Boise Housing Market: Trends & Prices

Boise Housing Market: Trends & Prices (2025)

Boise Real Estate Market Overview

(Last Updated – 4/2025)

Boise, the capital of Idaho, is a vibrant city known for its outdoor recreation, cultural attractions, and growing economy. Ranked the second-best place to live in the U.S. in 2024-25 by U.S. News & World Report, Boise boasts a hip restaurant scene, hundreds of miles of trails, and a mountain-fed river running through the center of town. The area’s unique mix of urban and rural living may explain why home values are up 3.2% over the past year, faster than the national growth rate of 2.6%, according to Zillow.

Despite these rising prices, Boise remains desirable due to its easy access to outdoor activities (including hiking, biking, and skiing), strong job market, and thriving tech industry. The city’s rich cultural offerings, including galleries, museums, theaters, and music festivals, contribute to its appeal as a place to live.

Overall Boise Market Trends

Real estate experts consider the Boise market to be “somewhat competitive,” with homes receiving an average of four offers and selling in around 37 days.

Thanks to a slight rise in inventory, buying a home in Boise isn’t the crazy rush it was a couple of years ago. That said, highly desirable (aka, “hot”) homes can get snapped up within seven days, according to Redfin.

In February 2025, the median sales price of a home in Boise was $480,000. The median sale price per square foot was $302. On average, homes sell for about 1% below list price.

$480,000

Median Sale Price

$302

Median Price Per Square Foot

37 days

Median Time on Market

Boise Housing Market Forecast

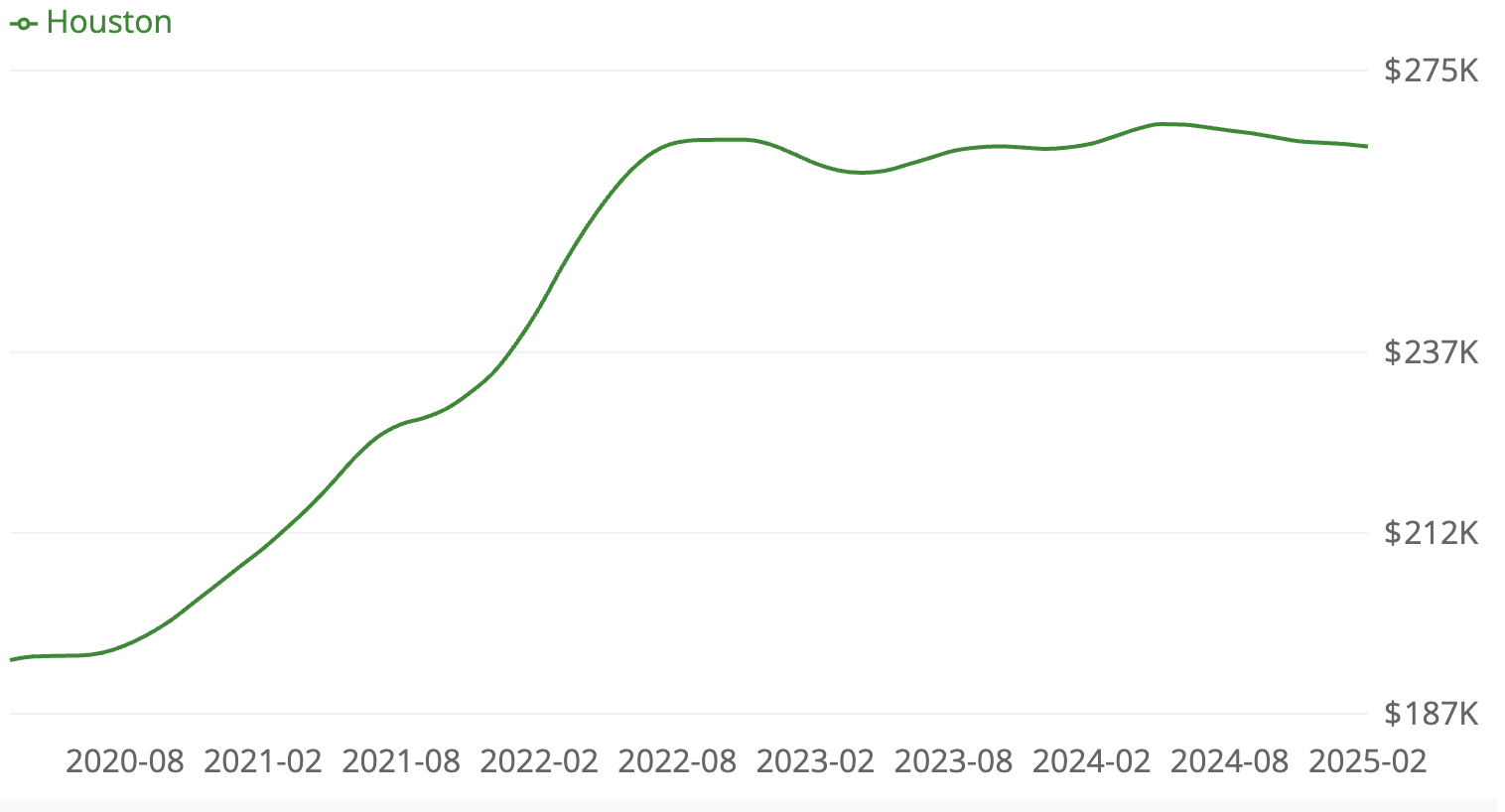

Home prices aren’t skyrocketing the way they were between August 2020 and June 2022. After a period of decline between June 2022 and May 2023, however, costs have been creeping up. Even so, the average home value of $492,024 in February 2025 is still below the market high of $527,413 in June 2022.

Still, many realtors characterize Boise as more of a seller’s than a buyer’s market, and forecast prices either holding steady or gradually going up in the next couple of years.

Demographics of the Boise Market

Nearly 47% of Boise’s residents are college educated, which is higher than the national average of 35%.

The city is touted as a good place to raise a family, thanks to its low crime rate and easy access to outdoor activities. It also appeals to retirees looking for affordability and access to good health care.

Boise is a hub for a number of industries, including a burgeoning technology sector, led by memory chip manufacturer Micron Technology. Several other large companies, including Clearwater Analytics, Bodybuilding.com, and Cradlepoint, are based in Boise. As Idaho’s capital, the city is also home to many state government agencies. In addition, it has two large hospitals, which employ a large number of residents in the health care field. The average commute time to work is around 19 minutes, which is lower than the U.S. average of nearly 27 minutes.

Recommended: Best Affordable Places to Live in Idaho

Median Household Income: $79,977

Median Age: 39

College Educated: 46.6%

Homeowners: 63%

Married: 49%

Popular Boise Neighborhoods

Boise is home to 35 neighborhoods, but here are fast facts about five of the most popular ones to help make your decision a bit easier.

Recommended: Price-to-Rent Ratio in 50 Cities

North End

The stunning North End is known nationwide for being the gateway to the Boise foothills and home to Hyde Park, so nature lovers will feel right at home here.

This neighborhood is full of trees and flowers, plus sightseeing, dining, and shopping options. It’s pedestrian friendly and popular with singles and families alike.

Quick Facts

Population:

23,113

Median Age:

40.6

Housing Units:

12,388

Bike Score:

85/100

Walk Score:

65/100

Transit Score:

31/100

Median Household Income:

$136,312

North End Housing Market

The housing market in the North End is considered very competitive. In February 2025, the median price for home in this neighborhood was $950,000, a 78.4% increase from the year before. Homes are also selling faster — the average time on the market is now 27 days, compared to 52 days last year.

Median Sale Price

$950,000

Median Price Per Square Ft.

$466

Downtown

Downtown Boise has so much to offer: arts and entertainment, business and career opportunities, food galore, and an exciting energy and vibrancy.

Quick Facts

Population:

2,896

Median Age:

35

Housing Units:

1,333

Bike Score:

98/100

Walk Score:

81/100

Transit Score:

45/100

Median Household Income:

$127,830

Downtown Housing Market

While Downtown Boise is not very competitive, prices have been on the upswing. In February 2025, the median sales price of a home was up more than 40% year-over-year. On the plus side for buyers, the average home sells for about 3% below asking price, sits on the market for 80 days, and multiple offers are rare.

Median Sale Price

$768,250

Median Price Per Square Ft.

$584

Morris Hill

Morris Hill is dripping with charm thanks to its historic homes, mature trees, and stunning landscaping. It’s obvious why so many younger folks are moving in and reviving the homes from the turn of the century to midcentury.

Locals like to stroll down Orchard Street on the weekends. This hot spot offers a nice variety of restaurants, specialty shops, and locally owned businesses.

Quick Facts

Population:

6,414

Median Age:

34

Housing Units:

2,762

Bike Score:

86/100

Walk Score:

69/100

Transit Score:

28/100

Median Household Income:

$94,335

Morris Hill Housing Market

While the housing market in Morris Hill is considered somewhat competitive, the median Morris Hill home sale price in February 2025 was down slightly (0.77%) compared to a year ago. Homes are also staying on the market longer (58 days compared to 21 days last year). On average, homes in this neighborhood sell for roughly 2% to 4% above list price, and some get multiple offers.

Median Sale Price

$471,250

Median Price Per Square Ft.

$317

Southeast Boise

Southeast Boise is a rapidly growing neighborhood that offers access to a river, greenbelt, and the hustle and bustle of downtown.

Southeast Boise’s close proximity to major parks, sports complexes, trendy new restaurants, and Boise State University doesn’t hurt.

Quick Facts

Population:

24,190

Median Age:

35

Housing Units:

10,480

Bike Score:

67/100

Walk Score:

32/100

Transit Score:

20/100

Median Household Income:

$118,519

Southeast Boise Housing Market

You may be able to find your dream home in Southeast Boise. As of February 2025, Redfin considered the area only somewhat competitive, with the average home selling at about 2% below list price.

Nonetheless, the median sale price of a home in February was up 5.3% since last year, with some getting multiple offers, so be ready to bid.

Median Sale Price

$534,900

Median Price Per Square Ft.

$344

East End

This upscale historic district covers 39 blocks and consists of primarily single-family homes. Founded in 1890, East End has changed quite a bit over the years.

The most common architectural style in this area is the Craftsman bungalow, but you’ll also see quite a few Queen Anne cottages. Architecture buffs will love all of the options available to them.

Quick Facts

Population:

9,217

Median Age:

46.5

Housing Units:

4,469

Bike Score:

64/100

Walk Score:

33/100

Transit Score:

22/100

Median Household Income:

$133,195

East End Housing Market

In February 2025, East End Boise was considered a buyer’s market, with the median listing home price down 2.6% year-over-year. On average, homes in the East End are selling for 4.6% below asking price and sit on the market for 35 days. That said, the area is still pricey — with the median home sold price in February 2025 coming in at $754,100. If this price is beyond your budget, consider widening your search to include homes in popular neighborhoods around the East End.

Median Sale Price

$827,500

Median Price Per Square Ft.

$424

SoFi Home Loans

It’s easy to see why Boise has become such a popular market to buy a home in. There are some really amazing neighborhoods to choose from, whether you’re young and single or have a family to look after.

If you think Boise could be your home sweet home, then you may need to consider your mortgage loan options.

Looking for an affordable option for a home mortgage loan? SoFi can help: We offer low down payments (as little as 3% - 5%*) with our competitive and flexible home mortgage loans. Plus, applying is extra convenient: It's online, with access to one-on-one help.

View your rate

FAQ

Is it a good time to buy a house in Boise?

Boise’s housing market is competitive, but it can still be a good time to buy if you’re prepared. Inventory has recently increased, offering more choices. However, it remains below levels needed for a balanced market, keeping prices elevated. If you can afford the current prices and are ready to move quickly, you might find a great home.

Is there a housing shortage in Boise, Idaho?

Yes, Boise has been experiencing a housing shortage. The city’s rapid population growth and limited new construction have led to a tight market with low inventory. This shortage has driven up prices and made it challenging for buyers to find homes, especially in desirable areas. However, new developments are in the works to address this issue.

How long are houses on the market in Boise?

Houses in Boise typically stay on the market for a relatively short period, often just a few weeks in popular neighborhoods. On average, however, homes in Boise sell after 37 days on the market, according to Redfin. To increase your chances of securing a home, you’ll want to be ready to act fast and have your finances in order before you start your search.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

*SoFi requires Private Mortgage Insurance (PMI) for conforming home loans with a loan-to-value (LTV) ratio greater than 80%. As little as 3% down payments are for qualifying first-time homebuyers only. 5% minimum applies to other borrowers. Other loan types may require different fees or insurance (e.g., VA funding fee, FHA Mortgage Insurance Premiums, etc.). Loan requirements may vary depending on your down payment amount, and minimum down payment varies by loan type.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

Qualifying for the reward requires using a real estate agent that participates in HomeStory’s broker to broker agreement to complete the real estate buy and/or sell transaction. You retain the right to negotiate buyer and or seller representation agreements. Upon successful close of the transaction, the Real Estate Agent pays a fee to HomeStory Real Estate Services. All Agents have been independently vetted by HomeStory to meet performance expectations required to participate in the program. If you are currently working with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®. A reward is not available where prohibited by state law, including Alaska, Iowa, Louisiana and Missouri. A reduced agent commission may be available for sellers in lieu of the reward in Mississippi, New Jersey, Oklahoma, and Oregon and should be discussed with the agent upon enrollment. No reward will be available for buyers in Mississippi, Oklahoma, and Oregon. A commission credit may be available for buyers in lieu of the reward in New Jersey and must be discussed with the agent upon enrollment and included in a Buyer Agency Agreement with Rebate Provision. Rewards in Kansas and Tennessee are required to be delivered by gift card.

HomeStory will issue the reward using the payment option you select and will be sent to the client enrolled in the program within 45 days of HomeStory Real Estate Services receipt of settlement statements and any other documentation reasonably required to calculate the applicable reward amount. Real estate agent fees and commissions still apply. Short sale transactions do not qualify for the reward. Depending on state regulations highlighted above, reward amount is based on sale price of the home purchased and/or sold and cannot exceed $9,500 per buy or sell transaction. Employer-sponsored relocations may preclude participation in the reward program offering. SoFi is not responsible for the reward.

SoFi Bank, N.A. (NMLS #696891) does not perform any activity that is or could be construed as unlicensed real estate activity, and SoFi is not licensed as a real estate broker. Agents of SoFi are not authorized to perform real estate activity.

If your property is currently listed with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®.

Reward is valid for 18 months from date of enrollment. After 18 months, you must re-enroll to be eligible for a reward.

SoFi loans subject to credit approval. Offer subject to change or cancellation without notice.

The trademarks, logos and names of other companies, products and services are the property of their respective owners.

SOHL-Q125-224