Is There a Bright Side to Student Loans?

What comes to mind when you think of student loans? If you’re one of the 37 million people that are currently repaying student debt, your first thought is probably of the painful deduction that comes out of your bank account each month. Or maybe you picture someone you know who’s currently struggling with his or her loans. Or you recall an article you saw about the “student loan crisis.”

Whether you’ve had a personal experience with student loans or not, chances are you have a somewhat negative connotation of them. But the truth is that student loans can have some very positive, sometimes life-changing benefits – if they’re handled with care. For example:

1. Return on investment

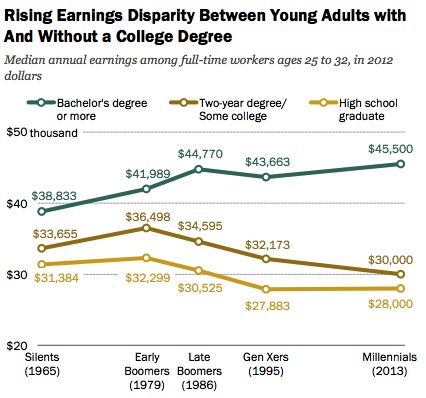

No matter what your opinion about the rising cost of education, the fact is that higher education is still, on the whole, a positive thing. According to the Bureau of Labor Statistics, people with degrees experience lower unemployment and higher earning potential than people without them. In fact, a recent study from the Pew Research Center showed that the cost of not going to college has risen, as evidenced by the growing earnings disparity between young people who have degrees vs. those who don’t:

Source: Pew Research Center

Clearly there are some major benefits to having a degree, but here’s the thing – most people can’t afford to get these degrees without some financial assistance in the form of student loans. If used wisely, these loans work as an investment in your future earning potential. In fact, one report shows that borrowers can earn twice the return on their student loan investment vs. other common investments.

Of course, you’re much more likely to reap this benefit if you actually approach your student loans like an investment and consider the risks vs. the potential upside. For education debt, this means taking your area of study and career choice into account when deciding how much to take out in loans. Research the earning potential for different majors up front, then only borrow what’s realistic for you to pay back – and your bank account will thank you later.

2. Opportunity to build credit

The world of credit is kind of like the chicken and the egg: In order to borrow money, you need to have a track record of using credit responsibly. But in order to use credit responsibly, you need someone to lend you money.

Student loans are a rare exception to this rule. The majority of undergrad borrowers have little to no credit history at the time they take out their first loan. Luckily, federal loans are available to them regardless of their credit scores (or lack thereof). Given how important credit is for most people’s financial futures, that’s a pretty remarkable opportunity.

But while student loans may open the door to credit, the borrower’s actions determine whether that’s a good or a bad thing. For example, making loan payments on time will contribute to better credit, which down the road can lead to more borrowing power and cost savings through lower interest rates. Making late payments (or missing them altogether) can mean the opposite – and might even prevent you from landing a job.

3. Potential tax benefit

This last benefit is small when compared with the magnitude of the first two, but it’s still worth mentioning as a potential cost saving measure that’s only available to those with student debt. Basically, if your student loans are in repayment, you may be able to deduct up to $2,500 on your tax return. In order to qualify, here are a few of the requirements:

- Your modified adjusted gross income (MAGI) is less than $75,000 (or $150,000 if you’re married and filing jointly).

- The loan was taken out for qualified education purposes (things like tuition, books and supplies).

- The student was you, your spouse, or your dependent.

You can find a full list of eligibility criteria here.

There’s no question that repaying a large amount of debt is a challenging thing. But if you keep these benefits top of mind, it may just take the edge off when that next student loan deduction comes through.

DISCLAIMER: This article is meant to provide useful information on the topic, but it does not purport to provide tax advice. You should consult with your own tax advisor for guidance based on your specific situation.