Los Angeles Housing Market: Trends & Prices

Los Angeles Housing Market: Trends & Prices (2025)

Los Angeles Real Estate Market Overview

(Last Updated – 4/2025)

The City of Dreams has seen a steady influx of new residents over the years, thanks to its eternally bustling film industry. The idea that Los Angeles offers glamour and excitement will probably never fade, though there are many reasons to appreciate LA aside from the silver screen.

You’re just hours (if not minutes) away from beaches, mountains, and theme parks. The city’s foodie and arts scenes have evolved to be major players, and the fact that there are excellent sports teams to cheer on is another plus. And who could forget the sun? On average, the city receives 263 sunny days a year — which could be part of why as of February 2025 the median sale price in Los Angeles was over $1 million. Yes, that’s a high figure, and the cost of living in Los Angeles is significantly above average (about 50% higher), as you might expect from a major urban hub in an expensive state.

If you need help navigating this real estate market, read on to take a look at the city as a whole as well as five popular neighborhoods where you may be able to snag a bargain.

Los Angeles Real Estate Market Trends

The City of Angels can have a robust housing market, for sure. The combination of career opportunity, sunshine, and everything else the area has to offer is a huge draw. But that shouldn’t discourage you if you are looking to buy there: The market is currently considered somewhat competitive, with homes on the market typically selling for around list price in around 54 days.

$1,060,000

Median Sale Price

$662

Median Price Per Square Foot

67 days

Median Time on Market

Los Angeles Housing Market Forecast

If you’re looking to make an offer on a home in Los Angeles, you may have to move quickly, as popular homes sell in only 22 days. Also, be prepared for rising prices. Data from February 2025 reveals that overall prices have climbed 9% year over year. However, current economic volatility can make it hard to forecast whether prices will continue to creep up.

*Graph taken from Zillow as of 4/2025

Recommended: 2025 Cost of Living by State

Demographics of the Los Angeles Market

From Beverly Hills to Malibu, you’ll find plenty of amazing areas and opportunities in greater LA. The beautiful weather combined with the allure of Hollywood can make this one of the most exciting places to live in the country.

Almost 4 million people call Los Angeles city home, according to the latest census data. Here, take a closer look at who they are.

Median Household Income: $79,701

Median Age: 37.2

College Educated: 39.2%

Homeowners: 35%

Married: 40%

Recommended: Guide to Buying, Selling, and Updating Your Home

Popular Los Angeles Neighborhoods

There are countless neighborhoods to choose from in Los Angeles, so you’re likely to find the right fit for you.

More than half a dozen regions make up Los Angeles, and each region contains many smaller neighborhoods worth exploring. Keep reading for breakdowns of some of the most popular neighborhoods in LA.

Westwood

This dynamic neighborhood has a lot going for it, and the home prices, which may necessitate a jumbo mortgage, reflect that. Westwood is home to UCLA and offers great restaurants, shops, and stores — many of which are within walking distance. Walkability is a major plus (it’s also been called a “jogger’s paradise”) for this area, as well as short commutes for many people who work in offices. There’s also the university’s Fowler and Hammer museums and its lush botanical garden to explore.

Quick Facts

Population:

49,226

Median Age:

22.9

Housing Units:

19,843

Bike Score:

55/100

Walk Score:

69/100

Transit Score:

66/100

Median Household Income:

$122,161

Westwood Housing Market

Westwood is a very desirable area of Los Angeles, and you’ll likely pay a premium to live there. Housing prices in Westwood are higher than Los Angeles, with a current median sale price of $1.84 million. Home values in this neighborhood rose 8.3% year over year as of February 2025.

On average, houses are currently on the market for 75 days vs. 57 days the year prior, and they sell for roughly 2% below list price.

Median Sale Price

$1,840,000

Median Price Per Square Foot

$819

Echo Park

If you lead an indie lifestyle and love a neighborhood with cute cafes, diverse restaurants, bars with live music, and non-cookie-cutter boutiques, welcome to Echo Park. You’ll feel right at home. This popular Los Angeles neighborhood has Echo Park Lake, for fun paddleboat outings, as well as charming vintage architecture, with Victorian homes adding to its allure. Bonus: You’re close to Dodger Stadium if you want to catch a game, and Chinatown is nearby, too.

Quick Facts

Population:

33,664

Median Age:

39

Housing Units:

14,709

Bike Score:

80/100

Walk Score:

98/100

Transit Score:

60/100

Median Household Income:

$111,168

Echo Park Housing Market

Home values in Echo Park rose almost 17% over the past year, and this area is considered somewhat competitive. Houses sell for roughly 1% above list price (hot properties tend to ring in at about 6% over asking) and stay on the market for an average of 41 days.

Median Sale Price

$1,262,500

Median Price Per Square Foot

$907

Silver Lake

Silver Lake is another hip area of Los Angeles that is known for its indie music scene, modern restaurants, and fun bars. Young professionals will love this neighborhood, but families will also appreciate it for its schools, walkability, and the popular walking trail at Silver Lake Reservoir.

Quick Facts

Population:

29,871

Median Age:

36.7

Housing Units:

13,202

Bike Score:

51/100

Walk Score:

81/100

Transit Score:

54/100

Median Household Income:

$135,123

Silver Lake Housing Market

The average sale price in Silver Lake was up 8.7% in a year as of February 2025 and is currently well above the Los Angeles average. Homes sell for about 4% above list price and stay on the market about 37 days. This is a very competitive market: Don’t be surprised if you find yourself in a bidding war, with some buyers willing to waive contingencies.

Median Sale Price

$1,522,500

Median Price Per Square Foot

$913

Venice

Why not relax and head to the beach? If you love the surf and sand, then Venice might be the neighborhood for you.

This area has maintained the arty, hippie vibe it’s known for while modernizing at the same time. You’re guaranteed to have a blast watching people at the boardwalk on weekends. There’s also Abbot Kinney Boulevard to explore, a mile-long stretch with sophisticated clothing stores, art galleries, and cafes, bars, and eateries, including vegan spots.

Quick Facts

Population:

27,543

Median Age:

39

Housing Units:

17,669

Bike Score:

88/100

Walk Score:

83/100

Transit Score:

52/100

Median Household Income:

$85,445

Venice Housing Market

Venice has been a popular neighborhood for decades in Los Angeles, and the housing market remains somewhat competitive, with high prices. You may want to investigate mortgage options and get preapproved if you are planning on living the dream.

Current home prices are up a significant 27% compared with last year as of February 2025. The average house sells for 3% below list price and stays on the market for 99 days, though hot properties can sell in half that time and for a bit over asking price.

Median Sale Price

$2,260,000

Median Price Per Square Foot

$1,130

Sherman Oaks

If you’re intrigued by glamorous, old-Hollywood architecture, Sherman Oaks might be a great neighborhood for you. You’ll cross paths with iconic roads like Mulholland Drive and Ventura Boulevard. Plus, the area has 1930s charm, perfect for putting down roots.

But Sherman Oaks has plenty to recommend it beyond its good looks. It’s close to some of the major studios for those who work in “the industry.” Families appreciate the well-regarded public and private school options, and plentiful dining and shopping options.

Quick Facts

Population:

67,698

Median Age:

38

Housing Units:

32,800

Bike Score:

52/100

Walk Score:

62/100

Transit Score:

44/100

Median Household Income:

$152,993

Sherman Oaks Housing Market

The Sherman Oaks housing market is considered somewhat competitive. As of February 2025, prices were down 1.6% vs. the previous year. Average homes sell for about 1% below list price and stay on the market 88 days as compared to 62 days for the preceding year.

Median Sale Price

$1,377,500

Median Price Per Square Foot

$702

Recommended: What to Know About Getting Preapproved for a Home Loan

SoFi Home Loans

It’s easy to see why Los Angeles remains attractive for homebuyers. There’s a wide array of neighborhoods to choose from, whether you’re young and single or have a family to look after.

If you think LA could be your home sweet home, then you may need to consider different mortgage loans during your home buying process.

Looking for an affordable option for a home mortgage loan? SoFi can help: We offer low down payments (as little as 3% - 5%*) with our competitive and flexible home mortgage loans. Plus, applying is extra convenient: It's online, with access to one-on-one help.

FAQ

Should I buy a house now or wait to see if prices go down?

Whether to buy a house in Los Angeles now or wait to see if prices go down is a very personal decision. The real estate market and economy in general can see ups and down and be hard to predict. Weigh your personal circumstances and risk tolerance to make the right choice.

Are home prices in LA dropping?

While LA home prices fluctuate, overall prices have been creeping up. That said, economic factors could shift and see a dip in the asking price of properties. It’s wise to keep your eye on the market if you are considering making a move soon.

Why is housing in Los Angeles so high-priced?

There are several reasons for the high prices of Los Angeles real estate. One factor to consider is that the entire state of California is very high-priced, with one of the highest costs of living in the country. Also, Los Angeles was originally built as single-family houses on sizable tracts of land, meaning that while new housing is being built, there is still a limited supply of residential real estate. Factor in how many people move to LA in search of its quality of life and job market, and you see why it can be so pricey.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

*SoFi requires Private Mortgage Insurance (PMI) for conforming home loans with a loan-to-value (LTV) ratio greater than 80%. As little as 3% down payments are for qualifying first-time homebuyers only. 5% minimum applies to other borrowers. Other loan types may require different fees or insurance (e.g., VA funding fee, FHA Mortgage Insurance Premiums, etc.). Loan requirements may vary depending on your down payment amount, and minimum down payment varies by loan type.

[cd_product_push_jumbo]

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Qualifying for the reward requires using a real estate agent that participates in HomeStory’s broker to broker agreement to complete the real estate buy and/or sell transaction. You retain the right to negotiate buyer and or seller representation agreements. Upon successful close of the transaction, the Real Estate Agent pays a fee to HomeStory Real Estate Services. All Agents have been independently vetted by HomeStory to meet performance expectations required to participate in the program. If you are currently working with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®. A reward is not available where prohibited by state law, including Alaska, Iowa, Louisiana and Missouri. A reduced agent commission may be available for sellers in lieu of the reward in Mississippi, New Jersey, Oklahoma, and Oregon and should be discussed with the agent upon enrollment. No reward will be available for buyers in Mississippi, Oklahoma, and Oregon. A commission credit may be available for buyers in lieu of the reward in New Jersey and must be discussed with the agent upon enrollment and included in a Buyer Agency Agreement with Rebate Provision. Rewards in Kansas and Tennessee are required to be delivered by gift card.

HomeStory will issue the reward using the payment option you select and will be sent to the client enrolled in the program within 45 days of HomeStory Real Estate Services receipt of settlement statements and any other documentation reasonably required to calculate the applicable reward amount. Real estate agent fees and commissions still apply. Short sale transactions do not qualify for the reward. Depending on state regulations highlighted above, reward amount is based on sale price of the home purchased and/or sold and cannot exceed $9,500 per buy or sell transaction. Employer-sponsored relocations may preclude participation in the reward program offering. SoFi is not responsible for the reward.

SoFi Bank, N.A. (NMLS #696891) does not perform any activity that is or could be construed as unlicensed real estate activity, and SoFi is not licensed as a real estate broker. Agents of SoFi are not authorized to perform real estate activity.

If your property is currently listed with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®.

Reward is valid for 18 months from date of enrollment. After 18 months, you must re-enroll to be eligible for a reward.

SoFi loans subject to credit approval. Offer subject to change or cancellation without notice.

The trademarks, logos and names of other companies, products and services are the property of their respective owners.

SOHL-Q125-223

Columbus Housing Market: Trends & Prices

Columbus Housing Market: Trends & Prices (2025)

Columbus Real Estate Market Overview

(Last Updated – 4/2025)

The beautiful city of Columbus often takes on a scarlet and gray tint thanks to some very loyal football fans. Columbus residents have a fierce loyalty for the Ohio State Buckeyes, and it isn’t uncommon to see their favorite team’s colors adorning the streets.

While sports are beloved in Columbus, the city is also teeming with culture, music, theater, and art. Ohio State University and many large and local businesses also provide a broad array of job and career opportunities. What’s more, Columubus offers family-friendly neighborhoods and a lower cost of living compared to larger cities.

Keep reading to learn more about the Columbus real estate market, housing costs, and the benefits of living in some of Columbus’s most popular neighborhoods.

Overall Columbus Market Trends

The housing market in Columbus is considered somewhat competitive, according to Redfin. On average, homes receive two offers and stay on the market for about 50 days, compared to 42 days a year ago. In February 2025, the median home sale price was $270,000, down around 1% from the prior year. The average home sells for about 1% above the asking price.

$270,000

Median Home Price

$185

Median Price Per Sq. Ft

50

Median Days on Market

Columbus Housing Market Forecast

While home prices in Columbus have risen significantly over the past five years (as you can see from the chart below), real estate agents are seeing signs of softening in the market in 2025. Average home prices in Columbus aren’t exactly going down, but they aren’t going up at the same pace.

There are other good signs for buyers: Homes are taking longer to sell, giving house hunters more time to shop around and evaluate their options. Some sellers are also coming down on price in order to make a sale. Though it’s not quite a “buyer’s market,” it appears to be shifting that way.

Demographics of the Columbus Market

With a median age of around 33 and many family-friendly suburbs, Columbus attracts a younger demographic. It also has a multicultural flair, thanks to Ohio State University, which draws people from all around the world to the city. About 20% of the population of Columbus has moved to the area within the last year.

For job-seekers, Columbus offers employment opportunities in a wide variety of sectors. Ohio State and other schools are among the city’s largest employers. As the state capital, Columbus also offers many government jobs. In addition, a number of large U.S. companies have their headquarters in Columbus. These include JPMorgan Chase & Co, Nationwide Insurance, Victoria’s Secret & Co., Bath & Body Works, Inc., Honda of America, and American Electric Power.

Median Household Income: $62,350

Median Age: 32.7

College Educated: 23.11%

Homeowners: 44.73%

Married: 38.58%

Popular Columbus Neighborhoods

With so many great neighborhoods to choose from in Columbus, it can be hard to know where to put down roots.

Every neighborhood has its own unique perks, and the right fit will depend on your needs, budget, lifestyle, and personal preferences. To help you narrow down your choices, here’s a look at five of the city’s most popular neighborhoods, including key demographics and costs.

Recommended: Best Affordable Places to Live in Ohio 2025

Short North

The Short North neighborhood is considered to be a pioneer in the urban revitalization of Central Ohio. This vibrant neighborhood leans into artistic and cultural pursuits, which may appeal to those looking for a less suburban feel. With over 300 businesses in this area, there are plenty of exciting job opportunities to be discovered as well.

Quick Facts

Population:

1,803

Median Age:

27

Housing Units:

1,014

Bike Score:

91/100

Walk Score:

95/100

Transit Score:

56/100

Median Household Income:

$89,321

Short North Housing Market

If you’re interested in buying a home in Short North, there is good news: The housing market in this neighborhood is not very competitive, according to Redfin. While February 2025 prices were up slightly from a year prior, homes tend to sit on the market for nearly three months before selling, giving shoppers plenty of time to weigh their options.

Median Home Price

$375,000

Median Price Per Square Ft.

$310

German Village

A quick trip over a highway bridge is all it takes for German Village residents to hop on over to downtown Columbus. This is an ideal arrangement for residents who enjoy the historic charm of German Village, but want to work amongst the modern hustle and bustle of downtown.

Architecture lovers will appreciate that the structures and sidewalks are crafted of orange masonry and about half the streets are still made of brick pavers.

Quick Facts

Population:

2,629

Median Age:

32

Housing Units:

1,519

Bike Score:

68/100

Walk Score:

90/100

Transit Score:

54/100

Median Household Income:

$97,513

German Village Housing Market

The housing market in German Village is considered somewhat competitive, according to Redfin. In February 2025, the median home sale price was $729,000, up nearly 6% over the prior year. Homes are sitting on the market for slightly longer, however — an average of 95 days compared to 73 days last year. On average, homes in German Village sell for about 1% above asking price.

Median Home Price

$728,900

Median Price Per Square Ft.

$271

Downtown

Downtown Columbus is particularly charming thanks to its tree-lined streets, panoramic penthouses, and traditional townhomes.

Living in Downtown can be a blast due to how easy it is to walk to great shops, restaurants, and attractions. For those who want to avoid suburban life, Downtown may just be the right fit.

Recommended: Cost of Living in Ohio

Quick Facts

Population:

15,917

Median Age:

27

Housing Units:

10,313

Bike Score:

72/100

Walk Score:

81/100

Transit Score:

69/100

Median Household Income:

$93,125

Downtown Housing Market

The housing market in Downtown is currently not very competitive, according to Redfin. While prices were up slightly in February 2025 compared to February 2024, homes are sitting on the market longer — an average of 96 days compared to 86 days a year ago. Multiple offers are rare in this neighborhood, and homes generally sell for 5% below the asking price. All of this puts buyers in the driver’s seat.

Median Home Price

$283,450

Median Price Per Square Ft.

$352

University District

The University District is a massive neighborhood that encompasses 13 smaller neighborhoods that surround one of the nation’s largest public universities, Ohio State University. Hence this area’s collegiate name.

This bold and exciting area offers an eclectic mix of living options for students, working professionals, and families alike.

Quick Facts

Population:

33,120

Median Age:

23

Housing Units:

N/A

Bike Score:

85/100

Walk Score:

88/100

Transit Score:

53/100

Median Household Income:

$24,044

University District Housing Market

The housing market in the University District is currently not very competitive, according to Redfin. In February 2025, the median home sale price was $330,000, down around 14% from a year prior. Homes are also sitting on the market more days before selling — an average of 77, compared to 54 last year. Buyers don’t necessarily have to offer list price, either: The average home goes for about 5% below ask, and multiple offers are rare.

Median Home Price

$330,000

Median Price Per Square Ft.

$192

Franklin Park

The residents of Franklin Park like to say that they “turn visitors into neighbors and neighbors into friends!” This friendly neighborhood is conveniently located near the center of Columbus and has easy access to freeways and public transit.

Locals enjoy strolling through the Bryden Road Historic District in the Franklin Park neighborhood and taking in the charming architecture.

Quick Facts

Population:

12,600

Median Age:

34

Housing Units:

7,350

Bike Score:

67/100

Walk Score:

56/100

Transit Score:

44/100

Median Household Income:

$79,303

Franklin Park Housing Market

The housing market in Franklin Park is considered somewhat competitive, according to Redfin. In February 2025, the median home sale price was $520,000, up around 10% from the prior year. Still, you don’t necessarily have to pay list price to snag a home in this neighborhood: On average, homes sell for about 3% below list price, after sitting on the market for roughly two months.

If you have your heart set on a highly desirable home, however, you may have to pony up and act faster — “hot” homes tend to get their asking price and come off the market in less than one month.

Median Home Price

$520,000

Median Price Per Square Ft.

$202

SoFi Home Loans

It’s easy to see why Columbus has become such a popular market to buy a home in. There are some really amazing neighborhoods to choose from whether you’re young and single or have a family to look after.

If you think Columbus could be your home sweet home, then you may need to consider your home loan options.

Looking for an affordable option for a home mortgage loan? SoFi can help: We offer low down payments (as little as 3% - 5%*) with our competitive and flexible home mortgage loans. Plus, applying is extra convenient: It's online, with access to one-on-one help.

FAQ

Is now a good time to buy a house in Columbus, Ohio?

Now can be a good time to buy a house in Columbus, Ohio. The market has seen some stabilization in recent months, which could present better opportunities for buyers. However, Columbus remains a fairly competitive market and inventory is still limited. If you’re prepared with a solid down payment, preapproval, and a stable income, it could still be a smart time to make a move.

Is Columbus, Ohio a seller’s market?

Yes, Columbus is currently a seller’s market, driven by strong demand and limited inventory. Sellers often receive multiple offers, and homes are selling quickly, sometimes above asking price.

That said, there are signs that the market is starting to soften. Prices are down slightly year-over-year, and homes are sitting on the market for an average of 50 days, compared to 42 days last year. While the market still favors sellers, buyers can find success by being proactive, having their finances ready, and understanding local home values.

Why are houses so expensive in Columbus Ohio?

Houses in Columbus, Ohio, are expensive due to several factors. The city’s robust job market (particularly in education, government, professional services, and health care), has attracted many new residents, increasing demand. Limited housing inventory and the cost of new construction have also contributed to higher prices. Additionally, the city’s quality of life, strong school systems, and affordability (compared to larger cities) make it an attractive place to live, further driving up demand for homes.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

*SoFi requires Private Mortgage Insurance (PMI) for conforming home loans with a loan-to-value (LTV) ratio greater than 80%. As little as 3% down payments are for qualifying first-time homebuyers only. 5% minimum applies to other borrowers. Other loan types may require different fees or insurance (e.g., VA funding fee, FHA Mortgage Insurance Premiums, etc.). Loan requirements may vary depending on your down payment amount, and minimum down payment varies by loan type.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

Qualifying for the reward requires using a real estate agent that participates in HomeStory’s broker to broker agreement to complete the real estate buy and/or sell transaction. You retain the right to negotiate buyer and or seller representation agreements. Upon successful close of the transaction, the Real Estate Agent pays a fee to HomeStory Real Estate Services. All Agents have been independently vetted by HomeStory to meet performance expectations required to participate in the program. If you are currently working with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®. A reward is not available where prohibited by state law, including Alaska, Iowa, Louisiana and Missouri. A reduced agent commission may be available for sellers in lieu of the reward in Mississippi, New Jersey, Oklahoma, and Oregon and should be discussed with the agent upon enrollment. No reward will be available for buyers in Mississippi, Oklahoma, and Oregon. A commission credit may be available for buyers in lieu of the reward in New Jersey and must be discussed with the agent upon enrollment and included in a Buyer Agency Agreement with Rebate Provision. Rewards in Kansas and Tennessee are required to be delivered by gift card.

HomeStory will issue the reward using the payment option you select and will be sent to the client enrolled in the program within 45 days of HomeStory Real Estate Services receipt of settlement statements and any other documentation reasonably required to calculate the applicable reward amount. Real estate agent fees and commissions still apply. Short sale transactions do not qualify for the reward. Depending on state regulations highlighted above, reward amount is based on sale price of the home purchased and/or sold and cannot exceed $9,500 per buy or sell transaction. Employer-sponsored relocations may preclude participation in the reward program offering. SoFi is not responsible for the reward.

SoFi Bank, N.A. (NMLS #696891) does not perform any activity that is or could be construed as unlicensed real estate activity, and SoFi is not licensed as a real estate broker. Agents of SoFi are not authorized to perform real estate activity.

If your property is currently listed with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®.

Reward is valid for 18 months from date of enrollment. After 18 months, you must re-enroll to be eligible for a reward.

SoFi loans subject to credit approval. Offer subject to change or cancellation without notice.

The trademarks, logos and names of other companies, products and services are the property of their respective owners.

SOHL-Q125-234

Minneapolis Housing Market: Trends & Prices

Minneapolis Housing Market: Trends & Prices (2025)

Minneapolis Real Estate Market Overview

(Last Updated – 4/2025)

Nature lovers will enjoy this fun fact about Minneapolis’ parks. In 1904 a European florist, Theodore Wirth, was hired as the Minneapolis Park Board superintendent. He made a promise to build a park within six blocks of every city resident and secured the land to do so. Today, residents are still never farther than six blocks from a park.

Minneapolis has grown to a city of more than 425,000 people in the years since Wirth left his mark, but his green legacy lives on. Make sure to stop by 759-acre Theodore Wirth Regional Park to golf, ski, bike, hike, or birdwatch. You might also want to take in the Somali Museum of Minnesota in this diverse city. If you decide to stay in the Mini-Apple, you’ll want to dive more deeply into the housing market — so study this guide.

Overall Minneapolis Market Trends

The real estate pros at Redfin say the Minneapolis housing market is somewhat competitive.

Some homes receive multiple offers. The average home sells for about 1% below asking price, but popular properties can go for 3% above list price and are snapped up in just 12 days.

$340,000

Median Sale Price

$228

Median Sale Price Per Square Foot

50 days

Median Time on Market

Minneapolis Student Market

If you are looking to invest in rental property, Minneapolis could be a good choice. Home to 11 colleges — some of which are the largest state campuses in the country — Minneapolis has an abundant student population. The University of Minnesota, Twin Cities enrolls over 50,000 students alone, many of whom look to rent apartments off campus. In addition, there are nearly 50 colleges within a 50-mile radius of Minneapolis, with well over 200,000 enrollees.

In addition to the students looking to rent apartments, many who go to college in and around Minneapolis stay for work after graduation but can’t afford a home yet, so they must rent.

The multifamily housing market in Minneapolis got a boost not long ago, which could make buying property in the Twin Cities enticing. In 2018, the city supported the elimination of single-family zoning, legalizing up to three residential units on single-family plots. The purpose was to improve housing affordability and meet increased demand. This paves the way for more multifamily properties, allowing owners to live on their property while renting out the other units.

Minneapolis Property Taxes

Whether you are considering buying or investing in Minneapolis real estate, it’ll be good to know, of course, about property taxes. The average property tax rate is 1.16%, slightly above the national average. But as commercial property values in the county have decreased, an increasing proportion of the tax burden has shifted to homeowners.

While the median Minneapolis home sale price of $340,000 was up 10% last year, it’s still lower than the typical U.S. home sale price of $424,429. And there are a number of neighborhoods in Minneapolis where you can find home prices below the city’s overall average.

Minneapolis Housing Market Forecast

For those who are interested in the Minneapolis housing market, it can be helpful to review local housing market trends and forecasts.

Home values in Minneapolis rose 10.1% over the past year. Homes are selling close to list price, and hot homes go for 3% above list and are off the market in less than two weeks.

If you see a property in Minneapolis that you love, it could be the right time to scoop it up. Getting preapproved for a mortgage loan can help speed your search. Below, check out the current home values in Minneapolis, which are on the upswing in the last few months.

Demographics of the Minneapolis Market

Minneapolis is a diverse and exciting city with a lot to offer across its 54 square miles. At last count, 425,142 residents called this city home.

Before settling on a specific neighborhood in Minneapolis, it can be helpful to review some key demographics, according to the latest data.

Median Household Income: $81,001

Median Age: 33.3

College Educated: 58.8%

Homeowners: 48%

Married: 42%

Popular Minneapolis Neighborhoods

When planning a move to, or within, Minneapolis, homebuyers will have 83 residential neighborhoods to choose from. While everyone loves choices, that many options can feel a bit overwhelming.

Check out five popular Minneapolis neighborhoods that could make house hunting a bit easier.

Linden Hills

This pretty neighborhood is bordered by two of Minneapolis’ most popular lakes, Bde Maka Ska and Lake Harriet, offering plenty of water activities, such as canoeing and kayaking, and good views.

In the summer, there are free concerts and movies by the lake, and in the winter families love attending the annual Lake Harriet Winter Kite Festival. A commercial hub in the neighborhood brims with cafes and indie shops that locals like to visit year-round.

Quick Facts

Population:

7,955

Median Age:

38

Housing Units:

3,503

Bike Score:

69/100

Walk Score:

65/100

Transit Score:

39/100

Median Household Income:

$125,450

Linden Hills Housing Market

Home prices were up 0.7% year-over-year as of February 2025, and Redfin reports that some homes get multiple offers. Sales happen in an average of 26 days, significantly faster than the Minneapolis market as a whole. Linden Hills is considered a somewhat competitive market, and home prices are high.

Median Sale Price

$604,000

Median Price Per Square Foot

$300

Ericsson

With over 1,500 family households in Ericsson, this neighborhood is a great option for raising a family. Parents appreciate its well-ranked schools.

The majority of homes here were built in 1939, meaning there are plenty of historic gems to scoop up, but newer homes are also out there for those looking for a more modern feel.

Quick Facts

Population:

7,096

Median Age:

36

Housing Units:

3,169

Bike Score:

85/100

Walk Score:

70/100

Transit Score:

57/100

Median Household Income:

$85,036

Ericsson Housing Market

Many homes in this very competitive area receive multiple offers, some with waived contingencies, and sell in about 13 days. Homes sell at roughly 1% above list price, and prices in this area are up 4.6% in February 2025 compared to last year. Nevertheless, the median sale price is still below the typical U.S. level. Now could be a good time to find your dream home in this area at a decent price.

Median Sale Price

$332,000

Median Price Per Square Foot

$349

North Loop

Known as the Warehouse District, this progressive neighborhood has award-winning restaurants, hip bars, and indie boutiques in converted warehouses. It’s home to the Minnesota Twins.

The North Loop also offers access to a part of the Mississippi Riverfront where singles and families can get active and enjoy the views of the Minneapolis skyline.

Quick Facts

Population:

7,418

Median Age:

31

Housing Units:

5,337

Bike Score:

92/100

Walk Score:

84/100

Transit Score:

81/100

Median Household Income:

$70,425

North Loop Housing Market

North Loop home prices have jumped by almost 13% in the last year. Redfin considers this area to be “somewhat competitive,” with houses selling in approximately 93 days at 2% below list price.

Median Sale Price

$310,000

Median Price Per Square Ft.

$416

Loring Park

Home to one of the largest parks in Minneapolis, the Twin Cities Gay Pride Festival, and the first Roman Catholic basilica in the United States, this unique and diverse neighborhood at the edge of downtown is mainly made up of young professionals and retired suburban homeowners.

The neighborhood welcomes a variety of lifestyles and is considered to be a great place to both live and work. It’s also a welcoming spot for bikers and walkers, with high scores from Walkscore for both.

Quick Facts

Population:

17,354

Median Age:

34

Housing Units:

12,906

Bike Score:

86/100

Walk Score:

91/100

Transit Score:

78/100

Median Household Income:

$59,928

Loring Park Housing Market

Homebuyers who are looking for a deal may want to check out Loring Park. Homes here are pretty affordable, and median prices have dropped 14% year over year. Homes are also lingering longer on the market here of late, so negotiating may be an option for thrifty homebuyers.

Median Sale Price

$172,000

Median Price Per Square Ft.

$233

Uptown

If the Uptown neighborhood sounds familiar, that’s because Prince made this area famous by referencing it in his song “Uptown.” It’s easy to see why Prince took note of Uptown, with its indie and trendy vibe, global cuisine options, and nightlife scene.

For those looking for a more relaxed experience, this neighborhood is fairly close to the breathtaking Bde Maka Ska lake.

Quick Facts

Population:

7,093

Median Age:

30

Housing Units:

3,664

Bike Score:

94/100

Walk Score:

93/100

Transit Score:

58/100

Median Household Income:

$71,423

Uptown Housing Market

The Uptown market is considered to be somewhat competitive, and, in fact, saw the median sales price rise more than 80% in the last year. Buyers may have some wiggle room here, however, as homes sit on the market for an average of more than 80 days. Homes typically sell for 3% below their list price.

Median Sale Price

$286,000

Median Price Per Square Foot

$228

SoFi Home Loans

It’s easy to see why Minneapolis has become so popular: enticing neighborhoods, lakes and parks, breweries, museums — something for everyone from foodies to families.

If you think Minneapolis could be your home sweet home, then you may need to consider different mortgage loans during your home buying process.

Looking for an affordable option for a home mortgage loan? SoFi can help: We offer low down payments (as little as 3% - 5%*) with our competitive and flexible home mortgage loans. Plus, applying is extra convenient: It's online, with access to one-on-one help.

FAQ

What are the Minneapolis housing market predictions?

As of early 2025, the Twin Cities was still a seller’s market, with local-market experts not predicting any change to that in the near future. Single-percentage-point price increases are all that is expected in this market. The uncertainty in financial markets and the possibility of inflation mean that conditions could change quickly, however.

What is the next up-and-coming Minneapolis neighborhood?

The Near North neighborhood of Minneapolis, long one of the city’s more diverse neighborhoods, is home to cultural landmarks, parks, and locally owned businesses. A community skate park draws a crowd, and the neighborhood is home to the Minnesota African American Heritage Museum and Gallery. Home prices have risen almost 10% in the last year, but they’re still nicely below the local average.

Is there a housing shortage in Minneapolis?

There is not so much a housing shortage in Minneapolis as there is a shortage of affordable housing. Minnesota as a whole needs 101,000 more affordable homes to meet the needs of extremely low-income renters, and many will need to be in Minneapolis.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

*SoFi requires Private Mortgage Insurance (PMI) for conforming home loans with a loan-to-value (LTV) ratio greater than 80%. As little as 3% down payments are for qualifying first-time homebuyers only. 5% minimum applies to other borrowers. Other loan types may require different fees or insurance (e.g., VA funding fee, FHA Mortgage Insurance Premiums, etc.). Loan requirements may vary depending on your down payment amount, and minimum down payment varies by loan type.

Qualifying for the reward requires using a real estate agent that participates in HomeStory’s broker to broker agreement to complete the real estate buy and/or sell transaction. You retain the right to negotiate buyer and or seller representation agreements. Upon successful close of the transaction, the Real Estate Agent pays a fee to HomeStory Real Estate Services. All Agents have been independently vetted by HomeStory to meet performance expectations required to participate in the program. If you are currently working with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®. A reward is not available where prohibited by state law, including Alaska, Iowa, Louisiana and Missouri. A reduced agent commission may be available for sellers in lieu of the reward in Mississippi, New Jersey, Oklahoma, and Oregon and should be discussed with the agent upon enrollment. No reward will be available for buyers in Mississippi, Oklahoma, and Oregon. A commission credit may be available for buyers in lieu of the reward in New Jersey and must be discussed with the agent upon enrollment and included in a Buyer Agency Agreement with Rebate Provision. Rewards in Kansas and Tennessee are required to be delivered by gift card.

HomeStory will issue the reward using the payment option you select and will be sent to the client enrolled in the program within 45 days of HomeStory Real Estate Services receipt of settlement statements and any other documentation reasonably required to calculate the applicable reward amount. Real estate agent fees and commissions still apply. Short sale transactions do not qualify for the reward. Depending on state regulations highlighted above, reward amount is based on sale price of the home purchased and/or sold and cannot exceed $9,500 per buy or sell transaction. Employer-sponsored relocations may preclude participation in the reward program offering. SoFi is not responsible for the reward.

SoFi Bank, N.A. (NMLS #696891) does not perform any activity that is or could be construed as unlicensed real estate activity, and SoFi is not licensed as a real estate broker. Agents of SoFi are not authorized to perform real estate activity.

If your property is currently listed with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®.

Reward is valid for 18 months from date of enrollment. After 18 months, you must re-enroll to be eligible for a reward.

SoFi loans subject to credit approval. Offer subject to change or cancellation without notice.

The trademarks, logos and names of other companies, products and services are the property of their respective owners.

SOHL-Q125-221

Colorado Springs Housing Market: Trends & Prices

Colorado Springs Housing Market: Trends & Prices (2025)

Colorado Springs Real Estate Market Overview

(Last Updated – 4/2025)

What’s not to love about stunning vistas and fresh mountain air? Sitting near the base of the Rocky Mountains, Colorado Springs was founded in 1871 with the intention of becoming a high-quality resort community. So many British tourists came through the area that the neighborhood was nicknamed “Little London.”

Despite Colorado having a reputation for being pretty chilly, winters are relatively mild in this area, with large snow accumulations not happening often in the downtown areas. Colorado Springs receives about 18 inches of precipitation a year, with the average snowfall totaling 57 inches per year.

Today, Colorado Springs still maintains a resort-like feel that locals and tourists alike can enjoy, thanks to stunning scenery such as Pikes Peak, Garden of the Gods Park, the Broadmoor Seven Falls, and Cave Of the Winds Mountain Park. For those looking for culture, this city can offer that, too, with historical attractions, a fine arts center, and multiple museums to choose from.

Keep reading to learn more about what it’s like to live in Colorado Springs and for a breakdown of its key demographics and most important neighborhoods.

Overall Colorado Springs Market Trends

The Colorado Spring real estate market is considered somewhat competitive, according to Redfin. On average, homes receive one offer and sit on the market for around 66 days before being sold. In February 2025, the median sale price of a home in Colorado Springs was $450,000, up 3.4% from the prior year.

$450,000

Median Home Price

$211

Median Price Per Square Foot

66 days

Median Time on Market

Colorado Springs Housing Market Forecast

Home prices in Colorado Springs have increased dramatically over the last five years, as you can see from the chart below. But there is some good news for buyers: After peaking in July 2022, prices have been easing over the last few years and real estate agents believe they will remain relatively stable, or drop slightly, in 2025.

Demographics of the Colorado Springs Market

The population of Colorado Springs is as varied as its geography. It includes students attending the area’s colleges, professionals, military families (connected to the Army, Air Force, or Space Force hubs), along with retired couples. The city is home to a roughly equal number of marrieds and singles, and has a median age of about 36. Nearly 45% of Colorado Springs residents are college educated, which is higher than the national average of 35%.

Colorado Springs offers employment opportunities in a variety of sectors, including aerospace, defense, cybersecurity, and sports. The city is home to the North American Aerospace Defense Command (NORAD), the U.S. Army’s Fort Carson, the U.S. Air Force Academy, and the Peterson and Schriever U.S. Space Force base. Other major employers in the area include military contractors, the U.S. Olympic Committee, local government, and schools.

Recommended: Cost of Living in Colorado

Median Household Income: $83,215

Median Age: 36.4

College Educated: 44.8%

Homeowners: 62%

Married: 54%

Popular Colorado Springs Neighborhoods

With 20 charming neighborhoods to choose from in Colorado Springs, prospective home buyers will have a lot of difficult choices to make.

To save home searchers some time, we rounded up five of the most popular Colorado Springs neighborhoods and broke down their key demographics, what their real estate market looks like, and what it’s like to live there.

Briargate

This neighborhood may appeal to newer Colorado Spring residents who are looking for a master-planned community that is family friendly and designed to foster a sense of community.

Who wouldn’t love gorgeous parks (including a playground designed to be inclusive for children with disabilities), hiking trails, and well-maintained landscaping in their neighborhood? Not to mention, many homes in this area can offer stunning mountain views.

Quick Facts

Population:

38,727

Median Age:

36.5

Housing Units:

14,546

Bike Score:

47/100

Walk Score:

34/100

Transit Score:

0/100

Median Household Income:

$128,902

Briargate Housing Market

The housing market in Briargate is considered somewhat competitive, according to Redfin. In February 2025, the median home sale price was $545,000, up around 9% year-over-year. On average, homes sell for about 1% below asking price and sit on the market for around 47 days. You may need to move more quickly to get a highly desirable home, however, as these listings tend to go for list price and get snapped up within 18 days.

Median Home Price

$545,000

Median Price Per Square Ft.

$209

Recommended: Best Affordable Places to Live in Colorado

Broadmoor

Broadmoor is considered one of Colorado Springs’ more prestigious neighborhoods, with historic mansions built as far back as the 1920’s, 30’s, and 40’s.

Most homes are within walking distance of the beloved and historic Broadmoor hotel and resort, which is a perfect spot for welcoming out of town visitors or for stopping by for a drink or a great meal on the weekends.

Quick Facts

Population:

38,732

Median Age:

38.7

Housing Units:

16,314

Bike Score:

40/100

Walk Score:

36/100

Transit Score:

21/100

Median Household Income:

$124,351

Broadmoor Housing Market

In this somewhat competitive housing market, some homes on the market receive multiple offers from buyers. In February 2025, the median sale price of a Broadmoor home was $528,000, up 20% from the prior year. On average, homes in this neighborhood sit on the market for one to two months before being sold.

Median Home Price

$528,000

Median Price Per Square Ft.

$231

Garden Ranch

The amenities in Garden Ranch are just as lovely as the name of this neighborhood implies. For example, Colorado Springs’ largest city park, Palmer Park, resides in Garden Ranch.

A strategic location near the intersection of Union and Academy makes this community a fairly walkable one.

Quick Facts

Population:

5,051

Median Age:

36

Housing Units:

2,386

Bike Score:

45/100

Walk Score:

45/100

Transit Score:

25/100

Median Household Income:

$100,751

Garden Ranch Housing Market

The Garden Ranch housing market is somewhat competitive, so buyers may want to familiarize themselves with the market.

Generally, homes in this area sell in around 54 days for about 3% below list price, and it isn’t uncommon for these homes to receive multiple offers from buyers. In February 2025, the median home sales price was $450,000, down around 2% year-over-year.

Median Home Price

$450,000

Median Price Per Square Ft.

$219

Knob Hill

Busy workers will appreciate the fact that, on average, commuters in this area only spend 15 to 30 minutes traveling to work, which is less than the average time spent to get to work for most Americans.

This neighborhood features numerous single family homes. Plus, many homes in the area are older (built between 1940 and 1969), which is ideal for buyers looking for a home with a history and some character.

Quick Facts

Population:

37,113

Median Age:

36.3

Housing Units:

16,613

Bike Score:

52/100

Walk Score:

64/100

Transit Score:

37/100

Median Household Income:

$72,120

Knob Hill Housing Market

The housing market in Knob Hill is considered somewhat competitive. Homes typically sell for 2% below their list price and stay on the market for about 41 days. In February 2025, the median home sale price was $375,000, up 5.3% year-over-year. Some homes get multiple offers.

Median Home Price

$375,000

Median Price Per Square Ft.

$168

Old North End

History Buffs will love calling Old North End home. There are plenty of large, stately homes to admire that were built in the late 1800s. Many of the homes are so historical they are on the National Register, which can make the renovation process a bit on the trickier side for homeowners who are looking to modernize.

Residents enjoy close proximity to the upper reaches of Monument Valley Park, as the west side of Old North End is bordered by the park. Locals love the biking and hiking trails, as well as the sports fields and playgrounds designed for family fun.

Quick Facts

Population:

9,657

Median Age:

35

Housing Units:

4,543

Bike Score:

75/100

Walk Score:

35/100

Transit Score:

33/100

Median Household Income:

$72,168

Old North End Housing Market

The Old North End housing market is cooling off a bit. In February 2025, the median sale price was $515,000, down around 34% from the prior year. Homes in this neighborhood generally don’t sell over asking price and stay on the market for an average of 27 days.

Median Home Price

$515,000

Median Price Per Square Ft.

$273

SoFi Home Loans

It’s easy to see why Colorado Springs has become such a popular market to buy a home in. There are some really amazing neighborhoods to choose from, whether you’re young and single or have a family to look after.

If you think Colorado Springs could be your home sweet home, then you may need to consider your home loan options.

Looking for an affordable option for a home mortgage loan? SoFi can help: We offer low down payments (as little as 3% - 5%*) with our competitive and flexible home mortgage loans. Plus, applying is extra convenient: It's online, with access to one-on-one help.

FAQ

Are house prices dropping in Colorado Springs?

House prices in Colorado Springs have shown some signs of stabilization, but they remain relatively high due to strong demand and limited inventory. In February 2025, the median sale price of a home in Colorado Springs was $450,000, up 3.4% from the prior year. Moving forward, however, we may see some softening in the market that favors buyers. More homes are currently being listed than sold in Colorado Springs, giving buyers more options and, potentially, more negotiating power.

How long are houses sitting on the market in Colorado Springs?

On average, homes in Colorado Springs sell in around 66 days, according to February 2025 data from Redfin. That said, homes in desirable areas often get snapped up within a few weeks. Being prepared and acting fast can significantly improve your chances of securing a home.

Is Colorado a buyer’s or seller’s market?

As of January 2025, the Colorado housing market is considered more of a buyer’s than a seller’s market. This is due to increased inventory and homes sitting more days on the market. While housing prices are up slightly year-over-year, fewer homes go for above listing price. More time on the market also benefits buyers by giving them more time to shop around and evaluate their options. Colorado market trends vary by region, however.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

*SoFi requires Private Mortgage Insurance (PMI) for conforming home loans with a loan-to-value (LTV) ratio greater than 80%. As little as 3% down payments are for qualifying first-time homebuyers only. 5% minimum applies to other borrowers. Other loan types may require different fees or insurance (e.g., VA funding fee, FHA Mortgage Insurance Premiums, etc.). Loan requirements may vary depending on your down payment amount, and minimum down payment varies by loan type.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

Qualifying for the reward requires using a real estate agent that participates in HomeStory’s broker to broker agreement to complete the real estate buy and/or sell transaction. You retain the right to negotiate buyer and or seller representation agreements. Upon successful close of the transaction, the Real Estate Agent pays a fee to HomeStory Real Estate Services. All Agents have been independently vetted by HomeStory to meet performance expectations required to participate in the program. If you are currently working with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®. A reward is not available where prohibited by state law, including Alaska, Iowa, Louisiana and Missouri. A reduced agent commission may be available for sellers in lieu of the reward in Mississippi, New Jersey, Oklahoma, and Oregon and should be discussed with the agent upon enrollment. No reward will be available for buyers in Mississippi, Oklahoma, and Oregon. A commission credit may be available for buyers in lieu of the reward in New Jersey and must be discussed with the agent upon enrollment and included in a Buyer Agency Agreement with Rebate Provision. Rewards in Kansas and Tennessee are required to be delivered by gift card.

HomeStory will issue the reward using the payment option you select and will be sent to the client enrolled in the program within 45 days of HomeStory Real Estate Services receipt of settlement statements and any other documentation reasonably required to calculate the applicable reward amount. Real estate agent fees and commissions still apply. Short sale transactions do not qualify for the reward. Depending on state regulations highlighted above, reward amount is based on sale price of the home purchased and/or sold and cannot exceed $9,500 per buy or sell transaction. Employer-sponsored relocations may preclude participation in the reward program offering. SoFi is not responsible for the reward.

SoFi Bank, N.A. (NMLS #696891) does not perform any activity that is or could be construed as unlicensed real estate activity, and SoFi is not licensed as a real estate broker. Agents of SoFi are not authorized to perform real estate activity.

If your property is currently listed with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®.

Reward is valid for 18 months from date of enrollment. After 18 months, you must re-enroll to be eligible for a reward.

SoFi loans subject to credit approval. Offer subject to change or cancellation without notice.

The trademarks, logos and names of other companies, products and services are the property of their respective owners.

SOHL-Q125-235

Austin Housing Market: Trends & Prices

Austin Housing Market: Trends & Prices (2025)

Austin Real Estate Market Overview

(Last Updated – 4/2025)

Chances are you’ve heard a lot about Austin. This Southwestern hot spot has been all the rage in recent years thanks to its hip art, music, and food scenes. And the tech industry in Austin has attracted high earners to the city.

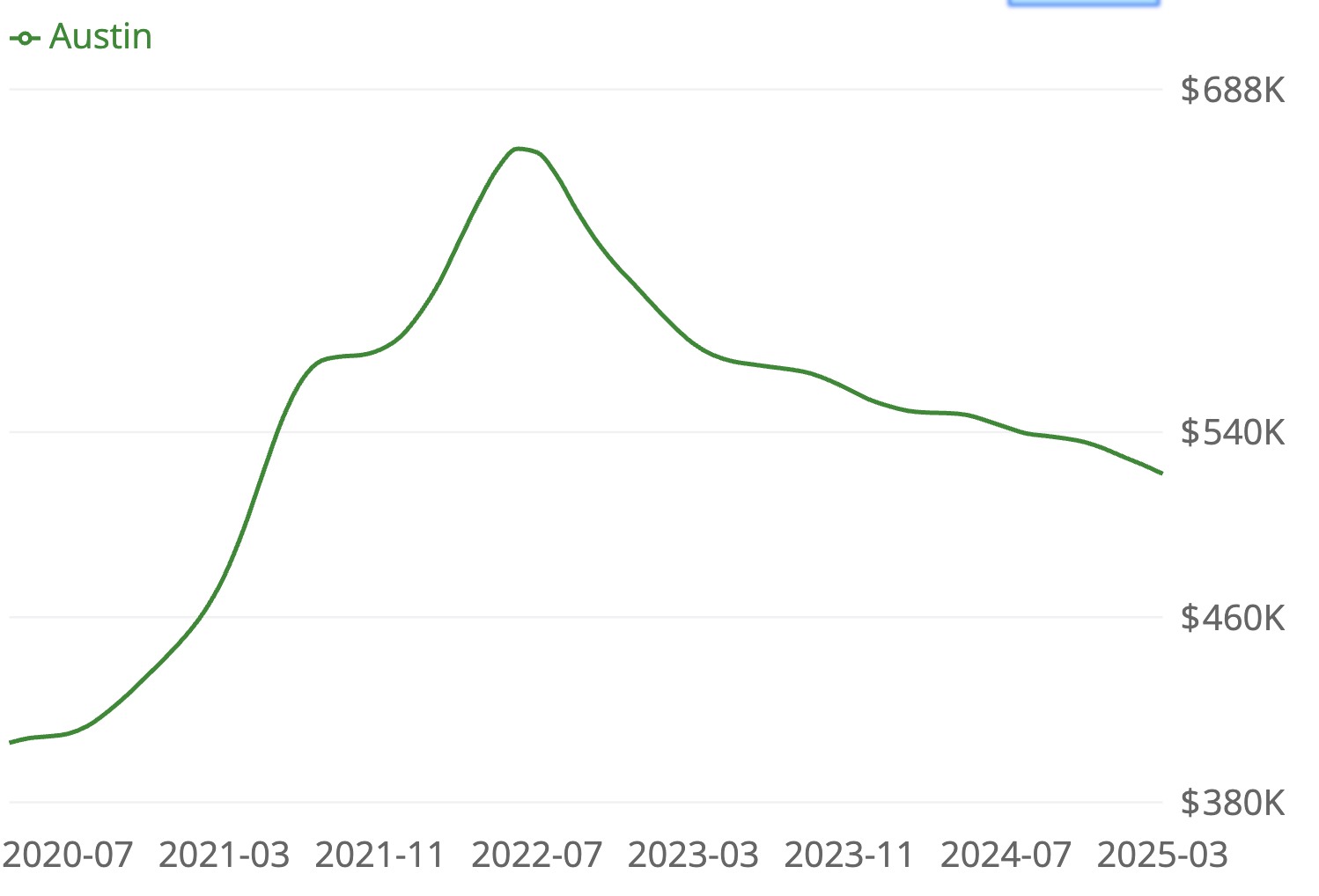

Is the market still overheated? Home values were rising steadily since 2015, and the pandemic surge elevated Austin to the second-most-overvalued market in the country in 2021. However, since mid-2022, the popular Austin housing market has slowly been returning to a post-pandemic normal. Austin home prices in early 2025 were down only marginally compared with the year before, but the median home value in the city is back to where it was in mid-2021, according to Zillow.

Frothy or not, the City of the Violet Crown (so named because of the color of the sky at sunset) holds appeal. For 12 years running, ending in 2023, Austin was America’s fastest-growing city, according to the U.S. Census Bureau. In 2024, it slipped to second place. With just shy of 1 million residents, Austin is the country’s 26th most-populous metro area.

Austin, with lower home prices than, say, San Francisco or Los Angeles, lures not only techies and music lovers but also foodies. If health is top of mind, Whole Foods is headquartered downtown.

Recommended: Local Housing Market Trends by City

Overall Austin Market Trends

Welcome to Austin, where sellers should have no problem offloading their homes, but buyers need to be ready to compete.

According to Redfin, some homes for sale in Austin receive multiple offers. Typical homes sell for 3% below list price and go pending in 70 days. Hot homes sell for around list price and go pending in around 33 days.

Recommended: Price-to-Rent Ratio in 50 Cities

$513,000

Median Sale Price

$319

Median Sale Price Per Square Foot

89 days

Median Time on Market

Austin Housing Market Forecast

There is no denying that house prices in Austin have seen a significant increase in recent years. The chart below illustrates the upswing that began in 2015, with a steady decline since summer 2022.

As Tesla made its home in Gigafactory Texas, Austin has attracted more wealthy investors and more people looking to start or advance their careers to this booming tech hub.

Demographics of the Austin City Market

Some consider Austin to be one of the best places to live in the United States (the city took ninth place in a U.S. News analysis), and it’s pretty obvious why. Not only does the city offer music festivals, art exhibits, and food fairs, but nature lovers will find what they need too.

The nearby Zilker Nature Preserve and Lady Bird Lake offer amazing views and a chance to escape the city for an hour or two. Families and active singles will have plenty of ways to fill their weekends and make memories in Austin.

Before making a move and buying a home, though, consider some of the key demographics of the Austin real estate market.

Recommended: Home Ownership Resources

Median Household Income: $91,501

Median Age: 34.9

College Educated: 61.7%

Homeowners: 44.4%

Married: 42%

Popular Austin Neighborhoods

Austin has many great neighborhoods to choose from, but let’s shine a spotlight on five of the biggest.

North Austin

If you like to walk to work or run errands, North Austin may be a good fit for you. This neighborhood isn’t the most pedestrian-friendly neighborhood in the city, but you’ll definitely have the option of walking to some of your favorite spots.

There are almost 100 restaurants, bars, and coffee shops to choose from, and most residents can walk to one of these establishments in just five minutes.

Quick Facts

Population:

175,955

Median Age:

32

Housing Units:

82,059

Bike Score:

61/100

Walk Score:

54/100

Transit Score:

45/100

Median Household Income:

$71,534

North Austin Housing Market

The North Austin housing market is somewhat competitive. Since last year, average home prices have dropped by 3.7%. On average, North Austin homes go to pending in around 69 days; some receive multiple offers but sale prices average 2% below asking price. If you want to be prepared to compete for a hot home (or if you want to get a solid sense of your borrowing power), it’s smart to seek preapproval for a mortgage loan before you start your search.

Median Sale Price

$405,000

Median Price Per Square Ft.

$295

Franklin Park

This is a primarily residential neighborhood known for having affordable housing options and some commercial buildings. The close proximity to downtown and the University of Texas will surely be appealing to students. The neighborhood has added more than a thousand new housing units in recent years.

A large state park borders the eastern side of this neighborhood and offers hiking, camping, fishing, and other outdoor activities.

Quick Facts

Population:

51,069

Median Age:

32

Housing Units:

20,035

Bike Score:

41/100

Walk Score:

40/100

Transit Score:

41/100

Median Household Income:

$78,474

Franklin Park Housing Market

Though the market in Franklin Park is somewhat competitive, the median home sale price is relatively stable year over year, as of March 2025. Homes tend to sit on the market for 68 days, though in-demand properties can sell in a little more than half that time. Some homes get multiple offers.

Median Sale Price

$305,000

Median Price Per Square Ft.

$215

West University

West University may be a college town, but anyone can enjoy the lively feel of this neighborhood. While the home of the University of Texas at Austin won’t be the most quiet neighborhood, there will be no shortage of fun events, great food, and school pride. Not surprisingly, this is a good place to be if you want to live the car-free life — getting around by bike and on foot is easy here.

Quick Facts

Population:

32,937

Median Age:

21

Housing Units:

12,519

Bike Score:

94/100

Walk Score:

92/100

Transit Score:

65/100

Median Household Income:

$30,336

West University Housing Market

The real estate market in West University is considered somewhat competitive, as the median sale price rose 4.6% since last year.

Typically, homes have been selling for 3% under list price in this neighborhood and stay on the market for around 72 days.

Median Sale Price

$359,000

Median Price Per Square Ft.

$388

Windsor Park

This neighborhood is home to charming ranch-style homes that provide a classic Texas feel. The family-friendly neighborhood has access to lots of parks and playgrounds. For parents who need to commute, downtown is just 15 minutes away.

Quick Facts

Population:

36,307

Median Age:

35

Housing Units:

17,065

Bike Score:

66/100

Walk Score:

55/100

Transit Score:

45/100

Median Household Income:

$87,978

Windsor Park Housing Market

The Windsor Park housing market is considered only somewhat competitive by Redfin, so you have a good shot at finding a home here amid the family-friendly vibes. The median sale price was down 14% in March 2025 compared with that month the prior year.

Houses in Windsor Park sell for around 3% below list price, with some receiving multiple offers. The typical home goes pending in 50 days.

Median Sale Price

$475,000

Median Price Per Square Ft.

$344

Garrison Park

This quiet neighborhood is conveniently located near both major highways that serve the area, making commuting a breeze.

When you want to stay closer to home, there are tons of stores and restaurants to choose from, including charming cafes.

Quick Facts

Population:

61,122

Median Age:

37

Housing Units:

31,246

Bike Score:

65/100

Walk Score:

53/100

Transit Score:

42/100

Median Household Income:

$84,529

Garrison Park Housing Market

In this moderately competitive real estate market, some sellers can look forward to receiving multiple offers; however, they can expect their house to stay on the market for around 111 days. In March 2025, prices were relatively flat year-over-year.

Buyers should expect typical homes to go for around 4% below list price and popular homes to go for about list price.

Median Sale Price

$450,000

Median Price Per Square Ft.

$330

SoFi Home Loans

It’s easy to see why Austin has become such a popular market to buy a home in. There are some really amazing neighborhoods to choose from whether you’re young and single or have a family to look after.

If you think Austin could be your home sweet home, then you may need to consider your mortgage loan options.

Looking for an affordable option for a home mortgage loan? SoFi can help: We offer low down payments (as little as 3% - 5%*) with our competitive and flexible home mortgage loans. Plus, applying is extra convenient: It's online, with access to one-on-one help.

FAQ

Is the Austin housing market crashing?

While home values in Austin have declined from their peak numbers in 2021, the market as a whole is still somewhat competitive and some homes in many well-regarded neighborhoods receive multiple offers. Popular homes tend to sell for list price. Some might describe this as a crash, but calmer heads would call it a return to normal after a fever-pitch period in the market.

Is now a good time to buy in Austin?

Median sale prices in the Austin market have declined in recent years, but whether it is the right time to buy depends as much on your personal financial situation as on home prices. If you have a solid credit score and can cover the cost of a home in your price range, including a down payment (which could be as low as 3% for some first-time homebuyers), then the time may be right for you. Have a look at the cost of renting vs. owning before making a decision.

Do many people in Austin rent?

A little more than half of Austin’s households, 56%, are renters, not unusual for a university town. But this is still far less than the proportion of renters you would find in an East Coast city such as Hartford or Newark.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

*SoFi requires Private Mortgage Insurance (PMI) for conforming home loans with a loan-to-value (LTV) ratio greater than 80%. As little as 3% down payments are for qualifying first-time homebuyers only. 5% minimum applies to other borrowers. Other loan types may require different fees or insurance (e.g., VA funding fee, FHA Mortgage Insurance Premiums, etc.). Loan requirements may vary depending on your down payment amount, and minimum down payment varies by loan type.

Qualifying for the reward requires using a real estate agent that participates in HomeStory’s broker to broker agreement to complete the real estate buy and/or sell transaction. You retain the right to negotiate buyer and or seller representation agreements. Upon successful close of the transaction, the Real Estate Agent pays a fee to HomeStory Real Estate Services. All Agents have been independently vetted by HomeStory to meet performance expectations required to participate in the program. If you are currently working with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®. A reward is not available where prohibited by state law, including Alaska, Iowa, Louisiana and Missouri. A reduced agent commission may be available for sellers in lieu of the reward in Mississippi, New Jersey, Oklahoma, and Oregon and should be discussed with the agent upon enrollment. No reward will be available for buyers in Mississippi, Oklahoma, and Oregon. A commission credit may be available for buyers in lieu of the reward in New Jersey and must be discussed with the agent upon enrollment and included in a Buyer Agency Agreement with Rebate Provision. Rewards in Kansas and Tennessee are required to be delivered by gift card.

HomeStory will issue the reward using the payment option you select and will be sent to the client enrolled in the program within 45 days of HomeStory Real Estate Services receipt of settlement statements and any other documentation reasonably required to calculate the applicable reward amount. Real estate agent fees and commissions still apply. Short sale transactions do not qualify for the reward. Depending on state regulations highlighted above, reward amount is based on sale price of the home purchased and/or sold and cannot exceed $9,500 per buy or sell transaction. Employer-sponsored relocations may preclude participation in the reward program offering. SoFi is not responsible for the reward.

SoFi Bank, N.A. (NMLS #696891) does not perform any activity that is or could be construed as unlicensed real estate activity, and SoFi is not licensed as a real estate broker. Agents of SoFi are not authorized to perform real estate activity.

If your property is currently listed with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®.

Reward is valid for 18 months from date of enrollment. After 18 months, you must re-enroll to be eligible for a reward.

SoFi loans subject to credit approval. Offer subject to change or cancellation without notice.

The trademarks, logos and names of other companies, products and services are the property of their respective owners.

SOHL-Q125-236