Home Equity Loans – Apply for a Home Equity Loan Online

Borrow at a lower rate with a home equity loan

Checking your rate will not affect your credit score

Received a mailer from us?

Enter confirmation #

✓ Access up to 85% or $750K of your home’s equity.

✓ Keep your current home loan interest rate.

✓ $0 origination fee options.1

✓ Fixed rates and flexible terms.

{/*Hero APR*/}

New, lower home equity rates with $0 origination fees.*

✓ Access up to 85% or $750K of your home’s equity.

✓ Enjoy lower rates for consolidating debt or

home upgrades.

✓ Get flexible terms that work for you.

View your rate

Checking your rate will not affect your credit score

Received a mailer from us?

Enter confirmation #

{/*trust pilot*/}

Received a mailer from us?

Enter confirmation #

{/*how it works*/}

How to apply for a

home equity loan online.

Help us understand your needs.

Answer a few questions online to help us

assist you better.

Get paired with a dedicated Mortgage

Loan Officer.

You’ll be connected with an experienced SoFi

Mortgage Loan Officer who’s ready to help you get

the best home equity loan for you.

Submit your application.

Your SoFi Mortgage Loan Officer will help you submit your home equity application so you can get access to your cash.

Get started

{/*what is a he loan*/}

What is a home

equity loan?

Home equity loans let you borrow money by leveraging the equity in your home. They’re one of the most affordable financing options since home equity rates are lower than interest rates for most other types of loans. These lower interest rates can help fund big purchases, home renovations, or consolidate high-interest debt.

Learn more

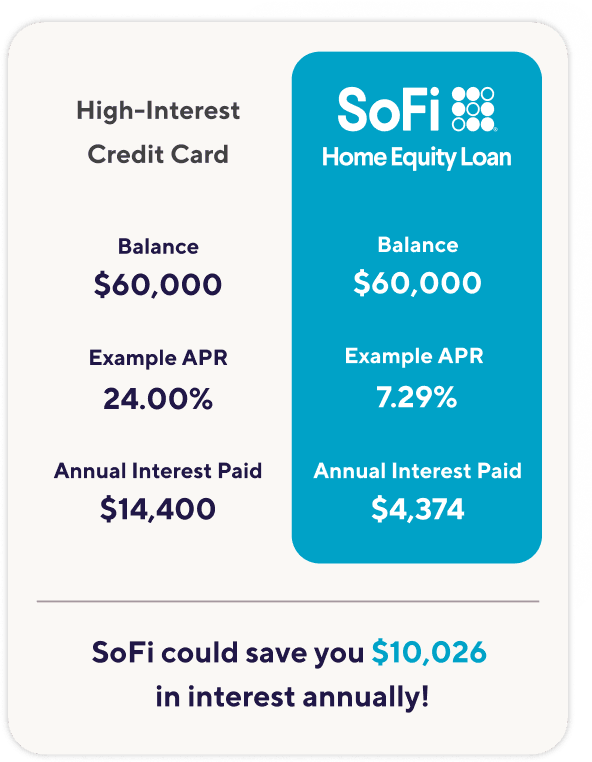

You could save thousands

with a SoFi home equity loan.

The savings claim above is based upon using a SoFi Home Equity Loan to pay-off credit card balance of $60,000. We assume a credit card APR of 24%. The savings shown assumed payments of only the interest due. We compare that against an assumed SoFi Home Equity Loan of $60,000 (to pay off the credit card) with an APR of 7.29%. Annual interest savings assumes you pay both loans on time. You might not be eligible for the home equity loan and, if you are eligible, your APR rate could be higher. Eligibility and the lowest APR rate depend on credit worthiness, income, and other factors. The 24% APR is the average credit card APR reported by Wallethub for Q1 March 2025 under their Good Credit category.

{/*requirements*/}

Home equity loan requirements:

View your rate

Checking won’t affect your credit score.†

{/*horizon*/}

{/*popular uses*/}

A home equity loan could

help with that.

-

Pay down high-interest debt.

You could save on your monthly payments

when you consolidate credit cards or

other unsecured loans into one lower rate. -

Fund home improvements.

Make your dream kitchen a reality without

having to take on high-interest debt. -

Make big purchases.

Tuition, weddings, and vacations can get

expensive. Instead of putting them on a

high-interest credit card, a home equity

loan could help you save on monthly payments.

{/*calculators*/}

Crunch the numbers on your

home equity loan.

HELOC monthly

payment calculator

Get help understanding your

monthly payments with a home

equity line of credit.

Learn more

HELOC repayment

calculator

Estimate how much you might be

paying with a home equity line of

credit.

Learn more

{/*why SoFi*/}

Why choose SoFi

for your home

equity loan?

No change to your existing mortgage rate.

Keep your current mortgage as is, no need to refinance. And for qualified borrowers, there are options to access your home’s equity.

Finance almost anything with up to $750K.

Access up to $750,000 of your home’s equity (up to 85%) to finance home improvements or consolidate debt.

Lower your monthly payment.

You could save compared to a high-interest credit card or unsecured personal loan.

Get dedicated one-on-one support.

You’ll have a dedicated SoFi Mortgage Loan Officer to help you find the right loan option for you.

“Austin and his team were awesome and easy to work with! Great communication and follow up. Kept us in the loop every step of the way! I would go back to Austin without question.”

“Spencer and his team totally went to bat for us and got our loan processed. Very happy with him and his teams efforts and follow up. Communication was excellent right up to the loan funding.”

“Mark and his team worked very closely with us to make sure that we were comfortable with the process, understood the expectations, timeline and overall schedule.”

300+ Reviews

Current home equity loan rates by state.

Compare current home equity loan rates by state and find a home equity loan rate that suits your financial goals.

Select a state to view current rates:

{/*learn more*/}

Learn more about home equity loans.

More resources on home equity

Get answers to questions like “What’s the difference between a home equity loan

and a HELOC (home equity line of credit)?”

FAQs

How does a home equity loan work?

To start, you’ll need to have sufficient home equity, which is the difference between the market value and what you owe. You may have built home equity by paying down your mortgage and by seeing your home appreciate. You’ll go through an application process, and the lender will likely order a home appraisal to ensure that there’s enough value there to lend against. You’ll have a lot more paperwork than some other loans and will sign mortgage lien documents that give the lender the right to start proceedings should you fail to make payments. After closing on the loan, you’ll receive all funds upfront. Repayment starts shortly after.

Learn more: What Is a Home Equity Loan?

How to apply for a home equity loan?

First, assess your financial situation – consider your income, how much equity you have available, if you have at least a “good” FICO® score, and your debt-to-income ratio. Exploring different loan options is encouraged!

Once you’ve found a fitting loan and are ready to apply, you’ll go through the application process, where you’ll submit information about your income, current mortgage, insurance, and other details the lender requests. If everything checks out, you’ll be able to close on your loan! Funds are disbursed around three business days after closing on the loan.

On a home equity loan where the funds are disbursed upfront and your interest rate is locked, the first payment will be due around 30 days after you close the loan.

How do I qualify for a home equity loan?

Home equity loans are contingent on income, credit history, and debt-to-income ratio. LTV is also considered. LTV compares the amount you owe against your home with its current value. Lenders usually want to see an LTV no higher than 85%. (LTV = Loan Value ÷ Property Value.) On a $400,000 home, for example, that means that you should owe no more than $340,000.

How long does it take to get a home equity loan?

It can take an estimated 30 days to close your loan. Funds are disbursed around three business days after closing on the loan. On a home equity loan where the funds are disbursed upfront and your interest rate is locked, the first payment will be due around 30 days after you close the loan.

What is the interest rate on a home equity loan?

A home equity loan offers a low interest rate because it uses your home’s equity to secure the loan. Because of the way it works, you may have access to a larger sum of money at a lower interest rate than you would if you used another source, such as a credit card. View your home equity rate here.

How much can I get with a home equity loan?

When it comes to how much home equity you can tap, many lenders allow a maximum of 90%, although some allow less, and some, more. In other words, your loan-to-value ratio shouldn’t exceed 90% in many cases.

If you’re taking out a second mortgage like a home equity loan or HELOC, your first mortgage and the equity loan compared with your home value is what is called the combined loan-to-value (CLTV) ratio. Most lenders will require a CLTV of 90% or less to obtain a home equity loan, although some will allow you to borrow 100% of your home’s value. For a better idea of exactly how much you can borrow, use SoFi’s Home Equity Loan Calculator.

Learn more: Ways to Pull Equity Out of Your Home

What is a home equity line of credit (HELOC)?

A home equity line of credit (HELOC) is a credit line secured by the value of your home, minus any existing mortgage owed. You can borrow against it, spend, repay, and borrow again using your home as collateral.

Learn more: What Is a Home Equity Line of Credit (HELOC)?

What is the difference between a HELOC vs home equity loan?

A HELOC is a revolving line of credit. You can take out money as you need it, up to your approved limit, during the draw period. You may be able to make interest-only payments on the amount you withdraw during that time, typically 10 years. A home equity loan is another type of second mortgage that uses your home as collateral, but in this case, the funds are disbursed all at once and repayment starts immediately. It is usually a fixed-rate loan of five to 30 years, and monthly payments remain the same until the loan is paid off.

Learn more: HELOC vs. Home Equity Loan

Can you have both a HELOC and home equity loan?

It is rare to have both a HELOC and a home equity loan. One would be a second mortgage and the other would be a third mortgage. Few banks are willing to lend money on a third mortgage, and for any that do, the interest rate would be high.

See more FAQs

Read more