Florida HELOC Calculator

By SoFi Editors | Updated December 23, 2025

For many homeowners, the equity built up in their property represents a significant financial asset. A home equity line of credit (HELOC) calculator is an excellent tool for exploring how to leverage this asset because it translates abstract numbers into real-world borrowing scenarios. Using the HELOC payment calculator can allow users to estimate potential credit lines and understand the possible payment structure of a HELOC before engaging with lenders. This guide will walk you through what a home equity line of credit is, share how to use the calculator effectively, and

- Key Points

- • A HELOC is a revolving line of credit that is secured by the equity in your home.

- • HELOCs have two phases: a draw period where you can access funds as needed, followed by a repayment period where you pay back the principal and interest.

- • Most HELOCs feature variable interest rates, meaning your monthly payments can change over time based on broader economic conditions.

- • The amount you can borrow is typically based on your home equity.

- • Because your home is used as collateral, failing to make payments puts your property at risk of foreclosure.

Calculator Definitions

• HELOC Balance: The HELOC balance is the total amount you plan to draw from your line of credit or the amount you’ve already drawn. Interest is calculated based on this outstanding balance.

• Current Interest Rate: This is the rate at which interest accumulates on your outstanding HELOC balance. If you’re considering multiple HELOC offers from lenders, you can use the calculator to see how their rates would impact your payment amount.

• Draw Period: The draw period is a specific time frame, often up to 10 years, during which you can borrow funds from your HELOC as needed until you reach your credit limit. During this phase, you likely will only be required to pay interest on what you’ve borrowed.

• Repayment Period: The repayment period starts after the draw period concludes and generally lasts from 10 to 20 years. During this time, you can no longer borrow funds and must make regular payments that cover both principal and interest.

• Monthly Interest Payment: This is the portion of a monthly payment that covers the interest that has accrued on the borrowed amount.

• Monthly Principal and Interest Payment: This is the amount you’ll be required to pay monthly during the repayment period. It’s typically higher than the interest-only payment. Because HELOCs have variable interest rates, these HELOC payment calculator figures are estimates; your exact payment will be based on current rates.

• Total Interest: This figure is what you can expect to pay in interest over the life of the HELOC. Again, due to variable interest rates, this should be considered a rough estimate.

How to Use the Florida HELOC Calculator

Used correctly, a Florida HELOC calculator greatly simplifies the process of estimating your borrowing potential and payments. Follow these steps for the best results:

Step 1: Enter Your Planned or Actual HELOC Balance

Homeowners with an existing HELOC should type in their current outstanding principal balance. Those considering a new HELOC should estimate the amount you plan to draw for your intended purpose, such as a renovation or debt consolidation.

Step 2: Estimate Your Interest Rate

This input is the rate that will be applied to your outstanding balance. The majority of HELOC rates are variable and can fluctuate, but for the purpose of this calculator you’ll need to choose one rate. Try inputting the current rate a lender is offering, but also experiment with a higher and lower rate to see how payments might be affected by rate shifts in the future.

Step 3: Choose the Length of the Draw Period

Here, you select the duration — often up to 10 years — during which you can access funds from your line of credit. This decision is important because it determines how long you can borrow and when the transition to the repayment period will occur.

Step 4: Select Your Repayment Period

This step defines the timeframe, typically between 10 and 20 years, over which the entire borrowed balance must be paid off after the draw period ends. A longer repayment period generally results in lower monthly payments but more total interest paid over the life of the HELOC.

Step 5: Review Your Results

The calculator’s outputs will include an estimated monthly interest-only payment for the draw period and an estimated monthly principal and interest payment, which is required during the repayment period. These estimates can be helpful as you budget for a HELOC and think about what credit limit, interest rate, and term you feel is optimal.

What Is a Home Equity Line of Credit?

If using the calculator makes you think a HELOC could be a good fit, it’s important to understand how a line of credit works before you dive in. The amount you can borrow will depend on your home equity, which is the difference between your home’s current market value and the amount you owe on your home loan. Most lenders require a homeowner to have at least 15% equity in their home in order to obtain a HELOC, and the amount a lender will let you borrow typically tops out at 90% of equity. To determine your equity percentage, you can subtract your mortgage balance from your home’s estimated value. Then divide the answer by the home value to arrive at your percentage of equity.

A HELOC’s structure as a revolving line of credit offers flexibility similar to a credit card. Once approved for a specific credit limit, you can borrow funds as needed, repay the balance, and borrow again throughout a designated “draw period.” Or if you prefer, you can carry the balance and pay interest on it. You’ll only pay interest on the amount you actually withdraw, not the entire credit limit. This makes a HELOC suitable for ongoing projects or expenses where the total cost is uncertain.

A HELOC is secured by your home. This arrangement generally allows for more competitive interest rates compared to unsecured options like personal loans or credit cards. However, it also introduces risk: If you are unable to make your payments, the lender has the right to foreclose on your home to satisfy the debt.

As noted above, a HELOC is divided into two distinct phases. The first is the draw period, which typically lasts for 10 years. A HELOC interest-only calculator is useful during this time if you want to keep close tabs on how much your monthly might be.

Once the draw period ends, the HELOC enters the repayment period, which can last from 10 to 20 years. During repayment, borrowing is no longer permitted, and you must make regular payments that cover both principal and interest. (This is when a HELOC repayment calculator can be useful.) This transition often results in a substantial increase in the monthly payment amount, which borrowers must be prepared for.

Finally, most HELOCs come with a variable interest rate. As the index fluctuates with economic conditions, your HELOC’s interest rate — and consequently your monthly payment — can rise or fall. If this unpredictability doesn’t suit your style, you might want to look into what is a home equity loan.

Recommended: HELOC vs. Home Equity Loan

Home Equity Trends in Florida

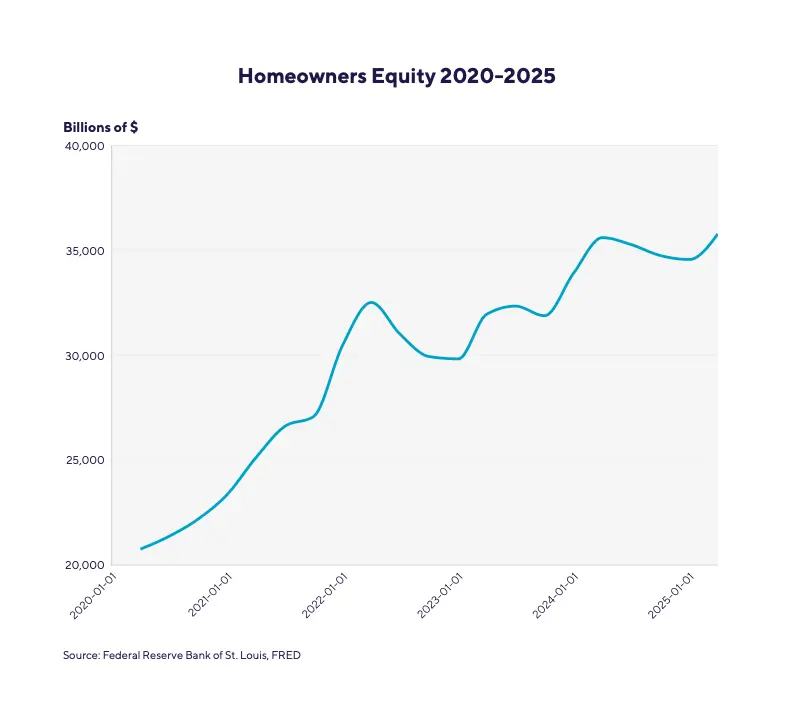

If many of your neighbors are talking about HELOCs, it’s not surprising. Homeowners in Florida saw their home equity more than double, on average, over the last five years. The average Florida homeowner is now sitting on more than $135,000 in equity, more than enough to support a HELOC that could allow them to consolidate debt, make renovations, or cover other large expenses. And Florida is part of a national trend. Take a look at how equity has increased in the U.S. as a whole.

Current HELOC rates by state.

Compare current home interest rates by state and find a HELOC rate that suits your financial goals.

Select a state to view current rates:

How to Use the HELOC Calculator Data to Your Advantage

If you’re ready to translate the HELOC calculator’s estimates into concrete decisions about borrowing, here are three ways you can use the information it provides.

• Budgeting and affordability: Take a good look at the estimated monthly payments for the draw and repayment phases. Can your household budget accommodate these payments?

• Scenario planning: Use the calculator to model different scenarios. Adjust the amount borrowed to see at what point the payments become uncomfortable. Try tinkering with either the interest rate or the payment term to see if you can afford a higher interest rate, should you encounter one, or a shorter term.

• Long-term cost awareness: The “total Interest” figure helps you visualize the full financial impact of the HELOC over its entire life. If you are opening a HELOC to renovate your home, for example, the total interest number reveals the true cost of the project.

Tips on HELOCs

While a HELOC offers remarkable flexibility, it is a significant financial commitment. Here are several practical tips for homeowners considering or already using a HELOC.

• Manage with care: Remember that your home secures the HELOC. It is imperative not to fall behind on payments. It bears repeating: Defaulting on a HELOC can put your home at risk of foreclosure.

• Shop around: Lenders can vary significantly in the rates and terms they offer. Before committing, compare options from multiple institutions, including banks, credit unions, and online lenders.

• Have a repayment plan: It can be tempting to use home equity for short-term wants or lifestyle purchases, but this is a risky practice. Before you draw funds, have a clear plan for how you will repay the borrowed amount. In an ideal world, you use your HELOC to improve your financial stability (by paying down high-interest debt, perhaps) or add value to your home.

• Understand the fees: Be aware of the full cost of the loan. HELOCs can come with closing costs (potentially 2% to 5% of the credit limit), annual maintenance fees, inactivity fees if you don’t use the line of credit, and early termination penalties if you close the account within a certain timeframe.

• Prepare for the repayment period: One of the biggest financial shocks for HELOC borrowers is the transition from the draw period to the repayment period. If you have been making interest-only payments, your monthly obligation will increase significantly when principal payments are added. Plan for this well in advance.

Recommended: Different Types of Home Equity Loans

Alternatives to HELOCs

A HELOC is just one of several ways to get equity out of your home. And there are also ways to borrow that don’t involve facing the risk of foreclosure if you fail to make payments. Here’s a look at your options:

Home Equity Loan

Often confused with a HELOC, a home equity loan, like a HELOC, involves using your home as collateral. It is critically different in three ways: The funds are disbursed all at once, the interest rate is typically fixed, and repayment of both principal and interest begins immediately. This makes it a better choice for those who know the exact cost of a project upfront and prefer the stability of a fixed monthly payment amount. If you want to test the waters and see what payments might be like should you choose this option, use a home equity loan calculator.

Home Improvement Loan

A home improvement loan is a type of personal loan and is typically unsecured. It provides a lump sum of cash. Unlike a HELOC, it features a fixed interest rate and a predictable schedule of equal monthly payments. In that way, it is more similar to a home equity loan. But because a home improvement loan is unsecured, the interest rate is generally higher than that of a HELOC or home equity loan.

Personal Line of Credit

A personal line of credit (PLOC) is a revolving line of credit that is not secured by collateral. It functions similarly to a HELOC in that you can draw and repay funds as needed. The key differences are that a PLOC is unsecured, which poses less risk to your assets but results in a higher interest rate and, possibly, a lower credit ceiling. Approval is based solely on your creditworthiness and income rather than home equity.

Cash-Out Refinance

A cash-out mortgage refinance involves replacing your existing mortgage with a new, larger one and receiving the difference in cash. If you’re thinking about a cash-out refinance vs. a home equity line of credit there are a few important considerations: A refinance will leave you with one monthly payment instead of two (one for the primary mortgage and one for the HELOC). This can be appealing, but it only makes financial sense if you can also secure a lower interest rate than you have on your original mortgage. Another consideration is that with a refi, you’ll begin repaying the loan immediately, while with a HELOC you can delay repaying your principal as long as you make the interest payments. A cash-out refinance might have higher closing costs than a HELOC, but it likely also has a lower credit score threshold for qualification. Which path you choose will depend on these variables.

The Takeaway

A free HELOC calculator can help empower homeowners in their financial planning. It will help you understand what your payments on a HELOC would be, whether you’re in the draw or repayment phase. Testing different scenarios can help you get a sense of what credit line amount, interest rate, and repayment term will work best with your budget. And running interest rates offered by different lenders through the calculator can help you make a decision about which lender to partner with on this important HELOC journey.

SoFi now partners with Spring EQ to offer flexible HELOCs. Our HELOC options allow you to access up to 90% of your home’s value, or $500,000, at competitively lower rates. And the application process is quick and convenient.

Unlock your home’s value with a home equity line of credit from SoFi, brokered through Spring EQ.

FAQ

What is the difference between a HELOC and a home equity loan?

A HELOC is a revolving line of credit that works much like a credit card, and that has a variable interest rate. You can borrow and repay funds as needed and only pay interest on the amount of the credit line that you use. In fact, during the initial draw phase of the HELOC, you likely won’t have to repay the principal you’ve borrowed at all. In contrast, a home equity loan provides a single, lump-sum amount at a fixed interest rate. Repayment begins immediately, with monthly payments of equal installments. Both a HELOC and home equity loan use your home as collateral.

How much can I borrow with a HELOC?

The amount you can borrow depends on the equity in your home. Lenders typically allow you to borrow up to 90% of your equity. Your equity is equal to your home’s estimated value minus your outstanding mortgage balance. The final credit limit is also influenced by factors such as your credit score, income, and overall debt.

What can I use the money for from a HELOC?

Funds from a HELOC can be used for almost any purpose. Common uses include home renovations, debt consolidation, funding education, or covering major unexpected costs like medical bills. Some homeowners use HELOC funds to invest in a business. Remember that investments like this can be risky, and if an investment doesn’t pay off and you can’t make your HELOC payments, you risk losing your home.

Is a HELOC interest rate fixed or variable?

Most HELOCs have a variable interest rate that can change over time. This rate is typically tied to the U.S. prime rate, so you can keep an eye on the prime rate for a sense of where rates are headed.

Learn more about mortgages:

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Checking Your Rates: To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score. However, if you choose a product and continue your application, we will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull and may affect your credit.²SoFi Bank, N.A. NMLS #696891 (Member FDIC), offers loans directly or we may assist you in obtaining a loan from SpringEQ, a state licensed lender, NMLS #1464945.

All loan terms, fees, and rates may vary based upon your individual financial and personal circumstances and state.You should consider and discuss with your loan officer whether a Cash Out Refinance, Home Equity Loan or a Home Equity Line of Credit is appropriate. Please note that the SoFi member discount does not apply to Home Equity Loans or Lines of Credit not originated by SoFi Bank. Terms and conditions will apply. Before you apply, please note that not all products are offered in all states, and all loans are subject to eligibility restrictions and limitations, including requirements related to loan applicant’s credit, income, property, and a minimum loan amount. Lowest rates are reserved for the most creditworthy borrowers. Products, rates, benefits, terms, and conditions are subject to change without notice. Learn more at SoFi.com/eligibility-criteria. Information current as of 06/27/24.In the event SoFi serves as broker to Spring EQ for your loan, SoFi will be paid a fee.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

SOHE-Q425-059