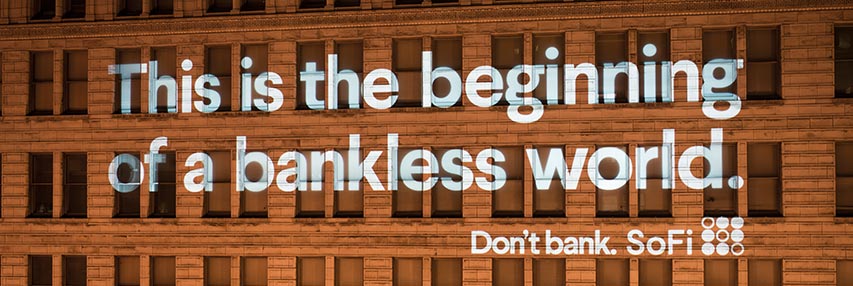

Why SoFi is Betting on a Bankless World

We recently hit the streets to ask people how they feel about their banks. The responses weren’t surprising:

“I don’t think my bank cares much about me.”

“I’ve never recommended my bank to anyone.”

“I don’t really trust banking institutions in general.”

Beating up on banks has become a national pastime. Yet what’s crazy is how long we’ve put up with it – the nickel-and-dime fees, the bad customer service, the being treated like a number. Most of us don’t even switch banks when we get fed up —it’s too much hassle, and aren’t they all the same anyway?

Read more