Increased Uncertainty over Fiscal Policy – Week of Mar. 1, 2017

As equities continue to charge ahead, both the dollar and real interest rates remain in a holding pattern. Increased uncertainty over the likelihood of tax cuts and increased infrastructure spending have led many to question the continued justification for a “Trump Rally.” Accelerating inflation and statements from Fed Bank Presidents Williams and Dudley have brought the Federal Reserve back to center stage as the March meeting of the Federal Open Market Committee approaches.

The path to tax cuts and infrastructure spending has become less clear. It seems unlikely that substantial tax cuts will be enacted before it is known how much a replacement for the Affordable Care Act will cost. House Speaker Paul Ryan has found little support in the Senate for his plan to reform corporate taxes through the imposition of a border tax. On the spending side, Senate Majority Leader Mitch McConnell has said he would oppose a large stimulus package.

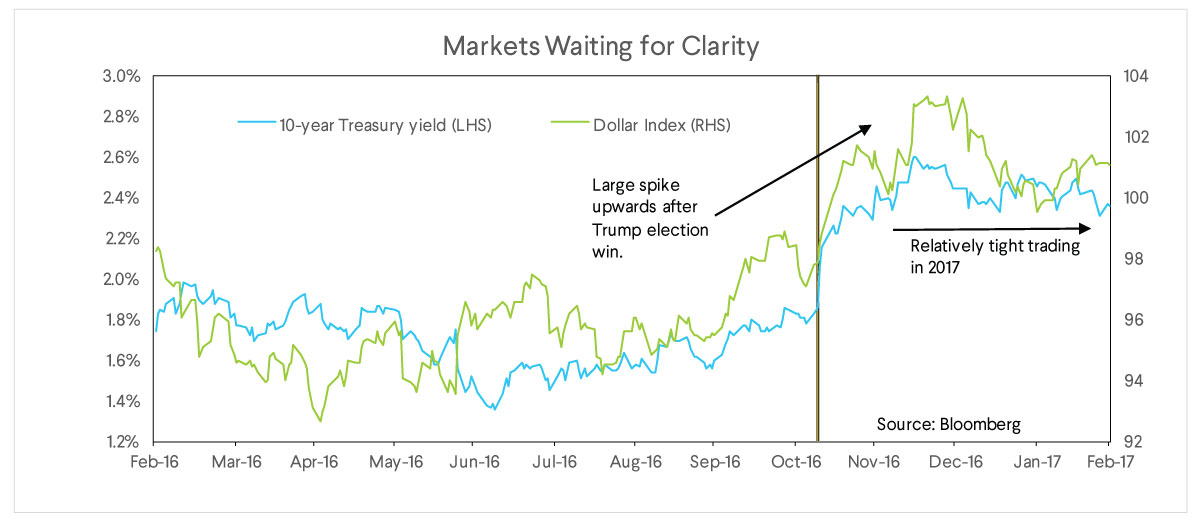

Markets have noticed the roadblocks. The figure below shows the 10-year Treasury yield and the Dollar Index pre and post-election. After an initial rise in interest rates and dollar appreciation post-election, both have traded roughly sideways through much of 2017. Fiscal policy decisions will be a key driver in determining whether or not rates and the dollar resume their path higher or return to levels seen for much of 2016.

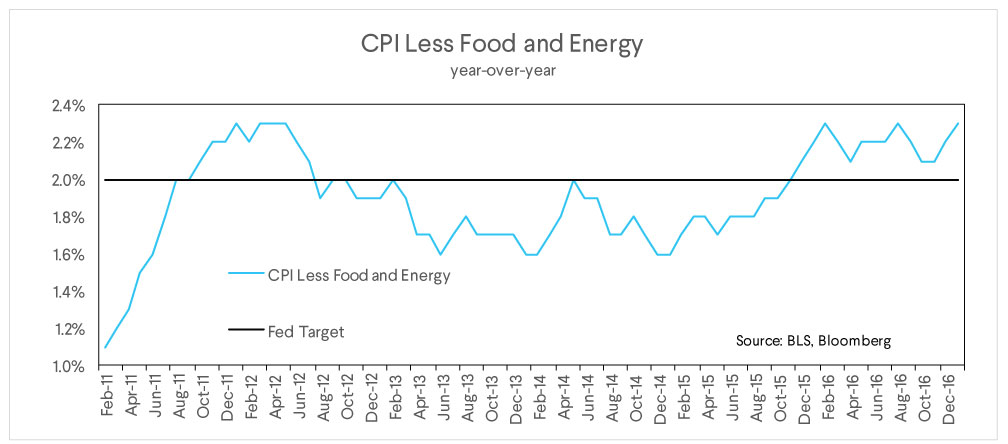

As we discussed in our last commentary, expected Fed policy has become more and more important in recent weeks. The latest release of the Consumer Price Index Less Food and Energy showed the fastest month over month gain in over ten years. On a year over year basis, the index has been above the Fed’s inflation target of 2% for 15 months. While this is not the Fed’s preferred measure of inflation, they are aware that prices are rising throughout the economy and markets are picking up a sense of increased urgency on the part of Fed officials.

This week the market’s implicit probability of the Fed raising the Federal Funds rate at its March meeting has risen from near 30% to over 80%. Fed Chair Yellen speaks on Friday, March 3rd and market participants will see if she reinforces statements made by various regional Fed Governors on the desirability of a March hike and want to hear her views on policy for the rest of 2017.

The impact of a rate hike will depend on the likelihood of a fiscal stimulus. Should tax cuts and infrastructure spending still seem likely, then it is possible that expectations of faster growth will help buoy equities against the effects of rising rates. However, if we get a rate hike without a clear path to some sort of fiscal stimulus, expect some near-term volatility as markets reprice assets based on higher rates and lower expected economic growth.

Our asset allocation remains unchanged. Equities are often said to “climb a wall of worry.” Even with possible near term volatility due to a more hawkish Fed or disappointing tax cuts, the long-term outlook for equities looks good. We continue to be overweight short-duration fixed income. On a longer-term basis, we see the return on fixed income as incommensurate with the risk of potential capital losses due to rising interest rates.

The SoFi Wealth Market Commentary does not provide individually tailored investment advice. It has been prepared without regard to the circumstances and objectives of those who receive it. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of one of our financial advisors. The appropriateness of an investment or strategy will depend on an investor’s circumstances and objectives. This is not an offer to buy or sell any security/instrument or to participate in any trading strategy. The value of and income from your investments may vary because of changes in interest rates, foreign exchange rates, default rates, prepayment rates, securities/instruments prices market indexes, operational or financial conditions of companies or other factors. Past performance is not a guide to future performance. Estimates of future performance are based on assumptions that may not be realized.