Liz Looks at: The Power of Earnings

Still Between the Uprights

In celebration of the start to the NFL’s regular season this week, please humor my football analogies and shameless plug for the Green Bay Packers…#gopackgo (that was it, that’s the plug).

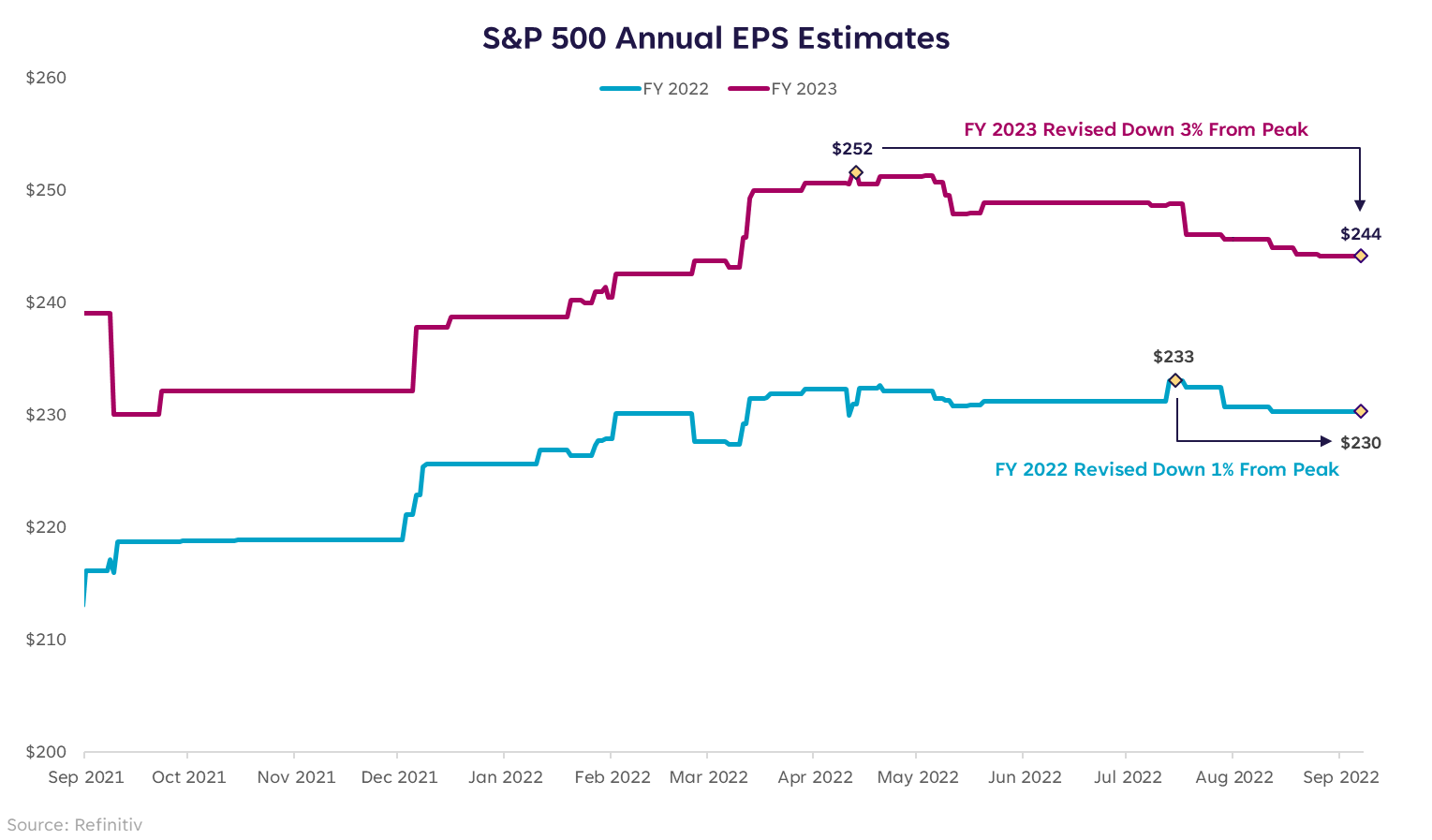

After many months of market pundits (self included) warning everyone about downward earnings revisions that were looming large, so far not much has transpired. As of this writing, 2022 S&P 500 earnings per share (EPS) are expected to be $230, down only 1% from their peak. Likewise, 2023 S&P EPS are expected to be $244, down only 3% from their peak.

Those revisions are a far cry from the punch in the gut many feared. Some could argue that a 24% peak-to-trough decline in the S&P, like we saw in the first half of this year, foretells a punch in the gut that just hasn’t happened yet. And that may be true. But for now, the scoreboard still says the game isn’t over.

Tied at the Half

Let’s say one team is “no recession” and the other team is “recession.” Each end zone is labeled accordingly. I’d currently put us with a tie score at halftime. The next critically important factor that will decide where the ball ends up is whether or not these negative earnings revisions come to be.

But how negative is negative?

Some downward move in earnings can be absorbed by the fact that S&P companies are running record-high profit margins. It’s the larger downward revisions that line-up with those seen in prior recession periods that would signal recession in the near future — especially when coupled with a market that is either approaching or already in bear market territory. (Note: as of close on Sept 7, the S&P is down 18% peak-to-trough — dangerously close to the “bear” definition of -20% or more).

During recessions, the average peak-to-trough decline in trailing 12-month earnings is roughly 30%. Not every recession sees that steep of a drop. Some are much more shallow (-4.6% in 1980) and some are much more severe (-91.9% from 2007-2009). There is no magic level that says “this is recessionary,” but earnings would need to come down markedly from here in order to become a recession signal, in my view. In particular, if 2023 EPS are revised down by 10-15% or more, it would be difficult for us to avert recession.

Pump Fake?

As much as I want to be positive, the current circumstances are such that being too positive runs the risk of sounding like a pollyanna. September is historically a tough month for markets, we’ve only seen one month of cooling in CPI, quantitative tightening accelerates this month, the S&P is again approaching bear market territory, and the next Fed meeting is just two weeks away.

Add those elements to the fact that inflation this high has never been “fixed” without a recession and you see why many are bearish. But as Stanford professor Scott Sagan once said, “Things that have never happened before happen all the time.” That quote is what begins chapter 12 of the book The Psychology of Money by Morgan Housel. It presents the idea that history can be a poor guide to the future because times have changed, and the market structures in place today are different from the market structures that were in place 25-50 years ago.

Was this recent rally just a pump fake? Perhaps. If we are headed to the “recession” end zone, the market is likely to see more downside and possibly new lows. But if we’re headed for the “no recession” end zone, the playbook looks different, and much more positive. Stay nimble, build your bench, and take the game one play at a time. And remember, the worst team from last year gets first pick in the draft. Even in the worst of times, there’s an opportunity to pick up winners.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser. Information about SoFi Wealth’s advisory operations, services, and fees is set forth in SoFi Wealth’s current Form ADV Part 2 (Brochure), a copy of which is available upon request and at www.adviserinfo.sec.gov. Liz Young Thomas is a Registered Representative of SoFi Securities and Investment Advisor Representative of SoFi Wealth. Her ADV 2B is available at www.sofi.com/legal/adv.

SOSS22090801