Liz Looks at: The Next Quarter

Like Sands Through the Hourglass

No matter how long the first quarter seemed, it’s almost over and we’re on to the next. For the soap opera enthusiasts reading this, it felt all too similar to a plot with multiple dramas unfolding simultaneously. Unfortunately, much like a soap opera, I think these dramas will drag on for a surprisingly long time.

Young and Restless

I’m talking about the tightening cycle. It’s young, it’s antsy, and it’s only going to get tighter. At this point, it’s something we can absorb — and as we saw last week, the market wasn’t too thrown by surprisingly hawkish comments from the Fed.

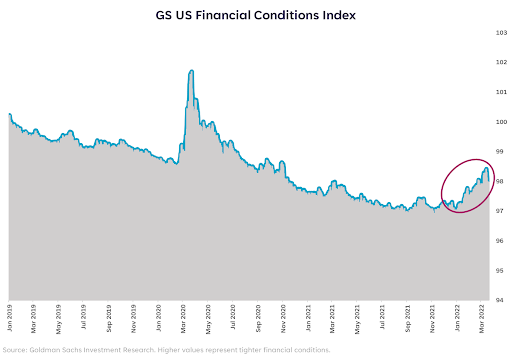

Despite a lightning fast rise in 10- and 2-year Treasury yields and recent tightening in financial conditions, they remain looser than they were pre-pandemic (chart 1). That’s a signal to the Fed that there’s room to keep tightening regardless of whether or not the stock market likes it.

This presents the concept of financial stability, and how much the financial system can handle before it breaks (or rather, before the Fed has to slow down). Recently, I wrote about curve inversion and what it means — we remain only ~20 basis points away from inversion between 2s/10s, and the part of the curve between 3- and 5-year Treasuries narrowly inverted starting last Friday.

But the saga continues. We must tighten, we must fight inflation, and this train is not slowing down anytime soon. Yet markets started to rally the day before the Fed meeting and have put up impressive results since (S&P +6.8%, Nasdaq +10.7%). We’ve exited bear market territory (down 20% or more) on the Nasdaq and investors seem to have breathed a sigh of relief.

Although I think a relief from volatility could last in the near-term, this is a year where we need to manage our expectations for returns. I think we can still finish the year in positive territory, but we can’t let this recent bounce lead us to believe the path will be smooth or easy from here.

Bold, but Not Beautiful

The continued war between Russia and Ukraine adds another layer of pressure to inflation, and is likely to have lingering effects on commodity prices and global trade relationships. As long as the conflict rages on, the risk of escalation or new geopolitical shocks remains possible. And even if the conflict ends soon, the effects of it on supply and demand won’t.

Hence the extension of inflationary pressures, and the renewed expectation of a 50 basis point hike from the Fed in a coming meeting or meetings. Although it may be the right move, it’s bold and not likely one of beauty.

Guiding Light

As investors, we’ve felt the tide shift and probably watched many of our positions fall in the first quarter. I don’t think the second quarter will be painful like the first, but it will include two more Fed meetings and could include a curve inversion, which is a recipe for more pops in volatility.

I do think this is a time when investors can start legging back into quality technology stocks, as the entry point is more attractive at these levels. I would also add or establish positions in traditional value sectors that are more insulated from geopolitical tensions (Financials) and those that aren’t as directly impacted by rate hikes (Health Care). But in times like these where uncertainty abounds and volatility lurks, it usually pays to do less trading and chasing.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser. Information about SoFi Wealth’s advisory operations, services, and fees is set forth in SoFi Wealth’s current Form ADV Part 2 (Brochure), a copy of which is available upon request and at www.adviserinfo.sec.gov. Liz Young Thomas is a Registered Representative of SoFi Securities and Investment Advisor Representative of SoFi Wealth. Her ADV 2B is available at www.sofi.com/legal/adv.

SOSS22032401