WHAT IS AN INVERTED YIELD CURVE AND WHAT IS ITS SIGNIFICANCE?

Over the past few weeks, the financial media has been focusing on bond market fluctuations, and the term “inverted yield curve” has been used quite frequently. The mention of the inverted yield curve is usually followed by a discussion of the possibility of a recession, causing some investors to panic.

The current inversion of the yield curve doesn’t mean that a recession will happen within the next few years, but it is one indicator that investors should be aware of when thinking about their finances.

What Is a Yield Curve?

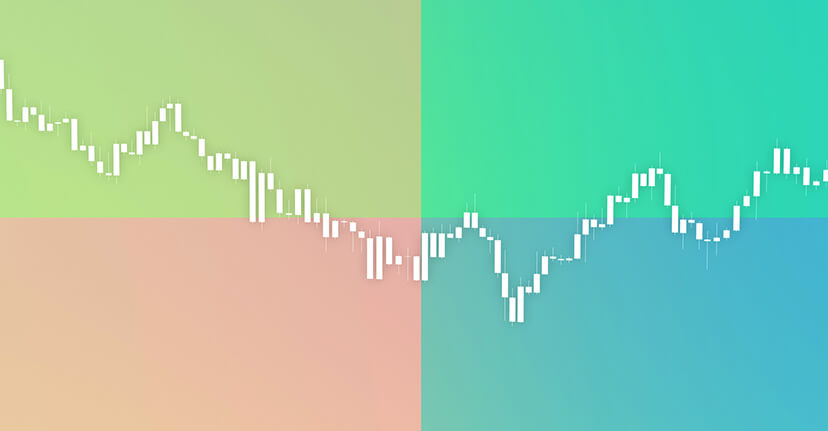

A yield curve is a graphical representation of the yields (aka interest rates) of similar bonds at different maturities. Yield curve graphs can also show the difference between short- and long-term bonds yields.

The most closely followed yield curves are for U.S. Treasury debt, specifically the difference between 10-year and 2-year Treasuries. Many investors and economists use this yield curve as a signal of what may lie ahead for the U.S. economy.

Each day, the yield curve rates are published on the Department of the Treasury’s website .

Recommended: What Is the Yield Curve? How It’s Used as a Market Indicator

What Is an Inverted Yield Curve?

An inverted yield curve occurs when the yields of short-term Treasury debt are higher than long-term Treasuries.

Usually, the yield curve is upward sloping, meaning interest rates on longer-term bonds are higher than on short-term bonds. An upward sloping yield curve occurs because the longer an investor lends out money, the more interest they expect to be returned since it’s riskier to lend out money over longer time frames.

However, when the yield curve inverts, it may mean that bond investors expect it is riskier to lend money in the short run.

What the Inverted Yield Curve Means for the Economy

An inverted yield curve doesn’t mean that a recession is imminent, but it may suggest that bond investors are concerned about the economy’s short- to medium-term prospects.

Since 1955, the yield curve of 10-year and 2-year Treasuries has inverted before all the U.S. recessions that have occurred. Usually, the yield curve inverts about two years before a recession hits, so it can be an early warning sign of trouble in the economy.

However, an inverted yield curve is not a perfect predictor of a recession. Several factors could be playing into the gyrations of the bond market right now.

The Federal Reserve is in the process of raising its benchmark interest rate, the federal funds rate. This move to combat inflation may be causing the yields of short-term bonds to rise relative to long-term yields. Additionally, the Federal Reserve’s quantitative easing program, where the Fed purchases longer-maturity Treasury bonds, may be keeping the yields of long-term bonds down. So, the Fed’s current policy moves could be causing the inverted yield curve, which may reverse as the Fed continues to shrink its balance sheet.

Other portions of the yield curve are not flashing warning signs. The yield curve between 3-month Treasury notes and 10-year Treasury bills is still steep, which has some analysts thinking that the current signals in the bond market may not mean a recession is right around the corner.

The Takeaway

The constant chatter in the media about turmoil in the bond market and the possibility of an upcoming recession may understandably cause investors stress.

It’s important to remember that an inverted yield curve is not a perfect indicator of a recession. Just because the yield curve inverted before previous recessions doesn’t mean that’s what the future holds.

Nonetheless, it’s still wise for investors to prepare for a recession, whether that means saving up an emergency fund, maintaining a monthly budget, or managing investment risks.

With the SoFi Invest®️ online brokerage, you can utilize an all-in-one investing tool that allows you to trade stocks and ETFs to prepare your portfolio for whatever the economy has in store.

INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

SoFi Invest is a trade name used by SoFi Wealth LLC and SoFi Securities LLC offering investment products and services. Robo investing and advisory services are provided by SoFi Wealth LLC, an SEC-registered investment adviser. Brokerage and self-directed investing products offered through SoFi Securities LLC, Member FINRA/SIPC.

For disclosures on SoFi Invest platforms visit SoFi.com/legal. For a full listing of the fees associated with Sofi Invest please view our fee schedule.

SOIN19187