So you have a variable rate loan. What to do if you receive a notice that interest rates have risen? First things first: Don’t panic. About a quarter of all SoFi borrowers choose variable rate loans for their student loan refinance, so you’re definitely not alone.Typically, variable rate loans start with interest rates that are 1% to 2% lower than comparable fixed rate loans. For example, you could be offered a fixed rate quote of 6% or a variable rate quote of 4%. SoFi’s variable rates are tied to the 30 day average SOFR index, a common global index that reflects short-term interest rates and can change monthly. The

30 day average SOFR index rose in very small increments several times in 2016, increasing overall by 0.33% (from 0.43% to 0.76%). If you have a SoFi variable rate loan, this means your interest rate also would have increased by 0.33% over the whole year. On a $100,000 loan, that’s only about a $15 difference in monthly payments.

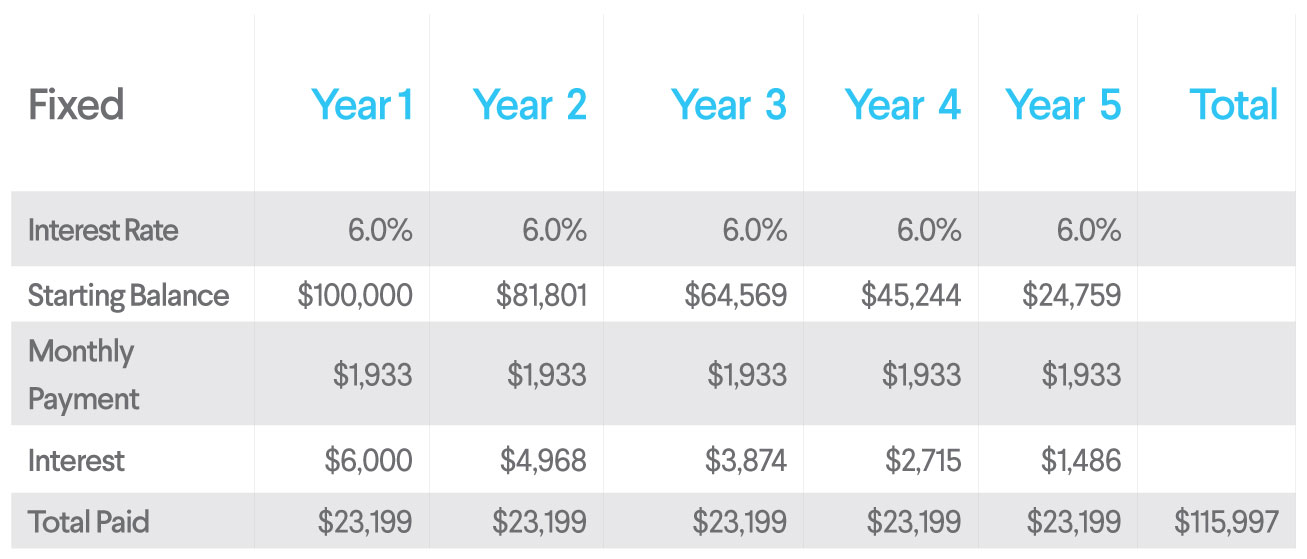

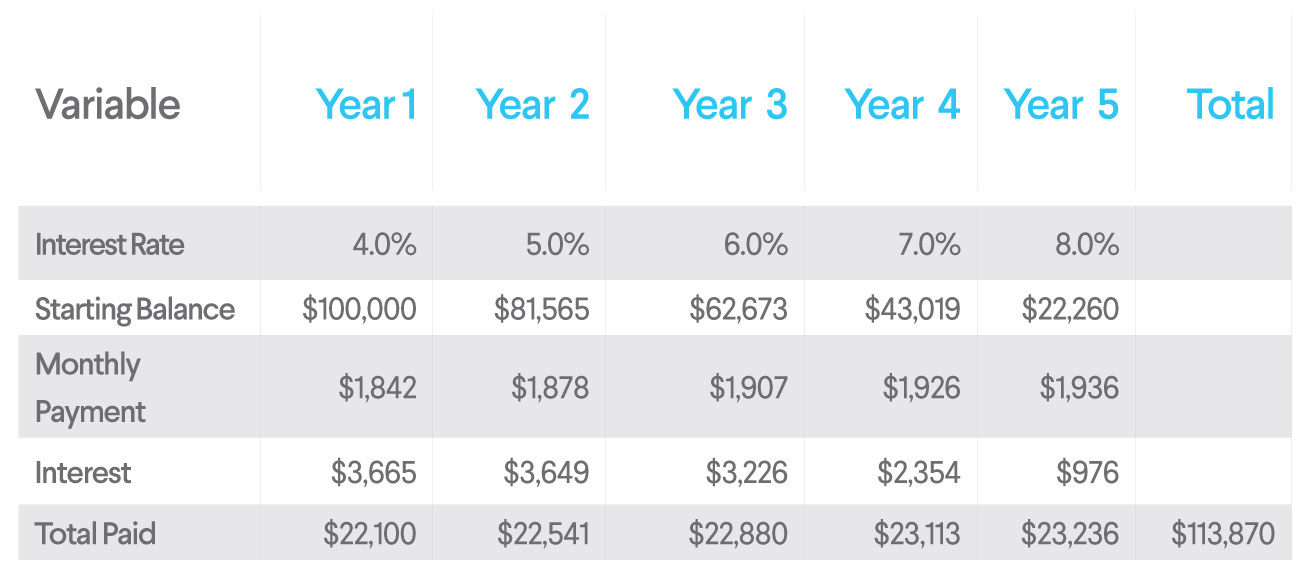

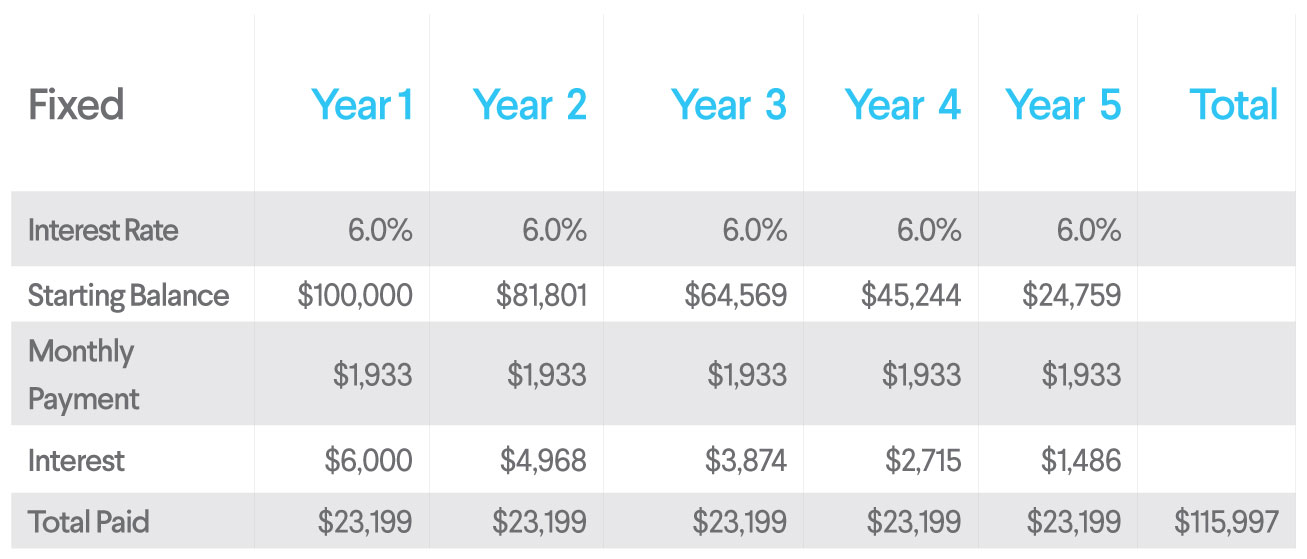

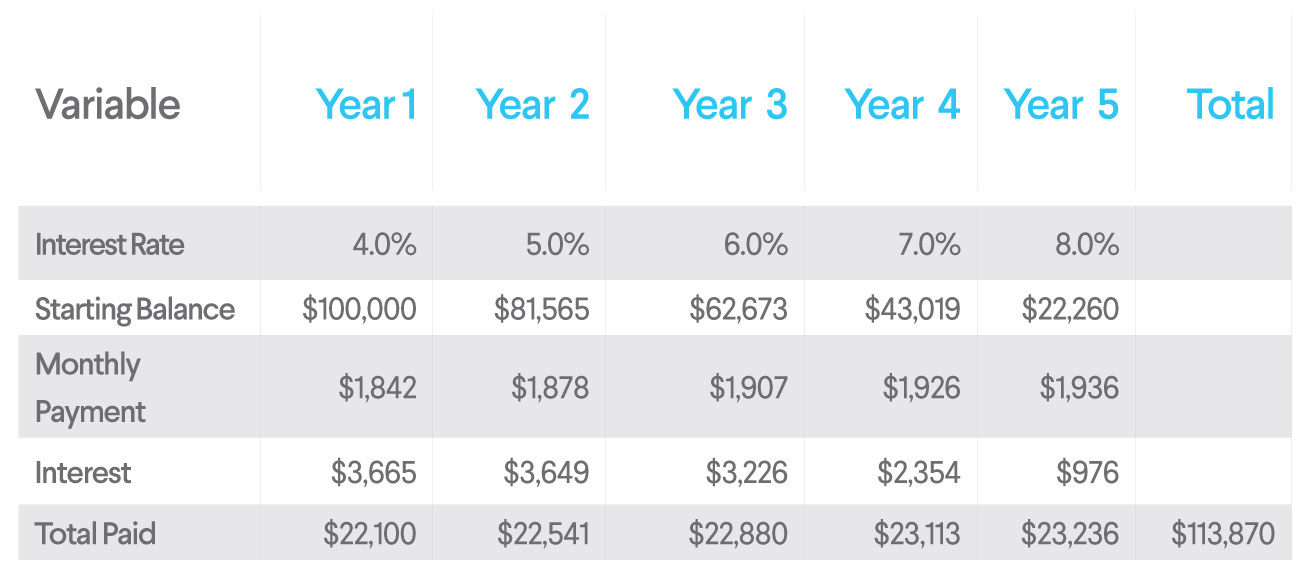

It can feel frustrating seeing your variable interest rate rise with SOFR. But even if interest rates rise, variable rates often still save money over the longer term. Consider this example:

Note that in the example, the loan is larger earlier in the term before the borrower has paid much of it off. In a rising rate environment, that is also when the interest rate is lowest. By the time the interest rate has risen, the total loan balance is much smaller. That means that even though the variable rate increased from 4% to 8% over the life of the loan, you’d still end up paying less in interest than you would if you had selected the 6% fixed rate from the beginning.

For context, in the last 20 years, interest rates have never increased more than five percentage points in a five-year period.

Many variable rate loans have a cap to protect borrowers so that no matter what happens to the 30 day average SOFR index, borrowers will never pay more than that cap. SoFi’s variable rate loans for student loan refinancing are capped at a maximum of 8.95% or 9.95%—depending on the loan term.

So, what can you do?

For most borrowers, the best course might be to do nothing. There’s no universal right or wrong answer for whether a fixed or variable rate is better. Your decision all depends upon your personal situation and flexibility.

You might prefer to keep your variable rate if you want to take advantage of the maximum possible savings (i.e., the lowest possible interest rate to start) but have the financial flexibility to make higher monthly payments if interest rates rise. You might also prefer a variable rate if you plan to pay off your loan in a short timeframe, such as seven years or less.

Alternatively, if you like the consistency of knowing exactly what your monthly payments will be over time, you can consider refinancing your variable rate loan into a new fixed rate loan. Also, if you plan to pay your loan back over a longer period of time (say 10 or 20 years), you might prefer to eliminate the risk of interest rate changes with a new fixed rate loan.

With SoFi, you’re always able to apply to refinance your loan again at no additional cost. There are no prepayment penalties for repaying your existing loan early, and there are no origination fees for taking out a new loan.

Ultimately the decision on the loan term, amount, and loan type depend on your personal situation.

Still have more questions? Click here to learn more about fixed and variable rates, or call our Customer Support team at 855-456-7634 (SOFI).

For people focused on their careers, finances, and relationships, podcasts are the self-help books of the 21st century. They’re typically pretty short (most under an hour) and easily accessible, allowing listeners to take in episodes while driving, working out, or whipping up something for dinner.

Because we know how important career success, wealth, and personal connections are to our members, we’ve handpicked 16 podcasts that offer everything from advice on achieving business success to finance tips to lessons on how to enrich your life.