SoFi Blog

Tips and news—

for your financial moves.

Pandemic Accelerates Push for Renewable Energy

With less people commuting to work due to COVID-19, the number of people refueling at gas stations has also shrunk.

Read moreSoFi Recognizes More Healthcare Heroes Helping Their Communities

Here are more healthcare heroes who were nominated for their dedication to helping their communities.

Read moreHoliday Shoppers May Soon Turn to YouTube

Retailers are on the lookout for creative ways to highlight their products. A new tool in marketers’ pockets may soon be YouTube.

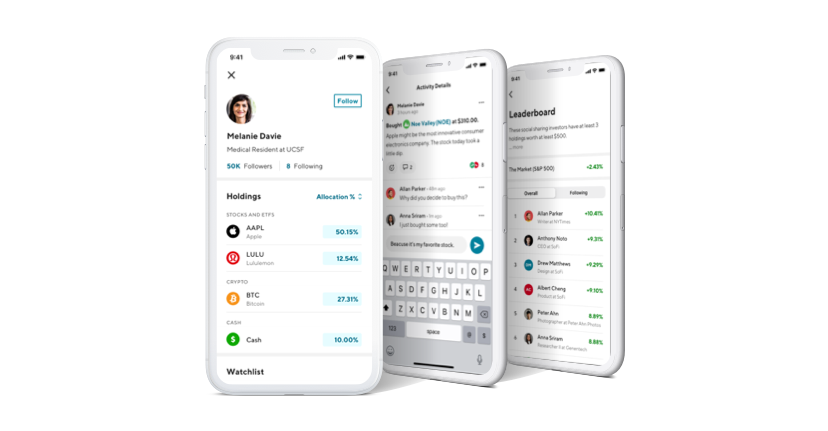

Read moreSocial Investing Now Available to All SoFi Invest Members!

We are excited to announce today that social investing features are now live for all SoFi Invest members!

Read more