Get ready for a pivotal week for financial markets. The calendar is full of important events, with the Federal Reserve’s interest rate decision sandwiched between a bunch of big corporate earnings reports and the release of monthly unemployment data.

This week is the busiest week of the second-quarter earnings season, with nearly a third of S&P 500 companies set to report results. Most closely watched and potentially market-moving are likely to be technology giants Meta Platforms (META), Microsoft (MSFT), Amazon (AMZN), and Apple (AAPL).

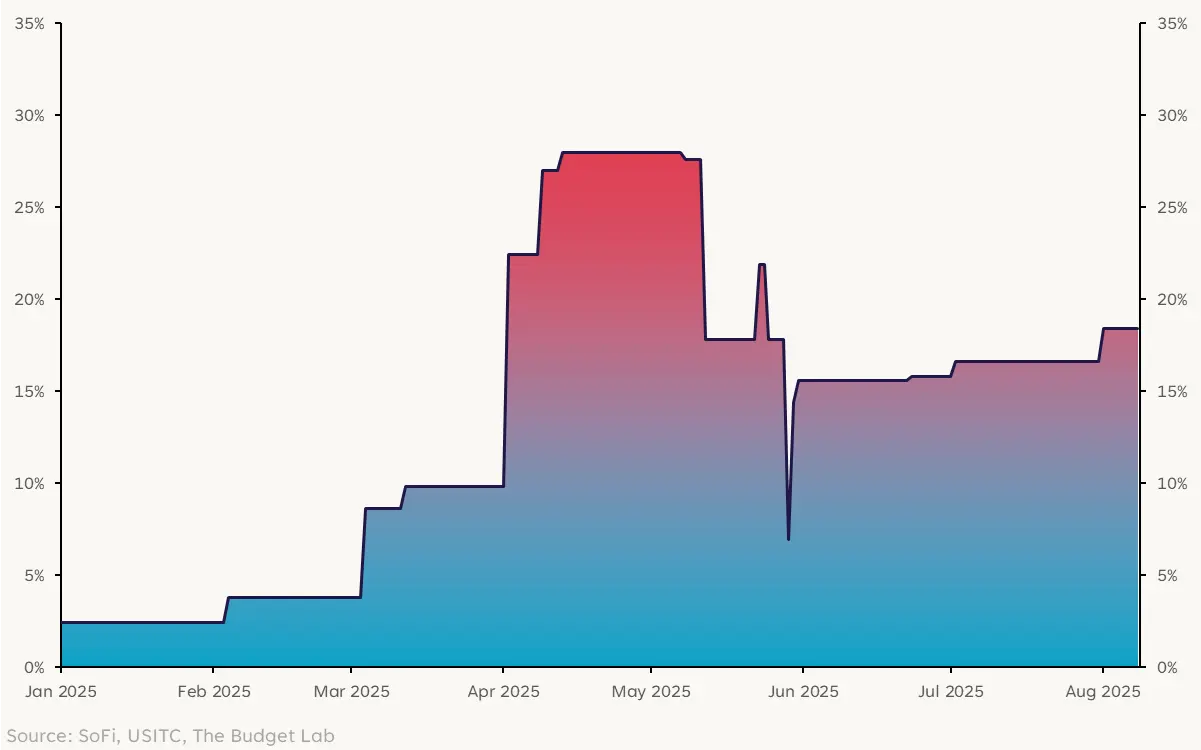

But not to be outshined, the Fed’s rate-setting committee will hold its July meeting, and no doubt tariffs and inflation will be a hot topic. Market pricing currently indicates just a 3% chance the Fed will cut its benchmark interest rate, so the main focus will likely be on the outlook for prices and economic growth. Investors will parse every word of the Fed statement and press conference on Wednesday, looking for clues on when the central bank might lower rates.

The week will be topped off with the release of second-quarter Gross Domestic Product (GDP) and July employment data, helping to shed light on the strength of the labor market, including how companies are responding to economic uncertainty. A strong or weak report could either complement or contrast with the Fed’s message from Wednesday.

However it goes, investors will have a lot to digest.

Economic and Earnings Calendar

Monday

• July Dallas Fed Manufacturing Activity: This is the Dallas Fed’s survey of manufacturing executives in the region on business conditions and their outlook.

• Earnings: Brown & Brown (BRO), Cadence Design Systems (CDNS), Cincinnati Financial (CINF), Hartford Financial Services Group (HIG), Nucor (NUE), Principal Financial Group (PFG), PerkinElmer (RVTY), Universal Health Services (UHS), Veralto Corporation (VLTO), Welltower (WELL), Waste Management (WM)

Tuesday

• June Wholesale Inventories and Sales: Wholesalers often operate as an intermediary between manufacturers and retailers, serving as a key part of the goods supply chain.

• June Wholesale and Retail Inventories: Wholesalers and retailers often operate as intermediaries for the sale of manufactured products, serving as a key part of the goods supply chain.

• May FHFA House Price Index: This is a broad measure of single-family house prices released by the Federal Housing Finance Agency.

• May S&P CoreLogic Case-Shiller Home Price Index: This is a private sector measure of national home prices.

• June Job Openings: A key measure of business demand for labor is the number of job openings, since reducing openings is easier and preferable to layoffs.

• July Conference Board Consumer Confidence: How consumers feel about economic conditions affect their spending habits. This survey places a particular focus on job availability and the state of the labor market.

• July Dallas Fed Non-Manufacturing Activity: This is the Dallas Fed’s survey of services executives in the region on business conditions and their outlook.

• Earnings: Arch Capital Group (ACGL), American Tower (AMT), Boeing (BA), Booking Holdings (BKNG), Boston Properties (BXP), Carrier Global Corp (CARR), CBRE Group (CBRE), Caesars Entertainment (CZR), DTE Energy (DTE), Electronic Arts (EA), Ecolab (ECL), Essex Property Trust (ESS), Expand Energy Corporation (EXE), Corning (GLW), Hubbell (HUBB), Incyte (INCY), Johnson Controls International (JCI), Mondelez International (MDLZ), Merck & Co (MRK), Norfolk Southern (NSC), Procter & Gamble (PG), PPG Industries (PPG), PayPal (PYPL), Royal Caribbean Cruises (RCL), Regency Centers (REG), Republic Services (RSG), Starbucks (SBUX), Seagate Technologies (STX), Stanley Black & Decker (SWK), Sysco (SYY), Teradyne (TER), UnitedHealth Group (UNH), United Parcel Service (UPS), Visa (V)

Wednesday

• July ADP Employment Report: This survey, usually released a day or two before the official government jobs report, offers insight into private sector employment trends.

• 2Q GDP First Estimate: The primary measure of economic activity in the United States, which is measured as total expenditure on a country’s goods and services.

• FOMC Interest Rate Decision: The Federal Reserve will announce any changes to monetary policy after the conclusion of its two-day FOMC meeting, in addition to providing commentary on the economy. It’s one of eight regularly scheduled meetings per year.

• Weekly Mortgage Applications: Mortgage activity gives insight on demand conditions in the housing market.

• Earnings: Automatic Data Processing (ADP), American Electric Power (AEP), Albemarle (ALB), Align Technology (ALGN), Allstate (ALL), AvalonBay Communities (AVB), American Water Works (AWK), Bunge Global S.A. (BG), CH Robinson Worldwide (CHRW), Cognizant Technology Solutions (CTSH), DexCom (DXCM), eBay (EBAY), Everest RE Group (EG), Equinix (EQIX), Entergy (ETR), Extra Space Storage (EXR), Ford (F), FirstEnergy (FE), F5 Networks (FFIV), Fair Isaac (FICO), Fortive (FTV), GE HealthCare Technologies Inc (GEHC), Generac Holdings (GNRC), Garmin (GRMN), Hologic (HOLX), Host Hotels & Resorts (HST), Hershey (HSY), Humana (HUM), IDEX (IEX), Invitation Homes (INVH), Illinois Tool Works (ITW), Kraft Heinz (KHC), Lam Research (LRCX), Live Nation Entertainment (LYV), Mid-America Apartment Communities (MAA), Meta Platforms, Inc. (META), MGM Resorts International (MGM), Altria Group (MO), Microsoft (MSFT), Old Dominion Freight Line (ODFL), Prudential Financial (PRU), Public Storage (PSA), PTC (PTC), Qualcomm (QCOM), Smurfit WestRock (SW), Trane Technologies (TT), Tyler Technologies (TYL), UDR (UDR), Vici Properties (VICI), Verisk Analytics (VRSK), Ventas (VTR), Western Digital (WDC), WEC Energy Group (WEC)

Thursday

• July Challenger Job Cuts: The firm Challenger, Gray & Christmas tracks the number of layoff announcements each month by sector.

• June Personal Income and Spending: These numbers give insight into how Americans are doing, which is important since consumer spending accounts for about two-thirds of economic growth in the United States.

• June Personal Consumption Expenditures Price Index: The Fed targets this inflation measure for its price stability mandate and believes PCE to be the best measure of consumers’ spending habits.

• 2Q Employment Cost Index: This is the most comprehensive measure of worker compensation, including wages, bonuses, benefits and more.

• July Chicago Business Barometer: The barometer provides information on U.S. economic activity and business conditions, consisting of seven activity

• Weekly Jobless Claims: This high frequency labor market data gives insight into filings for unemployment benefits. Initial jobless claims have remained mostly steady, while continuing claims have increased of late.

• Earnings Apple (AAPL), AbbVie (ABBV), Ameren (AEE), AES (AES), Arthur J Gallagher & Co (AJG), Ametek (AME), Amazon (AMZN), Air Products and Chemicals (APD), Aptiv (APTV), Baxter International (BAX), Biogen (BIIB), Builders FirstSource (BLDR), Bristol-Myers Squibb (BMY), Cigna (CI), Clorox (CLX), Comcast (CMCSA), CMS Energy (CMS), Coinbase (COIN), Camden Property Trust (CPT), CVS Health (CVS), Edison International (EIX), Eastman Chemical (EMN), Eversource Energy (ES), Exelon (EXC), First Solar (FSLR), Huntington Ingalls Industries (HII), Howmet Aerospace (HWM), Intercontinental Exchange (ICE), International Paper (IP), Ingersoll Rand (IR), Kellogg (K), Kimco Realty (KIM), KKR & Co (KKR), KLA-Tencor (KLAC), Mastercard (MA), Masco (MAS), Monolithic Power Systems (MPWR), Mettler-Toledo International (MTD), Norwegian Cruise Line Holdings (NCLH), PG&E (PCG), PPL (PPL), Quanta Services (PWR), ResMed (RMD), Southern Company (SO), S&P Global (SPGI), Stryker (SYK), Vulcan Materials (VMC), Willis Towers Watson Public (WTW), Xcel Energy (XEL), Xylem (XYL)

Friday

• July Employment Situation Summary: This monthly blockbuster release from the Labor Department gives a comprehensive look at employment, wages, and hours worked in the previous month.

• July ISM Manufacturing PMI: This index from the Institute for Supply Management tracks how purchasing managers across the manufacturing sector feel about the business environment.

• June Construction Spending: Construction data is a leading indicator of business activity.

• July University of Michigan Consumer Sentiment: How consumers feel about economic conditions affect their spending habits. This survey places a particular focus on inflation and its trajectory.

• July Wards Total Vehicle Sales: Cars are a big ticket item for consumers, so underlying vehicle sales trends can help shine a light on demand for durable goods.

• Earnings: Franklin Resources (BEN), Cboe Global Markets (CBOE), Church & Dwight (CHD), Colgate-Palmolive (CL), Chevron (CVX), Dominion Energy (D), WW Grainger (GWW), Kimberly-Clark (KMB), Linde PLC (LIN), LyondellBasell Industries (LYB), Moderna (MRNA), Motorola Solutions (MSI), Regeneron Pharmaceuticals (REGN), T Rowe Price Group (TROW), Exxon Mobil (XOM)

Want to see more stories like this?

On the Money is SoFi’s flagship newsletter

for all things personal finance.

Check it out

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

SoFi isn't recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

Read more