcare) as growth slows. It’s also the point in the cycle when inflation typically rises (check!) so Energy tends to do well (check!).

But is that enough to confirm where we are? The last expansion lasted almost 11 years — there’s nothing on the calendar that says it has to end.

Roll Over the Rainbow?

Cue the housing indicators. Another data point to help us figure out where to stick our “you are here” star.

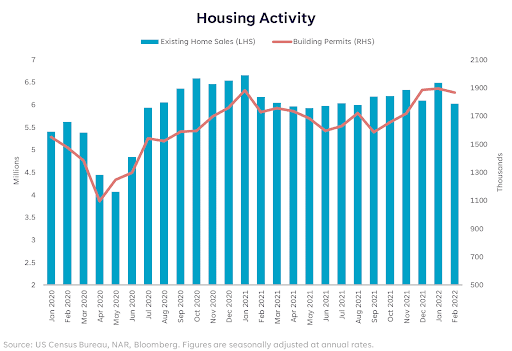

The housing market is thought of as an indicator of cyclicality, meaning in expansionary periods it’s strong, and it slows down as we move to later in the cycle. It is true that some of the indicators have softened or flattened out recently (see chart), but others, like housing starts and home prices, haven’t. Hard to call this a clear signal…yet.

Horse of a Different Color

Calling this a horse of a different color is my way to avoid using the phrase “it’s different this time.” Because in reality, it’s always a little bit different. What ended the last economic cycle is different from what ended the one before. What’s always the same is that it’s impossible to perfectly predict how long it will last.

I think most of us can agree that we’re past the “early cycle,” which means the big rebound and head snapping rallies in risky assets are probably behind us. But since we can’t know for sure, this doesn’t mean pile all of your stocks into defensive sectors. I still think there’s room to run for high quality Technology, Financials, and pockets of Consumer Discretionary. The results may just be more muted, and we need to ensure there’s protection in the portfolio for the bumps in the road ahead.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser. Information about SoFi Wealth’s advisory operations, services, and fees is set forth in SoFi Wealth’s current Form ADV Part 2 (Brochure), a copy of which is available upon request and at www.adviserinfo.sec.gov. Liz Young Thomas is a Registered Representative of SoFi Securities and Investment Advisor Representative of SoFi Wealth. Her ADV 2B is available at www.sofi.com/legal/adv.

SOSS22033102