1% Match IRA

{/* IRA Match 2026 Relaunch 12/6 */}

{/* https://www.sofi.com/invest/retirement-accounts/ */}

1% IRA MATCH

This year, aspire to retire a millionaire.

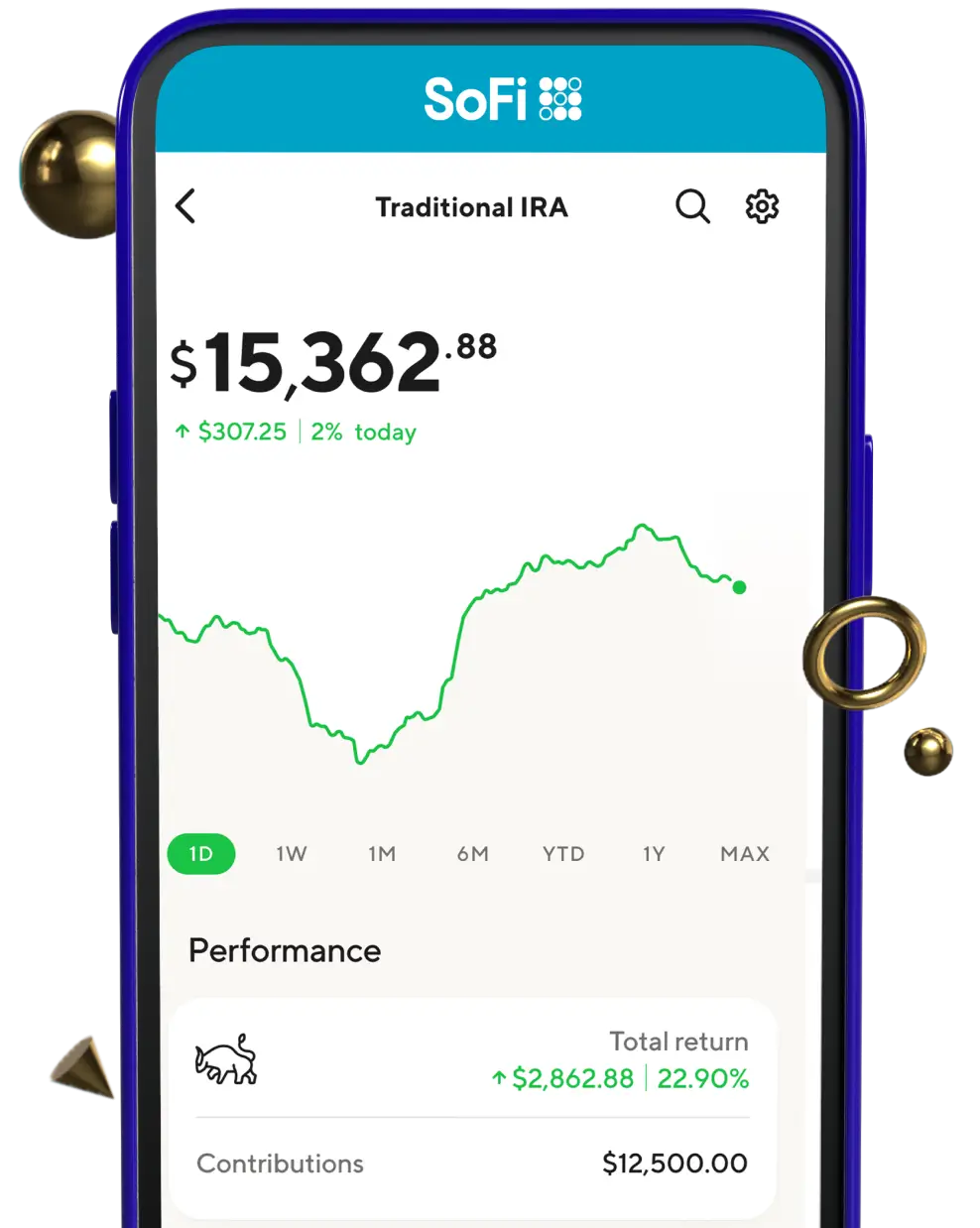

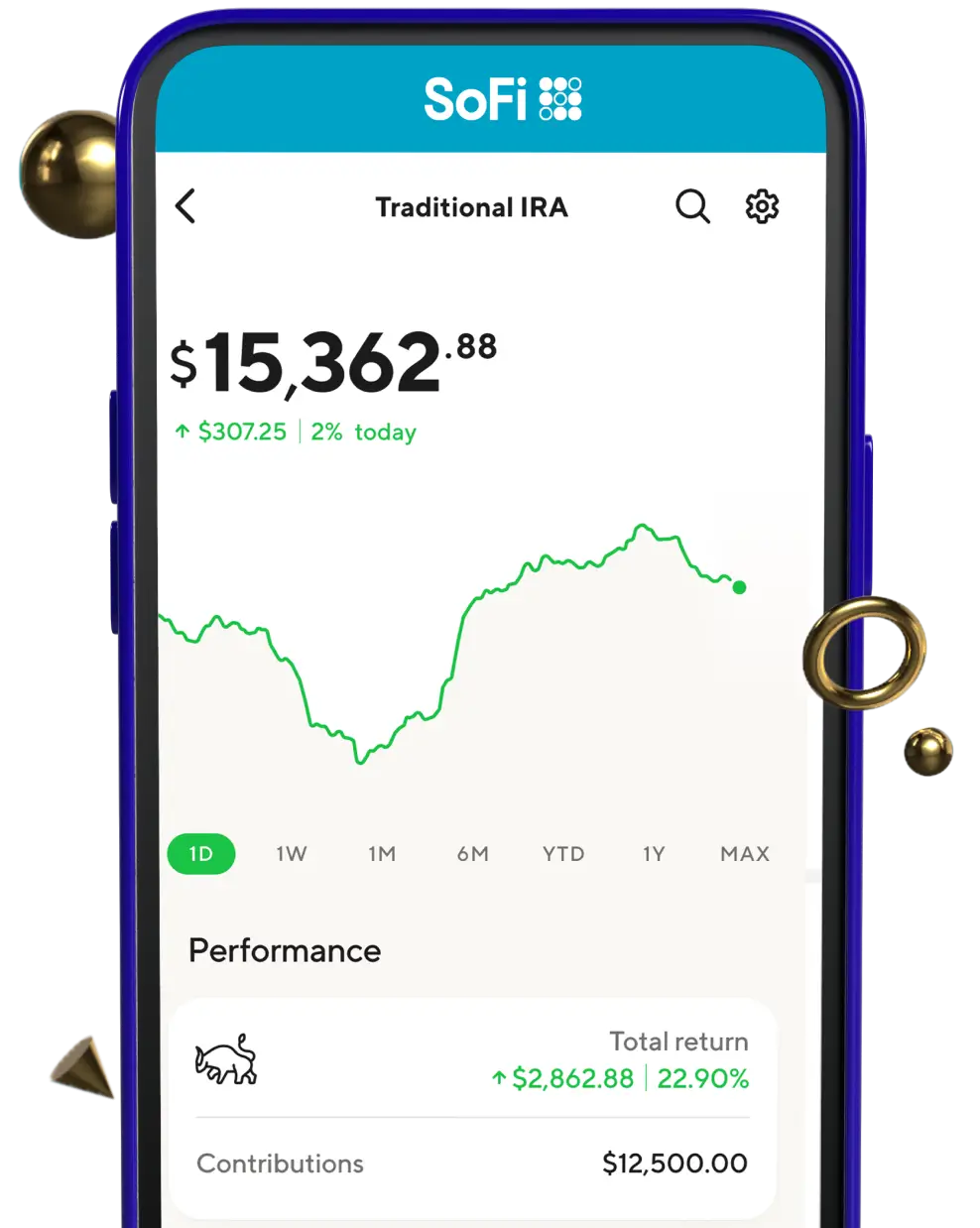

With a 1% IRA match on rollovers and contributions1—plus the power of compound returns—investing $7.5K a year for 40 years could put you on the path to retiring

a millionaire.2

Get a 1% IRA match

Begin rollover

1Terms and conditions apply. Matches on contributions are made up to the annual limits.

2The S&P 500 Index return does not include the reinvestment of dividends or account for investment fees, expenses, or taxes, which would reduce actual returns.

Based on SoFi Members. This claim may not be representative of the experience of all other customers. | Updated: 10/22/2025

{/* How to manage your IRA */}

Choose how you want to manage your IRA.

With SoFi’s Roth or Traditional IRAs, you have the flexibility to choose the investment style that suits you best: self-directed investing for hands-on control or robo investing for a portfolio built just for you with SoFi’s robo advisor.

-

Self-Directed IRAs

(Hands-On)

If you want to be hands-on and select your own investments in your IRA, self-directed investing could be the option for you. Be your own investor and pay no commissions on your trades. Other fees apply.

Open a Self-Directed IRA

-

Robo IRAs

(Hands-Off)

Overwhelmed by your investment options or not sure where to start? We’re here to help. Just tell us about your overall retirement and investment goals and our robo advisor will build and manage a custom portfolio for your IRA—just for you.

Open an Automated IRA

{/* The power of compound returns. */}

The power of compound returns.

It’s all due to one simple, yet powerful, idea: The longer your money stays in market, the harder it can work toward your future. Why? Because you could get returns on your original contribution, potentially stacking gains on top of previous gains, year over year.

Let’s walk it out: If you invest $7,500 in an IRA that returns 7%—the historical rate of return for the S&P 500 Index2—you could earn $525 in returns the first year. The following year, you could earn 7% on $8,025, which is $561, bringing your overall balance to $8,586. In year three, you could earn 7% on $8,586, and so on.

Making the max annual IRA contribution could help you reach millionaire status in retirement. Add our 1% match1 on top, and you’re retiring in style.

Get a 1% IRA match

1Terms and conditions apply. Matches on contributions are made up to the annual limits.

Are you investing enough to retire in style?

Use our calculator to help estimate how much to invest each year to reach your retirement goals.2

How our retirement calculator works.

expand={

/>

This calculator projects your retirement savings by considering your current balance, annual contributions, and the rate of return on your investments. This is for educational purpose and is based on hypothetical assumptions that may not reflect actual performance.

The projected amount is in today’s dollars, meaning it reflects the purchasing power of your savings in terms of today’s cost of living, after adjusting for inflation. It also assumes those amounts are in pre-tax dollars, meaning taxes on these funds will be paid when you withdraw them in retirement.

2The S&P 500 Index is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S. It is not an investment product, but a measure of U.S. equity performance. Historical performance of the S&P 500 Index does not guarantee similar results in the future. The historical return of the S&P 500 Index shown does not include the reinvestment of dividends or account for investment fees, expenses, or taxes, which would reduce actual returns.

{/* Why go with an IRA? */}

Why go with an IRA?

-

Tax advantages

IRA earnings have tax-deferred or tax-free growth potential, meaning you may keep more of what you save.

-

Choose active or auto

Take the wheel yourself with an active (or self-directed, SoFi Securities LLC) IRA, or let SoFi handle it with an automated (or robo, SoFi Wealth LLC) account.

-

Control and flexibility

Be as conservative or aggressive as you want when choosing investment strategies to work towards your goals and support your risk tolerance.

Open an account

SoFi doesn’t provide tax or legal advice. Individual circumstances are unique.

Consult with a qualified tax advisor or attorney about your specific needs.

{/* Is your 401(k) collecting dust? Roll it over with a 1% match. */}

{/* Column 1: IRA Image */}

Is your 401(k) collecting dust? Roll it over with a 1% match.

According to national data, abandoned 401(k) accounts exceed $2 trillion—don’t let yours be one of them. Roll over your 401(k) into a SoFi IRA and get a 1% match on every dollar.1

Don’t have a SoFi IRA? Open an account to get started—otherwise,

begin the rollover process now.

Contribute now

Begin rollover

1Terms and conditions apply. Matches on contributions are made up to the annual limits.

{/* Horizon 1*/}

{/* IRA 101 Section */}

{/* FLEX CONTAINER: align-bottoms ensures elements sit on the bottom edge */}

{/* — 1. DESKTOP IMAGE (Left) —

– Width: 50% on desktop

– Hidden on mobile/tablet

– Image tag allows it to sit flush to bottom naturally

*/}

{/* — 2. CONTENT COLUMN (Right) —

– Width: 50% on desktop, 100% mobile

– Padding added for breathing room

*/}

{/* Headline */}

IRA 101: The basics you need to know.

{/* Bullets */}

-

•An individual retirement account (IRA) can provide tax advantages when it comes to saving and investing money for your retirement. With a traditional IRA, your investments have the opportunity to grow tax-deferred with before-tax contributions. A Roth IRA offers tax-free growth potential on after-tax contributions.

-

•Each year, the IRS sets a maximum amount that you can contribute across all of your IRAs, including those outside of SoFi. For 2025, the contribution limit is $7,000 for people under age 50, and $8,000 for people age 50 and over. For 2026, the limits are $7,500 and $8,600. SoFi will match all contributions up to the annual limit at 1%.1

-

•There is no minimum or limit to what you can roll over from your 401(k) into a SoFi IRA—and every dollar counts toward the 1% match.

{/* CTA Area */}

Open an account

{/* Footnote / Disclaimer */}

{/* — 3. MOBILE IMAGE (Bottom) —

– Visible only on mobile/tablet

– Sits flush to bottom

*/}

There’s always more to learn.

Everything you never thought you needed to know about retirement planning.

See more investing articles

FAQs

The annual contribution limit for a traditional and Roth IRA is $7,000 for 2025 and $7,500 for 2026. Those 50 and older can contribute $8,000 in 2025 and $8,600 in 2026.

The SEP IRA contribution limit for 2025 is 25% of an employee’s total compensation, up to $70,000. The SEP IRA contribution limit for 2026 is 25% of an employee’s total compensation, up to $72,000. Other limitations may apply.

Traditional IRA contributions may be tax-deductible if you meet certain income requirements. Roth IRAs are not tax-deductible.

Learn more: IRA Tax Deduction Rules

For traditional IRAs, you can make penalty-free withdrawals once you reach age 59½. Roth IRA contributions can be withdrawn at any time without tax or penalty, for any reason at any age. Investment earnings on Roth contributions can typically be withdrawn, tax-free and without penalty, once the investor reaches the age of 59½, as long as the account has been open for at least a five-year period.

Learn more: Traditional and Roth IRA Withdrawal Rules & Penalties

Yes, you can have both a 401(k) and an IRA. Note that the two account types have different contribution and withdrawal rules, so be sure to understand those before opening an account.

How do I move my 401(k) to an IRA?

SoFi Invest offers a range of retirement accounts and

401(k) rollover options.

We offer Traditional, Roth, and SEP IRAs, and can help with the rollover process.

What is an IRA match and how does it work?

The IRA Match is an extra 1% that SoFi adds to your IRA for making contributions and rollovers. It does not count toward your annual contribution limits. The pay-out amount for the 1% contribution match is calculated based on each settled deposit up to the annual contribution limits. For example, if you deposit $3,000 into your IRA, your 1% match will be $30. There is no cap or limit on the 401(k) rollover match.

Is the SoFi IRA Match the same as an employer’s 401(k) match?

The SoFi IRA Match and employer 401(k) match both offer matches on retirement investments, but they aren’t the same. For starters, the IRA Matches do not count toward your annual contribution limit. Also, you don’t have to work for SoFi to earn an IRA Match. In contrast, a 401(k) employer match is a contribution that an employer makes to an employee’s retirement account. It is possible to have both an employer 401(k) match, earn the IRA 1% Contribution Match with a SoFi IRA and rollover a 401(k) from a previous employer to a SoFi IRA to earn a 1% Rollover Match.

Is my IRA deposit or 401(k) rollover automatically invested?

It depends. If you want your contributions or rollovers to be automatically invested and rebalanced, you have the option to open a Robo IRA where we’ll build a portfolio for you, based on your investment objectives and risk appetite. If you prefer to choose your investments yourself, you have the option to open an Active IRA. With an Active IRA, don’t forget to place trades to invest your IRA deposits so you don’t leave them as uninvested cash in your account.

Is my 403(b) or 457(b) eligible for the match?

Yes, as long as you completed the rollover via the SoFi platform utilizing this link, your rollover is eligible for the match.

When will I get paid my 1% match?

Bonuses will be paid within 60 days of the last day of the month in which the contributions settle in your SoFi Invest account. NOTE: Your IRA Contribution Match and Rollover Match will be paid out as two separate sums.

Required minimum distributions (RMDs) are minimum withdrawals set by the IRS that you must make when you reach a certain age. For traditional IRAs, RMDs kick in the year you turn 72 (73 if you reach age 72 after Dec. 31, 2022).

Yes, you can have multiple IRAs, but the total amount you contribute to all of your IRAs cannot exceed the annual IRS contribution limits.

There’s no cost to open a SoFi IRA.

SoFi retirement accounts don’t have any account fees. However, there may be fees associated with certain ETFs and mutual funds ranging from 0.03% to 0.40%. Other fees apply.

SoFi offers a variety of investment options for your retirement savings including ETFs, stocks, and more. You can choose to invest in individual investments or you can use SoFi’s automated investing service to create a diversified portfolio that’s tailored to your risk tolerance and investment goals.

SoFi IRAs are available to anyone who is a U.S. citizen or resident who’s at least 18 years old and has a valid Social Security number.

SoFi will match 1% of a customer’s ACH deposits or via cash transfers from SoFi Bank accounts, up to their contribution limit. Contributions over the annual contribution limit will not be matched. Please see examples below:

Example 1: If you have not made any contributions to your IRA for 2025 and contribute $7000 you will be matched 1% of your contribution amount, which is $70.

Example 2: If you have already made a contribution of $2,000 to your IRA for 2025 and contribute an additional $7,000, bringing you over the annual contribution limit, you will be matched 1% of your additional contribution up to the legal limit, which would be $50 if you are below 50 years old, or $60 if you are above 50 years old.

As long as you hold your eligible funds for at least five years, the IRA match is yours to keep. If your deposit or rollover is removed prior to the end of the five year Eligibility Period, SoFi will remove a proportional amount of the bonus from the member’s account. The proportional amount is based on the breach in retention value, not retention period. In the event of an ACAT transfer out, there will be an early withdrawal fee for the entire match amount.

Examples:

Scenario 1: If you deposit $7,000 into your IRA account for 2025, you’ll earn a $70 match. If you withdraw $500 less than 5 years from the deposit date, you’ll incur an early withdrawal fee of $4.95.

Scenario 2: If you deposit $7,000 into your IRA account, you’ll earn a $70 match. Your account balance then increases to $10,000 due to investment gains. If you withdraw $500 less than 5 years from the deposit date, you’ll incur an early withdrawal fee of $0 because your equity balance remains above the pre-promotion equity in the account, plus the qualifying deposit and match amount.

Scenario 3: If you deposit $7,000 into your IRA account, you’ll earn a $70 match. Your account balance then decreases to $5,000 due to investment losses. If you withdraw $500 less than 5 years from the deposit date, you’ll incur an early withdrawal fee of $30.39 because your equity balance fell below the pre-promotion equity in the account, plus the qualifying deposit and match amount.

Your IRA investments are savings for retirement, and you’ll incur penalties if you withdraw your funds early, so make your best effort to keep them there till you retire.

Contributions into Automated IRA, Automated Roth IRA, Active IRA, and Active Roth IRA are eligible for the match promo.

The rollover must be completed via the integrated Capitalize rollover experience within the SoFi Invest platform. To begin the rollover process, please click here.

Yes – you must keep the funds in your SoFi IRA for five years from the deposit settlement date. Early withdrawals will be subject to an early withdrawal fee. SoFi will remove a proportional amount of the bonus from the member’s account based on the breach in retention value. In the event of an ACAT transfer out, there will be an early withdrawal fee for the entire match amount.

The match will be paid out within 5 business days of the transfer being settled, subject to verification of eligibility and compliance with these terms.NOTE: Your IRA Contribution Match and Rollover Match will be paid out as two separate amounts.

Retirement reimagined.

A 1% match on both IRA contributions and rollovers1 with no minimum amount required could give you an easier way to build your future, without relying on an employer plan. Start saving today.

Open an account

1Terms and conditions apply. Matches on contributions are made up to the annual limits.

Home > Online Investing > IRA Accounts