Supply-Chain Disruptions Take a Toll on Apple, Amazon

Apple and Amazon Aren’t Immune to Supply-Chain Disruptions

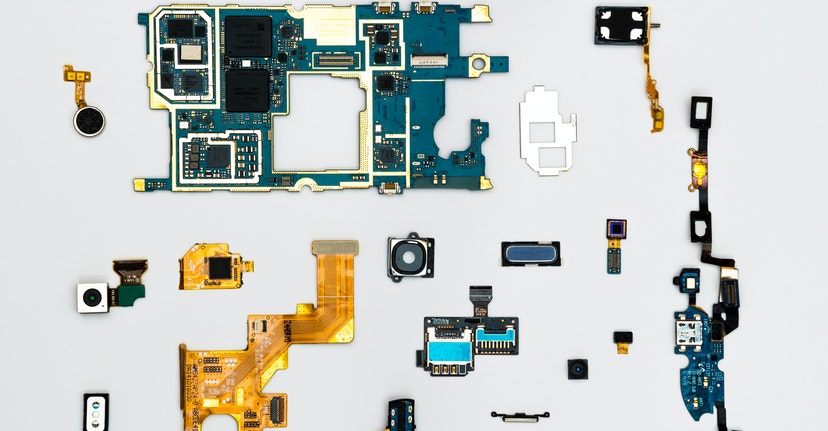

Apple (AAPL) and Amazon (AMZN) posted disappointing results for their most recent quarter. Strong consumer demand was not enough to offset supply-chain issues. Shipping delays and component shortages are hurting Apple’s ability to produce more iPhones, iPads, Apple Watches, Macs, and other products. Meanwhile severe labor shortages and shipping disruptions drove Amazon’s costs higher and made it difficult for the ecommerce giant to meet demand.

The tech titans’ quarterly results underscore the difficulties which all companies, even large ones, are having with managing shipping delays, component shortgages, and a scarcity of workers. Most analysts expected these issues to have improved by now. When reporting quarterly results Apple said it was surprised by the severity of the supply-chain disruptions.

Supply-Chain Delays Worse Than Apple Expected

Apple had been able to navigate component shortages and delivery delays better than rivals, but that all changed in July when the company warned that a lack of chips would impact iPhone production. During its fiscal fourth quarter, the iPhone maker had to contend with chip shortages and factory shutdowns in Southeast Asia due to COVID-19 outbreaks. All of that caused revenue to fall short of Wall Street’s expectations. Apple’s revenue did increase 29% year-over-year to $83.4 billion but Wall Street was looking for sales of $85 billion.

Amazon’s sales in the third quarter were also lower than Wall Street forecasts. Costs at the ecommerce giant increased by $2 billion due to supply-chain issues including a lack of workers which forced Amazon to reroute merchandise. Profits fell 50% from the year-earlier third quarter.

Microsoft, Google Buck the Trend

Chip shortgages and delivery delays are also hurting other industries including automakers and home appliance companies. Both General Motors (GM) and Ford (F) posted a big decline in third-quarter profits while Whirlpool (WHR) warned there will be a lack of dishwashers and refrigerators in 2022.

Some big companies are bucking the trend including Microsoft (MSFT) and Alphabet (GOOGL). Both are less reliant on the supply chain, which helped them post strong quarterly results. Microsoft showed continued growth in cloud computing while Google’s profit nearly doubled driven by increased ad sales. However, with supply-chain chaos lasting much longer than anticipated even some large, deep-pocketed companies are not immune.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

SOSS21110102