California HELOC Calculator

By SoFi Editors | Updated December 18, 2025

Understanding the equity in your home is a critical component of modern financial strategy. The California HELOC payment calculator is a valuable first step, translating abstract financial concepts into tangible figures for personal planning. This free HELOC calculator helps you estimate your monthly payments and total interest costs, before you formally apply for a line of credit with a lender.

By demystifying these figures, the calculator helps you grasp the key concepts you need to know before deciding if a HELOC is the right choice for your financial goals.

- Key Points

- • HELOCs and other home equity financing options allow you to use your home as collateral to secure funds.

- • A HELOC is a revolving line of credit that operates in two phases: a draw period (often 10 years) when you can borrow funds, and a subsequent repayment period (typically 10 to 20 years) when you repay the principal and interest.

- • You pay interest only on the amount you have borrowed from your credit line, not on the entire credit limit available to you.

- • HELOCs usually come with a variable interest rate, which can change over time. This contrasts with the fixed interest rate commonly associated with a traditional home loan.

- • To qualify, lenders generally require that homeowners have a minimum of 15% equity in their home. Qualified borrowers may be able to access up to 90% of their home equity.

Calculator Definitions

• HELOC Balance: The HELOC balance is the total amount of principal that a borrower currently owes on their line of credit.

• Current Interest Rate: This is the rate at which interest accrues on your outstanding balance. For most HELOCs, this is a variable rate that can change over time in response to market shifts.

• Draw Period: The draw period is the specific time frame, often lasting between 5 and 10 years, during which you can access funds from your HELOC up to your approved credit limit.

• Repayment Period: The repayment period is the phase that begins after the draw period ends, typically lasting 10 to 20 years. During this time, you can no longer borrow funds and must make regular payments on both the principal and interest.

• Monthly Interest Payment: This refers to the minimum payment required during the draw period. Some HELOCs allow for interest-only payments during this phase, which cover the interest accrued on the borrowed amount but do not reduce the principal balance.

• Monthly Principal and Interest Payment: This is the standard payment made during the repayment period. It includes a portion of the principal balance and the accrued interest, and is designed to pay off the line of credit over the specified term.

• Total Interest: This figure represents the cumulative amount of interest you will pay over the life of the HELOC. It includes all interest payments from the beginning of the draw period through the end of the repayment period.

How to Use the California HELOC Calculator

A HELOC payment calculator is a straightforward tool designed to demystify how a HELOC works. By inputting a few key pieces of financial information, you can get a clear estimate of what your payments could look like, providing a solid foundation for financial planning.

Step 1: Enter Your Planned or Actual HELOC Balance

Enter the outstanding principal balance on your current HELOC. If you are exploring a new line of credit, input the potential amount you are thinking about borrowing to see how it might affect your budget.

Step 2: Estimate Your Interest Rate

Input the annual interest rate for your line of credit. Since most HELOCs feature variable rates that can fluctuate, this figure will be used as an estimate to model potential payments and interest costs.

Step 3: Choose the Length of the Draw Period

Enter the duration of the draw period for your HELOC, which is typically between 5 and 10 years. This is the period during which you can access funds, and its length affects the overall timeline of your line of credit.

Step 4: Select Your Repayment Period

Enter the length of the repayment period, which often ranges from 10 to 20 years. This phase follows the draw period and determines the schedule over which you will pay back the principal and accumulated interest.

Step 5: Review Your Results

The HELOC payment calculator will provide you with estimated figures, including your potential monthly payments during both the draw and repayment periods, as well as the total interest you might pay over the life of the line of credit. Remember that these numbers are estimates intended for planning and informational purposes.

These estimated results provide a financial snapshot. To fully understand the mechanics behind these numbers, let’s explore in detail what is a home equity line of credit?

What Is a Home Equity Line of Credit?

A home equity line of credit, or HELOC, is a flexible financial tool available to homeowners who have built up equity in their property. Understanding its mechanics is the first step toward determining if it aligns with your financial strategy for how to get equity out of your home.

A HELOC is a revolving line of credit that functions much like a credit card but is secured by the equity in your home. Your home equity is the difference between the property’s current market value and the amount you still owe on your mortgage. Because the line of credit is secured by your home, lenders typically offer more competitive interest rates compared to unsecured options like credit cards or personal loans.

HELOCs are structured in two distinct phases. The first is the draw period, which typically lasts 5 to 10 years. During this time, you can withdraw funds as needed, up to your approved credit limit, and you are often only required to make payments on the interest that accrues on your outstanding balance. A HELOC interest-only calculator can give you the payment info for that first phase only.

Once the draw period ends, the repayment period begins, usually lasting 10 to 20 years. During this phase, you can no longer withdraw funds, and your required monthly payments will increase significantly to cover both the principal balance and the interest. Homeowners should use a HELOC repayment calculator to prepare for this transition, to ensure the new, larger payment fits their long-term budget.

Most HELOCs have variable interest rates, meaning the rate can fluctuate over time. This is a key distinction from a standard home equity loan, which usually offers a fixed interest rate and a predictable monthly payment schedule.

Accessing the funds from your HELOC is designed for convenience. Common methods include using special checks provided by the lender, a dedicated debit or access card, or transferring money directly to your checking account through online banking.

With these mechanics in mind, a specialized free HELOC calculator becomes the essential tool for translating these concepts—like draw periods and variable rates—into personalized, actionable figures.

Recommended: HELOC vs. Home Equity Loan

Home Equity Trends in California

The ability to secure and utilize different types of home equity loans is directly tied to the amount of equity a homeowner possesses, a figure that is heavily influenced by the dynamics of the housing market.

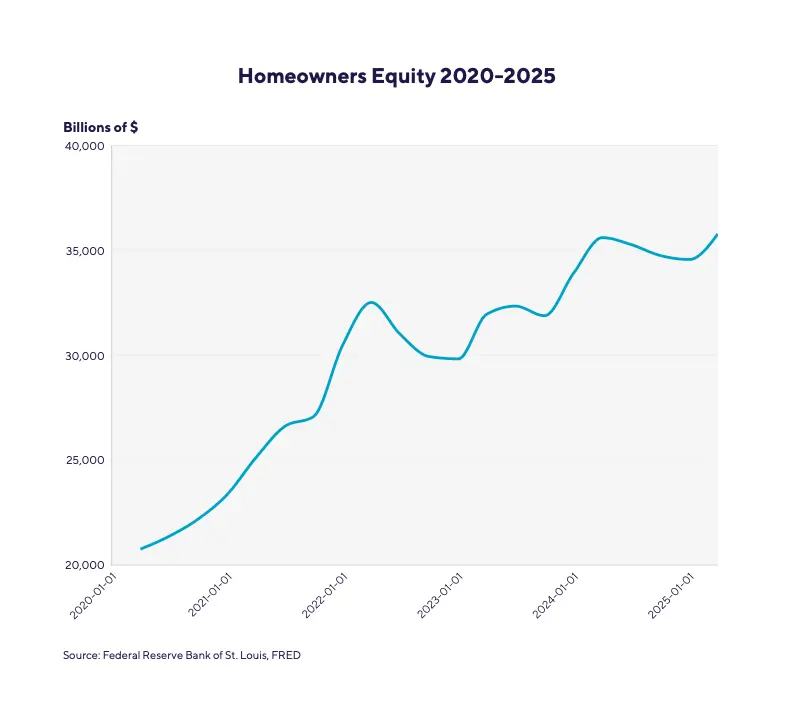

In recent years, rising home prices have impacted homeowners and prospective buyers in different ways. While appreciating home values can make it more challenging for first-time buyers to enter the market, this same trend has led to a significant “spike in home equity” for existing homeowners. As property values increase, the gap between a home’s market worth and the owner’s outstanding mortgage balance widens, creating more accessible equity.

Many homeowners, particularly in high-value states like California, may have more equity than they realize. Even those who have owned their homes for just a few years may find they have built enough equity to meet the minimum 15% lender requirement sooner than they might have expected, especially if they purchased in a rapidly appreciating market.

In California, home equity has increased 79% over the last five years. As a result, homeowners are sitting on a huge amount of equity: $348,200 on average. That’s more than enough to fund a home renovation or other large purchase and still maintain a comfortable equity cushion.

Current HELOC rates by state.

Compare current home interest rates by state and find a HELOC rate that suits your financial goals.

Select a state to view current rates:

How to Use the HELOC Calculator Data to Your Advantage

The data generated by a HELOC payment calculator is more than just a set of numbers; it provides actionable insights that can be used to make sound financial decisions. By translating your home equity into concrete borrowing potential and estimated costs, the calculator empowers you to plan strategically for your financial future.

• Budgeting for major projects: The estimated monthly payments for both the draw and repayment periods can be directly integrated into your household budget. This allows you to realistically assess the affordability of a large-scale project, such as a kitchen remodel or adding a new pool. By understanding the potential impact on your monthly cash flow, you can plan renovations without overextending your finances.

• Evaluating debt consolidation: If you are considering using a HELOC to consolidate high-interest debt, the calculator’s output is essential. You can compare the estimated monthly payment and total interest paid on the HELOC against the combined payments and interest costs of your current credit cards or personal loans. This direct comparison will reveal whether consolidation would result in genuine savings and a more manageable single payment.

• Informed lender conversations: Approaching a lender with a clear understanding of your borrowing capacity and estimated payments puts you in a position of strength. Instead of starting from scratch, you can have a more productive and confident discussion about your financial options, armed with realistic expectations and a solid baseline for negotiating terms.

• Understanding long-term impact: The calculator’s estimate of the total interest paid over the entire life of the HELOC provides a crucial long-term perspective. This figure helps you appreciate the full cost of borrowing and encourages a responsible approach to using the funds, ensuring that the benefits of the project or expense outweigh the long-term interest costs.

Armed with these insights, it becomes easier to follow best practices for managing this powerful financial tool.

Tips on HELOCs

While a HELOC can be a powerful and flexible financial tool, it requires careful and responsible management to avoid pitfalls. The following tips are designed to help you use your line of credit wisely, ensuring it serves as a benefit rather than a burden.

• Shop and compare lenders: Do not settle for the first offer you receive. Take the time to compare options from multiple lenders, including banks, credit unions, and online providers. Look beyond the advertised interest rate and scrutinize the full terms. Pay close attention to potential fees, such as annual fees, inactivity fees, and early termination or prepayment penalties, as these can significantly impact the overall cost of borrowing.

• Develop a clear repayment plan: Treat your home equity with the respect it deserves as a significant asset. Avoid the temptation to use HELOC funds for depreciating assets or discretionary lifestyle spending without an ironclad repayment strategy. Every draw should be an investment—in your property’s value or your family’s financial health—not a liability that puts your home at risk.

• Prepare for the repayment period: One of the most common surprises for HELOC borrowers is the significant increase in monthly payments when the line of credit transitions from the interest-only draw period to the principal-and-interest repayment period. Use a HELOC calculator to estimate what these future payments will be and ensure they fit comfortably within your long-term budget to avoid “payment shock.”

• Understand the risks of variable rates: Most HELOCs come with a variable interest rate, which means your monthly payment can increase if market rates rise. You must be financially prepared for potential fluctuations in your payment obligations. Budgeting for a rate that is higher than the current one can provide a valuable financial cushion.

• Maintain your financial health: Lenders look for strong financial credentials when approving a HELOC. This typically includes a credit score of 640 or higher and a debt-to-income (DTI) ratio below 45%. (To learn your DTI, add up all your monthly debt payments and divide by your gross monthly income.) Before applying, review your credit report for any errors, and work on managing your overall debt to position yourself for the best possible interest rate and terms.

While a HELOC is a strong option for many, it’s also wise to consider other financial products that might better suit your needs.

Alternatives to HELOCs

A HELOC is just one of several ways to access home equity or secure financing for a major expense. The best choice depends entirely on your individual financial circumstances, your goals, and your comfort with different repayment structures. It is always wise to evaluate all available options before making a decision.

Home Equity Loan

A home equity loan, often called a second mortgage, provides a one-time lump sum of cash that you borrow against your home’s equity. It is known for its fixed interest rate and predictable, regular monthly payments over a set term, making it a good option for those who know the exact amount they need for a specific project. A home equity loan calculator can help you compare the cost of this product to that of a HELOC.

Recommended: What Is a Home Equity Loan?

Home Improvement Loan

A home improvement loan is a type of personal loan specifically intended for financing home renovations and repairs. It is typically an installment loan, which means it comes with a fixed interest rate and predictable monthly payments. Because it’s not secured by your home, the interest rate is usually higher than that of a home equity loan.

Personal Line of Credit

A personal line of credit (PLOC) is an unsecured revolving line of credit that functions similarly to a HELOC (and a credit card) but does not use your home as collateral. Because it is unsecured, a PLOC may have a higher interest rate and a lower credit limit compared to a HELOC.

Cash-Out Refinance

A cash-out mortgage refinance replaces your current mortgage with a new, larger one. The difference between the new mortgage amount and your old mortgage balance is paid to you in cash. This consolidates your debt into a single mortgage payment but resets your mortgage term.

When comparing a cash-out refinance vs. home equity line of credit, you should understand that the former leaves you with one payment. The latter gives you a second payment on top of your original mortgage payment.

Understanding these alternatives provides a broader context for making the best financial choice for your future.

The Takeaway

A California HELOC calculator is a smart first step for any homeowner considering tapping into their home equity. It provides a clear, no-commitment estimate of borrowing power and potential costs, transforming a complex financial product into a manageable set of figures for planning. This preliminary step of calculation is not just about numbers; it’s about empowerment. It enables homeowners to make strategic, well-informed financial decisions regarding their most significant asset.

SoFi now partners with Spring EQ to offer flexible HELOCs. Our HELOC options allow you to access up to 90% of your home’s value, or $500,000, at competitively lower rates. And the application process is quick and convenient.

Unlock your home’s value with a home equity line of credit from SoFi, brokered through Spring EQ.

FAQ

What is the difference between a HELOC and a home equity loan?

A HELOC is a revolving line of credit with a typically variable interest rate, allowing you to borrow and repay funds as needed during a draw period. A home equity loan provides a one-time lump sum of cash with a fixed interest rate and predictable monthly payments from the start.

How much can I borrow with a HELOC?

Lenders typically allow you to borrow up to 90% of your equity. The exact amount depends on your creditworthiness, your income, your other debts, and the lender’s policies.

What can I use the money for from a HELOC?

You can use HELOC funds for almost anything, including home improvements, debt consolidation, educational expenses, medical bills, or other major purchases. However, borrowing against your home should be done with a clear purpose and a repayment plan.

Is a HELOC interest rate fixed or variable?

Most HELOCs have a variable interest rate that is tied to the U.S. Prime Rate. This means the rate, and your monthly payments, can change over time. Some lenders may offer a fixed-rate option.

What happens when the draw period ends?

When the draw period ends, the repayment period begins. You can no longer borrow from the line of credit, and your required monthly payments will increase to include both principal and interest.

What is the benefit of having a variable interest rate?

A variable interest rate can fluctuate with market conditions. While this means your rate could increase, it also means it could decrease if benchmark rates fall, which would lower your monthly interest payments.

Are there closing costs or fees for a HELOC?

Yes, HELOCs can have closing costs, typically ranging from 2% to 5% of the credit limit, though some lenders may waive them. Other potential fees include annual maintenance fees, inactivity fees, and early termination penalties.

What is the minimum credit score I need to qualify for a HELOC?

Requirements vary by lender, but a credit score of at least 640 is usually necessary to qualify, and many lenders like to see 680 or above. And a score of 700+ will help borrowers secure the most competitive interest rates.

Is the interest on a HELOC tax-deductible?

Interest paid on HELOCs and home equity loans may be tax-deductible. There are limits on the total amount of mortgage debt on which interest can be deducted, and in order to capture this deduction a homeowner would need to itemize deductions on their tax return. Your best move is to consult a tax advisor.

Learn more about mortgages:

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Checking Your Rates: To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score. However, if you choose a product and continue your application, we will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull and may affect your credit.²SoFi Bank, N.A. NMLS #696891 (Member FDIC), offers loans directly or we may assist you in obtaining a loan from SpringEQ, a state licensed lender, NMLS #1464945.

All loan terms, fees, and rates may vary based upon your individual financial and personal circumstances and state.You should consider and discuss with your loan officer whether a Cash Out Refinance, Home Equity Loan or a Home Equity Line of Credit is appropriate. Please note that the SoFi member discount does not apply to Home Equity Loans or Lines of Credit not originated by SoFi Bank. Terms and conditions will apply. Before you apply, please note that not all products are offered in all states, and all loans are subject to eligibility restrictions and limitations, including requirements related to loan applicant’s credit, income, property, and a minimum loan amount. Lowest rates are reserved for the most creditworthy borrowers. Products, rates, benefits, terms, and conditions are subject to change without notice. Learn more at SoFi.com/eligibility-criteria. Information current as of 06/27/24.In the event SoFi serves as broker to Spring EQ for your loan, SoFi will be paid a fee.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

SOHE-Q425-055