Liz Looks at: Holding Period Magic

I Got Five on It

What went up, came back down. From the most recent S&P low on Mar 8, the index ripped higher by 11% in the span of three weeks. Investors let out a collective sigh of relief, but many warned not to get too comfortable at that level. More volatility was coming. And they were right.

The S&P has lost 9.7% since Mar 29, and we are only a whisker away from that Mar 8 low. As the saying goes, “what the market giveth, the market taketh away.”

This is one of the few applications where all of the life coach advice to “focus on the present” and “live in the now” will actually work against you. Instead, chase yourself as an investor five years from now.

Time is Power

What’s the definition of long-term? Some will tell you 10 years or more. Others would say 15. And that’s what many traditional finance and investing principles will tell you. But I would venture a guess that most investors — especially newer investors — think of anything beyond a couple years as long-term. Especially if those couple years were tough to stomach.

Let’s settle on five years as an illustrative time period. I’m also going to assume that most investors reading this have a time horizon of at least five years.

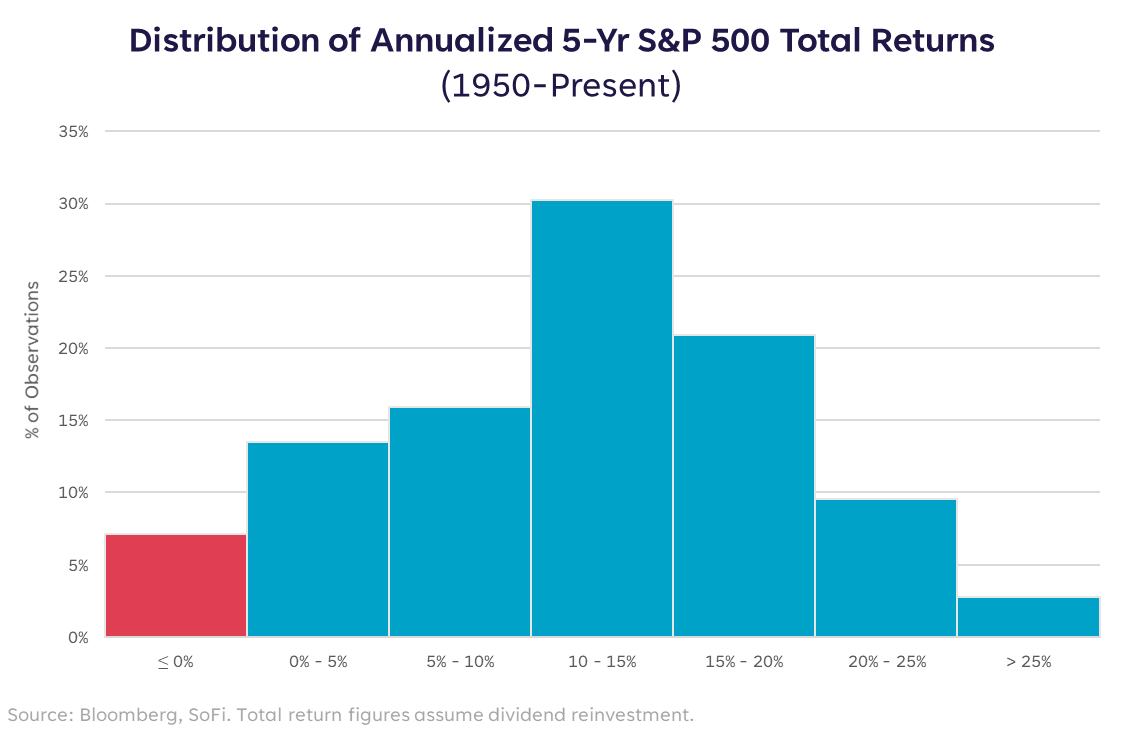

As an experiment, I looked at rolling five year periods in the S&P 500 back to 1950 to find out how often an investor has experienced a negative return. Turns out, not very often. Only 7% of the time over all of these observations (18,199 observations using daily data, to be exact) did an investor experience a negative annualized 5-year return.

In fact, the most common outcome was an annualized 10-15% return. Keep in mind the timeframe from 1950-present includes 11 recessions, multiple Fed tightening cycles, the dot-com bust, and seven periods when y/y CPI was above 5%.

There are annual periods within many of those moving windows where the index was negative, but if you held on through them, and set your sights on the investor five years down the road, 93% of the time that approach resulted in a positive return.

Change the Frame

Two things go up when the market goes down: volatility and correlation.

The VIX index (a standard measure of S&P 500 volatility) now sits just above 30, with both the 50-day and 100-day moving averages above the 200-day moving average. Mathematically that says it’s been trending upward over the last few months. In this environment, a “good” VIX level is now 20 – which is outside our recent comfort zone as investors, but something we need to get comfortable with for now.

Correlation is a measure of how closely assets move together. When the market has sharp drawdowns, most risk assets tend to go down in tandem. We can also call that indiscriminate selling, or a market with nowhere to hide.

Those two things together make us feel like diversification fails us when we need it most. The brightside is that it usually only lasts for brief periods. As I said before, focusing on “the now” can work against you in this environment. It could make you extrapolate the current moment further out than is realistic and paint an overly pessimistic view.

In those moments when your instincts are telling you to sell with everyone else, be reminded of this five-year holding period chart. And hold on to your time horizon with diamond hands.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser. Information about SoFi Wealth’s advisory operations, services, and fees is set forth in SoFi Wealth’s current Form ADV Part 2 (Brochure), a copy of which is available upon request and at www.adviserinfo.sec.gov. Liz Young Thomas is a Registered Representative of SoFi Securities and Investment Advisor Representative of SoFi Wealth. Her ADV 2B is available at www.sofi.com/legal/adv.

SOSS22042802