What to Do When Student Loan Variable Rates Rise

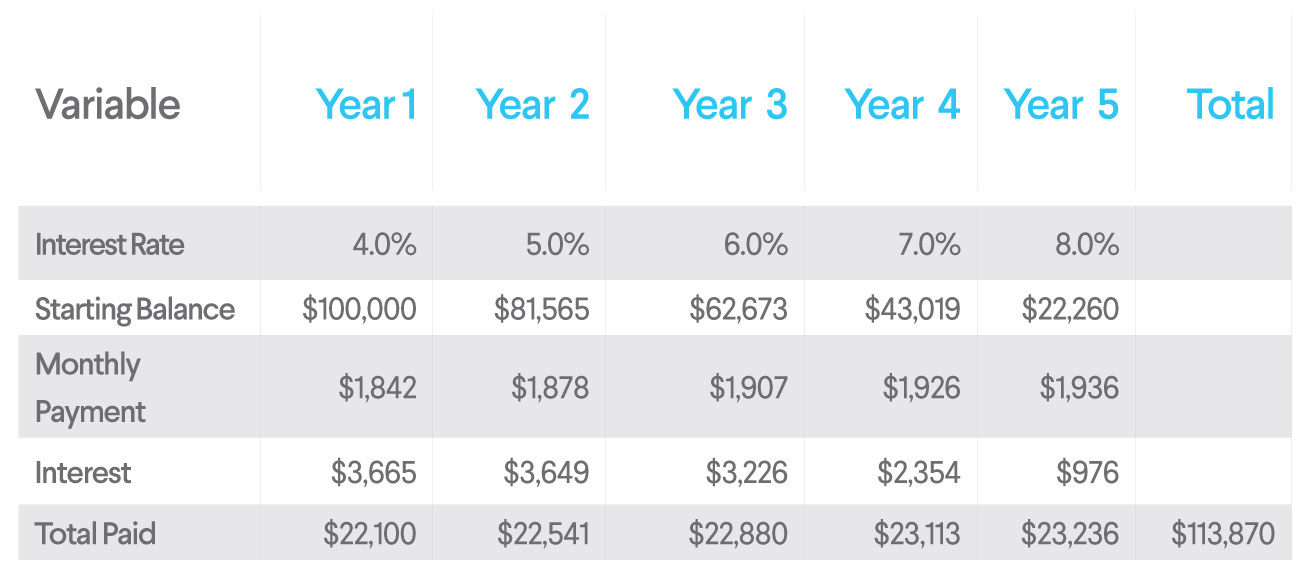

Note that in the example, the loan is larger earlier in the term before the borrower has paid much of it off. In a rising rate environment, that is also when the interest rate is lowest. By the time the interest rate has risen, the total loan balance is much smaller. That means that even though the variable rate increased from 4% to 8% over the life of the loan, you’d still end up paying less in interest than you would if you had selected the 6% fixed rate from the beginning.

For context, in the last 20 years, interest rates have never increased more than five percentage points in a five-year period.

Note that in the example, the loan is larger earlier in the term before the borrower has paid much of it off. In a rising rate environment, that is also when the interest rate is lowest. By the time the interest rate has risen, the total loan balance is much smaller. That means that even though the variable rate increased from 4% to 8% over the life of the loan, you’d still end up paying less in interest than you would if you had selected the 6% fixed rate from the beginning.

For context, in the last 20 years, interest rates have never increased more than five percentage points in a five-year period.

Many variable rate loans have a cap to protect borrowers so that no matter what happens to the 30 day average SOFR index, borrowers will never pay more than that cap. SoFi’s variable rate loans for student loan refinancing are capped at a maximum of 8.95% or 9.95%—depending on the loan term.

Many variable rate loans have a cap to protect borrowers so that no matter what happens to the 30 day average SOFR index, borrowers will never pay more than that cap. SoFi’s variable rate loans for student loan refinancing are capped at a maximum of 8.95% or 9.95%—depending on the loan term.

So, what can you do?

For most borrowers, the best course might be to do nothing. There’s no universal right or wrong answer for whether a fixed or variable rate is better. Your decision all depends upon your personal situation and flexibility. You might prefer to keep your variable rate if you want to take advantage of the maximum possible savings (i.e., the lowest possible interest rate to start) but have the financial flexibility to make higher monthly payments if interest rates rise. You might also prefer a variable rate if you plan to pay off your loan in a short timeframe, such as seven years or less. Alternatively, if you like the consistency of knowing exactly what your monthly payments will be over time, you can consider refinancing your variable rate loan into a new fixed rate loan. Also, if you plan to pay your loan back over a longer period of time (say 10 or 20 years), you might prefer to eliminate the risk of interest rate changes with a new fixed rate loan. With SoFi, you’re always able to apply to refinance your loan again at no additional cost. There are no prepayment penalties for repaying your existing loan early, and there are no origination fees for taking out a new loan. Ultimately the decision on the loan term, amount, and loan type depend on your personal situation. Still have more questions? Click here to learn more about fixed and variable rates, or call our Customer Support team at 855-456-7634 (SOFI).You Might Also Like

Fixed vs. Variable Rate Loans

What’s the difference between fixed rate loans and variable rate loans and which options is better? Here’s a resource to help you understand and choose between fixed and variable rate loans. More

How to Choose Between Variable and Fixed Rate Student Loans

Got student loans? We’ve got you covered with our Student Loan Smarts blog series. Our expert tips and hacks… More

Evaluating a Variable Rate Student Loan

There are a lot of factors to take into account when choosing a student loan—differing interest rates, private vs. public, the pros and cons of working with various lenders. More

Questions? Call us 7 days a week at 855-456-7634

Contact Us