The Week Ahead on Wall Street

Economic Data

Today, consumer credit will be released for October. In September the figure surpassed $16.2 billion, after declining by over $6.9 billion in August. Consumer credit generally refers to personal debt and describes the goods and services people purchase every day with products like credit cards.

Tomorrow, Productivity and Unit Labor Cost Reports for the third quarter are due. Unit Labor Cost describes the pay employees receive in exchange for one unit of work. That pay can include both wages and other benefits. When worker productivity increases, labor cost tends to decrease. Preliminary estimates showed unit labor costs plummeting 8.9% in the third quarter after growth during Q2.

October job openings and wholesale inventories will be released on Wednesday. In September, the number of job openings was largely unchanged from the month before. These metrics are part of the Employment Situation Report, which helps investors get a better sense of the labor market and overall job growth.

On Thursday, initial jobless claims, the November Consumer price index, November Core CPI, and November Federal budget will be released. Last week, jobless claims fell to a pandemic low of 712,000 after rising the week before.

On Friday, the November producer price index and December Consumer Sentiment Index will be released. The sentiment index measures the health of the economy as consumers understand it. Last month, consumer sentiment fell in response to rising coronavirus cases. Economists fear that if a stimulus package is not forthcoming, the economy may take another hit.

Earnings to Keep an Eye On

Today, Stitch Fix (SFIX) will report its earnings. Last quarter the apparel company saw a boost in sales after the pandemic slowed down supply chains and advertising spending earlier in the year. Despite a lack of growth in the apparel industry, Stitch Fix was able to gain market share with more leisurewear options and its direct to consumer model. Investors hope to hear how the company will adapt its marketing and apparel offerings to reflect shoppers’ appetite heading into the new year.

Tomorrow, Chewy (CHWY) will report its latest results. Pet adoptions surged during the pandemic. Between February and July, Chewy added more customers than in the whole of the previous financial year. As a result the company’s stock has climbed 150% this year. Investors will be curious to see if this trend continues.

Campbell’s Soup (CPB) will report earnings on Wednesday. Wall Street expects the juice, cookies, and soup maker to post year-over-year growth in earnings thanks to higher sales. Revenue from this most recent quarter is expected to hit $2.32 billion—a 6.3% increase from this time last year—as more people cooked and ate at home as a result of the pandemic.

On Thursday, Costco Wholesale (COST) will report its latest results. Investors expect the warehouse club to announce earnings of $2 per share and $42.43 billion in revenue. That represents revenue growth of 14.6% from this time last year. Thanks to robust demand as a result of quarantines and lockdowns, Costco’s stock has advanced nearly 30% so far this year.

Also Thursday, Lululemon Athletica (LULU) will report. Analysts expect earnings to land around $0.85 per share, or -11.5% compared to last year. Revenue, however, is expected to be up from this time last year, at $1.01 billion. As consumers stayed at home, the athleisure maker saw more demand. Analysts will be curious to hear how Black Friday and the holiday shopping season is shaping up for the company.

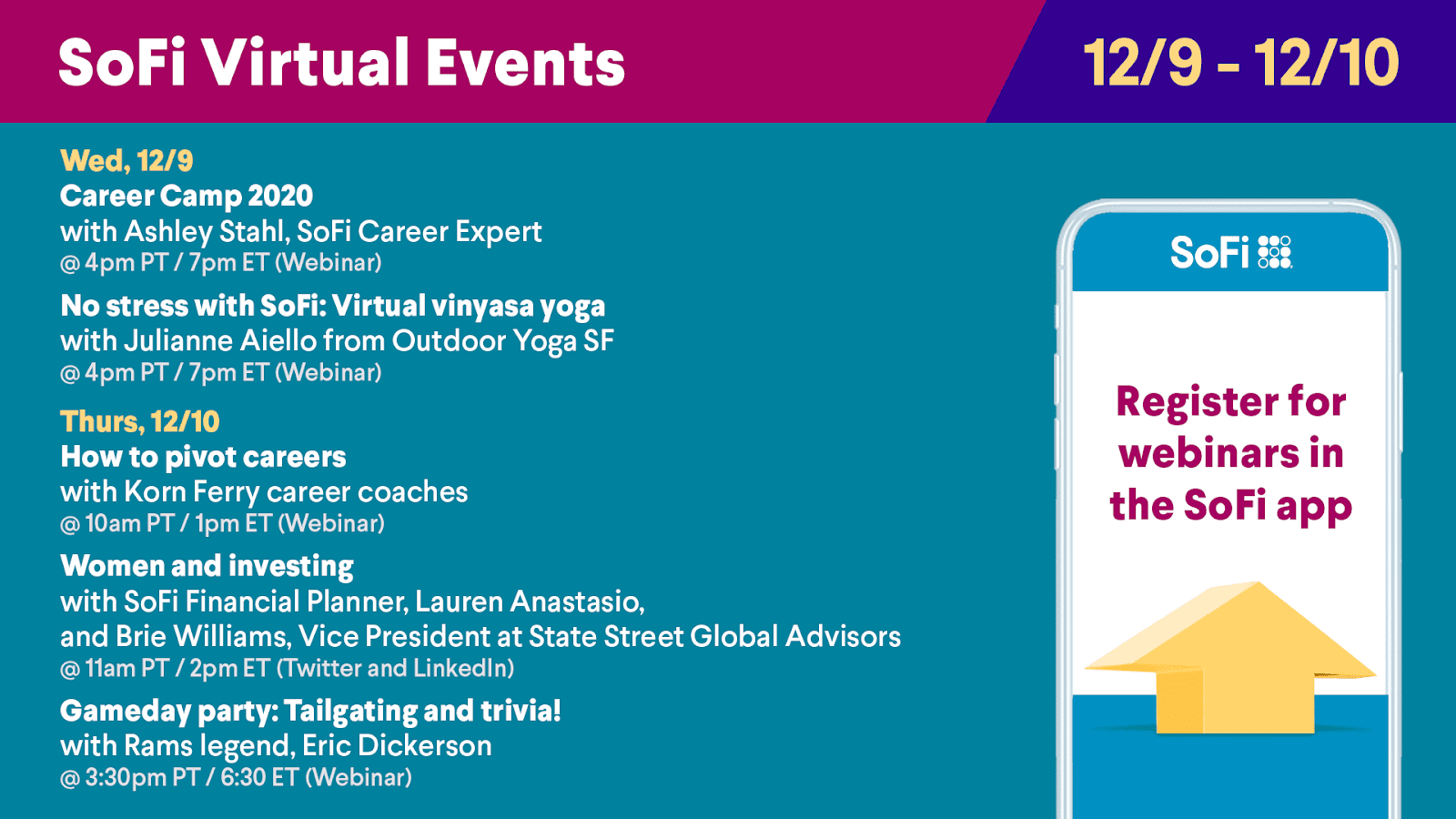

The Week Ahead at SoFi

Two days, twice the events! From yoga and tailgating, to pivoting careers and investing, it’s all happening this week on Zoom, Twitter, and LinkedIn. Register for upcoming events in the SoFi app, and catch up on past events on our YouTube channel.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Advisor

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

SOSS120701