Liz Looks At: Signs of Slowing

Slowdown Scaries

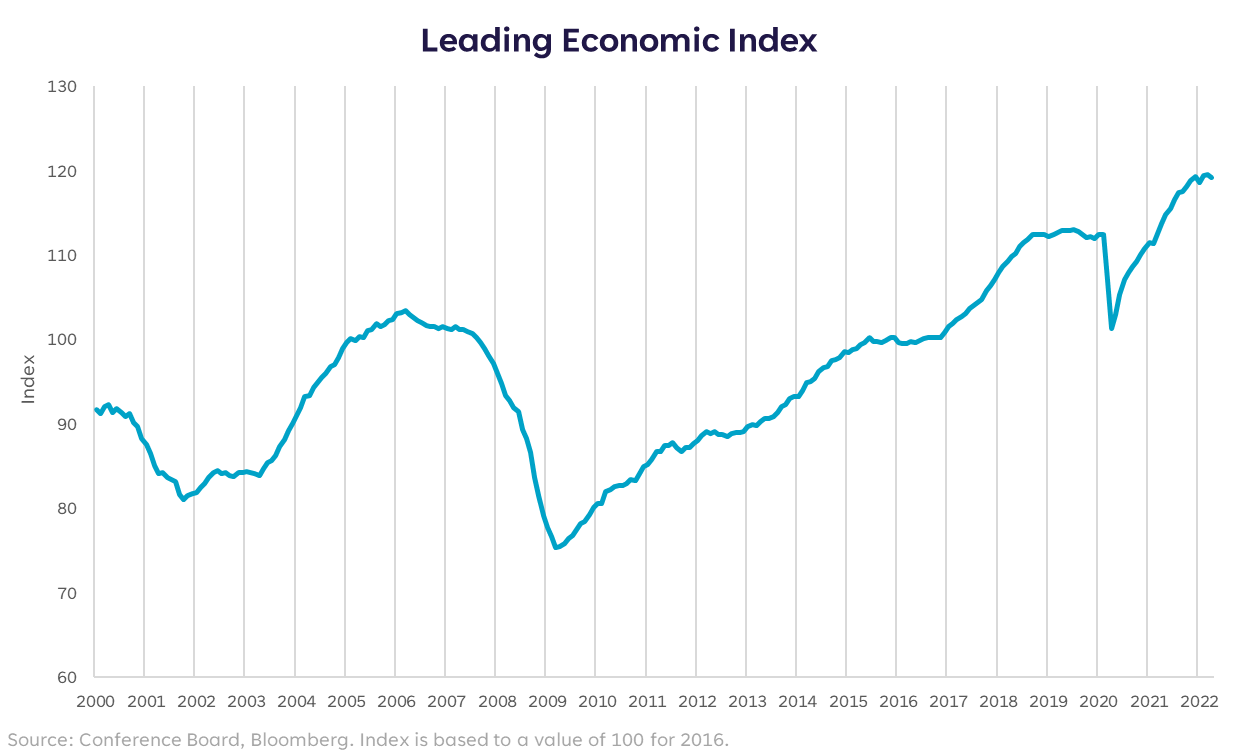

There are a number of indicators that attempt to predict a slowdown before it starts – one of which is the Conference Board’s Leading Economic Indicator Index, which is an aggregate measure of 10 components including, but not limited to: housing, manufacturing activity, jobless claims, and consumer expectations.

Looking at the path of the index (below), it still seems pretty promising. Maybe a slight rollover starting, but it’s still at historical highs and there are no signs of a persistent downward trend.

The problem with relying on indices like this is they still use data points that are mostly backward looking. The most recently reported manufacturing data is for the month ending April 30. Jobless claims data is reported more frequently, but even the weekly reads are for the prior week. By the time we’re warned about the slowdown, it’s probably well underway.

Canary vs. Confirmation

Markets are the canaries in the coalmine. They give us the best and earliest indication that things are going to crack. Sometimes they overreact (cue the overused quote about markets predicting nine of the last five recessions), but if we take a step back and look at the direction of the trend instead of the absolute levels, the stock market has been telling us since late 2021 that there was a slowdown ahead.

Economic data is confirmation that it’s happening. We’ve now seen weakness in regional manufacturing surveys, some increase in initial jobless claims, and let’s not forget the negative GDP growth number in Q1.

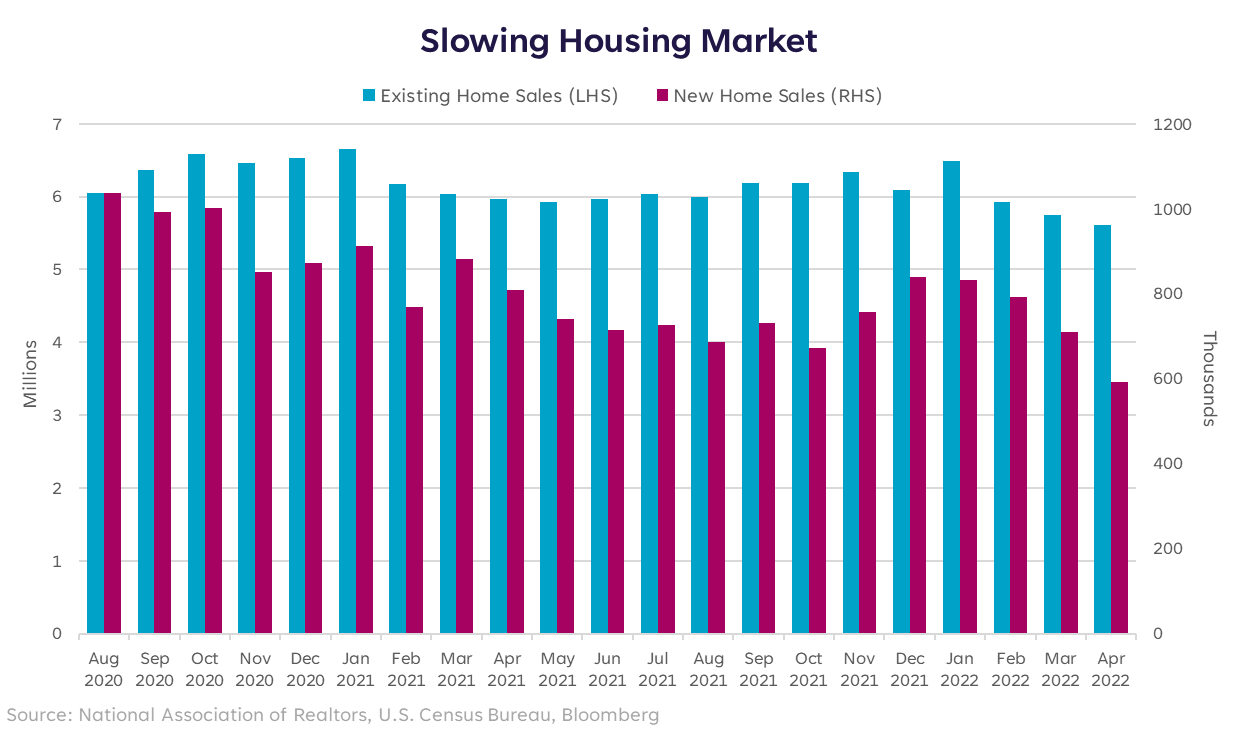

One of the most important sectors of the economy that indicates heating or cooling is the housing market. Those metrics had been signaling strength and relentless demand – home prices have risen 18-20% per month compared to the prior year for nine straight months.

Undoubtedly, the U.S. housing market has been a fighter. Defiant in the face of tightening talk. But this week changed that narrative. April new home sales fell 16.6% compared to March, and that’s on the backdrop of declining mortgage applications and softening existing home sales. Decreasing affordability of housing finally took a swing at the sector’s strength and confirmed that we are, in fact, experiencing slowing demand.

Back to the canary though – the market warned us about this too. Homebuilder stocks (represented by the SPDR S&P Homebuilders ETF) are down 30.6% YTD compared to the S&P being down only 16.8%.

Another Horse Out of the Barn

For some reason this makes me think of horses getting loose, with each horse representing another part of the story that needs to be written before we can defeat the real enemy: inflation. Cracks in the economy are the most recent horse that’s run amuk. Perhaps earnings reports from Target and Walmart signal that the next horse is a contraction in retail sales or personal consumption expenditures.

The thing is, we need this to happen in order to bring inflation down. It seems counterintuitive to hope for a slowdown in growth & demand in order to help the economy move forward, but it’s a necessary step. We can’t defeat inflation without also defeating the excess demand and removing the excess money that’s floating around.

There are still some more horses that need to get out of the barn, but I believe the second half of this year will see that process finish and the beginning of trying to wrangle them back in safely. If we succeed, we should also see the beginning of a cyclical bounce in markets. Stay tuned.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser. Information about SoFi Wealth’s advisory operations, services, and fees is set forth in SoFi Wealth’s current Form ADV Part 2 (Brochure), a copy of which is available upon request and at www.adviserinfo.sec.gov. Liz Young Thomas is a Registered Representative of SoFi Securities and Investment Advisor Representative of SoFi Wealth. Her ADV 2B is available at www.sofi.com/legal/adv.

SOSS22052601