South Dakota First-Time Home-Buying Assistance Programs & Grants

(Last Updated – 06/205)

The Mount Rushmore State saw a 2.3% increase in home prices from June 2024 to June 2025, according to Zillow data. South Dakota may appeal to both seasoned and first-time homebuyers, in part because of its low cost of living compared to other parts of the country. The median home price in the state was $334,000, as reported by Redfin, a real estate brokerage that tracks trends.

You’ll be most successful if you have a game plan for buying a home in South Dakota. This home buying guide will show you state and federal payment assistance for the first-time homebuyer in South Dakota.

Recommended: First Time Homebuyer Guide

Who Is Considered a First-Time Homebuyer in South Dakota?

It might surprise you to know that the definition of a first-time homebuyer in South Dakota is someone who hasn’t owned a home in the last three years. You might be a first-time homebuyer without realizing it!

The U.S. Department of Housing and Urban Development (HUD) defines a first-time homebuyer as such, but includes:

• A single parent who has only owned a home with a partner while married

• A displaced homemaker who has only owned a home with a spouse

• Someone who has owned a principal residence not permanently affixed to a permanent foundation

• Someone who has only owned a property that wasn’t in compliance with state, local, or model building codes

Keep in mind that veterans and people buying in targeted areas often qualify for the same state perks as first-time buyers, so ask your lender about a Veterans Waiver and see if you meet the criteria. Not sure where you want to settle in the state? Look at a list of the best affordable places to live in South Dakota.

6 South Dakota Housing Programs for First-Time Homebuyers

If you lack the money for a down payment or aren’t sure how you will afford a home mortgage loan, programs in the state may be able to provide assistance.

1. South Dakota Housing First-Time Homebuyer Program

The South Dakota Housing Development Authority has a first-time homebuyer program that provides low-interest, fixed-rate loans to prospective homeowners, including those who are veterans.

To qualify, you must meet criteria including household income and purchase price limits. The current price cap for first-time homebuyers is $410,000.

2. South Dakota Housing Repeat Homebuyer Program

SD housing also has a repeat homebuyer program that helps repeat homebuyers get the keys to their next home more easily and for less out-of-pocket expense. The program lets you buy your next home at a low fixed-rate, offers down payment and closing cost assistance, and reduces mortgage insurance premiums.

You’ll need to meet income limits and have a credit score of 620 or higher. The current price cap for first-time homebuyers is $460,000. See your Participating Lender for complete details.

3. South Dakota Downpayment Assistance

The agency also provides down payment and closing cost assistance in the form of a 0% interest, 30-year second mortgage, due upon the sale of the property or satisfaction of the first mortgage. Borrowers receive 3% or 5% of the purchase price in assistance.

4. Grow South Dakota Home Mortgage Loans

Grow South Dakota also offers home ownership programs for new or existing homes in South Dakota through this direct loan program. Loans are available for up to $300,000.

5. Grow South Dakota Down Payment/Closing Cost Assistance

Grow South Dakota also provides down payment and closing cost assistance in the form of a no-interest deferred loan. Currently, all funds for the down payment program have been committed, but check back.

6. Homes Are Possible, Inc. Closing Cost Assistance

Another organization that provides help with closing costs is Homes Are Possible, Inc. (HAPI) in Northeast South Dakota. The organization operates in 22 counties, offering a $5,000 Down Payment/Closing Cost non-forgivable loan to cover expenses such as loan origination fees, a title search and insurance, a survey, an appraisal, and closing fees.

Income limits apply and you must complete HAPI’s Home Buyer Education course before you close.

How to Apply to South Dakota Programs for First-Time Homebuyers

As you explore different types of mortgage loans and first-time homebuyer programs, make a list of qualifications and requirements. Then, when you’ve chosen the best first-time homebuyer program, you’ll be prepared to apply.

For South Dakota Housing Development Authority programs, contact one or more participating lenders .

To apply for a Grow South Dakota mortgage or closing cost assistance, first check this chart for details and eligibility requirements.

Recommended: Understanding Mortgage Basics

Federal Programs for First-Time Homebuyers

People with low credit scores or limited down payment funds will find that a number of federal government programs exist to help them achieve their dreams of becoming homebuyers. Although these resources are sometimes for repeat homeowners, the national programs can be helpful for many individuals or families who are buying a first home or who haven’t owned a home in several years.

The mortgages are generally for single-family homes, two- to four-unit properties that will be owner occupied, approved condos, townhomes, planned unit developments, and some manufactured homes.

Federal Housing Administration (FHA) Loans

The FHA, which is part of the U.S. Department of Housing and Urban Development (HUD), insures mortgages for borrowers with lower credit scores. Homebuyers choose from a list of approved lenders participating in the FHA loan program. Loans offer competitive interest rates and require down payments of 3.5% of the purchase price. Borrowers typically need FICO® credit scores of 580 or higher to qualify. Those with scores as low as 500 must put at least 10% down.

In addition to examining your credit score, lenders will look at your debt-to-income ratio (DTI, your monthly debt payments compared with your monthly gross income). FHA allows a DTI of up to 57%, vs. a typical 45% maximum for a conventional loan.

Gift money for the down payment from certain donors is allowed and will be documented in a gift letter for the mortgage.

FHA loans always require mortgage insurance premiums (MIP): This includes a fee of 1.75% of the base loan amount, which can be rolled upfront into the loan. Borrowers carry annual premiums for the life of the loan. As of 2025, monthly MIP for new homebuyers is 0.15% to 0.75%. A down payment of at least 10% allows the removal of mortgage insurance after 11 years..

For a $300,000 mortgage balance, upfront MIP would be around $5,250 and monthly MIP, at a rate of 0.55%, would be about $137. Learn more about these loans, including FHA loans for refinance and rehab of properties, by reading up on FHA requirements, loan limits, and rates.

Freddie Mac Home Possible Mortgages

Low- and very low-income borrowers may make a 3% down payment when they qualify for a Home Possible® mortgage. These loans allow various sources for down payments, including family gifts, co-borrowers, employer assistance, secondary financing, and sweat equity.

The Home Possible mortgage is for buyers with a credit score of at least 660. Once you pay off 20% of your loan, the Home Possible mortgage insurance will be canceled, which will lower your mortgage payments.

Fannie Mae HomeReady Mortgages

Fannie Mae HomeReady® Mortgages allow low-income borrowers to make down payments of as little as 3%. Applicants generally need a credit score of 620 or higher; pricing may be better for credit scores of 680 and above. Like the Freddie Mac program, HomeReady loans allow flexibility for down payment financing, such as gifts and grants.

For income limits, a comparison to an FHA loan, and other information, go to this Fannie Mae site .

Fannie Mae Standard 97 LTV Loan

The conventional 97 LTV loan is for first-time homebuyers of any income level who have a credit score of at least 620 and meet debt-to-income criteria. The 97% loan-to-value mortgage requires 3% down. Borrowers can get third-party-sourced down payment and closing cost assistance.

Department of Veterans Affairs (VA) Loans

Eligible active-duty members of the military, veterans, reservists, and surviving spouses may apply for loans backed by the VA. These loans designed for those who serve our country can be used to buy, build, or improve homes, have lower interest rates than most other mortgages and don’t require a down payment.

Another benefit of VA loans is that they do not require private mortgage insurance (PMI) for borrowers who make a down payment of less than 20%. And they have more flexible credit score requirements. In some cases, even those who have previously experienced foreclosure or bankruptcy can qualify.

Borrowers applying for a VA loan will need a Certificate of Eligibility from the VA so make sure to review a guide to qualifying for a VA loan as a first step in the process.

💡Quick Tip: Active duty service members who have served for at least 90 consecutive days are eligible for a VA loan. But so are many veterans, surviving spouses, and National Guard and Reserves members. It’s worth exploring with an online VA loan application because the low interest rates and other advantages of this loan can’t be beat.†

Native American Veteran Direct Loans (NADLs)

Eligible Native American veterans along with their spouses may use these no-down-payment loans to buy, improve, or build a home on federal trust land. Unlike VA loans listed above, the Department of Veterans Affairs is the mortgage lender on NADLs. The VA requires no mortgage insurance, but it does charge a funding fee.

US Department of Agriculture (USDA) Loans

No down payment is required on these loans that are for moderate-income borrowers and are guaranteed by the USDA in specified rural areas. Borrowers pay an upfront guarantee fee and an annual fee that serves as mortgage insurance.

The USDA also directly issues loans to low- and very low-income people. For loan basics and income and property eligibility, head to this USDA site .

HUD Good Neighbor Next Door Program

This program helps police officers, firefighters, emergency medical technicians, and teachers qualify for mortgages in the areas they serve. Borrowers can receive 50% off a home in what HUD calls a “revitalization area.” You will need to live in the home for at least three years.

Go to the HUD program page for more information. You can also reach HUD’s Sioux Falls Field Office at 605-330-422

First-Time Homebuyer Stats for 2025

• Median home sale price in South Dakota: $334,000

• 3% down payment: $10,020

• 20% down payment: $66,800

• Percentage of buyers nationwide who are first-time buyers: 24%

• Median age of first-time homebuyers: 38

• Average credit score (vs. average U.S. score of 715): 734

More Financing Tips for First-Time Homebuyers

In addition to federal and state government-sponsored lending programs, there are other financial strategies that may help you as a homebuyer in South Dakota. Some examples:

• Traditional IRA withdrawals. The IRS allows qualifying first-time homebuyers a one-time, penalty-free withdrawal of up to $10,000 from their IRA if the money is used to buy, build, or rebuild a home. A first-time homebuyer, for the purposes of IRA withdrawals, is someone who has not owned a principal residence in the last two years. You will still owe income tax on the IRA withdrawal. If you’re married and your spouse has an IRA, they may also make a penalty-free withdrawal of $10,000 to purchase a home. The downside, of course, is that large withdrawals may jeopardize your retirement savings.

• Roth IRA withdrawals are made with after-tax money, so the IRS allows tax- and penalty-free withdrawals of contributions to Roth IRAs for any reason as long as you’ve held the account for five years. You may also withdraw up to $10,000 in earnings from your Roth IRA without paying taxes or penalties if you are a qualifying first-time homebuyer and you have had the account for five years. With accounts held for less than five years, homebuyers will pay income tax on earnings withdrawn.

• 401(k) loans. If your employer allows borrowing from the 401(k) plan that it sponsors, you may consider taking a loan against the 401(k) account to help finance your home purchase. With most plans, you may borrow up to 50% of your 401(k) balance, maxing out at $50,000, within a 12-month period without incurring taxes or penalties. You pay interest on the loan, which is paid into your 401(k) account. You usually have to pay back the loan within five years, but if you’re using the money to buy a house, you may have up to 15 years to repay.

• State and local down payment assistance programs are usually offered at the regional or county level, and provide flexible second mortgages for first-time buyers looking into how to afford a down payment.

• The mortgage credit certificate program. First-time homeowners and those who buy in targeted areas can claim a portion of their mortgage interest as a tax credit, up to $2,000. (This doesn’t lower your mortgage payments, but can still be a good way to save.)

To qualify for the credit, you must be a first-time homebuyer, live in the home, and meet income and purchase price requirements, which vary by state. If you refinance, the credit disappears, and if you sell the house before nine years, you may have to pay some of the tax credit back. There are fees associated with applying for and receiving the mortgage credit certificate that vary by state. Often the savings from the lifetime of the credit can outweigh these fees.

• Your employer may offer access to lower-cost lenders and real estate agents in your area, as well as home buying education courses.

• Your lender is another one to ask about any first-time homebuyer grant or down payment assistance programs available from government, nonprofit, and community organizations in your area.

Here is a home affordability calculator that can help you determine how much house you might be able to afford.

The Takeaway

Income-qualified first-time homebuyers in South Dakota have options to help them pay for a home. Other first-time buyers can explore the wide world of mortgages on their own to find the right fit.

Looking for an affordable option for a home mortgage loan? SoFi can help: We offer low down payments (as little as 3% - 5%*) with our competitive and flexible home mortgage loans. Plus, applying is extra convenient: It's online, with access to one-on-one help.FAQ

Should I take first-time homebuyer classes?

You’ll have to take one if you are enrolled in certain first-time homebuyer programs. These courses can help you understand the process and the jargon. And anyway, they are required for many government-sponsored loan programs.

Do first-time homebuyers with bad credit qualify for homeownership assistance?

Yes — often they do. Many government and nonprofit homeowner assistance programs are available to people with the extra challenge of having low credit scores. Often, the interest rates and other costs that come with them are competitive with those of loans available to borrowers with higher credit scores. That said, almost any lending program has credit qualifications.

Is there a first-time homebuyer tax credit in South Dakota?

Yes. There is a mortgage credit certificate (MCC) program for first-time homebuyers and those who buy in targeted areas in South Dakota. With it, you can claim a portion of your mortgage interest as a tax credit, up to $2,000, as a dollar-for-dollar reduction in your tax bill and the remaining interest paid is still eligible for the home mortgage interest deduction.

The fee to acquire a South Dakota Housing Development Authority tax credit is $750, reduced to $250 if the mortgage certificate is used with the agency’s first-time homebuyer program. Participating lenders may also charge a fee up to $250.

Is there a first-time veteran homebuyer assistance program in South Dakota?

South Dakota Housing advises applicants to ask their lender about its veterans waiver to see if they qualify for the mortgage and down payment programs.

The U.S. Department of Veterans Affairs also offers home loans to service members, veterans, and eligible surviving spouses.

What credit score do I need for first-time homebuyer assistance in South Dakota?

A minimum score of 620 will help in getting a mortgage through the South Dakota Housing Development Authority.

Credit score requirements vary, depending on the assistance program and the lender.

What is the average age of first-time homebuyers in South Dakota?

If South Dakotans are anything like the nationwide median, the average age of a first-time homebuyer here is 38. That figure is according to data from the National Association of Realtors®.

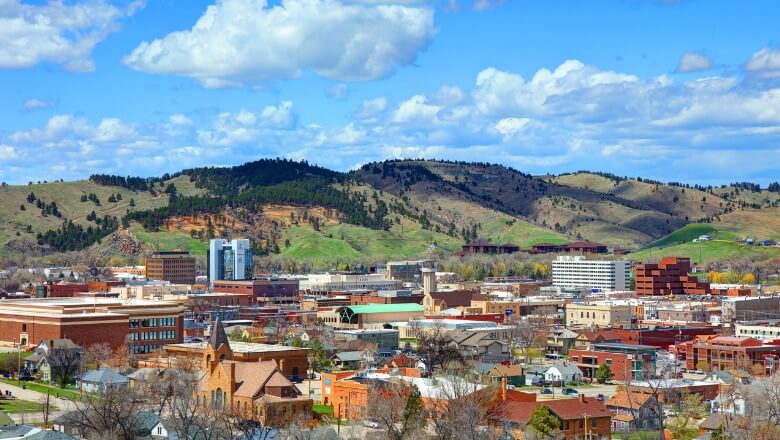

Photo credit: iStock/DenisTangneyJr

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

*SoFi requires Private Mortgage Insurance (PMI) for conforming home loans with a loan-to-value (LTV) ratio greater than 80%. As little as 3% down payments are for qualifying first-time homebuyers only. 5% minimum applies to other borrowers. Other loan types may require different fees or insurance (e.g., VA funding fee, FHA Mortgage Insurance Premiums, etc.). Loan requirements may vary depending on your down payment amount, and minimum down payment varies by loan type.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

‡SoFi On-Time Close Guarantee: If all conditions of the Guarantee are met, and your loan does not close on or before the closing date on your purchase contract accepted by SoFi, and the delay is due to SoFi, SoFi will provide you $2,000.^ Terms and conditions apply. This Guarantee is available only for loan applications submitted after 6/15/22 for the purchase of a primary residence. Please discuss terms of this Guarantee with your loan officer. The property must be owner-occupied, single-family residence (no condos), and the loan amount must meet the Fannie Mae conventional guidelines. No bank-owned or short-sale transactions. To qualify for the Guarantee, you must: (1) Have employment income supported by W-2, (2) Receive written approval by SoFi for the loan and you lock the rate, (3) submit an executed purchase contract on an eligible property at least 30 days prior to the closing date in the purchase contract, (4) provide to SoFi (by upload) all required documentation within 24 hours of SoFi requesting your documentation and upload any follow-up required documents within 36 hours of the request, and (5) pay for and schedule an appraisal within 48 hours of the appraiser first contacting you by phone or email. The Guarantee will be void and not paid if any delays to closing are due to factors outside of SoFi control, including delays scheduling or completing the appraisal appointment, appraised value disputes, completing a property inspection, making repairs to the property by any party, addressing possible title defects, natural disasters, further negotiation of or changes to the purchase contract, changes to the loan terms, or changes in borrower’s eligibility for the loan (e.g., changes in credit profile or employment), or if property purchase does not occur. SoFi may change or terminate this offer at any time without notice to you. ^To redeem the Guarantee if conditions met, see documentation provided by loan officer.Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

¹FHA loans are subject to unique terms and conditions established by FHA and SoFi. Ask your SoFi loan officer for details about eligibility, documentation, and other requirements. FHA loans require an Upfront Mortgage Insurance Premium (UFMIP), which may be financed or paid at closing, in addition to monthly Mortgage Insurance Premiums (MIP). Maximum loan amounts vary by county. The minimum FHA mortgage down payment is 3.5% for those who qualify financially for a primary purchase. SoFi is not affiliated with any government agency.

†Veterans, Service members, and members of the National Guard or Reserve may be eligible for a loan guaranteed by the U.S. Department of Veterans Affairs. VA loans are subject to unique terms and conditions established by VA and SoFi. Ask your SoFi loan officer for details about eligibility, documentation, and other requirements. VA loans typically require a one-time funding fee except as may be exempted by VA guidelines. The fee may be financed or paid at closing. The amount of the fee depends on the type of loan, the total amount of the loan, and, depending on loan type, prior use of VA eligibility and down payment amount. The VA funding fee is typically non-refundable. SoFi is not affiliated with any government agency.

Qualifying for the reward requires using a real estate agent that participates in HomeStory’s broker to broker agreement to complete the real estate buy and/or sell transaction. You retain the right to negotiate buyer and or seller representation agreements. Upon successful close of the transaction, the Real Estate Agent pays a fee to HomeStory Real Estate Services. All Agents have been independently vetted by HomeStory to meet performance expectations required to participate in the program. If you are currently working with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®. A reward is not available where prohibited by state law, including Alaska, Iowa, Louisiana and Missouri. A reduced agent commission may be available for sellers in lieu of the reward in Mississippi, New Jersey, Oklahoma, and Oregon and should be discussed with the agent upon enrollment. No reward will be available for buyers in Mississippi, Oklahoma, and Oregon. A commission credit may be available for buyers in lieu of the reward in New Jersey and must be discussed with the agent upon enrollment and included in a Buyer Agency Agreement with Rebate Provision. Rewards in Kansas and Tennessee are required to be delivered by gift card.

HomeStory will issue the reward using the payment option you select and will be sent to the client enrolled in the program within 45 days of HomeStory Real Estate Services receipt of settlement statements and any other documentation reasonably required to calculate the applicable reward amount. Real estate agent fees and commissions still apply. Short sale transactions do not qualify for the reward. Depending on state regulations highlighted above, reward amount is based on sale price of the home purchased and/or sold and cannot exceed $9,500 per buy or sell transaction. Employer-sponsored relocations may preclude participation in the reward program offering. SoFi is not responsible for the reward.

SoFi Bank, N.A. (NMLS #696891) does not perform any activity that is or could be construed as unlicensed real estate activity, and SoFi is not licensed as a real estate broker. Agents of SoFi are not authorized to perform real estate activity.

If your property is currently listed with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®.

Reward is valid for 18 months from date of enrollment. After 18 months, you must re-enroll to be eligible for a reward.

SoFi loans subject to credit approval. Offer subject to change or cancellation without notice.

The trademarks, logos and names of other companies, products and services are the property of their respective owners.

SOHL-Q225-231